Europe Rotomolding Market

Market Size in USD Million

CAGR :

%

USD

538.11 Million

USD

843.93 Million

2024

2032

USD

538.11 Million

USD

843.93 Million

2024

2032

| 2025 –2032 | |

| USD 538.11 Million | |

| USD 843.93 Million | |

|

|

|

|

Rotomolding Market Analysis

The Europe rotomolding market is experiencing significant growth driven by rising acceptance of rotomolded products such as containers and pallets in material handling and packaging applications as Material handling and packaging are among the five interconnected logistical roles that contribute significantly to logistics. The transportation, storage, control, and protection of materials, products, and packaged items during the manufacturing, distribution, and disposal processes are all part of material handling. Rotationally molded components are also a better alternative to conventional steel parts. Rotational molding is the ideal process for producing parts and components that may be utilized for collecting, storing, or moving nearly any substance due to its lower weight, improved corrosion resistance, and joint-free manufacture. As the positive outlook towards the construction sector is associated with the building, repair, renovation, and maintenance of infrastructures. The construction industry contributes to the nation's socioeconomic development and economic growth.

Rotomolding Market Size

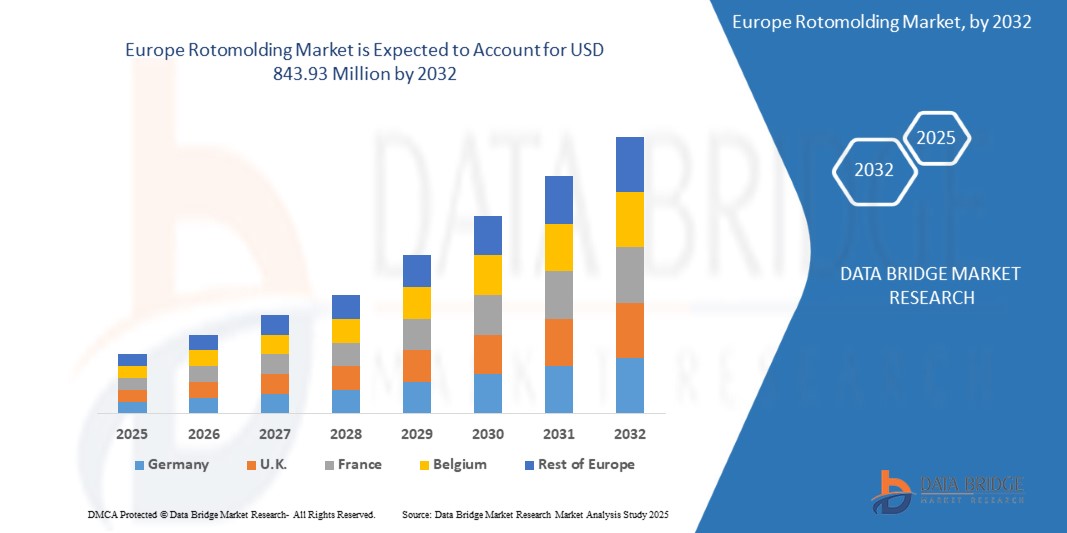

Europe rotomolding market size was valued at USD 538.11 million in 2024 and is projected to reach USD 843.93 million by 2032, growing with a CAGR of 5.9% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Rotomolding Market Trends

Technological advancements are enhancing the efficiency and versatility of the rotomolding process, allowing for the production of complex shapes and intricate designs with improved precision. Notably, the polyethylene segment is expected to dominate the market due to its excellent durability and cost-effectiveness, holding a significant market share. Additionally, there is a growing emphasis on sustainability within the industry, with companies increasingly exploring recyclable and biodegradable materials to meet environmental standards.

The automotive sector is particularly influential, as manufacturers seek lightweight rotomolded components to improve fuel efficiency and reduce overall vehicle weight. Overall, the rotomolding market is positioned for continued growth, characterized by technological innovations, sustainability initiatives, and increased investment in key sectors. This trend is expected to significantly contribute to the growth of the rotomolding markets the world moves towards rotomolding products and services.

