Europe Ready To Drink High Strength Premixes Market

Market Size in USD Billion

CAGR :

%

USD

5.31 Billion

USD

6.68 Billion

2024

2032

USD

5.31 Billion

USD

6.68 Billion

2024

2032

| 2025 –2032 | |

| USD 5.31 Billion | |

| USD 6.68 Billion | |

|

|

|

|

Ready to Drink/High Strength Premixes Market Size

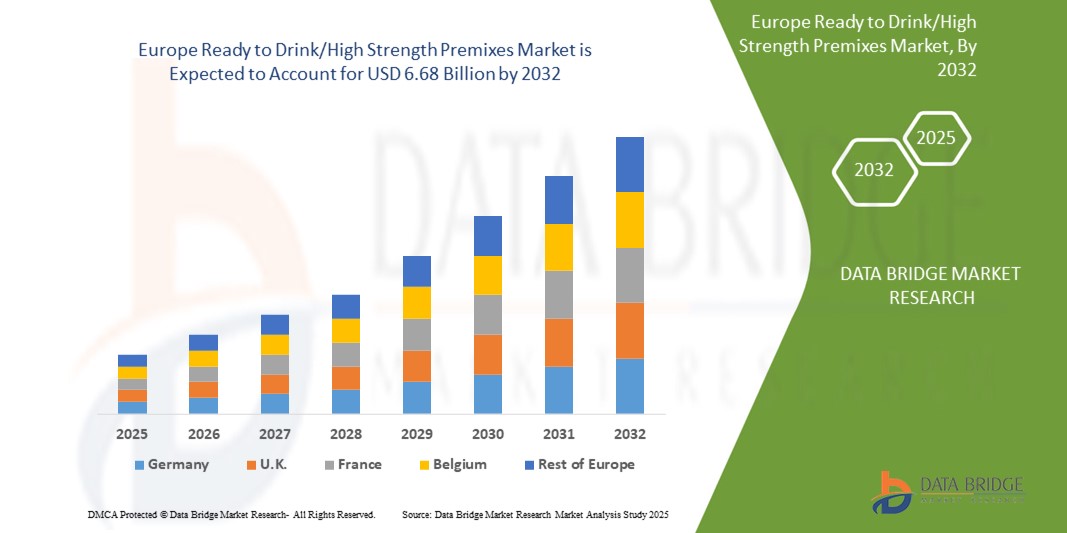

- The Europe ready to drink/high strength premixes market size was valued at USD 5.31 billion in 2024 and is expected to reach USD 6.68 billion by 2032, at a CAGR of 2.90% during the forecast period

- The market growth is primarily driven by increasing consumer preference for convenient, ready-to-consume alcoholic beverages, rapid urbanization, and a growing young population with rising disposable incomes

- The rising popularity of innovative flavors, premium branding, and the convenience of RTD products in social and on-the-go settings is further accelerating market adoption across Europe

Ready to Drink/High Strength Premixes Market Analysis

- Ready to Drink (RTD) and High Strength Premixes are pre-mixed alcoholic beverages offering convenience, consistent taste, and portability, making them a popular choice in social gatherings, nightlife, and home consumption settings

- The escalating demand for RTD beverages is fueled by changing consumer lifestyles, increasing acceptance of alcohol consumption among younger demographics, and the growing influence of Western drinking culture in urban areas

- U.K. dominated the Europe RTD/high strength premixes market with the largest revenue share of 31.28% in 2024, supported by a well-developed alcoholic beverage sector, rising demand for convenience, and a robust nightlife and pub culture

- Germany’s RTD/high strength premixes market is experiencing fastest growth rate, fueled by increasing demand for beer-based mixes, flavored spirits, and low-sugar options

- The malt-based RTDS segment dominated the largest market revenue share of 34.7% in 2024, driven by strong consumer preference, where high alcohol consumption per capita fuels demand for malt-based products such as hard seltzers and flavored alcoholic beverages

