Market Analysis and Size

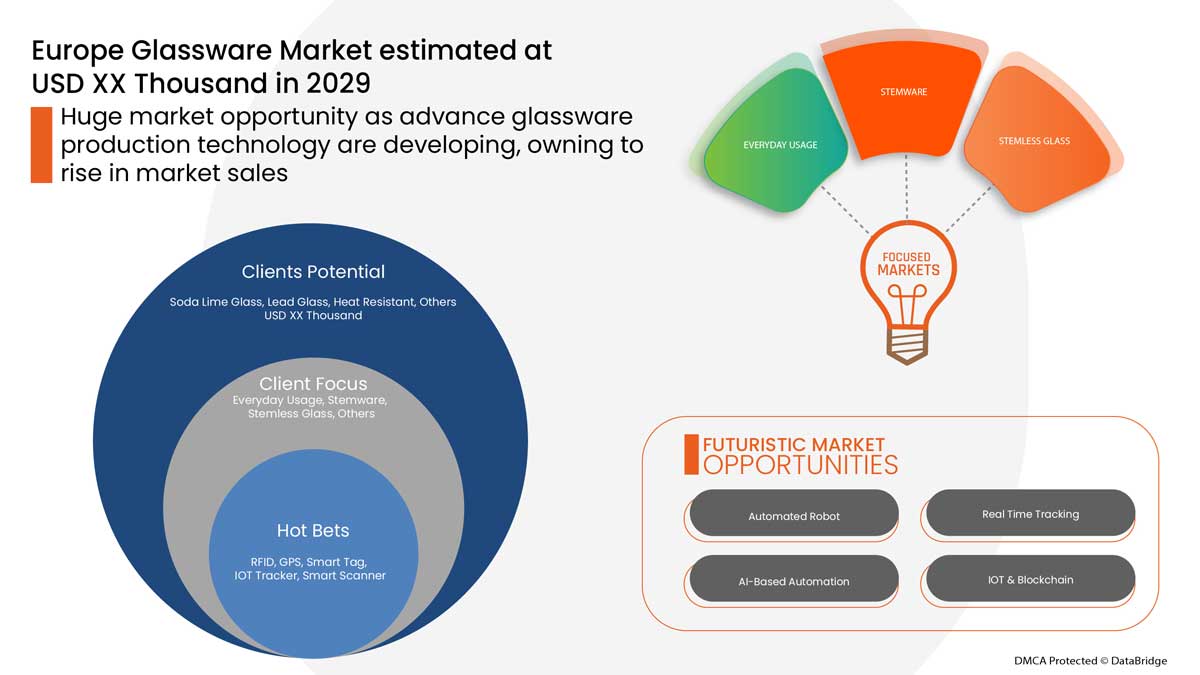

Growing levels of investment in the hotel and catering industry are expected to act as a driver for the growth of the glassware market in the forecast period. Changes in the lifestyle of the consumers are expected to act as a driver for the growth of the glassware market in the forecast period of 2022-2022. Advancements in glassware production technologies are expected to bring growth opportunities for the glassware market in future.

