Europe Beauty Devices Market

Market Size in USD Billion

CAGR :

%

USD

14.85 Billion

USD

36.26 Billion

2024

2032

USD

14.85 Billion

USD

36.26 Billion

2024

2032

| 2025 –2032 | |

| USD 14.85 Billion | |

| USD 36.26 Billion | |

|

|

|

|

Europe Beauty Devices Market Size

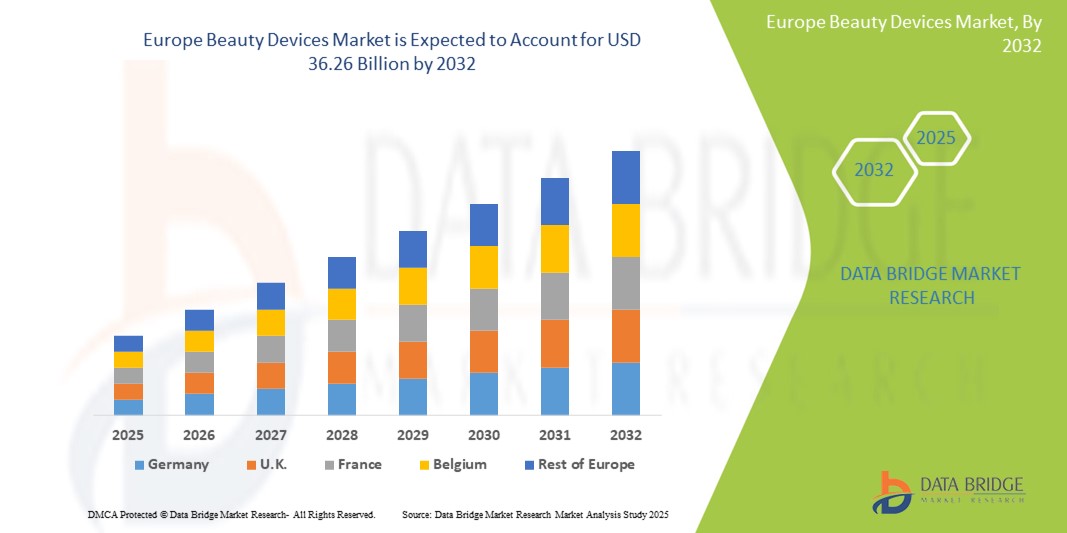

- The Europe beauty devices market size was valued at USD 14.85 billion in 2024 and is expected to reach USD 36.26 billion by 2032, at a CAGR of 11.80% during the forecast period

- The market growth is largely fueled by increasing consumer awareness regarding aesthetic appearance and the rising adoption of at-home beauty technologies across key European economies, especially in France, Germany, and the U.K.

- Furthermore, rising disposable incomes, the expanding aging population, and technological innovations in skincare and haircare devices are driving consumer demand for effective, non-invasive treatments. These factors are propelling the demand for beauty devices, thereby significantly boosting the industry’s growth

Europe Beauty Devices Market Analysis

- Europe components in both professional and home-based cosmetic treatments across Europe, driven by their effectiveness, ease of use, and integration with digital health and wellness ecosystems

- The rising demand for beauty devices in Europe is primarily fueled by increasing consumer awareness about personal appearance, growing aging populations seeking anti-aging solutions, and the popularity of non-invasive aesthetic treatments

- Germany dominated the Europe beauty devices market with the largest revenue share in 2024, attributed to its strong healthcare infrastructure, high consumer spending on personal care products, and presence of major beauty tech brands

- Italy is expected to be the fastest growing country in the Europe beauty devices market during the forecast period due to increasing demand for home-use aesthetic devices, growing beauty consciousness, and a surge in cosmetic procedure alternatives driven by a tech-savvy younger population.

