Europe Glass Packaging Market

Market Size in USD Billion

CAGR :

%

USD

22,400.07 Billion

USD

28,841.88 Billion

2024

2032

USD

22,400.07 Billion

USD

28,841.88 Billion

2024

2032

| 2025 –2032 | |

| USD 22,400.07 Billion | |

| USD 28,841.88 Billion | |

|

|

|

|

What is the Europe Glass Packaging Market Size and Growth Rate?

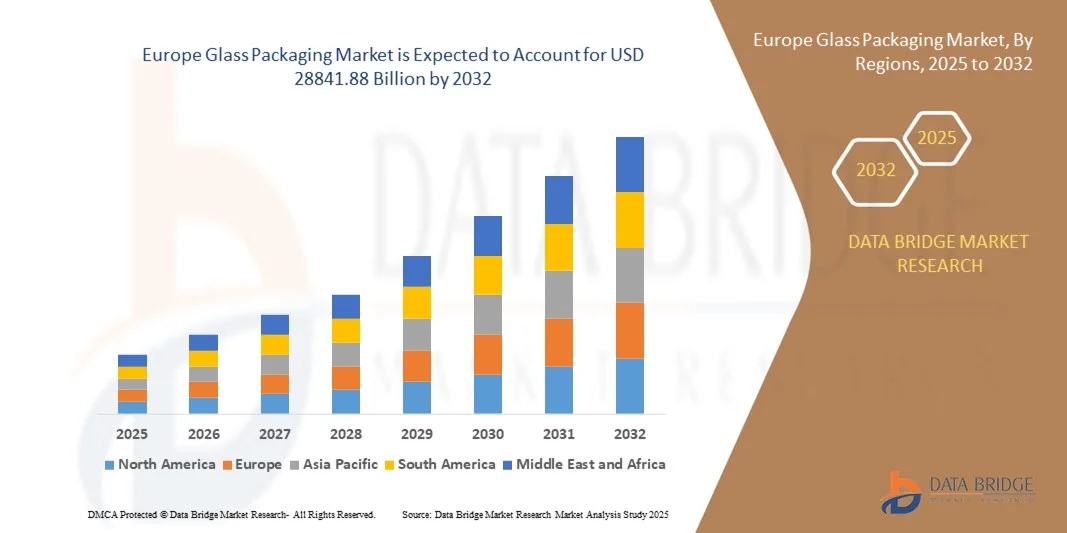

- The Europe glass packaging market size was valued at USD 22,400.07 billion in 2024 and is expected to reach USD 28841.88 billion by 2032, at a CAGR of3.21% during the forecast period

- Rising urbanization, modernization, and globalization is driving the growth in the market value. Growing demand for high quality glass packaging materials by logistics and transportation industries and growth and expansion of cosmetics and personal care industry will further induce growth in the market value

What are the Major Takeaways of Glass Packaging Market?

- Surging research and development proficiencies, rising consumption of both alcoholic and non-alcoholic beverages around the globe and growing demand for environmental friendly, recyclable and cost effective packaging solutions are some other market growth determinants

- However, lack of an adequate infrastructure in the underdeveloped economies will create hindrances for the market growth rate. Fluctuations in the prices of raw materials and high levels of competition from other packaging materials will further dampen the market growth rate

- Germany dominated the Europe glass packaging market in 2024, accounting for the largest revenue share of 35.7%, driven by high demand from the food, beverage, and pharmaceutical sectors

- The France glass packaging market is witnessing fastest growth rate of 11.32%, supported by rising demand for premium beverages, cosmetics, and gourmet food products

- The Type III segment dominated the market in 2024, accounting for a market share of 49.6%, driven by its widespread use in food, beverage, and cosmetic packaging applications

Report Scope and Glass Packaging Market Segmentation

|

Attributes |

Glass Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Glass Packaging Market?

Sustainability and Lightweight Innovation

- A major trend influencing the glass packaging market is the industry-wide transition toward lightweight, recyclable, and eco-friendly glass solutions aimed at reducing carbon emissions and energy consumption during production. This shift is driven by growing global awareness of sustainable packaging and circular economy goals

- Manufacturers are developing lightweight glass bottles and jars that maintain durability while reducing raw material use and transportation costs

- In addition, the use of recycled glass cullet in manufacturing processes is gaining momentum, significantly lowering melting temperatures and energy requirements

- A notable instance is Ardagh Group S.A. (Luxembourg), which introduced its EcoLite range, a lightweight glass bottle line designed to minimize environmental impact without compromising product quality

- This trend toward sustainability and material efficiency is transforming the market, encouraging manufacturers to invest in green production technologies, recycled materials, and carbon-neutral packaging solutions to meet both consumer and regulatory expectations

What are the Key Drivers of Glass Packaging Market?