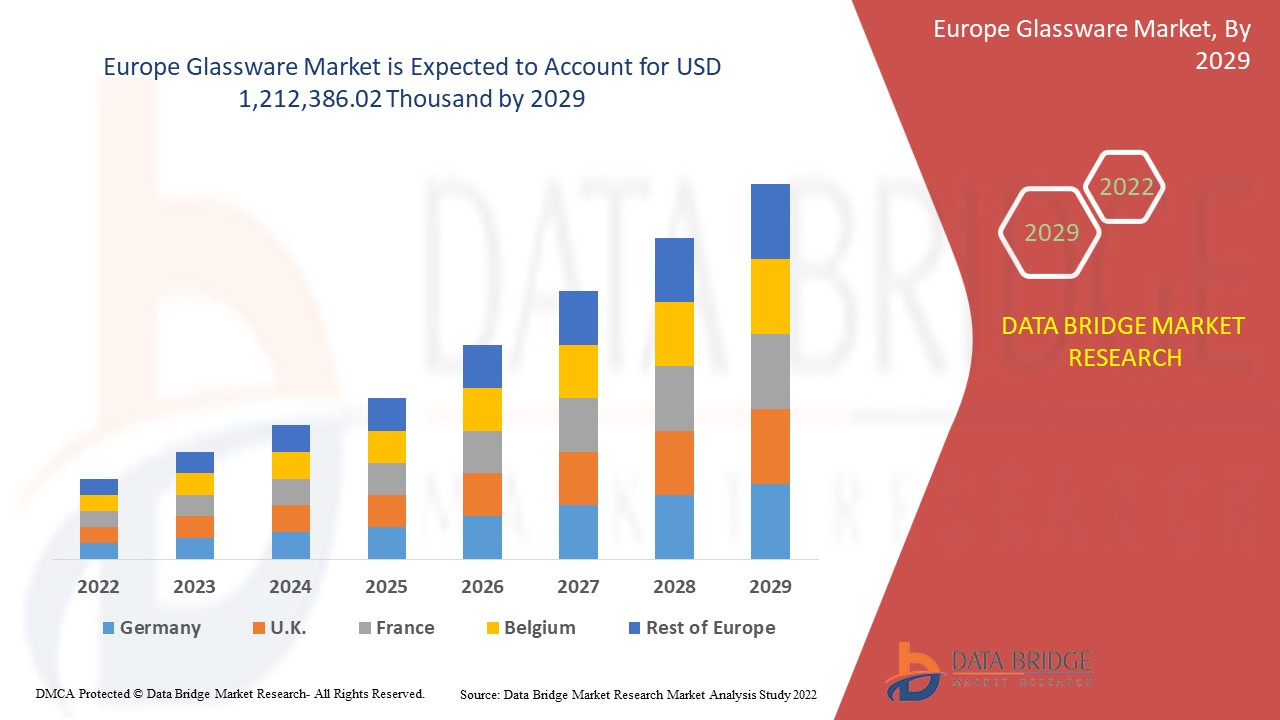

Data Bridge Market Research analyses that the glassware market is expected to reach the value of USD 1,212,386.02 thousand by 2029, at a CAGR of 5.4% during the forecast period. "soda lime" accounts for the most prominent material segment as this type of glass provides scratch resistant surfaces. The glassware market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Thousand, Volume in Units, Pricing in USD |

|

Segments Covered |

Material (Soda Lime Glass, Lead Glass, Heat Resistant, and Others), Style (Stemless Glass, Stemware, Everyday Usage, and Others), Distribution Channel (B2B, Specialized Stores, Supermarkets/Hypermarkets, E-Commerce, and Others), Price Range (Medium, Premium, and Economy), End-Use (Hotels & Restaurants, Bars & Café, Household, Corporate Canteens, and Others) |

|

Countries Covered |

Germany, France, Italy, U.K., Turkey, Switzerland, Spain, Russia, Netherlands, Belgium, Rest of Europe |

|

Market Players Covered |

Hrastnik1860, Oneida, NoritakeGermany, Ocean Glass Public Company Limited, Lenox Corporation, Treo.in, Libbey Inc, Fiskars Group, WMF (A Subsidiary of Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco S.p.A., Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne, Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware among others |

Market Definition

Glass is a brittle, rigid material that is generally clear or translucent. It might be made of a mixture of sand, soda, lime, or other minerals. The most typical glass formation method involves heating raw ingredients until they become molten liquid, then rapidly cooling the mixture to make toughened glass. Glass varieties may be classified based on their mechanical and thermal qualities to identify which applications are most suited.

Soda lime glass: Soda-lime glass is the most common form of glass used for windowpanes and glass containers such as bottles and jars for drinks, food, and certain commodities items.

Lead Glass: Lead glass is a glass with a high percentage of lead oxide with exceptional clarity and brightness.

Heat Resistant: Heat-resistant glass is intended to withstand heat stress and is commonly used in kitchens and industrial applications.

Glassware Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

- Growing levels of investment in the hotel and catering industry

Tourism has enhanced the business of the hotel and restaurant sector all over the world and provided great scope for the hotel industry. The industry has flourished mainly through tourism and due to diverse landscapes, beliefs, and societies in different countries which provided a great attraction to tourists from different regions. The hotel and catering sectors of many nations have gradually expanded over the last two decades, and development is predicted in the next years, coupled with an increase in demand for various types of glassware goods.

- Changes in lifestyle of the consumers

Consumer lives are constantly evolving. Consumer habits and values are influenced by existing and new trends, as well as the continuously changing demographic mix, worldwide cultural upheavals, and fast developments in technology. Businesses may capitalize on new possibilities by acquiring a deep understanding of customer preferences following shifting behaviours and beliefs. In recent times, consumers from all generations are focusing more on branded products in many areas of their daily lives.

