Europe Kyphoplasty Market

Market Size in USD Million

CAGR :

%

USD

254.64 Million

USD

608.31 Million

2025

2033

USD

254.64 Million

USD

608.31 Million

2025

2033

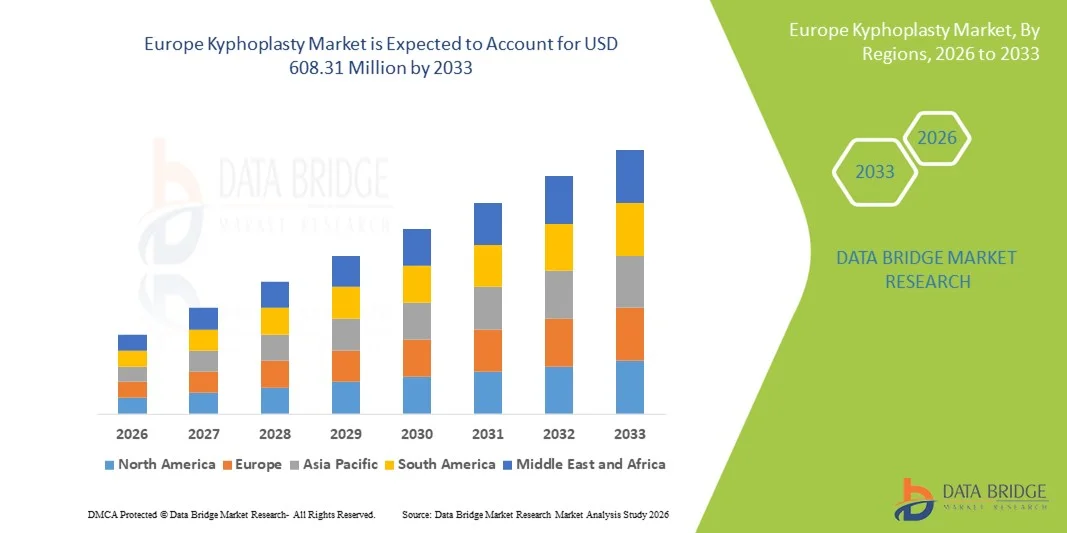

| 2026 –2033 | |

| USD 254.64 Million | |

| USD 608.31 Million | |

|

|

|

|

Europe Kyphoplasty Market Size

- The Europe Kyphoplasty market size was valued at USD 254.64 million in 2025 and is expected to reach USD 608.31 million by 2033, at a CAGR of 11.50% during the forecast period

- The market growth is largely fueled by the rising prevalence of osteoporotic vertebral compression fractures, increasing geriatric population, and growing awareness regarding minimally invasive spinal procedures across Europe

- Furthermore, advancements in balloon kyphoplasty systems, improved reimbursement frameworks in key European countries, and the increasing preference for rapid pain relief and shorter hospital stays are establishing kyphoplasty as a preferred vertebral augmentation procedure. These converging factors are accelerating the adoption of kyphoplasty devices, thereby significantly driving the market’s expansion

Europe Kyphoplasty Market Analysis

- Kyphoplasty, a minimally invasive vertebral augmentation procedure designed to treat vertebral compression fractures by stabilizing the fractured bone and restoring vertebral height using balloon tamp technology and bone cement, has become an essential interventional solution across European hospitals and specialty spine centers due to its ability to provide rapid pain relief and improved mobility

- The escalating demand for kyphoplasty procedures is primarily fueled by the rising prevalence of osteoporosis-related fractures, increasing geriatric population across Europe, growing awareness of minimally invasive spine treatments, and the clinical preference for procedures that reduce hospital stay and enable faster functional recovery

- Germany dominated the Europe kyphoplasty market with the largest revenue share of 29.4% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement framework, high procedural adoption rates, and the presence of leading orthopedic and spine care centers, with increasing volumes of vertebral compression fracture treatments among the aging population

- France is expected to be the fastest growing country in the Europe kyphoplasty market during the forecast period driven by rising osteoporosis incidence, expanding access to minimally invasive spinal procedures, and increasing healthcare investments in advanced interventional technologies

- Balloon kyphoplasty segment dominated the Europe kyphoplasty market with a market share of 61.3% in 2025, driven by its established clinical effectiveness in vertebral height restoration, rapid pain relief, and strong preference among spine surgeons for minimally invasive fracture management techniques

Report Scope and Europe Kyphoplasty Market Segmentation

|

Attributes |

Europe Kyphoplasty Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Kyphoplasty Market Trends

