Europe Refractive Surgery Devices Market

Market Size in USD Million

CAGR :

%

USD

422.98 Million

USD

746.40 Million

2021

2029

USD

422.98 Million

USD

746.40 Million

2021

2029

| 2022 –2029 | |

| USD 422.98 Million | |

| USD 746.40 Million | |

|

|

|

Market Definition and Insights

Refractive surgery devices are used to improve or correct refractive errors such as nearsightedness (myopia), farsightedness (hyperopia), presbyopia, or astigmatism. These devices include excimer lasers, YAG Lasers, microkeratomes, and femtosecond lasers. Refractive surgeries highly reduce the dependency on eyeglasses or contact lenses. Various refractive devices are used in the market to treat vision defects.

Refractive errors are caused due to the improper shape of the cornea or eyeballs. Refractive surgery procedure includes the reshaping of the eyeballs or cornea using various refractive surgery devices such as advanced lasers, LASIK treatments, photorefractive keratectomy, and various lenses such as phakic intraocular lenses and toric intraocular lenses.

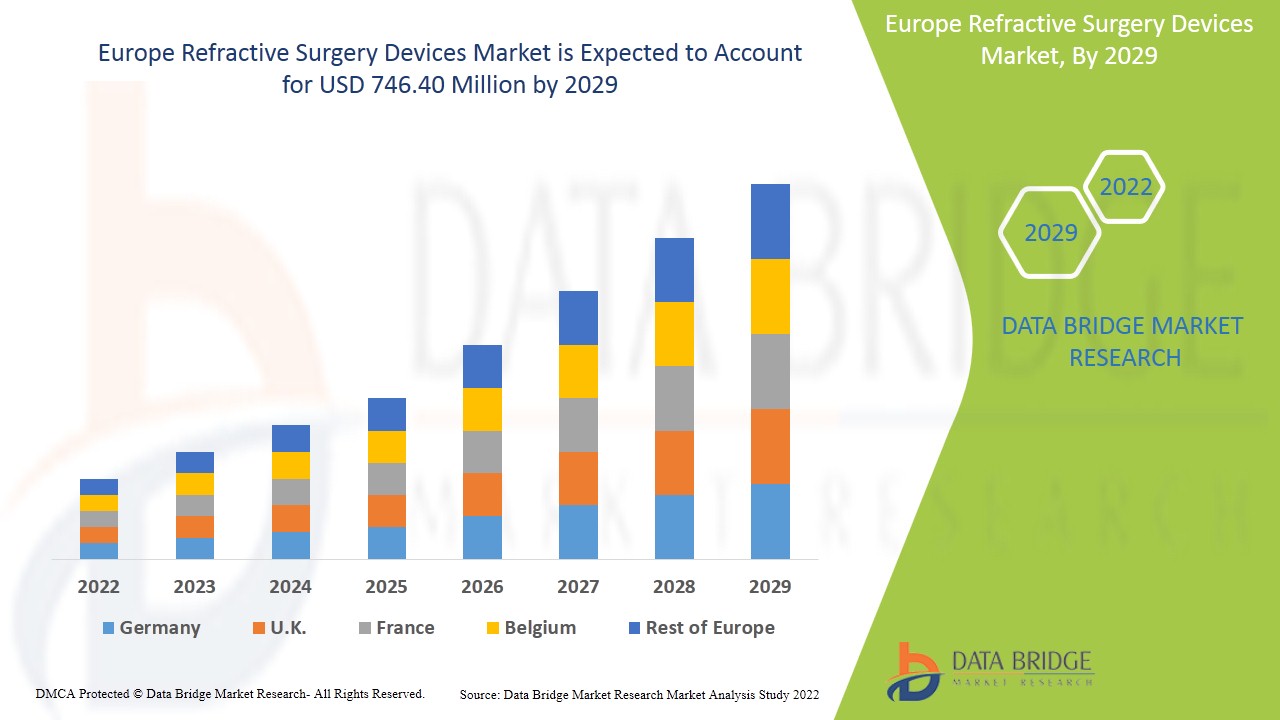

The refractive surgery devices market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.6% in the forecast period of 2022 to 2029 and is expected to reach USD 746.40 million by 2029 from USD 422.98 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Laser, Phakic Intraocular Lens (IOL), Aberrometers/Wavefront Aberrometry, Surgical Instruments & Accessories, Refractive Surgery Kits, Pupillary Diameter Meters, Epikeratomes, Microkeratomes, Thermokeratoplasty, Limbal Relaxing Incision Kits and Others), Surgery Type (LASIK (Laser In-Situ Keratomileusis, Photorefractive Keratectomy (PRK), Phakic Intraocular Lenses (IOL), Astigmatic Keratotomy (AK), Automated Lamellar Keratoplasty (ALK), Intracorneal Ring (INTACS), Laser Thermal Keratoplasty (LTK), Conductive Keratoplasty (CK), Radial Keratotomy (RK) and Others), Application (Nearsightedness (Myopia), Farsightedness (Hyperopia), Astigmatism and Presbyopia), End User (Hospitals, Speciality Clinics, Ambulatory Surgical Centers and Others), Distribution Channel (Direct Tender, Third Party Distributors and Others) |

|

Countries Covered |

Germany, France, U.K., Italy, Spain, Netherlands, Russia, Switzerland, Belgium, Turkey, Austria, Norway, Hungary, Lithuania, Ireland, Poland Rest of Europe |

|

Market Players Covered |

Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (A subsidiary of Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon among others |

The Market Dynamics of the Refractive Surgery Devices Market include

Drivers

- Increase in technological advancement

Acceleration in technology development in the healthcare sector has tremendously increased in the last few years. Advancement in the technology of refractive surgery devices supports painless and uncomplicated treatment during the management of a disease. Moreover, innovation and up gradation in various refractive surgery devices assist in a precise and rapid result of disease diagnosis. Innovation in refractive surgery devices also provides the cost-effectiveness of technology-based therapeutic tools during disease treatment.

