Europe Smart Medical Devices Market

Market Size in USD Billion

CAGR :

%

USD

17.53 Billion

USD

72.89 Billion

2025

2033

USD

17.53 Billion

USD

72.89 Billion

2025

2033

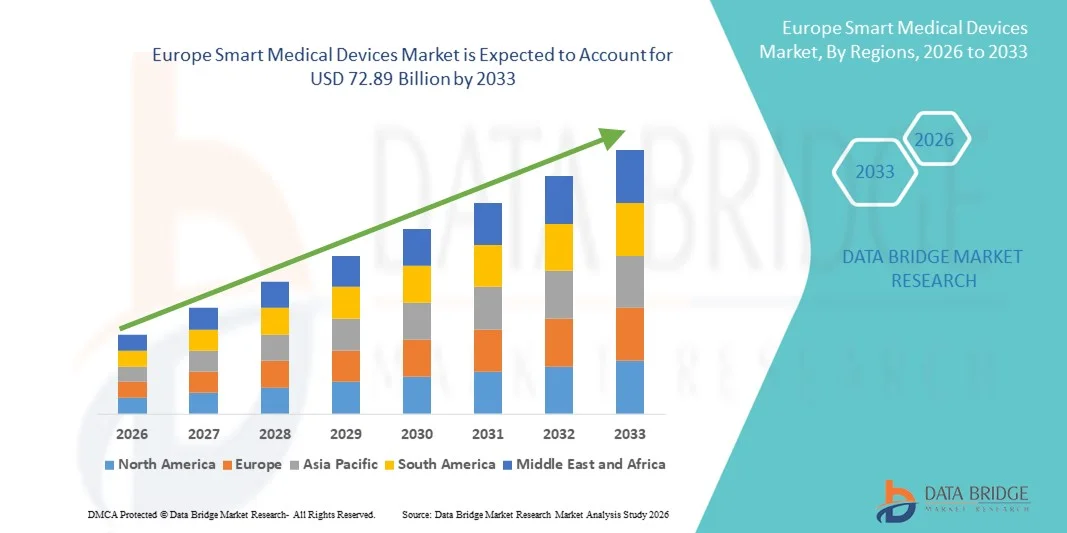

| 2026 –2033 | |

| USD 17.53 Billion | |

| USD 72.89 Billion | |

|

|

|

|

Europe Smart Medical Devices Market Size

- The Europe smart medical devices market size was valued at USD 17.53 billion in 2025 and is expected to reach USD 72.89 billion by 2033, at a CAGR of 19.5% during the forecast period

- The market growth is largely fueled by increasing adoption of connected healthcare solutions, wearable devices, and AI-enabled diagnostics, driving digital transformation across hospitals, clinics, and home-care settings

- Furthermore, rising demand for real-time health monitoring, interoperable devices, and patient-centric solutions is establishing smart medical devices as an essential component of modern healthcare infrastructure. These converging factors are accelerating the uptake of smart medical technologies, thereby significantly boosting the industry's growth

Europe Smart Medical Devices Market Analysis

- Smart medical devices, including wearable health monitors, AI-enabled diagnostic tools, and connected therapeutic equipment, are increasingly vital components of modern healthcare systems in hospitals, clinics, and home-care settings due to their ability to provide real-time patient monitoring, improve clinical decision-making, and enable telehealth integration

- The escalating demand for smart medical devices is primarily fueled by increasing healthcare digitization, rising prevalence of chronic diseases, and a growing preference for remote patient monitoring and AI-supported diagnostics

- Germany dominated the Europe smart medical devices market with the largest revenue share of 28.5% in 2025, characterized by advanced healthcare infrastructure, strong R&D investment, and widespread adoption of connected health technologies in both hospital and home-care environments

- The United Kingdom is expected to be the fastest-growing country in the Europe smart medical devices market during the forecast period due to increased adoption of telemedicine, government initiatives supporting digital health, and rising consumer awareness of wearable and remote monitoring devices

- Wearable devices segment dominated the Europe smart medical devices market with a market share of 41.7% in 2025, driven by their growing acceptance among patients and healthcare providers for continuous monitoring of vital signs and chronic disease management

Report Scope and Europe Smart Medical Devices Market Segmentation

|

Attributes |

Europe Smart Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Smart Medical Devices Market Trends

