Europe Alpha And Beta Emitters Based Radiopharmaceuticals Market

Market Size in USD Million

CAGR :

%

USD

215.99 Million

USD

465.84 Million

2024

2032

USD

215.99 Million

USD

465.84 Million

2024

2032

| 2025 –2032 | |

| USD 215.99 Million | |

| USD 465.84 Million | |

|

|

|

|

Alpha and Beta Emitters Based Radiopharmaceuticals Market Size

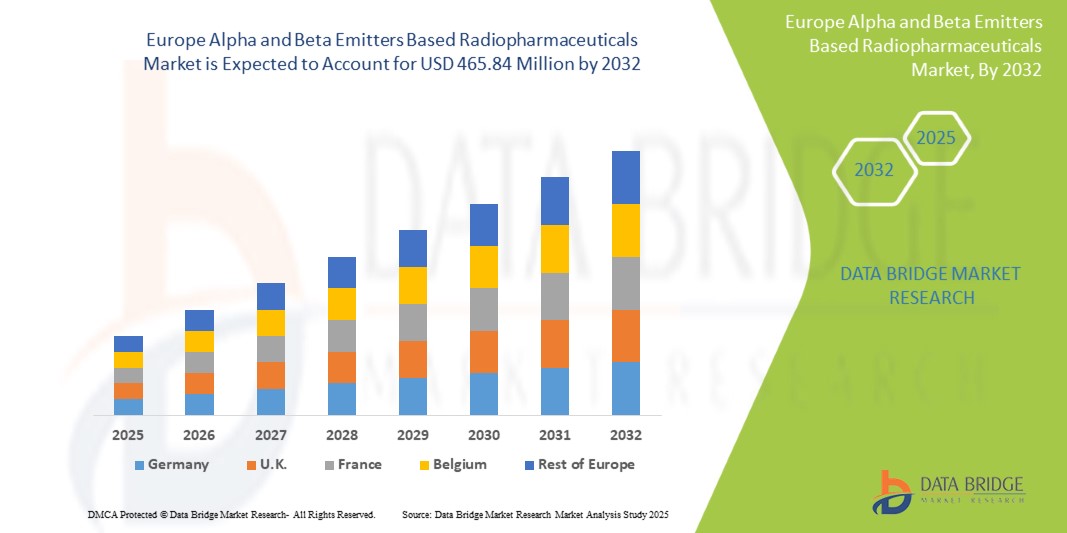

- The Europe alpha and beta emitters based radiopharmaceuticals market size was valued at USD 215.99 million in 2024 and is expected to reach USD 465.84 million by 2032, at a CAGR of 10.1% during the forecast period

- The market growth is largely fueled by the increased efficacy of targeted alpha and beta therapies

- Furthermore, growing adoption of theranostics in personalized medicine. These converging factors are accelerating the uptake of alpha and beta emitters based radiopharmaceuticals solutions, thereby significantly boosting the industry's growth

Alpha and Beta Emitters Based Radiopharmaceuticals Market Analysis

- Alpha and beta emitters based radiopharmaceuticals are increasingly recognized for their precision in targeted therapy, especially in oncology and nuclear medicine, providing effective diagnosis and treatment options with minimal side effects

- The rising incidence of cancer worldwide, along with growing awareness about personalized medicine and advancements in radiopharmaceutical technology, is driving Europe demand for alpha and beta emitters based radiopharmaceuticals

- Germany holds a significant share in the alpha and beta emitters based radiopharmaceuticals market, accounting for approximately 18.67% of the revenue in 2025, supported by advanced healthcare infrastructure, extensive R&D activities, and early adoption of novel therapeutic technologies

- Germany is anticipated to be the fastest-growing market for alpha and beta emitters based radiopharmaceuticals during the forecast period, propelled by expanding healthcare infrastructure, increasing cancer prevalence, government initiatives for healthcare improvement

- The beta emitters segment is expected to dominate the market with a share of 84.08% in 2025, driven by their high efficacy in Targeted Alpha Therapy (TAT), improved patient outcomes, and rising research focused on alpha-emitting isotopes like Actinium-225 and Radium-223 for cancer treatment

