Europe Baking Enzyme Market

Market Size in USD Million

CAGR :

%

USD

416.09 Million

USD

668.21 Million

2022

2030

USD

416.09 Million

USD

668.21 Million

2022

2030

| 2023 –2030 | |

| USD 416.09 Million | |

| USD 668.21 Million | |

|

|

|

|

Europe Baking Enzymes Market Analysis and Size

In terms of revenue, the bread sector represented the greatest share of the market in 2021. From a wide range of applications, it is a high consumable product in both developed and developing economies. Bread is utilized as a primary ingredient in frequently consumed food products such as pizza, burgers, and hotdogs, and is thus predicted to rise steadily during the projection period. Cakes and pastries containing baking enzymes are projected to rise effectively as demand from areas grows, and the development of new products with improved taste and flavour by multiple market players is expected to boost consumption rates in the future.

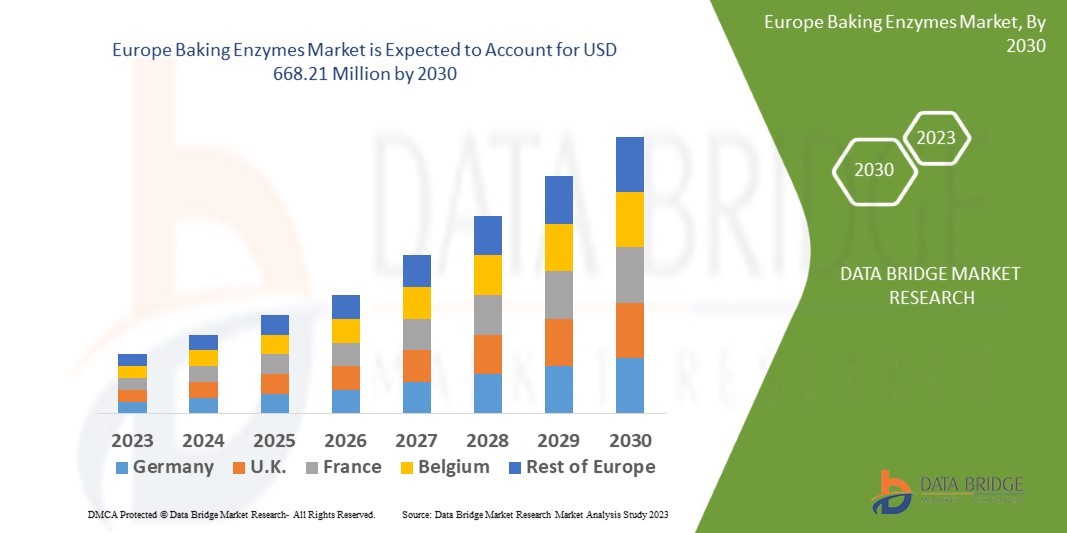

Data Bridge Market Research analyses that the baking enzymes market, which was USD 416.09 million in 2022, is expected to reach USD 668.21 million by 2030, at a CAGR of 6.10% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Europe Baking Enzymes Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Protease, Carbohydrase, Lipase, Hydrolases, Oxidoreductases, Others), Applications (Bread, Rolls and Buns, Biscuits and Cookies, Cake and Pastry, Muffins and Cupcakes, Pizza Bases, Donuts, Tortillas and Pretzels, Others), Category (Inorganic, Organic), Form (Powder/Granules, Liquid), End-User (Industries, Food Service Sector, Household/Retail), Source (Microorganisms, Plant, Animal) |

|

Countries Covered |

Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe |

|

Market Players Covered |

DuPont (U.S.), DSM (Netherlands), ADM (U.S.), BASF SE (Germany), Evonik Industries AG (Germany), Kemin Industries, Inc. (U.S.), Novozymes (Denmark), International Flavors and Fragrances Inc. (U.S.), Associated British Foods plc (U.K.), Kerry Group plc (Ireland) AAK AB (Sweden), British Bakels (U.K.), Corbion (Netherlands), Dawn Food Products, Inc. (U.S.), Aumenzymes (India), Amano Enzymes Inc. (Japan), Soufflet Biotechnologies SAS (France) |

|

Market Opportunities |

|

Market Definition

Bakery enzyme is frequently used to provide softness in the production of cakes and other baked goods, to avoid the formation of acrylamide in bakery products, and to enhance the characteristics of baking bread and other baked goods such as pastries and biscuits. Bakery enzymes are frequently used to adjust product softness in cake production, limit acrylamide generation in bakery products, and modify dough rheology, gas retention, and crumb softness in bread production. They can also affect dough rheology in pastry and biscuit manufacturing.