AI-Enhanced Monitoring and Predictive Diagnostics

- A significant and accelerating trend in the Europe smart medical devices market is the integration of artificial intelligence (AI) into wearable devices, diagnostic tools, and therapeutic systems, significantly improving real-time monitoring, predictive health insights, and clinical decision support

- For instance, the BioBeat wearable monitor integrates AI to continuously track vital signs and predict early deterioration, enabling timely clinical interventions and remote patient management

- AI integration in smart medical devices enables features such as analyzing patient data trends, alerting healthcare providers of anomalies, and recommending personalized care plans. For instance, some iRhythm devices leverage AI to improve arrhythmia detection accuracy and can notify clinicians automatically when irregularities are detected

- The seamless connectivity of smart medical devices with hospital information systems and telehealth platforms allows centralized monitoring of multiple patients, remote consultations, and integration with electronic health records for a unified healthcare delivery experience

- This trend toward more intelligent, predictive, and interconnected medical devices is reshaping patient care expectations. Consequently, companies such as Medtronic are developing AI-enabled devices with predictive alerts and remote monitoring capabilities

- The demand for smart medical devices with AI-driven analytics and interoperability is growing rapidly across hospitals and home-care settings, as healthcare providers increasingly prioritize efficiency, patient safety, and preventive care

- Increasing adoption of tele-rehabilitation devices is enabling remote physiotherapy sessions, reducing hospital visits and improving patient convenience, especially for post-operative and elderly patients

Europe Smart Medical Devices Market Dynamics

Driver

Rising Healthcare Digitization and Chronic Disease Management Needs

- The increasing adoption of digital healthcare solutions and the rising prevalence of chronic diseases are significant drivers of the Europe smart medical devices market

- For instance, in March 2025, Philips announced an AI-enabled remote patient monitoring system for chronic cardiac patients, highlighting the potential of connected medical devices to improve outcomes and reduce hospital readmissions

- As healthcare providers aim to optimize care delivery and reduce costs, smart medical devices offer advanced features such as continuous vital sign monitoring, teleconsultation support, and real-time patient alerts, providing a clear upgrade over traditional monitoring tools

- Furthermore, the growing demand for home-based care and remote monitoring solutions is making smart medical devices a key component of digital health ecosystems, enabling integration with hospital systems and telehealth platforms

- The convenience of real-time monitoring, automated alerts, and data-driven insights for healthcare providers and patients is driving adoption in both clinical and home-care settings. The trend toward patient-centric care and government incentives for telehealth initiatives further contribute to market growth

- For instance, increasing government funding for digital health programs in Germany and the UK is accelerating smart device adoption in public hospitals

- Rising consumer awareness about personal health and fitness tracking is driving demand for smart medical wearables such as heart rate monitors, blood pressure devices, and sleep trackers, especially among aging populations

Restraint/Challenge

Data Privacy Concerns and Regulatory Hurdles

- Concerns surrounding patient data privacy and cybersecurity vulnerabilities of connected medical devices pose a significant challenge to market growth, as these devices rely on network connectivity and cloud-based data storage

- For instance, reports of cybersecurity breaches in hospital-connected devices have made some healthcare providers cautious about deploying smart medical technologies at scale

- Addressing these challenges through robust encryption, secure authentication, and compliance with GDPR and EU medical device regulations is crucial for building trust. Companies such as Abbott and Medtronic emphasize advanced security measures and regulatory adherence to reassure hospitals and patients

- In addition, the relatively high cost of advanced AI-enabled medical devices compared to traditional tools can be a barrier for adoption, particularly for smaller clinics or budget-constrained healthcare providers. While some basic monitoring devices have become more affordable, premium features such as AI analytics, predictive alerts, or continuous remote monitoring often come at a higher price point

- Overcoming these challenges through improved cybersecurity, regulatory compliance, cost-effective solutions, and provider education will be essential for sustained growth of smart medical devices across Europe

- For instance, the lack of standardized interoperability protocols across hospitals can limit the integration of new devices with existing IT systems, creating adoption delays

- Limited technical training among healthcare staff for operating advanced smart devices can hinder effective utilization, making education and training programs a critical factor for market expansion

Europe Smart Medical Devices Market Scope

The market is segmented on the basis of product type, device type, technology, modality, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the Europe smart medical devices market is segmented into diagnostics and monitoring devices and therapeutic devices. The Diagnostics and Monitoring Devices segment dominated the market in 2025, driven by increasing demand for real-time patient monitoring, chronic disease management, and predictive diagnostics. Hospitals and clinics prefer these devices for continuous vital sign tracking, arrhythmia detection, glucose monitoring, and remote patient management. The segment benefits from advancements in wearable sensors, AI integration, and telehealth platforms. Rising patient awareness of personalized healthcare and preventive monitoring further strengthens demand. Government initiatives and reimbursement policies in EU countries promote adoption of diagnostic and monitoring devices.

