Europe Acerola Market

Market Size in USD Billion

CAGR :

%

USD

3.28 Billion

USD

517.00 Billion

2024

2032

USD

3.28 Billion

USD

517.00 Billion

2024

2032

| 2025 –2032 | |

| USD 3.28 Billion | |

| USD 517.00 Billion | |

|

|

|

|

Acerola Market Analysis

The European acerola market is expanding due to growing consumer demand for natural and functional ingredients. Acerola, known for its high vitamin C content, is increasingly used in food, beverages, and dietary supplements. The market is driven by health-conscious consumers seeking immunity-boosting and clean-label products. Key players focus on sustainable sourcing and organic production to meet regulatory and consumer expectations. The rise of plant-based and natural ingredients in the food industry further supports acerola's growth. Challenges include supply chain fluctuations and seasonal availability, but innovation in processing and formulation continues to create opportunities for market expansion.

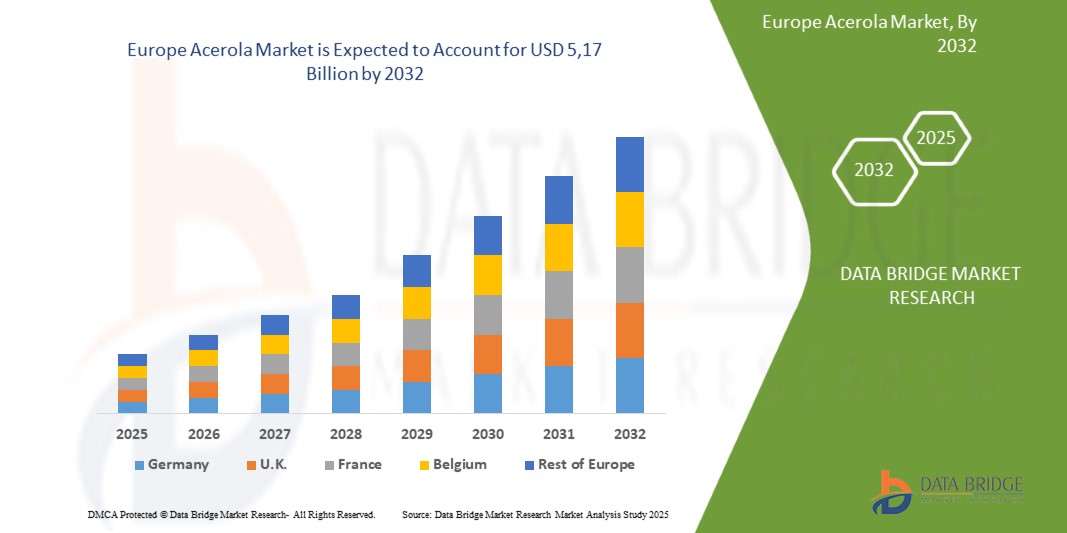

Acerola Market Size

Europe acerola market is expected to reach USD 5,17 billion by 2032 from USD 3.28 billion in 2024, growing with a substantial CAGR of 5.9% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Acerola Market Trends

