Europe Grinding Machinery Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

1.41 Billion

2024

2032

USD

1.08 Billion

USD

1.41 Billion

2024

2032

| 2025 –2032 | |

| USD 1.08 Billion | |

| USD 1.41 Billion | |

|

|

|

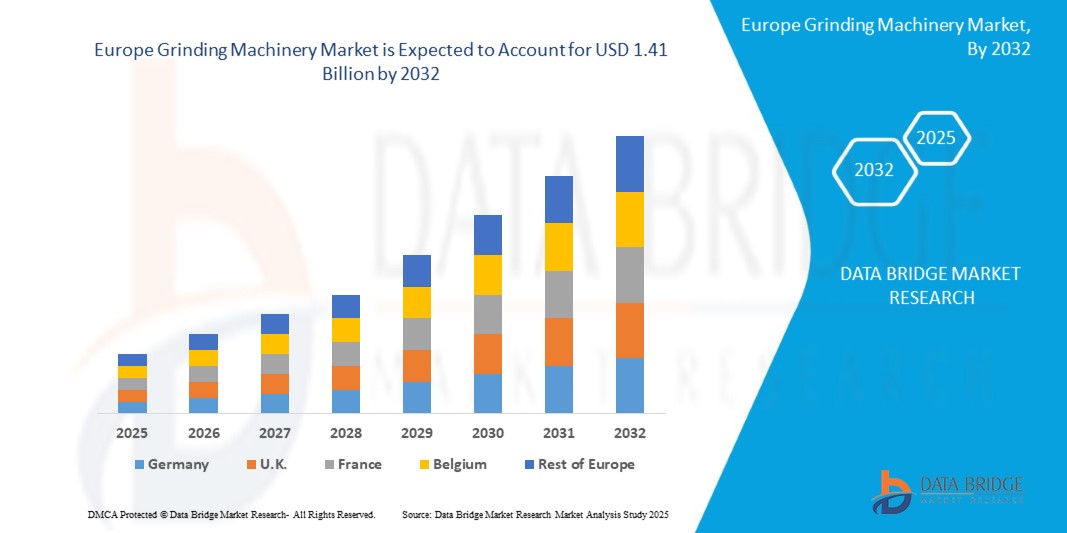

Grinding Machinery Market Analysis

The Europe grinding machinery market is experiencing steady growth due to increasing demand across industries such as automotive, aerospace, and manufacturing. Technological advancements, including automation and precision grinding, are driving market expansion. The rise in the production of high-quality and complex components requires advanced grinding solutions. North America and Europe are prominent markets, Key players are focusing on product innovation, efficiency, and sustainability to cater to evolving customer needs and maintain a competitive edge.

Grinding Machinery Market Size

The Europe grinding machinery market is expected to reach USD 1.41 billion by 2032 from USD 1.08 billion in 2024, growing with a substantial CAGR of 3.7% in the forecast period of 2025 to 2032.

“Grinding Machinery Market Trends”

Industry 4.0, often referred to as the fourth industrial revolution, emphasizes the integration of digital technologies, automation, and data exchange into manufacturing processes. This transformation has led to smarter, more efficient, and highly automated systems, which directly impact grinding machinery. As manufacturing operations increasingly rely on smart technologies such as the Internet of Things (IoT), big data analytics, Artificial Intelligence (AI), and machine learning, the demand for grinding machinery that can seamlessly integrate with these systems has risen. Smart manufacturing allows for real-time monitoring, predictive maintenance, and continuous process optimization, ensuring that grinding machines operate at peak performance with minimal downtime.

IoT-enabled grinding machines can collect and transmit data on machine performance, enabling manufacturers to track variables such as temperature, vibration, and tool wear. This data can be analyzed to predict potential issues before they cause failures, leading to improved operational efficiency and reduced maintenance costs. Additionally, AI and machine learning algorithms can optimize grinding parameters, such as speed, pressure, and feed rates, ensuring that the machines operate within the most efficient parameters for each specific task.

