Europe Dermatology Diagnostic Devices Market

Market Size in USD Billion

CAGR :

%

USD

9.14 Billion

USD

17.92 Billion

2024

2032

USD

9.14 Billion

USD

17.92 Billion

2024

2032

| 2025 –2032 | |

| USD 9.14 Billion | |

| USD 17.92 Billion | |

|

|

|

|

Europe Dermatology Diagnostic Devices Market Size

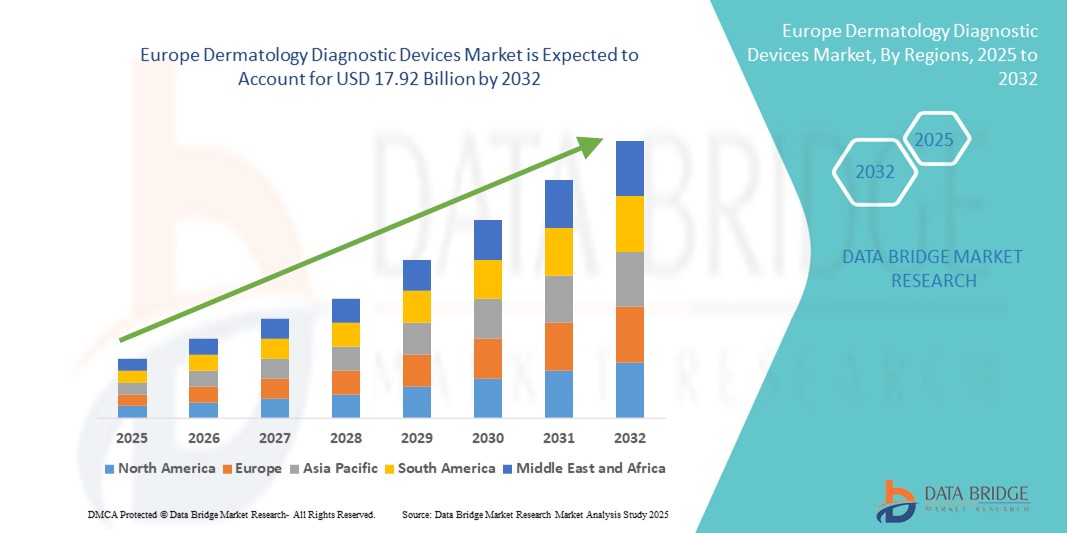

- The Europe dermatology diagnostic devices market size was valued at USD 9.14 billion in 2024 and is expected to reach USD 17.92 billion by 2032, at a CAGR of 8.78% during the forecast period

- The market growth is driven by increasing prevalence of skin disorders, rising awareness about early diagnosis, and advancements in non-invasive and imaging diagnostic technologies tailored for dermatological applications

- Moreover, the growing demand for accurate, rapid, and user-friendly diagnostic tools in dermatology clinics and hospitals across Europe is fueling the adoption of innovative devices, positioning them as essential components in modern dermatological care. These combined factors are propelling the market expansion steadily throughout the forecast timeline

Europe Dermatology Diagnostic Devices Market Analysis

- Dermatology diagnostic devices, including imaging systems, dermatoscopes, and biopsy tools, are becoming essential for early and accurate detection of skin diseases across clinical and hospital settings in Europe, driven by technological advancements and increasing emphasis on personalized skin care

- The market growth is mainly fueled by the rising prevalence of skin conditions such as melanoma and psoriasis, growing public and clinical awareness of early diagnosis, and increasing demand for non-invasive, precise diagnostic technologies among healthcare professionals and patients

- Germany dominated the Europe dermatology diagnostic devices market in 2024 with the largest revenue share of 29.2%, supported by its advanced healthcare infrastructure, substantial healthcare spending, and a strong presence of key dermatology diagnostic device manufacturers investing in innovation