Europe Baking Enzymes Market Dynamics

Drivers

- Growth in the consumption of bakery products will drive the market growth

Increased demand for bakery goods, particularly the packaged kind, has boosted the market's overall growth in terms of value sales. The need for bakery enzymes from the bakery business is driven by rapid urbanization, an increase in population disposable income, a rise in the trend of bread and cakes among millennials, advancements in the bakery, and constantly shifting buyer preferences. Rapid urbanization, increased convenience food consumption, and retail outlets such as as Pizza Hut, Domino's, McDonald's, and the tube are expected to drive the worldwide baking enzyme market in the future.

- Growing awareness about green technology will bolster market growth

The increased consumption of bakery enzymes is due to increased awareness of green technologies that boost productivity, address environmental concerns, and increase product value. This encourages expansion in the research and development sector. Furthermore, several bakery enzyme producers, including Associated British Foods plc, BASF SE, Novozymes, DuPont Danisco, and DSM, are backward integrated and involved in raw material production. This contributes to lower operating expenses while preserving product quality. Industry participants distribute their products through a variety of distribution methods, including direct supply, agreements with other parties, and internet portals.

Opportunities

- Increased demand from food and beverages industry to act as an opportunity

Bakery enzymes are widely employed to improve product quality and shelf life in the food and beverage industry. They are used in the food and beverage industry in the brewing and baking processes, as well as in dairy, starch, and sugar products that humans consume in considerable quantities on a daily basis. They are used in baking to impart specific properties to flour or dough. They aid in lowering the protein level of flour in biscuits and crackers, while their use in bread improves or standardises quality and ensures consistent browning.

Restraints/Challenges

- Problems associated with baking enzymes derail the market growth

Excessive baking enzyme consumption can cause allergies, headaches, and ulcers, all of which are important factors impacting the growth of the worldwide baking enzyme market. Furthermore, temperature and pH levels affect enzymes' ability to bake, and strict government rules and regulations on the use of proteins in baking in countries such as the United Kingdom and Canada are impeding the growth of the global baking enzymes market during the forecast period.

This baking enzymes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the baking enzymes market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Europe Baking Enzymes Market Scope

The baking enzymes market is segmented on the basis of type, applications, category, form, end-user, and source. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Protease

- Carbohydrase

- Lipase

- Hydrolases

- Oxidoreductases

- Others

Applications

- Bread

- Rolls and Buns

- Biscuits and Cookies

- Cake and Pastry

- Muffins and Cupcakes

- Pizza Bases

- Donuts

- Tortillas and Pretzels

- Others

Category

- Inorganic

- Organic

Form

- Powder/Granules

- Liquid

End-User

- Industries

- Food Service Sector

- Household/Retail

Source

- Microorganisms

- Plant

- Animal

Europe Baking Enzymes Market Regional Analysis/Insights

The baking enzymes market is analysed and market size insights and trends are provided by country, type, applications, category, form, end-user, and source as referenced above.

The countries covered in the baking enzymes market report are Germany, Sweden, Poland, Denmark, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe.

Germany has the largest market share in Europe because of the high demand for baking enzymes from the bakery industry in order to provide high-quality baked items on the market for baking enzymes. After Germany, France holds the majority of the market share since there is a significant market for baked goods there, which has resulted in the formation of numerous businesses. Given its rising product development and accessibility of enzymes and hydrolases, Italy is growing at the third-fastest rate in Europe for baking enzymes.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Baking Enzymes Market Share Analysis

The baking enzymes market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to baking enzymes market.

Some of the major players operating in the baking enzymes market are:

- DuPont (U.S.)

- DSM (Netherlands)

- ADM (U.S.)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Kemin Industries, Inc. (U.S.)

- Novozymes (Denmark)

- International Flavors and Fragrances Inc. (U.S.)

- Associated British Foods plc (U.K.)

- Kerry Group plc (Ireland)

- AAK AB (Sweden)

- British Bakels (U.K.)

- Corbion (Netherlands)

- Dawn Food Products, Inc. (U.S.)