Report Scope and Ready to Drink/High Strength Premixes Market Segmentation

|

Attributes |

Ready to Drink/High Strength Premixes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ready to Drink/High Strength Premixes Market Trends

“Increasing Integration of Innovative Flavors and Health-Conscious Formulations”

- The Europe Ready to Drink (RTD)/High Strength Premixes Market is experiencing a notable trend toward the integration of innovative flavors and health-conscious formulations

- Manufacturers are leveraging consumer preferences for unique and exotic flavor profiles, such as tropical fruits, yuzu, and low-sugar or zero-sugar options, to cater to evolving tastes, particularly in Thailand and the Philippines

- Health-focused RTDs, including low-calorie, low-sugar, and natural ingredient-based beverages, are gaining traction, driven by rising health awareness among younger consumers, especially Gen Z and millennials

- For instance, companies are developing spirit-based RTDs with natural extracts and functional ingredients, such as adaptogens or low-calorie sweeteners, to appeal to health-conscious drinkers

- This trend enhances the appeal of RTDs, making them more attractive to both individual consumers and on-trade establishments such as bars and restaurants

- Data analytics is being used to study consumer purchasing patterns, enabling brands to tailor flavors and marketing strategies to specific demographics, such as female consumers in Thailand who prefer lighter, fruit-flavored RTDs

Ready to Drink/High Strength Premixes Market Dynamics

Driver

“Rising Demand for Convenient and Premium Alcoholic Beverages”

- The increasing consumer demand for convenient, ready-to-consume alcoholic beverages, such as RTD cocktails and high-strength premixes, is a major driver for the Europe RTD/High Strength Premixes Market

- RTDs enhance consumer convenience by offering pre-mixed, portable drinks in bottles or cans, ideal for social gatherings, festivals, and on-the-go consumption

- Government initiatives in Thailand, where high alcohol consumption per capita drives demand, are supporting the growth of malt-based and spirit-based RTDs, with brands such as Thai Beverage Plc leading the market

- The proliferation of e-commerce and advancements in digital marketing are enabling wider distribution and brand visibility, particularly in the Philippines, the fastest-growing market, where young consumers seek fun and innovative drinking experiences

- Manufacturers are increasingly offering premium RTDs with sophisticated branding and packaging to meet consumer expectations for high-quality, aspirational products, especially in on-trade settings such as bars and clubs

Restraint/Challenge

“High Production Costs and Regulatory Constraints”

- The substantial initial investment required for production, packaging, and distribution of RTDs and high-strength premixes can be a significant barrier, particularly for smaller players in emerging markets such as the Philippines

- Developing innovative flavors and ensuring consistent quality in large-scale production, especially for blended RTDs, is complex and costly

- Regulatory constraints, including heavy taxation and strict advertising laws in countries such as Thailand and Malaysia, pose challenges. These regulations limit promotional activities and increase operational costs for manufacturers

- Concerns over alcohol-related health issues and cultural sensitivities in some Europen countries, such as Malaysia and Indonesia, may deter market expansion, particularly for high-strength premixes

- These factors can limit market growth, especially in regions with high cost sensitivity or stringent regulatory environments, despite the dominance of Thailand and the rapid growth in the Philippines

Ready to Drink/High Strength Premixes market Scope

The market is segmented on the basis of type, processing type, gender, packaging type, and trade.

• By Type

On the basis of type, the Asia-Pacific RTD/High Strength Premixes market is segmented into Malt-Based RTDs, Spirit-Based RTDs, Wine-Based RTDs, and Others. The Malt-Based RTDs segment dominated the market with the largest revenue share of 34.7% in 2024, primarily due to strong consumer preference in Thailand, where high per capita alcohol consumption supports demand for malt-based options like hard seltzers and flavored alcoholic beverages. Their affordability and variety in flavors attract a wide range of consumers.

