Europe Natural Vitamins Market

Market Size in USD Billion

CAGR :

%

USD

2.05 Billion

USD

3.40 Billion

2024

2032

USD

2.05 Billion

USD

3.40 Billion

2024

2032

| 2025 –2032 | |

| USD 2.05 Billion | |

| USD 3.40 Billion | |

|

|

|

|

Natural Vitamins Market Size

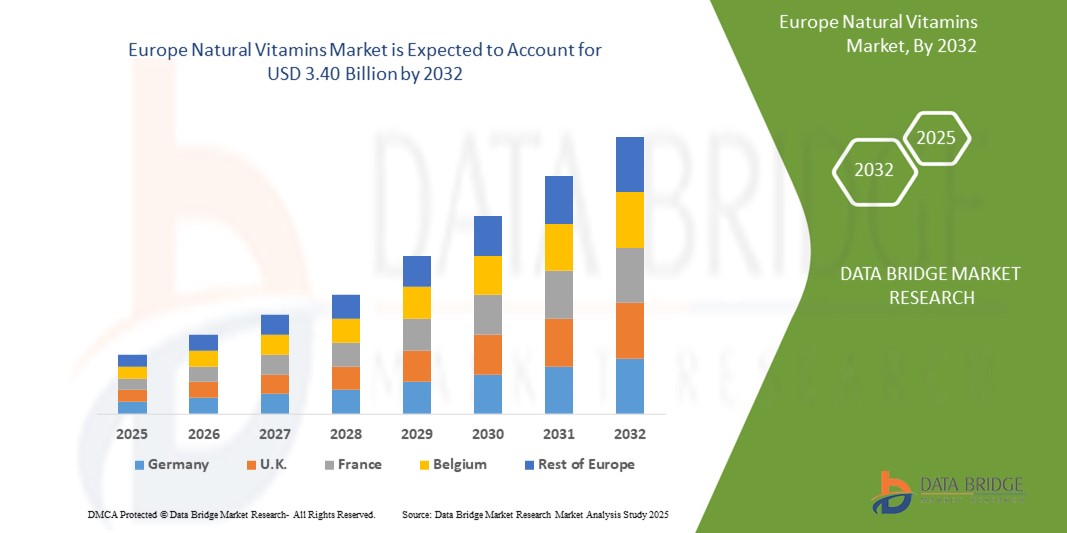

- The Europe natural vitamins market size was valued at USD 2.05 billion in 2024 and is expected to reach USD 3.40 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of health and wellness, growing demand for natural and organic products, and advancements in food fortification technologies

- Rising preferences for clean-label products and sustainable sourcing of vitamins are further propelling the adoption of natural vitamins across various applications, significantly boosting industry growth

Natural Vitamins Market Analysis

- Natural vitamins, derived from plant and animal sources, are essential components in promoting health and wellness across food & beverages, personal care, and feed applications due to their high bioavailability and consumer preference for non-synthetic alternatives

- The surge in demand for natural vitamins is fueled by growing health consciousness, increasing prevalence of vitamin deficiencies, and a shift toward preventive healthcare among European consumers

- The U.K. dominated the natural vitamins market with the largest revenue share of 38.5% in 2024, driven by high consumer awareness, a robust health and wellness industry, and the presence of leading market players. The U.K. market is further supported by widespread adoption in functional foods and dietary supplements

- Germany is expected to be the fastest-growing country in the natural vitamins market during the forecast period due to rising demand for organic products, increasing disposable incomes, and government initiatives promoting healthy lifestyles

- The Vitamin C segment dominated the largest market revenue share of 32.5% in 2024, driven by its widespread use in dietary supplements and fortified foods due to its immune-boosting properties and high consumer awareness

Report Scope and Natural Vitamins Market Segmentation

|

Attributes |

Natural Vitamins Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Natural Vitamins Market Trends

“Increasing Demand for Vitamin D and Personalized Nutrition”

- The Europe natural vitamins market is experiencing a significant trend toward increased demand for Vitamin D, driven by rising awareness of its role in immune health, bone strength, and overall wellness, particularly in regions with limited sunlight exposure

- Personalized nutrition is gaining traction, with consumers seeking tailored vitamin supplements based on individual health needs, supported by advancements in genetic testing and wearable technology for customized nutrient recommendations

- AI and data analytics are being integrated into the natural vitamins market to analyze consumer health data, enabling companies to offer personalized supplement formulations and targeted health solutions

- For instance, companies are developing platforms that use consumer health profiles to recommend specific vitamin blends, optimizing dosage and delivery for maximum efficacy.

