Europe Inflation Device Market

Market Size in USD Million

CAGR :

%

USD

246.81 Million

USD

345.65 Million

2025

2033

USD

246.81 Million

USD

345.65 Million

2025

2033

| 2026 –2033 | |

| USD 246.81 Million | |

| USD 345.65 Million | |

|

|

|

|

Europe Inflation Device Market Size

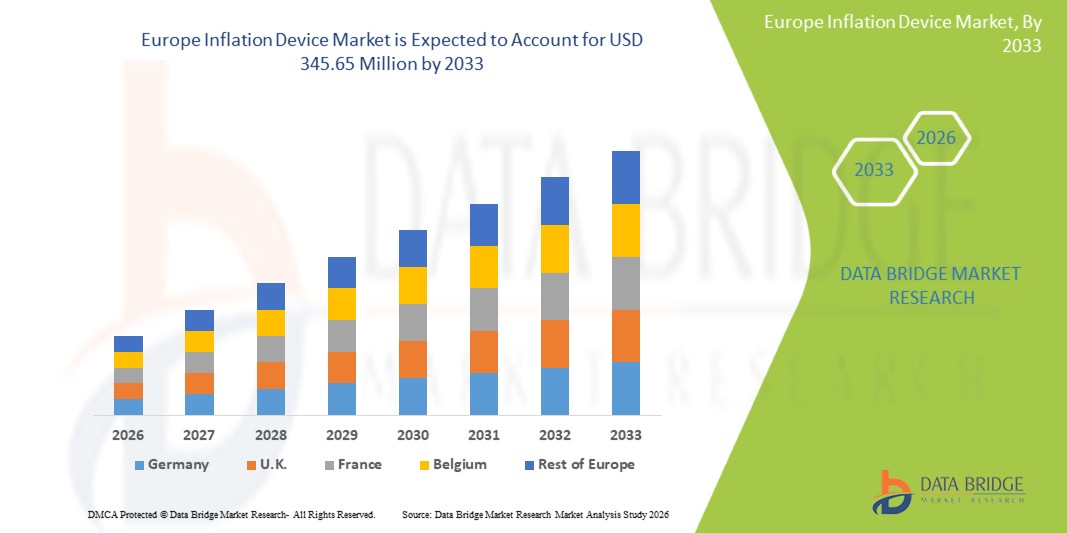

- The Europe inflation device market size was valued at USD 246.81 million in 2025 and is expected to reach USD 345.65 million by 2033, at a CAGR of 4.30% during the forecast period

- The market growth is primarily driven by the increasing prevalence of cardiovascular diseases and hypertension across European countries, which is prompting higher demand for accurate and reliable inflation devices in hospitals, clinics, and home healthcare settings

- Moreover, advancements in digital and automated inflation technologies, along with growing awareness of early diagnosis and monitoring, are encouraging healthcare providers and patients to adopt these devices, thereby supporting market expansion. Rising government initiatives to promote preventive healthcare further enhance the adoption of inflation devices across the region

Europe Inflation Device Market Analysis

- Inflation devices, used for measuring and monitoring blood pressure and assisting in minimally invasive procedures, are increasingly essential in hospitals, interventional laboratories, and clinics due to their precision, ease of use, and integration with modern medical equipment

- The rising demand for inflation devices is primarily driven by the growing prevalence of cardiovascular diseases, peripheral vascular disorders, and other chronic conditions across Europe, alongside increasing adoption of interventional procedures and preventive healthcare initiatives

- Germany dominated the Europe inflation device market with the largest revenue share of 37.9% in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of major medical device manufacturers, with hospitals and interventional laboratories leading adoption

- Poland is expected to be the fastest growing country in the Europe inflation device market during the forecast period, driven by rising healthcare investments, increasing awareness about cardiovascular and peripheral vascular procedures, and modernization of medical facilities

- Digital inflation device segment dominated the Europe inflation device market with a market share of 47.2% in 2025, driven by its high accuracy, user-friendly operation, and ability to support interventional cardiology and peripheral vascular procedures effectively

Report Scope and Europe Inflation Device Market Segmentation

|

Attributes |

Europe Inflation Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Inflation Device Market Trends

“Integration of Digital Monitoring and Automated Features”

- A significant and accelerating trend in the Europe inflation device market is the increasing integration of digital monitoring and automated inflation features, enhancing precision, ease of use, and workflow efficiency in clinical and interventional settings

