Market Analysis and Insights

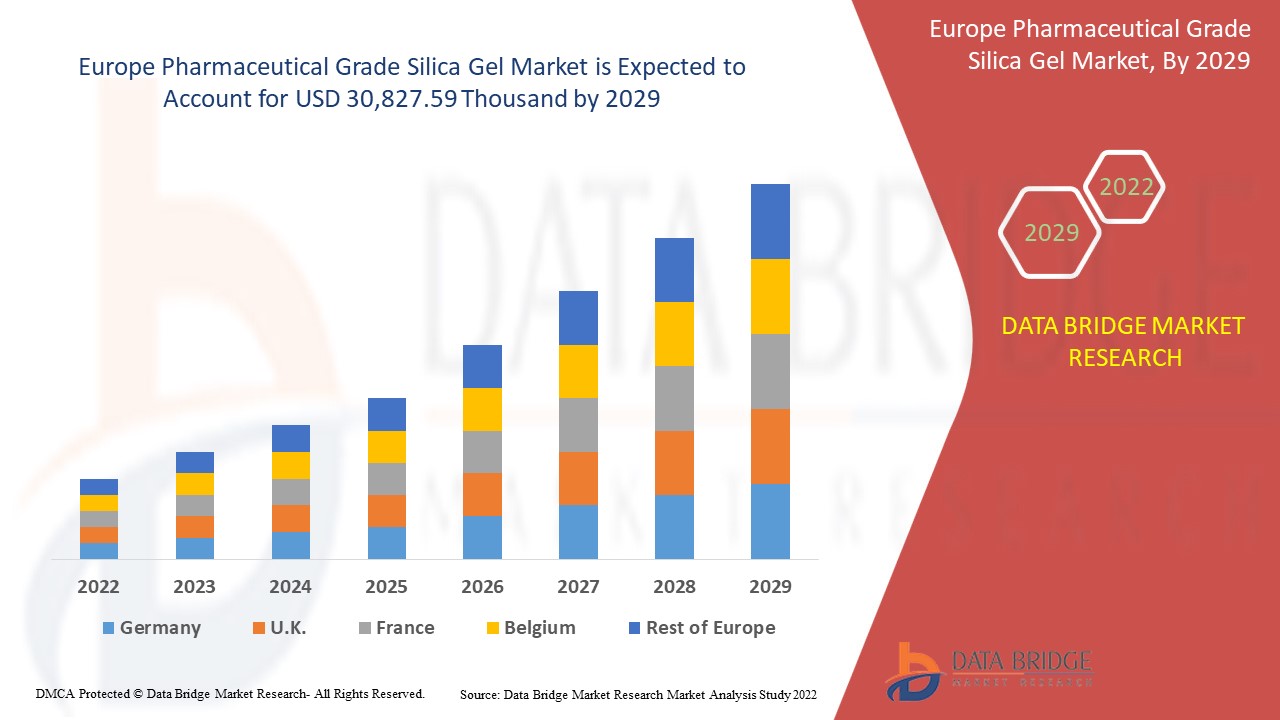

Europe pharmaceutical grade silica gel market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 2.8% in the forecast period of 2022 to 2029 and is expected to reach USD 30,827.59 thousand by 2029. The major factor driving the growth of the pharmaceutical grade silica gel market are growing demand for medicinal drugs, extensive deployment or R&D in the pharma sector, and rising spending on biotechnology using chromatography for detecting molecular components.

Silica gel as a stationary phase is largely accepted as one of the top adsorbents used in column chromatography as well as other separation techniques. One of the major advantages is its tremendous affinity for adsorption. Additionally, it is commercially very readily available in several different sizes and types. The major significant reason for silica gel used as a stationary phase in column chromatography is that it has feasible to obtain the extract essential size of the particle size for a particular method.

Silica gel is a polar adsorbent that is slightly acidic and has a strong capacity to adsorb the basic substance. The silica gel is most widely used in reversed-phase partition chromatography and it has broad applications that consist of the separation of steroids, amino acids, lipids, alkaloids, and several pharmaceutical processes.