For instance,

- As per Contoura Vision India, it is found that Contoura vision surgery is the latest advanced eye surgery in the removal of specs. It is one of the safest technological advancements in eye surgery, which not only corrects the power of the spectacles but also works for corneal irregularities

- According to the Eye and Laser Centre Organisation, in May 2017, it was found that Visumax Femtosecond Laser technology is one of the most advanced refractive surgical treatments. It is capable of performing visual defects of the eyes

The increased technological advancements in various refractive surgery devices, such as advancements in lasers variable spot scanning, are expected to drive the refractive surgery devices market. Hence, growing innovation and technological advancement in refractive surgery devices are expected to bolster the market growth during the forecast period.

- Rise in healthcare expenditure

Over the last decade, healthcare expenditure has risen drastically for better patient healthcare service. The U.S. is the largest healthcare market, where the total health expenditure has increased drastically in the last few years. The fundamental purpose behind growing expenditure is to provide appropriate, affordable, and high-quality refractive surgery devices. To promote a healthier population and address the healthcare emergencies in developed and developing countries, respective government bodies and healthcare organizations are taking the initiative under accelerating healthcare expenditure.

For instance,

- According to the Health Affairs Organisation, U.S. health care spending has increased 9.7% to reach USD 4.1 trillion in 2020, which is a much faster rate than that seen in 2019

- According to the U.K. government, in 2020, the government have provided nearly GBP 250 million, which is about USD 300 million, to digitalize and advance diagnostics care across the NHS (National Health Service) using the latest technology. This funding has been allocated specifically for technological improvements to the NHS diagnostic services to detect and begin treating health conditions as early as possible

- The National Free Diagnostic Service Initiative has been rolled out as part of the National Health Mission by the Government of India. This was important to provide comprehensive and quality healthcare free of cost under one roof. With this initiative by the Indian government, several states have attempted several models to ensure the availability of diagnostics in public health facilities

Growing healthcare expenditure is also beneficial for further economic growth as well as healthcare sector growth. It significantly affects the development of new diagnostic tests and new surgical tools. Hence, huge health care expenditure is a favorable factor for the market's growth.

