Europe Clinical Microscopes Market

Market Size in USD Million

CAGR :

%

USD

785.73 Million

USD

1,233.55 Million

2025

2033

USD

785.73 Million

USD

1,233.55 Million

2025

2033

| 2026 –2033 | |

| USD 785.73 Million | |

| USD 1,233.55 Million | |

|

|

|

|

Europe Clinical Microscopes Market Size

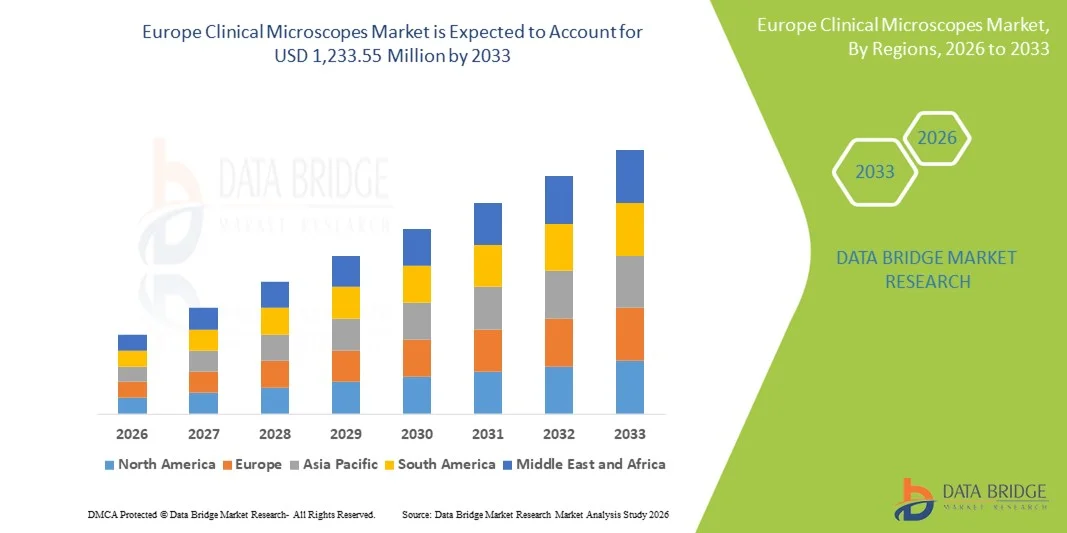

- The Europe clinical microscopes market size was valued at USD 785.73 million in 2025 and is expected to reach USD 1,233.55 million by 2033, at a CAGR of 5.8% during the forecast period

- The market growth is largely fueled by increasing adoption of advanced clinical imaging solutions across healthcare institutions, rising investments in life sciences research, and continual technological innovation in microscopy platforms that support enhanced diagnostics and laboratory workflows across Europe

- Furthermore, growing demand for high‑resolution imaging in pathology, microbiology, and cell biology, coupled with modernization of hospital and diagnostic lab infrastructure, is driving clinical microscopes to become a core component of clinical and research environments. These converging factors are accelerating uptake of clinical microscopy solutions, thereby significantly boosting industry growth

Europe Clinical Microscopes Market Analysis

- Clinical microscopes, providing high-precision imaging for biological and medical samples, are increasingly essential tools in hospitals, diagnostic laboratories, and research institutions across Europe due to their accuracy, versatility, and integration with digital imaging systems

- The growing demand for clinical microscopes is primarily driven by rising investments in healthcare infrastructure, increasing prevalence of chronic diseases, and the need for accurate diagnostics in pathology, microbiology, and cell biology

- Germany dominated the clinical microscopes market with the largest revenue share of 24.8% in 2025, supported by advanced healthcare infrastructure, high adoption of digital laboratory solutions, and the presence of leading industry players, with hospitals and research institutions actively upgrading to advanced imaging systems

- Poland is expected to be the fastest-growing country in the clinical microscopes market during the forecast period, due to rising healthcare spending, modernization of laboratory facilities, and increasing adoption of advanced microscopy technologies in emerging medical research hubs

- Optical microscopes dominated the Europe clinical microscopes market in 2025 with a market share of 46.2%, driven by their proven reliability, ease of use, and adaptability for routine diagnostics in pathology, microbiology, and cell biology applications

Report Scope and Europe Clinical Microscopes Market Segmentation

|

Attributes |

Europe Clinical Microscopes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Clinical Microscopes Market Trends

Digital Integration and AI-Assisted Imaging

- A significant and accelerating trend in the Europe clinical microscopes market is the growing integration of digital imaging and AI-assisted analysis, enhancing diagnostic precision and workflow efficiency in hospitals and research laboratories

- For instance, the Olympus BX53 fully integrates with digital imaging software, allowing automated image capture and analysis, while Leica DM6 AI-assisted microscopes support high-throughput screening with real-time analytics