Europe pharmaceutical grade silica gel market report provides details of market share, new developments, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

By Type (Liquid And Solid), Gel Breads Type (White Silica Gel Breads, Orange Silica Gel Breads, and Blue Silica Gel Breads), Form (Colorants, Lubricants & Glidants, Binders, Disintegrants, Flavoring Agents, Capsules, Solvents, Coatings, Preservatives, Fillers & Diluents, Suspension, Viscosity Agents And Others), Packaging Type (Canisters, Pouches, Sachets, Packets, Containers, Bottles, and Others), Chromatography (Analytical Chromatography, Preparative Chromatography, Process Chromatography, and Gravity Chromatography) |

|

Countries Covered |

Germany, U.K., France, Italy, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe. |

|

Market Players Covered |

BASF SE, DuPont, Solvay, Merck KGAA, W. R. Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical |

Pharmaceutical Grade Silica Gel Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growing Demand for Medicinal Drugs

The growing pharmaceutical industry has propelled the growth of drug production, which has increased the consumption of silica gel over the years. The demand for silica gel is expected to increase further as chromatography can be performed using silica gel. Silica gel column chromatography is widely used in the pharmaceutical industry to collect or separate different drug components.

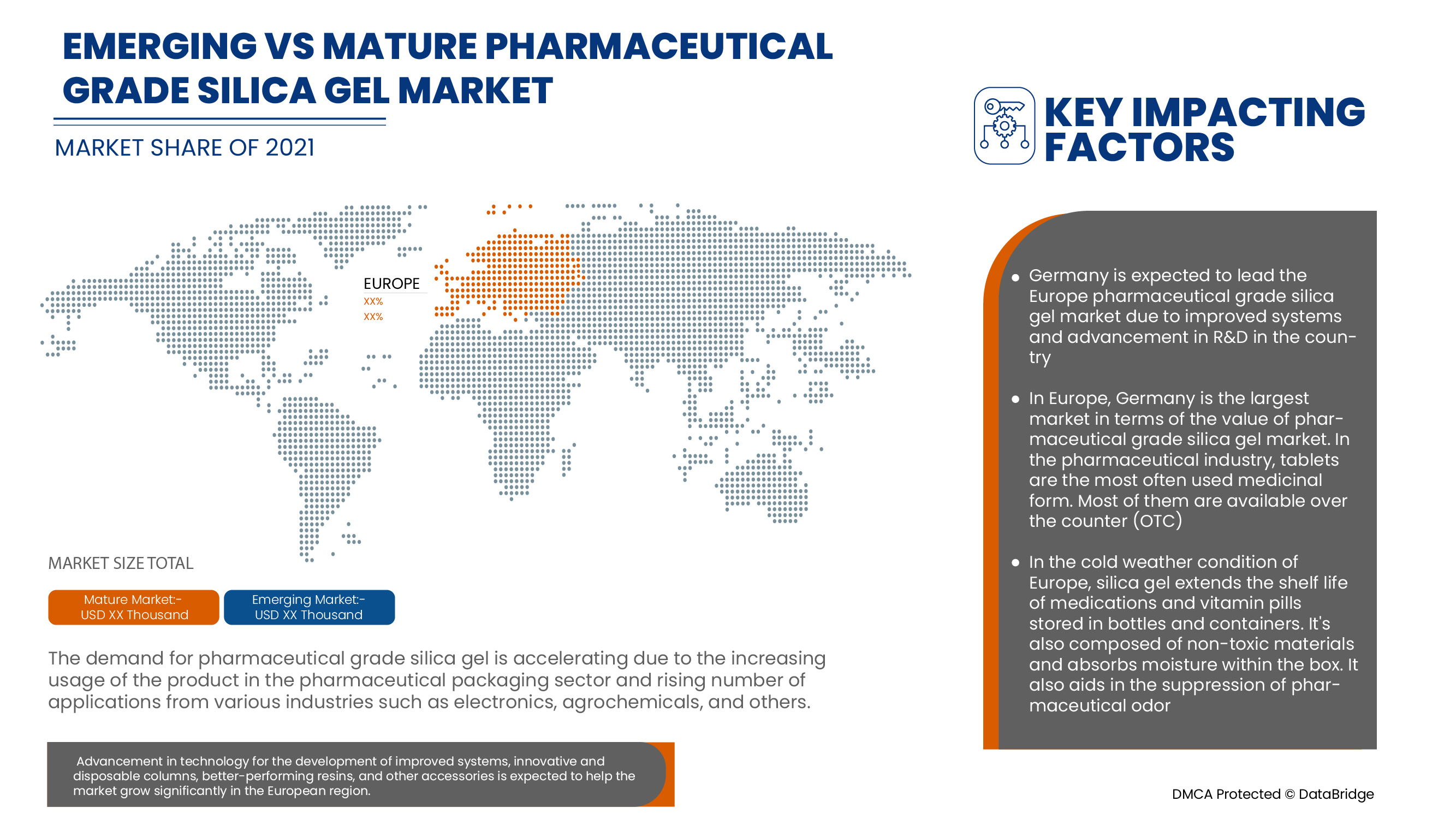

- Extensive Deployment of R&D in the Pharma Sector

The growing need for data integrity and automation has led to the integration of sophisticated software with contemporary chromatography systems. These advances in technology for the development of improved systems, innovative and disposable columns, better-performing resins, and other accessories may help the market to grow significantly.