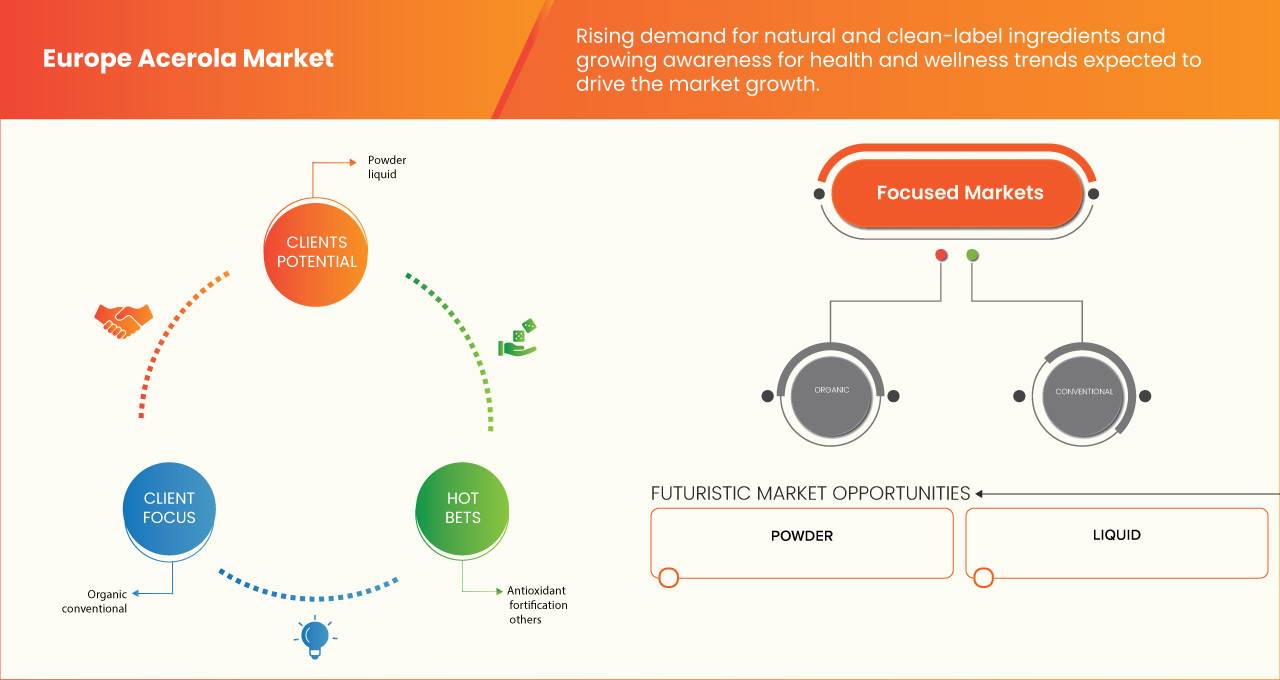

“RISING DEMAND FOR NATURAL AND CLEAN-LABEL INGREDIENTS ”

The European acerola market is growing due to increasing consumer demand for natural, clean-label ingredients. Acerola, valued for its high vitamin C and antioxidant content, is widely used in functional foods, beverages, supplements, and cosmetics. Stricter regulations on artificial additives and rising interest in organic, plant-based products further drive its adoption. Brands emphasizing sustainability, transparency, and natural sourcing are well-positioned to benefit from this trend. As consumers seek minimally processed, immune-boosting, and anti-aging solutions, acerola continues to gain traction as a preferred natural alternative to synthetic vitamin C in the European market.

Report Scope and Acerola Market Segmentation

|

Attributes |

Acerola Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Denmark, Sweden, Poland, Turkey, and Rest of Europe |

|

Key Market Players |

Kemin Industries, Inc. (U.S.), Symrise (Germany), NICHIREI CORPORATION (Japan), Nexira (France), Givaudan (Switzerland), Duas Rodas (Brazil), Handary S.A. (Belgium), Foodchem International Corporation (China), Blue Macaw Flora (Brazil), NP Nutra (U.S.), The Green Labs LLC. (U.S.), PLANTEX (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acerola Market Definition

Acerola (Malpighia emarginata) is a small, cherry-like fruit native to tropical regions of the Americas, particularly Brazil and the Caribbean. It is renowned for its exceptionally high vitamin C content, along with antioxidants, flavonoids, and essential nutrients. Acerola is commonly used in juices, dietary supplements, and cosmetics due to its immune-boosting and skin-enhancing properties. The fruit has a tart flavor and is often processed into powders or extracts for commercial use. Due to its health benefits and natural appeal, acerola is increasingly popular in functional foods and beverages, catering to the growing demand for clean-label and nutrient-rich products.

Acerola Market Dynamics

Drivers

- Growing Awareness for Health and Wellness Trends

Consumers are becoming more conscious of their dietary habits and are actively seeking natural, nutrient-rich ingredients that contribute to overall well-being. This shift in consumer behavior has fueled the demand for functional foods, natural supplements, and plant-based ingredients, positioning acerola as a preferred choice due to its exceptional vitamin C content and antioxidant properties. As people prioritize preventive health measures, they are moving away from synthetic supplements and opting for clean-label, plant-derived alternatives, further strengthening the market for acerola.

