Global Therapeutic Drug Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

2.30 Billion

USD

4.38 Billion

2024

2032

USD

2.30 Billion

USD

4.38 Billion

2024

2032

| 2025 –2032 | |

| USD 2.30 Billion | |

| USD 4.38 Billion | |

|

|

|

|

Therapeutic Drug Monitoring Market Size

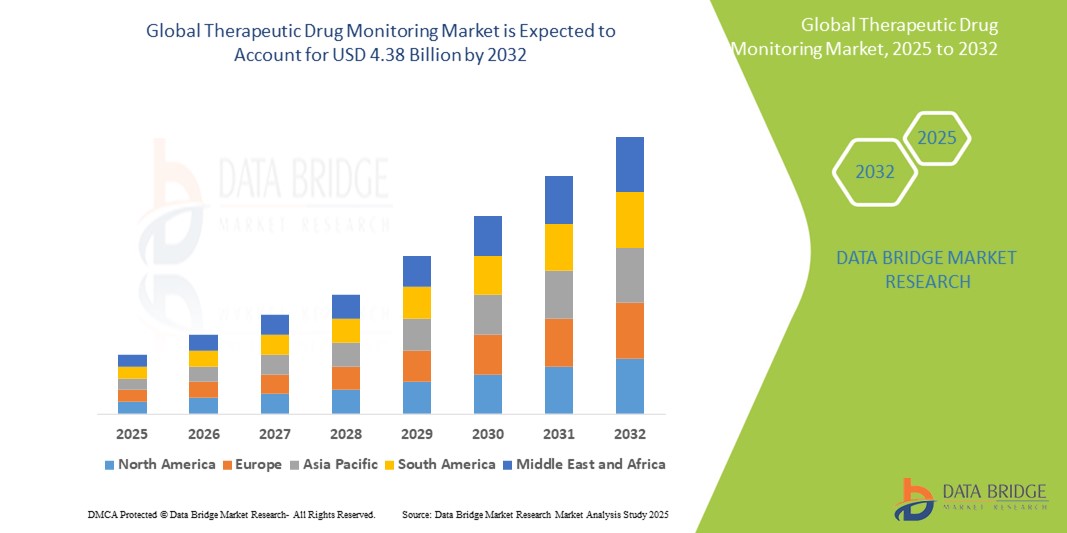

- The global therapeutic drug monitoring market was valued at USD 2.30 Billion in 2024 and is expected to reach USD 4.38 Billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.40 %, primarily driven by the rising prevalence of chronic diseases and the growing need for personalized medicine

- This growth is driven by factors such as the increasing demand for precise drug dosing, advancements in diagnostic technologies, and the rising use of therapeutic drug monitoring in clinical settings

Therapeutic Drug Monitoring Market Analysis

- Therapeutic drug monitoring involves measuring specific drug levels in a patient’s bloodstream to maintain a constant concentration, ensuring optimal efficacy and minimal toxicity. It is widely used in managing medications for conditions such as epilepsy, cardiovascular diseases, cancer, and transplant care

- The market demand is largely driven by the increasing prevalence of chronic diseases, rising cases of organ transplants, and growing emphasis on personalized treatment plans. These factors contribute to the expanding use of drug monitoring in both hospital and outpatient settings

- North America emerges as a leading market, supported by a robust healthcare infrastructure, high healthcare expenditure, and early adoption of advanced diagnostic practices

- For instance, the growing adoption of precision medicine and regular monitoring protocols in the U.S. have significantly contributed to the increased utilization of therapeutic drug monitoring in both acute and long-term care facilities

- Globally, therapeutic drug monitoring is considered one of the most critical components in clinical pharmacology, playing a vital role in optimizing drug therapy, reducing adverse effects, and improving patient outcomes

Report Scope and Therapeutic Drug Monitoring Market Segmentation

|

Attributes |

Therapeutic Drug Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Therapeutic Drug Monitoring Market Trends

“Integration of Advanced Analytical Technologies and Automation”

- A key trend in the global therapeutic drug monitoring market is the increasing integration of advanced analytical technologies and automation in diagnostic workflows