Report Scope and Rotomolding Market Segmentation

|

Attributes |

Rotomolding Key Market Insights |

|

Segments Covered |

By Application: Tank and Non-Tank |

|

Countries Covered |

Germany, U.K., France, Italy, Spain, Poland, Netherlands, Belgium, Turkey, Switzerland, Sweden, Russia, Denmark, and Rest of Europe |

|

Key Market Players |

Centro Incorporated (U S), Rototech (India), Prisma Colour Limited (U K), Arkema (France), LyondellBasell Industries Holdings B.V. (U S), ROTOPLAST INC. (Canada), Green Age Industries (India), Phychem Technologies Pvt. Ltd. (India), K. K. Nag Pvt. Ltd (Apparatus Solutions) (India), Dutchland Plastics (U S), ROTOVIA (Iceland), Centro Incorporated (U S), Rotomachinery Group (Italy), Naroto (India), Loopa (Brazil), Ferry, Industries, Inc (U S), Granger Industries Inc (U S), Shandong Zhongtian, Rubber & Plastic Technology Co., Ltd.(China), Persisco S.P.A (Italy), Fixopan (India), Orex (Poland), Rotomachines Ltd (U K) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Rotomolding Market Definition

Rotomolding, also known as rotational molding, is a manufacturing process specifically designed to produce hollow plastic parts and products. This technique involves the use of a heated mold, typically made of metal, which is filled with powdered plastic material. The mold is then rotated along multiple axes, allowing the plastic to melt and evenly coat the inner surfaces of the mold. This process enables the creation of complex shapes and large, seamless parts with varying wall thicknesses. Rotomolding is particularly valued for its cost-effectiveness in producing large plastic components, making it widely used in various applications such as automotive parts, water tanks, outdoor furniture, and playground equipment. The industry is currently experiencing growth due to rising demand in sectors like building and construction, as well as advancements in material technologies that enhance the performance of rotomolded products.

Rotomolding Market Dynamics

Drivers

- Rising Acceptance of Rotomolded Products Such as Containers and Pallets in Material Handling and Packaging Applications

Material handling and packaging are among the five interconnected logistical roles that contribute significantly to logistics. The transportation, storage, control, and protection of materials, products, and packaged items during the manufacturing, distribution, and disposal processes are all part of material handling. Packaging serves a crucial purpose in enclosing materials and goods for distribution and transportation.

The products manufactured through rotomolding technology offers affordable, safe, and durable solutions for material handling and packaging applications in various industries. They have a high load-bearing capacity because of their seamless and one-part design. Rotationally molded components are also a better alternative to conventional steel parts. Rotational molding is the ideal process for producing parts and components that may be utilized for collecting, storing, or moving nearly any substance due to its lower weight, improved corrosion resistance, and joint-free manufacture.

For instance,

- In November 2024, According to Globe Newswire, the Europe market for rotomolded containers is experiencing robust growth, with sales projected to reach USD 4.5 billion in 2024, as per the latest market insights. This growth trajectory is supported by the continued expansion of polyethylene-based containers, which are expected to account for more than 60% of the market share in 2024. Polyethylene’s structural versatility plays a key role in its dominance, enabling manufacturers to produce a diverse range of durable, cost-effective, and recyclable containers. The material’s adaptability guarantees strong performance and long-lasting integrity, making it a preferred choice for industries seeking sustainable, high-quality packaging solutions. With a steady annual growth rate of 3.4%, the market is forecast to reach a total value of USD 6.3 billion by 2034

Positive Outlook Towards the Construction Sector

The construction sector is associated with the building, repair, renovation, and maintenance of infrastructures. The construction industry contributes to the nation's socioeconomic development and economic growth. The construction industry generates activity and employment in other areas of the economy such as manufacturing, logistics, trade, and financial services. Population growth, growing urbanization, housing market, and infrastructure development are the key drivers of the construction industry.

The construction industry has the potential to be a major driving force in the expansion of rotomolded products. Rotomolded products have various applications in building construction projects such as water storage tanks and septic tanks among others. Moreover, products such as barricades and traffic cones that are used in the construction of roads and highways are also manufactured through rotomolding technology. Such products are durable, corrosion resistant, and require low maintenance which makes them ideal for infrastructure applications. Moreover, due to the light weight of products such as barricades and traffic cones, they are easy to carry which leads to lower fuel costs for the end user. In addition, they are easy to transport and relocate when compared to other products made from materials such as metal. The growing focus on developing efficient and long-lasting infrastructure adds up to the application growth of rotomolded products in the construction sector.

