Europe Automotive Logistics Market

Market Size in USD Billion

CAGR :

%

USD

65.50 Billion

USD

105.60 Billion

2024

2032

USD

65.50 Billion

USD

105.60 Billion

2024

2032

| 2025 –2032 | |

| USD 65.50 Billion | |

| USD 105.60 Billion | |

|

|

|

|

Europe Automotive Logistics Market Size

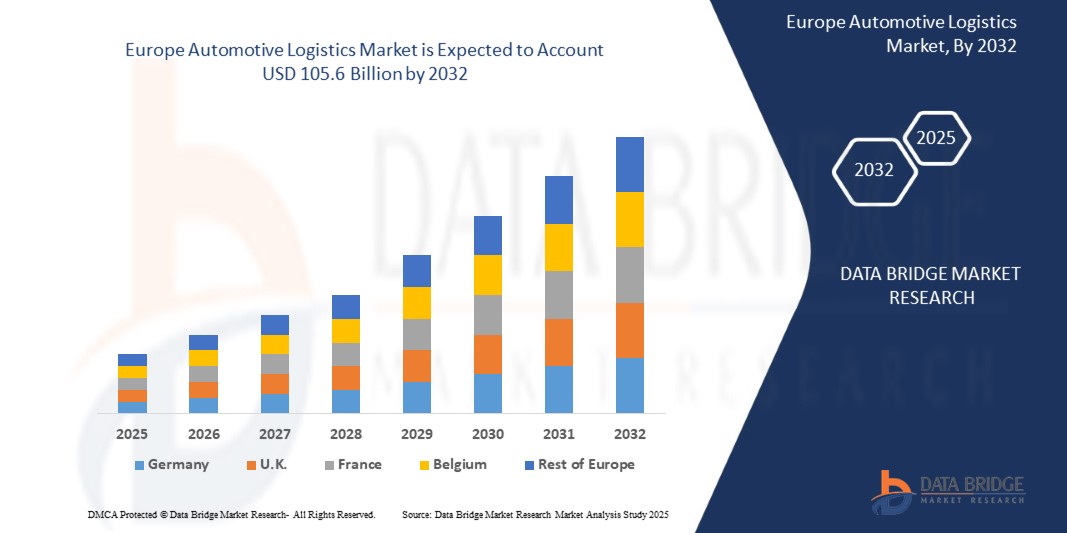

- The Europe Automotive Logistics Market was valued at USD 65.5 billion in 2025 and is projected to reach USD 105.6 billion by 2032, growing at a CAGR of 7% during the forecast period.

- Growth is driven by rising electric vehicle (EV) production, increased regional trade flows, stricter emissions regulations, and the integration of digital supply chain solutions. OEMs and Tier-1 suppliers are optimizing logistics strategies to meet consumer expectations, sustainability goals, and just-in-time (JIT) manufacturing demands.

Europe Automotive Logistics Market Analysis

- Automotive logistics includes the planning, execution, and control of transportation and warehousing for parts, components, and finished vehicles. It is critical for OEMs, suppliers, and dealers to maintain timely deliveries, inventory efficiency, and cost control across the production and delivery lifecycle.

- Increasing adoption of EVs and connected vehicles has shifted supply chain priorities toward high-value components like batteries and semiconductors, requiring specialized handling and secure transport systems.

- Digitalization, IoT-based fleet tracking, real-time inventory visibility, and cloud-based transport management systems are revolutionizing how automotive logistics is managed in Europe.

- Environmental regulations are pushing for the adoption of green logistics strategies, including electric vehicle fleets, rail freight expansion, and carbon-neutral warehousing, especially in Germany, France, and the Nordics.

- Brexit has reshaped cross-border logistics between the UK and mainland Europe, necessitating enhanced customs coordination and adaptive warehousing strategies.

