Europe Mass Spectrometry Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.84 Billion

2024

2032

USD

1.70 Billion

USD

2.84 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 2.84 Billion | |

|

|

|

|

Europe Mass Spectrometry Devices Market Size

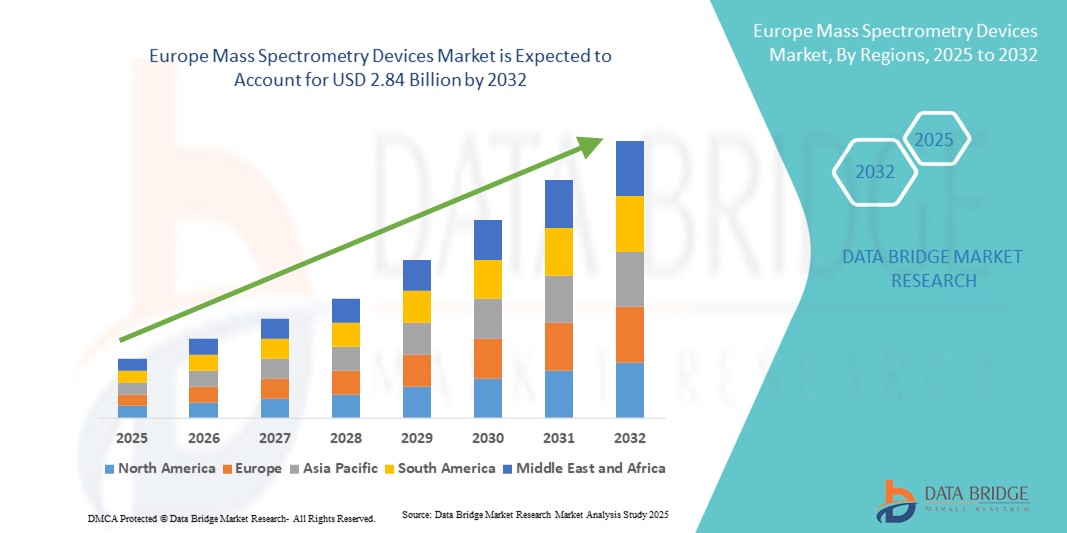

- The Europe mass spectrometry devices market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 2.84 billion by 2032, at a CAGR of 6.58% during the forecast period

- The market growth is largely driven by the increasing use of mass spectrometry in pharmaceutical research, clinical diagnostics, and proteomics, alongside advancements in life sciences instrumentation and analytical technologies across the region

- Furthermore, rising demand for accurate, rapid, and high-throughput analytical solutions in drug development, food safety testing, and environmental monitoring is positioning mass spectrometry as a vital tool for precision analysis. These converging factors are accelerating the adoption of mass spectrometry devices, thereby significantly boosting the industry’s growth

Europe Mass Spectrometry Devices Market Analysis

- Mass spectrometry devices, offering high-precision molecular detection and quantification, are increasingly essential in pharmaceutical development, biotechnology, clinical diagnostics, and environmental testing, owing to their superior sensitivity, rapid analysis, and reliability in handling complex samples

- The accelerating demand for mass spectrometry in Europe is largely fueled by the growing need for advanced proteomics and metabolomics research, rising pharmaceutical R&D investments, and stricter food safety and environmental monitoring regulations across the region

- Germany dominated the Europe mass spectrometry devices market with the largest revenue share of 29.6% in 2024, supported by its strong pharmaceutical industry, significant government research funding, and presence of leading life sciences companies and research institutions, with rapid adoption of hybrid mass spectrometry technologies for drug discovery and clinical research applications

- France is expected to be the fastest growing country in the Europe mass spectrometry devices market during the forecast period, driven by expanding biopharmaceutical activity, increasing diagnostic applications, and growing collaborations between research centers and medical institutions

- Hybrid mass spectrometry segment dominated the Europe mass spectrometry devices market with a market share of 42.8% in 2024, attributed to its advanced accuracy, versatility across multiple applications, and increasing adoption in pharmaceutical and clinical research

Report Scope and Europe Mass Spectrometry Devices Market Segmentation

|

Attributes |

Europe Mass Spectrometry Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Mass Spectrometry Devices Market Trends

Integration of Mass Spectrometry with AI and Data Analytics

- A significant and accelerating trend in the Europe mass spectrometry devices market is the integration of artificial intelligence (AI) and advanced data analytics, enabling faster, more accurate interpretation of complex datasets and supporting high-throughput research workflows