Acerola is widely used in various industries, including functional foods and beverages, dietary supplements, and cosmetics. The demand for fortified products such as juices, smoothies, and energy drinks continue to rise, with acerola being a key ingredient for its immune-boosting and antioxidant benefits. In the dietary supplement sector, acerola is increasingly incorporated into powders, capsules, tablets, and gummies, catering to consumers who prefer natural, plant-based solutions. Additionally, the cosmetics and skincare industry has embraced acerola for its ability to promote collagen production, combat oxidative stress, and enhance skin health, making it a popular ingredient in anti-aging and skincare formulations. As health-conscious consumers continue to seek functional and plant-based ingredients, the European acerola market is expected to expand further. The emphasis on transparency, sustainability, and clean-label formulations presents a significant opportunity for manufacturers to innovate and differentiate their offerings. Companies that align with the growing preference for natural health solutions will be well-positioned to capitalize on this trend and drive market growth in the coming years.

- INCREASED USE OF ACEROLA IN FUNCTIONAL BEVERAGES AND DIETARY SUPPLEMENTS

The European market is witnessing a surge in demand for acerola in functional beverages and dietary supplements due to its high vitamin C content and health benefits. Consumers prefer natural, clean-label, and plant-based products, driving acerola’s use in fortified drinks, wellness shots, and immune-boosting supplements. Unlike synthetic vitamin C, acerola offers additional phytonutrients and antioxidants, enhancing absorption and overall health benefits. The rise of preventive healthcare and sustainable sourcing further supports its growth. Companies focusing on organic, minimally processed formulations will gain a competitive edge as acerola continues to expand in the health and wellness market.

Opportunities

- EXPANSION OF ORGANIC AND SUSTAINABLE ACEROLA PRODUCTS

As consumers increasingly prioritize natural, clean-label products, organic acerola—rich in vitamin C and antioxidants—positions itself as a highly attractive ingredient for food, beverage, and nutraceutical applications. This shift toward organic and sustainable practices not only meets consumer expectations but also opens new avenues for market growth and differentiation.

The rising preference for organic products stems from heightened awareness of health and wellness, as well as concerns over synthetic additives and pesticides. By offering organic acerola, businesses can tap into this lucrative segment, appealing to consumers seeking transparency and purity in their dietary choices. Furthermore, the sustainable sourcing of acerola resonates with the European market’s strong emphasis on environmental stewardship. Companies that adopt eco-friendly practices, such as ethical farming, fair trade certifications, and reduced carbon footprints, can strengthen their brand image and build consumer trust. This trend also encourages innovation across product lines. Organic acerola can be incorporated into a variety of applications, including functional beverages, dietary supplements, and fortified foods, catering to the growing demand for natural health solutions. Additionally, the cosmetic industry can leverage sustainably sourced acerola for its antioxidant properties, further diversifying market opportunities.

- RISING DEMAND FOR PLANT-BASED AND VEGAN SUPPLEMENTS

As more consumers adopt vegan and plant-based lifestyles, the demand for natural, nutrient-rich ingredients like acerola is growing rapidly. Acerola, known for its high vitamin C content and antioxidant properties, is an ideal ingredient for plant-based supplements, aligning perfectly with the values of health, sustainability, and ethical consumption.

One of the key factors of this trend is the increasing awareness of the health benefits associated with plant-based diets. Consumers are actively seeking supplements that provide essential nutrients without relying on animal-derived ingredients. Acerola, being a natural and vegan-friendly source of vitamin C, positions itself as a superior alternative to synthetic additives, catering to the growing demand for clean-label and transparent products. This creates an opportunity for businesses to develop innovative acerola-based supplements, such as capsules, powders, and effervescent tablets, targeting health-conscious consumers.

