Europe Transfection Market

Market Size in USD Billion

CAGR :

%

USD

1.21 Billion

USD

2.55 Billion

2025

2033

USD

1.21 Billion

USD

2.55 Billion

2025

2033

| 2026 –2033 | |

| USD 1.21 Billion | |

| USD 2.55 Billion | |

|

|

|

|

Europe Transfection Market Size

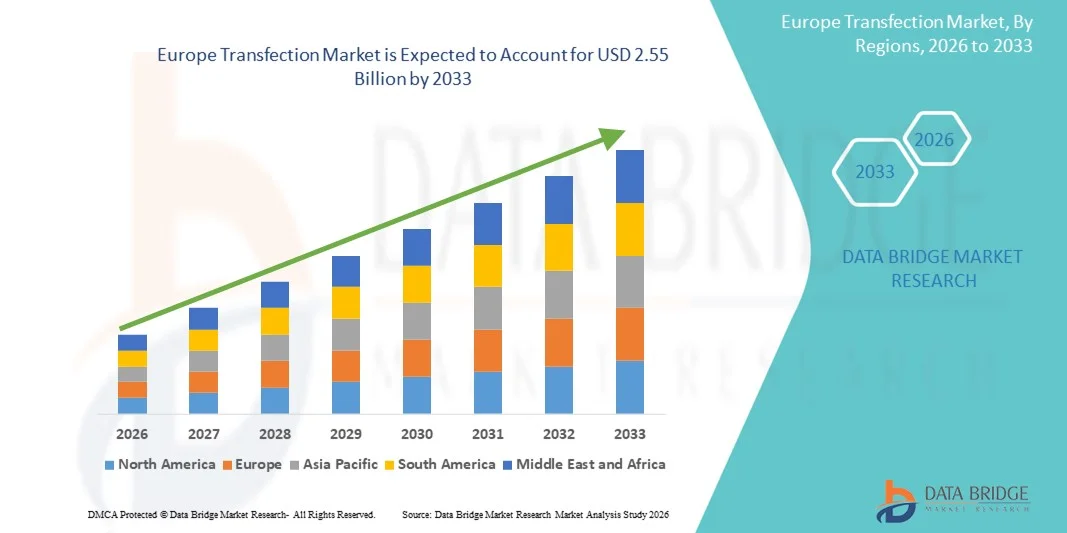

- The Europe transfection market size was valued at USD 1.21 billion in 2025 and is expected to reach USD 2.55 billion by 2033, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by increasing investments in genetic research, gene therapy, and biomedical studies across Europe, supported by robust funding, collaborative research initiatives, and a strong regulatory framework that accelerates transfection technology adoption

- Furthermore, the rising prevalence of chronic diseases, the demand for advanced therapeutics, and expanded use of transfection technologies in biopharmaceutical production, personalized medicine, and life sciences R&D are driving demand, positioning transfection solutions as essential tools in modern cellular biology and therapeutic development

Europe Transfection Market Analysis

- Transfection technologies, enabling the delivery of nucleic acids into cells for research, therapeutic, or biopharmaceutical applications, are increasingly vital tools in modern life sciences, biotechnology, and gene therapy, due to their precision, efficiency, and ability to support advanced cellular and molecular studies

- The escalating demand for transfection solutions is primarily fueled by the growing adoption of gene therapy, personalized medicine, and biomedical research, coupled with increasing government and private funding in R&D, and the rising prevalence of chronic and genetic disorders across Europe

- Germany dominated the Europe transfection market with a revenue share of 38% in 2025, characterized by a robust research infrastructure, early adoption of advanced biotechnologies, and a strong presence of key industry players, with extensive applications in academic research, pharmaceutical development, and clinical studies

- France is expected to be the fastest growing country in the Europe transfection market during the forecast period, driven by increasing biotechnology investments, expansion of biopharma manufacturing facilities, and rising adoption of advanced transfection methods in research and therapeutic applications

- The Transient transfection segment dominated the market with a share of 52.5% in 2025, driven by its rapid expression of target molecules, flexibility across cell types, and suitability for short-term experimental and research applications

Report Scope and Europe Transfection Market Segmentation

|

Attributes |

Europe Transfection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Transfection Market Trends