- Rising popularity of fine dining across the globe

A fine dining restaurant is either a specialty or a multi-cuisine establishment that places a premium on quality ingredients, presentation, and impeccable service. The category is increasing at a respectable pace of 15%, which has encouraged the arrival of premium Michelin-starred restaurants and other local competitors. Therefore, the growing demand for fine delicate dining is mainly accomplished by the successful operations of different types of brands of glassware products in hotels and restaurants.

- Availability of cheap quality products

Glass is one of the most complex and adaptable materials, and it is utilized in nearly every industry. The extensive use of glass contributes to the creation of a very hi-tech and modern appearance in both residential and commercial structures. Glass comes in a variety of shapes and sizes to suit a variety of applications and is used in a variety of architectural applications such as doors, windows, and partitions. Glass has come a long way from its humble beginnings as a windowpane to become a sophisticated structural component in the current day.

- Rising demand for steel and paper base drinkware

Paper and plastic are increasingly being used to make disposable plates and glasses, owing to their great environmental performance and rising demand for e-commerce and delivery services. Consumers, brands, and retailers all have high expectations for recyclable paper-based goods. The recycling rate of paper-based materials is around 85 percent, and the paper value chain is improving day by day. To reach even higher recycling objectives while extending the usefulness of paper-based packaging, it is critical, to begin with, the design phase, taking into account both the intended purpose and the end-of-life.

Post COVID-19 Impact on Glassware Market

COVID-19 created a major impact on the glassware market as almost every country has opted for the shutdown of every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing with this pandemic situation is the essential services that are allowed to open and run the processes.

The growth of the glassware market is rising due to the government policies to boost international trade post-COVID-19. Also, the opening of lockdown is boosting the hospitality industry which is rising the demand for Glassware in the market. However, factors such as congestion associated with trade routes and trade restrictions between some nations are restraining the market growth. The shutdown of production facilities during the pandemic situation has had a significant impact on the market.

Recent Development

- In October 2020, Libbey Inc. announced the confirmation of a plan of reorganization and expected to complete its court-supervised restructuring and emerge with a stronger balance sheet in the upcoming weeks. The company made this announcement to succeed in the current business operating environment.

- In October 2021, Lenox Corporation acquired Oneida Consumer LLC with its brand of table top products including flatware, dinnerware, and cutlery. The collaboration was undertaken to market a leading portfolio of brands and innovative goods with unrivalled customer awareness across a wide range of retail channels.

Europe Glassware Market Scope

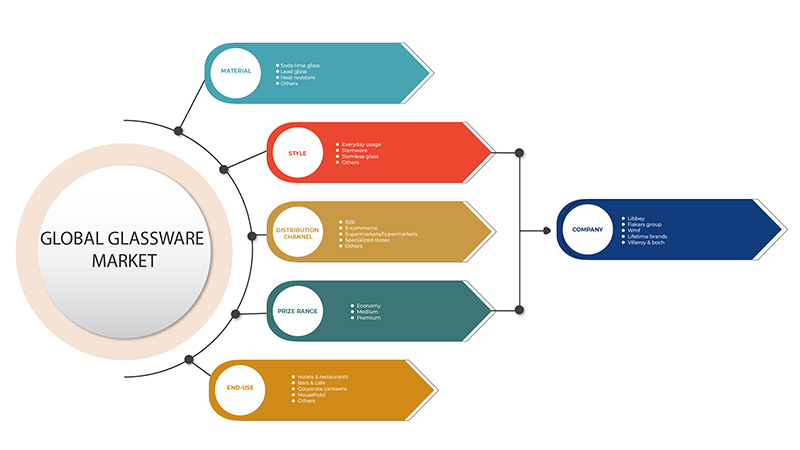

The glassware market is segmented based on material, style, distribution channel, price range, and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Material

- Soda Lime Glass

- Lead Glass

- Heat Resistant

- Others

Based on material, the glassware market is segmented into soda lime glass, lead glass, heat resistant, and others.

By Style

- Stemless Glass

- Stemware

- Everyday Usage

- Others

Based on style, the glassware market has been segmented into stemless glass, stemware, everyday usage, and others.

By Distribution Channel

- B2B

- Specialized Stores

- Supermarkets/Hypermarkets

- E-Commerce

- Others

Based on distribution channel, the glassware market has been segmented into b2b, specialized stores, supermarkets/hypermarkets, e-commerce, and others.