- Techniques such as liquid chromatography–mass spectrometry (LC-MS), immunoassays, and high-throughput analyzers are enhancing the speed, sensitivity, and accuracy of drug level detection in patient samples

- For instance, automated LC-MS platforms are increasingly being adopted in clinical laboratories for their ability to provide rapid and precise quantification of multiple drugs, especially in complex treatment regimens such as oncology or transplant care

- Automation also supports large-scale drug monitoring programs by reducing manual errors, streamlining lab operations, and enabling faster decision-making for individualized treatment adjustments

- This trend is transforming therapeutic drug monitoring into a more efficient, data-driven process, driving its adoption across hospitals, clinics, and diagnostic labs globally

Therapeutic Drug Monitoring Market Dynamics

Driver

“Rising Prevalence of Chronic and Lifestyle-Related Diseases”

- The increasing global burden of chronic and lifestyle-related diseases such as cardiovascular disorders, epilepsy, cancer, HIV, and autoimmune conditions is a major driver fueling the demand for therapeutic drug monitoring

- These conditions often require long-term or complex pharmacological treatments where maintaining appropriate drug concentrations is critical to ensure efficacy and minimize toxicity

- Personalized dosing regimens enabled through drug monitoring help prevent adverse drug reactions and improve therapeutic outcomes, especially in patients with varying metabolic rates, organ impairments, or polypharmacy

- As healthcare systems shift towards personalized and precision medicine, the role of drug monitoring becomes more prominent in optimizing patient-specific treatment strategies

- The increasing number of organ transplant procedures worldwide has led to a greater need for immunosuppressant drug monitoring to prevent rejection and maintain graft function

For instance,

- According to the Global Observatory on Donation and Transplantation, over 150,000 organ transplants were performed worldwide in 2022, a number that continues to rise annually, thereby increasing demand for continuous and accurate drug monitoring to support post-transplant care

- As per a report by the World Health Organization, chronic diseases are expected to account for 86% of the 90 million annual deaths by 2050, further reinforcing the need for sustained therapeutic interventions monitored through specialized tools and techniques

- As chronic diseases become more prevalent and long-term therapies more complex, therapeutic drug monitoring plays a vital role in enhancing treatment precision, reducing side effects, and improving patient outcomes, driving market growth

Opportunity

“Enhancing Drug Monitoring with Artificial Intelligence and Predictive Analytic”

- The integration of artificial intelligence (AI) and predictive analytics in therapeutic drug monitoring offers a significant opportunity to advance precision medicine by enabling more accurate, personalized, and proactive treatment strategies

- AI-driven algorithms can analyze large datasets, including patient demographics, genetic profiles, metabolic rates, and historical drug responses, to predict optimal dosing regimens and anticipate potential adverse drug reactions

- In Addition, these tools can support clinicians in real-time by recommending dosage adjustments, identifying at-risk patients, and streamlining decision-making in complex treatment scenarios, such as oncology, neurology, and transplant medicine

For instance,

- According to a study published in Nature Medicine in March 2024, AI models that incorporate patient-specific variables were able to predict drug concentrations and dosing needs with greater accuracy than conventional methods, reducing the likelihood of under- or overdosing in patients undergoing chemotherapy or immunosuppressive therapy

- In October 2023, research highlighted in the Journal of Clinical Pharmacology demonstrated that machine learning tools could analyze therapeutic drug monitoring data across patient populations to identify response patterns and inform personalized treatment protocols

- The growing use of AI and machine learning in therapeutic drug monitoring can not only improve treatment outcomes and patient safety but also reduce healthcare costs by minimizing trial-and-error approaches, hospital readmissions, and drug-related complications

Restraint/Challenge

“High Cost of Advanced Analytical Instruments and Limited Accessibility”

- The high cost associated with advanced therapeutic drug monitoring equipment and analytical technologies, such as liquid chromatography–mass spectrometry (LC-MS), presents a significant barrier to widespread market adoption—especially in low- and middle-income countries

- These systems require substantial investment not only for procurement but also for maintenance, calibration, and the hiring or training of skilled personnel to operate them effectively

- Smaller hospitals, diagnostic labs, and healthcare facilities in resource-constrained regions often face difficulties in integrating such high-cost systems into their workflow, limiting access to consistent and accurate drug monitoring