- For instance, digital inflation devices with automated pressure control allow clinicians to set target pressures for interventional cardiology or peripheral vascular procedures, reducing manual adjustments and procedural errors

- Advanced digital devices also provide real-time monitoring and data logging, enabling healthcare providers to track pressure trends and device performance, supporting better clinical decision-making and procedural safety

- The integration of wireless connectivity and compatibility with electronic health record (EHR) systems allows seamless transfer of device data for patient monitoring and record-keeping, improving operational efficiency

- This trend toward smart, automated, and interconnected inflation devices is driving higher adoption rates among hospitals and interventional laboratories, as companies such as Merit Medical are developing devices with precise digital control, automated inflation, and data connectivity features

- The demand for inflation devices with integrated digital monitoring and automated capabilities is growing rapidly across both hospitals and clinics, as healthcare providers increasingly prioritize accuracy, efficiency, and patient safety

Europe Inflation Device Market Dynamics

Driver

“Rising Cardiovascular Disease Prevalence and Interventional Procedures”

- The growing prevalence of cardiovascular diseases, hypertension, and peripheral vascular disorders in Europe is a significant driver for the increasing demand for inflation devices in clinical and interventional settings

- For instance, in March 2025, B. Braun introduced a next-generation digital inflation device for interventional cardiology procedures, designed to enhance accuracy and procedural efficiency, highlighting the trend of technologically advanced device adoption

- Hospitals and interventional laboratories are seeking precise, reliable, and easy-to-use inflation devices to support various procedures, including stent deployment and fluid delivery, which is fueling market expansion

- Increasing awareness about preventive healthcare and early intervention is motivating healthcare providers to invest in automated and digital inflation devices for better patient outcomes

- The convenience of automated pressure control, data logging, and integration with clinical workflows is propelling adoption in hospitals, clinics, and interventional laboratories, while the rising trend of minimally invasive procedures is further supporting market growth

- Expanding healthcare infrastructure and modernization of hospitals in countries such as Germany, France, and Poland are facilitating increased adoption of advanced inflation devices

- Government initiatives and reimbursement policies supporting interventional procedures and cardiovascular care are incentivizing healthcare providers to invest in reliable, automated inflation devices

Restraint/Challenge

“High Device Costs and Regulatory Compliance Hurdles”

- The relatively high cost of advanced digital and automated inflation devices compared to manual alternatives poses a challenge for adoption, particularly in smaller clinics or price-sensitive healthcare settings

- For instance, some hospitals in Eastern Europe have delayed procurement of high-end digital inflation devices due to budget constraints and cost considerations, despite their operational advantages

- Compliance with stringent European medical device regulations, including CE marking and ISO standards, can increase development and operational costs for manufacturers, potentially slowing market penetration

- In addition, concerns regarding device maintenance, calibration requirements, and technical training for staff can hinder adoption, especially in regions with limited technical expertise

- While prices are gradually stabilizing and more affordable digital devices are entering the market, overcoming regulatory, cost, and training challenges will be crucial for sustained growth in the Europe inflation device market

- Device interoperability issues with existing clinical systems can pose challenges for seamless integration, limiting adoption in some hospitals and clinics

- Limited awareness and training among healthcare personnel about the benefits of advanced digital inflation devices may slow the transition from manual to automated systems in certain regions

Europe Inflation Device Market Scope

The market is segmented on the basis of type, capacity, application, pressure, function, end user, and distribution channel.

- By Type

On the basis of type, the Europe inflation device market is segmented into analog inflation devices and digital inflation devices. The digital inflation device segment dominated the market with the largest market revenue share of 47.2% in 2025, driven by its high accuracy, automated pressure control, and compatibility with interventional procedures such as cardiology and peripheral vascular treatments. Hospitals and interventional laboratories prefer digital devices for real-time monitoring, data logging, and integration with electronic health records, improving procedural efficiency and patient safety. Digital devices also support wireless connectivity, enabling seamless data transfer and workflow integration. Automated features such as stent deployment and pressure alarms enhance clinical precision. The adoption of digital devices is further supported by increasing awareness about minimally invasive procedures and preventive care. Digital devices also provide consistent performance across multiple procedures, reducing the such aslihood of manual errors. Continuous innovation by manufacturers, including predictive analytics and improved ergonomic designs, strengthens the segment’s dominance.