Opportunity

- Achievements in LASIK surgeries

The LASIK success rate or LASIK outcomes are well understood, with thousands of clinical studies looking at visual acuity and patient satisfaction. Recent research reported 99 percent of patients achieve better than 20/40 vision, and more than 90 percent achieve 20/20 or better. Furthermore, LASIK has an unprecedented 96 percent patient satisfaction rate, the highest of any elective procedure.

For instance,

- A 2016 study in the Journal of Cataract & Refractive Surgery found that LASIK has a 96% patient satisfaction rate

As per the article, "LASIK: Know the Rewards and the Risks," 2018

- Eric Donnenfeld, MD, a former president of the American Society of Cataract and Refractive Surgery, completed around 85,000 procedures over his 28-year career

- According to Market Scope, around 10 million Americans have had LASIK surgery since the FDA first approved it in 1999. Around 700,000 LASIK surgeries are done each year, but that's down from a peak of 1.4 million in 2000

Henceforth, the rising number of successful LASIK surgeries worldwide is positively associated with product development, product registration, and product launch. Thus, this is expected to drive the refractive surgery devices market in the coming years.

- Strategic initiatives by market players

An increase in the burden of refractive errors across the world have created more demand for the refractive surgery devices market. The main aim is to improve health management with the development of innovative products and surgery types for quality care with the convenient application. The key players in the refractive surgery devices market have taken strategic initiatives, which include product launches, acquisitions, and many more, and are expected to lead and create more opportunities in the refractive surgery devices market.

For instances,

- In June 2021, Glaukos Corporation received regulatory approval from the Therapeutic Goods Administration (TGA) of Australia for PRESERFLO MicroShunt. PRESERFLO MicroShunt aimed to lessen intraocular pressure (IOP) in the eyes of patients with primary open-angle glaucoma where IOP would remain uncontrollable along with being the maximum tolerated medical therapy and/or where glaucoma progression requires surgery

- In June 2021: Bausch & Lomb Incorporated signed an agreement with Lochan, a company in the Information Technology Services Industry. These companies aimed to develop the next generation of Bausch & Lomb Incorporated's eyeTELLIGENCE clinical decision support software. By utilizing the prevailing cloud-based infrastructure of eyeTELLIGENCE, this software would be developed to allow surgeons to effortlessly combine all factors of the cataract, retinal, and refractive surgery procedures to boost their total practice efficiency

- In March 2021, NIDEK unveiled RT-6100 CB for Windows, optional control software for the RT-6100 Intelligent Refractor, and the TS-610 Tabletop Refraction System. This software attunes to the distinct requirements of patients and operators. Moreover, the software enables refractions, which fulfill social distancing requirements

These many strategic products launched and acquisitions by major companies in the refractive surgery devices market have opened up an opportunity for companies worldwide. These strategies are allowing the companies to strengthen their footprints in the market. Therefore, it is predicted that strategic initiative is the golden opportunity for the market players to accelerate their revenue growth in the market.

Challenges/Restraints

- Lack of awareness and people trust regarding the benefits of the procedure

In many countries, the general population is not aware of refractive surgery or its various benefits for refractive errors such as myopia astigmatism, presbyopia, and others. People are scared of surgeries that it will lead to some serious side effects which are expected to give a market a great challenge.

For instance,

- According to the study by the National Institute of Health (NIH) 2021, it stated that people refused to undergo surgery because they were worried about its complications and lacked information regarding the procedure. Moreover, the study showed that 82.5% of participants were unaware that refractive surgery could enhance their visual acuity due to the lack of awareness

- According to the study by the International Journal of Medicine in Developing Countries in 2019, it was stated that-

- 32.2% of the total participants thought that refractive surgery was dangerous and 9.5% thought that it causes advanced complications

- Also, the study from India showed that 64% of participants did not know that refractive surgery was able to improve their vision

The lack of awareness regarding the benefits of refractive surgery and people's fear of surgery complications is expected to create a great challenge for the market growth.

