Europe Immunoassay Gamma Counters Market

Market Size in USD Million

CAGR :

%

USD

22.03 Million

USD

32.54 Million

2025

2033

USD

22.03 Million

USD

32.54 Million

2025

2033

| 2026 –2033 | |

| USD 22.03 Million | |

| USD 32.54 Million | |

|

|

|

|

Europe Immunoassay-Gamma Counters Market Size

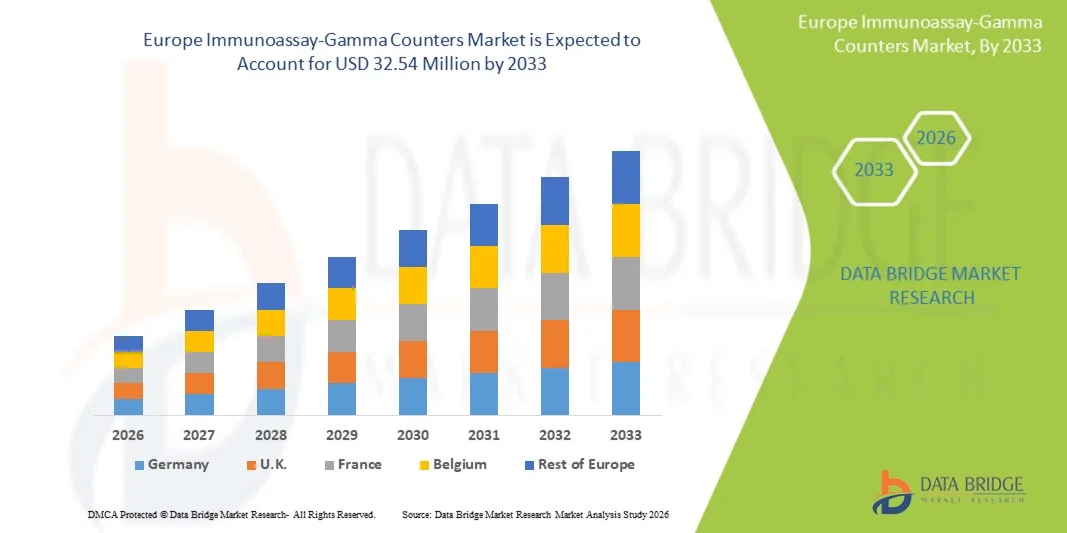

- The Europe Immunoassay-Gamma Counters Market size was valued at USD 22.03 Million in 2025 and is expected to reach USD 32.54 Million by 2033, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced diagnostic technologies and continuous progress in laboratory automation, leading to higher digitalization and efficiency across clinical, research, and pharmaceutical laboratories

- Furthermore, rising demand for accurate, sensitive, and high-throughput immunoassay-based diagnostic solutions is establishing gamma counters as a critical tool for disease detection, therapeutic monitoring, and biomedical research. These converging factors are accelerating the uptake of Immunoassay-Gamma Counter solutions, thereby significantly boosting the industry’s growth

Europe Immunoassay-Gamma Counters Market Analysis

- Immunoassay–gamma counters, used to measure radioisotopes in diagnostic and research applications, continue to gain importance across clinical laboratories, biotechnology centers, and pharmaceutical research facilities due to their high precision, sensitivity, and ability to support a wide range of immunoassay tests

- The growing demand for immunoassay–gamma counters is driven by the rising burden of chronic and infectious diseases, increasing adoption of nuclear medicine and radioimmunoassay techniques, and the expanding need for accurate and automated diagnostic tools in hospitals and diagnostic laboratories

- The U.K. dominated the immunoassay–gamma counters market with a revenue share of 28.9% in 2025, supported by strong diagnostic infrastructure, high adoption of advanced laboratory automation systems, and significant investments in nuclear medicine and clinical research. Growing demand for high-sensitivity testing and strong presence of leading diagnostic laboratories further strengthen the U.K.’s leadership position

- Germany is expected to be the fastest-growing country in the immunoassay–gamma counters market during the forecast period, driven by rapid expansion of nuclear medicine procedures, increased healthcare spending, rising demand for advanced diagnostic technologies, and a major push toward modernization of clinical laboratories

- The Out-right Purchase segment dominated the market with the largest revenue share of 72.8% in 2025, driven by strong adoption among hospitals, clinical laboratories, and research institutes that require permanent, uninterrupted access to gamma counting systems