- Rising Spending on Biotechnology using Chromatography for Detecting Molecular Components

Bioencapsulation involves the envelopment of tissues or biologically active substances in a semipermeable membrane to protect the enclosed biological structures such as cells, enzymes, drugs, and magnetic materials among others. The continuous research and development of silica gel based techniques like chromatography from the biotech end will lead to the growth of the Europe pharmaceutical grade silica gel market.

Opportunities

- Lucrative Outlook Towards In-House R&D

Chromatography is a continuously evolving technique and an increase in the demand for chromatography instruments and reagents for research and development is a major factor driving the growth and demand for the Europe pharmaceutical grade silica gel market.

- Easy Availability of Raw Materials through Well-Established Strategic Partners

The amorphous form of silicon dioxide is used to manufacture pharmaceutical-based silica gel. The enormous availability of different raw materials on the earth’s surface as well the ability to synthetically produce these raw materials along with the companies’ producing pharmaceutical grade silica gel well-established partnerships with various suppliers and partners, which continuously supply high-grade raw materials to these players for the production of silica gel.

Restraints/Challenges

- Stringent Regulations by the Government

USP's drug standards are enforceable in the U.S. by the Food and Drug Administration (FDA) and are also used in more than 140 countries across the globe. In the Pharmacy Act 1948 of India, there are various stringent regulations regarding the composition of drugs, which requires the pharmacists/chemists to follow various procedures and screening to get approved by the government. These stringent rules and regulations might be one of the biggest restraints faced by the Europe pharmaceutical-grade silica gel market.

- The Availability of Substitutes

Free silanols on the surface of silica are responsible for detrimental interactions of those compounds and the stationary phase. These show bad peak shape and low efficiency. This has also inclined manufacturers to opt for substitutes present in the market. For these reasons, several new stationary phases such as non-silica stationary phases, which have reduced and/or shielded silanols, are being introduced into the market.

- Pharmaceutical Items Meet Stringent Quality Control and Performance Standards

Across the globe, every government allocates a substantial proportion of its total health budget to medicines and pharmaceutical items. In developing countries, considerable administrative and technical efforts are directed to ensure that the patients and consumers receive effective medicines of good quality without any compromise on the quality.

- Limited Application Scope to Non-Volatile Compounds

The temperature of the system using silica gel for volatile compounds needs to be maintained at lower levels so that the compound does not vaporize very fast and there is a total loss of the sample before it is utilized and separated by the silica gel plate. Therefore, the scope of silica gel’s application is limited to non-volatile compounds, which may challenge the growth of the Europe pharmaceutical grade silica gel market.

Recent Development

- In February 2022, DuPont launched a new online sales portal for the needs of bioprocessing industry purchasers. DuPont bioprocessing enables sophisticated separations and purification for therapeutics, with different DuPont brands such as AmberChrom and AmberLite being very well established in the biopharma industry.

