Europe Molecular Point Of Care Testing Using Naat Market

Market Size in USD Billion

CAGR :

%

USD

2.16 Billion

USD

4.91 Billion

2024

2032

USD

2.16 Billion

USD

4.91 Billion

2024

2032

| 2025 –2032 | |

| USD 2.16 Billion | |

| USD 4.91 Billion | |

|

|

|

|

Europe Molecular Point of Care Testing (using NAAT) Market Size

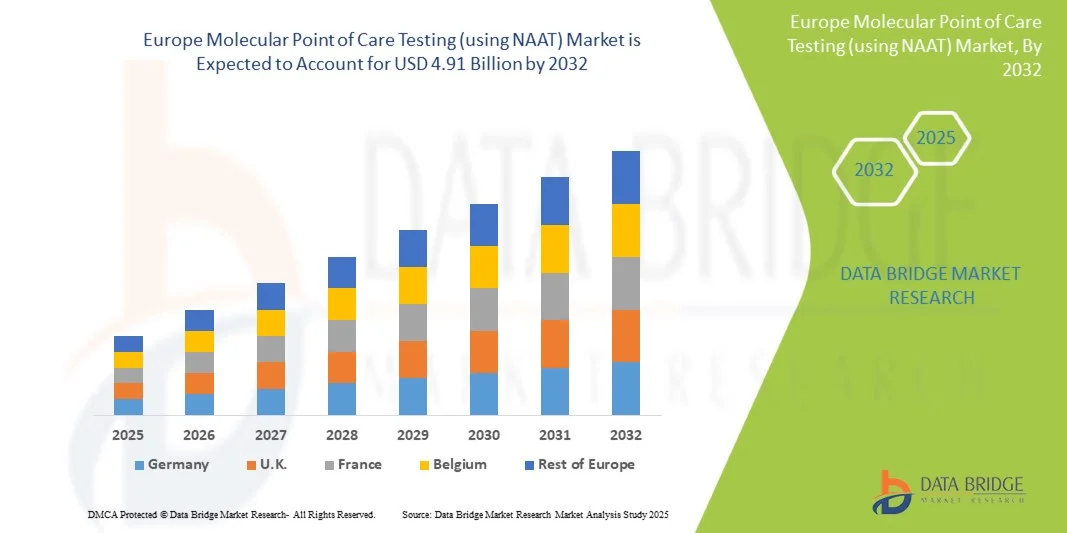

- The Europe molecular point of care testing (using NAAT) market size was valued at USD 2.16 billion in 2024 and is expected to reach USD 4.91 billion by 2032, at a CAGR of 10.8% during the forecast period

- The market growth is largely fueled by advancements in NAAT technologies, such as PCR and LAMP, and increasing demand for rapid, accurate diagnostic solutions across decentralized healthcare settings

- Furthermore, rising prevalence of infectious diseases, growing aging population, and regulatory approvals for NAAT-based point-of-care devices are driving adoption, making molecular point-of-care testing the preferred diagnostic choice in both clinical and non-clinical environments, thereby significantly boosting the industry's growth

Europe Molecular Point of Care Testing (using NAAT) Market Analysis

- Molecular point-of-care testing (POCT) using NAAT, providing rapid and highly accurate detection of infectious diseases, is increasingly becoming a vital component of modern healthcare systems in both clinical and decentralized settings due to its speed, reliability, and ease of integration with existing diagnostic workflows

- The rising adoption of NAAT-based POCT is primarily fueled by the increasing prevalence of infectious diseases, growing demand for rapid diagnostics, and a preference for decentralized testing outside traditional laboratory settings

- Germany dominated the Europe molecular POCT market with the largest revenue share of 35% in 2024, characterized by well-established healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players, with Germany experiencing substantial growth in adoption, driven by innovations from both established diagnostics companies and emerging biotech firms focusing on portable and automated NAAT devices

- France is expected to be the fastest-growing country in the Europe molecular POCT market during the forecast period, due to rising healthcare investments, increasing awareness of rapid diagnostics, and expansion of point-of-care facilities