Report Scope and Europe Immunoassay-Gamma Counters Market Segmentation

|

Attributes |

Immunoassay-Gamma Counters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Immunoassay-Gamma Counters Market Trends

“Enhanced Convenience Through Advanced Automation and AI-Enabled Diagnostic Integration”

- A significant and accelerating trend in the Europe Immunoassay-Gamma Counters Market is the deeper integration of AI, automated data processing, and advanced laboratory information systems (LIS). This technological fusion is enhancing diagnostic workflow efficiency, accuracy, and user convenience across clinical laboratories, research institutions, and oncology/hematology facilities

- For instance, next-generation gamma counters with cloud-based analytics and predictive maintenance features allow laboratories to streamline sample handling, automate result interpretation, and reduce manual errors. Similarly, automated benchtop systems with AI-driven calibration and quality-control functions offer faster throughput and improved operational consistency

- AI-enabled immunoassay-gamma counters now support functions such as pattern recognition, automated background correction, decay adjustment, and optimized assay interpretation, significantly improving precision in radioimmunoassay (RIA), receptor binding studies, and nuclear medicine applications. Furthermore, automated reporting and real-time data synchronization greatly reduce workload pressures in high-volume laboratories

- The seamless integration of gamma counters with laboratory information management systems (LIMS), radiotracer tracking platforms, and automated sample preparation modules facilitates centralized control over diagnostic operations. Through a single interface, laboratories can manage RIA tests, radioactive sample flow, QC parameters, calibration data, and compliance documentation

- This shift toward more intelligent, intuitive, and interconnected diagnostic equipment is reshaping expectations within the clinical and research communities. Consequently, companies are increasingly developing AI-enabled gamma counters featuring automated self-diagnostics, workflow optimization tools, and enhanced compatibility with modern LIS environments

- The demand for immunoassay-gamma counters that offer automation, AI-based accuracy enhancement, and seamless system interoperability is rapidly increasing across hospital laboratories, pharmaceutical research centers, and nuclear medicine departments.

Europe Immunoassay-Gamma Counters Market Dynamics

Driver

“Growing Need Due to Rising Diagnostic Volumes and Advancements in Radioimmunoassay Technologies”

- The rising global burden of cancer, autoimmune disorders, and metabolic diseases—combined with the expanding use of radioimmunoassay (RIA) in clinical diagnostics—is a major driver of the Europe Immunoassay-Gamma Counters Market

- For instance, in April 2025, Onity, Inc. (Honeywell International, Inc.) announced advancements in IoT-enabled laboratory monitoring systems, integrating enhanced sensors for improved radioactive sample tracking—an innovation expected to support the growth of the immunoassay-gamma counters segment over the forecast period

- As laboratories increasingly seek high-precision, low-error diagnostic platforms, gamma counters offer benefits such as high sensitivity, rapid sample processing, and superior reproducibility compared to manual RIA methods

- Furthermore, the rise in automated laboratory ecosystems, demand for efficient nuclear medicine equipment, and adoption of advanced immunoassay techniques is making gamma counters an essential component of diagnostic infrastructure

- The convenience of automated sample handling, real-time analysis, remote data monitoring, and simplified QC workflows is accelerating adoption across hospitals, academic research centers, and pharmaceutical companies

- The growth of user-friendly benchtop gamma counters, featuring automation and digital connectivity, continues to further strengthen market expansion

Restraint/Challenge

“Concerns Regarding Radiation Safety, Data Security, and High Initial Equipment Costs”

- Concerns surrounding handling of radioactive materials, regulatory compliance, and radiation-exposure risks continue to challenge the broader adoption of Immunoassay-Gamma Counters, especially in smaller laboratories. These systems require strict adherence to radiation-safety guidelines, specialized training, and controlled environments, which not all facilities can maintain

- For instance, in 2024, several diagnostic laboratories in Southeast Asia reported delays in adopting radioimmunoassay (RIA) systems due to concerns over insufficient shielding infrastructure and staff not being certified for radioactive material handling, which directly slowed procurement of new gamma counters

- High-profile discussions around radioisotope supply interruptions have also affected market confidence. For example, in 2023, disruptions in the supply of Iodine-125 and Cobalt-57—key isotopes used in RIA kits—led several European laboratories to temporarily reduce RIA testing volumes, highlighting a vulnerability that discourages new investment in gamma counters

