Europe Kirsten Rat Sarcoma Kras Market

Market Size in USD Million

CAGR :

%

USD

474.24 Million

USD

1,157.53 Million

2025

2033

USD

474.24 Million

USD

1,157.53 Million

2025

2033

| 2026 –2033 | |

| USD 474.24 Million | |

| USD 1,157.53 Million | |

|

|

|

|

Europe Kirsten Rat Sarcoma (KRAS) Market Size

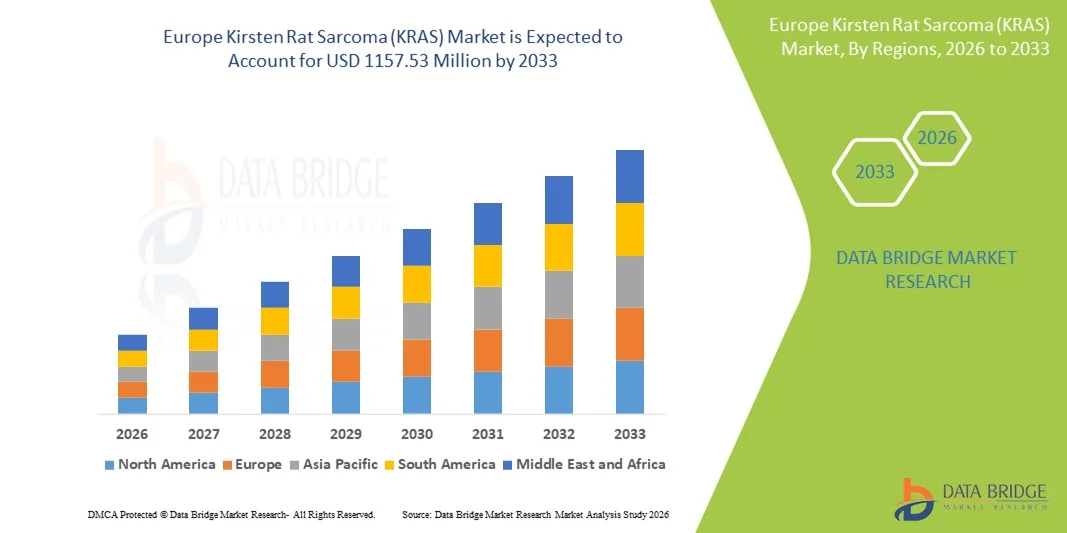

- The Europe Kirsten Rat Sarcoma (KRAS) market size was valued at USD 474.24 Million in 2025 and is expected to reach USD 1157.53 Million by 2033, at a CAGR of 11.80% during the forecast period

- The growth of the Kirsten Rat Sarcoma (KRAS) market is primarily driven by rapid advances in molecular biology, genomic sequencing technologies, and precision oncology, which are enabling improved identification and characterization of KRAS mutations across multiple cancer types. These technological developments are accelerating the integration of KRAS testing and targeted therapies into routine clinical practice in both hospital and research settings

- Furthermore, rising demand for personalized cancer treatments, increasing prevalence of KRAS-mutated cancers such as non-small cell lung cancer, colorectal cancer, and pancreatic cancer, and growing investment in oncology drug development are establishing KRAS-targeted therapies as a critical component of modern cancer care. These converging factors are significantly accelerating the adoption of KRAS-focused diagnostics and therapeutics, thereby driving sustained market growth

Europe Kirsten Rat Sarcoma (KRAS) Market Analysis

- Kirsten Rat Sarcoma (KRAS) plays a pivotal role in regulating key cell signaling pathways involved in cell proliferation and survival, and KRAS mutations are among the most frequently identified oncogenic drivers in cancers such as non-small cell lung cancer, colorectal cancer, and pancreatic cancer. As a result, KRAS-focused diagnostics and targeted therapies have become integral to precision oncology across clinical and research settings

- The increasing demand for KRAS-targeted therapies is primarily driven by rising global cancer incidence, expanding use of genomic testing, and rapid advancements in molecular diagnostics and oncology drug development. The introduction of mutation-specific KRAS inhibitors and combination treatment strategies is accelerating adoption in hospitals, specialty cancer centers, and research institutions