Rising Preference for Minimally Invasive Vertebral Augmentation Procedures

- A significant and accelerating trend in the Europe kyphoplasty market is the growing preference for minimally invasive spine procedures supported by advanced balloon catheter systems and high-viscosity bone cement technologies. This evolution in interventional techniques is significantly improving procedural precision, patient safety, and post-operative recovery outcomes

- For instance, leading medical device manufacturers have introduced next-generation balloon kyphoplasty systems designed to enhance vertebral height restoration and optimize cement delivery control, reducing the risk of leakage and adjacent vertebral fractures. Similarly, hospitals across Germany and Italy are increasingly adopting image-guided navigation systems to improve procedural accuracy

- Technological advancements in kyphoplasty devices enable improved cement viscosity management, better fracture stabilization, and shorter procedure times. For instance, some systems incorporate controlled cement injection mechanisms to minimize extravasation risks and enhance structural support. Furthermore, integration with advanced imaging modalities allows clinicians to achieve precise balloon placement and improved clinical outcomes

- The growing integration of kyphoplasty procedures within comprehensive osteoporosis management programs facilitates coordinated care pathways involving orthopedic surgeons, radiologists, and geriatric specialists. Through multidisciplinary treatment models, healthcare providers can ensure timely diagnosis, intervention, and long-term fracture prevention strategies, creating a more structured care continuum

- This trend toward safer, more efficient, and patient-centric vertebral fracture management is fundamentally reshaping treatment standards across Europe. Consequently, several device manufacturers are investing in R&D to develop bioactive bone cements and expandable implant technologies aimed at improving long-term spinal stability and reducing complication rates

- The demand for advanced kyphoplasty systems is growing steadily across European healthcare facilities, as providers increasingly prioritize minimally invasive solutions that reduce hospitalization time, enable faster mobilization, and improve quality of life for elderly patients

- In addition, the rising establishment of dedicated spine and interventional radiology centers across major European countries is improving patient access to kyphoplasty procedures and supporting overall market penetration

Europe Kyphoplasty Market Dynamics

Driver

Growing Need Due to Rising Osteoporosis Prevalence and Aging Population

- The increasing prevalence of osteoporosis and vertebral compression fractures, coupled with Europe’s rapidly expanding geriatric population, is a significant driver for the heightened demand for kyphoplasty procedures

- For instance, in 2024, several European healthcare systems expanded funding allocations for osteoporosis screening and fracture management programs to address the rising clinical and economic burden associated with fragility fractures. Such strategic healthcare initiatives are expected to drive the kyphoplasty market growth during the forecast period

- As awareness of the debilitating impact of untreated vertebral fractures increases, kyphoplasty offers rapid pain relief, vertebral stabilization, and improved mobility, providing a compelling alternative to prolonged conservative treatments such as bracing and analgesic therapy

- Furthermore, favorable reimbursement policies in countries such as Germany and France, along with strong hospital infrastructure and access to trained spine specialists, are making kyphoplasty a preferred interventional treatment option for eligible patients

- The clinical benefits of shorter hospital stays, reduced dependency on opioid-based pain management, and quicker return to daily activities are key factors propelling the adoption of kyphoplasty across public and private healthcare institutions. The expansion of specialized spine centers further contributes to procedural volume growth

- Increasing early diagnosis rates through improved bone density screening programs are enabling timely clinical intervention, thereby supporting higher treatment adoption rates across at-risk populations

- In addition, growing collaboration between orthopedic societies and public health agencies to promote vertebral fracture awareness campaigns is strengthening referral networks and driving patient inflow for kyphoplasty procedures

Restraint/Challenge

High Procedure Costs and Risk of Cement Leakage Complications

- Concerns surrounding procedure-related complications, including bone cement leakage and adjacent vertebral fractures, pose a significant challenge to broader adoption of kyphoplasty across certain European healthcare settings. As the procedure involves percutaneous cement injection, clinical precision is critical to avoid adverse outcomes

- For instance, reported cases of cement extravasation in vertebral augmentation procedures have led some clinicians to exercise caution when selecting patients, particularly those with complex fracture patterns or severe comorbidities

- Addressing these concerns through enhanced device design, improved cement viscosity control, and physician training programs is crucial for strengthening clinical confidence. Manufacturers are emphasizing safety-enhancing features and controlled delivery systems to mitigate complication risks and reassure healthcare providers

- In addition, the relatively high procedural cost of kyphoplasty compared to conservative management can be a barrier in cost-sensitive healthcare systems, particularly in parts of Southern and Eastern Europe where reimbursement coverage may be limited

- While healthcare investments are increasing, budget constraints and varying reimbursement frameworks across European countries can still limit widespread procedural adoption, especially in facilities with restricted capital expenditure capacity

- Lengthy regulatory approval timelines for new vertebral augmentation devices within the European medical device framework may delay product launches and slow technological diffusion across the region

