Europe Dental Diagnostic Surgical Equipment Market

Market Size in USD Billion

CAGR :

%

USD

5.80 Billion

USD

9.20 Billion

2024

2032

USD

5.80 Billion

USD

9.20 Billion

2024

2032

| 2025 –2032 | |

| USD 5.80 Billion | |

| USD 9.20 Billion | |

|

|

|

|

Europe Dental Diagnostic and Surgical Equipment Market Size

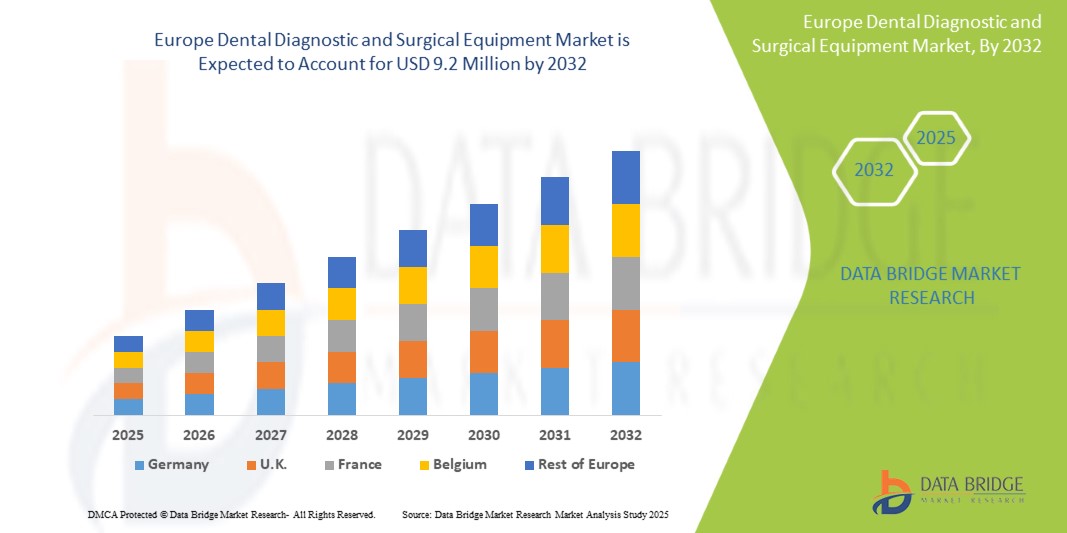

- The Global Europe Dental Diagnostic and Surgical Equipment Market size was valued at USD 5.8 billion in 2024 and is expected to reach USD 9.2 billion by 2032, at a CAGR of 6.0% during the forecast period

The market growth is largely fueled by the increasing adoption of digital dentistry and continuous technological advancements in diagnostic imaging, CAD/CAM systems, and laser-based surgical tools, leading to enhanced precision, efficiency, and patient outcomes across European dental practices.

- Furthermore, rising demand for minimally invasive procedures, aesthetic dental treatments, and integrated digital workflows is positioning advanced dental equipment as the standard in modern dental care. These converging factors are accelerating the uptake of diagnostic and surgical technologies, thereby significantly boosting the region’s market growth.

Europe Dental Diagnostic and Surgical Equipment Market Analysis

- Dental diagnostic and surgical equipment, featuring advanced imaging, CAD/CAM systems, and laser technologies, are becoming essential in modern dental practices across Europe due to their precision, improved treatment outcomes, and seamless integration with digital workflows.

- The growing demand for these technologies is driven by the rising incidence of oral diseases, increased focus on cosmetic and restorative dentistry, and the widespread adoption of patient-friendly, minimally invasive tools.

- Europe held a significant share of the global dental diagnostic and surgical equipment market in 2024, owing to its strong healthcare infrastructure, favorable reimbursement policies, and the early adoption of digital dentistry.