- For instance, Bruker introduced AI-enabled tools within its mass spectrometry platforms, enhancing data analysis speed in proteomics and metabolomics applications, reducing manual intervention, and improving diagnostic reliability across research and clinical settings

- AI-driven mass spectrometry solutions allow laboratories to identify molecular patterns, optimize workflows, and predict outcomes, thereby improving efficiency in pharmaceutical R&D and clinical diagnostics, and addressing the growing need for precision analysis in healthcare and biotechnology

- The adoption of AI-powered platforms is further enhancing the capability of mass spectrometry devices in identifying disease biomarkers, accelerating drug discovery pipelines, and strengthening applications in food safety and environmental testing across Europe

- This convergence of mass spectrometry with AI and big data analytics is fundamentally reshaping laboratory operations, setting new benchmarks for speed, precision, and scalability in research and diagnostics

- Consequently, companies such as Thermo Fisher Scientific and Waters Corporation are increasingly investing in AI-based analytical platforms to enhance the performance of mass spectrometry systems in European laboratories

Europe Mass Spectrometry Devices Market Dynamics

Driver

Growing Demand from Pharmaceutical and Biopharmaceutical Research

- The rising investments in pharmaceutical and biopharmaceutical R&D across Europe, coupled with the need for advanced analytical tools in drug discovery and development, are major drivers for the adoption of mass spectrometry devices

- For instance, in February 2024, Agilent Technologies announced new mass spectrometry solutions tailored for biopharma applications, helping European drug developers accelerate research timelines and enhance molecular characterization accuracy

- Mass spectrometry provides vital capabilities such as protein analysis, metabolomics, and pharmacokinetics, enabling researchers to improve efficiency and precision in drug development pipelines

- Furthermore, regulatory agencies in Europe increasingly emphasize detailed molecular profiling and quality testing, creating additional demand for mass spectrometry solutions in compliance-driven pharmaceutical environments

- The wide use of mass spectrometry across proteomics and metabolomics research makes it a cornerstone technology in Europe’s life sciences innovation landscape

- The expansion of partnerships between research institutions and pharmaceutical companies is further propelling demand for advanced mass spectrometry platforms in the region

Restraint/Challenge

High Costs and Complexity of Advanced Systems

- The relatively high acquisition and operational costs of mass spectrometry devices, particularly hybrid systems, pose a challenge to broader adoption, especially among smaller laboratories and academic institutions in Europe

- For instance, reports highlight that while large pharmaceutical companies are early adopters of advanced mass spectrometry, smaller research centers face financial barriers in procuring and maintaining these complex instruments

- The intricate operation and need for skilled personnel further limit accessibility, as specialized training and expertise are required to fully utilize mass spectrometry technologies in research and diagnostics

- In addition, the cost of consumables, service contracts, and software upgrades can add to the long-term financial burden, making adoption challenging for institutions with limited budgets

- While vendors are developing more user-friendly and affordable systems, the perception of high costs continues to hinder faster penetration across academic and smaller clinical settings

- Overcoming these challenges through cost-effective product innovations, increased automation, and training initiatives will be critical to expanding the mass spectrometry devices market in Europe

Europe Mass Spectrometry Devices Market Scope

The market is segmented on the basis of technology, application, and end-user.

- By Technology

On the basis of technology, the Europe mass spectrometry devices market is segmented into hybrid mass spectrometry, single mass spectrometry, and others. The hybrid mass spectrometry segment dominated the market with the largest revenue share of 42.8% in 2024, driven by its advanced capabilities combining multiple mass analyzers such as quadrupole-time of flight (Q-TOF) and ion trap technologies. These instruments are preferred in pharmaceutical and biotechnology research due to their high resolution, sensitivity, and ability to handle complex molecular structures. Hybrid systems are widely adopted in proteomics, metabolomics, and biomarker discovery applications, offering comprehensive insights critical for both drug discovery and diagnostics. Their versatility across research areas, combined with technological advancements and growing collaborations between academia and industry in Europe, further reinforce their leadership position.

The single mass spectrometry segment is anticipated to witness the fastest growth rate of 8.9% from 2025 to 2032, fueled by its affordability, simpler workflows, and expanding use in routine testing. Single MS devices are increasingly used in food safety testing, clinical diagnostics, and environmental monitoring, particularly among smaller laboratories and research centers with budget constraints. Their ease of operation and lower maintenance requirements make them attractive for institutions seeking cost-effective solutions without compromising analytical accuracy. The rising demand for accessible technologies in academic and medical laboratories across Europe is driving faster adoption of single MS systems.

