Europe Anti Nuclear Antibody Test Market

Market Size in USD Million

CAGR :

%

USD

659.47 Million

USD

1,728.50 Million

2024

2032

USD

659.47 Million

USD

1,728.50 Million

2024

2032

| 2025 –2032 | |

| USD 659.47 Million | |

| USD 1,728.50 Million | |

|

|

|

|

Europe Anti-Nuclear Antibody Test Market Size

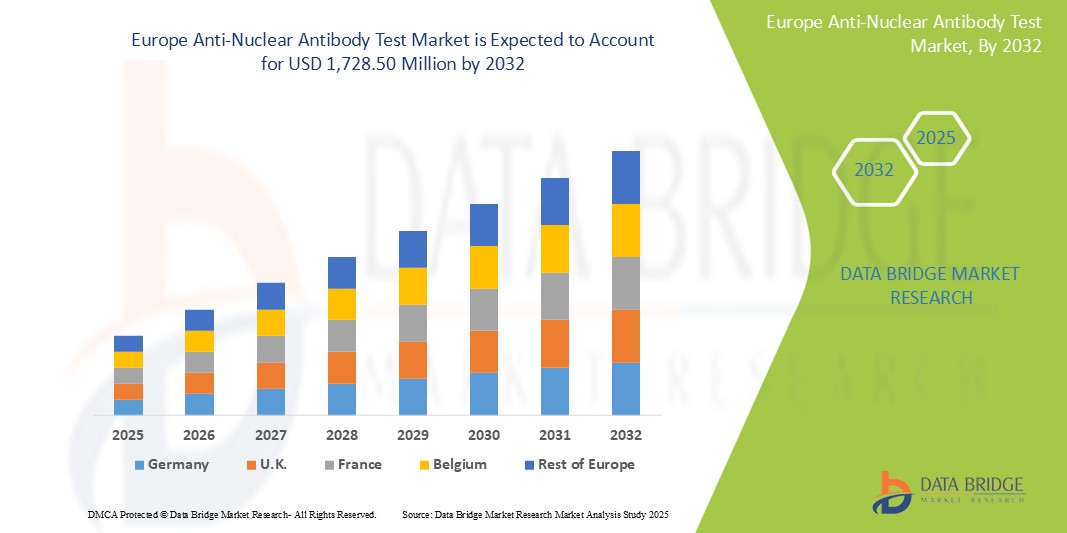

- The Europe anti-nuclear antibody test market size was valued at USD 659.47 million in 2024 and is expected to reach USD 1,728.50 million by 2032, at a CAGR of 12.8% during the forecast period

- This growth is driven by factors such as the rising prevalence of autoimmune diseases, technological advancements in diagnostic methods, and increased public awareness and early detection initiatives

Europe Anti-Nuclear Antibody Test Market Analysis

- Anti-Nuclear Antibody (ANA) tests are critical diagnostic tools used to detect autoantibodies in the blood, aiding in the diagnosis of autoimmune diseases such as systemic lupus erythematosus (SLE), rheumatoid arthritis, and Sjögren’s syndrome. These tests play a vital role in early detection and management of these conditions

- The demand for ANA tests is significantly driven by the rising prevalence of autoimmune disorders, increasing awareness of early diagnosis, and advancements in diagnostic technologies

- Germany is expected to dominate the Europe anti-nuclear antibody test market with 25.6% market share due to its advanced healthcare system, high patient awareness, and presence of advanced testing technologies

- Italy is expected to be the fastest growing country Europe anti-nuclear antibody test market with a CAGR of 13.4%, to an increase in autoimmune diseases such as lupus, rheumatoid arthritis, and Sjögren’s syndrome. This rising disease burden has led to a higher demand for early and accurate diagnostic testing, including ANA tests

- Indirect immunofluorescence (IIF), is expected to dominate the market with a with a market share of 59.9%. This dominance is attributed to its status as the gold standard for ANA testing, offering high sensitivity and the ability to detect a wide range of autoantibodies

Report Scope and Europe Anti-Nuclear Antibody Test Market Segmentation

|

Attributes |

Europe Anti-Nuclear Antibody Test Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Anti-Nuclear Antibody Test Market Trends

“Technological Advancements in Anti-Nuclear Antibody Testing for Autoimmune Disease Diagnosis”