- AI integration in clinical microscopes enables features such as automated cell counting, pattern recognition, and predictive diagnostics, improving accuracy and reducing manual errors. For instance, ZEISS AI-powered microscopes can detect subtle morphological changes in tissue samples and generate intelligent reports

- The seamless integration of microscopes with laboratory information management systems (LIMS) and cloud platforms enables centralized data storage, remote collaboration, and streamlined reporting, creating a unified diagnostic workflow across institutions

- This trend towards intelligent, interconnected, and digitally enhanced microscopy is reshaping expectations for laboratory and clinical imaging, driving companies such as Nikon to develop AI-enabled and fully digital microscope solutions

- The demand for microscopes offering digital imaging and AI-assisted analysis is growing rapidly across hospitals, research labs, and academic institutions, as users increasingly prioritize accuracy, efficiency, and integration with modern laboratory infrastructure

- Miniaturized and portable microscopes are emerging as a trend for field diagnostics and point-of-care testing, enhancing accessibility. For instance, Swift Optical’s compact digital microscopes are being deployed in smaller clinics and mobile labs

Europe Clinical Microscopes Market Dynamics

Driver

Rising Demand for Accurate Diagnostics and Advanced Research

- The increasing need for precise diagnostic tools in hospitals and research centers, coupled with rising investment in life sciences and clinical research, is a key driver of the Europe clinical microscopes market

- For instance, in March 2025, Leica Microsystems announced the launch of an AI-assisted imaging platform for high-throughput pathology labs, aiming to enhance diagnostic efficiency and accuracy

- As clinicians and researchers require more accurate and faster analysis of biological samples, clinical microscopes provide high-resolution imaging, automated measurement, and integrated software for improved results

- Furthermore, the modernization of healthcare facilities and research laboratories is increasing adoption of advanced microscopes that integrate digital imaging, AI analysis, and ergonomic designs

- The growing focus on cell biology, microbiology, and pathology research, combined with increasing funding for scientific projects, is propelling demand for high-end microscopes in hospitals and academic institutions

- Advancements in multimodal imaging combining optical and electron microscopy are enabling more comprehensive sample analysis, driving higher adoption. For instance, JEOL’s hybrid systems support simultaneous high-resolution imaging and spectroscopy

- Government funding and research grants for clinical and life sciences research in Europe are boosting procurement of advanced microscopes. For instance, Horizon Europe grants are facilitating purchases of AI-enabled digital microscopy systems

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The high purchase and maintenance costs of advanced clinical microscopes, particularly AI-enabled and digital models, pose a significant barrier to widespread adoption, especially in smaller laboratories and outpatient facilities

- For instance, high-end ZEISS and Nikon digital microscopes can cost several tens of thousands of euros, limiting accessibility for budget-constrained labs

- In addition, compliance with stringent EU medical device regulations, calibration standards, and certification requirements can slow product deployment and increase operational costs for manufacturers and buyers

- While mid-range optical microscopes are more affordable, advanced features such as AI-assisted analysis, high-resolution cameras, and automated scanning often carry a premium, restricting uptake

- Overcoming these challenges through cost-effective models, leasing options, and streamlined regulatory approvals will be crucial for sustained growth in the Europe clinical microscopes market

- Limited technical expertise in smaller labs to operate advanced AI-enabled microscopes can restrict adoption. For instance, many outpatient facilities rely on basic optical models due to lack of trained personnel

- Data privacy and cybersecurity concerns for AI-integrated digital microscopes in hospitals may slow deployment, as patient sample images and diagnostic data must comply with GDPR regulations. For instance, institutions must ensure secure cloud storage and access controls

Europe Clinical Microscopes Market Scope

The market is segmented on the basis of product, ergonomics, modality, application, end user, and distribution channel.

- By Product

On the basis of product, the Europe clinical microscopes market is segmented into optical microscopes, electron microscopes, scanning probe microscopes, and others. The optical microscope segment dominated the market with the largest market revenue share of 46.2% in 2025, driven by its reliability, affordability, and widespread use in routine diagnostics and educational applications. Optical microscopes are commonly used in hospitals and research labs for pathology, microbiology, and cell biology, providing high-resolution imaging with simple operation. Their adaptability for both routine laboratory workflows and advanced research applications makes them a preferred choice across institutions. Furthermore, the integration of optical microscopes with digital imaging systems and AI-assisted analysis is enhancing their value proposition, increasing demand.

The electron microscope segment is expected to witness the fastest growth rate of 19.8% from 2026 to 2033, fueled by the increasing need for high-resolution imaging in advanced research and pathology applications. Electron microscopes provide detailed ultrastructural analysis of tissues, cells, and microorganisms, making them indispensable for neuroscience, nanotechnology, and molecular biology research. Rising investments in clinical research and university laboratories across Europe are accelerating adoption of electron microscopes. In addition, ongoing innovations that reduce size and cost are enabling wider deployment beyond large research centers.