Report Scope and Alpha and Beta Emitters Based Radiopharmaceuticals Market Segmentation

|

Attributes |

Alpha and Beta Emitters Based Radiopharmaceuticals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Alpha and Beta Emitters Based Radiopharmaceuticals Market Trends

“Increased Efficacy of Targeted Alpha and Beta Therapies”

- A major driving force behind the Europe alpha and beta emitters based radiopharmaceuticals market is the increasing clinical adoption of targeted radionuclide therapies, owing to their proven efficacy in treating advanced cancers such as neuroendocrine tumors and metastatic castration-resistant prostate cancer (mCRPC). These therapies offer high precision and minimal toxicity compared to conventional treatments

- For instance, in May 2023, according to the article published by NCBI, the approved [177Lu]Lu-PSMA-617 regimen (7.4 GBq per cycle every 6 weeks for up to 6 cycles) has shown strong safety and anti-tumor efficacy in real-world use, with flexible dosing (6–9.3 GBq) and treatment intervals (4–10 weeks). This consistent clinical performance enhances physician confidence and accelerates market adoption

- Radiopharmaceuticals like Lu-177, particularly when used in peptide receptor radionuclide therapy (PRRT), have demonstrated remarkable success in the treatment of neuroendocrine tumors, delivering potent beta radiation directly to tumor sites while preserving healthy tissues—leading to improved outcomes and increased demand

- Technological advancements and clinical validation of alpha-emitting isotopes, such as Ac-225, have further propelled the market. Ac-225 has proven highly effective in targeting prostate cancer cells resistant to traditional therapies, with minimal side effects and strong therapeutic impact

Alpha and Beta Emitters Based Radiopharmaceuticals Market Dynamics

Driver

“Growing Adoption of Theranostics in Personalized Medicine”

- The increasing adoption of theranostic alpha- and beta-emitter radiopharmaceuticals—such as Lutetium-177 (Lu-177) and Terbium-161 (Tb-161)—is a major driver propelling the Europe radiopharmaceuticals market. By pairing diagnostic imaging with targeted therapy in a single clinical workflow, these agents deliver precise, patient-specific care that improves outcomes and streamlines treatment planning

- For instance, in July 2023, a review published in NCBI reported rising clinical use of Lu-177–based theranostic regimens (e.g., ¹⁷⁷Lu-DOTATATE for neuroendocrine tumors and ¹⁷⁷Lu-PSMA for prostate cancer). FDA approvals for these agents validated their safety and efficacy, accelerating adoption and highlighting the powerful synergy of matched diagnostic–therapeutic pairs

- Growing awareness among oncologists and nuclear-medicine specialists of the workflow efficiency, treatment accuracy, and reduced toxicity associated with theranostic approaches is driving demand, as clinicians seek reliable tools for personalized cancer management.

- Furthermore, as healthcare systems face mounting pressures to improve survival rates and control costs, integrated imaging-therapy solutions like Lu-177 and Tb-161 reduce time to treatment, avoid ineffective interventions, and enhance quality of life—solidifying their value proposition

- The rising preference for precision oncology, coupled with ongoing R&D in next-generation isotopes such as Tb-149, Tb-152/155, and Ac-225, positions theranostic radiopharmaceuticals as a cornerstone of modern cancer care and a key growth engine for the Europe market

Restraint/Challenge

“Supply Chain and Scalability Challenges from Short Isotope Half-Lives”

- The short half-life of radionuclides such as Lead-212 (~10.6 hours) creates major logistical and operational hurdles: production must occur close to treatment sites, transport windows are only a few hours, and highly coordinated “just-in-time” supply chains are required—collectively constraining large-scale manufacturing and market reach

- For instance, in April 2025 L.E.K. Consulting noted that Pb-212’s 10.6-hour half-life forces decentralized, near-patient production and on-site generator infrastructure, limiting economies of scale and complicating distribution logistics

- Furthermore, the intricate generator systems needed to extract Pb-212 (and other short-lived isotopes) add layers of regulatory compliance, radiation-safety requirements, and capital expenditure, making broad deployment difficult for hospitals and radiopharmacies

- While advances in compact generators, faster purification methods, and regional production hubs could eventually ease these pressures, the fundamental time-sensitive nature of short-lived isotopes remains a significant restraint on the widespread adoption and growth of the radiopharmaceuticals market

Alpha and Beta Emitters Based Radiopharmaceuticals Market Scope

The market is segmented on the of isotope, sources, therapeutic application, vector type, and end user.