Europe Pharmaceutical Grade Silica Gel Market Scope

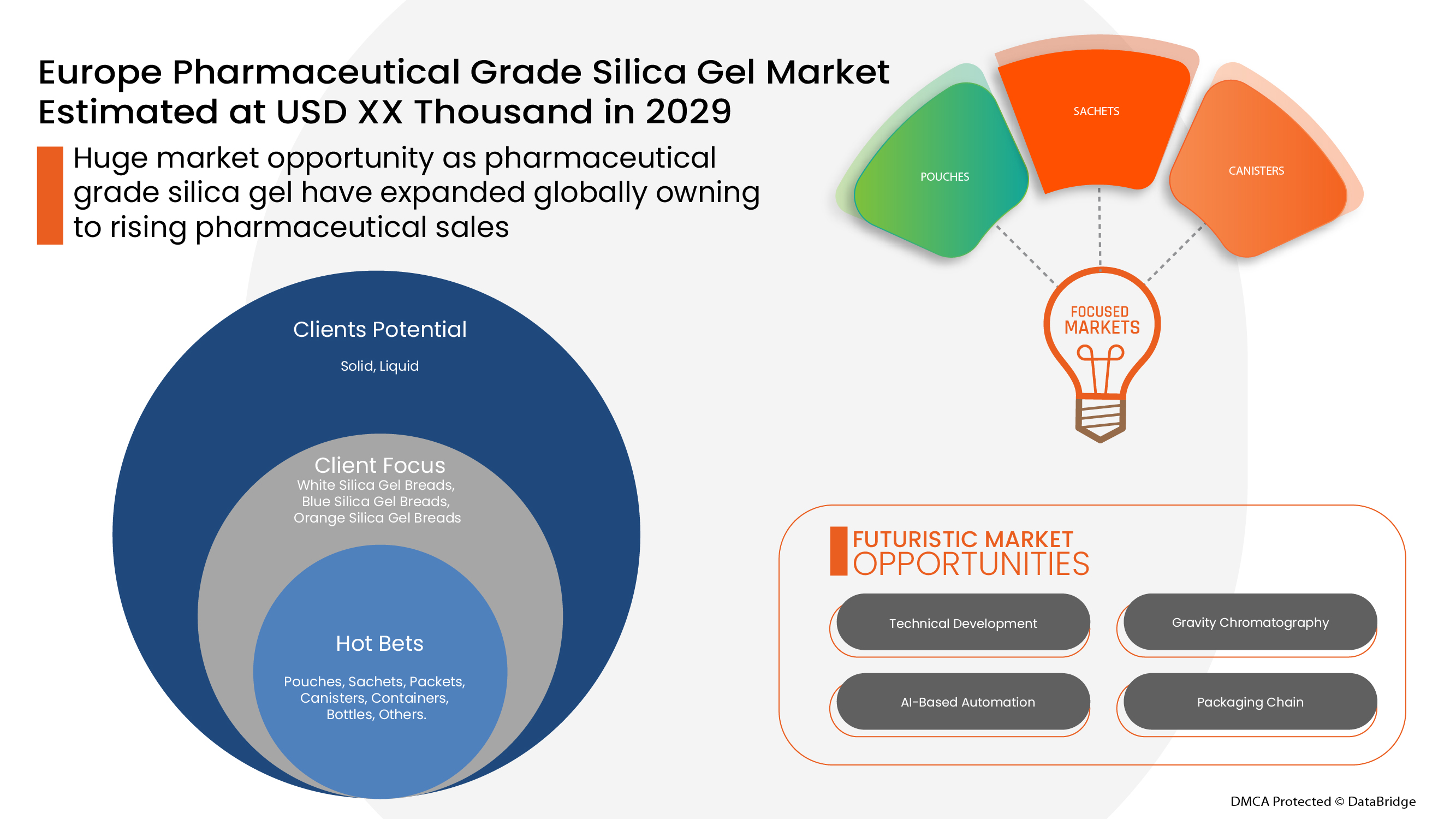

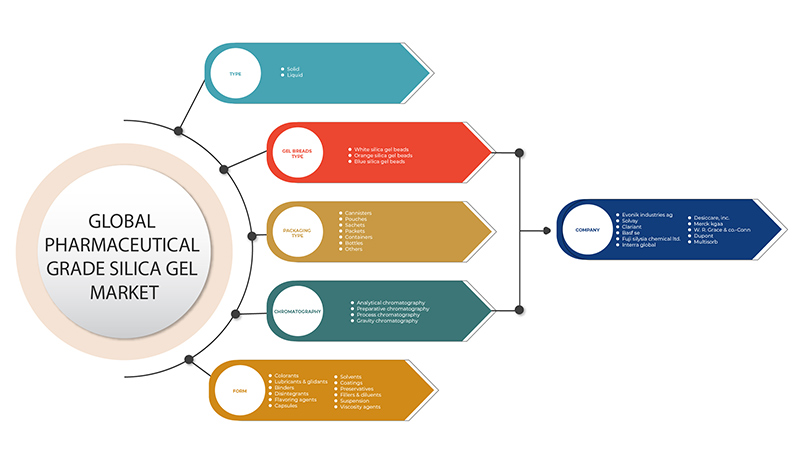

Europe pharmaceutical grade silica gel market is categorized based on type, gel breads, form, packaging type, and chromatography. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Solid

- Liquid

On the basis of type, the Europe pharmaceutical grade silica gel market is segmented into solid and liquid.

Gel Breads Type

- White Silica Gel Breads

- Orange Silica Gel Breads

- Blue Silica Gel Breads

On the basis of gel breads type, the Europe pharmaceutical grade silica gel market is segmented into white silica gel breads, orange silica gel breads, and blue silica gel breads.

