Europe Lab Automation Market

Market Size in USD Billion

CAGR :

%

USD

2.88 Billion

USD

4.59 Billion

2025

2033

USD

2.88 Billion

USD

4.59 Billion

2025

2033

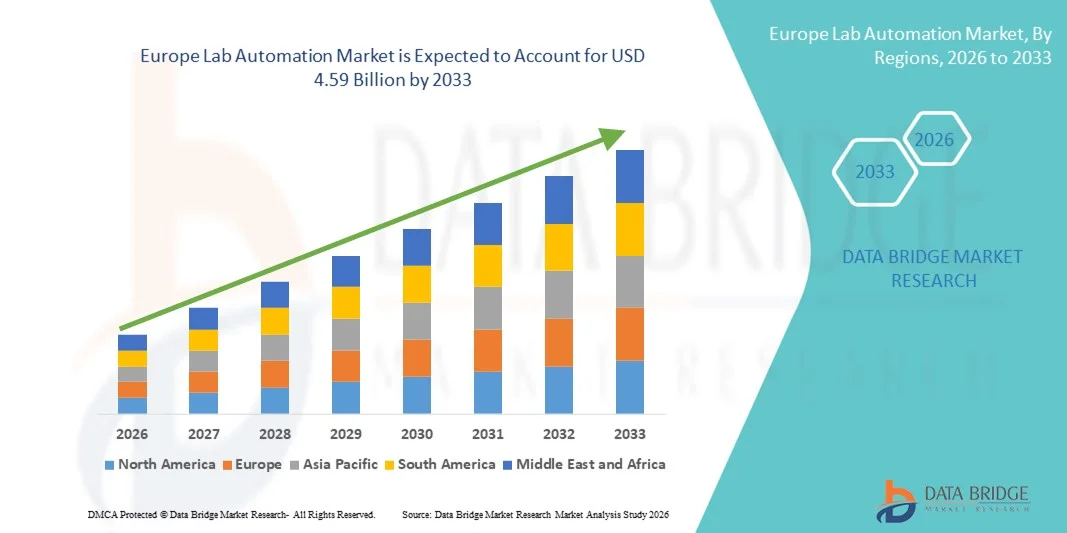

| 2026 –2033 | |

| USD 2.88 Billion | |

| USD 4.59 Billion | |

|

|

|

|

Europe Lab Automation Market Size

- The Europe lab automation market size was valued at USD 2.88 billion in 2025 and is expected to reach USD 4.59 billion by 2033, at a CAGR of 6.0% during the forecast period

- The market growth is largely fueled by increasing adoption of automated laboratory equipment and advanced robotic systems, enabling higher efficiency, accuracy, and throughput in research and clinical laboratories

- Furthermore, rising demand for streamlined laboratory workflows, reduced human error, and cost-effective operational solutions is establishing lab automation as a key component of modern laboratories. These converging factors are accelerating the uptake of lab automation technologies, thereby significantly boosting the industry's growth

Europe Lab Automation Market Analysis

- Lab automation, encompassing automated laboratory equipment, software & informatics, and analyzers, is becoming an essential component of modern research, clinical, and industrial laboratories in both public and private sectors due to enhanced efficiency, accuracy, and reproducibility of experiments

- The rising demand for lab automation is primarily driven by the need to increase laboratory throughput, reduce human error, and optimize operational costs, alongside growing investments in R&D and biotechnology across Europe

- Germany dominated the Europe lab automation market with the largest revenue share of 38.7% in 2025, supported by advanced research infrastructure, high adoption of cutting-edge technologies, and a strong presence of key industry players, with substantial growth in automated laboratory solutions across pharmaceutical, clinical diagnostics, and academic research labs

- Poland is expected to be the fastest growing country in the Europe lab automation market during the forecast period due to increasing investments in healthcare and life sciences research, coupled with modernization of laboratory facilities

- Equipment segment dominated the Europe lab automation market with a market share of 42.3% in 2025, driven by its critical role in supporting diverse applications such as drug discovery, clinical diagnostics, genomics, proteomics, and analytical chemistry across biotechnology, pharmaceutical, and academic laboratories

Report Scope and Europe Lab Automation Market Segmentation

|

Attributes |

Europe Lab Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Lab Automation Market Trends

Integration of AI and Advanced Analytics in Lab Workflows

- A significant and accelerating trend in the Europe lab automation market is the growing integration of artificial intelligence (AI) and advanced data analytics into laboratory equipment and software, enhancing experimental accuracy, predictive insights, and workflow optimization

- For instance, Tecan’s Fluent robotic platform leverages AI-driven protocols to optimize liquid handling operations and reduce experimental errors, while PerkinElmer’s lab informatics solutions provide predictive analytics for sample tracking and experiment outcomes