- The rising demand for sustainable and premium packaging across industries such as food, beverages, pharmaceuticals, and cosmetics is a primary driver of the Glass Packaging market

- For instance, in February 2025, Owens-Illinois, Inc. (U.S.) announced a $95 million investment in expanding its recycled glass processing capacity to meet increasing demand for eco-friendly bottles in the beverage industry

- The market is also benefiting from a growing consumer preference for non-toxic, reusable, and inert packaging that preserves product freshness and purity

- Moreover, stringent environmental regulations banning single-use plastics are accelerating the adoption of glass as a sustainable alternative

- In addition, innovations such as smart glass labeling, digital printing, and decorative finishes are enhancing brand visibility and product differentiation, driving global market expansion

Which Factor is Challenging the Growth of the Glass Packaging Market?

- The high production cost and fragility of glass packaging remain major challenges affecting market scalability. Energy-intensive manufacturing processes and expensive raw materials such as soda ash and silica sand contribute to higher operational costs compared to plastic or metal alternatives

- For instance, in 2024, rising global energy prices and transportation costs significantly impacted Bormioli Rocco S.p.A. (Italy) and other European glass producers’ profit margins.

- Furthermore, the heavier weight of glass leads to higher logistics expenses and increased carbon emissions during transport

- Companies such as Amcor plc (Switzerland) and Gerresheimer AG (Germany) are addressing these issues through advanced lightweighting techniques, electric furnaces, and increased recycling rates to reduce energy consumption and costs

- However, achieving a balance between durability, affordability, and sustainability remains a persistent challenge, requiring ongoing technological innovation and strategic investment for long-term competitiveness

How is the Glass Packaging Market Segmented?

The glass packaging market is segmented on the basis of glass type, jar size, raw material and application.

- By Glass Type

On the basis of glass type, the glass packaging market is categorized into Type I, Type II, Type III, and Others. The Type III segment dominated the market in 2024, accounting for a market share of 49.6%, driven by its widespread use in food, beverage, and cosmetic packaging applications. Type III glass, also known as soda-lime glass, offers high strength, cost efficiency, and recyclability, making it the most commonly used glass in packaging production. Its versatility in molding and decoration supports product differentiation across industries.

The Type I segment is projected to record the fastest CAGR from 2025 to 2032, fueled by growing demand in the pharmaceutical and biotechnology sectors. Type I borosilicate glass is highly resistant to chemical corrosion and thermal shock, making it ideal for storing sensitive drugs, vaccines, and injectable solutions. Increasing regulatory emphasis on high-purity packaging materials is boosting its market expansion.

- By Jar Size

Based on jar size, the glass packaging market is segmented into 20–50 mL, 51–100 mL, 101–250 mL, 251–500 mL, and Above 500 mL. The 101–250 mL segment dominated the market in 2024 with a market share of 35.9%, owing to its extensive use in food condiments, cosmetics, and small beverage packaging. This size range offers optimal portability, product visibility, and convenience for both manufacturers and consumers. The segment’s dominance is also attributed to strong adoption in the personal care and nutraceutical industries.

The 251–500 mL segment is anticipated to grow at the fastest CAGR during 2025–2032, driven by increasing consumption of premium beverages, sauces, and specialty oils. The global trend toward sustainable, reusable packaging and the rising popularity of glass jars for home storage are further amplifying this segment’s demand.

- By Raw Material

On the basis of raw material, the glass packaging market is classified into Cullet, Selenium, Cobalt Oxide, Limestone, Dolomite, Coloring Material, and Others. The Cullet segment dominated the market in 2024, capturing a market share of 52.4%, as recycled glass cullet significantly reduces energy consumption and raw material costs during manufacturing. The growing circular economy movement and government incentives for recycling are accelerating cullet use in glass production. This segment also supports environmental sustainability by lowering carbon emissions and reducing landfill waste.

The Coloring Material segment is projected to register the fastest CAGR from 2025 to 2032, driven by the increasing use of tinted and decorative glass in premium beverage, cosmetic, and pharmaceutical packaging. The use of oxides such as chromium and cobalt for aesthetic enhancement and UV protection is gaining traction across industries focused on brand differentiation and product preservation.

- By Application

Based on application, the glass packaging market is segmented into Alcoholic Beverage, Non-Alcoholic Beverage, Food, Pharmaceutical, Personal Care, Beauty Products, and Others. The Alcoholic Beverage segment dominated the market in 2024, holding a market revenue share of 41.8%, due to the strong demand for glass bottles in beer, wine, and spirits packaging. Glass offers superior chemical inertness and premium aesthetics, making it the preferred packaging for preserving beverage quality and enhancing brand image.

The Pharmaceutical segment is expected to exhibit the fastest CAGR from 2025 to 2032, fueled by rising global healthcare expenditure and the expanding biopharmaceutical industry. The increasing use of glass vials, ampoules, and syringes for vaccine and drug storage is driving demand. Moreover, growing regulatory support for non-reactive and sterile packaging solutions further strengthens glass’s position in medical and laboratory applications.

Which Region Holds the Largest Share of the Glass Packaging Market?