- Lack of healthcare facilities for eye treatment

The poverty-stricken population in low- and middle-income countries suffer more from blindness and ophthalmic disorders than the wealthier population. The advancement and strategic plans taken in developed countries are not equally initiated in low-income countries. Many low-income countries usually rely on community health workers, physician assistants, and cataract surgeons for their initial primary eye care. Ophthalmology in low-income countries (LIC) is very challenging due to its complexities such as tropical climates, frail electric grids, poor road and water infrastructure, limited diagnostic capability, and limited treatment options.

For instance,

- As per the article, "Innovative Diagnostic Tools for Ophthalmology in Low-Income Countries," the 2020 report states that the prevalence of blindness and ocular disorders in high-income countries is 0.3 per 1,000 people, but in low-income countries, the estimation is 1.5 per 1,000. This shows the unmet need for ophthalmology care in low-income countries

Another major problem in low-income countries is the lack of awareness among people regarding ocular pain and other disorders. Many research studies report the high requirement of low-income countries for eye health care, and their unmet needs are still gaining attention among many health care organizations.

For instance,

- In 2014, the British Journal of Ophthalmology reported that the vision 2020 plan initiated by the government is still far from achieved due to the lack of initiatives taken targeting middle and low-income countries

Hence, the poor healthcare facility for eye treatments in low and middle-income countries are considered the greatest challenge to the growth of the refractive surgery devices market.

Post COVID-19 Impact on Refractive Surgery Devices Market

The COVID-19 has affected the market. Lockdowns and isolation during pandemics restricted the movement of the masses. As a result surgeries date and times were delayed. Hence, the pandemic has negatively affected this market

Recent Development

- In July 2021, Johnson & Johnson Vision launched the VERITAS Vision System, next-generation phacoemulsification (phaco) system. This system is developed to look after three important areas: surgeon efficiency, patient safety, and comfort. This has increased the company's product portfolio

Refractive Surgery Devices Market Scope

The refractive surgery devices market is segmented into product type, surgery type, application, end user, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Laser

- Phakic Intraocular Lens (IOL)

- Aberrometers / Wavefront Aberrometry

- Surgical Instruments & Accessories

- Refractive Surgery Kits

- Pupillary Diameter Meters

- Epikeratomes

- Microkeratomes

- Thermokeratoplasty

- Limbal Relaxing Incision Kits

- Others

On the basis of product type, the refractive surgery devices market is segmented into a laser, phakic intraocular lens (IOL), aberrometer/wavefront aberrometry, surgical instruments & accessories, refractive surgery kits, pupillary diameter meters, epikeratomes, microkeratomes, thermokeratoplasty, limbal relaxing incision kits, and others.

Surgery Type

- Lasik (Laser In-Situ Keratomileusis)

- Photorefractive Keratectomy (PRK)

- Phakic Intraocular Lenses (IOL)

- Astigmatic Keratotomy (AK)

- Automated Lamellar Keratoplasty (ALK)

- Intracorneal Ring (INTACS)

- Laser Thermal Keratoplasty (LTK)

- Conductive Keratoplasty (CK)

- Radial Keratotomy (RK)

- Others

On the basis of surgery type, the refractive surgery devices market is segmented into LASIK (laser in-situ keratomileusis), photorefractive keratectomy (PRK), phakic intraocular lenses (IOL), astigmatic keratotomy (AK), automated lamellar keratoplasty (ALK), intracorneal ring (INTACS), laser thermal keratoplasty (LTK), conductive keratoplasty (CK), radial keratotomy (RK), and others.

Application

- Nearsightedness (Myopia)

- Farsightedness (Hyperopia)

- Astigmatism

- Presbyopia

On the basis of application, the refractive surgery devices market is segmented into nearsightedness (myopia), farsightedness (hyperopia), astigmatism, and presbyopia.

End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

On the basis of end user, the refractive surgery devices market is segmented into hospitals, specialty clinics, ambulatory surgical centers, and others.

Distribution Channel

- Direct Tender

- Third Party Distributors

- Others

On the basis of distribution channel, the refractive surgery devices market is segmented into direct tender, third party distributors, and others.