By Price Range

- Medium

- Premium

- Economy

Based on price range, the glassware market has been segmented into medium, premium, and economy.

By End-Use

- Hotels & Restaurants

- Bars & Cafe

- Household

- Corporate Canteens

- Others

Based on end-use, the glassware market has been segmented into hotels & restaurants, bars & café, household, corporate canteens, and others.

Glassware Market Regional Analysis/Insights

The glassware market is analysed and market size insights and trends are provided by country, material, style, distribution channel, price range, and end-use as referenced above.

The countries covered in the glassware market report are Germany, France, Italy, U.K., Turkey, Switzerland, Spain, Russia, Netherlands, Belgium and Rest of Europe.

Germany dominates the Europe glassware market. Germany is likely to be the fastest-growing Europe glassware market. The rising infrastructure, commercial, and industrial developments in emerging countries such as Germany are credited with the market's dominance. With the increasing development in the countries number of restaurants and bars is increasing, which will boost the demand for glassware products in the European region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Glassware Market Share Analysis

The glassware market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to glassware market.

Some of the major players operating in the glassware market are Hrastnik1860, Oneida, Noritake China, Ocean Glass Public Company Limited, Lenox Corporatio, Treo.in, Libbey Inc, Fiskars Group, WMF (A Subsidiary of Groupe SEB), Lifetime Brands, Inc, Villeroy & Boch, Bormioli Rocco S.p.A., Wonderchef Home Appliances Pvt. Ltd., The Zrike Company, Inc, Shandong Hikingpac Co., Ltd., Addresshome, Stölzle Lausitz GmbH, Eagle Glass Deco (P.) Ltd., Degrenne. Cello World, MYBOROSIL, Jiangsu Rongtai Glass Products Co., Ltd., Cumbria Crystal, Garbo Glassware.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of EUROPE GLASSWARE MARKET

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- product LIFE LINE CURVE

- MULTIVARIATE MODELING

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- MARKET application COVERAGE GRID

- DBMR MARKET CHALLENGE MATRIX

- vendor share analysis

- IMPORT-EXPORT DATA

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Europe

- asia-pacific

- middle east and africa

- North America

- South America

- Europe

- market overview

- drivers

- Growing levels of investment in the hotel and catering industry

- Changes in lifestyle of the consumers

- Rising popularity of fine dining across the globe

- Increasing demand for premium decorative glassware products

- restraints

- Availability of cheap quality products

- Rising demand for steel and paper base drinkware

- Difficulty in maintaining the glassware products

- opportunities

- Advancements in glassware production technologies

- Rising demand for glassware products for clinical use in hospitals and forensic laboratories

- challenges

- Complexity in manufacturing glassware products

- Rising difficulty in recycling glassware products

- IMPACT OF COVID-19 on the Europe GLASSWARE MARKET

- ANALYSIS on IMPACT OF COVID-19 ON THE EUROPE GLASSWARE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE EUROPE GLASSWARE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe GLASSWARE market, BY Material

- overview

- Soda Lime Glass

- Lead Glass

- Heat Resistant

- OTHERS

- Europe GLASSWARE market, BY style

- OVERVIEW

- Stemware

- Red wine glass

- BORDEAUX

- CABERNET

- ZINFANDEL

- BURGUNDY

- PINOT NOIR

- ROSE

- white wine glass

- SPARKLING

- CHARDONNAY

- VIOGNIER

- SWEET WINE

- VINTAGE

- STEMLESS GLASS

- Liquor Glass

- Beer Glass

- Everyday Usage

- Others

- Europe GLASSWARE market, BY Distribution channel

- OVERVIEW

- B2B

- Specialized Stores

- Supermarkets/Hypermarkets

- E Commerce

- Others

- Europe GLASSWARE market, BY price range

- OVERVIEW

- Medium

- Premium

- Economy

- Europe GLASSWARE market, BY End-use

- OVERVIEW

- Hotels & Restaurants

- Bars & Cafe

- HOUSEHOLD

- Corporate Canteens

- others

- EUROPE Glassware market, BY GEOGRAPHY

- Europe

- Germany

- France

- italy

- u.k.

- turkey

- switzerland

- Spain

- russia

- netherlands

- belgium

- rest of europe

- EUROPE GLASSWARE MARKET, COMPANY landscape

- company share analysis: EUROPE

- swot analysis

- company profiles

- Libbey inc

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATE

- Lifetime brands, inc.

