Europe Data Center Ups Market

Market Size in USD Billion

CAGR :

%

USD

2.16 Billion

USD

3.49 Billion

2024

2032

USD

2.16 Billion

USD

3.49 Billion

2024

2032

| 2025 –2032 | |

| USD 2.16 Billion | |

| USD 3.49 Billion | |

|

|

|

|

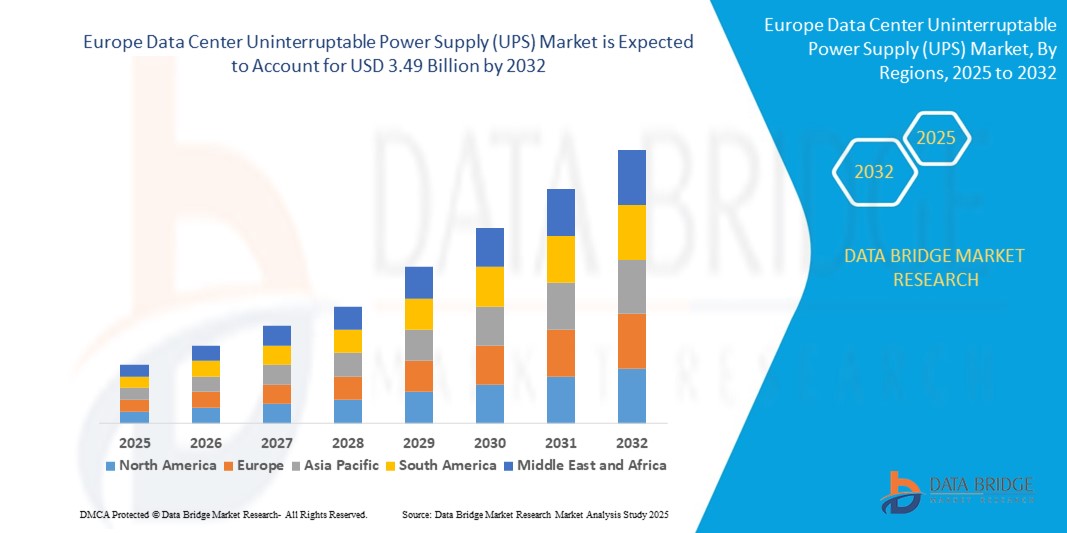

What is the Europe Data Center Uninterruptable Power Supply (UPS) Market Size and Growth Rate?

- The Europe data center uninterruptable power supply (UPS) market size was valued at USD 2.16 billion in 2024 and is expected to reach USD 3.49 billion by 2032, at a CAGR of 6.20% during the forecast period

- In commercial spaces, Data Center Uninterruptable Power Supply (UPS) market are extensively used to create sophisticated and inviting environments. These floors offer a balance of elegance and durability, making them suitable for high-traffic areas such as offices, retail stores, restaurants, and hotels. Their aesthetic appeal enhances the ambiance of commercial establishments, contributing to a positive customer experience

- In addition, wood engineered floors are favoured for their ease of maintenance, ensuring that businesses can maintain a clean and attractive appearance with minimal effort

What are the Major Takeaways of Europe Data Center Uninterruptable Power Supply (UPS) Market?

- Online platforms offer a wide range of product options, enabling consumers to compare prices, styles, and specifications easily. This accessibility is particularly appealing for consumers in remote areas or those with limited access to physical stores

- In addition, online sales channels provide a platform for manufacturers to display their products to a broader audience, fostering market penetration and brand visibility. The digital marketplace also facilitates direct-to-consumer sales, allowing for more competitive pricing and promotions, further stimulating demand for wood engineered floors

- U.K. dominated the Europe data center uninterruptible power supply (UPS) market with the largest revenue share of 40.8% in 2024, driven by the rapid expansion of hyperscale and colocation facilities, coupled with increasing investments in cloud and edge computing infrastructure

- Germany is projected to witness the fastest growth rate throughout the forecast period, driven by its leadership in Industry 4.0 and the rising adoption of high-performance computing solutions

- The Parquet Wood Flooring segment dominated the market with the largest revenue share of 34.2% in 2024, driven by its aesthetic appeal, durability, and rising adoption in premium residential and commercial spaces

Report Scope and Europe Data Center Uninterruptable Power Supply (UPS) Market Segmentation

|

Attributes |

Europe Data Center Uninterruptable Power Supply (UPS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Europe Data Center Uninterruptable Power Supply (UPS) Market?

Sustainable and Modular Power Solutions Driving Market Transformation

- A significant trend in the global data center UPS market is the shift toward energy-efficient, modular, and sustainable UPS systems to support the growing demand for reliable and eco-conscious data center operations

- For instance, in April 2024, Schneider Electric introduced its Galaxy VL UPS with high energy efficiency (up to 99%) and lithium-ion battery options, reducing total cost of ownership and carbon footprint

- Modular UPS designs are gaining traction as they enable scalable expansion, reduced downtime, and easier integration for hyperscale and edge data centers

- The growing emphasis on green data centers and compliance with environmental standards (LEED, ISO 50001) is driving adoption of UPS systems designed with recyclable materials and lower emissions

- Companies such as Eaton and Vertiv are investing heavily in lithium-ion technology and digital monitoring platforms to enhance predictive maintenance and operational efficiency

- This trend is reshaping the Data Center UPS market, making sustainable and modular solutions essential for both large hyperscale operators and emerging edge computing facilities

What are the Key Drivers of Europe Data Center Uninterruptable Power Supply (UPS) Market?