For instance,

- In February 2024, according to an article by Rotoline, the rotomolding process is gaining significant traction in the civil construction sector, where it is being applied to manufacture a wide range of essential components. From sinks and bathtubs to thermal insulation blocks, the versatility of rotomolding plays a crucial role in producing parts that meet stringent functional and durability standards. The ability to create durable, cost-effective, and reliable construction elements through this innovative technique is contributing to its growing adoption across the industry, providing significant benefits in terms of performance and long-term value for construction projects

Opportunities

- Possibility of Inclusion of New Printing and Labelling Technologies

Over time, new label demands from customers and changing market dynamics will influence the choice of printed label type and new label technological developments. The packaging industry and its customers are constantly working to reduce the weight of product packaging, either by employing smaller rigid containers made of metal, glass, or plastic or by transitioning to flexible plastic formats

The inclusion of new printing and labelling technologies in rotomolding offers a great opportunity for the incorporation of designs, texts, and logos over rotomolded products. Technological advancements such as direct-to-object printing, digital printing, and labeling technologies help in the application of customized and personalized branding into rotomolded products. The incorporation of logos and branding labels on the product has the potential to increase brand popularity. There are other opportunities associated with new printing and labelling as it will help in traceability by incorporating information such as manufacturing date, batch number, and usage information directly on products.

For instance,

- In September 9, 2024, a blog from MANN SUPPLY highlighted the rapid advancements in label printing, driven by innovations like smart labels with RFID technology and eco-friendly materials. To remain competitive, businesses must embrace these trends for improved efficiency and enhanced customer engagement. For the Europe rotomolding products market, these innovations offer advanced labelling solutions that boost product traceability and sustainability, meeting evolving regulatory and market demands

Increasing Access to Bio-Based Polymers

Bio- Increasing access to bio-based polymers presents a significant opportunity for the Europe rotomolding products market. Bio-based polymers, derived from renewable resources like plants, algae, or biomass, offer an eco-friendly alternative to traditional petroleum-based plastics. As environmental sustainability becomes a key priority for industries worldwide, the demand for bio-based materials is steadily rising. For the rotomolding market, these materials align with the growing trend toward reducing carbon footprints and minimizing environmental impact.

The adoption of bio-based polymers can further enhance the versatility and performance of rotomolded products. These polymers offer advantages such as improved strength, flexibility, and resistance to wear, making them ideal for a variety of applications, from automotive and construction to consumer goods. As the supply chain for bio-based polymers becomes more accessible and cost-effective, manufacturers in the rotomolding industry will have more opportunities to innovate and produce sustainable, high-quality products.

For instance,

- In 13 January 2025, according to a report published by Nova-Institute GmbH Renewable Carbon News, Europe capacity for bio-based polymers is forecasted to grow robustly, driven by significant investments in China, Europe, and the Middle East. This expansion is supported by new political regulations in Europe, which are boosting the demand for biodegradable plastics. The bio-based polymer market is expected to experience a compound annual growth rate (CAGR) of 18% from 2024 to 2029, significantly outpacing fossil-based polymers. As the capacity share of bio-based polymers rises, their increased utilization in applications such as rotomolding products will play a critical role in this market growth

Restraints/Challenges

- Limitations Regarding Processing of other Materials Namely Metals and Ceramics

Rotomolding technology is used to process thermoplastic polymeric materials like polyethylene and polypropylene. Moreover, the raw material used in the formation of rotomolding products be easily converted from granules to fine powder and should have high thermal stability. This limits the material selection to only poly-based resins in the formation of rotomolded products. The high thermal stability requirement leads to the high cost of raw materials and the expense of grinding material into powder rises.

Although rotomolding offers various advantages when plastic based products are processed. However, it faces restraints while processing other materials such as metals and ceramics. They have high melting points compared to polymers, therefore offering a disadvantage because metal and ceramics require high temperatures. Ceramics and metals too have high structural strength and weight-bearing capability that are less seen in rotomolded plastics. The metals and ceramics have high heat resistance and thermal conductivity, therefore used in industrial applications where heat and thermal resistant properties are required. Hence, the inability to process materials such as metals and ceramics through rotomolding technology is expected to limit the growth of the Europe rotomolding products market.