The Therapeutic Devices segment is anticipated to witness the fastest growth rate during the forecast period, fueled by increasing adoption of AI-enabled treatment delivery systems, home-based rehabilitation devices, and automated drug delivery solutions. Patients and healthcare providers prefer these devices for personalized therapy, reduced hospital visits, and continuous care. Innovations in smart insulin pumps, AI-guided physiotherapy, and automated inhalers support this growth. Home-care adoption and remote treatment capabilities further accelerate market expansion. Rising government support for home healthcare solutions enhances adoption. Technological integration with mobile apps and cloud platforms adds to convenience and efficacy.

- By Type

On the basis of type, the market is segmented into on-body (adhesive patch), off-body (belt clip), and hand held. The On-Body (Adhesive Patch) segment dominated the market in 2025, driven by its comfort, discreet design, and ability to provide continuous monitoring of vital signs and chronic conditions. Patients prefer adhesive patches due to skin contact reliability, ease of wear, and integration with smartphones and hospital systems. Hospitals and home-care providers utilize these devices for long-term monitoring and preventive care. Rising adoption in diabetes, cardiac, and sleep disorder management further strengthens demand. Improvements in materials, sensor accuracy, and battery life support the segment. AI-enabled patches that provide predictive alerts and remote monitoring are boosting popularity.

The Off-Body (Belt Clip) segment is expected to witness the fastest growth during the forecast period due to its portability, ease of use, and non-invasive design for remote monitoring. Belt clip devices are preferred by elderly patients or those with sensitive skin who avoid adhesive patches. Integration with mobile apps and cloud platforms allows seamless data sharing with healthcare providers. The segment sees rising adoption in outpatient care, home monitoring, and rehabilitation. Growing demand for wearable alternatives that do not require skin adhesion supports growth. AI-enabled analytics and alerts further enhance the appeal of these devices.

- By Technology

On the basis of technology, the market is segmented into spring-based, motor-driven, rotary pump, expanding battery, pressurized gas, and others. The Motor-Driven technology segment dominated the market in 2025, attributed to its precision, reliability, and suitability for automated diagnostic and therapeutic functions. Hospitals and clinics prefer motor-driven devices for controlled drug delivery, robotic rehabilitation, and automated monitoring. These devices integrate with AI platforms and telehealth systems for improved patient care. Compliance with EU medical device standards strengthens adoption. Continuous operation reliability, accuracy, and long-term durability enhance market preference. Advanced features such as predictive alerts and automated functions further drive demand.

The Expanding Battery segment is expected to witness the fastest growth rate during the forecast period due to its long operating time, portability, and suitability for wearables and remote monitoring devices. Patients prefer devices with minimal charging requirements for continuous monitoring. Adoption is rising in smart insulin pumps, cardiac monitors, and tele-rehabilitation devices. Integration with cloud-based platforms and mobile apps enhances convenience. Technological advancements in battery efficiency further boost growth. Growing home-care and outpatient monitoring demand accelerates adoption.

- By Modality

On the basis of modality, the market is segmented into wearable and non-wearable devices. The Wearable segment dominated the market in 2025 with a market share of 41.7%, driven by rising demand for chronic disease monitoring, preventive healthcare, and real-time patient tracking. Wearables such as smart glucose monitors, heart rate sensors, and AI-enabled patches are widely adopted in hospitals and home care. Integration with telehealth platforms and mobile apps allows continuous monitoring and remote alerts. Patient comfort, convenience, and acceptance support market growth. High adoption for outpatient monitoring and preventive care strengthens demand. Technological improvements and interoperability with EHR systems further enhance adoption.