- Germany, the U.K., and France lead the region in terms of market adoption, supported by well-established dental care systems, skilled professionals, and high awareness of oral health.

- Technological innovations such as chairside CAD/CAM units and 3D dental imaging are increasingly being adopted in both private clinics and hospital-based dental centers across Europe.

- The market is also influenced by the rise in geriatric population, rising healthcare spending, and demand for efficient, faster dental treatments.

- Countries in Eastern Europe are witnessing accelerated growth due to increasing investments in healthcare and expanding access to advanced dental technologies.

Report Scope and Europe Dental Diagnostic and Surgical Equipment Market Segmentation

|

Attributes |

Europe Dental Diagnostic and Surgical Equipment Market Insights |

|

Segments Covered |

|

|

Countries Covered |

• Germany Rest of Europe |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Dental Diagnostic and Surgical Equipment Market Trends

“Integration of AI and Digital Technologies in Diagnostic and Surgical Equipment”

- AI-powered imaging systems analyze dental scans with high precision, enabling earlier and more accurate detection of oral diseases. This reduces human error and allows dentists to plan treatments more effectively. Integration of AI enhances diagnostic capabilities significantly. The technology supports deeper insights from imaging data. This leads to improved patient outcomes.

- Digital technologies combined with AI help create customized treatment plans by processing patient data and predicting outcomes. This allows for more targeted interventions tailored to individual needs. Patients receive more personalized care, improving satisfaction and treatment success rates. AI algorithms analyze complex clinical information swiftly. The result is optimized treatment pathways.

- AI integration in surgical equipment provides real-time guidance during dental procedures, increasing precision and minimizing risks. Smart tools can adjust automatically based on intraoperative feedback, improving safety. This technology supports minimally invasive surgeries with higher accuracy. It helps reduce complications and speeds up recovery. Surgeons benefit from enhanced decision-making tools.

- Digital workflows enabled by AI streamline data management, appointment scheduling, and patient monitoring. This reduces administrative burdens for dental clinics and enhances operational efficiency. Automated systems improve communication between staff and patients. AI helps organize large volumes of clinical data seamlessly. The overall process becomes faster and error-free.

- AI algorithms monitor the condition of diagnostic and surgical devices, predicting maintenance needs before breakdowns occur. This lowers downtime and ensures consistent performance of equipment. Predictive maintenance saves costs by avoiding emergency repairs. It helps maintain high standards of hygiene and safety. Equipment lifespan is extended through timely interventions.

- The use of AI-driven virtual consultations, digital impressions, and automated follow-ups enhances patient engagement and convenience. Digital tools offer clearer visualizations, helping patients understand their treatment plans better. This improves communication and trust between patients and dentists. The experience becomes more interactive and less stressful. Patient adherence to care protocols increases

Europe Dental Diagnostic and Surgical Equipment Market Dynamics

Driver

“Government Initiatives and Increased Healthcare Spending”

- The increasing focus of European governments on improving public oral health through expanded screening and prevention programs is a significant driver for the rising demand for advanced dental diagnostic and surgical equipment.

- For instance, in 2023, the UK government allocated substantial funding toward the NHS Dental Recovery Plan, aiming to enhance preventive dental care and expand access to services. These investments are expected to boost procurement of modern dental technologies during the forecast period.

- As awareness of oral health’s impact on overall wellbeing grows, public and private dental providers are upgrading to digital systems such as CAD/CAM, 3D imaging, and laser surgery tools to improve patient outcomes and treatment efficiency.

- Furthermore, government initiatives targeting underserved regions and vulnerable populations are increasing the need for portable, user-friendly dental equipment, enabling expanded care access and driving market demand.

- The establishment of favorable reimbursement policies and regulatory support across many European countries encourages dental clinics to adopt state-of-the-art diagnostic and surgical solutions, facilitating market growth in both urban and rural healthcare settings.