- U.K. dominated the Kirsten Rat Sarcoma (KRAS) market with the largest revenue share of approximately 38.7% in 2025, supported by a well-established healthcare infrastructure, high adoption of precision oncology and molecular diagnostics, strong government support for cancer care programs, and rapid implementation of KRAS testing in major hospitals and cancer centers

- Germany is expected to be the fastest-growing region in the Kirsten Rat Sarcoma (KRAS) market during the forecast period, driven by rising cancer prevalence, increasing healthcare expenditure, growing access to genomic testing and personalized medicine, and expanding participation in oncology clinical trials. The market is projected to witness strong double-digit CAGR growth, supported by advanced hospital networks and government initiatives promoting early cancer detection and targeted therapies

- The Adult segment dominated with a market share of 91.2% in 2025, as KRAS-associated cancers primarily affect adult populations. Lung, colorectal, and pancreatic cancers have higher incidence in adults

Report Scope and Kirsten Rat Sarcoma (KRAS) Market Segmentation

|

Attributes |

Kirsten Rat Sarcoma (KRAS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Europe Kirsten Rat Sarcoma (KRAS) Market Trends

Rising Focus on Targeted and Mutation-Specific KRAS Therapies

- A major and accelerating trend in the global Kirsten Rat Sarcoma (KRAS) market is the increasing focus on mutation-specific targeted therapies, particularly for KRAS-driven cancers such as non-small cell lung cancer (NSCLC), colorectal cancer, and pancreatic cancer. Historically considered “undruggable,” KRAS has become a viable therapeutic target due to advances in molecular biology and drug design

- For instance, in January 2022, Amgen received FDA approval for Lumakras (sotorasib) for KRAS G12C-mutated NSCLC, marking the first approved targeted therapy against KRAS mutations. Similarly, Mirati Therapeutics’ adagrasib (Krazati) gained regulatory approval in December 2022, reinforcing momentum in KRAS-targeted drug development

- Pharmaceutical companies are increasingly investing in next-generation KRAS inhibitors targeting additional mutations such as G12D and G13D to expand treatment eligibility beyond G12C-positive patients

- The trend is further supported by growing clinical trial activity combining KRAS inhibitors with immunotherapies and chemotherapy to improve treatment durability and overcome resistance

- Advances in companion diagnostics and next-generation sequencing (NGS) are enabling accurate patient stratification, ensuring higher treatment efficacy and personalized therapy selection

- This shift toward precision oncology is fundamentally reshaping treatment paradigms for KRAS-mutant cancers and is expected to significantly expand the therapeutic landscape over the forecast period

Europe Kirsten Rat Sarcoma (KRAS) Market Dynamics

Driver

Growing Burden of KRAS-Mutated Cancers and Expansion of Precision Oncology

- The increasing global prevalence of KRAS-mutated cancers, particularly lung, colorectal, and pancreatic cancers, is a key driver fueling growth in the KRAS market. KRAS mutations are present in approximately 25–30% of all human cancers, making them a critical focus for oncology drug development

- For instance, in June 2023, the U.S. National Cancer Institute (NCI) highlighted the expanding role of KRAS mutation testing in routine oncology diagnostics, emphasizing its importance in guiding targeted treatment decisions and clinical trial enrollment

- Rising adoption of molecular diagnostics and biomarker testing is enabling earlier identification of KRAS mutations, increasing demand for KRAS-targeted therapeutics

- In addition, growing investments in oncology R&D by biopharmaceutical companies and favorable regulatory support for breakthrough cancer therapies are accelerating drug approvals

- Increased awareness among clinicians regarding KRAS mutation profiling and its clinical significance is further supporting market expansion

- Together, these factors are driving sustained growth of the KRAS market across both developed and emerging healthcare systems

Restraint/Challenge

Therapeutic Resistance, Limited Mutation Coverage, and High Treatment Costs

- Despite recent breakthroughs, therapeutic resistance and limited mutation coverage remain significant challenges in the KRAS market. Current approved therapies primarily target KRAS G12C mutations, which represent only a subset of KRAS-driven cancers

