Europe Digital Diabetes Management Market

Market Size in USD Billion

CAGR :

%

USD

4.52 Billion

USD

16.76 Billion

2024

2032

USD

4.52 Billion

USD

16.76 Billion

2024

2032

| 2025 –2032 | |

| USD 4.52 Billion | |

| USD 16.76 Billion | |

|

|

|

|

Europe Digital Diabetes Management Market Size

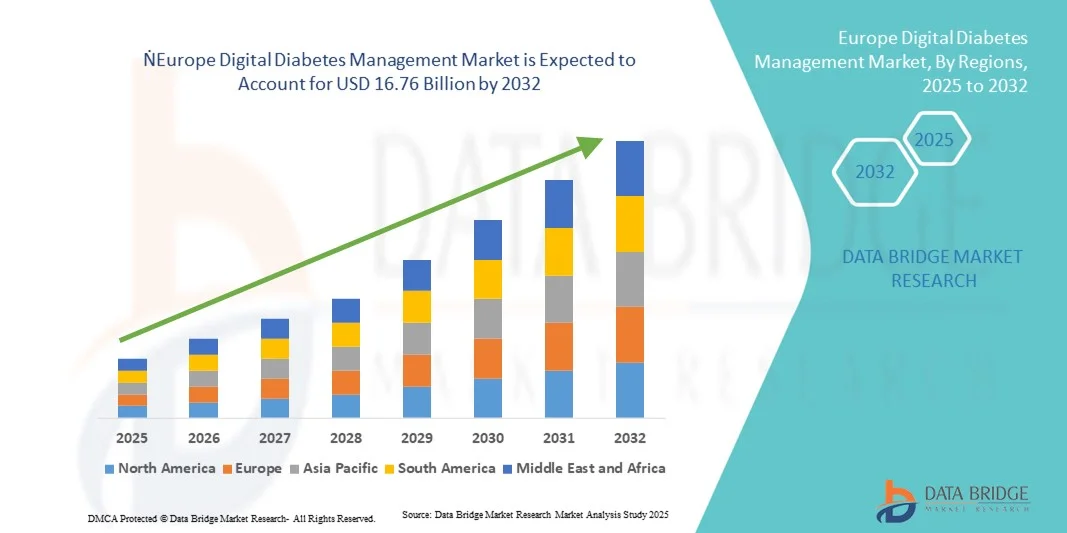

- The Europe digital diabetes management market size was valued at USD 4.52 billion in 2024 and is expected to reach USD 16.76 billion by 2032, at a CAGR of 17.8% during the forecast period

- The market growth is largely fueled by increasing adoption and technological progress within connected health devices and digital diabetes management platforms, leading to enhanced remote monitoring, patient engagement, and personalized care in both residential and clinical settings

- Furthermore, rising consumer and healthcare demand for secure, user-friendly, and integrated diabetes management solutions is establishing digital platforms as the preferred tool for monitoring and managing diabetes. These converging factors are accelerating the uptake of digital diabetes solutions, thereby significantly boosting the industry's growth

Europe Digital Diabetes Management Market Analysis

- Digital diabetes management solutions, including wearable devices, handheld devices, digital diabetes management apps, data management software and platforms, and services, are increasingly vital components of modern diabetes care in both home and clinical settings due to their enhanced convenience, real-time monitoring capabilities, and seamless integration with connected health ecosystems

- The escalating demand for digital diabetes management is primarily fueled by the widespread adoption of connected health technologies, growing prevalence of diabetes in Europe, and a rising preference for personalized, remote, and data-driven care solutions

- Germany dominated the digital diabetes management market with the largest revenue share of 28.9% in 2024, characterized by advanced healthcare infrastructure, high patient awareness, and strong presence of key industry players, with substantial growth in adoption of digital platforms driven by innovations from both established medical technology companies and startups focusing on AI-driven insights and telehealth integration

- The U.K. is expected to be the fastest growing country in the digital diabetes management market during the forecast period, due to increasing healthcare digitization, rising disposable incomes, and growing government initiatives to improve diabetes care

- Digital diabetes management apps dominated the market with a market share of 42.5% in 2024, driven by their ability to provide real-time glucose monitoring, data analysis, and integration with wearable and handheld devices

Report Scope and Europe Digital Diabetes Management Market Segmentation

|

Attributes |

Europe Digital Diabetes Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Digital Diabetes Management Market Trends

