Europe Enteral Feeding Formula Market

Market Size in USD Billion

CAGR :

%

USD

7.16 Billion

USD

10.74 Billion

2024

2032

USD

7.16 Billion

USD

10.74 Billion

2024

2032

| 2025 –2032 | |

| USD 7.16 Billion | |

| USD 10.74 Billion | |

|

|

|

|

Europe Enteral Feeding Formula Market Size

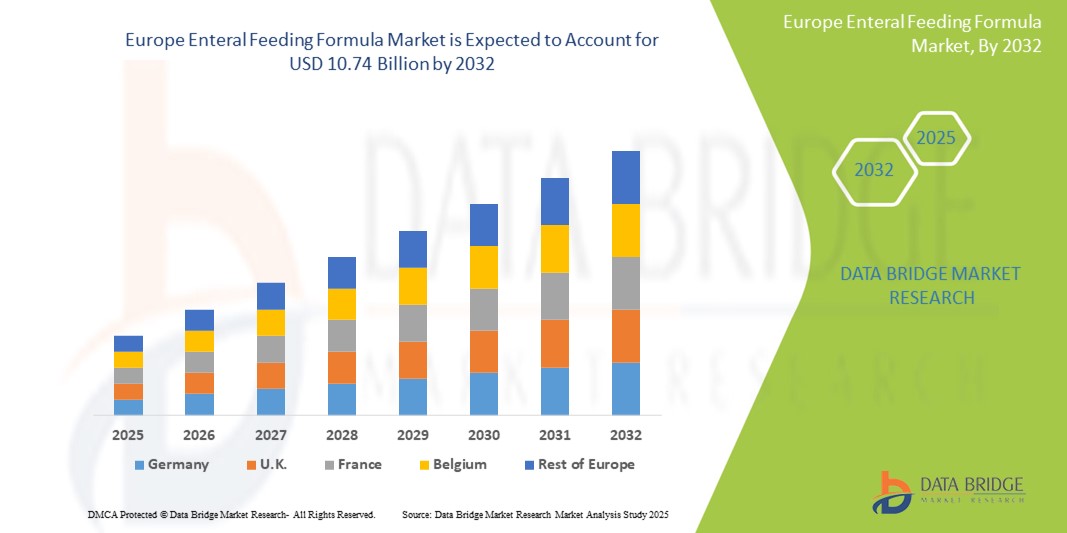

- The Europe enteral feeding formula market size was valued at USD 7.16 billion in 2024 and is expected to reach USD 10.74 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely driven by the rising prevalence of chronic diseases, aging population, and increased hospital admissions, which are fueling the demand for effective nutritional support across clinical and homecare settings

- Furthermore, growing awareness about disease-related malnutrition and the shift towards home enteral nutrition are establishing enteral feeding formulas as a critical component in patient recovery and care. These converging factors are accelerating the adoption of specialized nutritional solutions, thereby significantly boosting the industry's growth

Europe Enteral Feeding Formula Market Analysis

- Enteral feeding formulas, designed to deliver essential nutrients via the gastrointestinal tract, are increasingly critical in managing patients with chronic illnesses, surgical recovery, or age-related nutritional deficiencies across hospital and homecare settings due to their targeted nutrition, ease of administration, and clinical effectiveness

- The rising demand for enteral feeding formulas is primarily fueled by a growing geriatric population, increasing prevalence of conditions such as cancer and neurological disorders, and a surge in demand for home enteral nutrition due to shorter hospital stays

- Germany dominated the enteral feeding formula market with the largest revenue share of 26.9% in 2024, supported by its advanced healthcare infrastructure, robust clinical nutrition programs, and growing elderly population requiring long-term nutritional care

- Poland is expected to be the fastest growing country in the enteral feeding formula market during the forecast period due to improving healthcare access, rising awareness about enteral nutrition, and increased healthcare investments

- Standard formula segment dominated the Europe enteral feeding formula market with a market share of 42.2% in 2024, driven by its broad applicability, cost-effectiveness, and favorable tolerance among patients across varied clinical conditions

Report Scope and Europe Enteral Feeding Formula Market Segmentation

|

Attributes |

Europe Enteral Feeding Formula Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Enteral Feeding Formula Market Trends

Personalized Nutrition and Disease-Specific Formulas Driving Innovation

- A significant and accelerating trend in the Europe enteral feeding formula market is the growing demand for disease-specific and personalized nutrition formulas tailored to patients with chronic conditions such as cancer, gastrointestinal disorders, and diabetes. This trend reflects the broader shift in clinical nutrition toward more targeted and effective therapeutic interventions