The Spirit-Based RTDs segment is projected to grow at the fastest CAGR of 8.2% from 2025 to 2032, driven by rising demand for premium canned or bottled cocktails in the Philippines, influenced by urbanization, Western drinking culture, and the popularity of low-sugar, exotic flavors among younger consumers.

• By Processing Type

On the basis of processing type, the market is categorized into Single Compound and Blended. The Blended segment accounted for the largest revenue share of 60.5% in 2024, supported by its ability to deliver complex flavor combinations using spirits, juices, and flavorings. This format is especially prevalent in Thailand, catering to both premium and mass-market audiences.

The Single Compound segment is expected to witness the fastest CAGR of 7.9% from 2025 to 2032, as health-conscious consumers, particularly in the Philippines, increasingly prefer minimalist RTDs like hard seltzers with transparent labels and low-calorie profiles.

• By Gender

On the basis of gender, the market is divided into Male and Female. The Male segment dominated with the highest market revenue share of 56.3% in 2024, owing to higher alcohol consumption among men across the Asia-Pacific, especially in Thailand, where cultural factors and social drinking habits contribute to the popularity of bold and high-alcohol RTDs.

The Female segment is anticipated to grow at the fastest CAGR of 8.5% from 2025 to 2032, supported by increasing female participation in social drinking in the Philippines. RTD manufacturers are launching low-alcohol, fruit-infused drinks in stylish packaging that align with wellness and visual appeal trends.

• By Packaging Type

On the basis of packaging, the market is segmented into Bottle, Can, and Others. The Can segment held the largest revenue share of 54.6% in 2024, favored for its portability, durability, and suitability for on-the-go consumption—especially in urban and tourist regions of Thailand. Cans are also preferred due to their recyclability and freshness preservation.

The Bottle segment is projected to grow at the fastest CAGR of 8.1% from 2025 to 2032, particularly in the Philippines, where premium RTDs such as wine- and spirit-based variants are increasingly sought for at-home or social consumption, with bottles being seen as more sophisticated.

• By Trade

On the basis of trade, the market is classified into Off-Trade and On-Trade channels. The Off-Trade segment captured the largest market share of 66.2% in 2024, driven by strong distribution through supermarkets, convenience stores, and e-commerce platforms across Asia-Pacific. In Thailand, the ease of access and rising trend of home consumption among millennials and Gen Z significantly contributed to off-trade dominance.

The On-Trade segment is forecasted to grow at the fastest CAGR of 8.7% from 2025 to 2032, as bars, restaurants, and pubs in the Philippines rebound post-pandemic. Rising demand for premium RTDs, enhanced by experiential marketing and cocktail innovations, supports the growth of this segment.

Ready to Drink/High Strength Premixes Market Regional Analysis

- U.K. dominated the Europe RTD/high strength premixes market with the largest revenue share of 31.28% in 2024, supported by a well-developed alcoholic beverage sector, rising demand for convenience, and a robust nightlife and pub culture

- Consumers increasingly prefer RTDs for their portability, balanced alcohol content, and broad flavor options, particularly among younger adults and working professionals

- Market growth is driven by premiumization trends, functional and low-calorie innovations, and the expansion of online retail and supermarket channels

Germany Ready to Drink/High Strength Premixes Market Insight

Germany’s RTD/high strength premixes market is experiencing fastest growth rate, fueled by increasing demand for beer-based mixes, flavored spirits, and low-sugar options. The rise in urban living, busy lifestyles, and health awareness has led consumers to seek convenient and refreshing alcoholic beverages. Retailers and convenience stores are expanding RTD shelves, particularly targeting younger adults with experimental flavor profiles and limited-edition variants. Growth is concentrated in urban areas and during seasonal social events such as festivals and gatherings.

France Ready to Drink/High Strength Premixes Market Insight

France’s RTD market is gradually gaining momentum as traditional alcohol consumers, especially wine drinkers, increasingly explore spirit-based and cocktail premixes. Urban millennials and tourists are key growth drivers, seeking convenience and premium taste without preparation time. The market sees seasonal spikes, especially in summer and festive periods. Brands are investing in elegant packaging and sophisticated flavor blends to attract a mature, style-conscious audience. Distribution is expanding via retail chains, cafés, and premium beverage shops.