The Non-Wearable segment is expected to witness the fastest growth rate during the forecast period due to increasing adoption in outpatient clinics, home care, and sports rehabilitation centers. Devices such as handheld diagnostics, portable imaging, and AI-guided therapy machines offer mobility and affordability. Remote monitoring and tele-rehabilitation adoption drive growth. Integration with mobile apps and cloud-based analytics enhances usability. Rising awareness among healthcare providers of home-based care and preventive monitoring accelerates demand. Continuous innovation in portable devices supports expansion.

- By Application

On the basis of application, the market is segmented into oncology, diabetes, auto-immune disorders, infection diseases, sports and fitness, sleep disorders, and others. The Diabetes segment dominated the market in 2025, driven by increasing prevalence across Europe and adoption of continuous glucose monitors and smart insulin pumps. Hospitals and home care providers prioritize diabetic monitoring to reduce complications and improve outcomes. AI-enabled predictive analytics in devices enhance patient management. Government initiatives, reimbursement policies, and rising patient awareness support growth. Integration with mobile apps and telehealth platforms improves convenience and adherence. Advanced features such as automatic alerts and cloud data access further strengthen adoption.

The Sports and Fitness segment is expected to witness the fastest growth during the forecast period due to rising health awareness, adoption of wearable fitness monitors, and smart rehabilitation devices. Athletes and consumers increasingly use AI-enabled devices to track performance, recovery, and overall health. Remote monitoring and predictive analytics enhance usability. Home-based physiotherapy and fitness monitoring support adoption. Rising preference for personalized fitness insights fuels growth. Integration with smartphones and cloud platforms drives continuous data tracking and analytics.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home care, sports clubs, and others. The Hospitals segment dominated the market in 2025, driven by integration of smart medical devices into diagnostics, monitoring, and therapeutic workflows. Hospitals benefit from AI analytics, remote monitoring, and telehealth integration for improved patient outcomes. Regulatory compliance and reimbursement policies strengthen adoption. Technological integration with EHR systems enhances operational efficiency. Adoption in chronic disease management and critical care supports market dominance. Continuous innovation and predictive analytics further fuel growth.

The Home Care segment is expected to witness the fastest growth during the forecast period due to rising preference for remote patient monitoring, chronic disease management, and tele-rehabilitation solutions. Patients increasingly adopt devices for self-management, convenience, and cost reduction. AI-enabled wearable devices and cloud-based monitoring enhance usability. Growth is supported by government initiatives promoting home healthcare. Integration with mobile apps allows real-time alerts to clinicians. Continuous innovations in sensors and predictive analytics drive expansion.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into pharmacies, online channels, and others. The Pharmacies segment dominated the market in 2025, driven by accessibility, reliability, and regulatory compliance. Pharmacies provide guidance for correct usage of AI-enabled monitoring devices and home-care therapeutic equipment. Partnerships with medical device companies and insurers strengthen adoption. Trusted reputation and availability of trained staff enhance patient confidence. Integration with prescription-based sales for chronic disease devices supports growth. Technological support and customer education further drive market preference.

The Online Channel segment is expected to witness the fastest growth rate during the forecast period due to rising e-commerce penetration, convenience of doorstep delivery, and digital support for users. Patients increasingly prefer online purchase of wearables, monitoring devices, and home-care equipment. Integration with mobile apps and remote tutorials enhances usability. Discounts, promotions, and direct-to-consumer models accelerate adoption. Increased awareness of telehealth-compatible devices supports growth. Continuous platform improvements and online customer service further drive expansion.

Europe Smart Medical Devices Market Regional Analysis

- Germany dominated the Europe smart medical devices market with the largest revenue share of 28.5% in 2025, characterized by advanced healthcare infrastructure, strong R&D investment, and widespread adoption of connected health technologies in both hospital and home-care environments

- Healthcare providers in Germany highly value real-time patient monitoring, predictive analytics, and seamless integration of smart devices with hospital information systems, telehealth platforms, and electronic health records

- This widespread adoption is further supported by government initiatives promoting digital health, high patient awareness, a strong R&D ecosystem, and increasing investments in home-care and wearable technologies, establishing smart medical devices as a critical component of modern healthcare delivery across hospitals, clinics, and home-care settings

The Germany Smart Medical Devices Market Insight

The Germany smart medical devices market dominated Europe in 2025, driven by advanced healthcare infrastructure, high R&D investment, and strong adoption of AI-enabled diagnostic, therapeutic, and wearable monitoring devices. Hospitals and clinics highly value predictive analytics, real-time monitoring, and integration with hospital IT systems for improved patient outcomes. Increasing awareness of preventive healthcare, government support for digital health initiatives, and home-care adoption are key growth drivers. Patients and healthcare providers prioritize secure, reliable, and data-compliant devices, aligning with local regulatory standards. Germany’s emphasis on innovation and technological sustainability promotes widespread adoption across residential, clinical, and outpatient settings.