Enhanced Convenience Through AI-Enabled and Mobile Integration

- A significant and accelerating trend in the Europe digital diabetes management market is the deepening integration with AI-enabled analytics and mobile platforms, improving real-time monitoring, personalized insights, and patient engagement

- For instance, the mySugr app integrates with multiple CGM devices and insulin pumps, allowing users to track glucose trends, calculate insulin doses, and receive AI-generated insights on the go

- AI integration in digital diabetes management platforms enables predictive alerts, personalized dosing recommendations, and trend analysis; for instance, Tidepool’s platform uses AI to detect unusual glucose patterns and provides actionable insights for both patients and clinicians

- Mobile and cloud integration facilitates centralized management of diabetes data, enabling healthcare providers to monitor multiple patients remotely and allowing patients to access historical data, trend analysis, and automated reports through a single interface

- This trend towards more intelligent, intuitive, and interconnected diabetes management solutions is fundamentally reshaping patient expectations for self-care and remote monitoring; for instance, Roche’s Accu-Chek system combines AI-driven analytics with mobile connectivity for enhanced decision support

- The demand for digital diabetes management solutions with seamless AI and mobile platform integration is growing rapidly across home and clinical settings, as patients and providers increasingly prioritize convenience, personalization, and continuous monitoring

- The integration of digital platforms with telehealth consultations is another emerging trend, allowing real-time feedback and virtual support for patients; for instance, Livongo provides AI insights combined with clinician access through its platform

Europe Digital Diabetes Management Market Dynamics

Driver

Growing Need Due to Rising Diabetes Prevalence and Digital Health Adoption

- The increasing prevalence of diabetes across Europe, combined with accelerating adoption of digital health technologies, is a significant driver for heightened demand for digital diabetes management solutions

- For instance, in March 2024, Dexcom announced the integration of its CGM devices with major European telehealth platforms to enhance remote diabetes monitoring for patients

- As patients and healthcare providers seek improved disease management and better glycemic control, digital platforms offer real-time data tracking, trend analysis, and automated alerts, providing a compelling upgrade over manual logbooks

- Furthermore, the rising popularity of connected health devices and apps makes digital diabetes management an integral component of modern diabetes care, offering seamless integration with insulin pumps, wearable sensors, and mobile applications

- The convenience of remote monitoring, personalized insights, and automated data sharing with clinicians are key factors propelling adoption in both home care and clinical settings; for instance, Abbott’s FreeStyle Libre system allows real-time sharing of glucose data with caregivers and healthcare professionals

- Collaborations between tech companies and healthcare providers to integrate AI-based insights into clinical workflows are driving adoption; for instance, Roche and IBM Watson partnered to enhance diabetes management using predictive analytic

Restraint/Challenge

Data Privacy Concerns and High Cost of Advanced Solutions

- Concerns surrounding patient data privacy and regulatory compliance pose a significant challenge to broader adoption of digital diabetes management solutions in Europe

- For instance, high-profile reports of data breaches in connected health apps have made some patients hesitant to adopt digital diabetes platforms

- Addressing these concerns through robust encryption, GDPR compliance, and secure authentication is crucial for building trust; for instance, Medtronic emphasizes its secure cloud infrastructure and privacy measures in its platforms

- In addition, the relatively high cost of advanced CGM systems, mobile apps, and integrated platforms compared to traditional glucose monitoring can be a barrier for price-sensitive patients, particularly in countries with limited reimbursement policies

- While lower-cost options are emerging, the perceived premium for AI-enabled, connected devices can hinder adoption; overcoming these challenges through improved affordability, patient education, and secure systems will be vital for sustained market growth

- Limited digital literacy among certain patient segments may slow adoption, as older or less tech-savvy users struggle to use apps and devices; for instance, some patients require caregiver support to fully leverage digital platforms

- Regulatory hurdles for cross-border digital health services, including certification and interoperability challenges, can delay market expansion; for instance, EU-wide compliance standards must be met before platforms can operate across multiple countries

Europe Digital Diabetes Management Market Scope

The market is segmented on the basis of product and services, type, and end user.

- By Product and Services

On the basis of product and services, the Europe digital diabetes management market is segmented into devices, digital diabetes management apps, data management software and platforms, and services. The digital diabetes management apps segment dominated the market with the largest revenue share of 42.5% in 2024. This dominance is driven by their ability to provide real-time glucose monitoring, personalized insights, and seamless integration with wearable and handheld devices. Patients and healthcare providers prefer apps and platforms for centralized management of glucose data, automated reporting, and trend analysis. The market also sees strong demand due to increasing awareness of remote monitoring benefits and the growing prevalence of diabetes across Europe. Apps such as mySugr and Tidepool are widely adopted because they combine AI-driven recommendations with patient-friendly interfaces. Integration with telehealth services further strengthens their market position.