- AI integration in lab automation enables features such as predictive maintenance, intelligent scheduling of experiments, and real-time anomaly detection in assays, enhancing productivity and reducing operational downtime

- The seamless integration of laboratory automation systems with cloud-based informatics platforms allows centralized monitoring and control of multiple instruments and workflows, creating a unified laboratory management environment

- This trend towards smarter, data-driven, and interconnected laboratory systems is fundamentally reshaping expectations for research efficiency and reproducibility. Consequently, companies such as Hamilton Company are developing AI-enabled automated liquid handling systems with features for workflow optimization and real-time decision support

- The demand for lab automation solutions with integrated AI and analytics capabilities is growing rapidly across pharmaceutical, biotechnology, and academic research laboratories, as institutions increasingly prioritize efficiency, accuracy, and high-throughput capabilities

- Increased focus on personalized medicine and high-throughput genomics applications is driving demand for automation platforms capable of handling large-scale and complex datasets efficiently

Europe Lab Automation Market Dynamics

Driver

Rising R&D Investments and Need for Workflow Efficiency

- The increasing investments in pharmaceutical, biotechnology, and clinical research, coupled with the need to streamline laboratory workflows, is a significant driver for the heightened demand for lab automation solutions

- For instance, in March 2025, Sartorius announced an expansion of its automated laboratory solutions for biopharmaceutical R&D, targeting faster and more reproducible assay development

- As research institutions and commercial laboratories seek higher throughput and reduced human error, automated systems offer precise handling, standardized protocols, and integration with laboratory information management systems (LIMS), providing compelling operational advantages

- Furthermore, the growing adoption of high-throughput screening, genomics, and proteomics applications is making lab automation a critical component of modern research infrastructure

- The increasing need for scalable, cost-effective, and reproducible experimental workflows, along with rising pressure to accelerate drug discovery and diagnostics, is propelling the adoption of lab automation across Europe

- Government and private funding initiatives to modernize laboratories and promote biotechnology innovation are further accelerating the adoption of automation technologies

- Expansion of the biopharmaceutical and clinical diagnostics sector in countries such as Germany, France, and Switzerland is creating additional opportunities for lab automation equipment and software adoption

Restraint/Challenge

High Cost and Integration Complexity

- The relatively high initial investment required for advanced laboratory automation equipment and informatics solutions poses a significant challenge to broader market penetration, particularly for smaller laboratories or academic institutions

- For instance, sophisticated modular automation systems from companies such as Beckman Coulter can cost several hundred thousand euros, making them less accessible for budget-constrained labs

- Integration challenges, including compatibility across different instruments and software platforms, require additional resources, technical expertise, and training, slowing adoption and increasing operational complexity

- In addition, concerns regarding data security and compliance with stringent regulatory requirements in clinical and research laboratories can restrict the deployment of connected automation solutions

- While costs are gradually decreasing and modular solutions offer scalable options, perceived complexity and high upfront investment remain barriers for widespread adoption, especially in smaller or resource-limited laboratory settings

- Overcoming these challenges through standardized integration protocols, user-friendly software interfaces, and cost-effective automation packages will be vital for sustained growth in the Europe lab automation market

- Limited skilled personnel capable of operating and maintaining advanced automated systems continues to restrict adoption in certain research and academic laboratories

- Variability in regional regulatory frameworks across Europe can slow implementation and commercialization of advanced automation solutions, requiring additional compliance resource

Europe Lab Automation Market Scope

The market is segmented on the basis of product type, automation type, application, and end user

- By Product Type

On the basis of product type, the Europe lab automation market is segmented into equipment, software & informatics, and analyzers. The equipment segment dominated the market with the largest revenue share of 42.3% in 2025, driven by the essential role of instruments such as automated liquid handlers, robotic arms, and microplate readers in modern laboratories. These systems provide high precision, reproducibility, and scalability across applications such as drug discovery, clinical diagnostics, and proteomics, making them indispensable in research and biopharmaceutical settings. The robust demand is further supported by the need for high-throughput workflows and reduced human intervention. Laboratories in countries such as Germany, France, and Switzerland are investing heavily in automated equipment to enhance productivity and efficiency. The compatibility of automated equipment with other lab systems and informatics platforms also strengthens its market position. In addition, continuous technological innovations, including modular designs and AI-assisted functionality, sustain growth in this segment.

The software & informatics segment is anticipated to witness the fastest growth from 2026 to 2033 due to the increasing need for data management, integration of laboratory information management systems (LIMS), and advanced analytics. Cloud-based solutions and AI-driven software enable remote monitoring, workflow optimization, and predictive maintenance. Academic and industrial laboratories are rapidly adopting software platforms to enhance collaboration, improve data integrity, and accelerate research outcomes. Rising demand for compliance, regulatory reporting, and seamless connectivity across multi-site laboratories further fuels adoption. As laboratories increasingly handle complex datasets from genomics and proteomics research, the need for sophisticated informatics solutions will drive strong CAGR in this segment.

