Europe Craniomaxillofacial Implants Market

Market Size in USD Million

CAGR :

%

USD

558.04 Million

USD

958.82 Million

2024

2032

USD

558.04 Million

USD

958.82 Million

2024

2032

| 2025 –2032 | |

| USD 558.04 Million | |

| USD 958.82 Million | |

|

|

|

|

Europe Craniomaxillofacial Implants Market Size

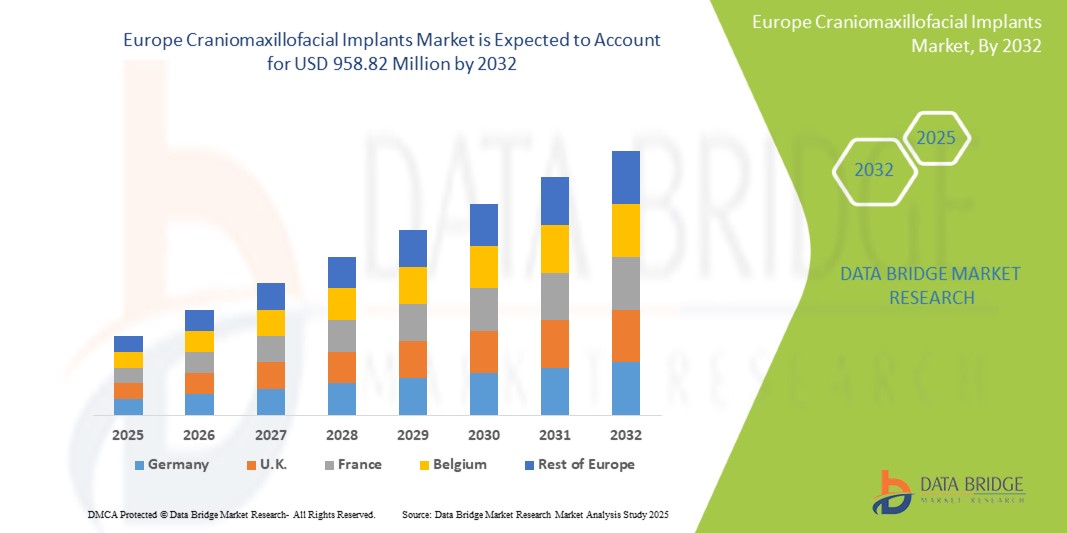

- The Europe craniomaxillofacial Implants market size was valued at USD 558.04 million in 2024 and is expected to reach USD 958.82 million by 2032, at a CAGR of 6.90% during the forecast period

- The market growth in Europe for craniomaxillofacial Implants is primarily driven by increasing awareness about craniofacial deformities and trauma, along with advancements in surgical techniques and implant materials. Enhanced diagnostic capabilities and timely medical interventions are enabling better patient outcomes, contributing to rising demand for these implants across the region

- In addition, growing investments in research and development within the medical device sector, combined with supportive regulatory policies across the European Union, are fostering innovation in implant design and biocompatibility. This supportive environment is encouraging the adoption of next-generation craniomaxillofacial implants, which offer improved durability, reduced complications, and enhanced patient recovery

Europe Craniomaxillofacial Implants Market Analysis

- The Europe craniomaxillofacial Implants market is experiencing robust growth driven by advancements in surgical techniques and increasing demand for reconstructive and cosmetic procedures across the region. This growth is supported by rising awareness of craniofacial deformities, trauma cases, and tumor resections requiring implant solutions

- Increasing investments in healthcare infrastructure and the availability of skilled surgeons are further fueling the adoption of craniomaxillofacial implants in Europe. In addition, the expansion of insurance coverage and reimbursement policies in key countries are enhancing patient access to advanced implant procedures

- Germany dominated the Europe craniomaxillofacial implants market with the largest revenue share of 33.8% in 2024, owing to its well-established healthcare system, extensive network of specialized clinics, and early adoption of innovative implant technologies