In addition to above, the vegan movement is closely tied to sustainability, as consumers increasingly prioritize environmentally friendly products. Acerola, when sourced sustainably, appeals to eco-conscious buyers who seek to minimize their environmental footprint. By emphasizing ethical sourcing practices and eco-friendly packaging, companies can differentiate their acerola products in a competitive market, building brand loyalty and trust among consumers.

Restraints/Challenges

- HIGH PRODUCTION AND PROCESSING COSTS

The high perishability of acerola leads to costly production and processing, requiring rapid handling, advanced preservation, and compliance with strict EU regulations. Limited growing regions, seasonal availability, and reliance on imports further increase costs, making acerola-based products expensive. Price-sensitive consumers often choose cheaper alternatives like synthetic vitamin C or other natural sources, restricting market growth. Manufacturers face challenges in maintaining affordability while ensuring quality and profitability, limiting acerola’s competitiveness in the European market.

- STIFF COMPETITION FROM OTHER NATURAL VITAMIN C SOURCES

While acerola is highly valued for its exceptionally high vitamin C content, it competes directly with established alternatives such as camu camu, rose hips, sea buckthorn, and citrus extracts. These competing sources offer similar health benefits and are often more familiar to European consumers, making market penetration for acerola more difficult.

Camu camu, for instance, is another superfruit known for its high vitamin C concentration, and it has gained traction in the supplement industry. Similarly, rose hips have been widely used in Europe for their antioxidant properties and immune-supporting benefits, making them a preferred choice in herbal and traditional medicine markets. Additionally, sea buckthorn, which is rich in both vitamin C and omega fatty acids, has positioned itself as a multifunctional ingredient in both the food and cosmetics industries. Price sensitivity also plays a crucial role in market competitiveness. Acerola’s sourcing and processing costs can be higher compared to other plant-based vitamin C sources, making it less attractive for cost-conscious manufacturers. Established supply chains for citrus-derived vitamin C further strengthen competition, as they offer a stable and affordable alternative for functional food and supplement producers. European acerola market faces strong competition from other natural vitamin C sources like camu camu, rose hips, sea buckthorn, and citrus extracts, which are well-established and often more cost-effective. Consumer familiarity with these alternatives and price sensitivity further challenge acerola’s market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Acerola Market Scope

The market is segmented on the basis of product form, nature, function, and application . The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Form

- Powder

- Liquid

Nature

- Organic

- Conventional

Function

- Antioxidant

- Fortification

- Others

Application

- Food & Beverage Industry

- Pharmaceutical Industry

- Cosmetics & Skin Care

- Nutraceuticals & Dietary Supplements

- Animal Nutrition & Pet Food

- Others

Acerola Market Regional Analysis

The market is analyzed and market size insights and trends are provided by product form, nature, function, and application as referenced above.

The countries covered in the market are Germany, U.K., Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Denmark, Sweden, Poland, Turkey, and Rest of Europe.

Germany dominates the European acerola market due to strong demand for natural, clean-label products, a health-conscious consumer base, and the presence of major food and supplement manufacturers. Its advanced research facilities and efficient distribution networks further strengthen its market leadership.

Germany is the fastest-growing market as consumers seek natural immunity-boosting ingredients, driving demand for acerola in functional foods and supplements. Strict regulations on artificial additives, a growing plant-based movement, and a strong retail and e-commerce sector contribute to its rapid market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Acerola Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Acerola Market Leaders Operating in the Market Are:

- Kemin Industries, Inc. – U.S.

- Symrise – Germany

- NICHIREI CORPORATION – Japan

- Nexira – France

- Givaudan – Switzerland

- Duas Rodas – Brazil

- Handary S.A. – Belgium

- Foodchem International Corporation – China

- Blue Macaw Flora – Brazil

- NP Nutra – U.S.

- The Green Labs LLC. – U.S.

- PLANTEX – France

Latest Developments in Acerola Market:

- In April 2021, Kemin Industries introduced an online ingredient library to assist customers in selecting optimal solutions for color, freshness, and safety in various food products, including meat, poultry, baked goods, snacks, and fats and oils. The website provides detailed information on ingredients such as acerola, green tea, rosemary, propionic acid, dry calcium propionate, and buffered vinegar, highlighting their applications in preserving flavor, color, and extending shelf life.