Refractive Surgery Devices Market Regional Analysis/Insights

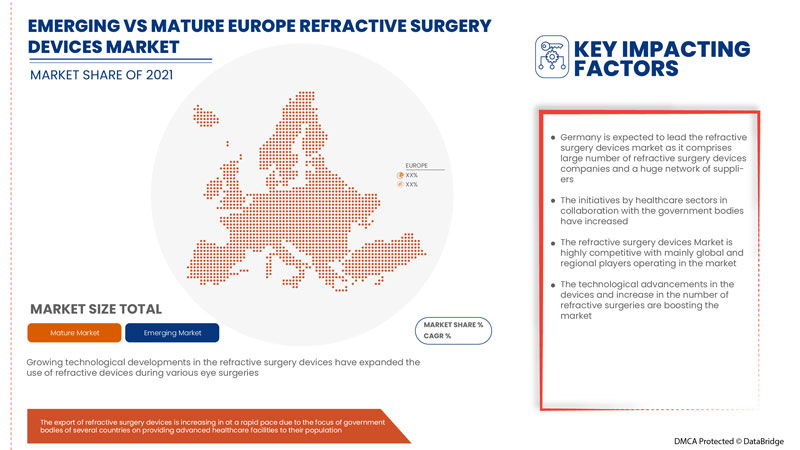

The refractive surgery devices market is analysed and market size insights and trends are provided by country, product type, surgery type, application, end user, and distribution channel as referenced above.

The countries covered in the refractive surgery devices market report are the Germany, France, U.K., Italy, Spain, Netherlands, Russia Switzerland, Belgium, Turkey, Austria, Norway, Hungary, Lithuania, Ireland, Poland Rest of Europe.

Germany is expected to dominate the market due to the rising adoption of minimal invasive surgeries.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Refractive Surgery Devices Market Share Analysis

The refractive surgery devices market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on refractive surgery devices market.

Some of the major companies dealing in the refractive surgery devices market are Tracey Technologies, Bausch + Lomb Incorporated, BD, STAAR SURGICAL, SCHWIND eye-tech-solutions, Hoya Surgical Optics, Johnson & Johnson Services, Inc., Ophtec BV, Glaukos Corporation, Amplitude Laser, Reichert, Inc., NIDEK CO., LTD., Ziemer Ophthalmic Systems, ROWIAK GmbH, Moria, LENSAR, Inc., Topcon Canada Inc. (A subsidiary of Topcon Corporation), Aaren Scientific Inc., Rayner Intraocular Lenses Limited., iVIS Technologies, Alcon, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analysed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global vs. Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analysed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Factbook) or can assist you in creating presentations from the data sets available in the report

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE REFRACTIVE SURGERY DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S FIVE FORCES MODEL