- For instance, clinical studies published in 2023 in journals such as Nature Medicine reported the emergence of acquired resistance mechanisms in patients treated with KRAS G12C inhibitors, limiting long-term treatment efficacy

- High treatment costs associated with targeted oncology drugs also pose affordability challenges, particularly in low- and middle-income countries with limited reimbursement coverage

- In addition, complex tumor biology and pathway redundancies often reduce the effectiveness of monotherapies, necessitating combination treatment strategies that increase overall treatment costs

- Regulatory hurdles, lengthy clinical development timelines, and uncertainty regarding long-term outcomes further restrain rapid market penetration

- Addressing these challenges through next-generation inhibitors, combination therapies, and broader mutation targeting will be essential for sustained growth of the KRAS market

Europe Kirsten Rat Sarcoma (KRAS) Market Scope

The market is segmented on the basis of product, cancer type, age group, application, end user, and distribution channel.

- By Product

On the basis of product, the Kirsten Rat Sarcoma (KRAS) market is segmented into Reagents and Kits, Analyzers, and Consumables. The Reagents and Kits segment dominated the market with a revenue share of 46.8% in 2025, owing to their extensive use in KRAS mutation detection across PCR, NGS, and liquid biopsy techniques. These products are essential for routine diagnostic testing, companion diagnostics, and therapy selection. High testing volumes in lung, colorectal, and pancreatic cancers support strong demand. Frequent repeat purchases further strengthen revenue generation. Regulatory-approved kits enhance clinical confidence and adoption. Diagnostic laboratories heavily rely on these kits for standardized workflows. Growing global cancer incidence increases utilization. Expansion of precision oncology programs boosts demand. Reagents and kits are compatible with multiple platforms, increasing flexibility. Reimbursement support further drives usage. Continuous product innovation sustains dominance. Strong manufacturer presence reinforces market leadership.

The Analyzers segment is expected to witness the fastest CAGR of 14.9% from 2026 to 2033, driven by rising adoption of automated molecular diagnostic systems. Hospitals and laboratories are investing in advanced analyzers to improve throughput and accuracy. Automation reduces manual errors and turnaround time. Increasing KRAS testing volumes necessitate high-capacity instruments. Technological advancements such as multiplexing and AI integration support growth. Expansion of molecular diagnostics infrastructure globally fuels demand. Oncology centers prefer integrated platforms for efficiency. Growing laboratory automation trends accelerate adoption. Emerging markets are investing heavily in diagnostic equipment. Strategic collaborations between analyzer and kit manufacturers support uptake. Increasing government funding further accelerates growth. These factors collectively drive rapid expansion.

- By Cancer Type

On the basis of cancer type, the KRAS market is segmented into Lung Cancer, Colorectal Cancer, Pancreatic Cancer, Breast Cancer, Prostate Cancer, Cervical Cancer, Skin Cancer, Kidney Cancer, Blood Cancer, and Others. The Lung Cancer segment dominated the market with a revenue share of 38.5% in 2025, owing to the high prevalence of KRAS mutations in non-small cell lung cancer (NSCLC). Routine molecular testing is now standard in lung cancer diagnosis. KRAS testing guides treatment selection, prognostic assessment, and therapy monitoring. High patient volumes in NSCLC significantly drive demand. FDA-approved and CE-marked KRAS-targeted therapies increase testing frequency. Strong clinical guidelines support widespread adoption. Diagnostic laboratories prioritize lung cancer KRAS panels. Reimbursement coverage further enhances testing uptake. Rising smoking-related cancer incidence sustains volume. Pharma focus on NSCLC drug pipelines increases companion diagnostics demand. Advanced NGS and PCR-based panels improve detection accuracy. Established oncology workflows and laboratory infrastructure reinforce dominance. These factors collectively ensure the segment’s leading position.

