Europe Accounts Payable Automation Market

Market Size in USD Billion

CAGR :

%

USD

1.01 Billion

USD

2.25 Billion

2024

2032

USD

1.01 Billion

USD

2.25 Billion

2024

2032

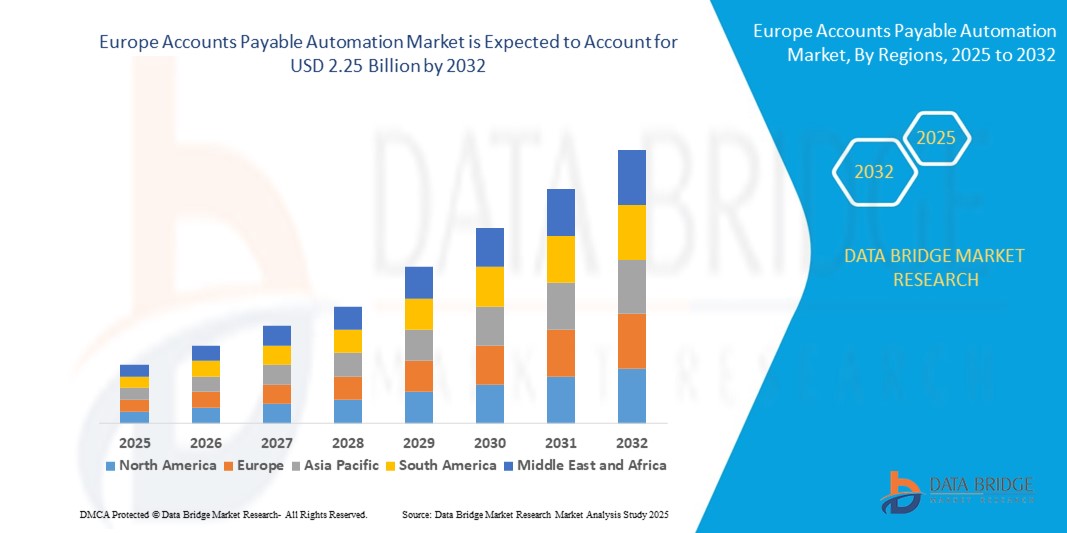

| 2025 –2032 | |

| USD 1.01 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Europe Accounts Payable Automation Market Size

- The Europe accounts payable automation market size was valued at USD 1.01 billion in 2024 and is expected to reach USD 2.25 billion by 2032, at a CAGR of 10.60% during the forecast period

- The market growth is primarily driven by the increasing focus on streamlining financial operations, minimizing manual errors, and improving operational efficiency across enterprises of all sizes

- In addition, the shift toward cloud-based solutions, regulatory compliance requirements, and the demand for real-time visibility into payables are encouraging widespread adoption of automation tools. These evolving priorities are accelerating the deployment of accounts payable automation across sectors, significantly propelling the market's expansion

Europe Accounts Payable Automation Market Analysis

- Accounts payable automation, which streamlines invoice processing and payment workflows through digital solutions, is becoming increasingly essential for enterprises across Europe seeking to boost financial accuracy, reduce manual workload, and enhance operational agility

- The growing demand for AP automation is primarily fueled by accelerated digital transformation, increasing regulatory compliance requirements and the push for real-time visibility in finance operations

- Germany dominated the Europe accounts payable automation market with the largest revenue share of 35.1% in 2024, owing to its robust industrial base, advanced IT infrastructure, and early adoption of financial automation tools among large enterprises

- Poland is projected to be the fastest-growing country in the Europe accounts payable automation market during the forecast period, driven by increasing SME adoption, government-led digital economy initiatives, and rising awareness about the benefits of workflow automation

- The cloud-based deployment segment dominated the Europe accounts payable automation market with a share of 46.8% in 2024, supported by its cost-effectiveness, ease of integration, and ability to provide secure, real-time access across distributed finance teams

Report Scope and Europe Accounts Payable Automation Market Segmentation

|

Attributes |

Europe Accounts Payable Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Accounts Payable Automation Market Trends

