Europe Swabs Collection Kits Market

Market Size in USD Billion

CAGR :

%

USD

1.76 Billion

USD

3.33 Billion

2025

2033

USD

1.76 Billion

USD

3.33 Billion

2025

2033

| 2026 –2033 | |

| USD 1.76 Billion | |

| USD 3.33 Billion | |

|

|

|

|

Europe Swabs Collection Kits Market Size

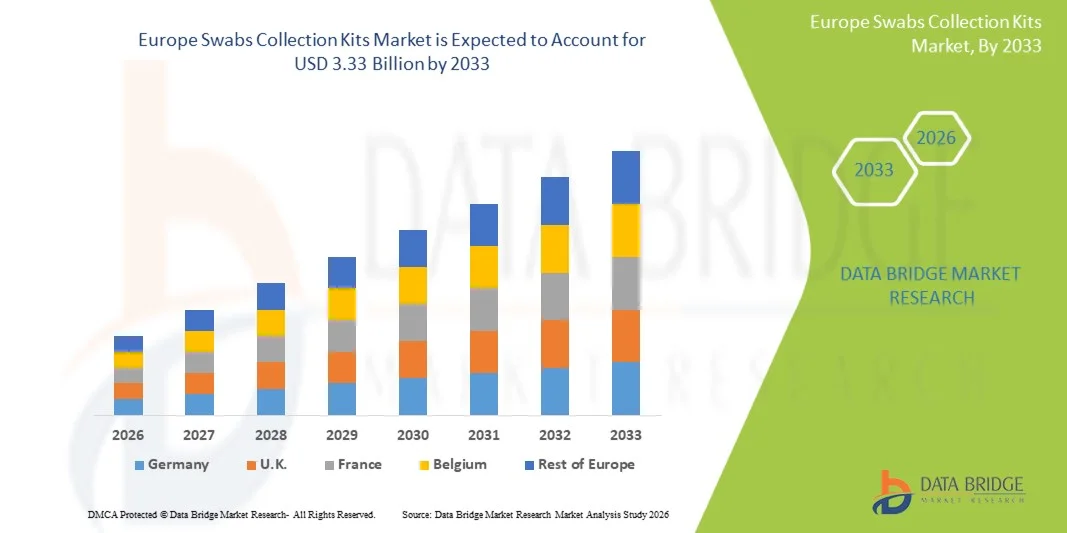

- The Europe swabs collection kits market size was valued at USD 1.76 billion in 2025 and is expected to reach USD 3.33 billion by 2033, at a CAGR of 8.30% during the forecast period

- The market growth is largely fueled by the increasing implementation of advanced diagnostic and laboratory testing procedures, rising demand for accurate and efficient biological sample collection methods, and expansion of healthcare infrastructure across key European countries

- Furthermore, growing prevalence of infectious diseases, ongoing technological advancements in swab and collection kit designs, and heightened focus on public health surveillance and clinical diagnostics are driving adoption of swabs collection solutions in clinical, hospital, and laboratory settings, significantly boosting industry growth

Europe Swabs Collection Kits Market Analysis

- Europe collection kits, essential for accurate biological sample collection across diagnostic, clinical, and research settings, are increasingly vital tools in modern healthcare and laboratory workflows due to their ease of use, reliability, and compatibility with diverse testing procedures

- The growing demand for swabs collection kits is primarily driven by rising prevalence of infectious diseases, expanding diagnostic and laboratory testing requirements, and ongoing investments in healthcare infrastructure across Europe

- Germany dominated the Europe swabs collection kits market in 2025 with a market share of 27.9% of regional demand, supported by strong diagnostic laboratory networks and high adoption of advanced swab types such as nasopharyngeal kits and regular configuration products

- The United Kingdom is expected to be fastest growing country in Europe swabs collection kits market during forecast period, driven by high testing volumes in hospitals, research institutes, and diagnostic facilities and strong distribution networks through direct tender and retail channels

- Nasopharyngeal segment dominated the market in 2025, with the largest revenue share of 45.6% due to their strong clinical acceptance, high diagnostic accuracy, and continued demand for respiratory and infectious disease diagnostics

Report Scope and Europe Swabs Collection Kits Market Segmentation

|

Attributes |

Europe Swabs Collection Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Swabs Collection Kits Market Trends

“Advancements in Flocked and Multi-Specimen Swabs”