- By Ergonomics

On the basis of ergonomics, the market is segmented into inverted and upright microscopes. The upright microscope segment dominated the market with the largest revenue share of 42.7% in 2025, primarily due to its extensive use in routine pathology and microbiology laboratories. Upright microscopes offer easy handling of standard slides and samples, providing a familiar workflow for lab technicians and pathologists. They are compatible with a wide range of optical and digital imaging accessories, enhancing versatility. Hospitals and research institutions frequently prefer upright microscopes for day-to-day clinical work and teaching purposes due to their ergonomic design and operational efficiency.

The inverted microscope segment is expected to witness the fastest growth rate of 21.3% from 2026 to 2033, driven by increasing applications in cell culture analysis, live cell imaging, and biomedical research. Inverted microscopes are ideal for observing cells in culture plates or flasks without disturbing samples, making them critical in cell biology and drug development research. The rising number of biotechnology and pharmaceutical research projects across Europe is accelerating demand. Moreover, integration with digital imaging systems and AI-based analysis is enhancing their functionality and adoption.

- By Modality

On the basis of modality, the market is segmented into digital and optical microscopes. The optical modality segment dominated the market with a share of 53.1% in 2025, owing to its established use in diagnostic laboratories, teaching institutions, and hospitals for standard sample observation. Optical microscopes offer high reliability, low maintenance, and ease of use for routine diagnostics in microbiology, pathology, and cell biology. Their compatibility with conventional laboratory workflows ensures steady demand. In addition, the integration of digital cameras with optical microscopes is gradually enhancing functionality without replacing the fundamental optical system.

The digital modality segment is expected to witness the fastest growth rate of 22.0% from 2026 to 2033, driven by rising adoption of AI-assisted imaging, cloud-based storage, and remote collaboration tools in hospitals and research labs. Digital microscopes enable automated image analysis, remote diagnostics, and telepathology, making them essential for high-throughput laboratories and academic research. Increased government funding for digital infrastructure in clinical research centers is further accelerating market growth.

- By Application

On the basis of application, the market is segmented into microbiology, cell biology, pathology, neuroscience, and others. The pathology segment dominated the market with the largest revenue share of 38.9% in 2025, due to the increasing prevalence of chronic diseases and rising demand for accurate diagnostic solutions in hospitals and clinical laboratories. Pathology labs rely heavily on clinical microscopes for tissue examination, slide analysis, and disease detection. Integration with digital imaging and AI-assisted diagnostics is further driving the adoption in pathology departments. The growing number of hospitals and research centers investing in advanced imaging systems is boosting demand.

The cell biology segment is expected to witness the fastest growth rate of 23.1% from 2026 to 2033, fueled by increasing research in regenerative medicine, drug development, and stem cell studies across Europe. Clinical microscopes are critical in observing cell cultures, live cell dynamics, and cellular interactions. Rising government and private funding for cell biology research is driving adoption. Furthermore, the need for precision imaging for advanced research applications is expanding the use of digital and inverted microscopes in cell biology.

- By End User

On the basis of end user, the market is segmented into hospitals, research and academic institutions, outpatient facilities, and others. The hospitals segment dominated the market with the largest revenue share of 42.1% in 2025, owing to the growing need for accurate diagnostics, modernization of laboratory infrastructure, and integration of clinical microscopes into routine workflows. Hospitals utilize microscopes extensively in pathology, microbiology, and hematology departments, creating steady demand. The preference for high-resolution, reliable, and easy-to-use systems is driving adoption. Digital integration and AI-assisted analysis are further increasing the attractiveness of microscopes for hospital laboratories.

The research and academic institutions segment is expected to witness the fastest growth rate of 24.2% from 2026 to 2033, fueled by expanding university research programs, biotechnology projects, and scientific publications across Europe. Institutions require high-end microscopes, including electron and digital microscopes, for advanced experiments and training purposes. Increased funding for research infrastructure and grants for laboratory modernization are driving growth. Furthermore, integration with digital platforms enables collaborative research and remote learning applications.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail sales. The direct tender segment dominated the market with the largest share of 51.4% in 2025, as hospitals and research institutions prefer bulk procurement through tenders for cost-effective and standardized solutions. Direct tender ensures long-term service agreements, maintenance, and timely delivery, making it the preferred method for large institutions. Companies supplying clinical microscopes focus on institutional contracts for stable revenue streams.

The retail sales segment is expected to witness the fastest growth rate of 20.5% from 2026 to 2033, driven by the rising demand for smaller, portable, and affordable microscopes especially in outpatient facilities, academic labs, and in home-based research. The retail sales provide quick access to microscopes without complex procurement processes. The growing popularity of digital and portable microscopes for educational and research purposes is accelerating retail adoption.