- In addition, cybersecurity concerns related to modern, network-connected gamma counters pose a restraint. Since these systems store patient data, laboratories worry about potential breaches when equipment is linked to LIMS software. For example, in early 2025, a mid-sized diagnostic network in the U.S. reported attempted unauthorized access to its cloud-connected diagnostic devices, prompting many facilities to postpone upgrades to digitally integrated gamma counters

- The high initial cost of advanced immunoassay-gamma counters—especially fully automated multi-detector models—also remains a substantial barrier. For instance, hospitals in Latin America and parts of Eastern Europe have cited upfront purchase prices (plus costs for shielding, calibration, and radiation-monitoring equipment) as reasons for preferring non-radioactive immunoassay platforms instead

- While pricing is gradually decreasing with new compact benchtop models, premium features such as AI-enabled analytics, high-sensitivity detectors, and automated QC modules still carry a higher cost, limiting adoption in budget-constrained laboratories

- Overcoming these challenges through improved radiotracer supply chains, enhanced shielding, stronger data-security protocols, and more affordable equipment tiers will be crucial for sustained market expansion

Europe Immunoassay-Gamma Counters Market Scope

The market is segmented on the basis of product type, well, application, disease condition, purchase mode, end user, and distribution channel.

• By Product Type

On the basis of product type, the Europe Immunoassay-Gamma Counters Market is segmented into Automated and Manual/Semi-Automated. The Automated segment dominated the largest market revenue share of 67.4% in 2025, driven by its widespread adoption in clinical laboratories requiring high-throughput, precise, and reproducible assay results. Automated gamma counters provide significant workflow efficiency by minimizing manual intervention and optimizing sample handling accuracy. Their ability to support large testing volumes makes them the preferred choice for laboratories dealing with complex immunoassays and nuclear medicine diagnostics. In addition, automated systems integrate advanced software for quality control, calibration, and analytical reliability, helping laboratories meet stringent regulatory requirements. Rising demand for fully standardized processes in cancer biomarker testing, infectious disease screening, and endocrine hormone assays is further strengthening the adoption of automated systems. The segment also benefits from the increasing preference for automated radiopharmaceutical quantification to reduce human radiation exposure. Furthermore, as hospitals and diagnostic centers modernize testing infrastructure, automated gamma counters are becoming essential instruments to improve operational efficiency. Growing investments in molecular imaging and nuclear medicine departments continue to reinforce dominance. The automated category remains the primary choice for organizations prioritizing speed, precision, compliance, and reduced operational errors.

The Manual/Semi-Automated segment is anticipated to witness the fastest growth at a CAGR of 11.6% from 2026 to 2033, driven by its increasing adoption among small-to-medium laboratories, research institutions, and facilities with limited testing volumes. Manual/semi-automated systems are preferred for their cost-effectiveness, making them accessible for emerging markets and institutions operating under budget constraints. Their flexibility allows researchers to customize assay conditions, supporting exploratory and academic research environments. In addition, semi-automated counters provide an ideal balance between affordability and accuracy, making them suitable for specialized assays that do not require fully automated operations. Increased demand from teaching hospitals and academic laboratories conducting hands-on training is further boosting adoption. As diagnostic labs expand geographically into tier-2 and tier-3 cities, the demand for lower-cost instrumentation rises significantly. Improved designs with enhanced usability, radiation safety features, and intuitive interfaces make these units more appealing to new users. The segment also grows due to its suitability for pilot studies and low-throughput testing scenarios where automation is not essential. Rising research activity in endocrine, autoimmune, and neonatal assays further accelerates adoption. Thus, the segment is poised for strong growth owing to affordability, flexibility, and expanding research-driven applications.

• By Well

On the basis of well configuration, the Europe Immunoassay-Gamma Counters Market is segmented into Multi-well and Single-well.