AI-Driven Intelligence and Cloud Integration Enhancing Financial Workflows

- A prominent and growing trend in the Europe accounts payable automation market is the adoption of artificial intelligence (AI) and cloud-based technologies to automate and optimize financial workflows, enabling faster processing, greater accuracy, and real-time decision-making capabilities

- For instance, SAP and Basware offer AI-powered AP automation platforms that analyze invoice data to detect discrepancies, automate approvals, and recommend optimal payment timings. These platforms integrate seamlessly with major ERP systems and cloud environments

- AI integration allows for intelligent data extraction, fraud detection, and predictive analytics, enhancing the accuracy of invoice matching and enabling finance teams to proactively manage cash flow. For instance, companies such as Yooz utilize machine learning to improve OCR accuracy and adapt to changing invoice formats over time

- The shift to cloud-based solutions facilitates real-time access, scalability, and remote processing essential features for decentralized or hybrid workforces. Vendors such as Coupa and Medius offer SaaS-based platforms that allow businesses to automate AP processes with minimal infrastructure investment

- These innovations are transforming how finance departments operate, enabling centralized control over multi-location operations and accelerating digital transformation across industries. This trend is particularly evident in sectors such as retail, manufacturing, and healthcare, where high invoice volumes require scalable automation

- The growing emphasis on AI-driven, cloud-integrated AP automation solutions is reshaping expectations across European businesses. As a result, vendors are focusing on improving user interfaces, compliance support and intelligent analytics to meet evolving market needs

Europe Accounts Payable Automation Market Dynamics

Driver

Digital Transformation and Regulatory Mandates Fueling Adoption

- The widespread push for digital transformation across Europe, along with increasing regulatory requirements such as e-invoicing mandates and data transparency laws is a major driver behind the adoption of accounts payable automation

- For instance, in January 2024, Italy expanded its e-invoicing requirements to cross-border transactions, accelerating demand for compliant AP automation platforms. Similarly, France and Poland are advancing national e-invoicing mandates, pushing companies to digitize their invoice management processes

- Businesses are seeking to streamline financial operations, reduce manual errors, and improve audit readiness, leading to increased investments in AP automation tools that ensure compliance while boosting operational efficiency

- The ability to automate repetitive tasks such as data entry, invoice approval, and payment scheduling not only reduces human error but also allows finance teams to focus on strategic activities such as cost optimization and vendor management

- Growing awareness of AP automation’s ROI such as shorter processing cycles, reduced fraud risk, and improved supplier relationships is encouraging adoption among both large enterprises and SMEs. Cloud-based and modular deployment options are further aiding penetration across diverse organizational sizes and sectors

Restraint/Challenge

Integration Complexities and Legacy System Limitations

- Despite the strong benefits, integration challenges with legacy ERP systems and concerns over data migration pose notable hurdles for broader AP automation adoption across Europe

- Many businesses, particularly in the mid-market segment, still rely on outdated financial software or fragmented systems, making it difficult to implement seamless automation without major infrastructure upgrades

- For instance, companies using customized legacy systems often face long deployment timelines and increased costs when integrating with modern AP platforms, leading to project delays or scaled-back implementations

- Furthermore, data security and compliance concerns—especially related to GDPR continue to make some organizations hesitant about moving financial operations to the cloud. Ensuring end-to-end encryption, audit trails, and regulatory adherence is critical for winning customer trust

- The lack of in-house expertise to manage AP automation platforms also acts as a barrier, especially for SMEs. Without adequate training and support, companies may struggle to fully utilize advanced features such as AI-based fraud detection or dynamic discounting

- Overcoming these challenges through standardized APIs, improved interoperability, user-friendly platforms, and localized customer support will be essential for unlocking the full growth potential of the European AP automation market

Europe Accounts Payable Automation Market Scope

The market is segmented on the basis of component, organization size, process, deployment mode, and vertical.

- By Component

On the basis of component, the Europe accounts payable automation market is segmented into solution and services. The solution segment dominated the market with the largest revenue share in 2024, driven by rising demand for integrated platforms that enable automated invoice processing, real-time visibility into accounts payable, and compliance with regional regulations. Enterprises across sectors increasingly rely on AP automation solutions to streamline operations and reduce manual errors, especially as invoicing and audit standards tighten across the EU.