Advancements in CRISPR and Non-Viral Transfection Methods

- A significant and accelerating trend in the Europe transfection market is the increasing adoption of CRISPR-based gene editing technologies and non-viral transfection methods, which offer higher efficiency, safety, and versatility for research and therapeutic applications

- For instance, researchers are leveraging non-viral CRISPR transfection kits to perform precise genome editing in mammalian cell lines, improving both research outcomes and experimental reproducibility

- Integration of automated transfection platforms with laboratory management software enables real-time monitoring, optimization of transfection protocols, and data tracking, enhancing overall experimental efficiency. For instance, some high-throughput systems allow simultaneous transfection of multiple cell types while adjusting conditions based on previous results

- The combination of CRISPR techniques with advanced transfection reagents facilitates faster and more accurate gene manipulation, supporting applications in personalized medicine, drug discovery, and biopharmaceutical production. For instance, transient transfection of plasmid DNA is widely used for rapid protein expression studies in oncology research

- This trend towards more precise, efficient, and scalable transfection technologies is fundamentally transforming research workflows, enabling both academia and industry to accelerate discoveries. For instance, companies such as Lonza and Thermo Fisher are developing optimized CRISPR-compatible transfection solutions for mammalian and stem cells

- The demand for advanced transfection methods that improve gene editing efficiency while minimizing cytotoxicity is growing rapidly across both academic and industrial research sectors, as organizations increasingly prioritize speed, reproducibility, and experimental reliability

Europe Transfection Market Dynamics

Driver

Rising Demand from Gene Therapy and Biopharmaceutical Research

- The growing adoption of gene therapy, biologics development, and personalized medicine across Europe is a significant driver for the heightened demand for transfection solutions

- For instance, in March 2025, a leading European CRO announced expansion of its gene therapy R&D facility with high-throughput transfection systems to support biopharmaceutical production

- As researchers seek reliable and scalable methods for nucleic acid delivery, transfection solutions offer higher efficiency, reproducibility, and compatibility with multiple cell types, providing a compelling upgrade over traditional delivery methods

- Furthermore, the increasing prevalence of chronic and genetic diseases is boosting demand for innovative therapeutics and research tools, positioning transfection technologies as essential instruments in preclinical and clinical studies

- Rapid advancements in personalized medicine and cell-based therapies are fueling demand for transfection technologies that allow targeted gene delivery. For instance, patient-specific CAR-T cell research relies heavily on optimized transfection protocols

- Increasing government funding and EU-level grants for genetic research and biotechnology are supporting expansion of transfection research infrastructure. For instance, funding programs in Germany, France, and the Netherlands are enabling state-of-the-art laboratory setups for academic and industrial research

- The availability of user-friendly reagents, kits, and automated transfection platforms further accelerates adoption, enabling both academic and industrial laboratories to perform complex experiments efficiently. For instance, universities and biotech firms are adopting reagent-based and non-viral CRISPR transfection kits for in vitro and in vivo studies

Restraint/Challenge

High Costs and Regulatory Hurdles

- The relatively high cost of advanced transfection reagents, kits, and instruments poses a significant challenge to broader market penetration, particularly for smaller academic laboratories or budget-conscious biotech firms

- For instance, premium CRISPR-compatible transfection kits with optimized delivery reagents are considerably more expensive than conventional plasmid transfection methods

- Strict regulatory frameworks governing gene editing, clinical trials, and therapeutic research across Europe can delay approvals and increase compliance costs for companies deploying transfection technologies. For instance, biotech firms working on viral transfection vectors must adhere to stringent biosafety and regulatory guidelines before commercial application

- While ongoing innovations and cost-reduction strategies are helping to improve affordability, the perceived premium for high-performance transfection solutions can still limit adoption, especially in early-stage research projects

- Overcoming these challenges through optimized reagent design, streamlined regulatory pathways, and cost-effective non-viral methods will be vital for sustained growth of the Europe transfection market. For instance, several suppliers are now offering standardized non-viral transfection kits at lower prices for academic research

- Limited technical expertise and training in advanced transfection methods can hinder adoption in smaller labs or emerging biotech companies. For instance, some researchers in Eastern Europe require specialized training to efficiently use CRISPR-compatible viral and non-viral transfection kits

- Concerns over long-term safety and reproducibility of certain viral transfection methods continue to pose challenges in clinical and commercial applications. For instance, regulatory agencies require extensive validation studies before approving viral transfection-based therapeutics

Europe Transfection Market Scope

The market is segmented on the basis of type, methods, CRISPR transfection methods, products, organism, types of molecule, application, stage, end user, and distribution channel.