- Aumenzymes (India)

- Amano Enzymes Inc. (Japan)

- Soufflet Biotechnologies SAS (France)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BAKING ENZYMES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE EUROPE BAKING ENZYMES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKET COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 EUROPE BAKING ENZYMES MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 SUPPLY CHAIN ANALYSIS

11.1 OVERVIEW

11.2 LOGISTIC COST SCENARIO

11.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

12 CLIMATE CHANGE SCENARIO

12.1 ENVIRONMENTAL CONCERNS

12.2 INDUSTRY RESPONSE

12.3 GOVERNMENT’S ROLE

12.4 ANALYST RECOMMENDATIONS

13 EUROPE BAKING ENZYMES MARKET, BY TYPE, 2018-2032 (USD MILLION) (KILO TONS)

13.1 OVERVIEW

13.2 HYDROLASES

13.2.1 AMYLASES

13.2.1.1. ALPHA AMYLASE

13.2.1.2. BETA AMYLASE

13.2.1.3. MALTOGENIC AMYLASE

13.2.2 LIPASES

13.2.3 PHOSPHOLIPASE

13.2.4 PROTEASES

13.2.4.1. EXOPEPTIDASES

13.2.4.2. ENDOPEPTIDASES

13.2.5 HEMICELLULASES

13.2.5.1. XYLANASE

13.2.5.2. GLYCOSIDASE

13.2.6 CARBOHYDRASE

13.2.7 ASPARAGINASE

13.2.8 LIPOXYGENASE

13.2.9 TRANSGLUTAMINASE

13.2.10 PENTOSANASES

13.2.11 PAPAIN

13.2.12 CELLULASE

13.2.13 MALTASE

13.2.14 INVERTASE

13.2.15 OTHERS

13.3 OXIDOREDUCTASES

13.3.1 LIPOXYGENASES

13.3.2 GLUCOSE OXIDASE

13.3.3 HEXOSE OXIDASE

13.3.4 OTHERS

13.4 TRANSFERASES

14 EUROPE BAKING ENZYMES MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 ORGANIC

14.3 CONVENTIONAL

15 EUROPE BAKING ENZYMES MARKET, BY FORM, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 POWDER/GRANULES

15.3 LIQUID

16 EUROPE BAKING ENZYMES MARKET, BY SOURCE, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 MICROORGANISMS

16.2.1 BACTERIA

16.2.2 FUNGI

16.2.3 OTHERS (IF ANY)

16.3 PLANT

16.4 ANIMAL

17 EUROPE BAKING ENZYMES MARKET, BY FUNCTION, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 ACRYLAMIDE REDUCTION

17.3 APPEALING APPEARANCE

17.4 DOUGH CONDITIONING

17.5 DOUGH STRENGTHENING

17.6 FLOUR CORRECTION

17.7 FRESHNESS

17.8 GLUTEN STRENGTHENING

17.9 FERMENTATION ENHANCER

17.1 BREAD VOLUME IMPROVER

17.11 TEXTURE IMPROVER

17.12 DOUGH TOLERENCE IMPROVER

17.13 DECREASED STICKNESS

17.14 REDUCE MICROBIAL SPOILAGE

17.15 OXIDISING AGENT

17.16 REDUCING AGENTS

17.17 EMULSIFIERS

17.18 VITAL WHEAT GLUTEN (VWG)

17.19 OTHERS

18 EUROPE BAKING ENZYMES MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

18.1 OVERVIEW

18.2 BREAD

18.2.1 WHITE BREAD

18.2.2 WHOLE WHEAT BREAD

18.2.3 OTHERS

18.3 ROLLS AND BUNS

18.4 BISCUITS & COOKIES

18.5 CAKES & PASTRIES

18.6 MUFFINS

18.7 CRACKERS

18.8 CUPCAKES

18.9 PIZZA BASES

18.1 DONUTS

18.11 TORTILLAS

18.12 PRETZELS

18.13 BAGUETTES

18.14 BRIOCHE

18.15 PANETTONE

18.16 OTHERS

19 EUROPE BAKING ENZYMES MARKET, BY END USER, 2018-2032 (USD MILLION)