The analog inflation device segment is anticipated to witness the fastest growth from 2026 to 2033 due to their simplicity, lower cost, and suitability for clinics and smaller hospitals. Analog devices are widely used for routine monitoring and non-interventional procedures, where budget constraints limit digital device adoption. They are valued for ease of use, minimal maintenance, and reliable performance in basic clinical settings. Analog devices require minimal technical training and are highly dependable in varied hospital environments. Their affordability makes them attractive in emerging European markets. Analog devices continue to maintain strong demand due to long-standing clinical trust and availability. They are also preferred in regions where digital device integration is not feasible, ensuring uninterrupted patient care.

- By Capacity

On the basis of capacity, the market is segmented into 20ml, 25ml, 30ml, and 60ml inflation devices. The 30ml inflation device segment dominated the market in 2025 due to its versatility and suitability for most interventional procedures, including stent deployment and fluid delivery. Hospitals and interventional laboratories prefer 30ml devices as they provide sufficient capacity for multiple procedures without frequent adjustments, improving workflow efficiency. Standardized 30ml devices ensure compatibility with a wide range of catheters and interventional tools, simplifying training and usage. They are widely supported by manufacturers and are the default choice in many European healthcare facilities. The segment benefits from strong clinical adoption, high reliability, and cost-effectiveness. Adoption of 30ml devices is also supported by procedural standardization and ease of maintenance. They are preferred for both routine and complex interventions, making them a versatile option for hospitals.

The 60ml inflation device segment is expected to witness the fastest growth during the forecast period due to increasing use in complex interventional procedures requiring higher fluid volumes or sequential inflations. Large-capacity devices are preferred in advanced cardiology and peripheral vascular procedures. These devices reduce the need for repeated inflation cycles, saving time and improving procedural efficiency. Adoption is supported by the expansion of high-volume interventional centers across Europe. High-capacity devices provide flexibility for multi-step procedures and longer interventions. They are increasingly demanded in specialized laboratories where procedural complexity requires reliable high-volume devices.

- By Application

On the basis of application, the market is segmented into interventional cardiology, peripheral vascular procedures, interventional radiology, urological procedures, gastroenterological procedures, and others. The interventional cardiology segment dominated the market in 2025, driven by the high prevalence of cardiovascular diseases and the growing number of minimally invasive procedures. Hospitals and interventional laboratories extensively use inflation devices for stent deployment, balloon angioplasty, and other cardiac interventions. Precision and reliability are critical, which drives adoption of automated and digital devices. The segment benefits from strong reimbursement support and high procedural volumes in Germany, France, and the U.K. Digital monitoring and data logging further strengthen the segment’s dominance. Hospitals also prefer interventional cardiology devices for standardization and staff training purposes. Increasing technological advancements in cardiology interventions also support market growth for this segment.

The peripheral vascular procedures segment is anticipated to witness the fastest growth from 2026 to 2033 due to increasing awareness of peripheral artery diseases, rising demand for minimally invasive interventions, and adoption of advanced inflation devices capable of supporting diverse vascular procedures. Growth is supported by increasing investments in specialized vascular centers. Peripheral vascular procedures require precision, which drives demand for advanced digital inflation devices. Increasing prevalence of peripheral vascular disorders among the aging population further contributes to adoption. Hospitals are expanding interventional services to address vascular complications efficiently. Digital inflation devices facilitate safer and faster procedures in peripheral interventions, accelerating growth.

- By Pressure

On the basis of pressure, the market is segmented into 30 atm, 40 atm, 55 atm, and others. The 30 atm segment dominated the market in 2025 as it is widely used in standard interventional procedures and provides sufficient pressure for most stent deployment and fluid delivery applications. Hospitals and interventional laboratories prefer 30 atm devices for safety, consistency, and reliability. They are compatible with most catheters and interventional tools, making them standard in clinical practice. Adoption is supported by strong clinical trust and ease of handling. The segment also simplifies staff training and procedural standardization. 30 atm devices are cost-effective and widely available, making them a preferred choice for most European hospitals. Their reliability and simplicity make them ideal for routine procedures in both large and small hospitals.