- France is expected to be the fastest growing region in the Europe craniomaxillofacial implants market with a CAGR of 11.9% during the forecast period, driven by growing healthcare expenditure, government initiatives promoting advanced surgical treatments, and an increasing geriatric population requiring reconstructive surgeries

- The internal fixators segment held the largest revenue share of 62.4% in 2024, owing to their widespread use in stabilizing fractures and reconstructing craniofacial bones with minimally invasive techniques. Internal fixators are favored for their ability to provide rigid fixation while minimizing patient discomfort and improving healing outcomes

Report Scope and Europe Craniomaxillofacial Implants Market Segmentation

|

Attributes |

Europe Craniomaxillofacial Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Craniomaxillofacial Implants Market Trends

Advancements in Therapeutics and Surge in Clinical Research Driving Europe Craniomaxillofacial Implants Market

- The Europe craniomaxillofacial implants market is experiencing significant growth fueled by ongoing therapeutic advancements and an increase in clinical research focused on improving implant efficacy and patient outcomes. Innovations in biomaterials, surgical techniques, and implant customization are reshaping treatment protocols across the region

- European medical device companies and research institutions are investing in next-generation implants that leverage cutting-edge technologies such as 3D printing and bioactive coatings to enhance osseointegration and reduce post-surgical complications. These advancements support more precise and durable craniofacial reconstructions

- Personalized treatment approaches are becoming prevalent, supported by sophisticated diagnostic tools like 3D imaging and virtual surgical planning, enabling surgeons to tailor implants to individual anatomical and functional needs, thereby improving success rates and patient satisfaction

- Clinical trials in countries such as Germany, France, and the U.K. are increasingly focusing on novel implant materials, including bioresorbable polymers and hybrid composites, which promise better biocompatibility and long-term stability. Regulatory agencies are facilitating faster approvals to meet rising patient demand

- Integrated care pathways that combine surgery with rehabilitation therapies, including physiotherapy and speech therapy, are expanding, ensuring comprehensive recovery and improved quality of life post-implantation

- Strategic partnerships between technology firms, academic institutions, and governmental bodies are enhancing surgeon training, improving reimbursement policies, and simplifying market entry processes, thereby accelerating adoption of advanced craniomaxillofacial implants

- With Europe’s focus on precision healthcare and aging populations requiring complex reconstructive solutions, the Craniomaxillofacial Implants market is poised for robust growth, driven by innovation, improved clinical outcomes, and expanding access to premium implant technologies

Europe Craniomaxillofacial Implants Market Dynamics

Driver

Accelerating Growth Driven by Advances in Surgical Techniques and Expanding Clinical Research

- The Europe craniomaxillofacial implants market is witnessing substantial growth fueled by improvements in surgical technologies and increasing investments in clinical research aimed at enhancing patient outcomes. Key countries such as Germany, France, and the U.K. are strengthening healthcare infrastructure and adopting advanced diagnostic and imaging tools to support precise implant placement and better recovery rates

- For instance, in early 2024, several leading medical device companies reported progress in clinical trials focusing on bioengineered implants and 3D-printed customized solutions, which promise improved biocompatibility and reduced surgical complications. These innovations are expected to significantly boost market expansion throughout the forecast period

- There is a growing emphasis on personalized treatment approaches involving virtual surgical planning and computer-aided design, which enable tailored implants that match individual anatomical variations, thereby improving functional and aesthetic outcomes

- Regulatory bodies such as the European Medicines Agency (EMA) continue to facilitate market growth by streamlining approval processes for novel implant materials and providing incentives for innovation in craniofacial reconstructive technologies

- Collaborative efforts between biotech firms, academic centers, and government health agencies are fostering an ecosystem that promotes research, patient registries, and awareness campaigns, all of which are vital for expanding access and optimizing treatment protocols

Restraint/Challenge

Infrastructure Gaps and Uneven Clinical Adoption Across Regions

- Despite technological advances, high costs associated with advanced craniomaxillofacial implants and surgical procedures pose significant barriers to widespread adoption, particularly in Eastern Europe and rural areas where healthcare funding is limited