Restraint/Challenge

“High Cost and Regulatory Complexities Hindering Market Growth”

- The high cost of advanced dental diagnostic and surgical equipment remains a significant barrier for many dental practices, particularly small and medium-sized clinics, limiting widespread adoption across Europe.

- For example, the stringent requirements of the EU Medical Device Regulation (MDR) have increased approval times and compliance costs, delaying product launches and raising expenses for manufacturers and end-users alike.

- As a result, some clinics in Southern and Eastern Europe struggle to invest in cutting-edge technologies, impacting the overall market growth and widening the gap between developed and emerging dental markets.

- Furthermore, reimbursement limitations and complex insurance policies in certain countries reduce the financial incentives for dentists to upgrade equipment, restricting demand for high-end diagnostic and surgical tools.

- The need for skilled professionals trained in operating advanced digital and surgical equipment adds another layer of challenge, as a shortage of adequately trained personnel slows technology adoption in various European regions.

Europe Dental Diagnostic and Surgical Equipment Market Scope

The market is segmented on the basis By Device, By End User, By Product, By Age Group, By Application, By Distribution Channel, By Country

- By Device

On the basis of device, the Europe dental diagnostic and surgical equipment market is segmented into Covers the various dental equipment used in diagnostics and surgeries, including CAD/CAM systems for digital impressions, instrument delivery systems, dental chairs and handpieces, light cure devices, scaling units for cleaning, dental lasers, and radiology equipment for imaging.

- By Product

On the basis product this includes a diverse range of dental restoration products like crowns, bridges, and implants that restore tooth function and aesthetics, along with restorative materials such as ceramics, composites, and metals that ensure durability, biocompatibility, and patient safety during dental treatments.

- By Age group

On the basis of age group, the Europe dental diagnostic and surgical equipment market is segmented into The segmentation addresses the distinct dental care requirements of different age groups—children needing preventive and early orthodontic care, adults seeking cosmetic and restorative solutions, and the geriatric population often requiring complex treatments due to age-related oral health issues.

- By Application

On the basis of application, the Europe dental diagnostic and surgical equipment market is segmented into The equipment is utilized across various dental care applications including preventive care aimed at avoiding dental diseases, cosmetic dentistry focused on enhancing smile aesthetics, restorative dentistry for repairing damaged teeth, orthodontics for correcting misaligned teeth, and periodontics which deals with the treatment of gum diseases and supporting structures.

- By End User

On the basis of end user, the Europe dental diagnostic and surgical equipment market is segmented he market caters to various healthcare settings such as hospitals equipped with multidisciplinary dental departments, specialized dental clinics focused on patient-centric care, diagnostic centers that provide imaging and testing services, and other end users including academic institutions and mobile dental units, each with unique equipment needs.

- By Distribution Channel

On the basis of Distribution channel, the Europe dental diagnostic and surgical equipment market is segmented Products and equipment are distributed through multiple channels such as consumer stores offering over-the-counter oral care products, dental dispensaries specializing in professional dental supplies, retail pharmacies that cater to general consumer needs, and the growing online distribution platforms providing convenience and wider accessibility.

Europe Dental Diagnostic and Surgical Equipment Market Regional Analysis

- Germany dominated the dental diagnostic and surgical equipment market with the largest revenue share of approximately 35% in 2024, driven by widespread adoption of advanced digital dentistry technologies and strong healthcare infrastructure.

• Dental practices and hospitals across the region prioritize precision, efficiency, and patient-centric care, which has accelerated the integration of CAD/CAM systems, laser equipment, and advanced imaging devices.

•This dominant position is supported by high healthcare expenditure, growing awareness of oral health, and government initiatives promoting dental care innovation, making Europe a key market for cutting-edge dental diagnostic and surgical solutions.