The Multi-well segment dominated the largest market revenue share of 71.3% in 2025, driven by its ability to support high-throughput testing environments where multiple samples must be processed simultaneously with precision and efficiency. Multi-well gamma counters are widely adopted in clinical laboratories performing large volumes of radioimmunoassays, nuclear medicine assays, and endocrine hormone testing, where batch processing significantly reduces turnaround time. Their advanced plate-handling mechanisms allow seamless integration with automated workflows, contributing to operational standardization and reduced manual errors. The segment benefits from rising demand for mass screening in oncology, infectious diseases, and therapeutic drug monitoring, where laboratories prioritize parallel sample evaluation. Multi-well systems also offer improved reproducibility, enhanced signal detection stability, and superior data consistency, making them essential for regulated diagnostic environments. Increasing investments in hospital laboratories and molecular imaging centers further reinforce dominance, as institutions upgrade to equipment capable of managing expanding test menus. As healthcare facilities shift toward fully automated diagnostic infrastructures, multi-well counters remain the backbone for high-capacity operations. In addition, their compatibility with robotics and LIMS platforms supports large-scale workflows, making this configuration indispensable for high-efficiency laboratories across global markets.

The Single-well segment is anticipated to witness the fastest growth at a CAGR of 10.9% from 2026 to 2033, driven by its growing use in research laboratories, specialized clinical setups, and facilities performing focused, low-volume assays. Single-well gamma counters are preferred for their precision in individual sample measurements, making them suitable for niche nuclear medicine studies and exploratory biomarker research. They offer higher measurement control, minimal cross-contamination risk, and superior accuracy for assays requiring isolated sample handling. The segment experiences increasing adoption in academic and research institutions conducting pilot studies, radioactive tracer evaluations, and fundamental hormone and immunology experiments. Their affordability and compact design make them attractive for laboratories with limited space or budget capacities. Advancements in detector sensitivity and user-friendly digital interfaces also contribute to growing preference, enabling researchers to achieve high-level analytical performance without high-throughput systems. In emerging markets, single-well counters are gaining traction as entry-level equipment for labs establishing nuclear medicine testing capabilities. Rising investments in translational research and personalized medicine further accelerate demand for precise single-sample measurement tools. As R&D intensifies across oncology, neonatal screening, autoimmune studies, and endocrine research, single-well configurations are expected to experience sustained, rapid growth.

• By Application

On the basis of application, the Europe Immunoassay-Gamma Counters Market is segmented into Radio Immunoassays, Nuclear Medicine Assays, and Others. The Radio Immunoassays segment dominated the market with the largest revenue share of 58.4% in 2025, driven by its critical role in sensitive quantification of hormones, biomarkers, and therapeutic drug levels across clinical laboratories worldwide. Radio immunoassays (RIA) remain a gold-standard method for high-accuracy measurement of endocrine hormones such as TSH, cortisol, insulin, and reproductive hormones, making them indispensable in endocrine disorder diagnosis. Their ability to detect ultra-low concentrations with superior specificity ensures continued preference among diagnostic centers handling complex metabolic and autoimmune cases. The segment benefits from increasing prevalence of chronic diseases requiring routine hormonal monitoring, including thyroid dysfunction, diabetes-related endocrine imbalances, and fertility-related conditions. RIA’s compatibility with multi-well gamma counters enables high-throughput processing for population-scale screening programs, further strengthening its dominance. Laboratories also rely on RIA for therapeutic drug monitoring, especially in oncology and transplant medicine, where precise dosage measurement is essential. Despite a gradual shift toward non-radioactive immunoassays in some regions, RIA continues to lead due to validated clinical protocols, established laboratory infrastructure, and regulatory familiarity. Growing investments in diagnostic capacity expansion, particularly in emerging markets, further support strong adoption. As hospitals and reference labs prioritize diagnostic reliability, the RIA segment maintains significant influence across global testing workflows.

The Nuclear Medicine Assays segment is projected to witness the fastest growth at a CAGR of 11.7% from 2026 to 2033, driven by rising global demand for nuclear imaging studies, radiotracer evaluations, and in-vitro measurements supporting diagnostic and therapeutic applications. Nuclear medicine assays are increasingly used to assess organ function, radiopharmaceutical biodistribution, metabolic activity, and receptor binding, making them essential in oncology, cardiology, and neurology workflows. The segment benefits from the expanding use of PET and SPECT tracers, which require precise gamma counting to evaluate radiochemical purity, labeling efficiency, and quantitative uptake analysis. Growth is further accelerated by the rising need for accurate dosimetry calculations in targeted radionuclide therapies, particularly for cancers treated with Lu-177, Y-90, and I-131. Research institutions rely heavily on nuclear medicine assays for developing next-generation radiopharmaceuticals, supporting increased adoption of single-well and multi-well counters for experimental validation. Government investments in nuclear imaging facilities across Asia-Pacific, Europe, and the Middle East further drive demand, as laboratories expand capabilities for radionuclide-based diagnostic programs. The segment also gains momentum from the emergence of personalized radiopharmaceutical therapy, which requires precise pre-treatment and post-treatment activity measurement. As global cancer incidence rises and nuclear imaging becomes more accessible, nuclear medicine assays are expected to experience robust, rapid growth throughout the forecast period.