- By Automation Type

On the basis of automation type, the market is segmented into modular automation and total lab automation. The modular automation segment dominated the market with a share of 55.1% in 2025, as laboratories prefer flexible, customizable solutions that can be integrated with existing equipment. Modular systems allow incremental upgrades, enabling labs to optimize workflows without significant upfront investment. Their adaptability across diverse applications—from drug discovery to clinical diagnostics—makes them widely popular in Europe. Laboratories also benefit from reduced downtime, improved throughput, and easier maintenance with modular configurations. Germany, the U.K., and France lead in adopting modular automation due to advanced research infrastructure and high R&D spending. Furthermore, modular systems provide better scalability for laboratories expanding into high-throughput genomics and proteomics applications.

The total lab automation segment is expected to witness the fastest growth from 2026 to 2033 due to increasing demand for fully integrated, end-to-end automated solutions. Total lab automation reduces manual intervention, minimizes human error, and enhances reproducibility in high-volume laboratories. The rising focus on biopharmaceutical R&D, clinical diagnostics, and personalized medicine drives the need for fully automated workflows. Countries such as Poland, Czech Republic, and Sweden are investing in total lab automation to modernize laboratories and support multi-site collaboration. Growing adoption of AI-enabled robotics and integrated analytical platforms further accelerates growth in this segment.

- By Application

On the basis of application, the market is segmented into drug discovery, clinical diagnostics, genomics solutions, proteomics solutions, bio analysis, protein engineering, lyophilization, system biology, analytical chemistry, and others. The drug discovery segment dominated the market with a share of 40.6% in 2025, owing to the high demand for automated high-throughput screening, sample preparation, and assay reproducibility in pharmaceutical research. Automated systems enable faster lead identification, reduced operational costs, and minimized human error, critical for competitive drug development. European pharmaceutical hubs such as Germany, Switzerland, and the U.K. are investing heavily in automated drug discovery platforms to accelerate R&D timelines. Collaboration between automation companies and research institutions further strengthens adoption. In addition, regulatory requirements for data integrity in drug discovery workflows reinforce the need for reliable automation systems.

The genomics solutions segment is expected to witness the fastest growth from 2026 to 2033 due to the rising demand for personalized medicine, next-generation sequencing, and high-throughput genomic analysis. Automated platforms improve sample handling, reduce contamination risks, and allow efficient processing of large genomic datasets. Countries investing in precision medicine initiatives, such as France, Spain, and the Netherlands, are adopting genomics-focused automation solutions at a rapid pace. Integration with AI and cloud-based analytics further enhances efficiency and scalability. Growing applications in diagnostics, disease research, and biomarker discovery continue to propel strong CAGR in this segment.

- By End Users

On the basis of end users, the market is segmented into biotechnology & pharmaceuticals, hospitals & laboratories, research and academic institutions, and others. The biotechnology & pharmaceuticals segment dominated the market with a share of 44.5% in 2025, as these organizations require high-throughput, reproducible workflows for R&D, clinical trials, and drug manufacturing. The increasing complexity of biological experiments, coupled with the need for regulatory compliance and faster time-to-market, drives investment in lab automation. European pharmaceutical and biotech hubs, including Germany, Switzerland, and the U.K., are leading adopters of automated systems to enhance productivity and accuracy. Collaborations with automation solution providers and instrument manufacturers further support implementation. Moreover, these end users benefit from modular and total lab automation systems that can handle genomics, proteomics, and analytical chemistry workflows efficiently.

The research and academic institutions segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising investments in life sciences education, academic research, and government-funded laboratory modernization programs. Automation enables institutions to perform high-throughput experiments, reduce manual errors, and improve reproducibility in teaching and research labs. Countries such as Poland, Czech Republic, and Sweden are emerging as rapidly growing markets for academic lab automation. Integration of AI, robotics, and informatics solutions enhances research output, collaboration, and data management capabilities. Growing focus on genomics, proteomics, and system biology in academia further accelerates adoption in this segment.

Europe Lab Automation Market Regional Analysis

- Germany dominated the Europe lab automation market with the largest revenue share of 38.7% in 2025, supported by advanced research infrastructure, high adoption of cutting-edge technologies, and a strong presence of key industry players, with substantial growth in automated laboratory solutions across pharmaceutical, clinical diagnostics, and academic research labs

- Laboratories in the country highly value the efficiency, accuracy, and reproducibility offered by automated equipment, software, and analyzers across applications such as drug discovery, clinical diagnostics, and genomics solutions

- This widespread adoption is further supported by government initiatives promoting laboratory modernization, high disposable R&D budgets, and collaborations between automation providers and research institutions, establishing Germany as the leading hub for lab automation solutions in Europe

The U.K. Lab Automation Market Insight

The U.K. lab automation market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing focus on biopharmaceutical R&D, genomics, and personalized medicine. In addition, academic and clinical laboratories are adopting automated systems to improve workflow efficiency and data reproducibility. The U.K.’s strong research infrastructure, coupled with government initiatives supporting laboratory modernization, is expected to continue stimulating market growth. The integration of robotic equipment with laboratory software and informatics platforms further strengthens adoption by providing streamlined operations and real-time monitoring capabilities.

