Europe Iot Internet Of Things For Public Safety Market

Market Size in USD Billion

CAGR :

%

USD

7.30 Billion

USD

19.40 Billion

2024

2032

USD

7.30 Billion

USD

19.40 Billion

2024

2032

| 2025 –2032 | |

| USD 7.30 Billion | |

| USD 19.40 Billion | |

|

|

|

|

Europe IOT (Internet of Things) For Public Safety Market Size

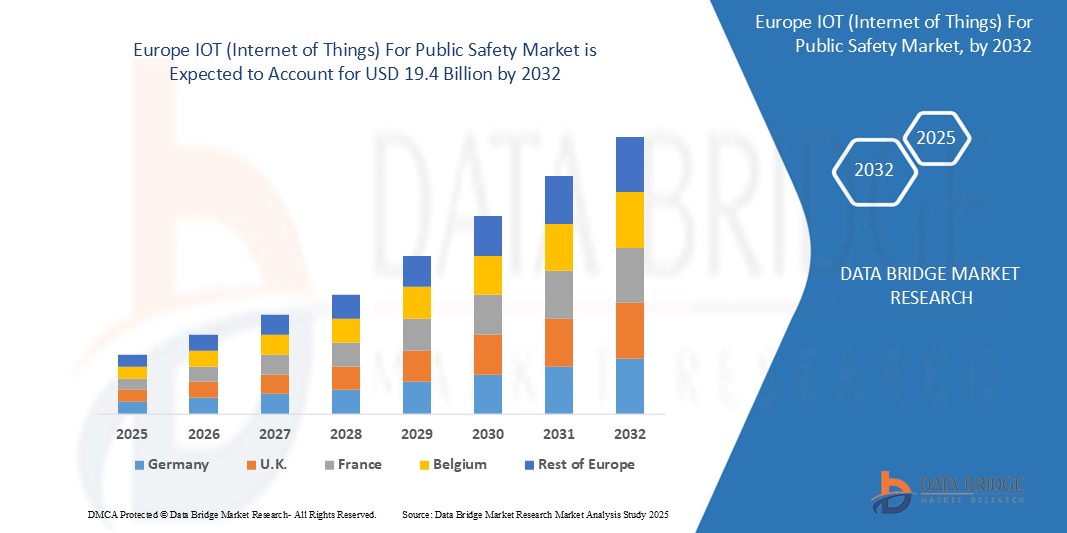

- The Europe IOT (Internet of Things) For Public Safety Market size was valued at USD 7.3 billion in 2024 and is expected to reach USD 19.4 billion by 2032, at a CAGR of 15% during the forecast period.

- This growth is driven by Increasing incidents of natural disasters, mass shootings, and urban crime have driven adoption of IoT-based emergency response systems. In 2023, Motorola Solutions expanded its Command Central platform across GERMANY cities, enabling real-time surveillance and data sharing with first responders.

Europe IOT (Internet of Things) For Public Safety Market Analysis

- Germany federal and state-level funding programs, like the Infrastructure Investment and Jobs Act (2022), are fuelling smart city and public safety projects using IoT. For example, Cisco partnered with San Diego in 2023 to deploy IoT sensors for urban crime mapping.

- The rollout of 5G across Europe is enabling faster, more reliable public safety networks. AT&T FirstNet, the dedicated public safety broadband network, launched upgraded IoT-enabled services in 2024 to support police and emergency services.

- Germany holds a significant market share due to Technological Advancements.

- Germany is expected to register the fastest growth, fuelled by Rising Need for Real-Time Emergency Response.

- The Solutions segment is projected to account for a significant market share of approximately 47.2% in 2025, driven by growth in Smart City Development.

Report Scope and Europe IOT (Internet of Things) For Public Safety Market Segmentation

|

Attributes |

Europe IOT (Internet of Things) For Public Safety Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe IOT (Internet of Things) For Public Safety Market Trends

“Smart Infrastructure Integration”

- IoT technologies are increasingly being integrated into smart city infrastructures, enabling enhanced surveillance, efficient traffic management, and improved emergency response systems. This integration supports better resource management during critical events.

- The adoption of cloud computing in IoT for public safety offers scalability, flexibility, and cost-efficiency. Cloud-based platforms allow for real-time data analysis and remote access to critical information, improving response times and coordination among public safety agencies.

- In 2022, European governments are adopting IoT to enhance public safety infrastructure, including flood warning systems and connected emergency services. In 2023, Bosch launched smart environmental sensors in Germany for early disaster detection.

- IoT-based traffic control, street lighting, and surveillance are being integrated with emergency response systems. In 2024, GE Current deployed smart lighting in New York that doubles as emergency alert and video capture systems.

Europe IOT (Internet of Things) For Public Safety Market Dynamics

Driver

“Regulatory Compliance and Risk Management”

- The increasing complexity of regulatory environments necessitates robust IoT solutions that ensure compliance with safety standards and data protection regulations, thereby enhancing public trust and operational efficiency.

- Modern IoT platforms empower public safety personnel to manage and analyze data without extensive IT involvement, accelerating decision-making processes and reducing reliance on specialized IT teams.