- By Type

On the basis of type, the Europe transfection market is segmented into transient transfection and stable transfection. The Transient Transfection segment dominated the market with a largest revenue share of 52.5% in 2025, driven by its rapid expression of target molecules and suitability for short-term experimental applications. Researchers often prioritize transient transfection for protein expression studies, functional assays, and preliminary gene editing experiments due to its flexibility across various cell types. The segment also benefits from a wide availability of optimized reagents, kits, and automated platforms, enhancing reproducibility and efficiency in research workflows. Transient transfection is commonly used in both academic and industrial labs for drug discovery and high-throughput screening. Its low cytotoxicity and compatibility with multiple nucleic acid molecules further contribute to its dominance. The segment also sees increasing integration with CRISPR-based applications, boosting demand for efficient delivery systems.

The Stable Transfection segment is anticipated to witness the fastest growth rate of 14.5% CAGR from 2026 to 2033, fueled by the rising need for long-term gene expression in therapeutic research, protein production, and biopharmaceutical development. Stable transfection allows continuous expression of target genes, making it critical for generating recombinant cell lines and cell-based models. Increasing adoption of stable transfection in gene therapy and regenerative medicine research is driving its growth. Companies are increasingly providing specialized kits and viral vectors for stable integration, supporting large-scale bioproduction and translational research. The growing focus on reproducible and scalable cell line development also contributes to its rising adoption in commercial and clinical applications.

- By Methods

On the basis of methods, the Europe transfection market is segmented into non-viral methods and viral methods. The Non-Viral Methods segment dominated the market with a share of 58% in 2025, owing to its safety, ease of use, and lower regulatory barriers compared to viral transfection. Non-viral methods such as lipofection, electroporation, and chemical-based reagents are widely used in academic research, drug discovery, and preliminary therapeutic studies. The segment benefits from increasing demand for high-throughput screening, reproducibility, and reduced cytotoxicity. Non-viral methods are preferred for transient transfection, in vitro applications, and large-scale protein expression studies. Researchers also favor non-viral transfection for CRISPR-based genome editing due to lower risks of insertional mutagenesis. Availability of optimized reagents, kits, and automation solutions further strengthens this segment’s market dominance.

The Viral Methods segment is expected to witness the fastest CAGR of 15.2% from 2026 to 2033, driven by their high transfection efficiency and ability to achieve stable, long-term gene expression. Viral vectors such as lentivirus, adenovirus, and AAV are increasingly adopted in gene therapy, regenerative medicine, and biopharmaceutical production. Rising demand for clinical and preclinical applications, including CAR-T cell development, is boosting viral transfection adoption. Companies are developing safer, high-titer viral vectors to meet regulatory standards and improve reproducibility. The growth is also fueled by the need for reliable delivery in hard-to-transfect cells such as primary cells and stem cells.

- By CRISPR Transfection Methods

On the basis of CRISPR transfection methods, the Europe transfection market is segmented into non-viral methods and viral methods. The Non-Viral CRISPR Methods segment dominated with a share of 55% in 2025, owing to its simplicity, safety, and flexibility across cell types. Non-viral CRISPR delivery via plasmids, ribonucleoprotein complexes (RNPs), and electroporation is widely used for genome editing in academic and industrial research. Researchers favor this segment for transient gene editing experiments, functional genomics, and protein expression studies. Non-viral CRISPR methods are increasingly integrated with automated platforms for high-throughput applications. The segment also benefits from the growing focus on personalized medicine and drug discovery programs. Non-viral methods reduce insertional mutagenesis risks, making them suitable for preclinical research.

The Viral CRISPR Methods segment is expected to witness the fastest growth at 16% CAGR from 2026 to 2033, driven by its ability to achieve stable, long-term genome modification for therapeutic and bioproduction applications. Viral delivery systems such as lentivirus and AAV are critical in CAR-T cell therapy, gene therapy trials, and advanced biopharmaceutical development. Rising investments in clinical applications of CRISPR are boosting adoption. The segment is also supported by innovations in safer, high-efficiency viral vectors that meet regulatory standards. Viral CRISPR methods are preferred for hard-to-transfect primary cells and stem cells. Increasing collaboration between biotech firms and academic institutions further drives growth.

