Europe Energy Drinks Market

Market Size in USD Billion

CAGR :

%

USD

16.53 Billion

USD

25.18 Billion

2023

2031

USD

16.53 Billion

USD

25.18 Billion

2023

2031

| 2024 –2031 | |

| USD 16.53 Billion | |

| USD 25.18 Billion | |

|

|

|

|

Europe Energy Drinks Market Analysis and Size

In the hospitality industry within Europe, energy drinks play a multifaceted role. They are commonly utilized as mixer ingredients in cocktails and mixed drinks, catering to patrons seeking both stimulation and socialization in bars, clubs, and restaurants. Energy drinks add a unique flavor profile and provide an extra kick of energy to traditional beverages, appealing to a younger demographic and enhancing the overall drinking experience. Their presence in hospitality venues contributes to revenue generation and customer satisfaction, as they offer a diverse range of beverage options to meet varying preferences and tastes.

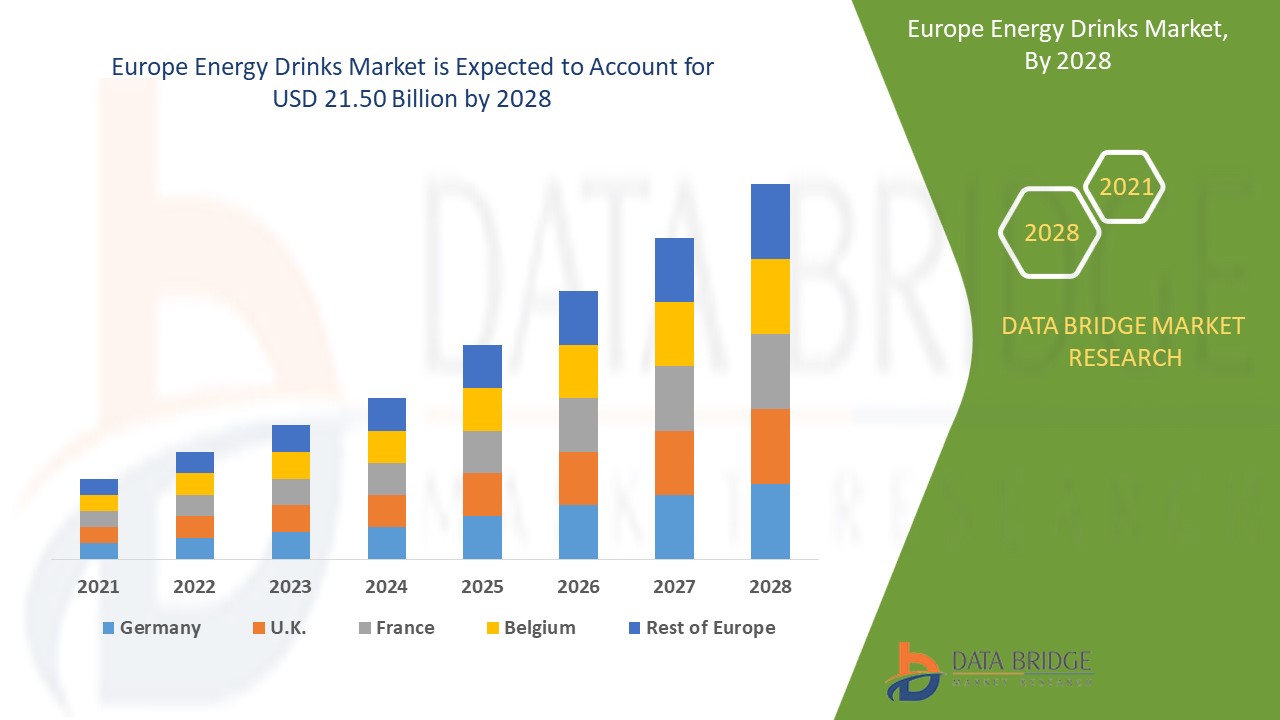

Europe energy drinks market size was valued at USD 16.53 billion in 2023 and is projected to reach USD 25.18 billion by 2031, with a CAGR of 5.40% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Non-Alcoholic, and Alcoholic), Type (Inorganic, and Organic), Application (Before Exercise, Recovery, and During Exercise), Consumption Time (Before 11 am, Post 9 pm, 11-2 pm, 2-5 pm, and 5-9 pm), Ingredients (Taurine, Caffeine, Guarana, Vitamin B, L-Carnitine, Antioxidants, and Others), Distribution Channel (Store Based Retailers, and Non-Store Retailing) |