- Overcoming these challenges through technological refinement, expanded reimbursement support, broader clinical evidence demonstrating long-term cost-effectiveness, and streamlined regulatory pathways will be vital for sustained market expansion across Europe

Europe Kyphoplasty Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the Europe kyphoplasty market is segmented into balloon kyphoplasty systems, needle kyphoplasty systems, and X-Ray device kyphoplasty systems. The Balloon Kyphoplasty Systems segment dominated the market with the largest revenue share of 61.3% in 2025, driven by its strong clinical evidence base and widespread physician preference for controlled vertebral height restoration. Balloon systems allow cavity creation prior to cement injection, which reduces cement leakage risk and improves structural stabilization. Hospitals across Germany, France, and Italy increasingly favor balloon systems due to better patient outcomes and shorter recovery periods. The ability to restore spinal alignment and correct deformity more effectively than conventional vertebroplasty further strengthens adoption. In addition, reimbursement support in major European countries supports procedural uptake. Continuous technological improvements in balloon catheter design and cement delivery mechanisms also contribute to sustained segment leadership.

The Needle Kyphoplasty Systems segment is anticipated to witness the fastest growth rate during the forecast period, fueled by demand for cost-effective and simplified vertebral augmentation solutions. Needle-based systems often involve fewer device components, potentially lowering procedural costs in budget-sensitive healthcare settings. Increasing adoption in ambulatory surgical centres and mid-sized hospitals supports segment expansion. Physicians in emerging European markets are exploring needle systems for selected patient populations where full balloon deployment may not be necessary. Growing awareness of minimally invasive spine procedures and expanding training programs are improving procedural confidence. Furthermore, technological refinement in cement viscosity control is enhancing the safety profile of needle-based systems, supporting future growth.

- By Application

On the basis of application, the Europe kyphoplasty market is segmented into restoring lost vertebral body and correction of the local kyphosis. The Restoring Lost Vertebral Body segment held the largest market revenue share in 2025, driven by the high prevalence of osteoporotic vertebral compression fractures among the elderly population. Restoration of vertebral height is a primary clinical objective in kyphoplasty procedures, as it directly contributes to pain reduction and improved spinal biomechanics. European clinicians prioritize height restoration to prevent progressive spinal deformity and pulmonary compromise. The increasing diagnosis rate of fragility fractures further strengthens procedural volumes within this segment. In addition, strong clinical evidence demonstrating functional mobility improvement supports physician preference. As aging demographics continue to expand across Europe, demand for vertebral body restoration procedures remains consistently high.

The Correction of the Local Kyphosis segment is expected to witness the fastest CAGR during the forecast period, driven by growing awareness of spinal alignment correction and long-term postural outcomes. Physicians are increasingly focusing not only on pain relief but also on restoring sagittal balance to improve quality of life. Technological advancements in balloon expansion systems enable better kyphotic angle correction. Rising clinical emphasis on comprehensive spinal deformity management is encouraging broader use of kyphoplasty in selected cases. Rehabilitation-focused healthcare models in Western Europe further support alignment-based treatment goals. Expanding research on the long-term benefits of kyphosis correction is anticipated to accelerate adoption in the coming years.

- By End User

On the basis of end user, the Europe kyphoplasty market is segmented into hospitals, clinics, ambulatory surgical centres, and others. The Hospitals segment dominated the market in 2025 due to the availability of advanced imaging infrastructure, multidisciplinary spine care teams, and higher procedural capacity. Most kyphoplasty procedures in Europe are performed in tertiary and specialized hospitals where complex fracture cases can be managed effectively. Favorable reimbursement frameworks in major countries further strengthen hospital-based procedural volumes. Hospitals also have greater access to skilled orthopedic surgeons and interventional radiologists trained in vertebral augmentation techniques. The presence of post-operative monitoring facilities enhances patient safety, supporting hospital dominance. Continuous investment in surgical innovation within large healthcare institutions further consolidates their leading position.

The Ambulatory Surgical Centres segment is projected to experience the fastest growth during the forecast period, supported by the increasing shift toward outpatient minimally invasive procedures. ASCs offer cost advantages and reduced hospital stay durations, making them attractive in cost-conscious healthcare systems. Improvements in anesthesia techniques and procedural efficiency enable safe same-day discharge for selected patients. Several European healthcare systems are encouraging outpatient spine interventions to optimize hospital resource utilization. Growing patient preference for shorter recovery timelines further accelerates ASC adoption. As minimally invasive technologies advance, the feasibility of performing kyphoplasty in outpatient settings is expected to expand significantly.