- This trend is enhancing the appeal of natural vitamins, making them more relevant to health-conscious consumers and driving demand in both individual and clinical settings

- Natural vitamin formulations are increasingly focusing on clean-label, plant-based, and organic ingredients to align with consumer preferences for sustainable and transparent products

Natural Vitamins Market Dynamics

Driver

“Rising Health Consciousness and Demand for Natural and Organic Products”

- Growing consumer awareness of health and wellness, coupled with a preference for natural and organic products, is a major driver for the Europe natural vitamins market

- Natural vitamins, sourced from plant and animal-based ingredients, are perceived as safer and more sustainable, boosting their adoption in food & beverages, personal care products, and dietary supplements

- Government initiatives promoting fortified foods and increased consumption of nutrient-rich diets, particularly in countries like the U.K., are further propelling market growth

- The rise of vegan and vegetarian lifestyles in Europe is increasing demand for natural vitamins, such as Vitamin D and B12, to address dietary deficiencies

- Advancements in e-commerce and digital marketing are enabling broader access to natural vitamin products, with online distribution channels facilitating convenient purchasing and personalized offerings

Restraint/Challenge

“High Production Costs and Regulatory Complexity”

- The high cost of sourcing natural ingredients and manufacturing natural vitamins, compared to synthetic alternatives, poses a significant barrier to market growth, particularly for small and medium-sized enterprises

- The complex and fragmented regulatory landscape across Europe, governed by the European Food Safety Authority (EFSA), imposes stringent requirements on labeling, health claims, and safety, increasing compliance costs for manufacturers

- Data privacy concerns related to personalized nutrition platforms, which collect consumer health data, raise challenges regarding compliance with GDPR and other regional regulations

- Limited availability of raw materials from natural sources, such as plants and fruits, can lead to supply chain disruptions and higher production costs, impacting market scalability

- These factors may deter price-sensitive consumers and limit market expansion in certain regions, particularly where regulatory scrutiny or cost concerns are high

Natural Vitamins market Scope

The market is segmented on the basis of ingredient type, form, application, material, and distribution channel.

- By Ingredient Type

On the basis of ingredient type, the Europe natural vitamins market is segmented into Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, and Vitamin K. The Vitamin C segment dominated the largest market revenue share of 32.5% in 2024, driven by its widespread use in dietary supplements and fortified foods due to its immune-boosting properties and high consumer awareness.

The Vitamin D segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of its role in bone health and immunity, particularly in regions with limited sunlight exposure. Rising demand for fortified food products and supplements in the Europe further accelerates adoption.

- By Form

On the basis of form, the Europe natural vitamins market is segmented into powder and liquid. The powder segment is expected to hold the largest market revenue share of 68.5% in 2024, primarily due to its longer shelf life, ease of storage, and versatility in applications such as food fortification and dietary supplements.

The liquid segment is anticipated to witness the fastest growth rate of 8.2% from 2025 to 2032, driven by increasing consumer preference for convenient, easy-to-consume formats like syrups and gummies, particularly among children and the elderly.

- By Application

On the basis of application, the Europe natural vitamins market is segmented into food & beverages, feed, personal care products, and others. The food & beverages segment is expected to hold the largest market revenue share of 45.5% in 2024, driven by the rising demand for fortified foods and functional beverages to address nutritional deficiencies across the region.

The personal care products segment is anticipated to experience robust growth from 2025 to 2032. Increasing consumer interest in natural and organic skincare and haircare products, incorporating vitamins like E and C for their antioxidant properties, is boosting adoption in the Europe.

- By Material

On the basis of material, the Europe natural vitamins market is segmented into steel, iron, and other materials. The steel segment is expected to hold the largest market revenue share of 55.5% in 2024, owing to its widespread use in packaging and processing equipment for natural vitamins, ensuring durability and compliance with food safety standards.

The other materials segment is anticipated to witness significant growth from 2025 to 2032, driven by the increasing adoption of sustainable and eco-friendly packaging materials, such as biodegradable plastics and glass, aligning with consumer preferences for environmentally responsible products.

- By Distribution Channel

On the basis of distribution channel, the Europe natural vitamins market is segmented into online and offline. The offline segment dominated the market revenue share of 70.5% in 2024, driven by the widespread presence of supermarkets, pharmacies, and specialty stores, particularly in South Africa, where consumers prefer purchasing nutritional products in-store for convenience and trust.

