Europe Terminal Management System Tms Market

Market Size in USD Million

CAGR :

%

USD

158.37 Million

USD

378.33 Million

2024

2032

USD

158.37 Million

USD

378.33 Million

2024

2032

| 2025 –2032 | |

| USD 158.37 Million | |

| USD 378.33 Million | |

|

|

|

|

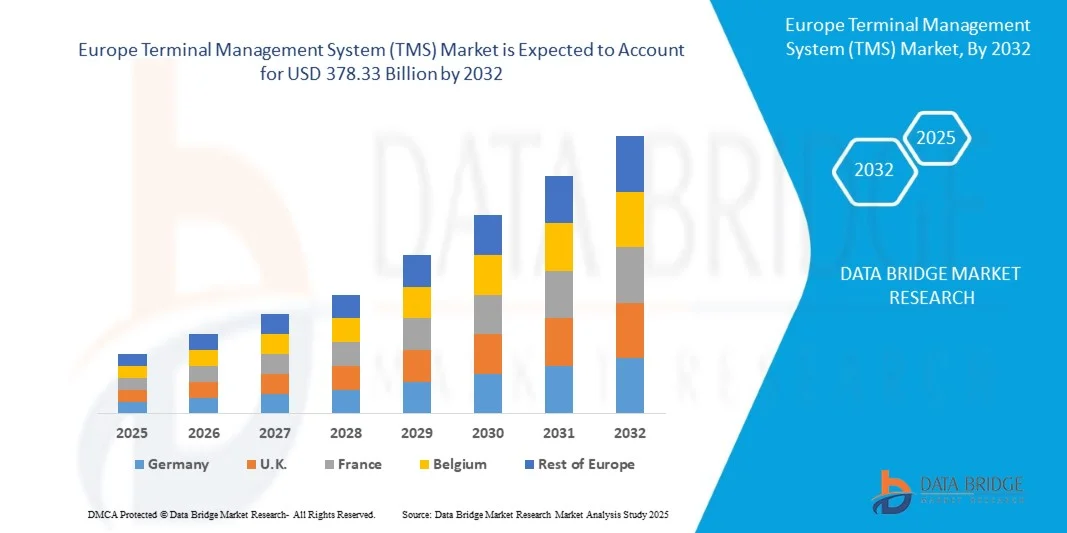

What is the Europe Terminal Management System (TMS) Market Size and Growth Rate?

- The Europe terminal management system (TMS) market size was valued at USD 158.37 million in 2024 and is expected to reach USD 378.33 million by 2032, at a CAGR of 11.5% during the forecast period

- The expansion of aviation sector, rapid urbanization and digitization, rising demand for safety and security solution in terminal management across the globe will emerge as the major factors to bolster the market growth

- In addition, rise in needs for safety and environmental norms in various verticals and increase in adoption of the technology as it offers various features such as control and management and detection of the whole product handling process that includes receiving material to storage and distribution and seamless integration between various business operations and cost control through terminal management systems is further estimated to cushion the growth of the market value. However, the fluctuation of oil prices in oil and gas industry and vulnerabilities across all verticals due to technological advancements act as a restraint for the market

What are the Major Takeaways of Terminal Management System (TMS) Market?

- Automation and digitalization in oil and gas industry and increasing number Greenfield projects in Asia-pacific and Africa region create new opportunities for growing the market within the forecast period. The presence of various stringent government policies and regulations and lack of technical expertise will dampen the growth rate that further result as a challenge for the market

- Germany dominated the terminal management system (TMS) market with the largest revenue share of 32.14% in 2024, supported by significant investments in digital port infrastructure, automation technologies, and environmental compliance regulations

- The U.K. terminal management system (TMS) market is set to witness fastest growth rate of 11.18%, supported by ongoing investments in smart port development and digital trade facilitation

- The software segment dominated the market with the largest revenue share of 42.8% in 2024, driven by the increasing adoption of AI-enabled and cloud-based platforms that facilitate predictive analytics, workflow optimization, and real-time terminal monitoring

Report Scope and Europe Terminal Management System (TMS) Market Segmentation

|

Attributes |

Europe Terminal Management System (TMS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Europe Terminal Management System (TMS) Market?

