Europe Hepato Pancreatico Biliary Hpb Surgeries Surgical Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.50 Billion

USD

2.75 Billion

2024

2032

USD

1.50 Billion

USD

2.75 Billion

2024

2032

| 2025 –2032 | |

| USD 1.50 Billion | |

| USD 2.75 Billion | |

|

|

|

|

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Size

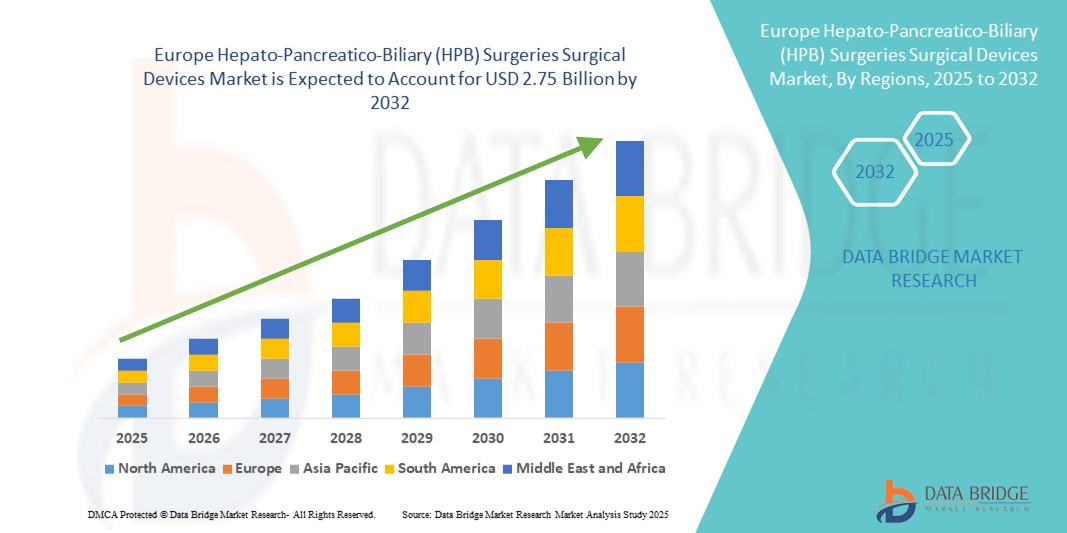

- The Europe hepato-pancreatico-biliary (HPB) surgeries surgical devices market size was valued at USD 1.50 billion in 2024 and is expected to reach USD 2.75 billion by 2032, at a CAGR of 7.90% during the forecast period

- The market growth is largely fueled by increasing awareness, rising healthcare access, and advancements in surgical technologies across Europe, enabling timely diagnosis and effective treatment of hepato-pancreatico-biliary disorders. The region is witnessing a surge in the number of complex HPB surgeries, particularly in rapidly urbanizing countries which is contributing to the growing adoption of advanced surgical devices for HPB procedures

- Furthermore, escalating investments in healthcare infrastructure, expansion of specialized surgical centers in both urban and rural areas, and increasing public-private partnerships are driving innovation and availability of premium HPB surgical devices. Government initiatives aimed at improving healthcare outcomes, coupled with the growing presence of international medical device companies and strengthening local manufacturing capabilities, are significantly boosting the growth of the Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices market

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Analysis

- The Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market is witnessing robust growth, driven by the increasing adoption of advanced surgical instruments and devices for complex liver, pancreas, and biliary tract procedures across major European countries

- The market expansion is fueled by the rising incidence of hepatobiliary cancers, an aging population, and continuous improvements in healthcare infrastructure and surgical capabilities across the region

- Germany dominated the Europe hepato-pancreatico-biliary (HPB) surgeries surgical devices market with the largest revenue share of 28.7% in 2024. This leadership is attributed to Germany’s advanced healthcare infrastructure, high concentration of specialized HPB surgical centers, and strong government initiatives promoting cancer treatment innovations

- Italy is projected to record the fastest CAGR of 12.6% in the urope hepato-pancreatico-biliary (HPB) surgeries surgical devices market during the forecast period, supported by growing public awareness about HPB disorders, rapid adoption of minimally invasive surgical techniques, and increased investments in upgrading hospital surgical departments

- The Adult age group dominated the Europe hepato-pancreatico-biliary (HPB) surgeries surgical devices market in 2024, accounting for 70.8% share, due to the higher prevalence of liver cancer, gallstones, and pancreatitis among adults compared to pediatric and geriatric groups