- The surging demand for cloud services, IoT, and AI workloads is significantly increasing the need for reliable UPS systems to ensure uninterrupted power for mission-critical applications

- For example, in March 2024, ABB partnered with Green Mountain Data Center to deploy high-efficiency UPS solutions supporting renewable energy integration

- Rising investments in hyperscale and colocation facilities, coupled with government initiatives promoting data localization, are accelerating UPS deployments globally

- The growing popularity of lithium-ion batteries due to their longer lifespan, smaller footprint, and lower maintenance compared to VRLA batteries is driving market growth

- Digital twin and AI-powered monitoring tools are improving predictive maintenance and reducing operational costs, making advanced UPS systems more attractive

- In addition, the increasing shift toward edge data centers to support 5G and low-latency applications is fostering demand for compact and scalable UPS solutions across regions

Which Factor is challenging the Growth of the Europe Data Center Uninterruptable Power Supply (UPS) Market?

- A major challenge in the data center UPS market is high capital investment and operational costs associated with advanced lithium-ion and modular systems

- For instance, in 2023, Vertiv reported pricing pressures due to rising costs of lithium and other battery raw materials, impacting deployment budgets for small and medium enterprises

- Complex integration requirements and lack of skilled professionals to manage advanced UPS systems hinder adoption in emerging markets

- Variability in energy efficiency standards and regulatory compliance across regions increases design complexity for global operators

- Furthermore, supply chain disruptions and semiconductor shortages have delayed UPS production, leading to longer lead times for large-scale projects

- Addressing these challenges through cost optimization, workforce training, and localized manufacturing will be crucial to ensure sustained market growth

How is the Europe Data Center Uninterruptable Power Supply (UPS) Market Segmented?

The market is segmented on the basis of type, offering, capacity, battery type, data center type, data center size, application, and end user.

- By Type

On the basis of type, the data center UPS market is segmented into On-Line Double-Conversion, Line Interactive, and Passive Standby. The On-Line Double-Conversion segment dominated the market with the largest revenue share of 56.4% in 2024, driven by its superior power conditioning, zero transfer time, and suitability for mission-critical applications in hyperscale and enterprise data centers.

The Line Interactive segment is projected to witness the fastest CAGR from 2025 to 2032, owing to its cost-effectiveness and growing deployment in small and medium-sized edge facilities requiring reliable yet economical UPS systems.

- By Offering

On the basis of offering, the market is segmented into Solution and Services. The Solution segment held the dominant revenue share of 68.7% in 2024, as enterprises prioritize advanced UPS hardware and integrated systems to ensure uninterrupted power supply.

The Services segment is anticipated to record the highest CAGR during the forecast period, driven by rising demand for maintenance, monitoring, and lifecycle management in complex data center environments.

- By Capacity

On the basis of capacity, the market is segmented into Below 500 KVA, 500-1000 KVA, and Above 1000 KVA. The Above 1000 KVA segment dominated with a market share of 47.9% in 2024, fueled by hyperscale data center expansions and large-scale cloud service providers requiring high-capacity systems to support heavy workloads.

The 500-1000 KVA segment is expected to grow at the fastest CAGR, supported by increasing adoption in medium-sized colocation and enterprise facilities.

- By Battery Type

On the basis of battery type, the market is segmented into VRLA UPS, Lithium-Ion UPS, Flywheel UPS, and Others. The VRLA UPS segment led with a revenue share of 52.3% in 2024, due to its widespread availability and cost advantage for legacy installations.

However, the Lithium-Ion UPS segment is projected to witness the fastest CAGR from 2025 to 2032, driven by longer lifecycle, compact footprint, and reduced maintenance requirements aligning with modern data center sustainability goals.

- By Data Center Type

On the basis of data center type, the market is segmented into Colocation Data Center, Enterprise Data Center, Cloud and Edge Data Center, and Managed Data Center. The Colocation Data Center segment dominated with 39.6% market share in 2024, supported by the surge in outsourcing IT infrastructure and demand for scalable power solutions.

The Cloud and Edge Data Center segment is anticipated to grow fastest, propelled by 5G rollout, IoT proliferation, and low-latency computing needs.

- By Data Center Size

On the basis of data center size, the market is segmented into Small, Medium, and Large. The Large Data Center segment accounted for 58.1% of the market in 2024, driven by hyperscale projects from global cloud providers.

The Small Data Center segment is expected to register the highest CAGR, as edge computing accelerates demand for compact UPS systems closer to end-users.