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATE

- villeroy & Boch

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATEs

- WMF GmbH

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATE

- Fiskars Australia Pty Ltd.

- COMPANY SNAPSHOT

- revenue analysis

- company share analysis

- Product Portfolio

- RECENT UPDATE

- Bormioli Rocco S.p.A.

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATE

- Cumbria Crystal

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATE

- degrenne

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT update

- Hrastnik1860

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATEs

- lenox corporation

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATE

- noritakechina

- COMPANY SNAPSHOT

- revenue analysis

- Product Portfolio

- RECENT UPDATE

- Stölzle Lausitz GmbH

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATEs

- The Oneida Group Inc.

- COMPANY SNAPSHOT

- Product Portfolio

- RECENT UPDATE

- The Zrike Company, inc.

- COMPANY SNAPSHot

- Product Portfolio

- RECENT UPDATE

- QUESTIONNAIRE

- related reports

List of Table

TABLE 1 IMPORT DATA of Drinking glasses (excluding glasses of glass ceramics or of lead crystal and stemware) HS Code - 701337 (USD Thousand)

TABLE 2 EXPORT DATA OF DRINKING GLASSES (EXCLUDING GLASSES OF GLASS CERAMICS OR OF LEAD CRYSTAL AND STEMWARE) HS CODE - 701337 (USD THOUSAND)

TABLE 3 Type of reusable cups consumers would prefer for drinkware in U.S, 2015

TABLE 4 Europe Glassware Market, By material, 2019-2028 (usd thousand)

TABLE 5 Europe Glassware Market, By material, 2019-2028 (Thousand Units)

TABLE 6 Europe Soda lime glass in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 7 Europe SODA LIME GLASS in GLASSWARE market, BY region, 2019-2028 (Thousand UNITS)

TABLE 8 Europe Lead Glass in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 9 Europe Lead Glass in GLASSWARE market, BY region, 2019-2028 (Thousand Units)

TABLE 10 Europe Heat resistant in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 11 Europe Heat resistant in GLASSWARE market, BY region, 2019-2028 (Thousand Units)

TABLE 12 Europe others in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 13 Europe others in GLASSWARE market, BY region, 2019-2028 (Thousand Units)

TABLE 14 Europe GLASSWARE market, BY style, 2019-2028 (USD Thousand)

TABLE 15 Europe Stemware IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 16 Europe Stemware IN GLASSWARE market, BY type, 2019-2028 (USD thousand)

TABLE 17 Europe red wine glass IN GLASSWARE market, BY type, 2019-2028 (USD thousand)

TABLE 18 Europe white wine glass IN GLASSWARE market, BY type, 2019-2028 (USD thousand)

TABLE 19 Europe stemless glass IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 20 Europe Stemless Glass IN GLASSWARE market, BY type, 2019-2028 (USD thousand)

TABLE 21 Europe Everyday usage IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 22 Europe Others IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 23 Europe GLASSWARE market, BY distribution channel, 2019-2028 (USD Thousand)

TABLE 24 Europe B2b in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 25 Europe specialized stores in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 26 Europe supermarkets/hypermarkets in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 27 Europe e-commerce in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 28 Europe others in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 29 Europe GLASSWARE market, BY price range, 2019-2028 (USD Thousand)

TABLE 30 Europe medium in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 31 Europe Premium in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 32 Europe Economy in GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 33 Europe GLASSWARE market, BY end-use, 2019-2028 (USD Thousand)

TABLE 34 Europe Hotels & Restaurants IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 35 Europe Bars & café IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 36 Europe Household IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 37 Europe Corporate Canteens IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 38 Europe others IN GLASSWARE market, BY region, 2019-2028 (USD thousand)

TABLE 39 Europe glassware Market, BY COUNtry, 2019-2028 (USD Thousand)

TABLE 40 Europe glassware Market, BY COUNtry, 2019-2028 (Thousand Units)