- France is expected to be the fastest-growing country in the Europe dermatology diagnostic devices market during the forecast period, driven by government initiatives promoting skin health awareness, expanding healthcare access, and rising investments in dermatology diagnostic technologies

- The imaging equipment segment dominated the Europe dermatology diagnostic devices market with a share of 41% in 2024, driven by advancements in high-resolution imaging, AI-powered diagnostic tools, and a growing preference for non-invasive and rapid diagnostic methods in dermatology

Report Scope and Europe Dermatology Diagnostic Devices Market Segmentation

|

Attributes |

Europe Dermatology Diagnostic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Dermatology Diagnostic Devices Market Trends

Advancements in AI-Powered Imaging and Non-Invasive Diagnostics

- A prominent and rapidly evolving trend in the Europe dermatology diagnostic devices market is the integration of artificial intelligence (AI) with high-resolution imaging systems, dermatoscopes, and other non-invasive diagnostic tools. These innovations significantly improve diagnostic accuracy and speed, enabling earlier detection of skin cancers and other dermatological conditions

- For instance, devices such as the FotoFinder AI Dermoscope combine AI algorithms with imaging to analyze skin lesions automatically, assisting dermatologists in identifying malignancies more precisely. Similarly, the MoleMap technology employs machine learning to monitor mole changes over time

- AI-powered diagnostics also facilitate risk stratification and predictive analysis by learning from vast datasets, helping clinicians prioritize cases that require urgent attention. Furthermore, non-invasive tools such as reflectance confocal microscopy (RCM) and optical coherence tomography (OCT) are gaining popularity due to their ability to provide real-time, detailed skin imaging without biopsy

- The integration of these diagnostic devices with electronic health records (EHR) and teledermatology platforms enhances remote consultations and follow-up care, expanding access to specialized skin care across Europe

- This trend towards smart, connected, and non-invasive dermatology diagnostic solutions is reshaping clinical practice, raising patient expectations, and driving demand for advanced diagnostic systems among European healthcare providers

- Companies such as Canfield Scientific and FotoFinder are pioneering these AI-enabled diagnostic devices with features such as automated lesion analysis and seamless connectivity to dermatology software platforms

Europe Dermatology Diagnostic Devices Market Dynamics

Driver

Increasing Skin Disease Burden and Early Detection Awareness

- The rising incidence of skin disorders such as melanoma, psoriasis, and eczema, coupled with increasing public and clinical awareness regarding early detection, is a major growth driver for dermatology diagnostic devices in Europe

- For instance, in March 2024, a European-wide initiative promoted skin cancer screening campaigns, emphasizing the importance of early diagnosis supported by advanced diagnostic tools, which stimulated device demand across participating countries

- The push for early diagnosis, driven by better patient outcomes and cost-effective treatment pathways, is encouraging healthcare providers to invest in innovative, precise diagnostic devices

- In addition, growing demand for personalized dermatology care and minimally invasive diagnostics further propels the adoption of imaging and AI-based diagnostic technologies

- Expansion of teledermatology services, especially in underserved or remote regions, also contributes to increasing demand for portable and easy-to-use diagnostic devices

Restraint/Challenge

High Device Costs and Regulatory Complexity

- The relatively high cost of advanced dermatology diagnostic devices, especially those incorporating AI and cutting-edge imaging technologies, presents a significant barrier to adoption in some European healthcare settings, particularly smaller clinics and public health systems with limited budgets

- For instance, premium dermatoscopes and AI-powered imaging systems can cost several thousand euros, making procurement challenging without clear reimbursement policies

- In addition, navigating complex European regulatory frameworks, such as the Medical Device Regulation (MDR), and ensuring compliance with data privacy laws (GDPR) when integrating AI and cloud-based platforms, can delay product launches and add to costs

- Some healthcare providers remain cautious due to uncertainties around the clinical validation and long-term efficacy of emerging AI-driven diagnostic solutions

- Addressing these challenges through cost reduction strategies, robust clinical evidence, streamlined regulatory approvals, and clear reimbursement pathways will be critical to unlocking the full market potential