- By Application

On the basis of application, the market is segmented into Cloud Storage, Data Warehouse, ERP System, File Servers, Application Servers, CRM Systems, and Others. The Cloud Storage segment held the dominant market share of 36.4% in 2024, driven by exponential data growth from AI, IoT, and big data analytics.

The Application Servers segment is projected to grow fastest, fueled by rising enterprise software deployments and hybrid cloud architectures.

- By End User

On the basis of end user, the market is segmented into IT & ITES, BFSI, Telecommunications, Manufacturing, Government and Public Sector, Healthcare and Life Sciences, and Media and Entertainment. The IT & ITES segment dominated with 42.8% market share in 2024, attributed to rapid cloud adoption and the continuous need for high-availability infrastructure.

The Healthcare and Life Sciences segment is anticipated to witness the fastest growth due to the surge in digital health services and data-intensive medical research requiring reliable power systems.

Which Country Holds the Largest Share of the Europe Data Center Uninterruptable Power Supply (UPS) Market?

- U.K. dominated the Europe data center uninterruptible power supply (UPS) market with the largest revenue share of 40.8% in 2024, driven by the rapid expansion of hyperscale and colocation facilities, coupled with increasing investments in cloud and edge computing infrastructure. The region benefits from favorable government policies supporting digital transformation and renewable energy integration in data centers

- A robust presence of global cloud providers, combined with advanced regulatory standards for energy efficiency, has accelerated the deployment of high-capacity, lithium-ion-based UPS systems in both new and retrofitted facilities

- The market is further supported by rising demand for AI and big data applications, continuous innovations in modular UPS architectures, and strong initiatives toward carbon-neutral data center operations

Germany Data Center Uninterruptible Power Supply (UPS) Market Insight

Germany is projected to witness the fastest growth rate throughout the forecast period, driven by its leadership in Industry 4.0 and the rising adoption of high-performance computing solutions. The country’s emphasis on renewable-powered data centers and strict environmental regulations are propelling demand for energy-efficient UPS systems with advanced monitoring capabilities. Manufacturers are increasingly focusing on scalable, double-conversion UPS systems and lithium-ion technologies to meet the needs of hyperscale and enterprise facilities. In addition, growing investments in smart manufacturing and 5G infrastructure further enhance market potential.

France Data Center Uninterruptible Power Supply (UPS) Market Insight

France is experiencing steady market expansion, supported by government-backed initiatives for digital sovereignty and the development of edge data centers. Demand is driven by the growing adoption of cloud services among enterprises and the rising need for reliable power backup in AI and IoT-driven applications. Domestic and global players are investing in innovative UPS designs, including compact modular solutions and flywheel technologies, to cater to urban data centers with space and efficiency constraints. Increasing focus on energy-efficient retrofits in existing facilities also contributes to the market’s growth across commercial and industrial sectors.

Which are the Top Companies in Europe Data Center Uninterruptable Power Supply (UPS) Market?

The data center uninterruptable power supply (UPS) industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Schneider Electric (France)

- Eaton (Ireland)

- Vertiv Group Corp (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Legrand (France)

- Delta Electronics, Inc. (Taiwan)

- Socomec (France)

- Borri S.p.A. (Italy)

- RPS Spa (Italy)

- AEG Power Solutions (Germany)

- Fuji Electric Co., Ltd. (Japan)

- Kohler Uninterruptible Power Limited (U.K.)

- SolarEdge Technologies, Inc. (Israel)

- Piller Power Systems (Germany)

- Cyber Power Systems (USA), Inc. (U.S.)

- Kehua Data Co., Ltd. (China)

- ENERSYS (U.S.)

- Panduit Corp. (U.S.)

What are the Recent Developments in Europe Data Center Uninterruptable Power Supply (UPS) Market?

- In July 2023, ABB India's Electrification business launched the MegaFlex DPA UPS solution, targeting India's data center industry. This sustainable offering addresses the sector's burgeoning power needs with its compact design, high energy efficiency, and alignment with circularity frameworks, ensuring reliability and scalability

- In February 2023, Socomec India launched a range of sustainable power solutions, notably the Delphys XL 1200kVA/kW UPS, aimed at Power Conversion, Monitoring, and Switching segments. These offerings underscore Socomec's commitment to efficient energy management, meeting customers' evolving needs with transformative technologies

- In April 2022, Numeric, under the Legrand Group umbrella, launched the Keor XPE 3, a modular and scalable UPS catering to Data Centers with its 500 KW – 2.1 MW power rating. With up to 7 power units, each boasting 250-300 KW, the Keor XPE 3 addresses the demand for high-power UPS solutions in data-centric environments

- In January 2022, Eaton launched the second generation 5PX UPS, featuring optional connectivity features designed for maintenance simplicity in distributed IT or edge environments. Supporting Eaton's Intelligent Power Manager software and PredictPulse remote monitoring service, the 5PX G2 contributes to Eaton's Brightlayer Data Centers suite, providing comprehensive Data Center Infrastructure Management (DCIM) solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Data Center Ups Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Data Center Ups Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Data Center Ups Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.