- By Isotope

On the basis of isotope type, the market is segmented into beta emitters and alpha emitters. In 2025, the beta emitters segment is expected to dominate the market with the 84.08% market share, owing to the widespread clinical adoption of isotopes such as Lutetium-177 (Lu-177) and Yttrium-90 (Y-90) for treating neuroendocrine tumors, liver cancer, and prostate cancer. Beta emitters are preferred for their relatively longer half-lives, established safety profiles, and compatibility with existing clinical workflows.

The beta emitters segment is projected to witness the fastest growth rate of 10.2% from 2025 to 2032, driven by increasing usage of Actinium-225 (Ac-225) and Lead-212 (Pb-212) in advanced cancer treatments. Alpha emitters offer high linear energy transfer (LET) and greater tumor-killing efficacy with minimal collateral damage, making them highly suitable for resistant and metastatic cancers.

- By Sources

On the basis of sources, the market is categorized into reactor-produced isotopes, generator-produced isotopes, and others. In 2025, reactor-produced isotopes will lead the market due to the high-volume supply and broad availability of key beta emitters such as Lu-177 and Iodine-131.

However, reactor-produced isotopes are expected to be the fastest-growing segment, propelled by increasing demand for isotopes like Pb-212 and Ra-223, which require decentralized and near-patient production. The rise of on-site generators also aligns with the growing interest in alpha therapies and short-lived radiopharmaceuticals.

- By Therapeutic Application

On therapeutic application, the market is segmented into oncology and others. In 2025, oncology dominates the market, as radiopharmaceuticals play a central role in targeted therapies for prostate cancer, neuroendocrine tumors, and lymphoma. The increasing success of PSMA-targeted and PRRT-based therapies reinforces the leadership of oncology in this space.

The oncology segment includes cardiovascular, endocrine, and neurological disorders and is anticipated to witness steady growth with the development of novel radioligands and expansion into non-oncologic indications.

- By Vector Type

On the basis of vector type, the market is segmented into small molecule ligands, peptides, monoclonal antibodies, and others. In 2025, small molecule ligands are expected to hold the largest market share due to their rapid tissue penetration and widespread use in PSMA and somatostatin-targeted therapies.

Small molecule ligands are poised for significant growth during the forecast period due to advances in conjugation technologies and their ability to offer enhanced tumor selectivity, longer circulation times, and improved binding efficiency. These vectors are especially critical for alpha emitter therapies where precision is paramount.

- By End User

On the basis of, the market is segmented by end user into hospitals, radiopharmacies, and research institutes. In 2025, hospitals will account for the largest share, driven by increasing patient access to nuclear medicine, growth of theranostic departments, and strong reimbursement frameworks in developed countries.

The radiopharmacies segment is expected to grow rapidly due to the rising demand for centralized and decentralized compounding of radiopharmaceuticals, especially those with short half-lives. Research institutes will continue to play a vital role in innovation and clinical trials, particularly for next-generation isotopes like Terbium-161 and Actinium-225.

Alpha and Beta Emitters Based Radiopharmaceuticals Market Regional Analysis

- Germany leads the Alpha and Beta Emitters Based Radiopharmaceuticals Market, holding the largest revenue share and is expected to register the fastest CAGR of 12.5% in 2025. This growth is driven by its advanced healthcare infrastructure, strong clinical research ecosystem, and growing demand for precision oncology treatments. The country is poised for steady growth, fueled by increased adoption of targeted alpha and beta therapies in cancer diagnostics and treatment.

- Robust government funding for nuclear medicine, strategic collaborations between academic institutions and pharmaceutical companies, and a well-established regulatory framework are accelerating innovation and commercialization in the radiopharmaceuticals space. These factors position Germany as a leading hub for radiopharmaceutical development and clinical application within Europe

U.K. Alpha and Beta Emitters Based Radiopharmaceuticals Market Insight

U.K. is poised to capture a significant share of the European market in 2025, supported by its expanding network of nuclear medicine centers, strong academic-clinical partnerships, and government initiatives aimed at advancing radiopharmaceutical research and commercialization. Strategic investments in isotope production capabilities, including facilities for actinium-225 and lutetium-177.

