Europe Hunter Syndrome Treatment Market

Market Size in USD Million

CAGR :

%

USD

206.37 Million

USD

265.52 Million

2025

2033

USD

206.37 Million

USD

265.52 Million

2025

2033

| 2026 –2033 | |

| USD 206.37 Million | |

| USD 265.52 Million | |

|

|

|

|

Europe Hunter Syndrome Treatment Market Size

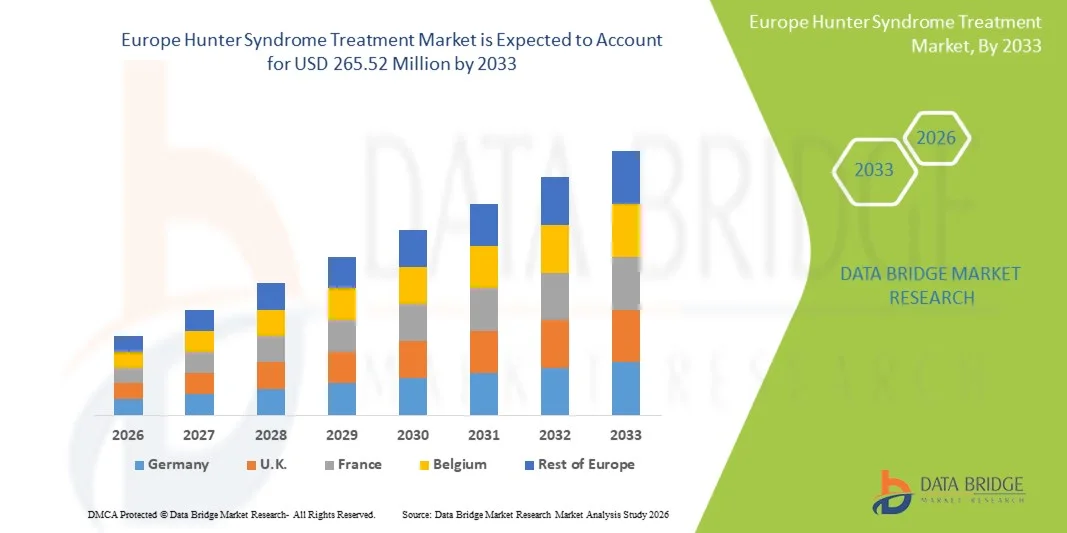

- The Europe Hunter Syndrome treatment market size was valued at USD 206.37 million in 2025 and is expected to reach USD 265.52 million by 2033, at a CAGR of 3.2% during the forecast period

- The market growth is primarily driven by the rising prevalence of rare genetic disorders, improved diagnostic capabilities, and increasing awareness among healthcare providers regarding early detection and management of mucopolysaccharidosis II (MPS II)

- In addition, the expanding availability of enzyme replacement therapies (ERTs), growing investment in innovative gene-based treatments, and continuous supportive initiatives from European regulatory bodies are accelerating adoption. These combined factors are significantly strengthening the demand for Hunter syndrome treatment solutions across Europe

Europe Hunter Syndrome Treatment Market Analysis

- Hunter Syndrome Treatment options, including enzyme replacement therapies (ERTs), supportive interventions, and advancing gene-targeted approaches, are becoming increasingly crucial across Europe due to the need for early diagnosis, sustained management, and improved long-term outcomes for patients affected by mucopolysaccharidosis II (MPS II)

- The demand for Hunter Syndrome treatment is rising primarily due to expanded newborn screening efforts, greater clinician awareness of lysosomal storage disorders, and accelerating orphan drug development supported by favorable European regulatory policies and strong patient advocacy networks

- Germany dominated the Europe Hunter Syndrome treatment market with the largest market share of 28.4% in 2025, driven by advanced healthcare infrastructure, high diagnostic accuracy, strong reimbursement support, and active involvement in clinical trials evaluating next-generation therapeutic options

- Poland is expected to be the fastest-growing country during the forecast period, propelled by improving access to metabolic specialists, gradually expanding rare-disease funding, and strengthened national initiatives focused on rare disorder care