TABLE 41 Europe Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 42 Europe Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 43 Europe Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 44 Europe Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 45 Europe Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 46 Europe White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 47 Europe Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 48 Europe Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 49 Europe Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 50 Europe Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 51 Germany Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 52 Germany Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 53 Germany Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 54 Germany Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 55 Germany Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 56 Germany White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 57 Germany Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 58 Germany Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 59 Germany Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 60 Germany Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 61 France Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 62 France Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 63 France Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 64 France Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 65 France Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 66 France White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 67 France Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 68 France Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 69 France Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 70 France Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 71 Italy Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 72 Italy Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 73 Italy Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 74 Italy Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 75 Italy Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 76 Italy White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 77 Italy Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 78 Italy Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 79 Italy Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 80 Italy Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 81 U.K. Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 82 U.K. Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 83 U.K. Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 84 U.K. Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 85 U.K. Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 86 U.K. White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 87 U.K. Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 88 U.K. Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 89 U.K. Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 90 U.K. Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 91 Turkey Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 92 Turkey Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 93 Turkey Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 94 Turkey Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 95 Turkey Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 96 Turkey White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 97 Turkey Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 98 Turkey Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 99 Turkey Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 100 Turkey Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 101 Switzerland Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 102 Switzerland Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 103 Switzerland Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 104 Switzerland Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 105 Switzerland Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 106 Switzerland White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 107 Switzerland Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 108 Switzerland Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 109 Switzerland Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 110 Switzerland Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 111 Spain Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 112 Spain Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 113 Spain Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 114 Spain Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 115 Spain Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 116 Spain White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 117 Spain Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 118 Spain Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 119 Spain Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 120 Spain Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 121 Russia Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 122 Russia Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 123 Russia Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 124 Russia Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 125 Russia Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 126 Russia White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 127 Russia Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 128 Russia Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 129 Russia Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 130 Russia Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 131 Netherlands Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 132 Netherlands Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 133 Netherlands Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 134 Netherlands Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 135 Netherlands Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 136 Netherlands White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 137 Netherlands Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 138 Netherlands Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 139 Netherlands Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 140 Netherlands Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 141 Belgium Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 142 Belgium Glassware Market, By Material, 2019-2028 (Thousand Units)

TABLE 143 Belgium Glassware Market, By Style, 2019-2028 (USD Thousand)

TABLE 144 Belgium Stemware in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 145 Belgium Red Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 146 Belgium White Wine Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 147 Belgium Stemless Glass in Glassware Market, By Type, 2019-2028 (USD Thousand)

TABLE 148 Belgium Glassware Market, By Distribution Channel, 2019-2028 (USD Thousand)

TABLE 149 Belgium Glassware Market, By Price Range, 2019-2028 (USD Thousand)

TABLE 150 Belgium Glassware Market, By End-Use, 2019-2028 (USD Thousand)

TABLE 151 rest of europe Glassware Market, By Material, 2019-2028 (USD Thousand)

TABLE 152 rest of europe Glassware Market, By Material, 2019-2028 (Thousand Units)

List of Figure

FIGURE 1 EUROPE GLASSWARE MARKET: segmentation

FIGURE 2 EUROPE GLASSWARE MARKET: data triangulation

FIGURE 3 EUROPE GLASSWARE MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GLASSWARE MARKET: Europe VS regional MARKET analysis

FIGURE 5 EUROPE GLASSWARE MARKET: company research analysis

FIGURE 6 EUROPE GLASSWARE MARKET: THE product LIFE LINE CURVE

FIGURE 7 EUROPE GLASSWARE MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE GLASSWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE GLASSWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE GLASSWARE MARKET: MARKET application COVERAGE GRID

FIGURE 11 EUROPE GLASSWARE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE GLASSWARE MARKET: vendor share analysis

FIGURE 13 EUROPE GLASSWARE MARKET: SEGMENTATION

FIGURE 14 Rising popularity of fine dining across the globe is DRIVING the EUROPE GLASSWARE MARKET in the forecast period of 2021 to 2028

FIGURE 15 soda lime glass SEGMENT is expected to account for the largest share of the EUROPE GLASSWARE MARKET in 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTs, OPPORTUNITies AND CHALLENGEs OF Europe glassware Market

FIGURE 17 Europe Luxury Hotel Count, in Luxury Class, 2002-2018 (Approximate)

FIGURE 18 Europe GLASSWARE market, BY material, 2020

FIGURE 19 Europe GLASSWARE market,BY style, 2020

FIGURE 20 Europe GLASSWARE market, BY distribution channel, 2020

FIGURE 21 Europe GLASSWARE market, BY price range, 2020

FIGURE 22 Europe GLASSWARE market, BY end-use, 2020

FIGURE 23 EUROPE Glassware market: SNAPSHOT (2020)

FIGURE 24 EUROPE Glassware market: by COUNTRY (2020)

FIGURE 25 EUROPE Glassware market: by COUNTRY (2021 & 2028)

FIGURE 26 EUROPE Glassware market: by COUNTRY (2020 & 2028)

FIGURE 27 EUROPE Glassware market: by Material (2021-2028)

FIGURE 28 EUROPE GLASSWARE MARKET: company share 2020 (%)

Europe Glassware Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Glassware Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Glassware Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.