- Respiratory infections segment dominated the Europe molecular POCT market with a market share of 42% in 2024, driven by the high demand for rapid testing during seasonal outbreaks and the proven efficacy of NAAT in detecting pathogens with high sensitivity and specificity

Report Scope and Europe Molecular Point of Care Testing (using NAAT) Market Segmentation

|

Attributes |

Europe Molecular Point of Care Testing (using NAAT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Molecular Point of Care Testing (using NAAT) Market Trends

Rapid and Accurate Diagnostics at the Point of Care

- A significant and accelerating trend in the European molecular POCT market is the increasing adoption of NAAT-based devices capable of delivering rapid and highly accurate diagnostics for infectious diseases, reducing reliance on centralized laboratories

- For instance, the Cepheid GeneXpert system provides results for respiratory infections within an hour, enabling timely clinical decisions and improved patient management

- Integration of NAAT devices with digital health platforms allows real-time result reporting, remote monitoring, and data analytics to track infection trends and optimize treatment strategies, improving workflow efficiency in hospitals and clinics

- The adoption of portable and automated NAAT devices facilitates decentralized testing in clinics, pharmacies, and emergency care units, making diagnostics accessible even in remote or resource-limited settings

- This trend towards faster, accurate, and connected molecular diagnostics is reshaping expectations for clinical testing speed and reliability, with companies such as Qiagen developing automated NAAT platforms with cloud-based reporting and multiplex testing capabilities

- The demand for highly sensitive, rapid, and connected molecular POCT solutions is growing across hospitals, clinics, and emergency care facilities as healthcare providers prioritize timely diagnosis and patient-centric care

Europe Molecular Point of Care Testing (using NAAT) Market Dynamics

Driver

Increasing Infectious Disease Burden and Demand for Decentralized Testing

- The rising prevalence of infectious diseases such as respiratory infections, STIs, and gastrointestinal pathogens, coupled with the need for decentralized diagnostic capabilities, is a key driver of NAAT-based molecular POCT adoption

- For instance, in March 2024, Roche launched a rapid NAAT platform for influenza and RSV detection in outpatient clinics, aiming to improve testing access and turnaround times

- Healthcare providers are increasingly seeking rapid, sensitive, and easy-to-use diagnostic tools that can deliver actionable results at the point of care, reducing delays associated with centralized laboratory testing

- Furthermore, the growth of outpatient care, urgent care clinics, and home healthcare services is increasing demand for portable, user-friendly NAAT devices that can be deployed in diverse healthcare settings

- The ability to quickly detect pathogens, track infection patterns, and integrate test results with electronic health records supports efficient patient management and disease surveillance, driving the adoption of molecular POCT across hospitals and clinics

Restraint/Challenge

High Device Costs and Regulatory Compliance Hurdles

- The high initial costs of NAAT-based molecular POCT systems, coupled with recurring expenses for cartridges and maintenance, pose a significant challenge to wider adoption, especially in smaller clinics or resource-constrained settings

- For instance, cost considerations have limited the deployment of some Cepheid and Thermo Fisher automated NAAT platforms in smaller outpatient facilities despite their clinical benefits

- Compliance with stringent European regulatory standards, including CE marking and ISO certifications, adds complexity and can delay market entry for new molecular POCT devices, creating hurdles for manufacturers

- In addition, the need for trained personnel to operate some NAAT platforms and ensure quality control may restrict adoption in decentralized or point-of-care settings

- Overcoming these challenges through cost reduction, simplified device operation, and streamlined regulatory approvals is essential for sustained market growth and broader adoption of molecular POCT across Europe

Europe Molecular Point of Care Testing (using NAAT) Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Product

On the basis of product, the Europe molecular POCT market is segmented into Instruments and Consumables & Reagents. The Instruments segment dominated the market with the largest revenue share of 54.3% in 2024, driven by the high demand for automated and portable NAAT devices that deliver rapid, accurate diagnostics. Hospitals and laboratories prefer investing in advanced instruments due to their ability to perform multiplex testing and reduce turnaround time, improving patient management. The compatibility of these instruments with digital health platforms and cloud reporting systems further boosts their adoption. The robustness, reliability, and brand reputation of key instrument manufacturers also enhance customer confidence, supporting market dominance. Routine screening and outbreak management in respiratory infections and STIs rely heavily on these instruments for efficient workflow. Increasing investments by governments and private healthcare providers in advanced diagnostic instruments also contribute to sustained growth.