- The enzyme replacement therapy (ERT) segment dominated the Europe Hunter Syndrome treatment market with a market share of 72.6% in 2025, attributed to its position as the primary approved treatment, well-established clinical efficacy, and broad availability across specialized European treatment centers

Report Scope and Europe Hunter Syndrome Treatment Market Segmentation

|

Attributes |

Europe Hunter Syndrome Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Hunter Syndrome Treatment Market Trends

“Advancements in Gene and Enzyme-Based Precision Therapeutics”

- A significant and accelerating trend in the Europe Hunter Syndrome Treatment market is the rapid advancement of gene therapy platforms and optimized enzyme replacement therapies (ERTs), which are enhancing treatment precision, improving disease management, and expanding therapeutic possibilities for patients across Europe

- For instance, investigational gene therapies under clinical development by companies such as Regenxbio and Takeda aim to deliver long-lasting therapeutic effects through single-dose administration, potentially reducing the burden of frequent infusions associated with traditional ERT

- AI-enabled innovations in rare disease management are also emerging, helping clinicians predict treatment response, optimize dosing patterns, and enhance monitoring. For instance, digital tools integrated with ERT programs can analyze patient-specific markers and provide alerts for abnormal disease progression or infusion-related issues

- The integration of treatment platforms with digital health ecosystems further supports centralized patient management, allowing metabolic specialists to coordinate enzyme infusions, monitor biomarkers, and access real-time patient data through unified interfaces

- This shift towards smarter, more personalized, and interconnected therapeutic solutions is reshaping expectations for rare disease care, prompting biopharmaceutical companies to focus on therapy optimization and long-term disease modification

- For instance, advancements by companies such as Shire/Takeda are emphasizing next-generation ERT formulations with improved tissue penetration and enhanced clinical outcomes, reflecting the growing demand for more effective and patient-friendly treatment modalities

Europe Hunter Syndrome Treatment Market Dynamics

Driver

“Growing Need Due to Rising Diagnostic Capabilities and Rare Disease Awareness”

- The increasing focus on early diagnosis of metabolic and lysosomal disorders, combined with expanding rare disease awareness among clinicians and healthcare systems, is a major driver accelerating the demand for Hunter Syndrome Treatment across Europe

- For instance, in 2025, advancements in newborn screening programs and biomarker-based diagnostic tools significantly improved early detection rates, enabling earlier intervention and strengthening long-term treatment outcomes for affected individuals

- As healthcare providers become more aware of the progressive nature of mucopolysaccharidosis II, the need for timely, effective, and continuous treatment such as ERTcontinues to rise, establishing these therapies as essential components of clinical care

- Furthermore, the growing prioritization of rare disease programs within European healthcare policies is supporting better reimbursement, wider specialist access, and seamless integration of advanced treatment approaches into national health systems

- The necessity of coordinated care pathways, regular treatment administration, and improved access to metabolic centers is further propelling adoption, with the increasing availability of patient-friendly infusion services contributing to broader treatment uptake

Restraint/Challenge

“High Treatment Costs and Regulatory Compliance Hurdle”

- Concerns related to the extremely high lifetime cost of enzyme replacement therapies and emerging gene-based options pose a significant restraint for broader adoption within European markets, particularly among countries with limited rare disease budgets

- For instance, the high annual treatment cost of ERT creates financial challenges for healthcare systems and families, sometimes delaying access or requiring stringent eligibility criteria depending on national reimbursement policies

- Addressing these financial barriers through expanded reimbursement schemes, value-based pricing models, and supportive national rare-disease frameworks is essential for sustaining long-term patient access and treatment continuity

- In addition, the complexity of regulatory approval pathways for advanced therapies such as gene therapy introduces extended timelines, heightened compliance requirements, and increased developmental investment for biopharmaceutical companies

- While innovation continues to advance, navigating these cost burdens and regulatory hurdles remains a critical challenge, particularly in regions where access to specialized metabolic centers is limited or reimbursement systems are still evolving

Europe Hunter Syndrome Treatment Market Scope

The market is segmented on the basis of severity, type, complications, end user, and distribution channel.