Europe Dermatology Diagnostic Devices Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the Europe dermatology diagnostic devices market is segmented into dermatoscopes, imaging equipment, microscopes and trichoscopes, biopsy devices, and others. The imaging equipment segment dominated the market with the largest revenue share of 41% in 2024, driven by advancements in high-resolution imaging technologies and growing preference for non-invasive, accurate diagnostic methods. Imaging equipment such as digital dermoscopy systems and reflectance confocal microscopes are increasingly adopted due to their ability to provide detailed visualization of skin structures, facilitating early detection of skin cancers and other dermatological conditions.

The dermatoscopes segment is expected to witness the fastest CAGR of 9.2% from 2025 to 2032, fueled by rising demand for portable, user-friendly devices among dermatologists and general practitioners. Dermatoscopes are valued for their ease of use in clinical and outpatient settings, enabling rapid and accurate examination of skin lesions. Their integration with AI-powered diagnostic software further enhances their growth prospects.

- By Application

On the basis of application, the Europe dermatology diagnostic devices market is segmented into skin cancer and others (including psoriasis, eczema, acne, and other skin disorders). The skin cancer application segment held the largest market share of 62.7% in 2024, driven by increasing prevalence of melanoma and non-melanoma skin cancers across Europe. Heightened awareness campaigns and government screening initiatives have stimulated the demand for specialized diagnostic devices tailored to early cancer detection.

The ‘others’ application segment is projected to register significant growth during forecast period, supported by increasing diagnosis rates of chronic skin conditions and the rising adoption of dermatology diagnostic devices in managing these diseases.

- By End User

On the basis of end user, the Europe dermatology diagnostic devices market is segmented into hospitals, clinics, and others (including diagnostic labs and teledermatology centers). Hospitals accounted for the largest market revenue share of 55.3% in 2024, owing to their advanced healthcare infrastructure and higher adoption of cutting-edge diagnostic technologies. Large hospital networks invest in comprehensive dermatology diagnostic setups to cater to growing patient volumes and complex cases.

The clinics segment is expected to exhibit the fastest growth with a CAGR of 8.7% from 2025 to 2032, as outpatient dermatology clinics increasingly adopt portable and cost-effective diagnostic devices to improve patient throughput and early diagnosis capabilities.

Europe Dermatology Diagnostic Devices Market Regional Analysis

- Germany dominated the Europe dermatology diagnostic devices market in 2024 with the largest revenue share of 29.2%, supported by its advanced healthcare infrastructure, substantial healthcare spending, and a strong presence of key dermatology diagnostic device manufacturers investing in innovation

- Healthcare providers and patients in Germany increasingly prioritize early and accurate skin disease diagnosis, supported by government initiatives promoting skin cancer screening and digital health adoption

- This robust demand is further fueled by continuous technological innovation, extensive dermatology research, and rising awareness about skin health, positioning Germany as a key hub for dermatology diagnostic advancements in Europe

The Germany Dermatology Diagnostic Devices Market Insight

The Germany dermatology diagnostic devices market dominated the European market with a 29.2% revenue share in 2024, attributed to its robust healthcare system, significant investments in medical technology, and strong presence of leading dermatology device manufacturers. The country’s focus on precision medicine and early detection encourages healthcare providers to integrate sophisticated diagnostic devices such as digital dermatoscopes, reflectance confocal microscopy (RCM), and optical coherence tomography (OCT) systems. Furthermore, government-supported skin cancer screening programs and growing teledermatology adoption are expanding device usage beyond hospitals to outpatient clinics and remote care settings.

France Dermatology Diagnostic Devices Market Insight

The France dermatology diagnostic devices market is projected to experience the fastest CAGR over the forecast period, driven by expanding public awareness campaigns and increased access to dermatology services across both urban and rural areas. The rise in telemedicine adoption, particularly accelerated by the COVID-19 pandemic, is boosting demand for portable and AI-integrated diagnostic devices. In addition, growing healthcare expenditure and modernization of clinics are facilitating the uptake of advanced imaging and biopsy technologies, enabling quicker and more accurate diagnosis.