- Hair Care Devices segment dominated the Europe beauty devices market with a market share of 31.9% in 2024, driven by its widespread use in both home and salon settings for hair styling, grooming, and hair removal solutions

Report Scope and Europe Beauty Devices Market Segmentation

|

Attributes |

Europe Beauty Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Beauty Devices Market Trends

“Technological Advancements Driving At-Home Beauty Solutions”

- A prominent and accelerating trend in the Europe beauty devices market is the rapid adoption of advanced technologies such as LED therapy, microcurrents, and radiofrequency in at-home devices, enhancing the effectiveness of personal beauty routines and bridging the gap between salon-grade treatments and home use

- For instance, FOREO’s UFO 2 combines LED light therapy with thermotherapy and T-sonic pulsations, offering a spa-such as facial experience at home. Similarly, Philips Lumea IPL devices utilize professional-grade intense pulsed light technology for long-lasting hair removal in home settings

- These devices are increasingly integrating smart features such as mobile app connectivity, treatment personalization, and usage tracking, which allow users to monitor progress, set goals, and receive treatment reminders—thereby improving engagement and outcomes

- The rising popularity of beauty influencers, social media tutorials, and online product reviews has significantly boosted consumer awareness and interest in high-tech beauty devices across countries such as Germany, France, and Italy

- Furthermore, anti-aging and skin rejuvenation technologies are being miniaturized and adapted for home use, catering especially to aging populations seeking non-invasive solutions. Devices equipped with sensors and AI capabilities are also being introduced to analyze skin conditions and recommend personalized treatments

- This growing trend toward smart, convenient, and effective beauty devices is reshaping consumer expectations and fueling a shift from traditional salon services to technologically advanced, user-friendly at-home solutions across Europe

Europe Beauty Devices Market Dynamics

Driver

“Increasing Demand for Anti-Aging and Non-Invasive Aesthetic Solutions”

- The growing focus on aesthetics, especially among the aging population, and the preference for non-invasive, cost-effective alternatives to cosmetic procedures are major drivers for the European beauty devices market

- For instance, L’Oréal and its tech incubator launched the HAPTA device in early 2024, a handheld smart makeup applicator designed for individuals with limited hand mobility, highlighting innovation focused on inclusivity and home usability

- Consumers in Europe are increasingly turning to devices such as facial massagers, LED therapy tools, and ultrasonic skin cleansers to achieve younger-looking skin and enhance their daily skincare routines

- Rising awareness about skincare and personal grooming, supported by social media trends and wellness influencers, is accelerating the uptake of advanced beauty devices

- The expanding availability of dermatology-grade devices for home use and growing consumer preference for personalized beauty care—enabled through app-based diagnostics and treatment tracking—are further fueling demand in both urban and suburban market

Restraint/Challenge

“High Device Cost and Regulatory Hurdles”

- The relatively high cost of technologically advanced beauty devices remains a challenge, especially for consumers in price-sensitive countries within Eastern and Southern Europe. Many premium devices incorporating features such as AI, skin analysis, and multifunctionality come at a steep price, limiting widespread adoption

- In addition, navigating Europe’s stringent regulations concerning the safety and efficacy of beauty and skincare devices can slow down product approvals and market entry for new players

- For instance, devices classified as medical-grade must comply with the EU Medical Device Regulation (MDR), adding to the time and cost of development and commercialization

- Concerns over potential side effects, such as skin irritation or improper use of light- or heat-based devices, also deter some consumers. Educational initiatives and dermatologist endorsements are critical to improving consumer confidence and safe usage

- Overcoming these challenges will require a combination of regulatory clarity, cost-effective innovations, and enhanced consumer education on product benefits and safety protocols

Europe Beauty Devices Market Scope

The market is segmented on the basis of product type, age group, mode of operation, end user, and distribution channel.