- By Severity

On the basis of severity, the Europe Hunter Syndrome treatment market is segmented into mild to moderate and moderate to severe. The mild to moderate segment dominated the market with the largest revenue share in 2025, driven by earlier diagnosis, proactive treatment initiation, and improved access to enzyme replacement therapies across major European countries. Patients in this category often maintain better cognitive and functional abilities, making them more responsive to available therapies, which increases treatment adherence. The dominance of this segment is further supported by national newborn screening expansion in countries such as Germany and Italy, allowing earlier detection and management. In addition, healthcare systems across Europe prioritize early-stage treatment to prevent progression, resulting in higher uptake of ERT among mild to moderate cases. Favorable reimbursement frameworks in countries such as France and the U.K. further strengthen this segment’s market presence.

The moderate to severe segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing clinical focus on advanced disease management and new therapeutic developments targeting severe phenotypes. Patients in this category often face rapid disease progression, prompting higher demand for intensive care interventions and emerging advanced treatments. For instance, research efforts across Europe are exploring next-generation ERT formulations and gene-based therapies catering specifically to severe cases. Improved access to multidisciplinary care centers specializing in complex lysosomal storage disorders also supports faster growth. As awareness of severe Hunter Syndrome increases among clinicians, diagnosis rates are rising, particularly in Eastern European regions. The growing emphasis on long-term disease monitoring and supportive care requirements further accelerates the expansion of this segment.

- By Type

On the basis of type, the Europe Hunter Syndrome treatment market is segmented into enzyme replacement therapy (ERT), stem cell transplant, surgical treatment, and others. The enzyme replacement therapy (ERT) segment dominated the market with the largest revenue share of 72.6% in 2025, driven by its status as the standard-of-care and the most widely available therapeutic option across Europe. ERT therapies such as idursulfase have been well-established for over a decade, resulting in strong physician familiarity and consistent patient uptake. Robust reimbursement support from national health systems in countries such as the U.K., Italy, Spain, and Germany significantly boosts adoption. The segment also benefits from ongoing improvements in infusion protocols, home-based infusion services, and supportive care programs that reduce treatment burden. In addition, expanding diagnostic awareness and increased screening initiatives continue to drive strong ERT demand. The reliability, accessibility, and proven clinical outcomes of ERT reinforce its dominant position in Europe.

The stem cell transplant segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by advancements in hematopoietic stem cell transplantation (HSCT) techniques and improved survival outcomes. Although historically limited due to risks, newer conditioning regimens and donor-matching technologies have enhanced treatment safety for selected severe cases. Europe’s growing investment in rare disease research is accelerating clinical trials exploring HSCT effectiveness in managing neurological complications. For instance, specialized centers in countries such as the U.K., France, and the Netherlands are expanding HSCT programs for lysosomal storage disorders. Increasing parental interest in potentially curative options and long-term therapeutic benefits further contributes to growth. As evidence supporting HSCT outcomes continues to evolve, the segment is expected to expand at a rapid pace.

- By Complications

On the basis of complications, the market is segmented into respiratory disorders, neurological disorders, gastrointestinal disorders, cardiovascular, ophthalmic, audiologic, dental, musculoskeletal, and others. The respiratory disorders segment dominated the market with the largest revenue share in 2025, attributed to the high prevalence of airway obstruction, chronic infections, and breathing difficulties among Hunter Syndrome patients in Europe. Respiratory complications remain one of the earliest and most frequent manifestations, requiring continuous medical management and specialized interventions. Hospitals across Europe report significant utilization of respiratory therapies, sleep apnea management solutions, and pulmonary support services among affected patients. For instance, ENT and pulmonology departments in Germany, the U.K., and France manage a substantial portion of Hunter Syndrome cases due to frequent airway-related complications. The strong clinical need and high treatment intensity reinforce the dominance of this segment.