• By Disease Condition

On the basis of disease condition, the Europe Immunoassay-Gamma Counters Market is segmented into Cancer Biomarker, Infectious Diseases, Therapeutic Drug Monitoring, Endocrine Hormones, Allergy, Neonatal Screening, Cardiac Markers, Autoimmune Diseases, and Others. The Endocrine Hormones segment dominated the market with the largest revenue share of 34.5% in 2025, driven by its essential role in diagnosing thyroid disorders, adrenal dysfunctions, reproductive hormone imbalance, and pituitary abnormalities. Rising global prevalence of hypothyroidism, PCOS, infertility, and metabolic disorders has increased the demand for highly sensitive gamma counter-based assays. The segment benefits from the unmatched precision of radioimmunoassays in detecting extremely low hormone concentrations, making them indispensable for endocrine specialists and advanced clinical laboratories. Routine tests for T3, T4, TSH, LH, FSH, prolactin, cortisol, estradiol, and testosterone rely heavily on multi-well gamma counter platforms to ensure high throughput and diagnostic reliability. Increasing adoption of hormonal monitoring in IVF centers and fertility clinics further strengthens segment dominance. Hospitals continue to favor gamma-based endocrine assays due to long-validated protocols, consistent performance across patient populations, and cost-effective repeatability. Growing awareness of early endocrine disease detection, combined with the expansion of metabolic disorder screening programs, positions this segment as the backbone of immunoassay-based diagnostics. Strong demand across developed and developing economies ensures sustained revenue contribution.

The Cancer Biomarker segment is projected to witness the fastest growth at a CAGR of 12.4% from 2026 to 2033, fueled by rising global cancer incidence and expanding use of radioisotope-based assays for early tumor marker detection. Gamma counters play a crucial role in quantifying key biomarkers such as AFP, CEA, CA-125, CA-15-3, and PSA, supporting accurate diagnosis, staging, treatment planning, and post-treatment monitoring. The growing adoption of personalized oncology and targeted therapies is driving demand for precise radiometric assays that measure biomarker fluctuations with high sensitivity. Research institutions increasingly rely on gamma counters for validating radiolabeled antibodies, peptides, and novel tracer-based biomarker studies, further accelerating segment growth. Expanding cancer screening initiatives in Asia-Pacific, Middle East, and Latin America also contribute significantly. Advances in radiopharmaceutical development and increased integration of nuclear medicine with oncology departments continue to boost utilization. As countries invest heavily in cancer diagnostic infrastructure, the cancer biomarker segment is positioned for rapid, sustained expansion throughout the forecast period.

• By Purchase Mode

On the basis of purchase mode, the Europe Immunoassay-Gamma Counters Market is segmented into Out-right Purchase and Rental Purchase. The Out-right Purchase segment dominated the market with the largest revenue share of 72.8% in 2025, driven by strong adoption among hospitals, clinical laboratories, and research institutes that require permanent, uninterrupted access to gamma counting systems. Out-right purchase provides long-term cost efficiency, full ownership of equipment, and the ability to customize systems based on workflow requirements. Laboratories performing large testing volumes prefer owning gamma counters to ensure scalability and avoid recurring rental fees. High-end automated multi-well gamma counters used for oncology, endocrinology, and therapeutic drug monitoring reinforce demand for ownership-based procurement. Institutions with established radiochemistry and nuclear medicine departments invest in owned equipment to maintain regulatory compliance and operational continuity. Furthermore, large hospitals and diagnostic networks benefit from integrated equipment management, extended warranties, and in-house calibration services, strengthening dominance of this segment. Growing investments in laboratory modernization programs across North America, Europe, and Asia further contribute to high adoption of permanent gamma counter installations.