- By Product Type

On the basis of product type, the Europe beauty devices market is segmented into hair care devices, facial devices, skin care devices, oral care devices, and eye care devices. The hair care devices segment dominated the market with the largest revenue share of 31.9% in 2024, driven by high consumer demand for hair styling, grooming, and long-term hair removal solutions. The widespread use of products such as straighteners, dryers, and IPL hair removal tools across both salons and households contributed significantly to the segment's lead. Increasing consumer inclination toward maintaining hair health and appearance, along with innovations in cordless and multifunctional hair devices, further bolster segment growth.

The facial devices segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for non-invasive facial treatments, such as LED therapy, microcurrent, and ultrasonic cleansing devices. The segment benefits from a growing aging population seeking anti-aging solutions and the growing popularity of skincare routines influenced by beauty influencers and digital platforms.

- By Age Group

On the basis of age group, the Europe beauty devices market is segmented into pediatrics, adult, and geriatrics. The adult segment held the largest market share of 52.7% in 2024, attributed to higher spending capacity and an increasing focus on personal appearance and grooming. Adults are also more such asly to invest in beauty technologies for anti-aging, acne treatment, and overall skin maintenance.

The geriatric segment is expected to grow at the fastest pace during the forecast period, supported by the expanding elderly population in Europe and increasing demand for skin rejuvenation and anti-wrinkle devices tailored for mature skin.

- By Mode Of Operation

On the basis of mode of operation, the Europe beauty devices market is segmented into electric and battery operated and manual. The electric and battery operated segment dominated the market with a share of 68.9% in 2024, driven by the convenience, precision, and effectiveness offered by automated devices. These devices are often integrated with smart technology, enabling better control and customization. Consumers prefer electric models for their time-saving features and consistent results in homecare routines.

The manual segment, expected to witness fastest growth in forecast period as, remains relevant in entry-level and travel-friendly products due to their affordability and ease of use without power dependency.

- By End User

On the basis of end user, the Europe beauty devices market is segmented into commercial and professional settings and domestic/personalized/homecare settings. The domestic/personalized/homecare settings segment led the market with a share of 56.2% in 2024, reflecting a post-pandemic shift toward DIY beauty solutions and self-care. Consumers increasingly prefer performing treatments such as hair removal, facial cleansing, and anti-aging therapy in the comfort of their homes.

The commercial and professional settings segment is expected to witness fastest growth during forecast period, dermatology clinics, salons, and spas, with advanced devices used for intensive treatments requiring professional supervision

- By Distribution Channel

On the basis of distribution channel, the Europe beauty devices market is segmented into direct and indirect. The indirect segment held the largest share at 61.8% in 2024, driven by the rising dominance of online retail channels, beauty e-commerce platforms, and widespread product availability in department stores and specialty beauty retailers. Online platforms offer a wide selection, competitive pricing, and customer reviews, increasing consumer confidence and reach.

The direct segment, including company-owned stores and official brand websites, is growing fastest, as brands focus on delivering personalized consumer experiences, exclusive product offerings, and subscription-based models.

Europe Beauty Devices Market Regional Analysis

- Germany dominated the Europe beauty devices market with the largest revenue share of % in 2024, attributed to its strong healthcare infrastructure, high consumer spending on personal care products, and presence of major beauty tech brands

- Consumers in these countries prioritize non-invasive, tech-enabled beauty treatments that offer convenience and visible results. The growth is further supported by aging demographics, greater focus on skincare and grooming, and the popularity of digital beauty influencers

- This widespread demand, coupled with innovation in device functionality and design, continues to drive the adoption of beauty devices in both domestic and professional settings across Europe

U.K. Europe Beauty Devices Market Insight

The U.K. beauty devices market is expected to grow at a notable CAGR during the forecast period, fueled by increased consumer focus on skincare, grooming, and wellness. The rise in demand for portable, personalized, and app-integrated beauty devices is evident, especially among urban populations. The country’s strong online retail ecosystem, coupled with beauty influencers and digital marketing, continues to boost sales across facial cleansing, anti-aging, and hair removal devices.