Report Scope and Grinding Machinery Market Segmentation

|

Attributes |

Grinding Machinery Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Germany, Spain, Italy, Netherlands, Luxemburg, Turkey, Belgium, Russia, Switzerland, Rest of Europe |

|

Key Market Players |

Rieter (Switzerland), EMAG Systems GmbH (Germany), Gleason Corporation (Germany), KLINGELNBERG (Germany), Walter Maschinenbau GmbH (Germany) and KNUTH Werkzeugmaschinen GmbH (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Grinding Machinery Market Definition

A grinding machine is a power tool used for precision machining, typically to finish or shape materials like metal, wood, or plastic. It uses an abrasive wheel or disc to remove small amounts of material from a workpiece through friction and abrasion. Grinding machines are commonly used in manufacturing and metalworking for tasks such as sharpening, polishing, and smoothing surfaces to achieve high levels of accuracy and smoothness.

Grinding Machinery Market Dynamics

Drivers

- Growing Adoption of Industry 4.0 and Smart Manufacturing Processes

Industry 4.0, often referred to as the fourth industrial revolution, emphasizes the integration of digital technologies, automation, and data exchange into manufacturing processes. This transformation has led to smarter, more efficient, and highly automated systems, which directly impact grinding machinery. As manufacturing operations increasingly rely on smart technologies such as the Internet of Things (IoT), big data analytics, Artificial Intelligence (AI), and machine learning, the demand for grinding machinery that can seamlessly integrate with these systems has risen. Smart manufacturing allows for real-time monitoring, predictive maintenance, and continuous process optimization, ensuring that grinding machines operate at peak performance with minimal downtime.

IoT-enabled grinding machines can collect and transmit data on machine performance, enabling manufacturers to track variables such as temperature, vibration, and tool wear. This data can be analyzed to predict potential issues before they cause failures, leading to improved operational efficiency and reduced maintenance costs. Additionally, AI and machine learning algorithms can optimize grinding parameters, such as speed, pressure, and feed rates, ensuring that the machines operate within the most efficient parameters for each specific task.

For instance,

- In December 2021, according to an article published by Lean Transition Solutions Ltd, Industry 4.0 transforms businesses by integrating smart technologies such as automation, AI, and IoT. This revolution boosts productivity, reduces costs, and improves communication, enabling companies to stay competitive. Embracing these innovations ensures long-term sustainability and operational excellence in manufacturing.

Rising Demand for High-Precision Tools

As industries such as aerospace, automotive, medical devices, and electronics push the boundaries of design and performance, the need for tools that can achieve extreme accuracy and tight tolerances has become increasingly crucial. This growing demand for high-precision tools directly impacts the grinding machinery market, as grinding is one of the primary methods used to achieve these exacting standards. In industries like aerospace, components such as turbine blades, engine parts, and structural elements require exceptional precision due to their complex shapes and critical performance requirements. Even the smallest deviation in size or surface finish can lead to failure, compromising safety and functionality. Grinding machinery is essential in these industries, providing the accuracy needed to produce parts that meet stringent specifications.

For instance,

- In August 2024, according to an article published by Rainford Precision Ltd, High-precision cutting tools are essential in watchmaking for achieving micrometre-level accuracy. These tools, including lathe cutters, laser engravers, and CNC machines, ensure precise machining of intricate components, reduce errors, and enhance productivity, preserving the craftsmanship and functionality of timepieces

Opportunities

- Technological Advancements and Development of Advanced Grinding Technologies

As industries continue to prioritize precision, efficiency, and productivity, the ongoing evolution of grinding technology provides manufacturers with the tools needed to meet these increasing demands. These innovations offer new capabilities in terms of speed, precision, and versatility, enabling grinding machines to handle more complex tasks and work with a wider range of materials. One key opportunity lies in the integration of automation and smart technologies into grinding machinery. With the rise of Industry 4.0, grinding machines are increasingly being equipped with sensors, IoT connectivity, and artificial intelligence (AI) systems. These features allow for real-time monitoring, predictive maintenance, and process optimization, leading to higher efficiency and reduced downtime. Additionally, automated grinding machines can improve consistency and precision, reducing the margin for human error and increasing production rates.