- One prominent trend in the Europe anti-nuclear antibody test market is the growing integration of advanced diagnostic technologies, including automated systems and multiplex assays, to improve accuracy and efficiency

- These innovations enhance diagnostic precision by allowing simultaneous detection of multiple autoantibodies, reducing turnaround times, and minimizing human error, thereby supporting early diagnosis and personalized treatment

- For instance, advanced multiplex assay platforms can detect a broad spectrum of autoantibodies in a single test, providing comprehensive patient profiles that are critical for managing complex autoimmune conditions such as systemic lupus erythematosus (SLE) and rheumatoid arthritis

- These advancements are transforming the autoimmune diagnostics landscape, improving patient outcomes, and driving the demand for next-generation ANA testing solutions with enhanced sensitivity and specificity

Europe Anti-Nuclear Antibody Test Market Dynamics

Driver

“Rising Prevalence of Autoimmune Diseases”

- The growing incidence of autoimmune disorders such as systemic lupus erythematosus (SLE), rheumatoid arthritis, Sjögren’s syndrome, and systemic sclerosis is significantly driving the demand for anti-nuclear antibody tests

- Autoimmune diseases are becoming more common due to a combination of genetic, environmental, and lifestyle factors, increasing the need for accurate and early diagnostics to manage these complex conditions

- As awareness about autoimmune disorders grows, healthcare providers are increasingly adopting ANA tests as part of routine diagnostics to improve patient outcomes and reduce long-term healthcare costs

For instance,

- In March 2024, according to a report published by the European Society of Rheumatology, the prevalence of SLE in Europe is estimated to be approximately 0.1-0.2% of the population, with a significant portion of these patients requiring regular ANA testing for disease management and monitoring

- As the prevalence of autoimmune diseases continues to rise, the demand for ANA tests is expected to grow, supporting early diagnosis, personalized treatment, and better patient outcomes

Opportunity

“Integration of Advanced Diagnostic Technologies”

- Technological advancements in ANA testing, including multiplex assays, automated platforms, and artificial intelligence (AI)-driven diagnostic tools, present significant growth opportunities in the market

- These technologies enable faster, more accurate, and cost-effective diagnosis by simultaneously detecting multiple autoantibodies, reducing turnaround times, and minimizing human error

- In addition, AI-powered systems can analyze test results in real-time, providing predictive insights into disease progression and helping clinicians make more informed decisions

For instance,

- In January 2025, according to a study published in the Journal of Autoimmunity, AI algorithms developed for ANA testing demonstrated higher accuracy in detecting early-stage autoimmune diseases, reducing false positives and improving overall diagnostic efficiency. This integration can significantly improve patient outcomes by facilitating early intervention and targeted therapies

- The adoption of these advanced technologies is expected to drive market growth, as laboratories and healthcare providers seek to enhance diagnostic capabilities and patient care

Restraint/Challenge

“High Cost of Advanced Diagnostic Systems”

- Despite the benefits, the high cost of advanced ANA testing systems and multiplex platforms presents a significant barrier to market growth, particularly for smaller laboratories and healthcare facilities with limited budgets

- The initial investment required for automated systems and specialized testing equipment can be prohibitive, impacting the affordability and accessibility of advanced diagnostics

- This financial burden can delay the adoption of cutting-edge technologies, particularly in regions with constrained healthcare budgets, limiting the reach of advanced autoimmune diagnostics

For instance,

- In November 2024, according to a report by the European Diagnostic Manufacturers Association, the high cost of multiplex assay platforms and automated ANA testing systems remains a critical challenge, as smaller laboratories struggle to justify the investment without substantial volume growth or reimbursement support

- Consequently, this cost barrier can lead to disparities in diagnostic quality, limiting access to early and accurate autoimmune disease detection for many patients

Europe Anti-Nuclear Antibody Test Market Scope

The market is segmented on the basis of antibody type, product, technique, application, end user and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Antibody Type |

|

|

By Product |

|

|

By Technique |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the indirect immunofluorescence (IIF) is projected to dominate the market with a largest share in technique segment

The indirect immunofluorescence (IIF) is expected to dominate the Europe anti-nuclear antibody test market with the largest share of 59.9% in 2025. This dominance is primarily due to its status as the gold standard for ANA testing, known for its high sensitivity and ability to detect a wide range of autoantibodies. IIF's capability to identify various staining patterns significantly aids in diagnosing multiple autoimmune diseases, making it the preferred choice among clinicians. Continuous advancements in IIF technology, coupled with the rising prevalence of autoimmune disorders, are key factors driving its market leadership.