- In November 2021, Nexira strengthened its position in the natural plant-based ingredients market by acquiring Swiss company UNIPEKTIN Ingredients AG, a leader in natural hydrocolloids. This strategic move enhances Nexira's portfolio, particularly in plant-based alternatives, dairy substitutes, and meat replacements.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 PRODUCTION CAPACITY OUTLOOK

4.5 VALUE CHAIN ANALYSIS

4.5.1 RAW MATERIAL SOURCING

4.5.2 HARVESTING AND INITIAL PROCESSING

4.5.3 EXPORT AND IMPORT LOGISTICS

4.5.4 PROCESSING AND MANUFACTURING IN EUROPE

4.5.5 DISTRIBUTION AND RETAIL CHANNELS

4.5.6 MARKETING AND CONSUMER AWARENESS

4.5.7 CONCLUSION

4.6 BRAND OUTLOOK

4.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.7.1 HEALTH & NUTRITIONAL BENEFITS

4.7.2 PRODUCT QUALITY & CERTIFICATIONS

4.7.3 PRICE SENSITIVITY & WILLINGNESS TO PAY

4.7.4 AVAILABILITY & DISTRIBUTION CHANNELS

4.7.5 CONSUMER AWARENESS & BRAND PERCEPTION

4.7.6 TASTE & SENSORY PREFERENCES

4.7.7 SUSTAINABILITY & ETHICAL CONSIDERATIONS

4.7.8 CONCLUSION

4.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.8.1 PRODUCT INNOVATION AND PORTFOLIO EXPANSION

4.8.2 GEOGRAPHIC EXPANSION AND MARKET PENETRATION

4.8.3 STRATEGIC PARTNERSHIPS AND COLLABORATIONS

4.8.4 SUSTAINABILITY AND ETHICAL SOURCING INITIATIVES

4.8.5 MERGERS, ACQUISITIONS, AND INVESTMENTS

4.8.6 CONCLUSION

4.9 IMPACT OF ECONOMIC SLOWDOWN

4.9.1 IMPACT OF PRICE

4.9.2 IMPACT ON SUPPLY CHAIN

4.9.3 IMPACT ON SHIPMENT

4.9.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.9.5 CONCLUSION

4.1 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.10.1 INCREASING DEMAND FOR NATURAL AND FUNCTIONAL INGREDIENTS

4.10.2 EXPANSION INTO NEW APPLICATION AREAS

4.10.3 ADVANCEMENTS IN PROCESSING TECHNOLOGIES

4.10.4 SUSTAINABILITY AND ETHICAL SOURCING INITIATIVES

4.10.5 REGULATORY COMPLIANCE AND CLEAN-LABEL CERTIFICATION

4.11 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.11.1 ADVANCED CULTIVATION TECHNIQUES

4.11.2 INNOVATIONS IN PROCESSING AND PRESERVATION

4.11.3 INNOVATIONS IN PRODUCT FORMULATION

4.11.4 SUSTAINABLE AND SMART PACKAGING INNOVATIONS

4.11.5 DIGITALIZATION AND SUPPLY CHAIN OPTIMIZATION

4.11.6 CONCLUSION

4.12 RAW MATERIAL SOURCING ANALYSIS

4.12.1 PRIMARY REGIONS OF ACEROLA CULTIVATION

4.12.2 FARMING AND HARVESTING PRACTICES

4.12.3 PROCESSING AT THE SOURCE AND EXPORT TO EUROPE

4.12.4 TRANSPORTATION AND SUPPLY CHAIN LOGISTICS

4.12.5 CHALLENGES IN RAW MATERIAL SOURCING AND MARKET TRENDS

4.12.6 CONCLUSION

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIAL SOURCING AND FARMING

4.13.2 POST-HARVEST HANDLING AND PRIMARY PROCESSING

4.13.3 EXPORT AND INTERNATIONAL LOGISTICS

4.13.4 EUROPEAN PROCESSING AND PRODUCT FORMULATION

4.13.5 DISTRIBUTION AND RETAIL NETWORKS

4.13.6 CONCLUSION

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR NATURAL AND CLEAN-LABEL INGREDIENTS