Europe Kyphoplasty Market Regional Analysis

- Germany dominated the Europe kyphoplasty market with the largest revenue share of 29.4% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement framework, high procedural adoption rates, and the presence of leading orthopedic and spine care centers, with increasing volumes of vertebral compression fracture treatments among the aging population

- Healthcare providers in the country highly value the clinical benefits of minimally invasive vertebral augmentation procedures, including rapid pain relief, vertebral height restoration, and reduced hospital stays compared to conservative treatment approaches

- This widespread adoption is further supported by a rapidly aging population, well-established orthopedic and interventional radiology networks, and continuous investment in advanced medical technologies, establishing kyphoplasty as a preferred treatment solution across major hospitals and specialized spine centers

The Germany Kyphoplasty Market Insight

The Germany kyphoplasty market captured the largest revenue share in 2025 within Europe, fueled by a high incidence of osteoporotic vertebral compression fractures and strong reimbursement support for minimally invasive spine procedures. Physicians increasingly prioritize vertebral augmentation techniques that provide rapid pain relief and improved mobility for elderly patients. The growing aging population, combined with well-established orthopedic and interventional radiology infrastructure, further propels procedural volumes. Moreover, the presence of advanced medical device technologies and continuous innovation in balloon kyphoplasty systems significantly contributes to market expansion across tertiary care hospitals.

France Kyphoplasty Market Insight

The France kyphoplasty market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising osteoporosis prevalence and increasing awareness regarding minimally invasive spinal treatments. The expansion of geriatric healthcare services, coupled with structured reimbursement policies, is fostering higher procedural adoption. Hospitals in France are emphasizing early fracture intervention to reduce long-term disability. In addition, growing investments in advanced imaging-guided spine procedures are supporting market growth.

U.K. Kyphoplasty Market Insight

The U.K. kyphoplasty market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing vertebral fracture incidence among the aging population and supportive public healthcare initiatives. National focus on osteoporosis screening and early diagnosis is encouraging timely intervention. The presence of skilled spine specialists and improved access to minimally invasive technologies further strengthens adoption. Emphasis on reducing hospital stay duration and improving patient recovery outcomes continues to stimulate market demand.

Italy Kyphoplasty Market Insight

The Italy kyphoplasty market is expected to expand at a considerable CAGR during the forecast period, fueled by rising geriatric demographics and growing awareness of vertebral compression fracture management. Italy’s expanding orthopedic care infrastructure and increasing adoption of interventional radiology techniques promote procedural growth. Hospitals are gradually integrating balloon kyphoplasty into standard fracture treatment pathways. The focus on enhancing quality of life for elderly patients further supports sustained market expansion.

Europe Kyphoplasty Market Share

The Europe Kyphoplasty industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Stryker (U.S.)

- Globus Medical, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Alphatec Holdings, Inc. (U.S.)

- Osseon LLC (U.S.)

- G-21 S.r.l. (Italy)

- SOMATEX Medical Technologies GmbH (Germany)

- joimax GmbH (Germany)

- Joline GmbH & Co. KG (Germany)

- IZI Medical Products, LLC (U.S.)

- Seawon Meditech Co., Ltd. (South Korea)

- Smith & Nephew plc (U.K.)

- MicroPort Scientific Corporation (China)

- Cook (U.S.)

- SPINUS (France)

- Tecres S.p.A. (Italy)

- Medacta International SA (Switzerland)

What are the Recent Developments in Europe Kyphoplasty Market?

- In June 2025, Amber Implants announced successful one-year follow-up data from its first-in-human VCFix® Spinal System clinical trial, reporting significant improvements in key clinical performance outcomes and demonstrating a strong safety profile for the treatment of vertebral compression fractures in The Netherlands

- In May 2025, Amber Implants reported that all patients in its first-in-human clinical study of the VCFix® Spinal System completed their one-year follow-up without any device-related adverse events, reinforcing clinical confidence in the novel spinal augmentation approach

- In June 2024, Amber Implants completed the enrolment of its first-in-human clinical trial for the VCFix® Spinal System, marking a significant clinical research advancement in spinal fracture treatment that may influence future kyphoplasty strategies across European healthcare settings

- In June 2024, Medtronic announced a strategic partnership with Merit Medical Systems to offer the Kyphon™ KyphoFlex™ unipedicular balloon catheter for treating vertebral compression fractures, expanding clinical options for minimally invasive spinal augmentation procedures across markets that include European distribution networks

- In October 2023, Amber Implants announced the start of its first-in-human clinical trial for the VCFix® Spinal System, a next-generation implant for vertebral compression fractures aiming to offer an alternative to traditional bone-cement-based kyphoplasty procedures. This milestone highlighted innovation in vertebral augmentation treatment modalities emerging in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.