- A significant and accelerating trend in the Europe swabs collection kits market is the increasing adoption of flocked swabs and kits capable of collecting multiple specimen types, enhancing sample quality and reducing contamination risks

- For instance, Copan FLOQSwabs offer multi-specimen collection for nasopharyngeal, throat, and rectal samples, enabling laboratories to streamline diagnostics while maintaining accuracy

- Innovations such as antimicrobial-treated swabs and optimized tip materials improve the reliability of sample collection, prevent microbial degradation, and support high-throughput laboratory workflows

- The integration of advanced swab designs with automated laboratory processing systems allows faster sample handling, reduced human error, and improved diagnostic efficiency across hospitals, clinics, and research facilities

- Growing adoption of swab kits in home healthcare testing is expanding the market, allowing patients to collect samples conveniently and send them to diagnostic labs

- Development of eco-friendly and biodegradable swab kits is emerging as a trend, driven by regulatory emphasis on sustainability and healthcare providers’ interest in reducing medical waste

- This trend towards more versatile, efficient, and high-precision swab collection kits is fundamentally reshaping laboratory standards and expectations for sample quality

- The demand for multi-specimen and flocked swabs is growing rapidly across both clinical and research applications, as healthcare providers increasingly prioritize accuracy, efficiency, and operational workflow optimization.

Europe Swabs Collection Kits Market Dynamics

Driver

“Rising Demand Due to Growing Diagnostic Testing and Infectious Disease Surveillance”

- The increasing prevalence of infectious diseases and expanding laboratory diagnostic testing is a major driver for the heightened demand for swabs collection kits across Europe

- For instance, in March 2025, Eurofins Scientific introduced new high-efficiency swab kits for multi-pathogen testing in hospitals and diagnostic labs, expected to boost swab kit adoption in the forecast period

- As healthcare providers focus on early detection and routine screening, swabs kits offer reliable, standardized sample collection essential for accurate molecular and microbiological testing

- Furthermore, the growing popularity of preventive healthcare and public health surveillance programs is increasing the requirement for versatile swabs compatible with diverse specimen types

- The convenience of ready-to-use kits, compatibility with multiple diagnostic platforms, and ability to streamline laboratory workflows are key factors propelling adoption in hospitals, clinics, and research institutions

- Rising collaborations between diagnostic companies and research institutes are driving innovation in swab design and distribution, boosting market penetration

- Government-led screening and vaccination programs across Europe are increasing the demand for large-scale, high-quality swab collection kits

- Increasing awareness of rapid testing protocols in pandemic preparedness is further driving the adoption of efficient swab collection systems in both public and private healthcare sectors

Restraint/Challenge

“Supply Chain Constraints and Regulatory Compliance Hurdles”

- Limited availability of high-quality raw materials and disruptions in supply chains pose significant challenges to swabs collection kit manufacturers in Europe, restricting market growth

- For instance, delays in importing specialized tip materials such as flocked nylon or rayon can slow production and create temporary shortages for laboratories and hospitals

- Adherence to stringent regulatory standards for medical devices and specimen collection kits across multiple European countries adds complexity and cost, potentially delaying product approvals While manufacturers continue to innovate, higher production costs and compliance requirements can result in premium pricing, limiting adoption in budget-sensitive diagnostic facilities

- Fluctuating raw material prices and dependency on international suppliers for specialized components create cost volatility for manufacturers

- Shortages in trained laboratory personnel to handle high-volume swab processing can limit effective utilization, especially in smaller clinics and research facilities

- Overcoming these challenges through supply chain optimization, local sourcing of materials, and regulatory harmonization will be vital for sustained market growth

- In addition, maintaining product sterility and quality during transportation and storage remains a critical operational challenge for manufacturers and distributors

Europe Swabs Collection Kits Market Scope

The market is segmented on the basis of type, configuration, tip material, shaft, specimen, application, end user, and distribution channel.

- By Type

On the basis of type, the Europe swabs collection kits market is segmented into nasopharyngeal, oropharyngeal, and nares. The nasopharyngeal swabs segment dominated the market with the largest share of 45.6% in 2025, driven by its widespread use in respiratory diagnostics, especially for detecting viral and bacterial infections. Hospitals and diagnostic laboratories prefer nasopharyngeal swabs for their accuracy in sample collection and compatibility with PCR and rapid testing methods. The market sees strong demand due to standardized collection protocols and high adoption in government-led screening and surveillance programs. Manufacturers are also innovating nasopharyngeal kits with flocked tips to improve viral recovery rates. The established clinical preference and integration into routine testing workflows sustain the dominance of this segment.