For instance,

- In February 2024, according to the GVL POLY while rotomolding is ideal for producing hollow plastic parts, its long cycle times, material limitations, and suitability for low-volume production can be constraints. Though advancements like Smart Molding Technology improve efficiency, the process remains slower than others. Additionally, limited resin options and larger tolerances can make it less suitable for high-volume or precision applications. Companies should assess these factors and consult experts to determine if rotomolding is the right solution for their needs

Substitutional Threat from Other Molded Materials

Rotomolding comprises of the manufacturing process through which hollow plastic products are created. Although rotomolding has various advantages in the production of plastic components that are durable, cost-effective, and have no joints. However, there is various other molding technology such as injection molding and blow molding that is an alternative to rotomolding technology. Through injection molding components from various materials such as polymers, ceramics, and metals are produced. The blow molding process is also used to manufacture hollow containers such as soda and water bottles. However, rotomolding can only process polymer materials to form rotomolded products

Injection molding offers to create a large number of products in a short span of time compared to rotomolding. Rotomolding has the advantage to create flexible materials. however, it is slow and less effective for large production when compared to other substitutional technologies.

For instance,

- In 2022, according to a blog by Industrial Custom Products, both thermoforming and rotomolding are effective methods for specialty plastic forming, but each has its own advantages. While rotomolding is known for its durability and versatility in producing larger, hollow plastic parts, thermoforming is often better suited for projects that demand higher precision, detail, or flexibility in tooling. Thermoforming is especially ideal for repeat part production or projects requiring intricate design work. For businesses unsure of which method to choose, consulting with a plastic production professional can help determine the most suitable approach for specific project requirements

Rotomolding Market Scope

The market is segmented into five notable segments based on the material, form, utility, machine type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Material

- Polyethylene

- By Type

- Ldpe

- Hdpe

- By Type

- Polypropylene

- By Type

- Homopolymer

- Random Copolymer

- Impact Copolymer

- By Type

- Pvc

- Polycarbonate

- Nylon

- Polyurethane

- Elastomers

- By Type

- Nitrile Rubber

- Butyl Rubber

- Polybutadiene

- Chiloroprene Rubber

- By Type

- Others

- By Type

- Polyester

- Epoxy

- Acrylics

- By Type

By Form

- Powder

- Liquid

By Utility

- Underfloor Heating & Cooling

- Ceiling Heating & Cooling

- Wall Heating & Cooling

- Others

- Finance And Accounting

By Machine Type

- Rock And Roll Machine

- Bi-Axial Machine

- Shuttle Machine

- Clamshell Machine

- Vertical Wheel Machine

- Open Flame Machine

- Carousel Machine

- Swing Arm Machine

- Others

By Application

- Non-Tank

- By Category

- Automotive

- By End Use

- Consoles

- Panels

- Bumpers

- Mudguards

- Others

- By Category

- Agriculture

- By End Use

- Tractors

- Harvesters

- Seeders

- Sprayers

- Others

- By End Use

- Building & Construction

- By End Use

- Single Family Homes

- Industrial Building

- Office Buildings

- Hotels

- By Application

- Road Barriers

- Pipes

- Conduits

- Others

- By End Use

- Packaging

- By End Use

- Pallets

- Industrial Containers

- Consumer Storage Bins

- Transport Containers

- Others

- By End Use

- Consumer Goods

- Furniture

- By End Use

- Chair

- Table

- Lounges

- Others

- Marine

- By End Use

- Chair

- Table

- Lounges

- Others

- By End Use

- Water Treatment

- Sports And Leisure

- Underground Chambers

- Others

- By End Use

- Tank

- By Type

- Water Tanks

- Chemical Tanks

- Rainwater Tanks

- Fuel Tanks

- Urea Tanks

- Hydraulic Oil Tanks

- Adbue Tanks

- Others

- By Type

Rotomolding Market Regional Analysis

The market is segmented into five notable segments based on the material, form, utility, machine type, and application as referenced above.

The countries covered in the market are Germany, U.K., France, Italy, Spain, Poland, Netherlands, Belgium, Turkey, Switzerland, Sweden, Russia, Denmark, and rest of Europe.

Germany is the fastest growing country in the Europe Rotomolding Market due to significant investments in rotomolding products also surge in construction activities, driven by urbanization and infrastructure development, which increases the demand for rotomolded products such as tanks, containers, and automotive parts.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Rotomolding Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Rotomolding Market Leaders Operating in the Market Are:

- Rotomachinery Group (Italy)

- Persisco S.P.A (Italy)

- Orex (Poland)

- Rotomachines Ltd (U K)

Latest Developments in Rotomolding Market

- In April 2023, according to the Shandong Zhongtian Rubber & Plastic Technology Co., Ltd, the advantages associated with the use of rotomolding process for plastic fishing boats are its safety, corrosion, resistance, and low maintenance costs. Plastic boats made out of rotational molding have low specific gravity when compared to water. It ensures that the boat doesn’t get sink even if it capsizes. Moreover, because it is made of plastic they have strong resistance to corrosion especially in the marine environment