U.K. Dermatology Diagnostic Devices Market Insight

The U.K. dermatology diagnostic devices market is steadily growing due to heightened patient awareness of skin diseases and increasing adoption of innovative diagnostic solutions in outpatient clinics and specialized dermatology centers. Integration of AI and machine learning with traditional imaging and dermoscopy devices is improving diagnostic accuracy, reducing human error, and enhancing clinical workflows. The presence of strong research institutions and ongoing clinical trials also support market expansion by validating and promoting cutting-edge diagnostic technologies.

Italy Dermatology Diagnostic Devices Market Insight

Italy’s dermatology diagnostic devices market is experiencing moderate but consistent growth, backed by increasing healthcare investments and a growing elderly population susceptible to various skin disorders. The government’s focus on enhancing diagnostic infrastructure and expanding telemedicine capabilities is encouraging adoption of portable and cost-effective diagnostic tools. Moreover, the rising prevalence of skin cancer and chronic dermatological conditions is creating ongoing demand for efficient and early diagnostic solutions

Europe Dermatology Diagnostic Devices Market Share

The Europe dermatology diagnostic devices industry is primarily led by well-established companies, including:

- FotoFinder Systems GmbH (Germany)

- Canfield Scientific, Inc. (U.S.)

- DermoScan GmbH (Germany)

- DermLite. (U.S.)

- Agfa-Gevaert Group (Belgium)

- Mavig GmbH (Germany)

- Heine Optotechnik GmbH & Co. KG (Germany)

- Welch Allyn, Inc. (U.S.)

- Medicam SAS (France)

- Nikon Corporation (Japan)

- Derma Medical Systems (Israel)

- Antera Health (U.S.)

- KayPentax (Japan)

- Esaote S.p.A. (Italy)

- Fotofinder AG (Germany)

- Fujifilm Holdings Corporation (Japan)

- Michelson Diagnostics Ltd. (U.K.)

- Stratpharma AG (Switzerland)

- Canfield Scientific Europe GmbH (Germany)

- Arjo AB (Sweden)

What are the Recent Developments in Europe Dermatology Diagnostic Devices Market?

- In July 2025, Philips announced a reduction in its estimated tariff impact by EUR 100 million after a new U.S.-EU trade agreement imposed a 15% rate on most EU goods. Originally expecting a EUR 250-300 million impact, Philips now anticipates EUR 150-200 million in tariff-related costs for the year. The company also reported a stronger-than-expected Q2, with its adjusted EBITA margin rising to 12.4

- In July 2025, The European Union announced plans to stockpile critical medical equipment and vaccines to prepare for future health crises. This initiative aims to address shortages experienced during the COVID-19 pandemic and to enhance coordination among EU countries in managing health emergencies

- In June 2025, The European Union has implemented restrictions on Chinese medical device companies bidding for public contracts exceeding EUR 5 million. This move, under the EU's International Procurement Instrument, aims to ensure fair market access following findings that Chinese tenders often exclude European firms. The decision may impact high-value contracts, encompassing around 60% of contract value despite making up only 4% of tenders by number

- In January 2025, Poland's leading medical diagnostics company, Diagnostyka, priced its initial public offering at 105 zlotys per share, valuing the company at EUR 874 million. The company reported 1.6 billion zlotys in revenue and a 383 million zloty profit in 2023. Diagnostyka aims to expand its presence in the medical diagnostics market, competing with companies such as Synevo and Grupa Alab

- In October 2024, Roche's CEO stated that more cases of mpox (monkeypox) are such asly present in Europe than reported. The company is prepared to increase production of diagnostic kits rapidly if the virus spreads more widely. This follows the detection of a new mpox variant in Germany, with the World Health Organization declaring it a global health emergency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.