For instance,

- According to an article published in Frontiers in Pharmacology in August 2023, the implementation of LC-MS-based drug monitoring systems can cost between USD 150,000 and USD 500,000, depending on system complexity and features. This investment is beyond the reach of many facilities in developing economies, contributing to uneven access to high-precision drug monitoring technologies

- Consequently, the unequal distribution of advanced diagnostic resources and the financial burden on healthcare systems can impede the broader adoption of therapeutic drug monitoring, ultimately affecting patient outcomes and slowing market growth in under-resourced areas

Therapeutic Drug Monitoring Market Scope

The market is segmented on the basis of product, technology, class of drugs, therapeutic areas and end users.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Class of Drugs |

|

|

By Therapeutic Areas |

|

|

By End Users |

|

Therapeutic Drug Monitoring Market Regional Analysis

“North America is the Dominant Region in the Therapeutic Drug Monitoring Market”

- North America holds the largest share in the global therapeutic drug monitoring market, driven by a well-established healthcare system, high healthcare spending, and early adoption of advanced diagnostic technologies

- U.S. leads the region due to the increasing prevalence of chronic and lifestyle-related diseases, such as cardiovascular disorders, cancer, and epilepsy, which require long-term and closely monitored drug therapies

- The favorable reimbursement policies, robust clinical research infrastructure, and widespread implementation of precision medicine initiatives further contribute to the region’s market dominance

- In addition, the presence of key market players and continuous innovations in monitoring platforms and analytical instruments support the market's sustained growth across North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the fastest growth in the therapeutic drug monitoring market, fueled by rising healthcare investments, increasing incidence of chronic diseases, and a growing focus on personalized medicine

- Countries such as China, India, and South Korea are emerging as key contributors due to their large patient populations, improving diagnostic capabilities, and growing demand for accurate and safe drug administration

- India and China are seeing expanded government initiatives and private investments aimed at strengthening clinical laboratories and promoting advanced diagnostic services, including drug monitoring

- Japan continues to play a pivotal role in the region, with strong technological innovation, an aging population with complex healthcare needs, and a high standard of care driving the adoption of therapeutic drug monitoring across healthcare facilities

Therapeutic Drug Monitoring Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Abbott (U.S.)

- Danaher Corporation (U.S.)

- SEKISUI MEDICAL CO., LTD. (Japan)

- Beckman Coulter, Inc. (U.S.)

- ARUP Laboratories (U.S.)

- Agilent Technologies, Inc. (U.S.)

- BÜHLMANN fCAL (Switzerland)

- Theradiag (France)

- Randox Laboratories Ltd. (U.K.)

- Exagen Inc. (U.S.)

- Hologic, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- BIOMÉRIEUX (France)

Latest Developments in Global Therapeutic Drug Monitoring Market

- In June 2024, Bio-Rad Laboratories launched new anti-idiotypic and anti-monomethyl auristatin E (MMAE) antibodies to improve the sensitivity and specificity of assays used in therapeutic drug monitoring. These advancements aim to enhance the accuracy of measuring biologic drug levels and assessing patient immune responses

- In October 2023, ProciseDx obtained FDA clearance for its innovative tests designed to monitor levels of biologic drugs, including Humira and Remicade. This approval marks a significant advancement in therapeutic drug monitoring, particularly for chronic conditions such as rheumatoid arthritis and Crohn's disease

- In September 2023, Axithra, a spin-off from Ghent University and Imec, raised USD 10.7 million to develop a photonic-based therapeutic drug monitoring platform. The technology aims to accurately and efficiently measure drug concentrations in blood, initially focusing on beta-lactam antibiotics for intensive care patients

- In February 2023, Sentinel Diagnostics acquired Eureka S.r.l., enhancing its capabilities in in vitro diagnostic testing. This acquisition allows Sentinel to offer a broader range of assays, including those for therapeutic drug monitoring, by incorporating Eureka's expertise in chromatographic applications

- In May 2022, THERADIAG introduced ez-Track1, a Point-of-Care Testing (POCT) solution designed for rapid therapeutic drug monitoring. The CE-marked system delivers results within 10 minutes using whole blood samples, facilitating swift decision-making in implementing biotherapies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.