- In February 2023, according to the Marine Technology News, Almarin, a Spanish business, updated its well-known Balizamar buoy design and re-launched it as the EVO. Rotomolded polyethylene modular components improve visibility and save maintenance costs on Balizamar EVO buoys. The inner structure is made of immersion galvanized steel, while the top mark is made of stainless steel. Thus, to maintain buoyancy, the hull is rotomolded and filled with closed-cell EPS foam, providing durability and long-lasting performance

- In February 2024, according to an article by Rotoline, the rotomolding process is gaining significant traction in the civil construction sector, where it is being applied to manufacture a wide range of essential components. From sinks and bathtubs to thermal insulation blocks, the versatility of rotomolding plays a crucial role in producing parts that meet stringent functional and durability standards. The ability to create durable, cost-effective, and reliable construction elements through this innovative technique is contributing to its growing adoption across the industry, providing significant benefits in terms of performance and long-term value for construction projects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE ROTOMOLDING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MATERIAL TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 IMPORT EXPORT SCENARIO

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING ACCEPTANCE OF ROTOMOLDED PRODUCTS SUCH AS CONTAINERS AND PALLETS IN MATERIAL HANDLING AND PACKAGING APPLICATIONS

6.1.2 POSITIVE OUTLOOK TOWARDS THE CONSTRUCTION SECTOR

6.1.3 GROWTH IN THE POPULARITY OF ATHLETICS AND WATER SPORTS

6.1.4 IMPROVEMENT IN THE SHIPBUILDING INDUSTRY

6.2 RESTRAINTS

6.2.1 LIMITATIONS IN PROCESSING MATERIALS SUCH AS METALS AND CERAMICS

6.2.2 RESTRICTIVE COMPETITION FROM ALTERNATIVE MOLDED MATERIALS

6.3 OPPORTUNITIES

6.3.1 INTEGRATION OF ADVANCED PRINTING AND LABELING TECHNOLOGIES FOR ENHANCED PRODUCT CUSTOMIZATION AND BRANDING

6.3.2 INCREASING ACCESS TO BIO-BASED POLYMERS

6.3.3 INCREASING DEMAND FOR SUSTAINABLE AND ECO-FRIENDLY MATERIALS

6.4 CHALLENGES

6.4.1 STRINGENT RULES AND REGULATIONS AIMED AT POLYMERS PROCESSING

6.4.2 EXCESSIVE ENERGY CONSUMPTION DURING MANUFACTURING PROCESSES

7 EUROPE ROTOMOLDING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 POLYETHYLENE

7.2.1 LDPE

7.2.2 HDPE

7.3 POLYPROPYLENE

7.3.1 HOMOPOLYMER

7.3.2 RANDOM COPOLYMER

7.3.3 IMPACT COPOLYMER

7.4 PVC

7.5 POLYCARBONATE

7.6 NYLON

7.7 POLYURETHANE

7.8 ELASTOMERS

7.8.1 NITRILE RUBBER

7.8.2 BUTYL RUBBER

7.8.3 POLYBUTADIENE

7.8.4 CHILOROPRENE RUBBER

7.9 OTHERS

7.9.1 POLYESTER

7.9.2 EPOXY

7.9.3 ACRYLICS

8 EUROPE ROTOMOLDING MARKET, BY FORM

8.1 OVERVIEW

8.2 POWDER

8.3 LIQUID

9 EUROPE ROTOMOLDING MARKET, BY UTILITY

9.1 OVERVIEW

9.2 UNDERFLOOR HEATING & COOLING

9.3 CEILING HEATING & COOLING

9.4 WALL HEATING & COOLING

9.5 OTHERS

10 EUROPE ROTOMOLDING MARKET, BY MACHINE TYPE

10.1 OVERVIEW

10.2 ROCK AND ROLL MACHINE

10.3 BI-AXIAL MACHINE

10.4 SHUTTLE MACHINE

10.5 CLAMSHELL MACHINE

10.6 VERTICAL WHEEL MACHINE

10.7 OPEN FLAME MACHINE

10.8 CAROUSEL MACHINE

10.9 SWING ARM MACHINE

10.1 OTHERS

11 EUROPE ROTOMOLDING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 NON-TANK

11.2.1 AUTOMOTIVE

11.2.1.1 Consoles

11.2.1.2 Panels

11.2.1.3 Bumpers

11.2.1.4 Mudguards

11.2.1.5 Others

11.2.2 AGRICULTURE

11.2.2.1 Tractors

11.2.2.2 Harvesters

11.2.2.3 Seeders

11.2.2.4 Sprayers

11.2.2.5 Others

11.2.3 BUILDING & CONSTRUCTION

11.2.3.1 Single Family Homes

11.2.3.2 Industrial Building

11.2.3.3 Office Buildings

11.2.3.4 Hotels

11.2.3.5 Road Barriers

11.2.3.6 Pipes

11.2.3.7 Conduits

11.2.3.8 Others

11.2.4 PACKAGING

11.2.4.1 Pallets

11.2.4.2 Industrial Containers

11.2.4.3 Consumer Storage Bins

11.2.4.4 Transport Containers

11.2.4.5 others

11.2.5 CONSUMER GOODS

11.2.6 FURNITURE

11.2.6.1 Chair

11.2.6.2 Table

11.2.6.3 Lounges

11.2.6.4 others

11.2.7 MARINE

11.2.7.1 Mooring And Marker Buoys

11.2.7.2 Boom Floats

11.2.7.3 Solas-Approved Lifebuoys

11.2.7.4 Avigation Aids

11.2.7.5 Others

11.2.8 WATER TREATMENT

11.2.9 SPORTS AND LEISURE

11.2.10 UNDERGROUND CHAMBERS

11.2.11 OTHERS

11.3 TANK

11.3.1 WATER TANKS

11.3.2 CHEMICAL TANKS

11.3.3 RAINWATER TANKS

11.3.4 FUEL TANKS

11.3.5 UREA TANKS

11.3.6 HYDRAULIC OIL TANKS

11.3.7 ADBUE TANKS

11.3.8 OTHERS