The 55 atm segment is expected to witness the fastest growth from 2026 to 2033 due to its application in high-pressure procedures such as complex cardiology and peripheral interventions. Higher-pressure devices are required for advanced procedures to ensure procedural success. Adoption is driven by the increasing number of complex interventions and availability of advanced device designs. Hospitals performing high-risk procedures prefer 55 atm devices to maintain procedural safety. Increased demand for high-pressure devices is also driven by the rise of specialized interventional centers in Europe.

- By Function

On the basis of function, the market is segmented into stent deployment and fluid delivery. The stent deployment segment dominated the market in 2025 due to widespread use in interventional cardiology and critical requirement for precise placement. Digital inflation devices with automated control and real-time feedback are highly preferred for stent deployment, ensuring procedural accuracy. Hospitals prioritize accuracy, safety, and integration with clinical monitoring systems. The segment benefits from strong clinical guidelines recommending automated inflation. Adoption is driven by higher procedural success rates and reduced complication risks. Stent deployment devices also improve procedural efficiency and reduce operator errors. Hospitals and interventional laboratories prefer stent deployment devices for standardized protocols and safer procedures.

The fluid delivery segment is expected to witness the fastest growth from 2026 to 2033 due to increasing demand for minimally invasive procedures requiring precise fluid administration, particularly in peripheral vascular and gastroenterological interventions. The segment is supported by technological advancements and integration with digital monitoring systems. Fluid delivery devices offer versatility for multi-procedure interventions and improve procedural safety. Rising awareness of patient safety standards encourages the adoption of fluid delivery devices. Clinics and hospitals are increasingly incorporating automated fluid delivery devices to improve efficiency.

- By End User

On the basis of end user, the market is segmented into hospitals, interventional laboratories, and clinics. The hospitals segment dominated the market in 2025, driven by advanced infrastructure, high procedural volumes, and adoption of automated inflation devices. Hospitals prioritize accuracy, safety, and digital integration, supporting dominance. Economies of scale and structured procurement channels facilitate adoption of high-end devices. Hospitals often conduct clinical trials and early adoption of new technologies, boosting market share. The segment benefits from ongoing investments in advanced interventional equipment. Hospitals also provide training and standardized procedural workflows, increasing reliance on automated devices.

The interventional laboratories segment is expected to witness the fastest growth from 2026 to 2033 due to the increasing number of specialized minimally invasive procedures. Growth is driven by investment in procedure-specific infrastructure and adoption of high-precision devices. Interventional labs benefit from digital device integration, workflow efficiency, and reduced procedure times. Rising procedural volumes and specialized vascular services contribute to segment growth. The segment is increasingly adopting automated and high-capacity devices for better patient outcomes.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and third-party distributors. The direct tender segment dominated the market in 2025 due to large-scale procurement by hospitals and interventional laboratories via institutional contracts and government tenders. Direct tender facilitates vendor relationships, negotiated pricing, and long-term service agreements. Hospitals benefit from bundled packages including training, maintenance, and warranty. Adoption is further supported by predictable supply chains and procurement efficiency. Direct tender is preferred for high-value digital devices with complex maintenance needs. This channel ensures timely delivery, support, and compliance with regulatory standards.

The third-party distributor segment is expected to witness the fastest growth from 2026 to 2033 due to wider reach to smaller clinics and emerging hospitals. Distributors enable access to both analog and digital devices across Europe. Growth is supported by expanding healthcare infrastructure and distributor networks into underserved regions. Distributors also provide technical support and training to smaller facilities, enhancing adoption. They facilitate cost-effective procurement for smaller hospitals and clinics. Increasing partnerships between distributors and manufacturers boost device availability and market penetration.

Europe Inflation Device Market Regional Analysis

- Germany dominated the Europe inflation device market with the largest revenue share of 37.9% in 2025, supported by advanced healthcare infrastructure, high healthcare expenditure, and strong presence of major medical device manufacturers, with hospitals and interventional laboratories leading adoption

- Hospitals and interventional laboratories in Germany highly value the precision, reliability, and real-time monitoring capabilities offered by modern inflation devices, which enhance procedural safety, improve workflow efficiency, and support integration with electronic health records

- France and the U.K. are significant markets in the region, with healthcare providers prioritizing high-accuracy devices for interventional cardiology, peripheral vascular procedures, and minimally invasive surgeries, supporting consistent clinical outcomes across major hospitals

The Germany Inflation Device Market Insight

The Germany inflation device market captured the largest revenue share in 2025, fueled by the country’s advanced healthcare infrastructure, high procedural volumes, and emphasis on clinical precision. Hospitals and specialized clinics prioritize high-accuracy devices for interventional cardiology, peripheral vascular, and radiology procedures. Adoption is further supported by reimbursement policies, government initiatives for cardiovascular care, and the preference for technologically advanced devices with digital monitoring capabilities.