- For instance, companies such as Nestlé Health Science and Fresenius Kabi are expanding their portfolios with formulas designed for oncology patients, renal care, and inflammatory bowel disease (IBD). These specialized formulations not only improve clinical outcomes but also enhance patient adherence by addressing specific nutritional deficits

- Technological advancements in enteral nutrition, such as formulas with modified macronutrient ratios, immune-enhancing ingredients, and fiber blends, are also gaining popularity. Abbott’s Glucerna and Nutricia’s Fortimel product lines offer tailored solutions for diabetic and cancer-related cachexia patients respectively

- In addition, the rise of home enteral nutrition (HEN) is driving innovation in ready-to-use, shelf-stable packaging and pump-assisted delivery systems. These improvements support greater flexibility, mobility, and patient autonomy outside clinical settings, especially relevant for long-term care in aging populations

- As hospitals and healthcare systems across Europe increasingly adopt value-based care models, personalized nutrition is becoming a strategic tool for improving recovery rates and reducing hospital readmissions

- The demand for advanced, condition-specific enteral feeding solutions continues to grow across the region, aligning with healthcare providers’ focus on efficient, patient-centered care and driving the development of next-generation nutritional therapies

Europe Enteral Feeding Formula Market Dynamics

Driver

Aging Population and Chronic Disease Burden Fueling Demand

- The increasing prevalence of chronic diseases such as cancer, neurological disorders, and gastrointestinal conditions, coupled with the aging population across Europe, is a major driver for the rising demand for enteral feeding formulas

- For instance, in February 2024, Nutricia (Danone) expanded its manufacturing capabilities in Poland to meet growing demand for adult and pediatric clinical nutrition products in Central and Eastern Europe. Such strategic investments by key players are expected to strengthen regional supply chains and stimulate market growth

- As healthcare systems prioritize early intervention and nutritional support to improve patient outcomes, enteral formulas are being more widely adopted in both acute care hospitals and homecare environments

- The rise in hospital admissions, post-surgical recovery cases, and patients with dysphagia further increases the reliance on enteral feeding solutions

- Enhanced clinical awareness, the availability of disease-specific formulas, and favorable reimbursement policies in countries such as Germany, France, and the Netherlands are reinforcing the market’s upward trajectory

- Increasing demand for HEN is also creating new opportunities for market players focused on patient-friendly packaging and administration technologies

Restraint/Challenge

Regulatory Complexity and Tolerance-Related Issues

- Navigating the diverse and stringent regulatory frameworks across European countries poses a significant challenge for enteral formula manufacturers. Differing standards and approval processes for medical foods, nutritional supplements, and disease-specific formulations can delay product launches and increase compliance costs

- For instance, clinical nutrition products in the EU must comply with the Medical Foods Directive and relevant national health authority regulations, requiring extensive clinical evidence and safety data

- Furthermore, patient intolerance to certain ingredients such as lactose, soy, or specific protein sources can limit product efficacy and acceptance, necessitating careful formulation and ongoing innovation in hypoallergenic and specialized nutrition segments

- Cost containment pressures within public healthcare systems also create pricing challenges, particularly for premium disease-specific or peptide-based formulas

- To overcome these hurdles, manufacturers are increasingly investing in clinical trials, local partnerships, and formulation diversification to meet compliance and patient needs.

- Streamlining regulatory pathways, increasing practitioner education, and expanding patient choice through product variety will be essential for driving long-term market expansion across Europe

Europe Enteral Feeding Formula Market Scope

The market is segmented on the basis of product, application, type of tube feeding, stage, and end-user

- By Product

On the basis of product, the Europe enteral feeding formula market is segmented into standard formulas and disease-specific formulas. The standard formulas segment dominated the market with the largest market revenue share of 42.2% in 2024, driven by their broad suitability for patients with general nutritional needs and ease of use in both clinical and homecare settings. Healthcare providers often prioritize standard formulas due to their balanced macronutrient profiles and lower cost, making them the go-to option for short-term nutritional support across a wide patient population.

The disease-specific formulas segment is anticipated to witness the fastest growth rate of 8.9% from 2025 to 2032, fueled by increasing demand for targeted nutrition among patients with conditions such as cancer, diabetes, and renal disorders. These formulas offer enhanced therapeutic benefits and are tailored to address specific metabolic and digestive requirements, making them an essential component in long-term disease management.