Report Scope and Europe Automotive Logistics Market Segmentation

|

Attributes |

Automotive Logistics Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Logistics Market Trends

“Digital Platforms, Green Initiatives, and Supply Chain Resilience Transforming Automotive Logistics”

- A key and rapidly evolving trend in the Europe Automotive Logistics Market is the adoption of cloud-based logistics platforms that provide real-time shipment visibility, centralized transport orchestration, and AI-driven predictive analytics. These technologies enhance route optimization, reduce lead times, and enable more efficient coordination between OEMs, suppliers, and distribution centers across Europe.

- In response to EU climate regulations and carbon reduction targets, automakers and logistics providers are prioritizing green logistics practices, including the use of electric and hydrogen-powered trucks, expanded rail freight corridors, biofuel usage, and carbon-neutral warehouses. These initiatives help meet ESG goals and reduce emissions per vehicle shipped.

- ERP system integration with Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) is becoming widespread, improving real-time coordination of production logistics, inventory flows, and outbound vehicle movements. This alignment supports just-in-time (JIT) and just-in-sequence (JIS) operations across Europe’s complex manufacturing ecosystem.

- IoT and telematics solutions are being deployed to monitor fleet performance, enable predictive maintenance, and provide end-to-end supply chain transparency. These tools are especially critical for the secure transport of sensitive automotive components like EV batteries and electronics.

- There is a growing shift toward multi-modal transport strategies, as companies seek to combine road, rail, and maritime logistics to improve efficiency, lower costs, and meet sustainability mandates. Enhanced rail connectivity between Eastern and Western Europe and expanded port infrastructure are enabling smoother cross-border vehicle and parts movement

Europe Automotive Logistics Market Dynamics

Driver

“Regulatory Push and Electrification Trends Driving Transformation in Automotive Logistics”

The rapid electrification of the automotive industry across Europe, coupled with strict climate policy mandates, is compelling OEMs and logistics providers to revamp their operations for greater sustainability and compliance. National governments and EU directives are encouraging the shift toward low-emission transport solutions, reshaping the structure of automotive supply chains.

• Regulatory initiatives such as the EU Green Deal, Fit for 55, and Euro 7 emissions standards are driving the adoption of electric and hydrogen-powered fleets, rail freight integration, and investments in sustainable logistics infrastructure. These efforts are directly influencing fleet upgrades and cross-border logistics strategies.

• Automotive manufacturers and tier suppliers are increasingly aligning logistics strategies with Extended Producer Responsibility (EPR) regulations and EV battery safety standards. This includes logistics protocols for temperature-controlled warehousing, secure battery handling, and reverse logistics for recycling and disposal of hazardous materials.

• To manage supply chain complexity and meet environmental audit benchmarks, companies are investing in real-time visibility platforms integrated with ERP, TMS, and WMS systems. These digital tools enable precision logistics, improve delivery accuracy, and enhance responsiveness to regulatory changes across multiple European markets.

• European governments are also promoting logistics innovation through smart mobility corridors, automated customs clearance systems, and intermodal infrastructure upgrades. These investments support more efficient cross-border movement of vehicles and components, reduce delays, and enhance the overall resilience of the automotive logistics network.

Restraint/Challenge

“Geopolitical Uncertainty and Trade Policy Volatility Disrupt Logistics Planning”

- One of the primary challenges in the Europe Automotive Logistics Market is ongoing geopolitical instability, including the Russia-Ukraine conflict, evolving EU border policies, and post-Brexit trade realignments. These disruptions have caused rerouting of logistics corridors, delayed shipments, and increased security and insurance costs for cross-border vehicle and component movement.

- For instance, Brexit has resulted in more complex customs procedures, non-tariff barriers, and extended lead times between the U.K. and EU member states. Automotive logistics providers face higher operational costs due to added compliance layers, delays in documentation processing, and real-time coordination challenges.

- Unpredictable shifts in EU and international trade policies, such as sanctions, tariff adjustments, and supply chain localization pressures, force OEMs and Tier-1 suppliers to constantly reevaluate sourcing and distribution strategies, increasing strain on logistics planning and inventory optimization.