The Consumables & Reagents segment is expected to witness the fastest growth rate of 12.5% from 2025 to 2032, fueled by recurring demand for NAAT cartridges, test kits, and reagents required for continuous diagnostic testing. Consumables are essential for daily operations in clinics, hospitals, and ambulatory care centers, ensuring consistent testing capacity. Their growth is further driven by the rising number of decentralized testing facilities and adoption of portable NAAT platforms. Manufacturers are innovating to provide user-friendly and ready-to-use reagents, reducing procedural errors. Increasing disease surveillance and seasonal testing cycles for infections further drive demand. Cost-effectiveness, shorter shelf life, and frequent replenishment create recurring revenue opportunities for suppliers, supporting rapid growth.

- By Indication

On the basis of indication, the market is segmented into Respiratory Infections Testing, Sexually Transmitted Infection (STI) Testing, Gastrointestinal Tract Infections Testing, and Others. The Respiratory Infections Testing segment dominated the market with a revenue share of 42% in 2024, driven by high prevalence of influenza, RSV, and COVID-19, necessitating rapid diagnosis. Healthcare providers prioritize NAAT-based testing due to high sensitivity and specificity, ensuring accurate patient management. Outbreak surveillance in hospitals and public health settings further increases adoption. Point-of-care NAAT devices provide quick turnaround, critical in emergency and ICU settings. Seasonal demand fluctuations create recurring testing cycles, reinforcing market dominance. Government-supported testing initiatives during epidemics further support the segment’s leadership.

The STI Testing segment is expected to witness the fastest growth rate of 13.1% from 2025 to 2032, fueled by rising awareness, increased screening programs, and the adoption of discreet point-of-care diagnostics. Rapid NAAT testing for chlamydia, gonorrhea, and syphilis improves patient compliance and reduces the need for follow-up visits. Growing prevalence among young adults and targeted community health programs drive demand. Innovative self-collection kits and integration with telehealth platforms enhance accessibility. Rising investments in sexual health clinics and mobile testing units accelerate growth. Continuous innovation in multiplex STI panels also boosts market expansion.

- By End User

On the basis of end user, the market is segmented into Laboratories, Hospitals, Clinics, Ambulatory Centers, Homecare, Assisted Living Facilities, and Others. The Hospitals segment dominated the market with a revenue share of 48.2% in 2024, due to high patient footfall and demand for rapid diagnostics in emergency, ICU, and outpatient departments. Hospitals require NAAT-based instruments and consumables for timely treatment decisions and infection control. Integration with hospital information systems and electronic medical records enhances efficiency. Large-scale procurement by hospitals ensures consistent demand, while clinical expertise supports adoption. Seasonal outbreaks of respiratory infections and pandemic preparedness initiatives further increase testing volumes. Hospitals also benefit from vendor-supported training and maintenance contracts, reinforcing market dominance.

The Homecare segment is expected to witness the fastest growth rate of 14.2% from 2025 to 2032, driven by rising demand for at-home NAAT-based testing kits, remote monitoring, and patient-centric care models. The convenience of self-testing and telehealth integration appeals to chronic disease patients and elderly populations. Increasing awareness and adoption of OTC testing for STIs and respiratory infections enhance market penetration. Rising investments in home healthcare infrastructure and logistics support the expansion of this segment. Innovations in compact, easy-to-use devices and rapid result interpretation facilitate adoption. Homecare testing also reduces burden on hospitals and clinics, supporting overall market growth.