6.1.2 GROWING AWARENESS FOR HEALTH AND WELLNESS TRENDS

6.1.3 INCREASED USE OF ACEROLA IN FUNCTIONAL BEVERAGES AND DIETARY SUPPLEMENTS

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION AND PROCESSING COSTS

6.2.2 LIMITED AVAILABILITY AND SEASONAL PRODUCTION

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF ORGANIC AND SUSTAINABLE ACEROLA PRODUCTS

6.3.2 RISING DEMAND FOR PLANT-BASED AND VEGAN SUPPLEMENTS

6.4 CHALLENGES

6.4.1 REGULATORY COMPLIANCE CHALLENGES

6.4.2 STIFF COMPETITION FROM OTHER NATURAL VITAMIN C SOURCES

7 EUROPE ACEROLA MARKET, BY PRODUCT FORM

7.1 OVERVIEW

7.2 POWDER

7.3 LIQUID

8 EUROPE ACEROLA MARKET, BY NATURE

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 EUROPE ACEROLA MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 ANTIOXIDANT

9.3 FORTIFICATION

9.4 OTHERS

10 EUROPE ACEROLA MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGE INDUSTRY

10.2.1 FOOD & BEVERAGE INDUSTRY, BY APPLICATION

10.3 PHARMACEUTICAL INDUSTRY

10.4 COSMETICS & SKIN CARE

10.4.1 COSMETICS & SKIN CARE, BY APPLICATION

10.5 NUTRACEUTICALS & DIETARY SUPPLEMENTS

10.5.1 NUTRACEUTICALS & DIETARY SUPPLEMENTS, BY APPLICATION

10.6 ANIMAL NUTRITION & PET FOOD

10.6.1 ANIMAL NUTRITION & PET FOOD, BY APPLICATION

10.7 OTHERS

11 EUROPE ACEROLA MARKET, BY COUNTRY

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 ITALY

11.1.4 FRANCE

11.1.5 SWITZERLAND

11.1.6 NETHERLAND

11.1.7 BELGIUM

11.1.8 RUSSIA

11.1.9 DENMARK

11.1.10 SWEDEN

11.1.11 POLAND

11.1.12 TURKEY

11.1.13 REST OF EUROPE

12 EUROPE ACEROLA MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 KEMIN INDUSTRIES, INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 SYMRISE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 NEXIRA

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 HANDARY S.A.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 NICHIERI CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 BLUE MACAW FLORA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 DUAS RODAS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 FOODCHEM INTERNATIONAL CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 GIVAUDAN

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 NP NUTRA

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 PLANTEX.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 THE GREEN LABS LLC.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY OF KEY MANUFACTURERS

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 5 EUROPE ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD/KG)