The Pancreatic Cancer segment is expected to grow at the fastest CAGR of 16.7% from 2026 to 2033, driven by the extremely high incidence of KRAS mutations in pancreatic tumors. Nearly all pancreatic cancers harbor KRAS alterations, making testing essential. Increasing emphasis on early diagnosis accelerates adoption. Expanding clinical trials targeting KRAS mutations fuel demand. Precision oncology initiatives prioritize pancreatic cancer molecular profiling. Improved liquid biopsy and tissue biopsy technologies enhance accessibility. Rising research funding supports KRAS molecular diagnostics. Awareness among clinicians about KRAS testing is increasing. Efforts to improve survival outcomes encourage early testing. Expansion of tertiary cancer centers and oncology networks supports adoption. Strategic collaborations between pharma and diagnostics companies accelerate market penetration. Growth in personalized therapy pipelines further stimulates uptake. These combined factors drive the segment’s fastest growth.

- By Age Group

On the basis of age group, the market is segmented into Adult and Paediatric. The Adult segment dominated with a market share of 91.2% in 2025, as KRAS-associated cancers primarily affect adult populations. Lung, colorectal, and pancreatic cancers have higher incidence in adults. Routine KRAS testing is integrated into adult oncology care. Greater access to healthcare facilities supports dominance. Most approved KRAS-targeted therapies are indicated for adults. Higher screening rates contribute significantly. Established treatment pathways reinforce adoption. Diagnostic laboratories focus largely on adult samples. Clinical trial enrollment is predominantly adult-based. Reimbursement policies favor adult oncology diagnostics. Strong disease burden sustains demand. Long-standing clinical guidelines reinforce leadership.

The Paediatric segment is anticipated to grow at the fastest CAGR of 12.3% from 2026 to 2033, driven by increasing genomic research in pediatric oncology. Rare KRAS-driven pediatric malignancies are gaining attention. Advances in sequencing technologies support early detection. Growing investment in pediatric cancer research accelerates growth. Improved access to molecular diagnostics benefits adoption. Increased emphasis on genetic profiling supports expansion. Academic research institutions play a major role. Development of pediatric-targeted therapies fuels demand. Government funding supports innovation. Expansion of pediatric oncology centers boosts testing. Rising awareness among clinicians enhances uptake. These factors contribute to steady growth.

- By Application

On the basis of application, the market is segmented into Disease Diagnostics, Predictive, Drug Discovery and Development, Therapeutic Approach/Prognostics, Development of Molecular Diagnostics, Research and Development, Personalised Medicine, and Others. The Disease Diagnostics segment dominated the market with a revenue share of 41.6% in 2025, owing to the widespread adoption of KRAS mutation testing for cancer diagnosis and treatment planning. High testing frequency drives strong demand across hospitals and diagnostic laboratories. KRAS profiling is essential for patient stratification and therapy monitoring. Companion diagnostics support targeted therapy selection. Clinical guidelines recommend routine KRAS testing for lung, colorectal, and pancreatic cancers. Increasing incidence of these cancers sustains testing volume. Standardized laboratory workflows improve adoption and efficiency. Integration into oncology care pathways reinforces usage. Reimbursement support in developed regions strengthens market penetration. Technological advancements enhance diagnostic accuracy. Rapid adoption in well-equipped centers sustains leadership. These factors collectively secure the segment’s dominant position.

The Personalised Medicine segment is projected to grow at the fastest CAGR of 18.9% from 2026 to 2033, driven by the expansion of precision oncology approaches. KRAS mutation profiling enables individualized treatment strategies and therapy optimization. Increasing adoption of targeted therapies fuels growth. Pharma and biotech investments in biomarker-driven treatments support segment expansion. Companion diagnostics are critical for patient-specific therapy decisions. Global genomic testing programs are on the rise. Oncology centers are shifting toward personalized care models. Patient awareness of precision medicine is increasing. AI-enabled analytics enhance treatment planning. Regulatory approvals of KRAS inhibitors accelerate adoption. Clinical trials increasingly require molecular stratification. These combined factors drive rapid growth in the personalised medicine segment.