“Enhanced Efficiency Through AI and Predictive Analytics”

- A prominent and accelerating trend in the global terminal management system (TMS) market is the growing integration of artificial intelligence (AI) and predictive analytics into logistics and port operations. This fusion of technologies is significantly enhancing operational efficiency, shipment tracking, and terminal throughput

- For instance, some next-generation terminal management system solutions integrate AI-powered scheduling and load optimization, enabling operators to predict peak periods, allocate resources efficiently, and reduce vessel turnaround times. Similarly, digital twin simulations are being adopted to model terminal workflows for smarter decision-making

- AI integration in terminal management system also enables predictive maintenance of equipment, anomaly detection, and real-time performance monitoring, helping prevent operational bottlenecks and delays. Predictive alerts guide operators to optimize gate operations, yard planning, and container handling

- The seamless integration of terminal management system with enterprise resource planning (ERP) systems and IoT-enabled devices provides centralized control over all terminal functions, allowing managers to coordinate shipping, storage, and transportation in real time

- This trend toward AI-driven, data-centric terminal management is reshaping expectations for port and logistics efficiency. Consequently, companies such as INFORM and NAVIS are deploying AI-enabled terminal management system solutions with predictive analytics, real-time monitoring, and automated workflow optimization

- The demand for intelligent, integrated terminal management system solutions is rising across ports, freight terminals, and logistics hubs globally, as operators increasingly prioritize operational efficiency, transparency, and cost reduction

What are the Key Drivers of Europe Terminal Management System (TMS) Market?

- The increasing complexity of global supply chains, coupled with rising trade volumes, is driving the demand for terminal management system solutions to optimize operations, reduce delays, and minimize costs

- For instance, in March 2024, Port of Rotterdam implemented AI-powered terminal management system tools to optimize container handling and berth allocation, demonstrating the benefits of predictive analytics in port operations. Such strategies by key operators are expected to accelerate terminal management system adoption globally

- Growing adoption of IoT and real-time monitoring devices in terminals allows operators to capture and analyze large volumes of operational data, driving the implementation of intelligent terminal management system solutions

- Moreover, the need for regulatory compliance, improved cargo visibility, and enhanced safety standards encourages terminals and shipping operators to invest in advanced TMS platforms

- TMS solutions also enable centralized workflow management, automated gate operations, and remote monitoring of terminal assets, enhancing efficiency across commercial, industrial, and logistics applications. The trend toward digitalization of ports and freight networks further supports terminal management system adoption

Which Factor is Challenging the Growth of the Europe Terminal Management System (TMS) Market?

- Cybersecurity concerns related to connected systems and real-time data exchange pose a significant challenge to terminal management system adoption. Since terminal management system relies heavily on networked software and IoT devices, the risk of hacking or operational disruption is a critical issue

- For instance, reports of cyberattacks on port operations and terminal software have caused some operators to delay terminal management system implementation due to concerns about data security and operational downtime

- Ensuring robust encryption, secure authentication, and frequent software updates is essential for building trust among terminal operators. Companies such as NAVIS and INFORM emphasize advanced cybersecurity protocols in their terminal management system offerings

- In addition, the high initial cost of sophisticated terminal management system deployments, including AI and predictive analytics capabilities, can be a barrier for smaller ports and terminals, especially in developing regions. Basic TMS solutions are more affordable but may lack advanced optimization features

- Although terminal management system pricing is gradually becoming more competitive, perceived costs and technological complexity can still slow adoption. Addressing these challenges through cybersecurity measures, operator training, and cost-effective solutions will be vital for sustained market growth

How is the Europe Terminal Management System (TMS) Market Segmented?

The market is segmented on the basis of offering, project, application, and vertical.

• By Offering

On the basis of offering, the terminal management system (TMS) market is segmented into hardware, software, and services. The software segment dominated the market with the largest revenue share of 42.8% in 2024, driven by the increasing adoption of AI-enabled and cloud-based platforms that facilitate predictive analytics, workflow optimization, and real-time terminal monitoring. TMS software enables seamless integration with IoT devices, ERP systems, and automated reporting tools, making it an essential component for efficient port and logistics operations.

The services segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by rising demand for consulting, installation, training, and maintenance services to support complex TMS deployments, particularly in emerging markets and large-scale terminals. Companies are increasingly leveraging managed services to ensure smooth operation and reduced downtime.

• By Project

On the basis of project, the market is segmented into greenfield and brownfield projects. The greenfield segment held the largest revenue share of 56.1% in 2024, driven by rapid urbanization, development of new ports, and increasing investment in automated terminals. Greenfield projects allow stakeholders to implement state-of-the-art TMS solutions with minimal legacy constraints, enabling fully digital and integrated terminal operations from inception.

Conversely, the brownfield segment is expected to register the fastest CAGR of 20.7% during 2025–2032, fueled by modernization efforts in existing terminals. Retrofitting advanced TMS solutions in brownfield projects helps enhance operational efficiency, reduce bottlenecks, and extend the lifecycle of existing infrastructure. The adoption of hybrid solutions combining hardware upgrades with software optimization further propels growth.