12 EUROPE ROTOMOLDING MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 ITALY

12.1.5 SPAIN

12.1.6 POLAND

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 TURKEY

12.1.10 SWITZERLAND

12.1.11 SWEDEN

12.1.12 RUSSIA

12.1.13 DENMARK

12.1.14 REST OF EUROPE

13 EUROPE ROTOMOLDING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 GRANGER INDUSTRIES INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ARKEMA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 CENTRO INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 DUTCHLAND PLASTICS

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 FERRY INDUSTRIES INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 FIXOPAN

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 GREEN AGE INDUSTRIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 K.K NAG PVT. LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 LOOPA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 NAROTO

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 OREX

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 PERSICO S.P.A.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PHYCHEM TECHNOLOGIES PVT. LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 PRISMA COLOUR LIMITED

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ROTO DYNAMICS

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 ROTOMACHINERY GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 ROTO MACHINES LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 ROTOPLAST INC

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 ROTOTECH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ROTOVIA.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SHANDONG ZHONGTIAN RUBBER & PLASTIC TECHNOLOGY CO., LTD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 PRODUCT CODES:

TABLE 2 EUROPE ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 3 EUROPE POLYETHYLENE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 EUROPE POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE POLYPROPYLENE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 EUROPE POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 EUROPE PVC IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE POLYCARBONATE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE NYLON IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE POLYURETHANE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE ELASTOMERS IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE OTHERS IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE POWDER IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE LIQUID IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE UNDERFLOOR HEATING & COOLING IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE CEILING HEATING & COOLING IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE WALL HEATING & COOLING IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE OTHERS SEGMENT IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE ROTOMOLDING MARKET: BY MACHINE TYPE , 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE ROCK AND ROLL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE BI-AXIAL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE SHUTTLE MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 EUROPE CLAMSHELL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 EUROPE VERTICAL WHEEL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 EUROPE OPEN FLAME MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 EUROPE CAROUSEL MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 EUROPE SWING ARM MACHINE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 EUROPE OTHERS SEGMENT IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 EUROPE ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 EUROPE NON-TANK IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 EUROPE NON TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 36 EUROPE AUTOMOTIVE IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 37 EUROPE AGRICULTURE IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 EUROPE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 39 EUROPE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 40 EUROPE PACKAGING IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 41 EUROPE FURNITURE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 42 EUROPE MARINE IN ROTOMOLDING MARKET, BY END USE, 2018-2032 (USD THOUSAND)