- By Mode of Testing

On the basis of mode of testing, the market is segmented into Prescription-Based Testing and OTC Testing. The Prescription-Based Testing segment dominated the market with a revenue share of 62.7% in 2024, as clinical oversight ensures accurate diagnosis, proper reporting, and treatment follow-up. Hospitals, laboratories, and clinics rely on physician-guided NAAT testing for respiratory infections, STIs, and gastrointestinal pathogens. Prescription-based testing enables insurance reimbursement and regulatory compliance. It also ensures professional handling of samples and integration with patient records. The critical nature of rapid and reliable diagnostics in acute care settings reinforces its market dominance. Established diagnostic protocols favor prescription-guided testing over self-administered approaches.

The OTC Testing segment is expected to witness the fastest growth rate of 15.3% from 2025 to 2032, fueled by the increasing availability of at-home NAAT kits for STIs and respiratory infections. Convenience, privacy, and immediate access to results drive adoption among patients. Integration with mobile apps and telehealth services enhances usability and patient engagement. Rising public awareness campaigns and direct-to-consumer marketing accelerate penetration. Technological improvements in test accuracy and ease of use support rapid growth. OTC testing also aligns with preventive healthcare trends and decentralized care initiatives.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hospital Pharmacy, Retail Pharmacy, and Online Pharmacy. The Hospital Pharmacy segment dominated the market with a revenue share of 51.9% in 2024, due to direct supply to hospitals, ensuring timely availability of NAAT instruments, cartridges, and reagents. Hospitals prefer in-house procurement to maintain inventory for continuous patient care. Strategic partnerships between suppliers and hospital networks reinforce distribution efficiency. Bulk purchases and long-term contracts create stable demand. Integration with hospital supply chain management systems enhances operational efficiency. Hospital pharmacies also provide training and maintenance support for molecular POCT systems, further strengthening adoption.

The Online Pharmacy segment is expected to witness the fastest growth rate of 16.4% from 2025 to 2032, fueled by increasing e-commerce penetration, direct-to-consumer sales of at-home NAAT kits, and growing acceptance of online healthcare services. Consumers increasingly prefer convenient, home-delivered testing solutions. Integration with mobile apps and telehealth platforms allows easy ordering and result interpretation. Online pharmacies reduce logistical constraints in remote or underserved regions. Marketing campaigns and subscription-based supply models support rapid growth. Expansion of e-health initiatives by governments and private players further accelerates adoption.

Europe Molecular Point of Care Testing (using NAAT) Market Regional Analysis

- Germany dominated the Europe molecular POCT market with the largest revenue share of 35% in 2024, characterized by well-established healthcare infrastructure, high healthcare expenditure, and a strong presence of key industry players

- Healthcare providers in Germany highly value the accuracy, speed, and reliability offered by NAAT-based point-of-care testing for infectious diseases such as respiratory infections, STIs, and gastrointestinal pathogens

- This widespread adoption is further supported by government initiatives promoting early disease detection, increasing awareness of rapid diagnostics, and the presence of key industry players developing automated and portable NAAT devices, establishing molecular POCT as a preferred diagnostic solution for hospitals, clinics, and laboratories across the country

France Europe Molecular Point of Care Testing (using NAAT) Market Insight

The France molecular POCT market is expected to witness the fastest growth during the forecast period, driven by rising awareness of rapid diagnostics and increasing demand for decentralized testing in hospitals, clinics, and outpatient facilities. The country is experiencing a surge in adoption of NAAT-based testing for respiratory infections, STIs, and gastrointestinal diseases. French healthcare policies supporting early detection, telemedicine integration, and community health programs are fostering market growth. Portable and user-friendly NAAT devices are gaining traction, enabling faster testing in outpatient and homecare settings. Rising investments in healthcare infrastructure, combined with patient-centric care models, are accelerating adoption. In addition, continuous product innovation by key players and the availability of multiplex testing solutions further drive the market’s rapid expansion.