France Smart Medical Devices Market Insight

The France smart medical devices market is expanding steadily due to increasing adoption of wearable diagnostics, AI-assisted monitoring devices, and telehealth solutions. Hospitals and home-care providers prefer devices that improve workflow efficiency, enhance patient monitoring, and integrate seamlessly with electronic health records. Government initiatives promoting chronic disease management and reimbursement policies further drive adoption. Rising patient awareness of preventive healthcare and self-monitoring is boosting uptake in home-care settings. AI-enabled features, predictive alerts, and real-time monitoring are key differentiators strengthening growth. Continuous technological innovation in wearable and portable devices supports market expansion.

Italy Smart Medical Devices Market Insight

The Italy smart medical devices market is expected to grow at a significant CAGR during the forecast period, fueled by rising chronic disease prevalence, telemedicine adoption, and increasing demand for remote patient monitoring. Hospitals, clinics, and home-care providers increasingly rely on AI-enabled wearable devices and telehealth-integrated monitoring solutions for improved patient management. Government programs supporting e-health, home-based care, and preventive health initiatives further stimulate growth. Patients are showing growing interest in self-managed monitoring for diabetes, cardiovascular diseases, and sleep disorders. Integration with mobile applications and cloud platforms enhances usability. Technological advancements and AI analytics support efficient care delivery.

U.K. Smart Medical Devices Market Insight

The U.K. smart medical devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of remote patient monitoring, telemedicine, and wearable diagnostics. Concerns regarding chronic disease management, preventive healthcare, and hospital efficiency are encouraging adoption across hospitals and home-care settings. The U.K.’s robust healthcare IT infrastructure, combined with patient awareness of connected health solutions, is expected to continue stimulating market growth. Integration with national electronic health records, mobile applications, and AI-enabled analytics supports improved patient outcomes. The growing popularity of home-based monitoring devices and telehealth platforms is further accelerating adoption. Government funding and digital health programs act as key enablers for market expansion.

Europe Smart Medical Devices Market Share

The Europe Smart Medical Devices industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- B. Braun SE (Germany)

- Brainlab SE (Germany)

- BioSerenity (France)

- MESI d.o.o. (Slovenia)

- PKVitality (France)

- Sencure BV (Netherlands)

- Rhythm Diagnostic Systems (France)

- Mode Sensors AS (Norway)

- DrDoctor (U.K.)

- Abbott (U.S.)

- Medtronic plc (Ireland)

- Dexcom, Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- GE Healthcare (U.S.)

- Omron Healthcare, Inc. (Japan)

- Withings SA (France)

- Garmin Ltd. (Switzerland)

What are the Recent Developments in Europe Smart Medical Devices Market?

- In October 2025, Huawei introduced the Watch D2 as Europe’s first CE‑approved smartwatch capable of clinical‑grade blood pressure monitoring and heart rhythm analysis, enabling advanced cardiovascular tracking and remote health monitoring directly from the wrist

- In February 2025, a wearable heart monitor received CE Mark approval for widespread use across Europe, allowing real‑time cardiovascular monitoring (heart rate, arrhythmia detection), bolstering remote patient care and chronic disease management

- In October 2024, Olympus announced CE approval of three cloud‑AI medical devices CADDIE, CADU, and SMARTIBD in Europe, marking a major milestone in AI‑enhanced endoscopy systems aimed at improving diagnostic accuracy and operational efficiency in gastrointestinal care

- In April 2024, BIOTRONIK launched the BIOMONITOR IV, an AI‑enhanced insertable cardiac monitor in Europe featuring advanced SmartECG algorithms to significantly reduce false positives and support remote cardiac patient management

- In April 2021, Empatica’s EmbracePlus wearable secured the European CE mark as a Class IIa medical device for continuous health monitoring, enabling remote monitoring and early detection of clinical conditions such as stress and potentially infection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.