- The complexity and multidisciplinary nature of craniofacial reconstruction—requiring coordinated care from surgeons, radiologists, rehabilitation therapists, and other specialists—often restricts access to well-equipped treatment centers concentrated in urban locations, resulting in disparities in patient care

- In addition, there is a lack of standardized clinical guidelines for implant selection and post-operative management, especially in lower-volume hospitals, leading to inconsistent adoption of cutting-edge technologies across the region

- To address these challenges, increased governmental support, enhanced cross-border collaboration in research and training, and the establishment of specialized craniofacial treatment hubs are critical to broadening patient access and ensuring sustainable market growth in Europe’s Craniomaxillofacial Implants sector

Europe Craniomaxillofacial Implants Market Scope

The market is segmented on the basis of type, design, packaging, product type, brand, incision size, pupil dependence, power, material, adjustability, price range, flexibility, age group, gender, application, end user, and distribution channel.

• By Type

On the basis of type, the Europe craniomaxillofacial implants market is segmented into bone graft substitutes, mid-face implants, cranial/neuro implants, mandibular orthognathic implants, distraction systems, cranial flap fixation systems, patient specific implants (PSI), total temporomandibular (TMJ) replacement systems, dural repair products, and others. The bone graft substitute segment dominated the market with the largest revenue share of 34.2% in 2024, owing to its critical role in facilitating bone regeneration and structural support in a wide range of reconstructive and trauma surgeries. The increasing use of synthetic and allogenic bone graft materials has further expanded this segment.

Patient Specific Implants (PSI) are forecasted to grow at the fastest CAGR of 9.1% from 2025 to 2032, driven by technological advancements in 3D printing and imaging, which enable highly customized implants tailored to individual patient anatomy, thereby improving surgical outcomes and reducing recovery times

• By Material of Construction

On the basis of material, the Europe craniomaxillofacial implants market is segmented into metal, bone graft substitutes, polymers/biomaterials, and others. The metal segment held the largest revenue share of 45.7% in 2024, attributed to the superior strength, durability, and reliability of metals such as titanium alloys and stainless steel, which are extensively used in load-bearing craniofacial implants due to their excellent biocompatibility and resistance to corrosion.

The Polymers/Biomaterials segment is forecasted to grow at the fastest CAGR of 8.3% from 2025 to 2032, driven by advancements in bioresorbable polymers and composites that enhance flexibility, promote natural healing, and minimize long-term complications by eliminating the need for secondary implant removal surgeries.

• By Application Site

On the basis of application site, the Europe craniomaxillofacial implants market is segmented into internal fixators and external fixators. The internal fixators segment held the largest revenue share of 62.4% in 2024, owing to their widespread use in stabilizing fractures and reconstructing craniofacial bones with minimally invasive techniques. Internal fixators are favored for their ability to provide rigid fixation while minimizing patient discomfort and improving healing outcomes.

The external fixators segment is forecasted to grow at the fastest CAGR of 7.6% from 2025 to 2032, driven by increasing adoption in complex craniofacial trauma cases and deformity corrections where adjustable stabilization and easy access to the surgical site are critical. Advances in lightweight and adjustable external fixator designs are further supporting this segment’s growth.

• By Surgery Type

On the basis of surgery type, the market is segmented into reconstructive surgery, trauma surgeries, plastic surgeries, orthognathic surgeries, dental surgeries, ENT surgeries, and others. The reconstructive surgery segment held the largest market share of 38.6% in 2024, driven primarily by the rising incidence of congenital deformities such as craniosynostosis and facial clefts, as well as the increasing number of tumor resections requiring complex craniofacial reconstruction. In addition, post-traumatic craniofacial defects resulting from accidents or injuries further contribute to the demand for advanced implant solutions that can restore both function and aesthetics. The critical need for restoring structural integrity and facial symmetry after such surgeries positions reconstructive procedures at the forefront of the market.