The development of super abrasive materials such as Cubic Boron Nitride (CBN) and diamond also opens new opportunities in the grinding market. These materials offer superior hardness and wear resistance, enabling faster material removal and finer surface finishes. The ability to work with these advanced abrasives enhances the efficiency and capability of grinding machinery, making it highly attractive to industries such as aerospace, automotive, and medical devices that require intricate, high-precision components.

For instance,

- In February 2024, according to an article published by GCH Machinery, CNC grinding machines have advanced with technologies like direct drive spindles, linear motors, active wheel dressing, and in-process gauging, improving accuracy, productivity, and surface finishes. These innovations reduce operator intervention, enhance efficiency, and expand versatility across industries like aerospace, automotive, and medical

Increasing Government Initiatives and Policies Encouraging Local Manufacturing and Industrial Growth

Governments around the world are focusing on strengthening domestic manufacturing sectors to boost economic growth, create jobs, and reduce dependency on imports. These efforts are particularly evident in emerging economies, where governments are investing in infrastructure, technology, and skill development to stimulate industrial activity. As a result, there is a growing demand for advanced manufacturing technologies, including grinding machinery.

Government initiatives, such as subsidies, tax incentives, and grants for domestic manufacturers, are encouraging businesses to invest in modern equipment and upgrade their manufacturing capabilities. These incentives make it more financially feasible for companies to adopt advanced grinding machinery, which can improve their efficiency and product quality. Local manufacturers, especially in sectors like automotive, aerospace, electronics, and medical devices, require high-precision grinding machines to meet international standards, and government support makes these investments more accessible.

For instance,

- In December 2022, according to an article published by the Ministry of Commerce & Industry, The Government of India has undertaken various initiatives to boost the manufacturing sector, such as the Make in India campaign, industrial corridor development, and Production Linked Incentive (PLI) schemes for key sectors. Other measures include improving ease of doing business, implementing the National Logistics Policy, promoting electric vehicle manufacturing, fostering economic growth and job creation.

Restraints/Challenges

- Intense Competition Amongst Numerous Players in the Industry

The grinding machinery market is highly fragmented, with a large number of established and emerging players competing for market share. This competitive environment drives pressure on pricing, innovation, and customer retention, making it difficult for companies to maintain profitability and sustain long-term growth.

One of the primary challenges in this competitive landscape is the need for constant innovation. As customer demands evolve, especially in high-precision industries like aerospace, automotive, and medical devices, companies must continuously improve their products to stay ahead of the competition. This often involves significant investment in research and development to create more efficient, precise, and cost-effective machines. Companies that fail to innovate may find themselves losing market share to competitors that can offer more advanced and adaptable solutions.

- Shortage of Skilled and Trained Workforce to Operate Advanced Grinding Machines

As grinding technology becomes increasingly complex, with innovations such as automation, CNC systems, and advanced sensors, the demand for highly skilled operators has grown. However, there is a growing gap between the need for such expertise and the availability of trained professionals. Many manufacturers face difficulties in finding workers with the necessary knowledge of advanced grinding machinery, including understanding its intricate operations, maintenance, and troubleshooting. The specialized nature of modern grinding machines requires a deep understanding of both mechanical and digital systems, which is not easily acquired through general training or on-the-job experience. This shortage can lead to several problems, such as increased downtime, inefficiencies, and higher operational costs due to improper machine handling or maintenance.

Furthermore, the lack of skilled workers also hinders innovation and the ability to fully exploit the capabilities of advanced grinding technologies. Companies may be forced to rely on external contractors or face delays in production, which can impact their competitiveness.

For instance,

- In December 2023, according to an article published by Bennett, Coleman & Co. Ltd., A recent survey reveals that skilled labor shortages are significantly affecting Indian manufacturers, with 76% of companies reporting profitability impacts. Key challenges include production delays, employee burnout, and high attrition. To address these issues, companies are focusing on succession planning, reskilling, cross-training, and leveraging technology

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Grinding Machine Market Scope

The market is segmented on the basis of on type, application, and distribution channel and geography. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Surface

- Cylindrical

- Gear

- Tools & Cutter

- Other Grinding Machinery

Application

- Automotive

- Aerospace & Defense

- Electrical & Electronics

- Shipbuilding

- Others

Distribution Channel

- Offline

- Online

Grinding Machinery Market Regional Analysis

The market is analyzed and market size insights and trends are provided by type, application, and distribution channel and geography as referenced above.