Report Scope and Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Segmentation

|

Attributes |

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Trends

Growing Comfort-Oriented Innovation and Surgical Precision Enhancements

- A significant and accelerating trend in the Europe hepato-pancreatico-biliary (HPB) surgeries surgical devices market is the increasing focus on developing comfort-driven surgical devices and precision-enhancing technologies tailored to complex hepatobiliary procedures. Manufacturers are investing in ergonomic instrument designs that reduce surgeon fatigue and improve procedural accuracy

- Major device developers across the region are collaborating with healthcare professionals and biomedical engineers to create next-generation HPB surgical tools featuring improved maneuverability, minimally invasive capabilities, and enhanced tissue compatibility. These innovations address rising demand for safer, more efficient surgeries with quicker patient recovery times

- Increasing adoption of robotic-assisted and laparoscopic HPB surgery systems in hospitals and specialty clinics across countries is driving market growth. These systems offer enhanced visualization, precision, and reduced complication rates during hepato-pancreato-biliary surgeries

- Academic medical centers and research institutions in the Europe region are actively conducting clinical trials and outcome studies on advanced HPB surgical devices, focusing on safety profiles, operative efficiency, and long-term patient benefits. This evidence-based approach supports product development and clinician adoption

- As healthcare infrastructure expands and emphasis on minimally invasive surgical techniques grows across Europe, the hepato-pancreatico-Biliary (HPB) surgeries surgical devices market is poised for sustained growth—fueled by technological innovation, clinical validation, and increasing procedural volumes in hepatobiliary care

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Dynamics

Driver

Growing Demand Driven by Rising Health Awareness and Advancements in Surgical Care

- The Europe hepato-pancreatico-biliary (HPB) surgeries surgical devices market is experiencing significant growth due to increasing awareness about liver, pancreatic, and biliary health, as well as the rising prevalence of HPB diseases in the region. Countries are witnessing a surge in demand for advanced surgical devices as patients and healthcare providers prioritize timely, effective surgical interventions

- For instance, in early 2024, leading medical device manufacturers expanded their product portfolios to include state-of-the-art electrosurgery instruments and robotic-assisted surgical systems designed to improve precision and outcomes in complex HPB surgeries, catering especially to tertiary care hospitals and specialty clinics

- The growing incidence of liver cancer, pancreatic cancer, and gall bladder diseases, combined with enhanced diagnostic capabilities, is driving an increased number of surgeries, thereby propelling demand for innovative and minimally invasive surgical devices across the region

- Government initiatives focused on improving healthcare infrastructure and increasing access to specialized surgical care in rural and urban areas are further supporting market expansion. Public-private partnerships and investments in advanced surgical centers contribute to the growing adoption of HPB surgical devices

- The rapid digitization of healthcare and the integration of robotic and imaging technologies into HPB surgeries are enhancing surgical precision, reducing patient recovery times, and increasing procedural safety, making these technologies more attractive to providers and patients alike

Restraint/Challenge

Limited Penetration in Price-Sensitive and Rural Markets

- Despite significant technological advancements in Hepato-Pancreatico-Biliary (HPB) surgical devices, the high costs associated with these sophisticated technologies remain a substantial barrier to widespread adoption, especially within price-sensitive segments and rural markets. This challenge is particularly pronounced in countries across Southeast Asia and South Asia, where healthcare budgets are limited and infrastructure development is still progressing. Many healthcare facilities in these regions face financial constraints that restrict their ability to procure and maintain advanced surgical equipment

- Furthermore, limited awareness among healthcare providers in rural and less-developed areas about the clinical benefits and improved patient outcomes offered by cutting-edge HPB surgical devices contributes to their underutilization. In addition to this, a lack of specialized training and expertise among medical professionals in these locations further hinders the effective deployment of such technologies outside major urban centers and metropolitan hospitals

- Distribution and logistics also pose critical challenges for market penetration. The supply chains for HPB surgical devices are often fragmented, and the delicate nature of the equipment requires careful handling and reliable transportation. Delivering these sophisticated devices to remote and underserved locations can be difficult, resulting in delays and increased costs, which further limit accessibility

- Moreover, many countries in the Europe region depend heavily on imports for high-tech HPB surgical devices. This reliance on imported equipment raises the overall cost due to import duties, taxes, and shipping expenses, making these solutions less affordable and accessible for healthcare providers in lower-income settings where cost sensitivity is paramount

- To address these barriers, market players are increasingly focusing on strategies that strengthen local manufacturing capabilities, reducing dependence on imports and enabling more competitive pricing. In addition, targeted education and training programs for healthcare professionals are being implemented to improve awareness and expertise regarding advanced HPB surgical technologies. Companies are also developing more cost-effective and tailored solutions that meet the unique needs and economic realities of emerging markets in the Europe region, aiming to expand access and improve surgical outcomes across a broader patient population

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Scope

The market is segmented on the basis of product, indication, type of surgery, age group, end user, and distribution channel.