4.3 EUROPE REFRACTIVE SURGERY DEVICES MARKET: REGULATIONS

4.3.1 REGULATION IN THE U.S.

4.3.2 REGULATIONS IN EUROPE

4.3.3 REGULATIONS IN SINGAPORE

4.3.4 REGULATIONS IN AUSTRALIA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING TECHNOLOGICAL ADVANCEMENT

5.1.2 RISE IN HEALTHCARE EXPENDITURE

5.1.3 INCREASE IN POPULATION WITH MACULAR DEGENERATION

5.1.4 RISE IN ADOPTION OF MINIMALLY INVASIVE SURGERIES

5.2 RESTRAINTS

5.2.1 STRINGENT RULES AND REGULATIONS

5.2.2 HIGH COST ASSOCIATED WITH REFRACTIVE SURGERY DEVICES

5.2.3 SIDE EFFECTS OF SURGERY

5.3 OPPORTUNITIES

5.3.1 ACHIEVEMENTS IN LASIK SURGERIES

5.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

5.3.3 INCREASING GERIATRIC POPULATION

5.3.4 EXCESSIVE USAGE OF DIGITAL DEVICES

5.4 CHALLENGES

5.4.1 DEARTH OF SKILLED PROFESSIONALS

5.4.2 LACK OF HEALTHCARE FACILITIES FOR EYE TREATMENT

6 COVID-19 IMPACT ON EUROPE REFRACTIVE SURGERY DEVICES MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY

6.4 STRATEGIC DECISIONS BY MANUFACTURERS

6.5 CONCLUSION

7 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LASER

7.2.1 EXCIMER LASERS

7.2.2 FEMTOSECOND LASER/ULTRASHORT PULSE LASER

7.2.3 OTHERS

7.3 PHAKIC INTRAOCULAR LENS (IOL)

7.4 ABERROMETERS / WAVEFRONT ABERROMETRY

7.5 SURGICAL INSTRUMENTS & ACCESSORIES

7.6 REFRACTIVE SURGERY KITS

7.7 PUPILLARY DIAMETER METERS

7.8 EPIKERATOMES

7.9 MICROKERATOMES

7.1 THERMOKERATOPLASTY

7.11 LIMBAL RELAXING INCISION KITS

7.12 OTHERS

8 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY SURGERY TYPE

8.1 OVERVIEW

8.2 LASIK (LASER IN-SITU KERATOMILEUSIS)

8.3 PHOTOREFRACTIVE KERATECTOMY (PRK)

8.4 PHAKIC INTRAOCULAR LENSES (IOL)

8.5 ASTIGMATIC KERATOTOMY (AK)

8.6 AUTOMATED LAMELLAR KERATOPLASTY (ALK)

8.7 INTRACORNEAL RING (INTACS)

8.8 LASER THERMAL KERATOPLASTY (LTK)

8.9 CONDUCTIVE KERATOPLASTY (CK)

8.1 RADIAL KERATOTOMY (RK)

8.11 OTHERS

9 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 NEARSIGHTEDNESS (MYOPIA)

9.3 FARSIGHTEDNESS (HYPEROPIA)

9.4 PRESBYOPIA

9.5 ASTIGMATISM

10 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITAL

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 OTHERS

11 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTORS

11.4 OTHERS

12 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 NETHERLANDS

12.1.7 RUSSIA

12.1.8 SWITZERLAND

12.1.9 BELGIUM

12.1.10 TURKEY

12.1.11 AUSTRIA

12.1.12 NORWAY

12.1.13 HUNGARY

12.1.14 LITHUANIA

12.1.15 IRELAND

12.1.16 POLAND

12.1.17 REST OF EUROPE

13 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 JOHNSON AND JOHNSON SERVICES, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.1.5.1 PRODUCT LAUNCH

15.2 ALCON INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.2.5.1 ACQUISITION

15.2.5.2 PRODUCT LAUNCH

15.3 STAAR SURGICAL

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAUSCH + LOMB INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 ACQUISITION

15.4.5.2 CE APPROVAL

15.5 TOPCON CANADA INC., (A SUBSIDIARY OF TOPCON CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PARTNERSHIP

15.5.5.2 ACQUISITION

15.6 AAREN SCIENTIFIC INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMPLITUDE LASER

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.7.3.1 PARTNERSHIP

15.8 BD

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.8.4.1 CONFERENCE

15.8.4.2 PRODUCT LAUNCH

15.9 GLAUKOS CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 PRODUCT LAUNCH

15.9.4.2 ACQUISITION

15.1 HOYA SURGICAL OPTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 CONFERENCE

15.11 IVIS TECHNOLOGIES

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LENSAR INC. (A SUBSDIARY OF PDL BIOPHARMA, INC.)