The oropharyngeal swabs segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increased adoption in home healthcare testing and point-of-care diagnostics. Oropharyngeal swabs offer easier collection with minimal discomfort, making them suitable for mass screening and self-sampling kits. Rising awareness of preventive healthcare and ease of use in pediatric and elderly populations contribute to the growing demand. Innovations in multi-specimen collection kits, including oropharyngeal swabs, are enabling simultaneous sampling with other specimen types. Their compatibility with automated lab workflows and molecular testing platforms also drives rapid market expansion.

- By Configuration

On the basis of configuration, the market is segmented into regular swab, flocked swab, and others. The flocked swab segment dominated the market in 2025, accounting for the largest revenue share due to its superior sample collection efficiency and reduced risk of contamination. Flocked swabs are widely used in clinical, laboratory, and research applications, particularly for viral and bacterial diagnostics. Hospitals and diagnostic laboratories prefer flocked swabs for their ability to release almost all collected material into transport media. The market is further supported by innovations in antimicrobial flocked swabs and integration with automated testing platforms.

The regular swab segment is expected to witness the fastest growth from 2026 to 2033, driven by its cost-effectiveness and wide adoption in home healthcare testing kits. Regular swabs are easy to manufacture, suitable for high-volume routine screenings, and compatible with multiple specimen types. Their growth is fueled by rising demand in microbiological and pharmaceutical applications, particularly in emerging European markets. Manufacturers are also improving tip and shaft materials to enhance reliability and user comfort, further boosting adoption.

- By Tip Material

On the basis of tip material, the market is segmented into rayon, polyester, nylon, foam, cotton, calcium alginate, and others. The nylon tip segment dominated in 2025 due to its superior specimen absorption and release efficiency, widely used in PCR-based and molecular diagnostics. Diagnostic laboratories and hospitals prefer nylon swabs for high sensitivity in pathogen detection. Nylon tips are compatible with multiple specimen types, including nasopharyngeal, oropharyngeal, and rectal samples. The segment benefits from ongoing R&D for antimicrobial-coated tips to prevent sample degradation. High accuracy and widespread clinical validation sustain the dominance of nylon tips.

The rayon tip segment is anticipated to witness the fastest growth during the forecast period, fueled by affordability, ease of manufacturing, and growing use in routine clinical diagnostics. Rayon swabs are increasingly used in home healthcare and research applications where high-throughput sampling is needed. Rising demand for cost-effective swabs in large-scale screening programs supports rapid adoption. The segment is further strengthened by improvements in shaft-tip integration and ergonomic designs for better sample collection efficiency.

- By Shaft

On the basis of shaft, the market is segmented into plastic, aluminium, wooden, resins, and others. The plastic shaft segment dominated the market in 2025, accounting for the largest share due to low cost, durability, and widespread compatibility with diagnostic and laboratory applications. Plastic shafts are easy to sterilize and ideal for mass production, supporting high-volume testing in hospitals and clinics. The market also benefits from innovations in biodegradable and flexible plastic shafts for safer disposal. Hospitals prefer plastic shafts for both routine and specialized testing, maintaining their dominance in the market.

The resin shaft segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing adoption in automated laboratory equipment and point-of-care testing kits. Resin shafts provide enhanced rigidity, chemical resistance, and improved compatibility with multiple swab tips. Research and academic institutes favor resin shafts for precise specimen collection in microbiology and pharmaceutical applications. Growth is further supported by rising demand for specialty kits with multiple specimen collection capabilities.

- By Specimen

On the basis of specimen, the market is segmented into throat swab, vaginal swab, penile meatal swab, rectal swab, and others. The throat swab specimen segment dominated the market in 2025, accounting for the largest share due to its extensive use in diagnosing respiratory infections, including streptococcal and viral pathogens. Hospitals and diagnostic laboratories widely prefer throat swabs for routine screening, PCR testing, and culture-based analyses. The segment is supported by high adoption in government and private healthcare programs, especially during seasonal outbreaks. Innovations in tip materials and flocked swabs further enhance sample recovery, maintaining its dominance. Ease of collection and minimal discomfort for patients also contribute to sustained preference in clinical and laboratory workflows.