The countries covered in the market are U.K., France, Germany, Spain, Italy, Netherlands, Luxemburg, Turkey, Belgium, Russia, Switzerland, rest of Europe.

Germany is expected to dominate the Europe grinding machinery market due to its strong manufacturing base, rapid industrialization, increasing demand for high-precision machinery, and technological advancements. The country's investments in automation and infrastructure further contribute to its market leadership.

Germany is expected to be the fastest-growing market for the grinding machinery market due to its booming manufacturing sector, high demand for precision equipment, rapid industrialization, and significant investments in automation and technology.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Grinding Machinery Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Grinding Machinery Market Leaders Operating in the Market Are:

- Rieter (Switzerland)

- EMAG Systems GmbH (Germany)

- Gleason Corporation (Germany)

- KLINGELNBERG (Germany)

- Walter Maschinenbau GmbH (Germany)

- KNUTH Werkzeugmaschinen GmbH (Germany)

Latest Developments in Grinding Machinery Market:

- In October 2024, AMADA showcased new fiber laser machines with high-power oscillators At JIMTOF, EuroBLECH, and FABTECH 2024, expanding into new sectors. They also displayed advanced technologies in cutting, welding, grinding, and automation, demonstrating integrated solutions for future manufacturing

- In January 2024, Rieter Group acquired Petit Spare Parts SAS, a French supplier of spare parts, yarn guides, spindles, and belts. This acquisition strengthens Rieter's after-sales business and enhances Europe service offerings through its extensive repair network

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF INDUSTRY 4.0 AND SMART MANUFACTURING PROCESSES

5.1.2 RISING DEMAND FOR HIGH-PRECISION TOOLS

5.1.3 GROWTH IN MANUFACTURING AND AUTOMOTIVE SECTORS

5.1.4 RISING PREFERENCE FOR ENERGY-EFFICIENT GRINDING MACHINERY

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS FOR ADVANCED GRINDING MACHINES

5.2.2 FLUCTUATIONS AND VOLATILITY IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENT OF ADVANCED GRINDING TECHNOLOGIES

5.3.2 INCREASING GOVERNMENT INITIATIVES AND POLICIES ENCOURAGING LOCAL MANUFACTURING AND INDUSTRIAL GROWTH

5.3.3 ADVANCEMENTS AND INNOVATIONS IN ABRASIVE MATERIALS AND TECHNOLOGIES

5.4 CHALLENGES

5.4.1 INTENSE COMPETITION AMONGST NUMEROUS PLAYERS IN THE INDUSTRY

5.4.2 SHORTAGE OF SKILLED AND TRAINED WORKFORCE TO OPERATE ADVANCED GRINDING MACHINES

6 EUROPE GRINDING MACHINERY MARKET, BY TYPE

6.1 OVERVIEW

6.2 SURFACE

6.3 CYLINDRICAL

6.4 GEAR

6.5 TOOLS & CUTTER

6.6 OTHER GRINDING MACHINERY

7 EUROPE GRINDING MACHINERY MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 AUTOMOTIVE

7.3 AEROSPACE & DEFENSE

7.4 ELECTRICAL & ELECTRONICS

7.5 SHIPBUILDING

7.6 OTHERS

8 EUROPE GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.3 ONLINE

9 EUROPE GRINDING MACHINERY MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 ITALY

9.1.3 FRANCE

9.1.4 U.K.

9.1.5 SPAIN

9.1.6 BELGIUM

9.1.7 NETHERLANDS

9.1.8 RUSSIA

9.1.9 TURKEY

9.1.10 SWITZERLAND

9.1.11 REST OF EUROPE

10 EUROPE GRINDING MACHINERY MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 AMADA MACHINERY CO., LTD.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 RIETER