The online segment is expected to witness rapid growth of 10.5% from 2025 to 2032, fueled by the increasing penetration of e-commerce platforms and digital retail in the U.A.E., where rising disposable incomes and smartphone usage enhance accessibility to natural vitamin products

Natural Vitamins Market Regional Analysis

- The U.K. dominated the natural vitamins market with the largest revenue share of 38.5% in 2024, driven by high consumer awareness, a robust health and wellness industry, and the presence of leading market players. The U.K. market is further supported by widespread adoption in functional foods and dietary supplements

- Germany is expected to be the fastest-growing country in the natural vitamins market during the forecast period due to rising demand for organic products, increasing disposable incomes, and government initiatives promoting healthy lifestyles

U.K. Natural Vitamins Market Insight

The U.K. dominated the Europe natural vitamins market with the highest revenue share of 88.9% in 2024, fueled by robust consumer demand for natural health supplements and growing awareness of preventive healthcare benefits. The trend toward clean-label products and increasing regulations promoting high-quality standards further boost market expansion. The incorporation of natural vitamins in fortified foods and personal care products complements online and offline sales, creating a diverse market ecosystem.

Germany Natural Vitamins Market Insight

Germany is expected to witness the fastest growth rate in the Europe natural vitamins market, attributed to its advanced health and wellness industry and high consumer focus on sustainable and natural products. German consumers prefer innovative vitamin formulations that support immunity, skin health, and energy efficiency. The integration of natural vitamins in premium functional foods and cosmetics, along with strong aftermarket demand, supports sustained market growth.

Natural Vitamins Market Share

The natural vitamins industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- DSM Nutritional Products (Netherlands)

- Archer Daniels Midland Company (U.S.)

- Glanbia Plc (Ireland)

- Nature’s Bounty (U.S.)

- Amway (U.S.)

- Nestlé Health Science (Switzerland)

- Herbalife Nutrition (U.S.)

- Vitabiotics Ltd. (U.K.)

- Solgar Inc. (U.S.)

- NOW Foods (U.S.)

- Blackmores Limited (Australia)

- NutraMarks, Inc. (U.S.)

- Pharmavite LLC (U.S.)

- Himalaya Wellness (India)

- Zand Herbal (U.S.)

What are the Recent Developments in Europe Natural Vitamins Market?

- In November 2024, Nestlé Health Science launched a new range of Garden of Life probiotics in the U.K. and Ireland, marking a major expansion of its natural supplement portfolio. For the first time, these microbiome supplements became available in over 600 Holland & Barrett stores and online, significantly boosting the brand’s visibility in the region. The range includes high-potency, one-capsule-a-day formulas tailored for men, women, prenatal care, and mood support, with up to 50 billion CFU and 15 live bacteria strains per serving. This move reinforces Nestlé’s commitment to natural, science-backed wellness solutions in the European market

- In April 2024, Nutriearth, a specialist in natural vitamin D3, launched two innovative products at Vitafoods Europe 2025: N-utra, a vitamin D3-rich mealworm flour, and N-oil, a highly bioavailable vitamin D3 oil. N-utra received novel food approval from the European Commission in early 2025, marking a significant milestone for insect-based nutrition. Both products are designed to meet rising demand for sustainable, natural vitamin sources. To support this growth, Nutriearth expanded its production capacity by establishing two new cleanrooms in Lille, France, enabling large-scale output while maintaining pharmaceutical-grade hygiene standards

- In September 2023, Cosmos Holdings, Inc., operating as Cosmos Health, entered into an exclusive distribution agreement with Mediprovita GbR to bring its Sky Premium Life nutraceuticals to the German market. This partnership marked a strategic expansion of Cosmos Health’s European footprint, targeting the region’s growing demand for natural vitamins and supplements. Mediprovita, with over 30 years of experience in consumer product logistics and e-commerce, began distributing an initial 20 SKUs via Amazon, eBay, and its own platform, with plans to scale up to 70 SKUs. The collaboration leverages Mediprovita’s strong market presence to reach health-conscious consumers across Germany and Austria

- In July 2023, STADA Arzneimittel AG significantly expanded its European Consumer Healthcare portfolio by acquiring a range of well-established brands from Sanofi across countries including Belgium, Germany, Hungary, Spain, the UK, and the Nordic region. The acquisition included products such as Antistax, Lomudal, Omnivit, and Opticrom, strengthening STADA’s presence in the natural vitamins, supplements, and allergy care segments. This move supports STADA’s strategy to become a top-four player in Europe’s consumer healthcare market, leveraging its extensive sales and distribution network to grow these trusted brands

- In November 2022, Royal DSM completed its acquisition of AVA, a Boston-based personalized nutrition platform that leverages AI-driven analytics to deliver tailored nutrition and coaching recommendations across diverse health and wellness segments. This move reinforced DSM’s strategy to lead in personalized nutrition, combining AVA’s digital capabilities with DSM’s science-backed nutritional products. The acquisition supports DSM’s expansion in the European natural vitamins and supplements market, aligning with rising consumer demand for data-driven, individualized health solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Natural Vitamins Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Natural Vitamins Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Natural Vitamins Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.