- By Products

On the basis of products, the Europe transfection market is segmented into reagents & kits, instruments, and software. The Reagents & Kits segment dominated the market with a share of 60% in 2025, owing to their essential role in facilitating efficient transfection across various cell types and applications. Reagents and kits provide standardized protocols, reduce experimental variability, and are widely adopted in academic and industrial research. Their ease of use and compatibility with multiple delivery methods, including CRISPR and viral/non-viral approaches, further support dominance. The segment also benefits from increasing demand for high-throughput applications and automation in laboratories. Companies frequently introduce optimized kits for transient and stable transfection, driving broader adoption.

The Instruments segment is expected to witness the fastest CAGR of 15% from 2026 to 2033, driven by rising adoption of automated and high-throughput transfection platforms. Instruments such as electroporators, microfluidic devices, and robotics-enabled systems enhance reproducibility, efficiency, and scalability. Growing demand for precise control over transfection parameters in drug discovery and biopharmaceutical research fuels this growth. Integration of instruments with software for data tracking and optimization further accelerates adoption. Increasing investments in advanced laboratory infrastructure across Europe are also contributing to this trend.

- By Organism

On the basis of organism, the Europe transfection market is segmented into mammalian cells, plants, fungi, virus, and bacteria. The Mammalian Cells segment dominated with a share of 65% in 2025, due to their critical role in therapeutic research, protein production, and gene editing studies. Mammalian cell models are essential for drug discovery, gene therapy development, and biopharmaceutical production, making them the most commonly transfected organism. Compatibility with CRISPR, viral, and non-viral methods enhances their adoption. The segment also benefits from the increasing demand for personalized medicine and cell-based therapies in Europe. Availability of optimized reagents and high-throughput instruments further supports dominance.

The Plant segment is expected to witness the fastest CAGR of 14% from 2026 to 2033, driven by rising research in agricultural biotechnology, genetic engineering, and crop improvement. Non-viral transfection and CRISPR methods are increasingly applied to plant cells for trait modification and resistance studies. Investments in sustainable agriculture and biotech startups are supporting market growth. Demand for genetically engineered plants with higher yield or stress resistance is boosting adoption. Academic research in plant genomics further contributes to this trend.

- By Types of Molecule

On the basis of types of molecule, the Europe transfection market is segmented into Plasmid DNA, Small Interfering RNA (siRNA), Proteins, DNA Oligonucleotides, Ribonucleoprotein Complexes (RNPs), and Others. The Plasmid DNA segment dominated with a share of 50% in 2025, owing to its widespread use for gene expression, protein production, and genome editing applications. Plasmids are compatible with transient and stable transfection methods and are easy to produce at scale. They are extensively used in research, preclinical studies, and biopharmaceutical development. The segment also benefits from integration with CRISPR systems for gene knockout and functional studies. Commercial availability of optimized plasmids and kits further supports adoption.

The siRNA segment is expected to witness the fastest CAGR of 16% from 2026 to 2033, fueled by growing applications in gene silencing, therapeutic research, and drug discovery. siRNA transfection is widely used in functional genomics and target validation studies. Increasing demand for RNA interference-based therapeutics in oncology and rare disease research drives growth. Advancements in delivery reagents and reduced cytotoxicity enhance adoption. Expanding research funding and collaborative projects in Europe further support the segment’s rapid growth.

- By Application

On the basis of application, the Europe transfection market is segmented into In vitro application, in vivo application, bioproduction, and others. The In Vitro Application segment dominated with a share of 55% in 2025, due to its extensive use in drug discovery, functional genomics, and protein expression studies. In vitro transfection allows controlled experimentation, rapid results, and compatibility with high-throughput screening. Researchers prefer in vitro applications for CRISPR gene editing, transient/stable transfection, and RNA interference studies. The segment benefits from standardized reagents, kits, and automated platforms, supporting reproducibility. Its dominance is reinforced by strong adoption in academic and industrial laboratories.

The Bioproduction segment is expected to witness the fastest CAGR of 15% from 2026 to 2033, driven by increasing demand for recombinant proteins, vaccines, and gene therapy products. Biopharmaceutical companies increasingly rely on stable transfection and viral/non-viral methods for large-scale production. Rising investments in biologics manufacturing facilities and cell line development are fueling adoption. Integration with automated and high-throughput systems enhances scalability. Regulatory focus on reproducibility and safety further supports this segment’s growth.