Europe Clinical Microscopes Market Regional Analysis

- Germany dominated the clinical microscopes market with the largest revenue share of 24.8% in 2025, supported by advanced healthcare infrastructure, high adoption of digital laboratory solutions, and the presence of leading industry players, with hospitals and research institutions actively upgrading to advanced imaging systems

- Clinical laboratories and hospitals in Germany prioritize precision, reliability, and integration of microscopes with digital imaging and AI-assisted analysis, making high-end optical and digital microscopes the preferred choice for routine diagnostics and research

- This widespread adoption is further supported by strong government support for healthcare and life sciences research, well-funded academic and research institutions, and growing investments in laboratory modernization, establishing Germany as a key hub for clinical microscopy in Europe

The Germany Clinical Microscopes Market Insight

The Germany clinical microscopes market dominated Europe with the largest revenue share of 24.8% in 2025, fueled by advanced healthcare infrastructure, high adoption of digital imaging systems, and the presence of leading microscope manufacturers. Hospitals and research institutions prioritize precision, reliability, and integration with AI-based analysis tools. The growing focus on diagnostics, life sciences research, and laboratory modernization is driving adoption, while government funding and research grants further encourage procurement of high-end optical and electron microscopes.

France Clinical Microscopes Market Insight

The France clinical microscopes market is expected to grow at a noteworthy CAGR during the forecast period, driven by increased adoption in hospitals, research institutions, and universities focusing on pathology, cell biology, and microbiology. Rising government investment in healthcare and scientific research, coupled with expanding digital and telepathology solutions, is promoting market growth. Laboratories in France are increasingly integrating microscopes with advanced imaging software for precise diagnostics and high-throughput research applications.

U.K. Clinical Microscopes Market Insight

The U.K. clinical microscopes market is anticipated to expand at a considerable CAGR during the forecast period, fueled by rising demand for advanced diagnostic and research capabilities in hospitals and academic institutions. Growing emphasis on life sciences research, laboratory modernization, and digital integration is supporting market adoption. Universities and biotechnology labs are investing in AI-assisted microscopes for cell biology and pathology research, while hospitals are upgrading optical and digital systems to improve workflow efficiency and diagnostic accuracy.

Poland Clinical Microscopes Market Insight

The Poland clinical microscopes market is expected to witness the fastest CAGR from 2026 to 2033, driven by rapid modernization of laboratories, increasing research activities, and government initiatives to enhance healthcare infrastructure. Growing investment in academic and biotechnology institutions is supporting adoption of digital and AI-enabled microscopes. Poland’s emerging life sciences research hubs are integrating high-end microscopes for cell biology, pathology, and microbiology applications, creating strong growth potential for the market

Europe Clinical Microscopes Market Share

The Europe Clinical Microscopes industry is primarily led by well-established companies, including:

- Carl Zeiss Microscopy GmbH (Germany)

- Leica Microsystems (Germany)

- NIKON CORPORATION (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- Bruker Corporation (U.S.)

- Hitachi High-Tech Corporation (Japan)

- Keyence Corporation (Japan)

- Oxford Instruments plc (U.K.)

- Euromex Microscopen BV (Netherlands)

- JEOL Ltd. (Japan)

- Motic Inc. (Hong Kong)

- Andor – Oxford Instruments (U.K.)

- Labomed Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Optika Microscopes Inc. (U.S.)

- Prior Scientific Instruments Ltd. (U.K.)

- Swift Optical Instruments Inc. (U.S.)

- Accu-Scope Inc. (U.S.)

- Olympus Corporation (Japan)

What are the Recent Developments in Europe Clinical Microscopes Market?

- In June 2025, Evident announced the launch of the SLIDEVIEW™ DX VS200 whole slide scanner, a CE-marked high-resolution, high-throughput imaging solution compliant with EU IVDR, supporting versatile clinical pathology workflows and AI-assisted imaging modes

- In November 2024, Clair Scientific a Danish startup raised €12 million to advance its novel imaging microscope (‘Z1’), a compact and affordable digital microscope solution designed to broaden access to advanced microscopy across clinical and research applications in Europe

- In October 2024, Nikon launched the ECLIPSE Ui Ver. 1.3 digital imaging microscope for medical use in Europe, adding enhanced features such as high-definition overview display, automatic image capture, and improved autofocus tailored to streamline pathological observations

- In September 2024, Zomedica secured CE Mark approval for its TRUVIEW™ digital microscope and telepathology system, enabling commercialization of this advanced digital microscopy platform across the European Economic Area with features such as automated slide preparation and telepathology-capable remote diagnostics

- In March 2023, PreciPoint introduced its iO:M8 Digital Live Microscope, receiving CE-IVD certification under the new EU IVDR and marking a significant milestone for clinical digital microscopy use in intra-operative and diagnostic settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.