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 EMAG SYSTEMS GMBH

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 GLEASON CORPORATION

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 DANOBAT

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ANCA

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 JAINNHER MACHINE CO., LTD.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 KANZAKI KOKYUKOKI MFG. CO., LTD

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 KENT INDUSTRIAL USA, INC.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 KLINGELNBERG

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 KNUTH WERKZEUGMASCHINEN GMBH

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 WALTER MASCHINENBAU GMBH

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 EUROPE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 EUROPE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 3 EUROPE SURFACE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 4 EUROPE CYLINDRICAL IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 5 EUROPE GEAR IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 6 EUROPE TOOLS & CUTTER IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 7 EUROPE OTHER GRINDING MACHINERY IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 8 EUROPE GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE AUTOMOTIVE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 10 EUROPE AEROSPACE & DEFENSE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 11 EUROPE ELECTRICAL & ELECTRONICS IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 12 EUROPE SHIPBUILDING IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 EUROPE OTHERS IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 14 EUROPE GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE OFFLINE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 16 EUROPE ONLINE IN GRINDING MACHINERY MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 17 EUROPE GRINDING MACHINERY MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE GRINDING MACHINERY MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 19 EUROPE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 21 EUROPE GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 23 GERMANY GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 GERMANY GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 25 GERMANY GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 26 GERMANY GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 27 ITALY GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ITALY GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 29 ITALY GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 30 ITALY GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 31 FRANCE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 FRANCE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 33 FRANCE GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 FRANCE GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 35 U.K. GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 U.K. GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 37 U.K. GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 38 U.K. GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 39 SPAIN GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 SPAIN GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 41 SPAIN GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 SPAIN GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 43 BELGIUM GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 BELGIUM GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 45 BELGIUM GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 BELGIUM GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 47 NETHERLANDS GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NETHERLANDS GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 49 NETHERLANDS GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 NETHERLANDS GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 RUSSIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 RUSSIA GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 53 RUSSIA GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 RUSSIA GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 55 TURKEY GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 TURKEY GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 57 TURKEY GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 TURKEY GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 59 SWITZERLAND GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SWITZERLAND GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 61 SWITZERLAND GRINDING MACHINERY MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 62 SWITZERLAND GRINDING MACHINERY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 63 REST OF EUROPE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 REST OF EUROPE GRINDING MACHINERY MARKET, BY TYPE, 2018-2032 (THOUSAND UNITS)

List of Figure

FIGURE 1 EUROPE GRINDING MACHINERY MARKET

FIGURE 2 EUROPE GRINDING MACHINERY MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE GRINDING MACHINERY MARKET: DROC ANALYSIS

FIGURE 4 EUROPE GRINDING MACHINERY MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE GRINDING MACHINERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE GRINDING MACHINERY MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE GRINDING MACHINERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE GRINDING MACHINERY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE GRINDING MACHINERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 APPLICATION GRID

FIGURE 11 EUROPE GRINDING MACHINERY MARKET: SEGMENTATION

FIGURE 12 EUROPE GRINDING MACHINERY MARKET EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 FIVE SEGMENTS COMPRISE THE EUROPE GRINDING MACHINERY MARKET, BY TYPE

FIGURE 15 GROWING ADOPTION OF INDUSTRY 4.0 AND SMART MANUFACTURING PROCESSES IS EXPECTED TO DRIVE THE EUROPE GRINDING MACHINERY MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 16 THE SURFACE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE GRINDING MACHINERY MARKET IN 2025 AND 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE GRINDING MACHINERY MARKET

FIGURE 18 EUROPE GRINDING MACHINERY MARKET: BY TYPE, 2024

FIGURE 19 EUROPE GRINDING MACHINERY MARKET: BY APPLICATION, 2024

FIGURE 20 EUROPE GRINDING MACHINERY MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 21 EUROPE GRINDING MACHINERY MARKET: SNAPSHOT, 2024

FIGURE 22 EUROPE GRINDING MACHINERY MARKET: COMPANY SHARE 2024 (%)

Europe Grinding Machinery Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Grinding Machinery Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Grinding Machinery Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.