- These uncertainties also hinder long-term infrastructure and investment decisions. Logistics companies are cautious about expanding warehousing networks, rail terminals, or port operations in regions with political risk, regulatory inconsistency, or border instability, leading to delayed capacity upgrades and inefficient routing.

Europe Automotive Logistics Market Scope

The market is segmented on the basis of service type, mode of transport, logistics type, and vehicle type.

• By Service Type

The Automotive Logistics Market is segmented into Transportation, Warehousing, Inventory Management, and Distribution. In 2025, the Transportation segment holds the largest market share due to the high volume of vehicle and component movement across regional supply chains. Warehousing and inventory management are also gaining prominence as OEMs prioritize just-in-time (JIT) deliveries and efficient spare parts logistics to reduce downtime and cost.

• Mode of Transport

Modes of transport include Roadways, Railways, Maritime, and Air. Road transport dominates the market, especially for short- to mid-range distribution of finished vehicles and parts. However, railways and maritime logistics are growing rapidly due to their cost-effectiveness and lower environmental impact, particularly for cross-border and long-haul transport. Air logistics is primarily used for urgent deliveries and high-value components.

• By Logistics Type

The market is categorized into Inbound, Outbound, Reverse Logistics, and Aftermarket. Inbound logistics—which involves the transportation of parts to manufacturing plants—leads the segment, driven by the complexity of automotive assembly lines. Outbound logistics, including the delivery of finished vehicles to dealerships, is also significant. Aftermarket and reverse logistics are growing as automakers focus on post-sale services and sustainable parts recycling.

• By Vehicle Type

Vehicle types include Passenger Cars, Commercial Vehicles, and Electric Vehicles (EVs). Passenger cars account for the largest market share due to their production volume and distribution scale. However, electric vehicles represent the fastest-growing segment, as logistics providers adapt to new requirements for battery transport, temperature-sensitive warehousing, and hazardous material compliance.

•By Distribution

The Europe Automotive Logistics Market is segmented into Domestic and International logistics. Domestic logistics holds a major share, supported by dense manufacturing networks and robust intra-country vehicle distribution—particularly in automotive hubs such as Germany, France, and Italy. International logistics is also growing rapidly, driven by the strong export of finished vehicles and components to markets across Asia, North America, and Africa. Integrated EU trade agreements and streamlined customs processes across Schengen countries continue to support efficient cross-border movement of automotive goods.

• By Stage

Logistics stages in the Europe Automotive Logistics Market are categorized into Raw Materials Stage, Sub-Assembly Modules, Finished Product, and Final Product Delivery. The Raw Materials Stage involves transporting core inputs such as aluminum, electronics, and polymers to European component suppliers and manufacturing plants. Sub-Assembly Modules cover the movement of pre-assembled systems like powertrains, infotainment units, and battery packs to OEM final assembly lines. The Finished Product stage includes outbound logistics from assembly facilities to domestic and international distribution centers or port terminals. Lastly, Final Product Delivery involves last-mile transport of completed vehicles to dealerships or fleet buyers—requiring high precision, especially for just-in-time deliveries in urban and retail-intensive areas.

Europe Automotive Logistics Market – Regional Analysis

- The Europe Automotive Logistics Market is projected to grow steadily through 2032, driven by increasing demand for electric vehicles (EVs), cross-border trade within the EU, and the push for sustainable, multimodal logistics solutions. Strict emissions and supply chain compliance regulations, including REACH, EU MDR, and Euro 7 standards, are encouraging automakers and logistics providers to adopt integrated and digitalized logistics operations across the region.

- The region also benefits from advanced infrastructure, strong investment in rail and maritime freight, and the widespread adoption of just-in-time (JIT) and just-in-sequence (JIS) supply chain models. As OEMs localize production and regionalize supplier networks, Europe’s automotive logistics market continues to diversify and evolve.