U.K. Europe Molecular Point of Care Testing (using NAAT) Market Insight

The U.K. molecular POCT market is experiencing steady growth due to increasing demand for rapid diagnostics in hospitals, clinics, and diagnostic centers. Adoption of NAAT-based testing is driven by the high prevalence of respiratory infections and sexually transmitted infections, along with government initiatives supporting early detection and preventive healthcare. Healthcare providers are increasingly investing in automated and portable NAAT platforms to reduce turnaround time and improve patient management. Integration with telehealth services and electronic health records further enhances efficiency and accessibility. Rising awareness among patients and clinicians regarding point-of-care testing benefits is supporting market expansion. In addition, U.K.-based diagnostic companies are developing innovative solutions, reinforcing the adoption of molecular POCT.

Italy Europe Molecular Point of Care Testing (using NAAT) Market Insight

The Italy molecular POCT market is anticipated to grow at a considerable CAGR during the forecast period, driven by increasing investments in healthcare infrastructure and the modernization of diagnostic facilities. Hospitals, clinics, and assisted living centers are increasingly adopting NAAT platforms for rapid detection of infectious diseases. The integration of automated and portable devices with hospital information systems and real-time reporting is enhancing operational efficiency. Rising awareness among healthcare professionals regarding the benefits of point-of-care testing supports adoption. Government programs promoting preventive healthcare and disease surveillance further accelerate growth. Continuous product innovation and partnerships with international diagnostics companies are also contributing to market expansion.

Europe Molecular Point of Care Testing (using NAAT) Market Share

The Europe Molecular Point of Care Testing (using NAAT) industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Cepheid (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BIOMÉRIEUX (France)

- QIAGEN (Netherlands)

- BD (U.S.)

- Hologic, Inc. (U.S.)

- PerkinElmer (U.S.)

- QuidelOrtho Corporation (U.S.)

- GenMark Diagnostics, Inc. (U.S.)

- Seegene, Inc. (South Korea)

- Cue Health Inc. (U.S.)

- Novacyt (U.K.)

- Molbio Diagnostics Limited (India)

- Randox Laboratories Ltd (U.K.)

- Oxford Nanopore Technologies Ltd (U.K.)

- Binx Health, Inc. (U.S.)

- SD Biosensor, INC. (South Korea)

- Bio-Rad Laboratories, Inc. (U.S.)

What are the Recent Developments in Europe Molecular Point of Care Testing (using NAAT) Market?

- In March 2025, the European Health and Digital Executive Agency (HaDEA) published a call for tenders under the EU4Health program. The purpose is to speed up the development of a rapid point-of-care (POC) antimicrobial susceptibility testing (AST) diagnostic medical device. The call aims for a device that can provide AST results on bacteria or fungi in one hour or less from sample collection, which would be a significant development in combating antimicrobial resistance directly at the point of care

- In January 2025, Novus Diagnostics, a company developing a rapid point-of-care diagnostic platform, announced that it had received €4.6 million in equity financing. This funding will be used to accelerate the development of their technology, including a 15-minute point-of-care sepsis test. This news highlights the continued investment and innovation in the European POCT space

- In July 2024, Roche announced the completion of its acquisition of LumiraDx's innovative Point of Care technology. This acquisition is significant as it allows Roche to expand its diagnostics portfolio, especially in decentralized healthcare settings. The integration of LumiraDx's platform is expected to lead to faster and more affordable testing across multiple disease areas

- In April 2023, bioMérieux announced a strategic partnership with Oxford Nanopore Technologies to explore opportunities to bring nanopore sequencing to the infectious disease diagnostics market. This collaboration aims to leverage nanopore technology for rapid and cost-effective characterization of pathogens, representing a major trend towards more advanced molecular diagnostic tools

- In October 2021, Hologic launched its fully automated and on-demand molecular diagnostic platform, Novodiag, across Europe. This launch followed its earlier acquisition of Mobidiag and significantly expanded Hologic's presence in the European diagnostics market. The Novodiag platform provides rapid, high-quality results for infectious diseases and antimicrobial resistance directly at the point of care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.