- By End User

On the basis of end user, the market is segmented into Diagnostic Laboratories, Hospitals, Pharma & Biotech Companies, Oncology Specialty Clinics, Academic & Cancer Research Institutes, and Others. Diagnostic Laboratories dominated with a revenue share of 44.3% in 2025, supported by high test volumes and centralized testing capabilities. Advanced molecular infrastructure enables large-scale testing. Labs serve as primary KRAS testing hubs. Cost-effective testing models attract hospitals. High adoption of NGS supports dominance. Efficient logistics and reporting systems enhance performance. Liquid biopsy testing demand boosts volumes. Reimbursement alignment favors lab-based services. Contract testing services expand reach. Continuous technology upgrades strengthen leadership. Growing cancer burden sustains dominance. Strong partnerships reinforce market position.

Pharma & Biotech Companies are expected to witness the fastest CAGR of 17.5% from 2026 to 2033, driven by expanding KRAS drug development pipelines. Companion diagnostic development fuels demand. Increasing clinical trials require extensive biomarker testing. Rising R&D investment accelerates growth. Precision medicine strategies increase reliance on KRAS testing. Strategic collaborations enhance adoption. Regulatory emphasis on biomarker validation supports expansion. Growing oncology pipelines sustain demand. Biotech innovation drives assay development. Global expansion of trials boosts uptake. Increased funding accelerates growth. These factors drive rapid CAGR.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender, Retail Sales, and Third-Party Distributor. The Direct Tender segment dominated the market with a revenue share of 49.7% in 2025, as hospitals, large diagnostic laboratories, and government healthcare institutions primarily procure KRAS testing products through bulk purchasing contracts. Direct tendering ensures cost efficiency, standardized product quality, and long-term supply stability. Public healthcare systems strongly rely on tender-based procurement models to manage large-scale diagnostic demand. Large hospital networks favor centralized purchasing to reduce operational costs. Regulatory compliance and documentation are easier to manage through direct sourcing. Manufacturers benefit from predictable demand and long-term agreements. High-volume procurement supports consistent revenue generation. Developed regions such as North America and Europe heavily depend on tender systems. Strong supplier–buyer relationships further reinforce dominance. Tender-based procurement also supports rapid deployment of new diagnostic technologies. These factors collectively sustain the leadership of the direct tender segment.

The Third-Party Distributor segment is expected to witness the fastest CAGR of 15.4% from 2026 to 2033, driven by expanding access to KRAS diagnostics in emerging and underserved markets. Distributors play a critical role in improving regional penetration and product availability. Smaller laboratories and private clinics depend on distributors for timely supply. Rapid growth of diagnostic infrastructure in Europe and Latin America accelerates demand. Flexible pricing models offered by distributors attract cost-sensitive buyers. Distributor networks enable efficient logistics and inventory management. Improvements in cold-chain and transportation infrastructure enhance reliability. Growth of private healthcare facilities supports expansion. Strategic partnerships with manufacturers strengthen market reach. Distributors assist in navigating local regulatory frameworks. Increasing decentralization of diagnostics further boosts growth. These factors contribute to the segment’s strong CAGR.

Europe Kirsten Rat Sarcoma (KRAS) Market Regional Analysis

- The Europe Kirsten Rat Sarcoma (KRAS) market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by the rising prevalence of cancer, increasing healthcare expenditure, and rapid adoption of precision medicine across emerging economies such as China and India

- The region is witnessing significant advancements in molecular diagnostics, targeted therapies, and oncology research, supported by favorable government initiatives and expanding cancer care infrastructure

- In addition, growing awareness regarding early cancer diagnosis and the increasing availability of KRAS mutation testing are contributing to strong market expansion across Asia-Pacific

China Kirsten Rat Sarcoma (KRAS) Market Insight

China Kirsten Rat Sarcoma (KRAS) market dominated the Kirsten Rat Sarcoma (KRAS) market with the largest revenue share of approximately 39.4% in 2025, supported by a large cancer patient population, expanding oncology infrastructure, and strong government support for precision medicine initiatives. The country has witnessed rapid adoption of molecular diagnostic technologies in tertiary hospitals and specialized cancer centers, enabling wider KRAS mutation testing and targeted treatment planning. Moreover, the presence of robust domestic biotechnology companies, increasing clinical research activities, and favorable regulatory reforms are further strengthening China’s leadership position in the regional KRAS market.