- By Product

On the basis of product, the Europe hepato-pancreatico-biliary (hpb) surgeries surgical devices market is segmented into electrosurgery instruments, endoscope, visualization and robotic surgical system, hand instruments, access instruments, surgical suture and stapler devices, energy/vessel sealing devices, fluid management system, stents, and others. Among these, the visualization and robotic surgical system segment held a commanding lead with a revenue share of 28.5% in 2024. This dominance is attributable to the increasing integration of advanced imaging and robotic technologies in complex HPB procedures, which enhances surgical precision and patient outcomes.

On the other hand, the surgical suture and stapler devices segment is anticipated to experience the fastest growth, registering a CAGR of 11.2% from 2025 to 2032. This surge is driven by rising demand for minimally invasive surgical solutions and innovations in suturing technologies that offer improved efficiency and reduced operative times.

- By Indication

On the basis of indication, the market is segmented into liver cancer, pancreatic cancer, gall stones, bile duct cancer, cirrhosis, pancreatitis, cholecystitis, and others. The liver cancer segment emerged as the clear market leader in 2024, accounting for an 32.1% of total revenue. This dominance is largely attributed to the high incidence of liver malignancies across the Europe region, coupled with advancements in specialized surgical devices designed specifically for oncological procedures. These devices enhance precision in tumor resection and improve patient survival rates, making them indispensable in liver cancer management.

In contrast, the Pancreatitis segment is expected to register the fastest growth, with a CAGR of 12.5% during the forecast period. This rapid expansion is driven by growing awareness about the disease, improvements in early diagnostic techniques, and an increased adoption of surgical interventions to manage both acute and chronic pancreatitis cases, which are becoming more prevalent due to lifestyle changes and rising healthcare access.

- By Type of Surgery

On the basis of type of surgery, the market is divided into open surgery and minimally invasive surgery. Minimally invasive surgery commanded a significant share of 61.7% in 2024, reflecting a strong regional shift toward less invasive procedures. These surgical approaches are favored due to their numerous patient benefits, including shorter hospital stays, reduced post-operative pain, quicker recovery times, and lower complication rates. The rising availability of laparoscopic and robotic-assisted surgical devices tailored for HPB procedures further supports this preference. Moreover, this segment is forecasted to experience the highest growth rate with a CAGR of 13.8% from 2025 to 2032, driven by continuous technological innovations and the growing confidence of surgeons and patients in minimally invasive techniques.

- By Age Group

On the basis of age group, the market is segmented into pediatric, adult, and geriatric. The adult age group dominated the market in 2024 with a share of 70.8%, owing to the higher prevalence of HPB diseases such as liver cancer, pancreatitis, and gallstones in this demographic. The adult population’s increasing healthcare access and rising incidence of lifestyle-related conditions further reinforce this segment’s leadership.

Meanwhile, the Geriatric segment is poised for the fastest growth during the forecast period, with a CAGR of 10.9% through 2032. This growth is largely fueled by the aging population across Europe countries and the corresponding rise in age-associated HPB disorders, which necessitate specialized surgical management. The increasing focus on geriatric care and advancements in surgical techniques adapted for older patients are also contributing to this upward trend.

- By End User

On the basis of end user, the market includes hospitals, specialty clinics, ambulatory surgical centers, trauma centers, and others. Hospitals dominated as the largest end-user segment, commanding a revenue share of 74.2% in 2024. This dominance is primarily due to hospitals’ well-established infrastructure, advanced surgical facilities, and ability to manage complex Hepato-Pancreatico-Biliary (HPB) surgeries that require multidisciplinary teams and specialized equipment. Large hospital networks also benefit from higher patient volumes and stronger purchasing power, further solidifying their leadership in this segment.

On the other hand, ambulatory surgical centers (ASCs) are projected to register the fastest growth, with a CAGR of 12.3% from 2025 to 2032. This surge is driven by the increasing preference for outpatient surgical procedures that offer reduced hospital stays, lower costs, and faster patient turnover. ASCs are becoming attractive alternatives for less complex HPB surgeries, supported by advancements in minimally invasive techniques that enable safe and efficient treatment outside traditional hospital settings.