- For instance, In January 2024, Through the European Green Deal and Horizon Europe, cities like Barcelona and Amsterdam have scaled IoT use in urban security and emergency preparedness. Siemens partnered with Vienna in 2024 to deploy smart surveillance and traffic incident response systems.

- GERMANY efforts to upgrade to NextGen 911 systems—leveraging IoT for geolocation, video, and data feeds—present a massive opportunity. Rapid SOS is collaborating with local agencies to modernize dispatch platforms.

Opportunity

“Integration with Advanced Analytic”

- Rapid digitalization in regions within Europe presents opportunities for IoT vendors to offer solutions that streamline public safety operations and enhance decision-making capabilities.

- The incorporation of analytics capabilities such as predictive analytics and data mining into IoT platforms enables public safety agencies to derive actionable insights from vast datasets, supporting proactive measures and efficient resource allocation.

- For instance, as of 2025, Adoption of SaaS-based public safety solutions are growing, with firms like Amazon Web Services (AWS) offering secure, scalable IoT platforms tailored for government use.

- IoT devices are helping break down data silos between police, fire, and EMS units. In 2024, Hexagon Safety & Infrastructure rolled out integrated IoT dashboards for unified emergency management across several GERMANY states.

Restraint/Challenge

“High Implementation Costs”

- The initial investment required for advanced IoT systems, including hardware, software, and professional services, can be substantial, posing a barrier for small and medium-sized public safety agencies with limited budgets.

- As IoT systems become more connected, they are increasingly vulnerable to cyber threats. Ensuring the cybersecurity of these systems is a growing concern that requires continuous attention and investment.

- For instance, Increasing cyberattacks on public safety networks raise concerns about IoT vulnerabilities. A 2023 breach of a municipal surveillance system in Illinois highlighted risks tied to unsecured endpoints.

- Full-scale IoT deployment for public safety, including infrastructure, sensors, and data analytics, remains capital-intensive, limiting adoption among smaller municipalities.

Europe IOT (Internet of Things) For Public Safety Market Scope

The market is segmented based on Component, End User, and Application

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By End User |

|

|

By Application |

|

In 2025, Industrial IoT segment is projected to dominate the End User segment

The Industrial IoT segment is expected to hold a market share of approximately 39.3% in 2025, driven by Advanced 5G and Edge Connectivity.

The Surveillance and Security segment is expected to account for the largest share during the forecast period in the Road Type market

In 2025, the Cities segment is projected to account for a market share of 29.8%, driven by Integration with AI and Predictive Analytics.

“Germany Holds the Largest Share in the Europe IOT (Internet of Things) For Public Safety Market”

- Germany dominates the market due to Increasing incidents of natural disasters, mass shootings, and urban crime have driven adoption of IoT-based emergency response systems. In 2023, Motorola Solutions expanded its Command Central platform across GERMANY cities, enabling real-time surveillance and data sharing with first responders.

- The GERMANY holds a significant share, driven by Government Funding and Smart City Initiatives.

- The rollout of 5G across Europe is enabling faster, more reliable public safety networks. AT&T FirstNet, the dedicated public safety broadband network, launched upgraded IoT-enabled services in 2024 to support police and emergency services.

“Germany is Projected to Register the Highest CAGR in the Europe IOT (Internet of Things) For Public Safety Market”

- Germany growth is driven by Growth of IoT and Smart Devices.

- Germany is projected to exhibit the highest CAGR due to Interagency Communication and Data Sharing Improvements.

- IoT devices are helping break down data silos between police, fire, and EMS units. In 2024, Hexagon Safety & Infrastructure rolled out integrated IoT dashboards for unified emergency management across several GERMANY states.

Europe IOT (Internet of Things) For Public Safety Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SMARTCONE TECHNOLOGIES, INC.,

- Hitachi Vantara Corporation,

- Microsoft,

- IBM,

- NEC Corporation,

- ThroughTek Co., Ltd,

- Iskratel,

- Securens,

- KOVA Corporation,

- ESRI,

- Cradlepoint, Inc.,

- Endeavour Technology,

- X-SYSTEMS,

- West Corporation,

- Carbyne, Star Controls,

- Cisco Systems, Inc.,

- Sierra Wireless,

- Telit,

- Nokia.

Latest Developments in Europe IOT (Internet of Things) For Public Safety Market

- In 2023, Heightened threats in regions like France and the UK are pushing adoption of AI-integrated IoT surveillance. In 2023, Thales Group expanded its public safety IoT solutions to border and transit systems.

- In February 2024, Europe’s 5G rollout is enabling real-time data sharing for law enforcement and disaster services. Ericsson and Vodafone collaborated in 2024 to deploy IoT edge devices for emergency services in Spain.

- In January 2022, Cisco has been working with multiple city governments across the GERMANY to implement smart lighting, surveillance, and emergency response systems integrated with IoT platforms.

- As of May 2023, Cities and agencies are shifting to cloud-based incident command platforms. Atos and Microsoft Azure began implementing secure public sector IoT frameworks in France and the UK in 2023.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.