Form

- Fillers & Diluents

- Binders

- Disintegrants

- Lubricants & Glidants

- Colorants

- Flavoring Agents

- Preservatives

- Solvents

- Capsules

- Viscosity Agents

- Suspension

- Coatings

On the basis of form, the Europe pharmaceutical grade silica gel market is segmented into colorants, lubricants & glidants, binders, disintegrants, flavoring agents, capsules, solvents, coatings, preservatives, fillers & diluents, suspension, viscosity agents, and others hospitals and clinics, diagnostic centers, academic institutes and others.

Packaging Type

- Pouches

- Sachets

- Packets

- Cannisters

- Containers

- Bottles

- Others

On the basis of packaging type, the Europe pharmaceutical grade silica gel market is segmented into canisters, pouches, sachets, packets, containers, bottles, and others.

Chromatography

- Analytical Chromatography

- Preparative Chromatography

- Process Chromatography

On the basis of chromatography, the Europe pharmaceutical grade silica gel market is segmented into analytical chromatography, preparative chromatography, process chromatography, and gravity chromatography.

Pharmaceutical Grade Silica Gel Market Regional Analysis/Insights

The pharmaceutical-grade silica gel market is analysed and market size insights and trends are provided by country, type, gel breads type, form, packaging type, and chromatography as referenced above.

Europe market is segmented into Germany, U.K., France, Italy, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands and Rest of Europe.

Germany dominates the Europe pharmaceutical-grade silica gel market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the presence of major key players and well-developed healthcare infrastructure in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Europe brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Pharmaceutical Grade Silica Gel Market Share Analysis

Europe pharmaceutical grade silica gel market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the pharmaceutical grade silica gel market.

Some of the prominent participants operating in the Europe pharmaceutical grade silica gel market are BASF SE, DuPont, Solvay, Merck KGAA, W. R. Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Europe Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION (RIVALRY)

4.3 CLIMATE CHANGE SCENARIO

4.4 RAW MATERIAL PRODUCTION COVERAGE

4.5 TECHNOLOGY ADVANCEMENTS

4.6 REGULATORY COVERAGE

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 RAW MATERIAL PROCUREMENT

4.7.2.1 MANUFACTURING AND PACKING

4.7.2.2 MARKETING AND DISTRIBUTION

4.7.2.3 END USERS

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 VENDOR SELECTION CRITERIA

5 REGIONAL SUMMARY

5.1 EUROPE

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR MEDICINAL DRUGS

6.1.2 EXTENSIVE DEPLOYMENT OF R&D IN THE PHARMA SECTOR

6.1.3 RISING EXPENSES ON BIOTECHNOLOGY USING CHROMATOGRAPHY FOR DETECTING MOLECULAR COMPONENTS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS BY THE GOVERNMENT

6.2.2 AVAILABILITY OF SUBSTITUTES

6.2.3 RESTRICTIONS ON DERMAL AND ORAL EXPOSURE TO PHARMACEUTICAL GRADE SILICA GEL

6.2.4 HIGH PRICE OF SILICA GEL

6.3 OPPORTUNITIES

6.3.1 LUCRATIVE OUTLOOK TOWARDS IN-HOUSE R&D

6.3.2 EASY AVAILABILITY OF RAW MATERIALS THROUGH WELL-ESTABLISHED STRATEGIC PARTNERS

6.4 CHALLENGES

6.4.1 PHARMACEUTICAL ITEMS MEET STRINGENT QUALITY CONTROL AND PERFORMANCE STANDARDS

6.4.2 LIMITED APPLICATION SCOPE TO NON-VOLATILE COMPOUNDS

7 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE

7.1 OVERVIEW

7.2 SOLID

7.3 LIQUID

8 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE

8.1 OVERVIEW

8.2 WHITE SILICA GEL BEADS

8.3 ORANGE SILICA GEL BEADS

8.4 BLUE SILICA GEL BEADS

9 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM

9.1 OVERVIEW

9.2 FILLERS & DILUENTS

9.3 BINDERS

9.4 DISINTEGRANTS

9.5 LUBRICANTS & GLIDANTS

9.6 COLORANTS

9.7 FLAVORING AGENTS

9.8 PRESERVATIVES

9.9 SOLVENTS

9.1 CAPSULES

9.11 VISCOSITY AGENTS

9.12 SUSPENSION

9.13 COATINGS

10 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE

10.1 OVERVIEW

10.2 POUCHES

10.3 SACHETS

10.4 PACKETS

10.5 CANISTERS

10.6 CONTAINERS

10.7 BOTTLES

10.8 OTHERS

11 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY

11.1 OVERVIEW

11.2 ANALYTICAL CHROMATOGRAPHY

11.3 PREPARATIVE CHROMATOGRAPHY

11.4 PROCESS CHROMATOGRAPHY

11.5 GRAVITY CHROMATOGRAPHY

12 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 U.K.