- By Distribution Channel

On the basis of distribution channel, the market is divided into direct tender, retail sales, and others. The direct tender segment held the dominant position with a substantial market share of 65.3% in 2024. This leadership is attributed to procurement strategies adopted by governments and large healthcare institutions that favor bulk purchasing agreements and long-term supply contracts to ensure consistent availability and cost-effectiveness of surgical devices. Direct tenders also facilitate streamlined logistics and regulatory compliance, making them a preferred choice in public healthcare sectors across the Europe region.

Meanwhile, the retail sales is anticipated to experience the fastest growth, registering a robust CAGR of 14.1% during the forecast period. This rapid expansion is fueled by the rising penetration of e-commerce platforms, improved internet accessibility, and changing consumer preferences that favor the convenience of online purchasing. Additionally, online channels enable manufacturers and distributors to reach a broader customer base, offer detailed product information, and provide flexible delivery and return policies, all of which contribute to accelerating market growth in this segment.

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Regional Analysis

- Europe dominated the global hepato-pancreatico-biliary (HPB) surgeries surgical devices market, accounting for the largest revenue share of 35% in 2024. This leadership is driven by the region’s well-developed healthcare infrastructure, rising investments in advanced surgical technologies, and increasing prevalence of HPB diseases

- The growing number of specialized surgical centers, coupled with expanding medical tourism and supportive government initiatives, is further fueling the adoption of innovative HPB surgical devices

- Increasing demand from hospitals, specialty clinics, and ambulatory surgical centers, along with rising healthcare expenditure and a strong focus on improving cancer treatment outcomes, has significantly contributed to Europe’s robust market growth. Rapid advancements in minimally invasive surgical techniques and strong collaborations between medical device companies and healthcare institutions also play a pivotal role in sustaining market dominance

Germany Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Germany hepato-pancreatico-biliary (HPB) surgeries surgical devices market led the Europe HPB surgeries surgical devices market with the largest revenue share of 28.7% in 2024. This leadership is attributed to Germany’s advanced healthcare infrastructure, high concentration of specialized HPB surgical centers, and strong government initiatives promoting cancer treatment innovations. The country’s focus on precision medicine, extensive R&D in surgical instrumentation, and rapid adoption of cutting-edge technologies have contributed to its dominant market position.

Italy Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Insight

The Italy hepato-pancreatico-biliary (HPB) surgeries surgical devices market is projected to record the fastest CAGR of around 12.6% during the forecast period, driven by growing public awareness about HPB disorders, rapid adoption of minimally invasive surgical techniques, and increased investments in upgrading hospital surgical departments. The expansion of specialized oncology and hepatology units, along with training programs to enhance surgeon expertise, is expected to further boost market penetration in the country.

Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market Share

The Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Cook (U.S.)

- Olympus Corporation (Japan)

- B. Braun SE (Germany)

- TeleMed Systems, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- CONMED Corporation (U.S.)

- BD (U.S.)

- CooperSurgical Inc. (U.S.)

- KARL STORZ (Germany)

- Medorah Meditek Pvt. Ltd (India)

- STERIS plc (U.S.)

- FUJIFILM Corporation (Japan)

- Johnson & Johnson and its affiliates (U.S.)

Latest Developments in Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices market

- In March 2025, Medtronic announced the launch of its next-generation robotic-assisted surgical system specifically designed for HPB surgeries, featuring enhanced precision and AI-driven navigation to improve surgical outcomes in complex liver and pancreas procedures

- 🔗 Source – Medtronic Press Release

- In January 2025, Olympus Corporation expanded its HPB surgical device portfolio by introducing advanced endoscopic visualization systems that integrate 4K imaging with AI-powered diagnostic assistance to support minimally invasive HPB surgeries

- 🔗 Source – Olympus Newsroom

- In November 2024, Boston Scientific Corporation partnered with a leading Europe hospital network to pilot its novel vessel sealing and energy devices tailored for HPB surgeries, aiming to reduce intraoperative bleeding and enhance recovery times

- 🔗 Source – Boston Scientific News

- In October 2024, CONMED Corporation launched a new range of surgical stapler devices optimized for HPB applications, focusing on improving surgical efficiency and patient safety during hepatic and pancreatic resections

- 🔗 Source – CONMED Newsroom

- In August 2024, Johnson & Johnson Services, Inc. introduced its latest energy/vessel sealing system designed for complex HPB surgeries, featuring innovative tissue sensing technology and ergonomic design to assist surgeons during delicate procedures

- 🔗 Source – Johnson & Johnson News

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.