- By Application

On the basis of application, the Europe enteral feeding formula market is segmented into oncology, neurology, critical care, diabetes, gastroenterology, and others. The oncology segment held the largest market revenue share in 2024, driven by the growing burden of cancer across the region and the critical role of nutritional intervention in improving treatment outcomes and patient quality of life. Enteral formulas designed for oncology patients often feature high protein and calorie content to combat weight loss and malnutrition during therapy.

The neurology segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the increasing incidence of neurological conditions such as stroke, ALS, and Parkinson’s disease. These patients often require long-term tube feeding due to dysphagia and other complications, leading to sustained demand for neurologically focused enteral nutrition.

- By Type of Tube Feeding

On the basis of type of tube feeding, the Europe enteral feeding formula market is segmented into gastric tube feeding, nasogastric tube feeding, gastrostomy tube feeding, and duodenal or jejunal tube feeding. The gastric tube feeding segment dominated the market with the largest market revenue share in 2024 due to its widespread use in patients with intact gastrointestinal function. Gastric tubes are commonly used in both acute and chronic care settings, offering a reliable route for delivering a wide variety of formulas.

The duodenal or jejunal tube feeding segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its increasing use in critical care units and among patients with severe reflux, aspiration risk, or delayed gastric emptying. This method supports safer, more targeted nutrition for high-risk patients requiring continuous feeding.

- By Stage

On the basis of stage, the Europe enteral feeding formula market is segmented into adult and paediatric. The adult segment dominated the market with the largest market revenue share of 72.3% in 2024, driven by the rising prevalence of chronic illnesses and the increasing aging population across Europe. Adults—particularly the elderly—are more such asly to require enteral feeding due to post-surgical recovery, dysphagia, or prolonged illness.

The paediatric segment is expected to witness steady growth over the forecast period, fueled by rising awareness about early-life nutrition, increasing preterm births, and the growing need for specialized pediatric formulas for children with congenital or metabolic disorders.

- By End-User

On the basis of end-user, the Europe enteral feeding formula market is segmented into hospitals and long-term care facilities. The hospital segment held the largest market revenue share in 2024, as hospitals serve as the primary setting for the initiation of enteral nutrition in patients with acute conditions or those recovering from surgeries. High patient turnover and continuous demand for short-term nutritional support drive consistent usage of standard and specialized formulas in hospitals.

The long-term care facilities segment is anticipated to witness the fastest CAGR from 2025 to 2032, supported by the growing adoption of home enteral nutrition (HEN), an aging population requiring extended care, and the increasing shift from inpatient to outpatient management. Nursing homes, rehabilitation centers, and home care services are key contributors to this segment’s expansion.

Europe Enteral Feeding Formula Market Regional Analysis

- Germany dominated the enteral feeding formula market with the largest revenue share of 26.9% in 2024, supported by its advanced healthcare infrastructure, robust clinical nutrition programs, and growing elderly population requiring long-term nutritional care

- Healthcare providers in the country increasingly prioritize enteral feeding as a standard intervention for patients with chronic illnesses, post-surgical recovery, or age-related malnutrition, supporting continuous demand across hospitals and long-term care facilities

- The widespread adoption is further supported by an aging population, favorable reimbursement policies, and strong physician endorsement of early nutritional support, positioning Germany as a leader in both the clinical and homecare enteral feeding segments

The Germany Enteral Feeding Formula Market Insight

The Germany enteral feeding formula market captured the largest revenue share in Europe in 2024, supported by its advanced healthcare infrastructure, strong regulatory standards, and widespread clinical adoption of nutritional therapies. The country's large geriatric population and high incidence of chronic conditions such as cancer and gastrointestinal diseases are key contributors to sustained demand. Moreover, the presence of leading global and regional players, along with government-backed initiatives promoting home healthcare and nutritional intervention, is further propelling the market forward. Germany’s focus on evidence-based medicine continues to support early nutritional screening and enteral feeding in both hospitals and long-term care settings.

U.K. Enteral Feeding Formula Market Insight

The U.K. enteral feeding formula market is anticipated to grow at a significant CAGR during the forecast period, fueled by the increasing integration of nutritional support into public healthcare strategies and a heightened focus on post-acute care. The National Health Service (NHS) plays a pivotal role in the market by offering reimbursement and structured nutrition plans for patients requiring enteral feeding. Rising cancer and neurology-related cases, coupled with a growing preference for home-based care, are driving the demand for ready-to-use, easy-to-administer formulas. Innovation in pediatric and disease-specific formulas is also contributing to the evolving market landscape.