|

Countries Covered |

U.K., Germany, France, Spain, Italy, Netherlands, Switzerland, Russia, Belgium, Turkey, Ireland, Rest of Europe |

|

Market Players Covered |

Keurig Dr Pepper, Inc. (U.S.), PepsiCo (U.S.), Red Bull (Austria), Monster Energy (U.S.), SUNTORY HOLDINGS LIMITED (Japan), The Coca-Cola Company (U.S.), TC Pharmaceutical Industries Company Limited (Thailand), Döhler (Germany), Britvic PLC. (U.K.), FRUCOR SUNTORY (New Zealand), Hype Energy (Netherlands), D'Angelo Brands (Canada), Mutalo Group (Poland), XYIENCE Energy (U.S.), AJE Group (Peru) |

|

Market Opportunities |

|

Market Definition

Energy drinks are beverages typically containing caffeine, sugar, vitamins, and other stimulants such as taurine or guarana, designed to provide a quick boost in energy and mental alertness. They are popular among individuals seeking increased physical and mental performance, especially during periods of fatigue or intense activity. However, their high caffeine and sugar content can also pose health risks if consumed excessively, leading to concerns about potential adverse effects on cardiovascular health and sleep patterns.

Energy Drinks Market Dynamics

Drivers

- Rising Innovative Product Offerings

Energy drink manufacturers invest in research and development to introduce new flavors, formulations, and packaging designs that resonate with evolving consumer preferences. These innovations differentiate brands and cater to diverse consumer needs, such as sugar-free options, natural ingredients, or functional enhancements such as added vitamins or electrolytes. Additionally, packaging innovations, such as convenient on-the-go formats or eco-friendly packaging, enhance consumer convenience and environmental sustainability, further boosting market appeal. By staying ahead of trends and delivering novel experiences, energy drink companies maintain their relevance, drive consumer engagement, and sustain market growth in Europe.

- Expansion of Distribution Channels

Energy drink manufacturers have diversified their distribution strategies, ensuring widespread availability through various retail channels such as supermarkets, convenience stores, gas stations, vending machines, and online platforms. This broad distribution network enhances accessibility for consumers, allowing them to purchase energy drinks conveniently wherever they go. Additionally, partnerships with beverage distributors and wholesalers facilitate penetration into new markets and regions, further expanding the consumer base. Moreover, innovative packaging formats, such as single-serve bottles and multipacks, cater to different consumption occasions and preferences, amplifying product visibility and sales opportunities across diverse channels.

Opportunities

- Rise in Changing Lifestyles Trends

Individuals juggle multiple responsibilities and commitments, they seek quick and convenient solutions to combat fatigue and maintain alertness throughout the day. Energy drinks offer a convenient source of caffeine and other stimulants that provide an instant boost in energy and mental focus, aligning perfectly with the needs of modern lifestyles. Additionally, the prevalence of late-night socializing and nightlife culture further fuels the demand for energy drinks among young adults seeking to extend their evenings and maintain energy levels. This shift towards a fast-paced lifestyle promotes the consumption of energy drinks as a convenient and effective solution to meet the demands of modern living.

- Growing Marketing Strategies

Brands employ aggressive marketing campaigns across various platforms to create brand awareness, engage consumers, and differentiate themselves in a competitive landscape. Endorsements by celebrities, athletes, and influencers help to build credibility and attract the attention of target demographics, particularly the youth. Strategic sponsorships of sports events, music festivals, and other cultural activities enhance brand visibility and association with active lifestyles.