France Alpha and Beta Emitters Based Radiopharmaceuticals Market Insight

France shows solid expansion as climate-resilient healthcare policy encourages low-dose, high-efficacy therapies, and clusters around Orano and CEA channel funding into next-generation alpha-emitter programs and decentralized generator deployment.

Italy Alpha and Beta Emitters Based Radiopharmaceuticals Market Insight

Italy is witnessing steady growth in the Alpha and Beta Emitters Based Radiopharmaceuticals Market, driven by its national focus on personalized cancer care and expansion of nuclear medicine departments across major hospitals. Regional innovation hubs, supported by collaborations with institutions like ENEA and leading oncology centers, are channeling investments into advanced alpha-emitter research and pilot production of therapeutic isotopes. Italy's strategic push toward integrating targeted radiotherapies into public healthcare is reinforcing its role in shaping the future of radiopharmaceuticals in Southern Europe.

Alpha and Beta Emitters Based Radiopharmaceuticals Market Share

The alpha and beta emitters based radiopharmaceuticals market is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Eckert & Ziegler Germany)

- ITM Isotope Technologies Munich SE (Germany)

- SHINE Technologies, LLC (U.S.)

- Actinium Pharmaceuticals, Inc. (U.S.)

- ARICEUM THERAPEUTICS (Germany)

- Bayer AG (Germany)

- Curium (U.S.)

- Isotopia (Israel)

- Lantheus (U.S.)

- Lilly (U.S.)

- Oncoinvent (Norway)

- Orano Group (Paris)

- Telix Pharmaceuticals Limited (Australia)

- Terthera (Netherlands)

Latest Developments in Alpha and Beta Emitters Based Radiopharmaceuticals Market

- In May 2025, ITM Isotope Technologies Munich SE and Radiopharm Theranostics announced a supply agreement for non-carrier-added Lutetium-177 (n.c.a. 177Lu). The partnership supports Radiopharm’s clinical development of Lu-177-based therapies, including RAD 204, RAD 202, and RV01, ensuring high-quality isotope access for targeted radiopharmaceutical treatment of solid tumors in ongoing and future clinical trials

- In March 2025, the FDA approved Novartis’ Pluvicto (Lu-177 vipivotide tetraxetan) for earlier use in PSMA-positive metastatic castration-resistant prostate cancer, allowing administration after one ARPI and before chemotherapy. Based on Phase III PSMAfore trial results, Pluvicto reduced progression or death risk by 59%, doubling median radiographic progression-free survival while maintaining a favorable safety profile and expanding patient access significantly

- In March 2025, Eckert & Ziegler and AtomVie Europe Radiopharma signed a Europe supply agreement for non-carrier added Lutetium-177 (Theralugand). The partnership ensures a stable, high-quality Lu-177 supply for AtomVie’s CDMO radiopharmaceutical operations, supporting early-to-late-stage development worldwide and enhancing both companies' capabilities in radiopharmaceutical innovation, regulatory compliance, and patient-centered nuclear medicine solutions

- In March 2025, Eckert & Ziegler and Actinium Pharmaceuticals signed a supply agreement for high-purity Actinium-225 (Ac-225). The partnership ensures a reliable Ac-225 source to support the development of Actimab-A and other radiotherapeutic candidates targeting AML and solid tumors, strengthening Actinium’s clinical pipeline and addressing Europe isotope supply challenges in precision radiopharmaceutical therapy

- In May 2024, Novartis AG announced its agreement to acquire Mariana Oncology for USD 1 billion upfront and up to USD 750 million in milestone payments. The acquisition strengthens Novartis’ radioligand therapy (RLT) pipeline with preclinical assets targeting solid tumors, including actinium-based candidate MC-339 for small cell lung cancer, and enhances its RLT research, supply, and innovation capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 END USER MARKET COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 PIPELINE