TABLE 43 EUROPE TANK IN ROTOMOLDING MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 EUROPE TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 EUROPE ROTOMOLDING MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 46 EUROPE ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 47 EUROPE POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 EUROPE POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 EUROPE ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 EUROPE OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 EUROPE ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 52 EUROPE ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 53 EUROPE ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 EUROPE ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 EUROPE NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 56 EUROPE AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 GERMANY ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 65 GERMANY POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 GERMANY POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 GERMANY ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 GERMANY OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 GERMANY ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 70 GERMANY ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 71 GERMANY ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 GERMANY ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 GERMANY NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 74 GERMANY AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 75 GERMANY AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 76 GERMANY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 77 GERMANY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 GERMANY PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 79 GERMANY FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 80 GERMANY MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 81 GERMANY TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 FRANCE ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 83 FRANCE POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 FRANCE POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 FRANCE ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 FRANCE OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 FRANCE ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 88 FRANCE ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 89 FRANCE ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 FRANCE ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 FRANCE NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 92 FRANCE AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 93 FRANCE AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 94 FRANCE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 95 FRANCE BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 96 FRANCE PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 97 FRANCE FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 98 FRANCE MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 99 FRANCE TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 U.K. ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 101 U.K. POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 U.K. POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 U.K. ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 U.K. OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 U.K. ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 106 U.K. ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 107 U.K. ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 U.K. ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 109 U.K. NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 110 U.K. AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 111 U.K. AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 112 U.K. BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 113 U.K. BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 114 U.K. PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 115 U.K. FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 116 U.K. MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 117 U.K. TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 ITALY ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 119 ITALY POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 ITALY POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 ITALY ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 ITALY OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 ITALY ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 124 ITALY ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 125 ITALY ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 ITALY ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 ITALY NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 128 ITALY AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 129 ITALY AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 130 ITALY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 131 ITALY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 ITALY PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 133 ITALY FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 134 ITALY MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 135 ITALY TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SPAIN ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 137 SPAIN POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SPAIN POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SPAIN ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SPAIN OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SPAIN ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 142 SPAIN ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 143 SPAIN ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SPAIN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 145 SPAIN NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 146 SPAIN AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 147 SPAIN AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 148 SPAIN BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 149 SPAIN BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 150 SPAIN PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 151 SPAIN FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 152 SPAIN MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 153 SPAIN TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 POLAND ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 155 POLAND POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 POLAND POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 POLAND ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 POLAND OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 POLAND ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 160 POLAND ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 161 POLAND ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 POLAND ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 163 POLAND NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 164 POLAND AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 165 POLAND AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 166 POLAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 167 POLAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 POLAND PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 169 POLAND FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 170 POLAND MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 171 POLAND TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NETHERLANDS ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 173 NETHERLANDS POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NETHERLANDS POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NETHERLANDS ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NETHERLANDS OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NETHERLANDS ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 178 NETHERLANDS ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 179 NETHERLANDS ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 NETHERLANDS ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 181 NETHERLANDS NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 182 NETHERLANDS AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 183 NETHERLANDS AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 184 NETHERLANDS BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 185 NETHERLANDS BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 186 NETHERLANDS PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 187 NETHERLANDS FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 188 NETHERLANDS MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 189 NETHERLANDS TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 BELGIUM ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 191 BELGIUM POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 BELGIUM POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 BELGIUM ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 BELGIUM OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 BELGIUM ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 196 BELGIUM ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 197 BELGIUM ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BELGIUM ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 BELGIUM NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 200 BELGIUM AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 201 BELGIUM AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 202 BELGIUM BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 203 BELGIUM BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 204 BELGIUM PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 205 BELGIUM FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 206 BELGIUM MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 207 BELGIUM TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 TURKEY ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 209 TURKEY POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 TURKEY POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 TURKEY ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 TURKEY OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 TURKEY ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 214 TURKEY ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 215 TURKEY ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 TURKEY ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 217 TURKEY NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 218 TURKEY AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 219 TURKEY AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 220 TURKEY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 221 TURKEY BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 222 TURKEY PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 223 TURKEY FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 224 TURKEY MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 225 TURKEY TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SWITZERLAND ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 227 SWITZERLAND POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SWITZERLAND POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SWITZERLAND ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SWITZERLAND OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SWITZERLAND ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 232 SWITZERLAND ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 233 SWITZERLAND ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SWITZERLAND ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 235 SWITZERLAND NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 236 SWITZERLAND AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 237 SWITZERLAND AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 238 SWITZERLAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 239 SWITZERLAND BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 240 SWITZERLAND PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 241 SWITZERLAND FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 242 SWITZERLAND MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 243 SWITZERLAND TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SWEDEN ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 245 SWEDEN POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 SWEDEN POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 SWEDEN ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 SWEDEN OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 SWEDEN ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 250 SWEDEN ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 251 SWEDEN ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 SWEDEN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 253 SWEDEN NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 254 SWEDEN AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 255 SWEDEN AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 256 SWEDEN BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 257 SWEDEN BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 258 SWEDEN PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 259 SWEDEN FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 260 SWEDEN MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 261 SWEDEN TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 RUSSIA ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 263 RUSSIA POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 RUSSIA POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 RUSSIA ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 RUSSIA OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 RUSSIA ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 268 RUSSIA ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 269 RUSSIA ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 RUSSIA ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 271 RUSSIA NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 272 RUSSIA AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 273 RUSSIA AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 274 RUSSIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 275 RUSSIA BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 276 RUSSIA PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 277 RUSSIA FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 278 RUSSIA MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 279 RUSSIA TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 DENMARK ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 281 DENMARK POLYETHYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 DENMARK POLYPROPYLENE IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 DENMARK ELASTOMERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 DENMARK OTHERS IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 DENMARK ROTOMOLDING MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 286 DENMARK ROTOMOLDING MARKET, BY UTILITY, 2018-2032 (USD THOUSAND)