19.1 OVERVIEW

19.2 INDUSTRIAL

19.2.1 LARGE-SCALE BAKERIES

19.2.2 FOOD PROCESSORS

19.2.3 OTHERS

19.3 FOOD SERVICE SECTOR

19.3.1 HOTELS

19.3.2 ARTISAN BAKERIES

19.3.3 RESTAURANTS

19.3.4 CAFÉ

19.3.5 BARS AND CLUBS

19.3.6 CATERING

19.3.7 OTHERS

20 EUROPE BAKING ENZYMES MARKET, BY COUNTRY, 2018-2032 (USD MILLION) (KILO TONS)

EUROPE BAKING ENZYMES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

20.1 EUROPE

20.1.1 GERMANY

20.1.2 U.K.

20.1.3 ITALY

20.1.4 FRANCE

20.1.5 SPAIN

20.1.6 SWITZERLAND

20.1.7 BELGIUM

20.1.8 PORTUGAL

20.1.9 NETHERLANDS

20.1.10 RUSSIA

20.1.11 TURKEY

20.1.12 NORWAY

20.1.13 SWEDEN

20.1.14 FINLAND

20.1.15 DENMARK

20.1.16 POLAND

20.1.17 LUXEMBOURG

20.1.18 REST OF EUROPE

21 EUROPE BAKING ENZYMES MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: EUROPE

21.2 MERGERS & ACQUISITIONS

21.3 NEW PRODUCT DEVELOPMENT & APPROVALS

21.4 EXPANSIONS

21.5 REGULATORY CHANGES

21.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

23 EUROPE BAKING ENZYMES MARKET, COMPANY PROFILES

23.1 CARGILL, INCORPORATED

23.1.1 COMPANY SNAPSHOT

23.1.2 REVENUE ANALYSIS

23.1.3 PRODUCT PORTFOLIO

23.1.4 RECENT DEVELOPMENTS

23.2 ADM

23.2.1 COMPANY SNAPSHOT

23.2.2 REVENUE ANALYSIS

23.2.3 PRODUCT PORTFOLIO

23.2.4 RECENT DEVELOPMENTS

23.3 ABF INGREDIENTS

23.3.1 COMPANY SNAPSHOT

23.3.2 REVENUE ANALYSIS

23.3.3 PRODUCT PORTFOLIO

23.3.4 RECENT DEVELOPMENTS

23.4 DSM

23.4.1 COMPANY SNAPSHOT

23.4.2 REVENUE ANALYSIS

23.4.3 PRODUCT PORTFOLIO

23.4.4 RECENT DEVELOPMENTS

23.5 KERRY GROUP PLC

23.5.1 COMPANY SNAPSHOT

23.5.2 REVENUE ANALYSIS

23.5.3 PRODUCT PORTFOLIO

23.5.4 RECENT DEVELOPMENTS

23.6 CORBION

23.6.1 COMPANY SNAPSHOT

23.6.2 REVENUE ANALYSIS

23.6.3 PRODUCT PORTFOLIO

23.6.4 RECENT DEVELOPMENTS

23.7 IFF

23.7.1 COMPANY SNAPSHOT

23.7.2 REVENUE ANALYSIS

23.7.3 PRODUCT PORTFOLIO

23.7.4 RECENT DEVELOPMENTS

23.8 LALLEMAND INC.

23.8.1 COMPANY SNAPSHOT

23.8.2 REVENUE ANALYSIS

23.8.3 PRODUCT PORTFOLIO

23.8.4 RECENT DEVELOPMENTS

23.9 LESAFFRE CORPORATION

23.9.1 COMPANY SNAPSHOT

23.9.2 REVENUE ANALYSIS

23.9.3 PRODUCT PORTFOLIO

23.9.4 RECENT DEVELOPMENTS

23.1 NOVOZYMES

23.10.1 COMPANY SNAPSHOT

23.10.2 REVENUE ANALYSIS

23.10.3 PRODUCT PORTFOLIO

23.10.4 RECENT DEVELOPMENTS

23.11 AMANO ENZYME INC

23.11.1 COMPANY SNAPSHOT

23.11.2 REVENUE ANALYSIS

23.11.3 PRODUCT PORTFOLIO

23.11.4 RECENT DEVELOPMENTS

23.12 ENZYMES.BIO.

23.12.1 COMPANY SNAPSHOT

23.12.2 REVENUE ANALYSIS

23.12.3 PRODUCT PORTFOLIO

23.12.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

24 RELATED REPORTS

25 QUESTIONNAIRE

26 ABOUT DATA BRIDGE MARKET RESEARCH

Europe Baking Enzyme Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Baking Enzyme Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Baking Enzyme Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.