TABLE 6 EUROPE ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE ACEROLA MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE ACEROLA MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 15 GERMANY ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 16 GERMANY ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 17 GERMANY ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 18 GERMANY ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 19 GERMANY ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 GERMANY FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 21 GERMANY COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 GERMANY NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 GERMANY ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 U.K. ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 25 U.K. ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 26 U.K. ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 27 U.K. ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 28 U.K. ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 U.K. FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 U.K. COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 31 U.K. NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 32 U.K. ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 33 ITALY ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 34 ITALY ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 35 ITALY ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 36 ITALY ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 37 ITALY ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 38 ITALY FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 ITALY COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 40 ITALY NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 ITALY ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 FRANCE ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 43 FRANCE ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 44 FRANCE ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 45 FRANCE ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 46 FRANCE ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 FRANCE FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 FRANCE COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 49 FRANCE NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 FRANCE ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 SPAIN ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 52 SPAIN ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 53 SPAIN ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 54 SPAIN ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 55 SPAIN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 SPAIN FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 SPAIN COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 SPAIN NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 SPAIN ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 SWITZERLAND ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 61 SWITZERLAND ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 62 SWITZERLAND ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 63 SWITZERLAND ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 64 SWITZERLAND ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 SWITZERLAND FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 SWITZERLAND COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 SWITZERLAND NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 SWITZERLAND ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 69 NETHERLANDS ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 70 NETHERLANDS ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 71 NETHERLANDS ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 72 NETHERLANDS ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 73 NETHERLANDS ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 74 NETHERLANDS FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 75 NETHERLANDS COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 NETHERLANDS NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 NETHERLANDS ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 BELGIUM ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 79 BELGIUM ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 80 BELGIUM ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 81 BELGIUM ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 82 BELGIUM ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 BELGIUM FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 84 BELGIUM COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 85 BELGIUM NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 86 BELGIUM ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 87 RUSSIA ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 88 RUSSIA ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 89 RUSSIA ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 90 RUSSIA ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 91 RUSSIA ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 RUSSIA FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 93 RUSSIA COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 94 RUSSIA NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 RUSSIA ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 DENMARK ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 97 DENMARK ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 98 DENMARK ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 99 DENMARK ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 100 DENMARK ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 DENMARK FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 DENMARK COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 DENMARK NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 104 DENMARK ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 SWEDEN ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 106 SWEDEN ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 107 SWEDEN ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 108 SWEDEN ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 109 SWEDEN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 SWEDEN FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 SWEDEN COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 112 SWEDEN NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 113 SWEDEN ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 114 POLAND ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 115 POLAND ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 116 POLAND ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 117 POLAND ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 118 POLAND ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 POLAND FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 120 POLAND COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 POLAND NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 122 POLAND ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 123 TURKEY ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 124 TURKEY ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

TABLE 125 TURKEY ACEROLA MARKET, BY NATURE, 2018-2032 (USD THOUSAND)

TABLE 126 TURKEY ACEROLA MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 127 TURKEY ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 TURKEY FOOD & BEVERAGE INDUSTRY IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 129 TURKEY COSMETICS & SKIN CARE IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 TURKEY NUTRACEUTICALS & DIETARY SUPPLEMENTS IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 131 TURKEY ANIMAL NUTRITION & PET FOOD IN ACEROLA MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 REST OF EUROPE ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 133 REST OF EUROPE ACEROLA MARKET, BY PRODUCT FORM, 2018-2032 (TONS)

List of Figure

FIGURE 1 EUROPE ACEROLA MARKET

FIGURE 2 EUROPE ACEROLA MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ACEROLA MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ACEROLA MARKET: EUROPE MARKET ANALYSIS

FIGURE 5 EUROPE ACEROLA MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ACEROLA MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE ACEROLA MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE ACEROLA MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE ACEROLA MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE EUROPE ACEROLA MARKET, BY PRODUCT FORM

FIGURE 12 EUROPE ACEROLA MARKET: EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING DEMAND FOR NATURAL AND CLEAN-LABEL INGREDIENTS IS EXPECTED TO DRIVE THE EUROPE ACEROLA MARKET IN THE FORECAST PERIOD

FIGURE 15 THE POWDER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ACEROLA MARKET IN 2024 AND 2031

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 EUROPE ACEROLA MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 VALUE CHAIN ANALYSIS FOR EUROPE ACEROLA MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE ACEROLA MARKET

FIGURE 21 EUROPE ACEROLA MARKET: BY PRODUCT FORM, 2024

FIGURE 22 EUROPE ACEROLA MARKET, BY NATURE, 2024

FIGURE 23 EUROPE ACEROLA MARKET, BY FUNCTION, 2024

FIGURE 24 EUROPE ACEROLA MARKET, BY APPLICATION, 2024

FIGURE 25 EUROPE ACEROLA MARKET: SNAPSHOT (2024)

FIGURE 26 EUROPE ACEROLA MARKET: COMPANY SHARE 2024 (%)

Europe Acerola Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Acerola Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Acerola Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.