Germany Lab Automation Market Insight

The Germany lab automation market is expected to expand at a considerable CAGR during the forecast period, fueled by high investments in pharmaceutical, biotechnology, and clinical research and a growing emphasis on advanced laboratory technologies. Germany’s well-established research infrastructure and focus on innovation promote the adoption of automated laboratory equipment, analyzers, and informatics solutions. Integration of lab automation with AI and analytics enhances throughput, reproducibility, and operational efficiency. The country’s regulatory framework and commitment to precision and quality further support adoption in both academic and commercial laboratories, particularly across drug discovery, clinical diagnostics, and genomics applications.

France Lab Automation Market Insight

The France lab automation market is poised to grow at a strong CAGR during the forecast period, driven by increasing R&D activities in pharmaceuticals, biotechnology, and clinical diagnostics. Laboratories in France are adopting automated equipment and software to improve efficiency, reduce human error, and ensure high-quality data reproducibility. Government support for innovation and laboratory modernization, alongside collaborations between academic institutions and automation providers, is boosting market expansion. The growing focus on high-throughput genomics and proteomics applications further accelerates adoption, particularly in leading research hubs such as Paris and Lyon.

Poland Lab Automation Market Insight

The Poland lab automation market is expected to witness the fastest CAGR during the forecast period, driven by increasing investments in biotechnology, pharmaceuticals, and academic research laboratories. Laboratories in Poland are adopting automated equipment, software, and analyzers to improve workflow efficiency, reproducibility, and data integrity. Government initiatives to modernize research infrastructure and promote innovation are further accelerating adoption. The growing focus on high-throughput applications, including genomics, proteomics, and clinical diagnostics, is creating strong demand for automation solutions. Collaboration between local research institutions and international automation providers is enhancing accessibility to advanced systems.

Europe Lab Automation Market Share

The Europe Lab Automation industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Siemens Healthineers AG (Germany)

- Beckman Coulter (U.S.)

- Eppendorf SE (Germany)

- Agilent Technologies (U.S.)

- PerkinElmer (U.S.)

- Danaher (U.S.)

- Tecan Group (Switzerland)

- QIAGEN (Netherlands)

- Hamilton Company (U.S.)

- BD (U.S.)

- Hudson Robotics (U.S.)

- F. Hoffmann La Roche (Switzerland)

- Abbott (U.S.)

- BioMérieux (France)

- Sartorius AG (Germany)

- Analytik Jena (Germany)

- Inpeco (Switzerland)

- Azenta (U.S.)

What are the Recent Developments in Europe Lab Automation Market?

- In July 2025, MilliporeSigma (Merck KGaA) launched the AAW™ Workstation, a new automated assay platform designed to simplify and accelerate laboratory workflows across academia, biotech, and pharmaceutical labs in Europe. The plug‑and‑play system integrates verified protocols for protein, molecular, and cell biology workflows, enabling reduced hands‑on time and consistent results across diverse applications

- In May 2025, MGI Tech unveiled its next‑generation automation portfolio at SLAS Europe 2025 in Hamburg, including the new PrepALL liquid handling system and updated Smart8 platform, featuring AI‑optimized pipetting and modular design for enhanced throughput in genomics and diagnostics. This innovation supports labs of varied sizes with scalable automation solutions

- In April 2025, QIAGEN advanced plans to launch three new automated sample preparation instruments including QIAsymphony Connect and QIAmini beginning 2025 and continuing into 2026 to enhance lab automation in genomics, oncology, and pathogen workflows. Early customer sessions were held at European scientific events such as ESCMID to demonstrate the technology

- In January 2025, ABB and Agilent Technologies enter collaboration to advance laboratory automation. ABB Robotics and Agilent announced a strategic partnership in Zurich aimed at developing automated laboratory solutions combining ABB’s robotics with Agilent’s analytical instruments and software, to enhance workflow efficiency and precision across pharmaceutical, biotechnology, energy, and food labs

- In July 2023, GC biotech secured exclusive European distribution rights for Genie Life Sciences’ lab automation platform, including the Genie LabMate liquid handling robot and Genie LabOS software, expanding automation solutions available across European laboratories for genomics, proteomics, drug discovery, and cell culture workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.