The devices segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing adoption of wearable and handheld devices across home and clinical settings. Wearable devices such as continuous glucose monitors and smart insulin pens provide real-time data and improve patient adherence to treatment plans. Handheld devices offer portability and convenience, allowing patients to track glucose levels without visiting clinics. The growing demand is supported by technological innovations, better battery life, and enhanced connectivity with mobile apps. Devices also gain traction from their compatibility with multiple digital platforms, enabling seamless data synchronization. Rising patient preference for proactive self-management of diabetes and increasing reimbursement policies in countries such as Germany and the U.K. are further fueling growth.

- By Type

On the basis of type, the market is segmented into wearable devices and handheld devices. The wearable devices segment dominated the market with the largest revenue share of 55% in 2024. This dominance is attributed to the convenience of continuous glucose monitoring, the ability to provide real-time alerts, and integration with mobile apps for comprehensive diabetes management. Patients prefer wearables for their hands-free operation, long-term monitoring capabilities, and improved adherence to therapy. Healthcare providers also value wearables for remote monitoring and trend analysis, enabling better clinical decision-making. Wearable devices such as Abbott’s FreeStyle Libre and Dexcom G7 are widely used in Europe. The combination of AI analytics and connectivity to digital platforms makes wearables a central component of modern diabetes care.

The handheld devices segment is expected to witness the fastest growth from 2025 to 2032, driven by their portability and accessibility. Handheld glucometers are particularly preferred in regions with limited infrastructure or for patients requiring on-the-go testing. Technological improvements such as Bluetooth connectivity, app integration, and faster test results are increasing adoption. Handheld devices are often used alongside wearable sensors, providing flexibility for both clinical and home-based monitoring. Rising awareness about proactive diabetes management and the convenience of at-home monitoring are key growth factors.

- By End User

On the basis of end user, the Europe digital diabetes management market is segmented into home care settings, diabetes clinics, academic and research institutes, and others. The home care settings segment dominated the market with the largest share of 51% in 2024. This dominance is driven by the increasing preference for remote monitoring and self-management of diabetes, supported by digital apps, wearable devices, and connected platforms. Patients can track glucose levels, receive AI-driven insights, and share data with caregivers or healthcare professionals from the comfort of their homes. The rising trend of telehealth consultations and government initiatives supporting home care are further strengthening this segment. Patients value the convenience, personalized feedback, and real-time alerts offered by home-based solutions.

The diabetes clinics segment is expected to witness the fastest growth from 2025 to 2032, driven by the adoption of digital platforms for patient management, data analytics, and telemonitoring. Clinics increasingly leverage AI-enabled software and apps to monitor multiple patients remotely, optimize treatment plans, and provide real-time interventions. Growing investments in digital health infrastructure and the need for efficient patient management in Europe’s healthcare systems are key drivers. Clinics benefit from centralized data management, enhanced patient engagement, and improved clinical outcomes. Rising collaborations between tech providers and healthcare facilities are further accelerating growth.

Europe Digital Diabetes Management Market Regional Analysis

- Germany dominated the digital diabetes management market with the largest revenue share of 28.9% in 2024, characterized by advanced healthcare infrastructure, high patient awareness, and strong presence of key industry players, with substantial growth in adoption of digital platforms driven by innovations from both established medical technology companies and startups focusing on AI-driven insights and telehealth integration

- Patients and healthcare providers in the country highly value the convenience, real-time monitoring, and integration offered by digital diabetes management platforms with wearable and handheld devices, enabling improved adherence and clinical decision-making

- This widespread adoption is further supported by advanced healthcare infrastructure, high patient engagement, and government initiatives such as reimbursement programs for digital health apps, establishing digital diabetes management solutions as the preferred choice for both home care and clinical settings

The Germany Digital Diabetes Management Market Insight

The Germany market captured the largest revenue share in Europe in 2024, fueled by advanced healthcare infrastructure, high patient awareness, and strong adoption of digital diabetes solutions. Patients and clinics highly value platforms that provide real-time monitoring, predictive insights, and integration with wearable devices. The market growth is also supported by government programs that reimburse approved digital health apps and platforms, encouraging widespread use. Germany’s emphasis on innovation, data privacy, and patient-centric care drives demand for technologically advanced solutions. Both home care and clinical settings are incorporating digital devices and apps for improved diabetes management. Telehealth and AI-enabled analytics further strengthen the adoption of digital platforms across the country.