Orthognathic Surgeries are expected to register the highest CAGR of 8.5% from 2025 to 2032, reflecting a growing awareness among patients about the benefits of corrective jaw surgeries. These procedures are increasingly sought after not only for addressing functional issues such as malocclusion and breathing difficulties but also for enhancing facial aesthetics and overall quality of life. Advances in surgical techniques, including minimally invasive procedures and computer-aided surgical planning, alongside improvements in implant materials, are making orthognathic surgeries more accessible and effective, further propelling market growth.

• By Property Type

On the basis of property, the market comprises non-resorbable fixators and resorbable fixators. The non-resorbable fixators segment dominated the market with a substantial revenue share of 56.8% in 2024, primarily because these fixators offer robust, durable, and long-lasting mechanical stability that is critical in complex and extensive craniofacial reconstruction procedures. Their permanence ensures that the affected bone structures remain securely stabilized throughout the entire healing process, which is essential in cases involving significant bone loss or trauma. In contrast,

Resorbable Fixators are anticipated to grow at the fastest CAGR of 9.0% between 2025 and 2032. This rapid growth is attributed to the increasing adoption of advanced biodegradable materials that support natural bone regeneration by gradually breaking down within the body. The use of resorbable fixators reduces the need for secondary surgeries to remove implants, thereby minimizing patient discomfort, lowering the risk of infection, and cutting overall healthcare costs.

• By End User

On the basis of end user, the market is segmented into Hospitals, specialty clinics, trauma centres, ambulatory surgical centers (ASCs), and others. Hospitals held a commanding revenue share of 48.4% in 2024, attributed to their well-established surgical infrastructure, availability of multidisciplinary medical teams including surgeons, anesthesiologists, and rehabilitation specialists, and access to advanced diagnostic and operative technologies. Moreover, hospitals benefit from structured reimbursement frameworks and insurance coverage, which facilitate patient access to costly craniofacial implants and surgeries.

Specialty Clinics are projected to register the highest CAGR of 9.3% during the forecast period, driven by their expanding role in offering focused and specialized craniofacial surgical services. These clinics often provide elective and outpatient procedures, catering to patients seeking personalized and minimally invasive treatment options. The growth of specialty clinics is further supported by increasing urbanization, patient preference for convenient care settings, and advances in surgical technology that allow complex procedures outside traditional hospital environments.

• By Distribution Channel

On the basis of distribution channel, the market is divided into direct tender and retail sales. The Direct Tender segment accounted for the largest market share of 53.2% in 2024, largely due to government-led centralized procurement strategies that streamline purchasing for public healthcare facilities. These tenders ensure cost efficiency through bulk purchases and long-term contracts with leading manufacturers, which guarantees a steady and reliable supply of implants to hospitals and large healthcare systems. Furthermore, direct tenders help maintain quality control and regulatory compliance at the national and regional levels.

Retail Sales are forecasted to register the fastest CAGR of 10.1% from 2025 to 2032, fueled by the rise of private healthcare providers and enhanced patient awareness regarding advanced craniofacial implant options. The increasing penetration of digital health platforms and e-commerce channels has revolutionized the accessibility of implants, enabling faster, more convenient purchasing decisions by healthcare providers and even direct-to-patient sales in some cases. This digital transformation is expected to significantly drive retail sales growth by improving supply chain efficiency and patient engagement.

Europe Craniomaxillofacial Implants Market Regional Analysis

- Europe dominated the global craniomaxillofacial implants market with the largest revenue share of 30.3% in 2024. This strong position is driven by the region’s advanced healthcare infrastructure, especially in ophthalmology and reconstructive surgery, along with rising prevalence of conditions such as presbyopia and cataracts that require specialized implants. The widespread adoption of premium implant technologies and innovative surgical solutions is also fueling market growth

- The market’s expansion in Europe benefits from robust regulatory frameworks, comprehensive reimbursement policies, and high patient awareness, which collectively foster greater adoption across both public and private healthcare sectors. Increased government funding focused on improving vision health and reducing surgical backlogs post-pandemic further accelerates demand for advanced craniomaxillofacial implant procedures

- Europe is home to numerous leading medical device manufacturers and research centers dedicated to craniomaxillofacial implants, facilitating continuous innovation and clinical evaluation to improve patient outcomes and implant functionality