TABLE 287 DENMARK ROTOMOLDING MARKET, BY MACHINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 DENMARK ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 289 DENMARK NON-TANK IN ROTOMOLDING MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 290 DENMARK AUTOMOTIVE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 291 DENMARK AGRICULTURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 292 DENMARK BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 293 DENMARK BUILDING & CONSTRUCTION IN ROTOMOLDING MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 294 DENMARK PACKAGING IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 295 DENMARK FURNITURE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 296 DENMARK MARINE IN ROTOMOLDING MARKET, BY END-USE, 2018-2032 (USD THOUSAND)

TABLE 297 DENMARK TANK IN ROTOMOLDING MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 REST OF EUROPE ROTOMOLDING MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE ROTOMOLDING MARKET: SEGMENTATION

FIGURE 2 EUROPE ROTOMOLDING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE ROTOMOLDING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE ROTOMOLDING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE ROTOMOLDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ROTOMOLDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE ROTOMOLDING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE ROTOMOLDING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE ROTOMOLDING MARKET: MULTIVARIATE MODELING

FIGURE 10 EUROPE ROTOMOLDING MARKET: MATERIAL TIMELINE CURVE

FIGURE 11 EUROPE ROTOMOLDING MARKET: APPLICATION COVERAGE GRID

FIGURE 12 EUROPE ROTOMOLDING MARKET: SEGMENTATION

FIGURE 13 EIGHT SEGMENTS COMPRISE THE EUROPE ROTOMOLDING MARKET, BY MATERIAL (2024)

FIGURE 14 EUROPE ROTOMOLDING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWING RISING ACCEPTANCE OF ROTOMOLDED PRODUCTS SUCH AS CONTAINERS AND PALLETS IN MATERIAL HANDLING AND PACKAGING APPLICATIONS IS EXPECTED TO DRIVE THE EUROPE ROTOMOLDING MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 POLYETHYLENE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE ROTOMOLDING MARKET IN 2025 & 2032

FIGURE 18 EUROPE PRODUCTION OF PVC RESIN (2022)

FIGURE 19 EUROPE CONSUMPTION OF PVC RESIN (2022)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE ROTOMOLDING MARKET

FIGURE 21 PARTICIPATION RATE OF WATER SPORTS ACTIVITIES IN THE UNITED KINGDOM (U.K.)

FIGURE 22 EUROPE ROTOMOLDING MARKET: BY MATERIAL, 2024

FIGURE 23 EUROPE ROTOMOLDING MARKET: BY FORM, 2024

FIGURE 24 EUROPE ROTOMOLDING MARKET: BY UTILITY, 2024

FIGURE 25 EUROPE ROTOMOLDING MARKET: BY MACHINE TYPE, 2024

FIGURE 26 EUROPE ROTOMOLDING MARKET: BY APPLICATION, 2024

FIGURE 27 EUROPE ROTOMOLDING MARKET SNAPSHOT (2024)

FIGURE 28 EUROPE ROTOMOLDING MARKET: 2024 (%)

Europe Rotomolding Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Rotomolding Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Rotomolding Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.