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 MORIA

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 NIDEK CO., LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.14.3.1 WEBSITE LAUNCH

15.15 OPHTEC BV

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.15.3.1 PRODUCT LAUNCH

15.16 RAYNER INTRAOCULAR LENSES LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.16.3.1 NEW DISTRIBUTION UNIT

15.16.3.2 ACQUISITION

15.16.3.3 ACQUISITION

15.17 REICHERT, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.17.3.1 CONFERENCE

15.18 ROWIAK GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.18.3.1 R&D FACILITY

15.19 SCHWIND EYE-TECH-SOLUTIONS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TRACEY TECHNOLOGIES

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 R&D FACILITY

15.21 ZIEMER OPHTHALMIC SYSTEMS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 AGREEMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 EUROPE PHAKIC INTRAOCULAR LENS (IOL) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ABBEROMETERS/WAFEFRONT ABERROMETRY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SURGICAL INSTRUMENT & ACCESSORIES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE REFRACTIVE SURGERY KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PUPILLARY DIAMETER METERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE EPIKERATOMES IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE MICROKERATOMES IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE THERMOKERATOPLASTY IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE LIMBAL RELAXING INCISION KITS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE LASIK (LASER IN-SITU KERATOMILEUSIS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE PHOTOREFRACTIVE KERATECTOMY (PRK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE PHAKIC INTRAOCULAR LENSES (IOL) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ASTIGMATIC KERATOTOMY (AK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE AUTOMATED LAMELLAR KERATOPLASTY (ALK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE INTRACORNEAL RING (INTACS) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE LASER THERMAL KERATOPLASTY (LTK) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE CONDUCTIVE KERATOPLASTY (CK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE RADIAL KERATOTOMY (RK) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE NEARSIGHTEDNESS (MYOPIA) IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE FARSIGHTEDNESS (HYPEROPIA) IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE PRESBYOPIA IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ASTIGMATISM IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HOSPITALS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE SPECIALTY CLINICS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 EUROPE AMBULATORY SURGICAL CENTERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 EUROPE DIRECT TENDER IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE THIRD PARTY DISTRIBUTORS IN REFRACTIVE SURGERY DEIVCES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 EUROPE OTHERS IN REFRACTIVE SURGERY DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 GERMANY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 49 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 GERMANY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 FRANCE LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 55 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 FRANCE REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 U.K. REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 ITALY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 67 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 ITALY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SPAIN LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 SPAIN REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 NETHERLANDS LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 NETHERLANDS REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 85 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 SWITZERLAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 91 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 SWITZERLAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 BELGIUM LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 97 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 BELGIUM REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 100 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 TURKEY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 103 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 104 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 TURKEY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 AUSTRIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 109 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 AUSTRIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 NORWAY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 115 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 NORWAY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 HUNGARY LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 121 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 123 HUNGARY REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 124 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 LITHUANIA LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 127 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 LITHUANIA REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 IRELAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 133 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 IRELAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 POLAND LASER IN REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY SURGERY TYPE, 2020-2029 (USD MILLION)

TABLE 139 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 POLAND REFRACTIVE SURGERY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 REST OF EUROPE REFRACTIVE SURGERY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 2 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 EUROPE REFRACTIVE SURGERY DEVICES MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE REFRACTIVE SURGERY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE REFRACTIVE SURGERY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE REFRACTIVE SURGERY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 EUROPE REFRACTIVE SURGERY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASING TECHNOLOGICAL ADVANCEMENTS IN THE REFRACTIVE SURGERY DEVICES ARE EXPECTED TO DRIVE THE EUROPE REFRACTIVE SURGERY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE REFRACTIVE SURGERY DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE REFRACTIVE SURGERY DEVICES MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINT, OPPORTUNITIES, CHALLENGES FOR EUROPE REFRACTIVE SURGERY DEVICES MARKET

FIGURE 15 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2021

FIGURE 16 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, 2020-2029 (USD MILLION)

FIGURE 17 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2021

FIGURE 20 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, 2020-2029 (USD MILLION)

FIGURE 21 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, CAGR (2022-2029)

FIGURE 22 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY SURGERY TYPE, LIFELINE CURVE

FIGURE 23 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2021

FIGURE 24 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 25 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2021

FIGURE 28 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 29 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 33 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 EUROPE REFRACTIVE SURGERY DEVICES DISEASE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 EUROPE REFRACTIVE SURGERY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 EUROPE REFRACTIVE SURGERY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 EUROPE REFRACTIVE SURGERY DEVICES MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.