Germany Craniomaxillofacial Implants Market Insight

The Germany craniomaxillofacial implants market led the Europe market with a significant revenue share of 33.8% in 2024. This dominance is attributed to the country’s well-established healthcare system, extensive network of specialized clinics, and early adoption of innovative implant technologies. The German market is further bolstered by a strong medical device manufacturing base and comprehensive healthcare reimbursement mechanisms, enabling widespread patient access to advanced craniomaxillofacial implants. The growing elderly population with an increasing need for reconstructive and corrective surgeries, combined with government-supported eye care screening programs, supports steady market expansion. Additionally, collaboration between hospitals and implant manufacturers promotes the use of cutting-edge implant designs, including trifocal and extended depth of focus (EDOF) implants.

U.K. Craniomaxillofacial Implants Market Insight

The U.K. craniomaxillofacial implants market accounted for 22.6% of the Europe craniomaxillofacial implants market in 2024 and is poised for notable growth during the forecast period. This growth is driven by the National Health Service (NHS)’s initiatives to modernize cataract and reconstructive surgery care, alongside increasing demand for lifestyle-enhancing procedures among the aging population. Expansion of private ophthalmology centers, rising elective surgery volumes, and the inclusion of advanced implants under NHS Choice programs are facilitating greater accessibility. Technological advancements such as toric implants for astigmatism correction and improved implant materials are contributing to increased adoption rates in the region.

France Craniomaxillofacial Implants Market Insight

The France craniomaxillofacial implants market held an 18.2% revenue share of the European market in 2024 and is expected to register the fastest CAGR of 11.9% during the forecast period. This rapid growth is fueled by increasing healthcare expenditure, supportive government initiatives promoting advanced surgical treatments, and a rising geriatric population requiring reconstructive surgeries. National healthcare strategies, such as the French National Vision Plan, alongside growing patient preference for spectacle independence post-surgery, are boosting demand. Furthermore, enhanced surgeon training programs, clinical studies focusing on improved visual outcomes, and favorable reimbursement policies for novel implant designs with reduced side effects (like halos and glare) are key growth drivers.

Europe Craniomaxillofacial Implants Market Share

The Europe craniomaxillofacial implants industry is primarily led by well-established companies, including:

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Medtronic (U.S.)

- Renishaw Plc (U.K.)

- KLS Martin Group (Germany)

- Delphos Implants (U.S.)

- Acumed LLC (U.S.)

- Anatomics Pty Ltd (Australia)

- Bioplate Inc. (U.S.)

- Calavera Surgical Design (U.S.)

- Innovasis (Germany)

- Integra LifeSciences Holdings Corp. (U.S.)

- Dimeda Instrumente GmbH (Germany)

- General Implants GmbH (Germany)

- Xilloc Medical BV (Netherlands)

- B. Braun Melsungen SE (Germany)

- MONDEAL Medical Systems GmbH (Germany)

- OssDsign AB (Sweden)

- Rebstock Instruments GmbH (Germany)

- 3D Systems, Inc. (U.S.)

- Medartis AG (Switzerland)

- 7s Medical AG (Switzerland)

- Advin Health Care (India)

- Gesco Healthcare Pvt. Ltd (India)

- Auxein Medical Private Limited (India)

- Ortho Max Manufacturing Company Pvt. Ltd. (India)

- Vast Ortho (India)

- Skulle Implants Corporation (U.S.)

- PANTHERA DENTAL (India)

- Lucid Implants (U.S.)

Latest Developments in Europe Craniomaxillofacial Implants market

- In October 2021, AlloSource announced that they are launching the AlloMend Extra-Large (XL) Acellular Dermal Matrix (ADM), which is the newest addition to the AlloMend product line. This have increase companies product pipeline

- On August 2021, Medtronic plc announced its agreement with Intersect ENT a global ear, nose, and throat (ENT) medical technology leader. Medtronic's acquisition of Intersect ENT expands the company's portfolio of products used during ear, nose, and throat procedures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.