The extractable nuclear antigens (ENA) is expected to account for the largest share during the forecast period in antibody type market

In 2025, the extractable nuclear antigens (ENA) segment is expected to dominate the market with the largest market share of 34.7% due to its high diagnostic relevance in systemic autoimmune rheumatic diseases (SARDs), including systemic lupus erythematosus, Sjögren's syndrome, and systemic sclerosis. The ability of ENA panels to detect multiple autoantibodies simultaneously enhances diagnostic accuracy and efficiency. Increasing awareness among clinicians, advancements in multiplex assay technologies, and growing autoimmune disease prevalence further support the segment's leading position in the market.

Europe Anti-Nuclear Antibody Test Market Regional Analysis

- Western Europe holds a dominant share of the Europe anti-nuclear antibody test market, driven by a well-established healthcare infrastructure, advanced medical technologies, and a high demand for specialized diagnostic solutions. Western Europe accounts for approximately 28% of the Europe ANA test market

- Germany is the leading country in Europe with market share of 25.6%. due to its advanced healthcare system, high patient awareness, and presence of advanced testing technologies

- U.K. holds a significant share in the Europe anti-nuclear antibody test market, attributed to a robust healthcare infrastructure and increasing demand for specialized diagnostic tests

- Italy is projected to experience the highest compound annual growth rate (CAGR) of 13.4% in the market during the forecast period due to an increase in autoimmune diseases such as lupus, rheumatoid arthritis, and Sjögren’s syndrome. This rising disease burden has led to a higher demand for early and accurate diagnostic testing, including ANA tests

- Eastern European countries, including Poland, Russia, and Hungary, are experiencing rapid market growth due to increasing healthcare investments, rising awareness, and a shift toward modern healthcare solutions. Eastern Europe is estimated to contribute around 5–6% to the Europe ANA test market

- The growing trend of home healthcare in Europe, particularly in countries such as the Netherlands and Sweden, is boosting the demand for ANA testing services. Patients are increasingly treated at home for chronic conditions, driving the adoption of advanced diagnostic tools. Home healthcare-related diagnostic solutions in Europe account for approximately 4% of the Europe ANA test market

Europe Anti-Nuclear Antibody Test Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BioNTech SE (Germany)

- Genmab A/S (Denmark)

- Evotec SE (Germany)

- Grifols S.A. (Spain)

- CRISPR Therapeutics (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Trinity Biotech Ireland (Ireland)

- EUROIMMUN Medizinische Labordiagnostika AG (Germany)

Latest Developments in Europe Anti-Nuclear Antibody Test Market

- In June 2023, EUROIMMUN Medizinische Labordiagnostika AG (Germany), a Revvity company, launched the UNIQO 160, an advanced automated indirect immunofluorescence test (IIFT) system. This system automates the entire IIFT process—from sample preparation to image analysis—enhancing diagnostic efficiency and reliability in autoimmune disease testing

- In May 2023, Thermo Fisher Scientific introduced the Autoimmune Assay Kit, designed to provide rapid and accurate results for autoimmune disease detection. This new product aims to improve diagnostic capabilities and patient management

- In March 2023, Trinity Biotech launched the Autoimmune Panel Plus, a diagnostic assay offering enhanced accuracy and speed in detecting various autoimmune diseases. This product significantly improves diagnostic workflows in clinical laboratories

- In June 2022, THERADIAG entered into a partnership with Quotient Limited to advance autoimmune diagnostics by leveraging Quotient's MosaiQ platform. Under this agreement, Theradiag supplies Quotient with autoimmune reagents and quality controls for the development of autoimmune microarrays, with the first application focusing on Connective Tissue Diseases (CTD)

- In May 2022, ZEUS Scientific received FDA clearance for its dIFine digital immunofluorescence system, which is used with ZEUS's ANA HEp-2 indirect fluorescent antibody (IFA) assay. This clearance includes positive and negative determination and eight common ANA HEp-2 staining patterns, contributing to improved diagnostic precision

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.