4.4 SUPPLY CHAIN ECOSYSTEM

4.4.1 PROMINENT COMPANIES

4.4.2 SMALL & MEDIUM SIZE COMPANIES

4.4.3 END USERS

4.5 INDUSTRY INSIGHTS

4.5.1 MICRO AND MACRO ECONOMIC FACTORS

4.5.2 KEY PRICING STRATEGIES

4.6 MARKETED DRUG ANALYSIS

4.6.1 DRUG

4.6.1.1 BRAND NAME

4.6.1.2 GENERIC NAME

4.6.2 THERAPEUTIC INDICATION

4.6.3 PHARMACOLOGICAL CLASS OF THE DRUG

4.6.4 DRUG PRIMARY INDICATION

4.6.5 MARKET STATUS

4.6.6 MEDICATION TYPE

4.6.7 DRUG DOSAGE FORM

4.6.8 DOSAGES AVAILABILITY

4.6.9 PACKAGING TYPE

4.6.10 DRUG ROUTE OF ADMINISTRATION

4.6.11 DOSING FREQUENCY

4.6.12 DRUG INSIGHT

4.6.13 OVERVIEW OF DRUG DEVELOPMENT ACTIVITIES

4.6.13.1 FORECAST MARKET OUTLOOK

4.6.13.2 CROSS COMPETITION

4.6.13.3 THERAPEUTIC PORTFOLIO

4.6.13.4 CURRENT DEVELOPMENT SCENARIO

4.7 HEALTHCARE TARIFFS IMPACT ANALYSIS

4.7.1 OVERVIEW

4.7.2 TARIFF STRUCTURES

4.7.2.1 EUROPE VS. REGIONAL TARIFF STRUCTURES

4.7.2.2 UNITED STATES: MEDICARE/MEDICAID TARIFF POLICIES, CMS PRICING MODELS

4.7.2.3 EUROPEAN UNION: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

4.7.2.4 ASIA-PACIFIC: GOVERNMENT-IMPOSED TARIFFS ON IMPORTED MEDICAL PRODUCTS

4.7.2.5 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

4.7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

4.7.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

4.7.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

4.7.3.3 KEY TRADE AGREEMENTS AFFECTING PHARMACEUTICAL TARIFFS

4.8 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

4.8.1.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

4.8.1.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

4.8.1.3 TARIFFS AND THEIR ROLE IN MEDICAL TOURISM

4.8.2 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

4.8.2.1 WTO REGULATIONS ON HEALTHCARE TARIFFS

4.8.2.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

4.8.2.3 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

4.8.3 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

4.8.4 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

4.9 EPIDEMIOLOGY OVERVIEW

4.9.1 INCIDENCE OF ALL CANCERS BY GENDER

4.9.2 TREATMENT RATE

4.9.3 MORTALITY RATE

4.9.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

4.9.5 PATIENT TREATMENT SUCCESS RATES

5 REGULATORY FRAMEWORK

5.1 REGULATORY FRAMEWORK OVERVIEW FOR THE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

5.1.1 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.1.2 REGULATORY APPROVAL PATHWAYS