The Rental Purchase segment is projected to witness the fastest growth at a CAGR of 10.6% from 2026 to 2033, supported by increasing demand from small and mid-sized laboratories, emerging diagnostic centers, and academic research units operating under budget constraints. Rental models offer flexibility, reduced upfront costs, and access to advanced gamma counters without long-term capital commitment. Laboratories conducting short-term projects or seasonal testing campaigns particularly favor rental contracts. Rapid expansion of clinical trial activity—especially in oncology and radiopharmaceutical development—has driven higher adoption of temporary equipment rental. Rental agreements also appeal to organizations seeking to evaluate instrument performance before making a permanent purchase. In addition, manufacturers increasingly offer bundled rental packages that include maintenance, calibration, and technical support, making them attractive for institutions requiring predictable monthly operational expenditure. Growth in decentralized testing facilities and mobile labs in developing regions further supports strong momentum for the rental segment.

• By End User

On the basis of end user, the Europe Immunoassay-Gamma Counters Market is segmented into Laboratories, Hospitals, Research & Academic Institutes, Pharmaceutical & Biotechnology Companies, Blood Banks, and Others. The Laboratories segment dominated the market with the largest revenue share of 41.2% in 2025, as clinical diagnostic laboratories represent the highest volume users of gamma counters for hormone testing, tumor markers, infectious disease diagnostics, and therapeutic drug monitoring. Labs rely on multi-well automated systems to handle large specimen volumes with high precision and throughput. Their need for standardized testing protocols, consistent assay performance, and regulatory compliance drives heavy investment in gamma counting platforms. The rise of centralized diagnostic networks and reference laboratories has significantly strengthened this segment’s dominance. Increasing prevalence of chronic diseases requiring frequent biomarker monitoring—such as cancer, endocrine disorders, and autoimmune disease—further boosts utilization. Laboratories also frequently support regional hospitals and clinics, expanding overall test volume. Upgrading to automated gamma counters with enhanced sensitivity and digital reporting systems remains a priority across major lab chains worldwide.

The Pharmaceutical & Biotechnology Companies segment is projected to witness the fastest growth at a CAGR of 13.1% from 2026 to 2033, driven by extensive use of gamma counters in drug discovery, pharmacokinetics, radiolabeled compound studies, receptor binding assays, and preclinical research. Radiotracer-based experiments in oncology, immunology, and metabolic disease research rely heavily on precise gamma quantification. Biotech companies developing radiopharmaceuticals, monoclonal antibodies, and targeted therapies also utilize gamma counters to evaluate biodistribution and binding affinity. Expansion of R&D pipelines, growing investment in nuclear medicine therapeutics, and increasing clinical trial activity across the U.S., Europe, China, and India are key growth contributors. Adoption is further supported by rising interest in theranostics, requiring integrated diagnostic-therapeutic evaluation using radiolabeled agents. As precision medicine continues to expand, pharmaceutical and biotechnology companies represent one of the strongest growth engines for gamma counter demand.

• By Distribution Channel

On the basis of distribution channel, the Europe Immunoassay-Gamma Counters Market is segmented into Direct Tender and Third-Party Distributors. The Direct Tender segment dominated the market with the largest revenue share of 63.7% in 2025, driven by large-scale procurement by hospitals, government laboratories, public health institutions, and academic centers. Direct tender purchasing offers cost advantages, transparent bidding processes, and long-term service agreements, making it the preferred channel in regions with centralized healthcare systems. Government-funded clinical laboratories and nuclear medicine departments typically acquire gamma counters through national or regional tenders to ensure standardization of diagnostic equipment. Direct tenders also allow institutions to procure high-end automated systems with extended warranties, training, and calibration contracts. Countries investing in national screening programs for endocrine disorders, cancer biomarkers, and neonatal conditions heavily rely on direct tender procurement to expand diagnostic capacity. As healthcare infrastructure modernization accelerates, the dominance of direct tender channels continues to strengthen globally.

The Third-Party Distributors segment is projected to witness the fastest growth at a CAGR of 9.8% from 2026 to 2033, supported by strong expansion of diagnostic centers, private hospitals, and independent laboratories that prefer flexible procurement. Distributors provide faster delivery, localized support, easier financing options, and customized packages suitable for mid-sized institutions. In emerging markets, third-party distributors play a crucial role in expanding access to gamma counters by offering localized technical service, installation assistance, and inventory availability. Rapid growth of private-sector healthcare in Asia-Pacific, Middle East, and Latin America further accelerates adoption through distributor networks. In addition, distributors enable easier procurement of spare parts, consumables, and radioassay kits, making them attractive for laboratories seeking agility in their diagnostic operations.