The vaginal swab specimen segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing awareness of women’s health, rising screening for sexually transmitted infections, and preventive healthcare initiatives. Home healthcare and diagnostic kits are increasingly incorporating vaginal swabs for convenient self-sampling. Growth is also driven by adoption in research and academic institutes studying microbiome and reproductive health. Manufacturers are focusing on user-friendly designs and compatible transport media to improve patient compliance and testing accuracy.

- By Application

On the basis of application, the market is segmented into pharmaceutical, microbiological, laboratory, and disinfection. The laboratory segment dominated in 2025, capturing the largest market share due to the high demand for swab kits in diagnostic labs, clinical testing, and research facilities. Laboratory applications require precision, high-quality collection, and compatibility with molecular and culture-based tests. The market is driven by routine diagnostic testing, government screening programs, and growing adoption of automated lab equipment. Laboratories also prefer flocked and nylon-tip swabs for higher specimen recovery and standardized results. Continuous innovation in swab design and multi-specimen kits further strengthens laboratory segment dominance.

The pharmaceutical segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising adoption of swabs for drug testing, clinical trials, and sterile sampling during formulation. Pharmaceutical companies increasingly require high-quality, contamination-free swabs for quality control and R&D processes. Multi-specimen kits, antimicrobial tips, and compatibility with automated analysis systems support rapid adoption. Growth is further driven by increased pharmaceutical research investment and regulatory emphasis on accurate sampling.

- By End User

On the basis of end user, the market is segmented into diagnostic laboratories, hospitals & clinics, research & academic institutes, home healthcare, and others. The diagnostic laboratories segment dominated the market in 2025, holding the largest share due to the consistent demand for high-volume, accurate specimen collection in routine diagnostics. Diagnostic labs prefer flocked, nylon-tip swabs for efficient sample recovery and reliable test results. Adoption is further supported by integration with automated lab systems and compatibility with multiple specimen types. High throughput, standardization of protocols, and involvement in public health screening programs contribute to sustained dominance.

The home healthcare segment is anticipated to witness the fastest growth from 2026 to 2033, driven by increasing adoption of self-sampling kits and remote diagnostic services. Rising awareness of preventive healthcare and convenience of at-home testing is encouraging manufacturers to develop user-friendly kits with clear instructions. Compatibility with various specimen types and safe, sterile packaging enhances adoption. Growth is further accelerated by telehealth expansion and pandemic preparedness initiatives across Europe.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market in 2025, capturing the largest share due to bulk procurement by hospitals, diagnostic laboratories, and government healthcare programs. Large-scale tenders ensure steady demand and long-term contracts for swab manufacturers. This segment benefits from strong relationships with healthcare institutions, ensuring supply of high-quality, validated swab kits. Direct tender agreements also allow manufacturers to offer customized kits, multi-specimen solutions, and integrated logistics support.

The retail sales segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising demand for over-the-counter home testing kits and convenient point-of-care swab solutions. Retail availability enables patients and consumers to purchase kits for self-sampling, preventive testing, and travel requirements. Growth is driven by e-commerce platforms, pharmacy chains, and increasing awareness of self-testing programs. User-friendly packaging, multi-specimen compatibility, and safety features further support rapid adoption in retail channels.

Europe Swabs Collection Kits Market Regional Analysis

- Germany dominated the Europe swabs collection kits market in 2025 with a market share of 27.9% of regional demand, supported by strong diagnostic laboratory networks and high adoption of advanced swab types such as nasopharyngeal kits and regular configuration products

- Healthcare providers in Germany prioritize accuracy, reliability, and standardized sample collection, increasing demand for high-quality swab kits compatible with nasopharyngeal, oropharyngeal, and other specimen types

- This widespread adoption is further supported by strong investments in laboratory automation, the growing use of multi-specimen and flocked swabs, and rising preventive healthcare awareness, establishing Germany as the leading market in Europe for clinical, research, and home healthcare applications

The Germany Swabs Collection Kits Market Insight

The Germany swabs collection kits market dominated Europe in 2025 with the largest revenue share of 27.9%, driven by the country’s advanced healthcare infrastructure, high laboratory testing volumes, and strong government initiatives for disease prevention. German hospitals and diagnostic laboratories prioritize reliable, high-quality swab kits, including nasopharyngeal, oropharyngeal, and throat swabs. The market is also fueled by research institutes and academic centers adopting multi-specimen and flocked swabs for microbiological and pharmaceutical studies. Increasing awareness of preventive healthcare and standardization of testing protocols contributes to steady adoption. Germany’s emphasis on innovation, sustainability, and laboratory automation further reinforces market dominance.