The neurological disorders segment is projected to witness the fastest growth rate from 2026 to 2033, driven by increasing recognition of central nervous system involvement in Hunter Syndrome and the lack of current therapies addressing cognitive impairment. European research centers are accelerating efforts to develop CNS-penetrating therapies, including intrathecal ERT and gene-based treatments. As diagnostic technologies improve, cases with neurological manifestations are being identified earlier, especially in Spain, France, and the Nordic countries. The growing availability of multidisciplinary neurodevelopmental services supports better long-term patient management. Disease progression necessitates frequent interventions, further boosting segment growth. The rising focus on neurological complications as a major unmet clinical need fuels rapid expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home healthcare, and others. The hospitals segment dominated the Europe market in 2025, owing to the concentration of specialized metabolic disorder centers and advanced treatment facilities within hospital settings. Hospitals provide access to multidisciplinary teams required for complex Hunter Syndrome management, including geneticists, pulmonologists, cardiologists, neurologists, and surgeons. The administration of enzyme replacement therapy, stem cell transplantation, and surgical interventions predominantly occurs within hospital infrastructure. For instance, tertiary hospitals in France, Italy, and the U.K. manage the majority of MPS II treatment pathways. Strong reimbursement frameworks for in-hospital care and the availability of advanced diagnostic equipment further reinforce segment dominance. The comprehensive nature of hospital-based management ensures high patient flow and treatment adherence.

The home healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing adoption of home-based infusion services for ERT across Europe. Home healthcare reduces the treatment burden on families, improves convenience, and enhances patient quality of life. Countries such as Germany, the Netherlands, and the U.K. have expanded home infusion programs for lysosomal storage disorders, encouraging greater adoption. For instance, evolving telehealth infrastructure allows remote patient monitoring and coordination of care. Rising preference for minimally disruptive treatment routines and the high cost of hospital visits further support segment growth. As healthcare systems shift toward decentralized care models, home healthcare is expected to expand rapidly.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, online pharmacy, and others. The hospital pharmacy segment dominated the market in 2025, primarily due to the central role hospitals play in administering high-cost and specialized treatments such as ERT. Hospital pharmacies maintain strict control over storage, procurement, and distribution of rare disease therapeutics, ensuring treatment continuity. For instance, national rare disease management guidelines across Europe mandate hospital-based dispensing for complex biologics. The close coordination between physicians and hospital pharmacists supports timely treatment modifications and patient monitoring. In addition, reimbursement pathways often require hospital-linked supply chains, reinforcing this segment’s dominance.

The online pharmacy segment is projected to witness the fastest growth rate from 2026 to 2033, driven by increasing digitalization of pharmaceutical services across Europe. E-pharmacy platforms are expanding their capabilities to distribute supportive medications, home-care supplies, and ancillary therapies required by Hunter Syndrome patients. For instance, several countries such as Germany and Sweden have strengthened policies supporting prescription digitalization, enabling easier access to chronic care medications. Growing patient preference for home delivery, combined with improved regulatory clarity, contributes to rapid adoption. The expansion of online pharmacy networks also aligns with rising home healthcare adoption, further boosting segment growth.

Europe Hunter Syndrome Treatment Market Regional Analysis

- Germany dominated the Europe Hunter Syndrome treatment market with the largest market share of 28.4% in 2025, driven by advanced healthcare infrastructure, high diagnostic accuracy, strong reimbursement support, and active involvement in clinical trials evaluating next-generation therapeutic options

- Healthcare providers in Germany place significant emphasis on early detection, comprehensive disease monitoring, and structured treatment pathways, supported by advanced infrastructure and specialized hospital networks offering multidisciplinary care for rare genetic disorders

- This strong adoption is further supported by favorable reimbursement frameworks, extensive clinical research activity, and a high level of clinician awareness, establishing Germany as a leading hub for Hunter Syndrome management within the region

The Germany Hunter Syndrome Treatment Market Insight

The Germany Hunter Syndrome treatment market accounted for the largest revenue share in Europe in 2025, driven by its highly developed healthcare infrastructure and strong integration of metabolic disorder clinics. German healthcare providers emphasize precise diagnosis, continuous monitoring, and personalized treatment strategies for MPS II patients. Increasing access to specialized enzyme replacement therapy centers, combined with structured national guidelines for rare diseases, supports early and sustained treatment. Furthermore, Germany’s robust clinical research environment and active role in evaluating emerging gene therapies continue to strengthen market growth.