Europe Immunoassay-Gamma Counters Market Regional Analysis

- The Europe immunoassay–gamma counters market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising adoption of advanced diagnostic technologies and the increasing use of radioimmunoassay and nuclear medicine procedures across hospitals, research laboratories, and diagnostic centers

- Growing investments in healthcare infrastructure, greater focus on precision diagnostics, and the expansion of biotechnology and pharmaceutical research activities are further supporting market growth

- Europe is witnessing strong demand across clinical diagnostics, oncology testing, infectious disease monitoring, and endocrine disorder evaluation, with automated gamma counters gaining notable traction due to their accuracy and efficiency

U.K. Immunoassay–Gamma Counters Market Insight

The U.K. immunoassay–gamma counters market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong diagnostic infrastructure, high adoption of advanced laboratory automation systems, and significant investments in nuclear medicine and clinical research. The U.K. dominated the regional market with a 28.9% revenue share in 2025, driven by growing demand for high-sensitivity testing, expansion of research-intensive institutions, and the presence of leading diagnostic laboratories. Increasing utilization of radioimmunoassays for cancer, endocrine, and infectious disease diagnostics continues to accelerate market growth across the country.

Germany Immunoassay–Gamma Counters Market Insight

The Germany immunoassay–gamma counters market is expected to expand at a considerable CAGR during the forecast period, making it the fastest-growing country in Europe. Growth is fueled by a rapid expansion of nuclear medicine procedures, increased healthcare spending, and rising demand for technologically advanced diagnostic solutions. Germany’s strong emphasis on laboratory modernization, innovation in biomedical research, and the integration of automated gamma counters to improve workflow efficiency are driving widespread adoption. Increasing research activity in oncology, drug monitoring, and endocrine disorders further strengthens Germany’s growth outlook.

Europe Immunoassay-Gamma Counters Market Share

The Immunoassay-Gamma Counters industry is primarily led by well-established companies, including:

- PerkinElmer (U.S.)

- Hidex Oy (Finland)

- Berthold Technologies GmbH & Co. KG (Germany)

- LabLogic Systems Ltd. (U.K.)

- Beckman Coulter, Inc. (U.S.)

- Stratec SE (Germany)

- ORTEC (AMETEK Inc.) (U.S.)

- Zecotek Photonics Inc. (Canada)

- Comecer S.p.A. (Italy)

- Mirion Technologies, Inc. (U.S.)

- Ludlum Measurements, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Kromek Group plc (U.K.)

- Scintacor Ltd. (U.K.)

- EuroProbe Ltd. (U.K.)

- Mediso Ltd. (Hungary)

- Elysia-raytest GmbH (Germany)

- ENERSYS Co. Ltd (Japan)

- Shinjin Medics Inc. (South Korea)

Latest Developments in Europe Immunoassay-Gamma Counters Market

- In October 2021, Mirion Technologies completed its business combination and became publicly listed, strengthening its global and European expansion capabilities in nuclear medicine and radiation-measurement technologies

- In December 2021, Mirion Technologies acquired Computerized Imaging Reference Systems (CIRS), expanding its portfolio in imaging and radiological calibration systems widely used in nuclear medicine labs across Europe

- In August 2022, Mirion completed the acquisition of the Critical Infrastructure business of Collins Aerospace, later renamed Secure Integrated Solutions (SIS), enhancing its software and integrated systems capabilities supporting nuclear medicine workflows

- In March 2023, PerkinElmer underwent a major corporate restructuring by divesting its Applied, Food, and Enterprise Services businesses, narrowing its strategic focus on diagnostics and life sciences, which includes laboratory instruments used alongside gamma counters in Europe

- In November 2023, Mirion acquired ec² Software Solutions, adding nuclear-medicine workflow software platforms such as BioDose and NMIS, strengthening its position in European gamma-counter–supporting software ecosystems

- In April 2024, Berthold Technologies announced updates and new product enhancements across its radiation-measurement and bioanalytic instrumentation portfolio, including improved system efficiency and compact device designs

- In May 2024, Hidex highlighted a decade of innovation for the HIDEX AMG gamma counter, outlining upgrades made during 2021–2024 such as advanced software plugins, improved data-handling capabilities, and modernized automation components for clinical and research laboratories across Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.