U.K. Swabs Collection Kits Market Insight

The U.K. swabs collection kits market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for diagnostic testing, preventive healthcare, and home-based self-sampling kits. Hospitals, clinics, and research institutes are increasingly incorporating high-quality swabs with nylon or rayon tips and plastic shafts into their workflows. The growing trend of home healthcare testing and telehealth services supports adoption of user-friendly kits. Government screening programs and public awareness of early disease detection further drive market expansion. E-commerce and retail distribution channels enhance accessibility, stimulating growth across residential and clinical applications.

France Swabs Collection Kits Market Insight

The France swabs collection kits market is expected to expand steadily, fueled by high adoption of clinical diagnostics, microbiological testing, and preventive healthcare programs. French healthcare providers prefer flocked and multi-specimen swabs for enhanced sample recovery and compatibility with PCR and culture-based testing. Increasing investments in laboratory modernization, home healthcare testing kits, and government-supported disease surveillance initiatives contribute to market growth. Research institutions are also driving adoption for pharmaceutical and microbiological applications. The market is witnessing rising demand across hospitals, diagnostic laboratories, and academic centers due to efficiency, accuracy, and standardization requirements.

Italy & Spain Swabs Collection Kits Market Insight

The Italy and Spain swabs collection kits market is poised for significant growth, driven by increasing laboratory testing capacity, preventive healthcare initiatives, and awareness of infectious disease management. Hospitals, clinics, and diagnostic laboratories are investing in high-quality swab kits compatible with multiple specimen types. Multi-specimen and flocked swabs are gaining popularity for their efficiency and reliability. Home healthcare and self-sampling kits are increasingly adopted, supporting market expansion. Government screening programs and the modernization of laboratory infrastructure further reinforce growth in both countries.

Europe Swabs Collection Kits Market Share

The Europe Swabs Collection Kits industry is primarily led by well-established companies, including:

- Copan Diagnostics Inc. (U.S.)

- HiMedia Laboratories (India)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Puritan Medical Products Company LLC (U.S.)

- QIAGEN N.V. (Germany)

- DiaSorin S.p.A. (Italy)

- VIRCELL S.L. (Spain)

- BTNX, Inc. (Canada)

- QuidelOrtho Corporation (U.S.)

- Labcorp (U.S.)

- Hologic, Inc. (U.S.)

- Abbott (U.S.)

- Medline Industries, Inc. (U.S.)

- Medical Wire & Equipment Co. Ltd (U.K.)

- BIOMÉRIEUX (France)

- Sarstedt AG & Co. KG (Germany)

- Greiner Bio-One International GmbH (Austria)

- Norgen Biotek Corp. (Canada)

- Hardy Diagnostics (U.S.)

What are the Recent Developments in Europe Swabs Collection Kits Market?

- In October 2025, a new partnership was established to deliver Copan swabs to NHS laboratories ahead of the winter surge, improving supply availability, faster delivery, and technical support tailored to high‑volume testing workflows in the UK

- In September 2025, Sterilab Services was appointed as an authorised UK distributor for Copan’s swabs, expanding access to premium specimen collection and transport systems across National Health Service (NHS) microbiology departments and private labs to support rising diagnostic volume

- In June 2024, the Council of the EU adopted IVDR updates to help prevent shortages of medical devices, including in‑vitro diagnostic products such as swabs collection kits, requiring manufacturers to flag potential supply interruptions and improve transparency an important regulatory shift affecting availability in Europe

- In March 2024, laboratory supplier Sarstedt hosted a sample transport symposium in Leicester, UK, highlighting innovations in sample collection and transport systems, including advanced transport technologies relevant to swab kit workflows used by diagnostic labs and hospitals

- In January 2023, Copan’s research and product developments were highlighted in industry discussions (e.g., effectiveness of collection media and automation innovations) demonstrating ongoing technical focus on improving sample preparation and swab performance in clinical workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.