Italy Ready to Drink/High Strength Premixes Market Insight

Italy’s RTD/high strength premixes market is expanding rapidly, supported by the country’s strong aperitivo culture and a shift toward low-alcohol, ready-to-serve options. Consumers are embracing wine- and spritz-based RTDs that offer flavor variety and are suited for casual and social settings. Both domestic and international brands are innovating with herbal infusions and fruity notes to appeal to younger drinkers. The market thrives in urban hubs, beach destinations, and hospitality venues catering to locals and tourists alike.

Ready to Drink/High Strength Premixes Market Share

The ready to drink/high strength premixes industry is primarily led by well-established companies, including:

- Thai Spirit Industry Co., Ltd. (Thailand)

- Whistler Wine & Spirits Pte Ltd (Singapore)

- Destileria Limtuaco & Co., Inc. (Philippines)

- Winepak Corporation (U.S.)

- Thai Beverage Plc (Thailand)

- Diageo (U.K.)

- Carlsberg Group (Denmark)

- Siam Winery (Thailand)

- San Miguel Brewery Inc. (Philippines)

- Nestlé (Switzerland)

- Red Bull (Austria)

- The Coca-Cola Company (U.S.)

- BACARDI (Bermuda)

What are the Recent Developments in Europe Ready to Drink/High Strength Premixes Market?

- In May 2025, Diageo Thailand introduced new flavors for its Smirnoff Ice range, aiming to engage younger consumers with innovative taste profiles. This expansion strengthens Diageo’s presence in the ready-to-drink (RTD) segment, aligning with evolving consumer preferences in Southeast Asia’s high-strength premixes market. The launch coincides with Smirnoff Ice’s 25th anniversary, featuring updated packaging and a global campaign to enhance brand visibility and market reach

- In March 2025, ThaiBev Public Company Limited acquired a significant stake in a leading Vietnamese beverage distributor, reinforcing its distribution network and expanding its ready-to-drink alcoholic beverage market across Vietnam. This strategic move aligns with ThaiBev’s aggressive expansion strategy in the high-growth Southeast Asian market, enhancing its market presence and operational efficiency. The acquisition is expected to boost sales and brand visibility, strengthening ThaiBev’s competitive edge in the region

- In January 2025, Suntory PepsiCo Beverage (Thailand) Co., Ltd. partnered with a leading local e-commerce platform to expand online availability and delivery of its ready-to-drink coffee and tea premixes. This collaboration underscores the growing role of digital channels in consumer engagement, enhancing convenience and accessibility in the ready-to-drink market. The initiative aligns with Suntory PepsiCo’s broader strategy to strengthen its presence in Southeast Asia, leveraging e-commerce growth to meet evolving consumer preferences

- In November 2024, a leading Singapore-based food and beverage conglomerate partnered with a prominent Malaysian brewery to co-develop and launch a new line of fruit-flavored alcoholic premixes tailored for the Malaysian market. This collaboration leverages local expertise, aiming to introduce innovative products that align with regional taste preferences. The partnership reflects the growing demand for flavored alcoholic beverages in Southeast Asia, enhancing market diversity and consumer engagement

- In July 2023, Suntory Spirits Ltd. introduced "The PREMIUM MALT'S HOUSE", a flagship beer bar designed to bring the unique experience of "The Premium Malt's" to international consumers. This initiative launched in nine global cities, offering visitors a chance to enjoy the brand’s signature "Kami-Awa" creamy foam and premium brewing craftsmanship. The move strengthens Suntory’s global presence, enhancing brand recognition and expanding its appeal within the ready-to-drink and high-strength premixes market, particularly in Southeast Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Ready To Drink High Strength Premixes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Ready To Drink High Strength Premixes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Ready To Drink High Strength Premixes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.