U.K. Digital Diabetes Management Market Insight

The U.K. digital diabetes management market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of diabetes, telehealth expansion, and the growing demand for convenient, home-based care solutions. Patients and healthcare providers increasingly prefer apps and wearable devices that allow continuous monitoring and real-time feedback. The country’s strong digital infrastructure, combined with high consumer awareness and accessibility to connected health devices, supports market growth. In addition, reimbursement programs and integration of digital platforms into NHS services facilitate adoption. Home care and clinical environments are leveraging apps and platforms to enhance patient engagement and clinical decision-making. The U.K.’s focus on personalized, data-driven diabetes care is expected to continue fueling market expansion.

France Digital Diabetes Management Market Insight

The France digital diabetes management market is growing steadily, driven by increasing patient awareness, government healthcare initiatives, and the adoption of wearable devices and digital apps. Patients value remote monitoring, automated data tracking, and predictive alerts provided by digital platforms. Clinics and research institutes are increasingly leveraging digital diabetes management solutions for patient management and clinical studies. The availability of AI-enabled platforms and seamless integration with mobile applications further enhances the market appeal. Rising healthcare digitization and public health campaigns supporting proactive diabetes management are boosting adoption. Home care settings also see growing usage as patients prioritize convenience, real-time monitoring, and integration with telehealth services.

Italy Digital Diabetes Management Market Insight

The Italy market is expected to expand at a considerable CAGR during the forecast period, fueled by the rising prevalence of diabetes, growing awareness of digital health solutions, and increasing adoption of wearable and handheld devices. Patients and healthcare providers are adopting digital apps and platforms for improved glycemic control and trend analysis. Government policies supporting reimbursement of digital health solutions encourage wider uptake. Both home care and clinical settings are integrating devices, apps, and cloud-based platforms to enhance care delivery. The growing trend of remote monitoring and telehealth consultations is driving the use of digital diabetes management solutions across the country. Patient preference for data-driven insights and personalized care further supports market growth.

Europe Digital Diabetes Management Market Share

The Europe Digital Diabetes Management industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Medtronic (Ireland)

- F. Hoffmann La Roche Ltd. (Switzerland)

- Bayer AG (Germany)

- Sanofi. (France)

- Dexcom, Inc. (U.S.)

- Insulet Corporation (U.S.)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- B. Braun SE (Germany)

- Ypsomed Holding AG (Switzerland)

- LifeScan, Inc. (U.S.)

- ARKRAY, Inc. (Japan)

- One Drop (U.S.)

- DarioHealth Corp (U.S.)

- Emperra GmbH eHealth Technologies (Germany)

- pendiq GmbH (Germany)

- Care Innovations LLC (U.S.)

- Health2Sync Inc. (Taiwan)

- ACON Laboratories Inc. (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

What are the Recent Developments in Europe Digital Diabetes Management Market?

- In September 2025, Roche announced CE‑Mark approval for the integration of Accu‑Chek SmartGuide CGM with its mySugr app (“mySugr Glucose Insights”) at the European Association for the Study of Diabetes (EASD) meeting, enabling patients to view predictive glucose analytics, meal logs, connected‑device data and bolus‑calculator support in one app highlighting a move toward unified digital diabetes ecosystems

- In June 2025, SocialDiabetes achieved certification under the European Medical Device Regulation (MDR) Class IIb for all its diabetes‑management products, marking a regulatory milestone that enables safer and broader deployment of its digital tools across Europe

- In November 2024, The Spanish startup SocialDiabetes, leading the SmartDiabetes consortium, was awarded €1.15 million by EIT Health to develop a value‑based digital diabetes management programme combining digital therapy, data‑driven tools and value‑based public procurement across European healthcare systems

- In September 2024, The MedTech Europe Diabetes Sector Group finalised its “Access Paper” outlining key barriers and recommendations for digitally‑enabled diabetes care across Europe, signalling a policy push to accelerate adoption of digital diabetes management tools at national and EU levels

- In July 2024, Roche received CE‑Mark approval for its Accu‑Chek SmartGuide continuous glucose monitoring (CGM) solution in Europe, which features predictive AI algorithms forecasting glucose levels up to two hours ahead and nightly low‑glucose alerts. This milestone paves the way for broader European rollout and underscores growing emphasis on AI‑enabled diabetes care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.