12.1.3 FRANCE

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 RUSSIA

12.1.7 SWITZERLAND

12.1.8 TURKEY

12.1.9 BELGIUM

12.1.10 NETHERLANDS

12.1.11 REST OF EUROPE

13 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

13.1.1 COLLABORATIONS

13.1.2 EXPANSIONS

13.1.3 NEW PRODUCT DEVELOPMENTS

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 BASF SE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATE

15.2 DUPONT

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 SOLVAY

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATES

15.4 MERCK KGAA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 W. R. GRACE & CO.-CONN

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATE

15.6 EVONIK INDUSTRIES AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 CLARIANT

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 DESICCARE, INC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 FUJI SILYSIA CHEMICAL LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 INTERRA EUROPE

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATE

15.11 MULTISORB

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATE

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SILICON DIOXIDE; HS CODE - PRODUCT: 281122 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 6 EUROPE SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 EUROPE SOLID IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 8 EUROPE LIQUID IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 EUROPE LIQUID IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 10 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 11 EUROPE WHITE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 EUROPE ORANGE SILICA GEL BEADS IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 EUROPE BLUE SILICA GEL BEADS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 15 EUROPE FILLERS & DILUENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 EUROPE BINDERS IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 EUROPE DISINTEGRANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 EUROPE LUBRICANTS & GLIDANTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 EUROPE COLORANTS IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 EUROPE FLAVORING AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 EUROPE PRESERVATIVES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 EUROPE SOLVENTS IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 EUROPE CAPSULES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 EUROPE VISCOSITY AGENTS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 EUROPE SUSPENSION IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 EUROPE COATINGS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 EUROPE POUCHES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 EUROPE SACHETS IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 EUROPE PACKETS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 EUROPE CANISTERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 EUROPE CONTAINERS IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 EUROPE BOTTLES IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 EUROPE OTHERS IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 35 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 36 EUROPE ANALYTICAL CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 EUROPE PREPARATIVE CHROMATOGRAPHY IN EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 EUROPE PROCESS CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 39 EUROPE GRAVITY CHROMATOGRAPHY IN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 41 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 42 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 44 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 48 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 50 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 GERMANY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 54 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 56 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 58 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 U.K. PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 60 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 62 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 63 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 FRANCE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 66 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 68 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 ITALY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 72 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 74 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 SPAIN PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 78 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 80 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 81 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 82 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 RUSSIA PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 84 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 86 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 88 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 SWITZERLAND PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 90 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 92 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 94 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 TURKEY PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 96 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 98 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 BELGIUM PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 102 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 104 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY GEL BEADS TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 NETHERLANDS PHARMACEUTICAL GRADE SILICA GEL MARKET, BY CHROMATOGRAPHY, 2020-2029 (USD THOUSAND)

TABLE 108 REST OF EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 REST OF EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET, BY TYPE, 2020-2029 (KILO TONS)

List of Figure

FIGURE 1 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 2 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: DROC ANALYSIS

FIGURE 4 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: TYPE LIFE LINE CURVE

FIGURE 7 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: CHALLENGE MATRIX

FIGURE 11 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: SEGMENTATION

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 GROWING DEMAND FOR MEDICINAL DRUGS IS EXPECTED TO DRIVE EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET IN THE FORECAST PERIOD

FIGURE 15 SOLID SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 17 VENDOR SELECTION CRITERIA

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET

FIGURE 19 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE, 2021

FIGURE 20 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY GEL BEADS TYPE, 2021

FIGURE 21 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY FORM, 2021

FIGURE 22 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY PACKAGING TYPE, 2021

FIGURE 23 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY CHROMATOGRAPHY, 2021

FIGURE 24 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET : SNAPSHOT (2021)

FIGURE 25 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021)

FIGURE 26 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: BY TYPE (2022-2029)

FIGURE 29 EUROPE PHARMACEUTICAL GRADE SILICA GEL MARKET: COMPANY SHARE 2021 (%)

Europe Pharmaceutical Grade Silica Gel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Pharmaceutical Grade Silica Gel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Pharmaceutical Grade Silica Gel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.