5.1.3 LICENSING AND REGISTRATION

5.1.4 POST-MARKETING SURVEILLANCE

5.1.5 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED EFFICACY OF TARGETED ALPHA AND BETA THERAPIES

6.1.2 GROWING ADOPTION OF THERANOSTICS IN PERSONALIZED MEDICINE

6.1.3 RISING CLINICAL DEMAND FOR ALPHA-BASED RADIOTHERAPIES

6.1.4 RISING CHRONIC DISEASE BURDEN DRIVING RADIOPHARMACEUTICAL DEMAND

6.2 RESTRAINTS

6.2.1 SUPPLY CHAIN AND SCALABILITY CHALLENGES FROM SHORT ISOTOPE HALF-LIVES

6.2.2 STRINGENT REGULATORY LANDSCAPE LIMITING MARKET FLEXIBILITY

6.2.3 SAFETY AND EXPOSURE RISKS IN RADIOPHARMACEUTICAL USE

6.3 OPPORTUNITIES

6.3.1 SURGE IN R&D ACTIVITY EXPANDING RADIOPHARMACEUTICAL APPLICATIONS

6.3.2 EXPANSION OF LU-177-PSMA THERAPY IN PROSTATE CANCER TREATMENT

6.3.3 STRATEGIC COLLABORATIONS DRIVING RADIOPHARMACEUTICAL INNOVATION

6.4 CHALLENGES

6.4.1 HIGH COST OF DEVELOPMENT AND IMPLEMENTATION OF RADIOPHARMACEUTICALS

6.4.2 SHORTAGE OF SKILLED WORKFORCE IN NUCLEAR MEDICINE AND RADIOCHEMISTRY

7 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE

7.1 OVERVIEW

7.2 BETA EMITTERS

7.2.1 LUTETIUM-177

7.2.2 TERBIUM-161

7.3 ALPHA EMITTERS

7.3.1 ACTINIUM-225

7.3.2 LEAD -212

8 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES

8.1 OVERVIEW

8.2 REACTOR-PRODUCED ISOTOPES

8.3 GENERATOR-PRODUCED ISOTOPES

8.4 OTHERS

9 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION

9.1 OVERVIEW

9.2 ONCOLOGY

9.2.1 PROSTATE CANCER

9.2.2 NEUROENDOCRINE TUMORS

9.2.3 LIVER CANCER

9.2.4 BRAIN TUMORS

9.2.5 BREAST CANCER

9.2.6 LEUKEMIA

9.3 OTHERS

10 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULE LIGANDS

10.3 PEPTIDES

10.4 MONOCLONAL ANTIBODIES

10.5 OTHERS

11 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.2.1 ONCOLOGY CENTERS

11.2.2 NUCLEAR MEDICINE DEPARTMENTS

11.3 RADIOPHARMACIES

11.4 RESEARCH INSTITUTES

12 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K.

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 POLAND

12.1.7 RUSSIA

12.1.8 NORWAY

12.1.9 TURKEY

12.1.10 AUSTRIA

12.1.11 IRELAND

12.1.12 NETHERLANDS

12.1.13 SWITZERLAND

12.1.14 REST OF EUROPE

13 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 NOVARTIS AG

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 ECKERT & ZIEGLER

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 ITM ISOTOPE TECHNOLOGIES MUNICH SE

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SHINE TECHNOLOGIES, LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ACTINIUM PHARMACEUTICALS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 PIPELINE PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ALPHA TAU MEDICAL LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 PIPELINE PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ARICEUM THERAPEUTICS

15.7.1 COMPANY SNAPSHOT

15.7.2 PIPELINE PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BAYER AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PIPELINE PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 CURIUM

15.9.1 COMPANY SNAPSHOT

15.9.2 PIPELINE PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 IONETIX CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PIPELINE PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 ISOTOPIA

15.11.1 COMPANY SNAPSHOT

15.11.2 PIPELINE PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 LANTHEUS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PIPELINE PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 LILLY

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PIPELINE PRODUCT PORTFOLIO

15.14 NIOWAVE

15.14.1 COMPANY SNAPSHOT

15.14.2 PIPELINE PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 NMR

15.15.1 COMPANY SNAPSHOT

15.15.2 PIPELINE PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ONCOINVENT

15.16.1 COMPANY SNAPSHOT

15.16.2 PIPELINE PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ORANO GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PIPELINE PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 RADIOPHARM THERANOSTICS LIMITED

15.18.1 COMPANY SNAPSHOT

15.18.2 PIPELINE PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TELIX PHARMACEUTICALS LIMITED

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PIPELINE PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TERTHERA

15.20.1 COMPANY SNAPSHOT

15.20.2 PIPELINE PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 EUROPE CLINICAL TRIAL MARKET FOR EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET

TABLE 5 PENETRATION AND GROWTH PROSPECT MAPPING

TABLE 6 INCIDENCE OF CANCER BY GENDER

TABLE 7 CANCER MORTALITY RATE

TABLE 8 CANCER TREATMENT SUCCESS RATE

TABLE 9 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE REACTOR-PRODUCED ISOTOPES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE GENERATOR-PRODUCED ISOTOPES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE SMALL MOLECULE LIGANDS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE PEPTIDES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE MONOCLONAL ANTIBODIES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE OTHERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE RADIOPHARMACIES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE RESEARCH INSTITUTES IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 43 GERMANY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 GERMANY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 46 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 GERMANY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 GERMANY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 GERMANY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 52 U.K. BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 U.K. ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 55 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 U.K. ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.K. ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 59 U.K. HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 61 FRANCE BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 FRANCE ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 64 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 FRANCE ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 FRANCE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 68 FRANCE HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 70 ITALY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 ITALY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 73 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 74 ITALY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 ITALY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 77 ITALY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 79 SPAIN BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 SPAIN ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 82 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 SPAIN ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 SPAIN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 86 SPAIN HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 88 POLAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 POLAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 91 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 POLAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 POLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 95 POLAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 97 RUSSIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 RUSSIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 100 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 RUSSIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 RUSSIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 104 RUSSIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 106 NORWAY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NORWAY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 109 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 NORWAY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NORWAY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 113 NORWAY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 115 TURKEY BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 TURKEY ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 118 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 119 TURKEY ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 TURKEY ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 122 TURKEY HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 124 AUSTRIA BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 AUSTRIA ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 127 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 128 AUSTRIA ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 AUSTRIA ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 131 AUSTRIA HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 133 IRELAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 IRELAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 136 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 137 IRELAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 IRELAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 140 IRELAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 142 NETHERLANDS BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 NETHERLANDS ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 145 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 146 NETHERLANDS ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 NETHERLANDS ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 149 NETHERLANDS HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

TABLE 151 SWITZERLAND BETA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SWITZERLAND ALPHA EMITTERS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY SOURCES, 2018-2032 (USD THOUSAND)

TABLE 154 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY THERAPEUTIC APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 SWITZERLAND ONCOLOGY IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY VECTOR TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SWITZERLAND ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 158 SWITZERLAND HOSPITALS IN ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 REST OF EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: SEGMENTATION

FIGURE 2 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: MULTIVARIATE MODELLING

FIGURE 7 CURVE LINE CHART, BY ISOTOPE

FIGURE 8 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: END USER MARKET COVERAGE GRID

FIGURE 12 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: SEGMENTATION

FIGURE 13 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 TWO SEGMENTS COMPRISE THE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET, BY ISOTOPE 2024

FIGURE 16 INCREASED EFFICACY OF TARGETED ALPHA AND BETA THERAPIES IS EXPECTED TO DRIVE THE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET IN THE FORECAST PERIOD

FIGURE 17 BETA EMITTERS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET IN 2025 & 2032

FIGURE 18 INCIDENCE BY CANCER SITE

FIGURE 19 CANCER MORTALITY RATE WITH CANCER SITE

FIGURE 20 DROC ANALYSIS

FIGURE 21 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY ISOTOPE, 2024

FIGURE 22 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY ISOTOPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 23 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY ISOTOPE, CAGR (2025-2032)

FIGURE 24 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY ISOTOPE, LIFELINE CURVE

FIGURE 25 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY SOURCES, 2024

FIGURE 26 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY SOURCES, 2025 TO 2032 (USD THOUSAND)

FIGURE 27 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY SOURCES, CAGR (2025-2032)

FIGURE 28 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY SOURCES, LIFELINE CURVE

FIGURE 29 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY THERAPEUTIC APPLICATION, 2024

FIGURE 30 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY THERAPEUTIC APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 31 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY THERAPEUTIC APPLICATION, CAGR (2025-2032)

FIGURE 32 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY THERAPEUTIC APPLICATION, LIFELINE CURVE

FIGURE 33 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY VECTOR TYPE, 2024

FIGURE 34 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY VECTOR TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 35 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY VECTOR TYPE, CAGR (2025-2032)

FIGURE 36 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY VECTOR TYPE, LIFELINE CURVE

FIGURE 37 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY END USER, 2024

FIGURE 38 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 39 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 40 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: BY END USER, LIFELINE CURVE

FIGURE 41 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: SNAPSHOT (2024)

FIGURE 42 EUROPE ALPHA AND BETA EMITTERS BASED RADIOPHARMACEUTICALS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.