Europe Dental Diagnostic and Surgical Equipment Market Insight

The Europe dental diagnostic and surgical equipment market held a significant revenue share of around 35% in 2024, driven by rapid adoption of digital dentistry solutions and advanced surgical technologies. Dental clinics and hospitals are increasingly investing in CAD/CAM systems, dental lasers, and high-precision imaging devices to improve patient outcomes and treatment efficiency. Growing awareness of oral health, coupled with government support for healthcare innovation and rising demand for minimally invasive procedures, is fueling market growth. Additionally, the integration of digital workflows and AI-powered diagnostics is enhancing clinical accuracy and operational productivity, further accelerating market expansion across key European countries.

U.K. Europe Dental Diagnostic and Surgical Equipment Market Insight

The U.K. dental diagnostic and surgical equipment market is expected to grow steadily at a significant CAGR during the forecast period, fueled by rising adoption of digital dentistry and advanced surgical technologies. Increasing patient demand for minimally invasive and aesthetic dental treatments is driving investments in innovative equipment such as CAD/CAM systems and dental lasers. The country’s strong healthcare infrastructure, coupled with growing awareness of oral health and government initiatives supporting dental care advancements, is further propelling market expansion. Additionally, the integration of AI and digital workflows is enhancing diagnostic accuracy and operational efficiency across dental practices.

Germany Europe Dental Diagnostic and Surgical Equipment Market Insight

The Germany dental diagnostic and surgical equipment market is projected to grow at a considerable CAGR during the forecast period, driven by rising awareness of advanced dental care and strong healthcare infrastructure. The country’s focus on innovation and precision medicine fosters the adoption of cutting-edge technologies such as CAD/CAM systems, laser surgical devices, and digital imaging equipment. Growing demand for minimally invasive and aesthetic dental procedures in both private clinics and hospitals supports market expansion. Additionally, Germany’s emphasis on quality and patient safety aligns with the increasing integration of AI and digital workflows in dental practices.

Europe Dental Diagnostic and Surgical Equipment Market Share

- Ivoclar Vivadent AG (Liechtenstein)

- Dentsply Sirona (U.S.)

- Carestream Health (U.S.)

- Danaher Corporation (U.S.)

- Biolase Technologies (U.S.)

- Planmeca Oy (Finland)

- 3M (Oral Care Division) (U.S.)

- A‑dec Inc. (U.S.)

- Aseptico Inc. (U.S.)

- Straumann Group (Switzerland)

- Nobel Biocare (Switzerland)

- KaVo Kerr (Germany / U.S.)

- Coltene Holding AG (Switzerland)

- Envista Holdings Corporation (U.S.)

- Henry Schein, Inc. (U.S.)

- Midmark Corporation (U.S.)

- GC Corporation (Japan)

- ACTEON Group (France)

- Bien-Air Dental (Switzerland

What are the Recent Developments in Europe Dental Diagnostic and Surgical Equipment Market -

- In February 2025, Ivoclar Vivadent AG launched its next-generation IPS e.max CAD Press ceramic system across Europe. The system offers improved translucency and strength, supporting the demand for high-quality esthetic restorations in restorative dentistry.

- In January 2025, GSK Consumer Healthcare introduced the updated Sensodyne Repair & Protect Advanced toothpaste in several European countries. The new formula addresses dentin hypersensitivity and supports enamel repair through innovative bioactive ingredients.

- In May 2024, Colgate-Palmolive rolled out its Colgate Optic White Pro Series toothpaste across key European markets. Featuring hydrogen peroxide-based whitening technology, the product brings professional-grade cosmetic whitening into the consumer space.

- In March 2024, Dentsply Sirona partnered with dental technology providers in Germany and France to expand access to its Primescan and Primeprint digital systems. The partnership supports wider adoption of chairside CAD/CAM solutions for faster, more precise treatments.

- In February 2024, Unilever’s oral care brand Signal launched a sustainability-driven campaign in Western Europe. The initiative introduced biodegradable toothbrushes and recyclable toothpaste tubes, responding to increasing demand for eco-friendly oral care products.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.