- By Application

On the basis of application, the Europe mass spectrometry devices market is segmented into biotechnology, clinical research, diagnostics and environmental testing, drug discovery, metabolomics, pharmaceutical, proteomics, and others. The pharmaceutical segment dominated the market with the largest revenue share of 29.6% in 2024, driven by the expanding use of mass spectrometry in drug development, pharmacokinetics, and quality assurance. European pharmaceutical companies heavily rely on mass spectrometry for accurate molecular characterization, impurity analysis, and regulatory compliance testing. With growing R&D investments and demand for precision medicine, pharmaceutical applications remain the backbone of mass spectrometry usage across the region. The adoption is further accelerated by strict EU regulations requiring detailed analytical validation in drug approval processes, making mass spectrometry indispensable for industry players.

The clinical research segment is expected to witness the fastest growth rate of 9.4% from 2025 to 2032, driven by increasing applications in biomarker discovery, disease diagnostics, and personalized medicine. Mass spectrometry offers unparalleled sensitivity and specificity in detecting disease-related molecules, supporting early diagnosis and targeted therapies. European hospitals, medical institutions, and diagnostic labs are increasingly adopting mass spectrometry for cancer research, infectious disease detection, and metabolic disorder studies. The rising focus on translational research and integration of mass spectrometry in clinical workflows are fueling its rapid adoption in the clinical research domain.

- By End-User

On the basis of end-user, the Europe mass spectrometry devices market is segmented into institutes and research centers, medical, pharmaceutical and biopharmaceutical companies, suppliers and distributors of mass spectrometry system, and others. The pharmaceutical and biopharmaceutical companies segment dominated the market with the largest revenue share of 38.1% in 2024, driven by their extensive use of mass spectrometry in drug discovery, manufacturing, and quality assurance. The rising number of biopharmaceutical innovations, including monoclonal antibodies and cell and gene therapies, requires advanced analytical validation offered by mass spectrometry. Pharmaceutical giants in Germany, the U.K., and Switzerland are investing heavily in high-performance hybrid systems, reinforcing the segment’s leadership. Partnerships with academic institutions and CROs further expand its role as the primary end-user group.

The institutes and research centers segment is projected to witness the fastest growth rate of 10.2% from 2025 to 2032, supported by increasing public and private funding for life sciences research. Universities and government-backed labs across Europe are adopting mass spectrometry for fundamental studies in proteomics, metabolomics, and environmental sciences. The expansion of collaborative projects under EU research frameworks such as Horizon Europe is driving equipment adoption in academic research. With growing emphasis on scientific innovation, institutes and research centers are becoming critical growth drivers for mass spectrometry adoption in Europe.

Europe Mass Spectrometry Devices Market Regional Analysis

- Germany dominated the Europe mass spectrometry devices market with the largest revenue share of 29.6% in 2024, supported by its strong pharmaceutical industry, significant government research funding, and presence of leading life sciences companies and research institutions, with rapid adoption of hybrid mass spectrometry technologies for drug discovery and clinical research applications

- Laboratories and companies in the country increasingly rely on mass spectrometry for drug development, proteomics, metabolomics, and quality assurance, benefiting from advanced hybrid systems and growing collaborations between academia and industry

- This widespread adoption is further supported by the presence of leading analytical instrument manufacturers, a highly skilled scientific workforce, and strict EU regulatory frameworks that emphasize precise molecular characterization, establishing Germany as the leading hub for mass spectrometry adoption in Europe

The Germany Mass Spectrometry Devices Market Insight

The Germany mass spectrometry devices market captured the largest revenue share in Europe in 2024, supported by its robust pharmaceutical industry, strong research ecosystem, and high government funding for life sciences innovation. German laboratories and companies extensively use hybrid and single mass spectrometry systems for proteomics, drug discovery, and clinical diagnostics. The country’s emphasis on quality standards and strict EU regulatory compliance further strengthens its position as the regional leader. Germany’s collaborations between universities, research institutes, and international instrument manufacturers continue to fuel innovation and growth in the market.