France Enteral Feeding Formula Market Insight

The France enteral feeding formula market is experiencing consistent growth, driven by strong public healthcare support, widespread clinical adoption, and high awareness among physicians regarding the benefits of early nutritional intervention. France maintains robust reimbursement systems for medical nutrition, promoting usage in both hospital and homecare settings. An aging population and rising incidences of cancer and neurodegenerative diseases are further contributing to demand. The presence of leading clinical nutrition companies such as Danone (Nutricia) has strengthened product availability and innovation, particularly in the area of disease-specific and immune-enhancing formulas.

Italy Enteral Feeding Formula Market Insight

The Italy enteral feeding formula market is poised to grow steadily, supported by increasing healthcare expenditure, a rising elderly population, and an uptick in hospital admissions related to chronic illnesses and surgeries. The Italian healthcare system has been progressively incorporating clinical nutrition into its treatment protocols, especially for oncology, gastroenterology, and neurology patients. A shift toward home enteral nutrition is gaining momentum as healthcare providers and families seek cost-effective, patient-friendly solutions. Local and multinational manufacturers are responding with convenient packaging formats and targeted formulas tailored to Italy’s growing long-term care sector.

Spain Enteral Feeding Formula Market Insight

The Spain enteral feeding formula market is expanding at a steady pace, driven by a strong focus on chronic disease management and increasing emphasis on early nutritional support in clinical settings. The Spanish healthcare system has prioritized post-acute care for elderly patients, leading to increased use of enteral feeding in hospitals and long-term care facilities. In addition, public health programs aimed at nutritional education and disease prevention are supporting broader adoption. Spain’s demand is also benefiting from the growing availability of specialized formulas for patients with cancer, diabetes, and neurological conditions.

Poland Enteral Feeding Formula Market Insight

The Poland enteral feeding formula market is anticipated to grow at one of the fastest CAGRs in Europe during the forecast period, fueled by improvements in healthcare infrastructure, rising public health awareness, and government investments in clinical nutrition. As the country modernizes its healthcare system, enteral nutrition is increasingly adopted across hospitals and long-term care facilities. Poland’s growing aging population, combined with increasing incidences of cancer and neurological conditions, is accelerating demand for both standard and specialized formulas. Expansion by major players and domestic manufacturers is enhancing accessibility and affordability, particularly for home-based care.

Europe Enteral Feeding Formula Market Share

The Europe enteral feeding formula industry is primarily led by well-established companies, including:

- Nutricia (Netherlands)

- Hormel Foods Corporation (U.S)

- Medline Industries, Inc. (U.S)

- Mead Johnson & Company, LLC. (U.S)

- Nestlé Health Science (Switzerland)

- Abbott (U.S)

- Meiji Holdings Co., Ltd. (Japan)

- Fresenius Kabi AG (Germany)

- B. Braun SE (Germany)

- EuropeHealth Product Inc. (U.S)

- Trovita Health Science (U.S)

- Victus Inc. (U.S)

- Avanos Medical Inc. (U.S)

- Cardinal Health (U.S)

- Moog Inc (U.S)

- Conmed Corporation (U.S)

- Cook Medical (Indiana)

What are the Recent Developments in Enteral Feeding Formula Market?

- In May 2025, Danone completed the acquisition of a majority stake in Kate Farms, a U.S.-based company specializing in plant-based, organic nutritional formulas for medical and everyday needs. This strategic move aims to bolster Danone's specialized nutrition offerings, particularly in the field of plant-based enteral feeding solutions

- In September 2024, Nutricia reformulated its core Nutrison tube feeding range across Europe to include a 78% plant‑based protein blend, enhanced micronutrient levels (including vitamin D and B vitamins), and a 17% lower carbon footprint. This update aligns with ESPEN guidelines and sustainability goals, reflecting both clinical innovation and environmental responsibility

- In May 2024, Danone Nutricia announced a EUR 70 million investment to expand its tube‑feeding production line at its Steenvoorde site in northern France to support enteral feeding formula production. The facility is expected to produce around 20 million litres annually and support approximately 30 specialized recipes under the Nutricia brand highlighting Danone’s commitment to enhancing capacity and innovation in clinical nutrition

- In May 2024, Danone completed the acquisition of Functional Formularies, a U.S.-based whole‑foods tube‑feeding company. The acquisition strengthens Danone’s enteral nutrition portfolio and positions the company to better serve tube-fed patients and families with high-quality, organic feeding products across Europe and North America

- In March 2024, Fresenius Kabi showcased its latest enteral nutrition developments at the ESPEN 2024 Congress, reinforcing its pipeline of high‑protein and disease‑specific formulations. The company emphasized its commitment to furthering clinical nutrition innovation and regional product expansion in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.