Germany Europe Beauty Devices Market Insight

The Germany beauty devices market captured the largest revenue share in Europe in 2024, supported by high consumer spending on personal care, technological innovation, and the strong presence of both global and domestic beauty device brands. German consumers are highly receptive to home-use beauty solutions, especially those incorporating LED therapy, microcurrent, and smart skin analysis features. In addition, a well-established healthcare and regulatory infrastructure fosters trust and encourages market expansion.

France Europe Beauty Devices Market Insight

The France beauty devices market is experiencing strong growth due to the country’s rich cosmetic culture and the rising acceptance of technologically advanced beauty solutions. French consumers show a strong preference for skin rejuvenation and anti-aging devices that combine aesthetics with functionality. The presence of major luxury and skincare brands exploring device-based treatments is also contributing to market innovation and consumer trust.

Italy Europe Beauty Devices Market Insight

The Italy is expected to be the fastest growing country in the Europe beauty devices market during the forecast period due to increasing demand for home-use aesthetic devices, growing beauty consciousness, and a surge in cosmetic procedure alternatives driven by a tech-savvy younger population. Demand is especially strong for hair removal and facial toning devices, with a growing number of consumers adopting home-use solutions as alternatives to salon visits. Italy’s focus on wellness and appearance, along with a flourishing beauty retail sector, supports continuous growth.

Europe Beauty Devices Market Share

The Europe beauty devices industry is primarily led by well-established companies, including:

- L’Oréal S.A. (France)

- Beurer GmbH (Germany)

- FOREO AB (Sweden)

- CurrentBody Ltd. (U.K.)

- Rowenta GmbH (Germany)

- Talika S.A.S. (France)

- Medisana GmbH (Germany)

- HoMedics Europe Ltd. (U.K.)

- Braun GmbH (Germany)

- Laboratoires Filorga Cosmétiques (France)

- Nivea (Beiersdorf AG) (Germany)

- Sensica Ltd. (U.K.)

- Talgo S.A.S. (France)

- Unilever PLC (U.K.)

- Pierre Fabre Dermo-Cosmétique (France)

- ReFa Europe B.V. (Netherlands)

- Panasonic Marketing Europe GmbH (Germany)

What are the Recent Developments in Europe Beauty Devices Market?

- In April 2024, L’Oréal (France) launched the AirLight Pro, a high-performance, sustainable hair drying device developed in collaboration with Zuvi. The device uses infrared light technology to dry hair more efficiently while preserving moisture, reducing energy consumption by up to 30%. This innovation reflects L’Oréal’s commitment to eco-conscious beauty solutions that combine performance with sustainability, reinforcing its leadership in Europe’s evolving beauty tech market

- In March 2024, Beurer GmbH (Germany) expanded its beauty device portfolio with the introduction of the FC1000 Ion Cleansing Brush, designed to deliver deep facial cleansing through ion technology. The product targets consumers seeking professional-grade skincare treatments at home, supporting the trend of non-invasive and personalized skincare solutions across Europe

- In February 2024, FOREO (Sweden) unveiled the LUNA 4 Plus, an upgraded version of its flagship facial cleansing device, integrating microcurrent technology and thermotherapy. This launch aims to offer multifunctional skincare benefits, such as anti-aging and deep pore cleansing, in a single device, reinforcing FOREO’s position as a leading innovator in Europe’s home-use beauty technology space

- In January 2024, CurrentBody (U.K.) announced the launch of its new LED Eye Perfector, an at-home device specifically designed to address fine lines and signs of fatigue around the eyes. The development aligns with growing consumer demand for targeted, effective, and non-invasive anti-aging treatments and showcases the U.K.'s rising influence in the personalized beauty tech market

- In January 2024, Rowenta (France) introduced a new line of IPL (Intense Pulsed Light) hair removal devices under its Beauty Tech series, aimed at providing salon-quality results for home users. Featuring smart skin tone sensors and ergonomic designs, the launch highlights Rowenta’s focus on smart, user-friendly devices tailored to modern European consumers seeking long-term hair removal solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.