U.K. Mass Spectrometry Devices Market Insight

The U.K. mass spectrometry devices market is anticipated to expand at a noteworthy CAGR during the forecast period, driven by the growing biopharma sector, strong clinical research activity, and rising demand for precision diagnostics. The adoption of mass spectrometry in the U.K. is further supported by government initiatives, research funding, and collaborations under Horizon Europe. Hospitals, CROs, and universities are increasingly relying on advanced hybrid systems for biomarker discovery, cancer research, and personalized medicine. With its well-developed healthcare and research infrastructure, the U.K. remains a major growth contributor in the European market.

France Mass Spectrometry Devices Market Insight

The France mass spectrometry devices market is expected to grow at a considerable CAGR during the forecast period, fueled by increasing applications in pharmaceutical research, food safety testing, and environmental monitoring. French laboratories are adopting mass spectrometry devices to support advancements in proteomics and clinical diagnostics, aligned with the government’s focus on healthcare innovation. Collaborations between public research institutions and global life sciences companies are accelerating technology adoption. France’s emphasis on regulatory compliance and sustainability also positions mass spectrometry as a key tool across its healthcare and food sectors.

Italy Mass Spectrometry Devices Market Insight

The Italy mass spectrometry devices market is gaining momentum due to rising demand in clinical diagnostics, pharmaceutical research, and food quality assurance. The country’s strong food and beverage sector, coupled with EU regulatory requirements, is driving adoption of single and hybrid mass spectrometry systems. Italian universities and research centers are increasingly investing in advanced instruments for proteomics and metabolomics research. The integration of mass spectrometry into healthcare and life sciences workflows, supported by government funding programs, is expected to significantly contribute to market growth in Italy during the forecast period.

Europe Mass Spectrometry Devices Market Share

The Europe Mass Spectrometry Devices industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Waters Corporation (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Bruker (Germany)

- Shimadzu Corporation (Japan)

- PerkinElmer (U.S.)

- JEOL Ltd. (Japan)

- LECO Corporation (U.S.)

- Hitachi High-Tech Corporation (Japan)

- Analytik Jena AG (Germany)

- IONICON Analytik GmbH (Austria)

- Markes International Ltd (U.K.)

- SepSolve Analytical Ltd (U.K.)

- CTC Analytics AG (Switzerland)

- Metrohm AG (Switzerland)

- Oxford Instruments plc (U.K.)

- Restek Corporation (U.S.)

- SCIEX (U.S.)

- BIOMÉRIEUX (France)

- ZeptoMetrix (U.S.)

What are the Recent Developments in Europe Mass Spectrometry Devices Market?

- In December 2024, Roche received CE mark approval for its cobas Mass Spec solution. Roche announced it had been granted CE marking in Europe for its cobas Mass Spec solution, including the cobas i 601 analyzer and the first Ionify reagent pack (for steroid hormones). This gives Roche a foothold in bringing fully automated, integrated and standardised clinical mass spectrometry workflows into routine labs. It also marks the start of a plan to offer a menu of over 60 analytes

- In February 2023, Roche announced plans to launch a fully automated mass spec-based clinical analyzer in 2024 in the EU. Roche Diagnostics revealed its development of a fully automated sample-to-answer mass spectrometry clinical analyzer designed for routine labs. The goal is to mimic the ease of use of traditional clinical chemistry analyzers, reducing complexity and skill requirements. Initially targeting EU markets, with subsequent roll-outs planned for the US and China

- In June 2022, Shimadzu introduced the iMScope QT imaging mass microscope in Europe. Shimadzu officially launched the iMScope QT in Europe an instrument that combines mass spectrometry with an optical microscope, bringing imaging and morphological information together with spectral data. This offers enhanced applications in R&D including pharmaceuticals, food/agriculture, and disease-tissue studies

- In May 2021, bioMérieux and Specific Diagnostics formed a co-exclusive distribution agreement for the REVEAL Rapid AST system in Europe. BioMérieux agreed to distribute the REVEAL Rapid AST system (a rapid antimicrobial susceptibility testing system) in Europe. The technology is metabolomics-based, offering results for bloodstream infections in around five hours directly from positive blood cultures. This provides complementary speed and diagnostic capability alongside existing methods including mass spectrometry-based identification systems

- In April 2021, bioMérieux’s VITEK® MS PRIME MALDI-TOF mass spectrometry system obtained CE-marking. BioMérieux announced the CE-marking of their new system VITEK MS PRIME, a next-generation MALDI-TOF instrument for microorganism identification. The system promises faster, more accurate identification in clinical microbiology, helping with antimicrobial stewardship by enabling quicker targeted therapy. It also has features such as “continuous load & go” and better prioritization management for urgent tests

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.