Restraints/Challenges

- Increasing Awareness of Health Risks

Concerns over potential adverse effects such as cardiovascular issues, sleep disturbances, and dependency have led to heightened consumer caution and regulatory scrutiny. Public campaigns and media coverage highlighting these risks have contributed to a shift in consumer perception, deterring some individuals from regular consumption. As health-consciousness continues to rise, particularly among younger demographics, consumers are actively seeking healthier beverage alternatives, thus posing a challenge to the sustained growth of the energy drinks market in the region.

- High Economic Uncertainty

During periods of economic instability, consumers often prioritize essential purchases over discretionary items such as energy drinks. Decreased consumer spending power and cautious consumption behavior due to job insecurity or recessionary pressures lead to reduced demand for non-essential products, including energy drinks. Moreover, fluctuations in exchange rates, inflationary pressures, and changes in consumer confidence levels further exacerbate uncertainties, impacting market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In October 2023, Quality Pack International, a member of Hell Group, and an Azerbaijani company formed a joint venture, Quality Pack Caspian LLC, aiming to establish a vertically integrated aluminum beverage can manufacturing and non-alcoholic beverage filling factory in Azerbaijan's Alat Free Economic Zone. This venture intends to serve as a regional production hub for local and regional beverage brands, offering either empty cans or filled beverages

- In September 2023, Red Bull introduced its inaugural limited Winter Edition in the United Kingdom, showcasing Red Bull Winter Edition Spiced Pear. This seasonal offering features a blend of pear flavors with a hint of cinnamon, appealing to consumers seeking unique and festive flavor experiences during the colder months

- In April 2023, Prime debuted a new line of energy drinks with 200mg of caffeine and zero sugar, supplemented with 300mg of electrolytes and only 10 calories per serving. Available in a variety of flavors including blue raspberry, tropical punch, lemon-lime, orange mango, and strawberry watermelon, these beverages cater to health-conscious consumers seeking energy boosts without added sugars

Energy Drinks Market Scope

The market is segmented on the basis of product type, type, application, consumption type, ingredients and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Non-Alcoholic

- Alcoholic

Type

- Inorganic

- Organic

Application

- Before Exercise

- Recovery

- During Exercise

Consumption Time

- Before 11 am

- Post 9 pm

- 11-2 pm

- 2-5 pm

- 5-9 pm

Ingredients

- Taurine

- Caffeine

- Guarana

- Vitamin B

- L-Carnitine

- Antioxidants

- Others

Distribution Channel

- Store Based Retailers

- Non-Store Retailing

Europe Energy Drinks Market Regional Analysis/Insights

The market is analyzed and market size insights and trends are provided by country, product type, type, application, consumption type, ingredients and distribution channel as referenced above.

The countries covered in market are U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC), Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa(MEA).

U.K. dominates the market due to the strong presence of key industry players and a growing population of casual consumers and athletes seeking energy-boosting beverages. This trend is set to continue during the forecast period, fueled by the country's robust market infrastructure and evolving consumer preferences. With a well-established market landscape and increasing demand from various consumer segments, the U.K. is poised to maintain its leadership position in shaping the trajectory of the Europe energy drinks market.

Germany is expected to grow CAGR in the market due to there's a growing demand for energy drinks among consumers seeking quick boosts in energy and performance. Additionally, Germany's robust economy and high disposable income levels contribute to increased consumer spending on such products. Moreover, the country's progressive approach to health and wellness drives the adoption of energy drinks as a convenient solution for busy lifestyles.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Energy Drinks Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to organic coffee market.

Some of the major players operating in the market are:

- Keurig Dr Pepper, Inc. (U.S.)

- PepsiCo (U.S.)

- Red Bull (Austria)

- Monster Energy (U.S.)

- SUNTORY HOLDINGS LIMITED (Japan)

- The Coca-Cola Company (U.S.)

- TC Pharmaceutical Industries Company Limited (Thailand)

- Döhler (Germany)

- Britvic PLC. (U.K.)

- FRUCOR SUNTORY (New Zealand)

- Hype Energy (Netherlands)

- D'Angelo Brands (Canada)

- Mutalo Group (Poland)

- XYIENCE Energy (U.S.)

- AJE Group (Peru)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Energy Drinks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Energy Drinks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Energy Drinks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.