The services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the growing need for implementation, customization, support, and training services. As businesses seek to optimize their AP systems, service providers play a crucial role in ensuring successful deployment and user adoption of automation platforms.

- By Organization Size

On the basis of organization size, the Europe accounts payable automation market is segmented into large enterprises and small and medium enterprises (SMEs). The large enterprises segment dominated the market with the largest revenue share in 2024, owing to their high transaction volumes, complex finance structures, and strong investment capacity for advanced automation solutions. These organizations are prioritizing digital transformation initiatives and regulatory compliance, especially in countries such as Germany, France, and the U.K.

The SMEs segment is projected to witness the fastest growth rate from 2025 to 2032, supported by increasing awareness of automation benefits, affordable cloud-based offerings, and government initiatives to support SME digitization. Vendors are increasingly tailoring AP automation platforms to meet the specific cost and functionality needs of SMEs.

- By Process

On the basis of process, the Europe accounts payable automation market is segmented into invoice capture, invoice approval, payment authorization, payment execution, and export. The invoice capture segment dominated the market with the largest revenue share in 2024, driven by the growing use of AI and OCR technologies to automatically extract invoice data, reducing manual workload and improving processing speed and accuracy. Businesses are adopting smart capture tools to reduce errors and streamline the initial stages of accounts payable workflows.

The payment authorization segment is expected to witness the fastest growth rate from 2025 to 2032, as organizations seek greater control and security in payment approval processes. The need for role-based permissions, fraud prevention, and audit-ready workflows is fueling demand for automated authorization tools, particularly in finance-intensive sectors.

- By Deployment Mode

On the basis of deployment mode, the Europe accounts payable automation market is segmented into cloud and on-premise. The cloud segment held the largest market revenue share of 46.8% in 2024, driven by the rapid adoption of scalable, cost-efficient solutions that support real-time access and remote financial operations. Cloud-based AP automation platforms offer easier updates, lower upfront costs, and quick integration with ERP systems, making them the preferred choice for most businesses across Europe.

The on-premise segment, while more limited in growth, continues to serve organizations with strict internal data governance or security policies, particularly in industries such as government, BFSI, and healthcare, where full control over data and infrastructure remains a top priority.

- By Vertical

On the basis of vertical, the Europe accounts payable automation market is segmented into manufacturing, consumer goods and retail, energy and utilities, healthcare, banking, financial services and insurance (BFSI), IT and telecom, government, automotive, and others. The BFSI segment dominated the market with the largest revenue share in 2024, due to high invoice volumes, complex approval hierarchies, and strict compliance requirements. Financial institutions are rapidly digitizing their accounts payable processes to improve accuracy, reduce operational costs, and ensure regulatory alignment.

The healthcare segment is anticipated to witness the fastest growth rate from 2025 to 2032, as hospitals and medical providers seek to automate their financial workflows to reduce administrative burden, enhance supplier collaboration, and meet regulatory reporting standards. High procurement volumes and growing digital adoption in healthcare settings are driving this trend.

Europe Accounts Payable Automation Market Regional Analysis

- Germany dominated the Europe accounts payable automation market with the largest revenue share of 35.1% in 2024, owing to its robust industrial base, advanced IT infrastructure, and early adoption of financial automation tools among large enterprises

- Organizations in Germany prioritize automation to improve financial efficiency, minimize manual errors, and comply with national and EU-wide mandates for digital transactions and audit readiness

- The market’s growth is further supported by government initiatives promoting digital transformation, the presence of leading AP automation vendors, and a high concentration of large enterprises seeking scalable, secure, and compliant automation solutions for their accounts payable functions

The Germany Accounts Payable Automation Market Insight

The Germany accounts payable automation market captured the largest revenue share in Europe in 2024, fueled by the country’s technologically advanced financial infrastructure, early adoption of digitized solutions, and strict compliance requirements under EU regulations. German enterprises, particularly in manufacturing and automotive sectors, are leveraging AP automation to optimize invoice processing, enhance supplier collaboration, and support sustainability goals through paperless workflows.