U.K. Hunter Syndrome Treatment Market Insight

The U.K. Hunter Syndrome treatment market is expected to grow at a steady CAGR during the forecast period, supported by the expansion of rare disease programs and enhanced national screening initiatives. The country’s focus on early detection of lysosomal storage disorders facilitates timely intervention and structured care pathways. Increasing access to ERT, supported by NHS reimbursement frameworks, is improving treatment availability across major hospitals. In addition, growing clinical interest in next-generation therapies and patient-centered digital tools is contributing to improved disease management and market progression.

France Hunter Syndrome Treatment Market Insight

The France Hunter Syndrome treatment market is projected to witness substantial growth, owing to strong government support for rare disease treatment and expanding diagnostic capacity within national healthcare networks. French hospitals actively integrate multidisciplinary teams to manage MPS II, ensuring comprehensive clinical monitoring and therapy optimization. Broader participation in European rare disease research networks enhances treatment access, while reimbursement policies for ERT support continued adoption. Increasing clinical interest in advanced therapeutics, including gene therapy, is expected to further accelerate market development.

Poland Hunter Syndrome Treatment Market Insight

The Poland Hunter Syndrome treatment market is expected to grow at one of the fastest rates in Europe, fueled by improving healthcare infrastructure and expanding access to rare disease treatment programs. Diagnostic capabilities for lysosomal storage disorders are progressing rapidly, enabling earlier identification and management of MPS II. Increasing adoption of ERT, supported by government initiatives aimed at strengthening rare disease funding, is enhancing patient outcomes. Poland’s rising participation in European clinical research networks and increasing availability of specialized care centers continue to boost market expansion.

Europe Hunter Syndrome Treatment Market Share

The Europe Hunter Syndrome Treatment industry is primarily led by well-established companies, including:

- Takeda Pharmaceutical Company Limited (Japan)

- REGENXBIO (U.S.)

- JCR Pharmaceuticals Co., Ltd. (Japan)

- Sangamo Therapeutics, Inc. (U.S.)

- Denali Therapeutics (U.S.)

- Bioasis Technologies Inc. (U.S.)

- Inventiva (France)

- Green Cross Corporation (South Korea)

- Esteve Pharmaceuticals (Spain)

- AVROBIO, Inc. (U.S.)

- CANbridge Life Sciences Ltd. (China)

- ArmaGen, Inc. (U.S.)

- Sanofi (France)

- F. Hoffmann-La Roche AG (Switzerland)

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- GSK plc (U.K.)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

What are the Recent Developments in Europe Hunter Syndrome Treatment Market?

- In August 2025, the FDA extended its PDUFA action date for RGX-121 from November 9, 2025 to February 8, 2026, after REGENXBIO submitted 12-month data from all 13 patients in its pivotal trial; this extension follows a pre-license inspection and indicates continued regulatory scrutiny but no safety concerns

- In May 2025, REGENXBIO announced that its one-time RGX-121 gene therapy BLA (Biologics License Application) for MPS II was accepted by the FDA for priority review, targeting a PDUFA notably, RGX-121 has also been given ATMP classification by the European Medicines Agency.

- In June 2024, REGENXBIO announced the successful completion of a pre-BLA meeting with the U.S. FDA for its RGX-121 gene therapy, gaining alignment on its accelerated-approval pathway; the FDA agreed to allow CSF biomarker (heparan sulfate D2S6) as a surrogate endpoint, and discussions were held on manufacturing, trial design, and submission timelines

- In February 2024, REGENXBIO reported that its pivotal Phase I/II/III “CAMPSIITE” trial of RGX-121 met its primary endpoint, with a statistically significant reduction in CSF levels of the D2S6 biomarker; many patients also reduced or stopped standard ERT, and showed neurodevelopmental improvements

- In October 2023, the University of Manchester in the U.K. launched the first-ever autologous hematopoietic stem cell (HSC) gene therapy trial for Hunter syndrome (MPS II) in Europe, treating infants under one year with a therapy designed to deliver the IDS gene to the brain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.