India Kirsten Rat Sarcoma (KRAS) Market Insight

India Kirsten Rat Sarcoma (KRAS) market is expected to be the fastest-growing market in the Kirsten Rat Sarcoma (KRAS) landscape during the forecast period, driven by increasing cancer prevalence, rising healthcare spending, and improving access to genomic and molecular testing. Growing participation in oncology clinical trials, expanding hospital networks, and the adoption of advanced diagnostic platforms are supporting market growth. Furthermore, government initiatives aimed at strengthening cancer care infrastructure and promoting early diagnosis are expected to drive a strong double-digit CAGR for the KRAS market in India over the forecast period.

Europe Kirsten Rat Sarcoma (KRAS) Market Share

The Kirsten Rat Sarcoma (KRAS) industry is primarily led by well-established companies, including:

• Amgen, Inc. (U.S.)

• Merck & Co., Inc. (U.S.)

• Bristol Myers Squibb (U.S.)

• Novartis AG (Switzerland)

• Johnson & Johnson (U.S.)

• AbbVie Inc. (U.S.)

• Eli Lilly and Company (U.S.)

• Boehringer Ingelheim GmbH (Germany)

• Revolution Medicines, Inc. (U.S.)

• Mirati Therapeutics, Inc. (U.S.)

• Pfizer Inc. (U.S.)

• Roche Holding AG (Switzerland)

• AstraZeneca plc (U.K.)

• Takeda Pharmaceutical Company Limited (Japan)

• Bayer AG (Germany)

• BeiGene, Ltd. (China)

• Hengrui Medicine (China)

• Qilu Pharmaceutical (China)

• Genetron Health (China)

• Illumina, Inc. (U.S.)

Latest Developments in Europe Kirsten Rat Sarcoma (KRAS) Market

- In May 2021, Amgen announced FDA approval of LUMAKRAS™ (sotorasib), the first targeted treatment for patients with KRAS G12C-mutated locally advanced or metastatic non-small cell lung cancer (NSCLC). This landmark approval marked the first time a drug successfully targeted a KRAS mutation, a breakthrough in precision oncology after decades of KRAS being considered “undruggable”

- In December 2022, Mirati Therapeutics’ KRAS inhibitor KRAZATI™ (adagrasib) received accelerated approval from the U.S. FDA for adult patients with KRAS G12C-mutated NSCLC who had received prior therapy, expanding the limited therapeutic options for this mutation

- In January 2024, the European Medicines Agency (EMA) granted marketing authorization to adagrasib (Krazati) for the treatment of KRAS G12C-mutated NSCLC, making it accessible to patients across the European Union, further establishing its role in global KRAS-targeted therapy

- In August 2024, Innovent Biologics and GenFleet Therapeutics announced the NMPA approval of Fulzerasib (IBI351; marketed as Dupert) in China for previously treated advanced NSCLC with KRAS G12C mutations. This marked the first domestically developed KRAS G12C inhibitor approved in China, expanding regional treatment options

- In May 2025, Jacobio Pharma’s Glecirasib (JAB-21822; Airuikai) gained NMPA approval in China for KRAS G12C-mutated NSCLC, further strengthening the local arsenal of KRAS inhibitors and signaling rapid adoption in Europe markets

- In January 2025, the U.S. FDA approved sotorasib (Lumakras) in combination with panitumumab for previously treated KRAS G12C-mutated metastatic colorectal cancer (CRC), marking one of the first major regulatory expansions of KRAS-targeted therapy beyond lung cancer

- In May 2025, Verastem Oncology announced U.S. FDA approval of the AVMAPKI + FAKZYNJA co-pack for adult patients with KRAS-mutated recurrent low-grade serous ovarian cancer (LGSOC), representing a new indication in the KRAS market beyond NSCLC and CRC

- In September 2025, Eli Lilly disclosed that the U.S. FDA granted Breakthrough Therapy designation to the investigational KRAS G12C inhibitor olomorasib (in combination with pembrolizumab) for first-line treatment of advanced NSCLC with high PD-L1 expression, highlighting evolving combination strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.