Germany Automotive Logistics Market Insight

Germany remains the largest and most mature market in Europe, thanks to its globally competitive automotive manufacturing base, highly developed rail and road infrastructure, and focus on Industry 4.0. The country's logistics providers are rapidly adopting smart warehousing, real-time fleet tracking, and multimodal shipping solutions to support the efficient movement of vehicles, parts, and batteries. Germany also leads in EV logistics, supported by government-backed green mobility programs and automotive innovation hubs.

France Automotive Logistics Market Insight

France's automotive logistics sector is expanding due to investments in low-emission transport, digitized supply chains, and EV part distribution. The French government’s support for clean transportation zones, combined with growing automotive exports and rising e-commerce activity, is driving demand for warehousing, inventory management, and multimodal transport solutions. Logistics firms are integrating cloud-based TMS and WMS platforms to improve traceability and reduce delivery lead times.

United Kingdom Automotive Logistics Market Insight

Despite post-Brexit challenges, the U.K. remains a key player in Europe’s automotive logistics market. Strong domestic demand, a shift toward nearshoring, and expanded EV production are reshaping logistics strategies. Logistics providers are investing in customs-compliant digital platforms, automated warehouses, and alternative port routes to manage cross-border complexity. The U.K. is also actively supporting EV logistics infrastructure with policies favoring low-emission transport corridors.

Italy Automotive Logistics Market Insight

Italy is strengthening its role as a logistics hub in Southern Europe with continued investment in port infrastructure and rail-road interconnectivity. With a large auto-parts manufacturing base and increasing EV assembly capacity, Italy’s logistics providers are focusing on speed, sustainability, and multimodal efficiency. The growth of automotive aftermarket services is also boosting demand for reverse logistics and decentralized distribution centers.

Spain Automotive Logistics Market Insight

Spain’s automotive logistics sector is gaining momentum, supported by its strategic location for exports, especially to Latin America and North Africa. Government incentives to support EV production and green logistics corridors are helping logistics firms modernize their fleets and warehouse operations. Strong automotive exports and rising investments in smart logistics platforms are further accelerating market growth.

Poland & Eastern Europe Automotive Logistics Market Insight

Countries like Poland, Hungary, and Slovakia are emerging as automotive logistics powerhouses, driven by nearshoring of manufacturing, competitive labor costs, and EU-funded infrastructure upgrades. These countries serve as key transit points for both Eastern and Western Europe, with increasing investment in rail terminals, automated cross-docking centers, and battery logistics capabilities to support growing EV production and exports.

Europe Automotive Logistics Market Share

The Europe Automotive Logistics Market is led by a mix of global and regional logistics service providers:

- DHL Supply Chain

- DB Schenker

- CEVA Logistics

- Kuehne + Nagel

- DSV Panalpina

- BLG Logistics

- Gefco

- Ryder System, Inc.

- XPO Logistics

- Hellmann Worldwide Logistics

Latest Developments in Europe Automotive Logistics Market

- In March 2025, DB Schenker launched its first electric truck corridor for automotive parts delivery between Germany and France, aligning with EU Green Deal objectives. The initiative is aimed at reducing carbon emissions and promoting sustainable, cross-border transport solutions for Tier-1 suppliers and OEMs.

- In January 2025, CEVA Logistics opened a state-of-the-art automotive warehouse in Spain, featuring robotics-enabled material handling, digital inventory tracking, and dedicated zones for electric vehicle (EV) component storage, designed to support growing EV logistics needs across Southern Europe.

- In October 2024, DHL partnered with BMW Group to implement a digital twin-based logistics management system, enabling real-time monitoring and simulation of supply chain operations across BMW’s European manufacturing plants to increase transparency, resilience, and planning accuracy.

- In August 2024, Kuehne + Nagel expanded its rail freight services connecting Eastern Europe (Poland, Hungary) with Western automotive hubs in Germany and France. This move supports cost-efficient, low-emission cross-border logistics for components and sub-assemblies, accelerating multimodal transport adoption across the EU.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.