- Germany dominated the Europe glass packaging market in 2024, accounting for the largest revenue share of 35.7%, driven by high demand from the food, beverage, and pharmaceutical sectors. The country’s advanced manufacturing infrastructure, technological expertise, and strong sustainability policies support large-scale glass production. Germany’s focus on circular economy initiatives, coupled with high recycling rates and innovations in lightweight glass bottles, strengthens its leadership in the regional market

- The dominance is further enhanced by stringent European Union (EU) regulations encouraging the use of recyclable materials and the reduction of plastic waste. Leading companies are investing in digital glass-forming technologies and low-emission furnaces to align with climate goals

- Overall, Germany’s commitment to sustainable production, continuous R&D investments, and strong export base have solidified its position as the leading player in the Europe Glass Packaging market

France Glass Packaging Market Insight

The France glass packaging market is witnessing fastest growth rate of 11.32%, supported by rising demand for premium beverages, cosmetics, and gourmet food products. The country’s strong presence in the luxury and personal care segments drives the adoption of high-quality glass packaging designs. French manufacturers are focusing on lightweight glass containers and innovative shapes to enhance product appeal while reducing carbon emissions. Government initiatives promoting sustainability and recycling have accelerated industry transformation toward eco-friendly solutions. Additionally, collaborations with international packaging firms are improving production efficiency and quality standards. With a growing emphasis on aesthetic and sustainable packaging, France continues to play a key role in shaping the regional market landscape.

Italy Glass Packaging Market Insight

The Italy glass packaging market is expanding steadily, driven by increasing consumption of wines, spirits, and gourmet foods. The country’s deep-rooted tradition in glassmaking and its association with the luxury beverage industry contribute significantly to demand. Italian manufacturers are investing in automation, energy-efficient furnaces, and advanced molding technologies to improve productivity and reduce emissions. Rising exports of Italian wines and olive oils in sustainable glass bottles further boost market growth. Moreover, collaborations with international brands are fostering innovation in lightweight and decorative glass packaging. As a result, Italy remains one of the most influential markets in Europe’s glass packaging industry.

U.K. Glass Packaging Market Insight

The U.K. glass packaging market is growing rapidly, driven by increasing demand for sustainable alternatives to plastics in the food, beverage, and cosmetic sectors. The nation’s focus on recycling infrastructure and adoption of bottle-return schemes are enhancing circular economy initiatives. Manufacturers are embracing smart glass packaging technologies, such as digital labeling and refillable bottle systems, to meet evolving consumer expectations. Additionally, strong partnerships between local producers and global beverage brands are promoting innovation in lightweight and durable glass containers. The U.K.’s policy framework supporting carbon reduction and packaging waste minimization is reinforcing its growth trajectory. Consequently, the U.K. is emerging as a leading innovator in the European glass packaging landscape.

Which are the Top Companies in Glass Packaging Market?

The glass packaging industry is primarily led by well-established companies, including:

- Saint-Gobain (France)

- Owens-Illinois, Inc. (O-I Glass) (U.S.)

- Amcor plc (Switzerland)

- Ardagh Group S.A. (Luxembourg)

- Gerresheimer AG (Germany)

- HEINZ-GLAS GmbH & Co. KGaA (Germany)

- BA GLASS GROUP (Portugal)

- Bormioli Rocco S.p.A (Italy)

- Hindustan National Glass & Industries Limited (India)

- KOA GLASS CO., LTD. (Japan)

- Nihon Yamamura Glass Co., Ltd. (Japan)

- Orora Packaging Australia Pty Ltd (Australia)

- Piramal Enterprises Ltd. (India)

- Rockwood & Hines Glass Group (U.K.)

- Shanghai Vista Packaging Co., Ltd. (China)

- Sisecam (Türkiye)

- Stoelzle Oberglas GmbH (Austria)

- Vetropack (Switzerland)

- Vidrala (Spain)

- Wiegand-Glas Holding GmbH (Germany)

What are the Recent Developments in Europe Glass Packaging Market?

- In February 2024, O-I Glass launched a lightweight wine bottle called Estampe in France, designed to reduce environmental impact with a 25% smaller carbon footprint compared to conventional 500g bottles. The 390g bottle uses up to 80% recycled content, exceeding the European average of 50%, and has been verified by the Carbon Trust. This innovation highlights O-I Glass’s commitment to sustainable packaging solutions in the beverage industry

- In June 2023, Corning partnered with SGD Pharma to establish a new glass tubing plant in India, aimed at increasing pharmaceutical production capacity. The collaboration leverages Corning’s patented glass-coating technology and SGD Pharma’s vial converting expertise to enhance vial quality, filling-line efficiency, and injectable therapy delivery globally. This initiative strengthens India’s pharmaceutical manufacturing infrastructure and supports reliable global supply chains

- In November 2022, Weigand-Glass GmBH announced that Epice won the Trendtag Glas award for its aesthetically harmonious glass packaging, designed to safely protect aroma-sensitive dried flowers while highlighting the quality of the contents. The recognition underscores innovation in premium and functional glass packaging across niche markets

- In May 2022, Gerresheimer inaugurated new glass and plastic production facilities in India to serve its global pharmaceutical customers. The glass production line includes state-of-the-art sustainable furnace technology, aligned with Gerresheimer’s Formula G growth strategy, combining capabilities across its global network. This expansion reinforces the company’s leadership in providing advanced and environmentally responsible packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Glass Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Glass Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Glass Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.