• By Application

On the basis of application, the terminal management system (TMS) market is segmented into receipt/dispatch by truck, rail wagon, pipeline, access control, inspections, kiosk functionality, automatic bay/berth allocation, sealing, blending, automatic tank farm control, and others. Receipt/dispatch by truck accounted for the largest market revenue share of 33.5% in 2024, driven by the high volume of road-based freight transport and the need for real-time tracking and scheduling.

Automatic bay/berth allocation is projected to witness the fastest CAGR of 23.1% during 2025–2032, owing to the increasing adoption of AI and machine learning algorithms that optimize resource allocation and reduce vessel turnaround times. The trend toward automating complex workflows across multimodal terminals is accelerating the deployment of these applications globally.

• By Vertical

On the basis of vertical, the terminal management system (TMS) market is segmented into railway, renewable sector, aviation industry, chemicals, oil and gas, and others. The railway segment dominated the market with a 46.4% revenue share in 2024, supported by the rising need for automated yard management, cargo tracking, and compliance with safety regulations.

The renewable sector is expected to register the fastest CAGR of 24% from 2025 to 2032, driven by increasing investments in solar, wind, and bioenergy projects that require sophisticated terminal management for storage, blending, and distribution of energy resources. The growing emphasis on sustainability, efficiency, and regulatory compliance is pushing industries across all verticals to adopt TMS solutions.

Which Region Holds the Largest Share of the Europe Terminal Management System (TMS) Market?

- Germany dominated the terminal management system (TMS) market with the largest revenue share of 32.14% in 2024, supported by significant investments in digital port infrastructure, automation technologies, and environmental compliance regulations

- Businesses in the region prioritize efficient cargo handling, integration with renewable energy, and compliance with strict sustainability goals through advanced TMS platforms

- This momentum is further strengthened by strong cross-border trade, government-backed modernization programs, and the adoption of IoT-enabled solutions, positioning Europe as a leading hub for TMS implementation

France Terminal Management System (TMS) Market Insight

The France terminal management system (TMS) market is anticipated to grow steadily, fueled by government initiatives to modernize port infrastructure and strengthen multimodal logistics. The rising demand for automation, real-time monitoring, and energy-efficient operations is driving adoption. French logistics firms are integrating TMS platforms with ERP and fleet systems to enhance efficiency and compliance with sustainability standards.

U.K. Terminal Management System (TMS) Market Insight

The U.K. terminal management system (TMS) market is set to witness fastest growth rate of 11.18%, supported by ongoing investments in smart port development and digital trade facilitation. The increasing need for seamless cargo visibility, supply chain efficiency, and automation is fostering adoption. U.K. businesses are leveraging cloud-based TMS solutions integrated with advanced analytics to improve throughput and ensure compliance with international trade and environmental regulations.

Which are the Top Companies in Europe Terminal Management System (TMS) Market?

The terminal management system (TMS) industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Honeywell International, Inc. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Siemens (Germany)

- Schneider Electric (France)

- Yokogawa India Ltd. (India)

- Agidens International NV (Belgium)

- akquinet AG (Germany)

- Dearman Systems, LLC. (U.K.)

- EDS Systems OÜ (Estonia)

- Emerson Electric Co. (U.S.)

- Endress+Hauser Management AG (Switzerland)

- General Atomics (U.S.)

- Implico (Germany)

- Larsen & Toubro Infotech Limited (India)

- Oceaneering International, Inc. (U.S.)

- Offspring International Limited (U.K.)

- PumpingSol (Germany)

- Ramboll Group A/S (Denmark)

- SGS SA (Switzerland)

- i.Dohmann GmbH (Germany)

What are the Recent Developments in Europe Terminal Management System (TMS) Market?

- In June 2025, Modern Transportation achieved annual savings of USD 5 million after implementing BeyondTrucks’ multi-tenant TMS, demonstrating the financial efficiency and operational benefits of advanced terminal management solutions

- In May 2025, Uber Freight launched an AI-driven logistics network consisting of 30 autonomous agents, processing USD 1.6 billion in freight for clients including Colgate-Palmolive, highlighting the growing adoption of AI in large-scale freight management

- In April 2025, AROBS Transilvania Software reported a turnover of RON 415 million for 2024 and acquired SVT Electronics to strengthen its logistics technology capabilities, reinforcing its position in the Terminal Management System (TMS) market

- In March 2025, Omniful upgraded its cloud-based TMS for e-commerce fulfilment by adding enhanced fleet-management and live-tracking features, improving operational visibility and efficiency across client logistics networks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Europe Terminal Management System Tms Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Terminal Management System Tms Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Terminal Management System Tms Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.