France Accounts Payable Automation Market Insight

The France accounts payable automation market is anticipated to expand at a notable CAGR during the forecast period, driven by government-backed e-invoicing mandates, such as the 2026 B2B e-invoicing rollout. French businesses are accelerating digital finance initiatives to stay compliant while improving operational efficiency. The market is also witnessing increased adoption among SMEs, supported by user-friendly cloud-based platforms and local vendor presence.

U.K. Accounts Payable Automation Market Insight

The U.K. accounts payable automation market is expected to grow significantly over the forecast period, supported by a strong financial services ecosystem and increasing enterprise focus on cost control and fraud mitigation. The demand for real-time payment visibility, seamless ERP integration, and remote-friendly finance workflows is contributing to increased adoption, especially among large corporations and public sector organizations.

Italy Accounts Payable Automation Market Insight

The Italy accounts payable automation market is gaining traction as the country continues to expand mandatory e-invoicing across both domestic and cross-border transactions. Businesses are implementing automation to meet compliance standards, reduce invoice processing times, and enhance financial reporting accuracy. Growth is expected across both enterprise and mid-market segments, with cloud-based platforms seeing strong uptake.

Poland Accounts Payable Automation Market Insight

The Poland accounts payable automation market is forecasted to witness the fastest growth in Europe during the forecast period, supported by rising SME digitalization, supportive government policies, and growing awareness of AP automation benefits. The increasing availability of localized, affordable automation solutions and the upcoming national e-invoicing mandate are driving demand across various industries including retail, logistics, and healthcare.

Europe Accounts Payable Automation Market Share

The Europe accounts payable automation industry is primarily led by well-established companies, including:

- Basware Corporation (Finland)

- SAP SE (Germany)

- Sage Group plc (U.K.)

- Medius Group AB (Sweden)

- Tungsten Automation Corporation (U.S.)

- Oracle (U.S.)

- Coupa Software Inc. (U.S.)

- Tipalti, Inc. (U.S.)

- Tradeshift Holdings, Inc. (U.S.)

- ReadSoft AB (Sweden)

- Xero Limited (New Zealand)

- Workday, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Serrala Group GmbH (Germany)

- Quadient S.A. (France)

- Infor, Inc. (U.S.)

- Yooz SAS (France)

- ICD International Cash Distributors B.V. (Netherlands)

- Pagero Group AB (Sweden)

- ABBYY Europe GmbH (Germany)

What are the Recent Developments in Europe Accounts Payable Automation Market?

- In May 2024, Basware, a Finland-based leader in financial automation solutions, partnered with PwC Germany to expand AP automation adoption across the DACH region. This collaboration focuses on helping organizations achieve compliance with upcoming EU e-invoicing mandates through intelligent invoice processing and analytics. The partnership highlights the growing importance of regulatory readiness and digital transformation in Europe’s financial operations

- In April 2024, Sage Group plc, headquartered in the U.K., introduced new AI-driven features to its cloud-based accounting and AP automation platform. These enhancements include predictive analytics for cash flow management and automated approval routing, aimed at helping SMEs improve accuracy and efficiency in their accounts payable workflows. This development demonstrates Sage’s commitment to empowering small businesses with accessible, intelligent automation tools

- In March 2024, Kofax Inc., operating extensively across Europe, announced the integration of its AP automation software with Microsoft Dynamics 365 Finance. This move enables seamless invoice capture and processing within the Microsoft ecosystem, improving operational visibility and control for European enterprises. The integration reflects rising demand for end-to-end automation and interoperability with ERP platforms in the region

- In February 2024, SAP SE, based in Germany, enhanced its AP automation capabilities by embedding machine learning into the SAP Business Network. The upgrade allows companies to streamline supplier collaboration, optimize payment terms, and automate exception handling. The move supports SAP’s broader vision to drive connected, data-driven finance ecosystems across Europe’s enterprise landscape

- In January 2024, Medius, a Sweden-based AP automation provider, expanded its presence in France and the Netherlands by launching a new localized interface and compliance features to align with regional e-invoicing laws. The update supports seamless onboarding and invoice processing in multiple languages and formats, underscoring Medius’ commitment to serving diverse European markets and regulatory frameworks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Accounts Payable Automation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Accounts Payable Automation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Accounts Payable Automation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.