France Inflation Device Market Insight

The France inflation device market is expected to expand at a considerable CAGR during the forecast period, driven by increasing procedural volumes in interventional cardiology and peripheral vascular treatments. Hospitals and clinics are adopting digital inflation devices to ensure procedural efficiency, minimize errors, and enhance patient safety. Growing awareness of minimally invasive interventions and supportive reimbursement frameworks further encourage adoption. France also sees steady upgrades from analog to digital devices, especially in urban healthcare centers.

U.K. Inflation Device Market Insight

The U.K. inflation device market is anticipated to grow at a noteworthy CAGR, fueled by the rising number of cardiovascular and vascular interventions and increasing demand for automated, high-precision devices. Hospitals are focusing on integration with electronic health records and real-time monitoring systems, supporting workflow efficiency and standardized procedures. The adoption of digital inflation devices in interventional laboratories is further stimulated by clinical guidelines emphasizing safety and accuracy. The country’s advanced healthcare infrastructure and skilled workforce support sustained growth.

Poland Inflation Device Market Insight

The Poland inflation device market is expected to grow at a significant CAGR during the forecast period, driven by increasing investments in healthcare infrastructure, modernization of hospitals, and rising procedural volumes. Hospitals and clinics are gradually adopting digital and automated inflation devices to improve procedural accuracy, safety, and operational efficiency. Government initiatives to expand minimally invasive procedures and training programs for healthcare professionals are further supporting adoption. The market is witnessing upgrades from analog to digital devices, particularly in urban hospitals and specialized interventional centers. Poland is emerging as one of the fastest-growing markets in Eastern Europe due to rising awareness about cardiovascular and vascular diseases and growing access to advanced medical technology.

Europe Inflation Device Market Share

The Europe Inflation Device industry is primarily led by well-established companies, including:

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- Cook (U.S.)

- Teleflex Incorporated (U.S.)

- CONMED Corporation (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Cardinal Health (U.S.)

- Olympus Corporation (Japan)

- Terumo Corporation (Japan)

- iVascular S.L.U. (Spain)

- Biosensors International Group, Ltd. (Switzerland)

- Biotronik SE & Co. KG (Germany)

- Vygon SAS (France)

- US Endovascular, LLC (U.S.)

- AngioDynamics, Inc. (U.S.)

- C.R. Bard (U.S.)

- Stryker (U.S.)

- NIPRO CORPORATION (Japan)

What are the Recent Developments in Europe Inflation Device Market?

- In August 2025, MicroPort CardioFlow MedTech received CE‑mark approval for its balloon catheter Alwide® Plus Balloon Catheter making it the company’s fourth product cleared for the European market. The approval enables its use in TAVI and related interventional procedures, potentially boosting demand for inflation devices across Europe

- In August 2025, Getinge announced reinstatement of the EU CE Mark for its Cardiosave Intra‑Aortic Balloon Pump (IABP), after a temporary suspension since March 2024. The reinstatement follows design improvements and regulatory compliance efforts, meaning the device can again be supplied across CE‑mark countries by Q4 2025

- In May 2024, Merit Medical Systems launched the analog inflation tool basixSKY Inflation Device designed for fast inflation and ease of use broadening its product portfolio used in angioplasty and stent procedures. While the launch was in the U.S., Merit serves global markets including Europe; such new products typically influence supply and competitive dynamics for inflation devices internationally

- In April 2024, the European market for high‑pressure non‑compliant balloon catheters saw noticeable expansion, especially in Germany, where large volumes of interventional procedures such as PCI and TAVI are performed. This surge indirectly supports increased demand for inflation devices across Europe

- In November 2022, Merit Medical released another ergonomic device, basixALPHA Inflation Device, intended to streamline angioplasty through one‑handed preparation and simplified inflation. This enhances the range of available inflation devices globally and may accelerate adoption in clinics and interventional labs including European facilities that source international products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.