- By Stage

On the basis of stage, the Europe transfection market is segmented into research, preclinical, clinical phases, and commercial. The Research segment dominated with a share of 58% in 2025, due to widespread use in academic studies, functional genomics, and preliminary drug development. Research-stage transfection supports high-throughput experiments, transient gene expression, and early-stage CRISPR applications. Availability of standardized kits, reagents, and automated platforms reinforces adoption. The segment also benefits from strong funding for European universities and research institutes. Integration with imaging and analytical tools further enhances experimental reproducibility.

The Clinical Phases segment is expected to witness the fastest CAGR of 14.8% from 2026 to 2033, driven by the rising number of gene therapy and cellular therapy trials. Transfection technologies are increasingly applied for ex vivo modification of cells in CAR-T therapy and other clinical applications. Growing regulatory approvals for advanced therapeutics and increased clinical trial activity across Europe support market growth. Companies are developing scalable and safe transfection solutions for patient-derived cells. Adoption is further fueled by collaborations between CROs, hospitals, and biotech firms.

- By End User

On the basis of end user, the Europe transfection market is segmented into Biopharma, Contract Research Organizations (CROs), Contract Manufacturing Organization/Contract Development and Manufacturing Organization (CMOs/CDMOs), Academia, Hospitals, Clinical Labs, and Others. The Academia segment dominated with a share of 45% in 2025, due to extensive research and teaching applications in universities, research institutes, and biotechnology labs. Academic institutions use transfection technologies for functional genomics, protein expression, and CRISPR-based studies. The segment benefits from availability of affordable kits and non-viral methods for transient experiments. Strong government funding and EU grants further support adoption. Integration with high-throughput and automated systems enhances experimental reproducibility.

The Biopharma segment is expected to witness the fastest CAGR of 16% from 2026 to 2033, driven by demand for drug discovery, biologics production, and gene/cell therapy applications. Biopharma companies increasingly adopt transient and stable transfection, viral and non-viral delivery, and CRISPR methods for scalable protein production and cell-based therapeutics. Expansion of biopharmaceutical R&D and manufacturing facilities across Europe supports growth. Collaboration with CROs and CMOs/CDMOs further accelerates adoption. Regulatory approvals for advanced therapeutics drive increasing investment in transfection solutions.

- By Distribution Channel

On the basis of distribution channel, the Europe transfection market is segmented into direct tender, retail sales, and others. The Direct Tender segment dominated with a share of 52% in 2025, owing to bulk purchases by academic, industrial, and clinical laboratories. Direct tender allows procurement of large volumes of reagents, kits, and instruments at negotiated pricing. It is commonly used by universities, CROs, and biopharma companies for research and production purposes. The segment benefits from strong supplier relationships and customized solutions. Long-term contracts and partnerships further enhance adoption.

The Retail Sales segment is expected to witness the fastest CAGR of 15% from 2026 to 2033, driven by increasing demand from small laboratories, startups, and individual researchers. Retail sales provide easy access to standardized kits, reagents, and instruments without bulk procurement requirements. Online marketplaces and specialized distributors enhance convenience and reach. Retail sales support transient transfection, CRISPR applications, and small-scale in vitro research. Growing interest in DIY biology and academic labs is contributing to segment growth.

Europe Transfection Market Regional Analysis

- Germany dominated the Europe transfection market with a revenue share of 38% in 2025, characterized by a robust research infrastructure, early adoption of advanced biotechnologies, and a strong presence of key industry players, with extensive applications in academic research, pharmaceutical development, and clinical studies

- Researchers and biopharma companies in the country highly value the efficiency, reproducibility, and versatility offered by transfection solutions, including CRISPR, non-viral, and viral methods, for applications in gene therapy, protein expression, and functional genomics studies

- This widespread adoption is further supported by robust government funding, collaborative research initiatives, and investments in state-of-the-art laboratory facilities, establishing Germany as a key hub for both academic and industrial transfection research across Europe

The Germany Transfection Market Insight

The Germany transfection market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s well-established biotechnology research infrastructure, high concentration of academic and industrial laboratories, and increasing awareness of gene therapy applications. Germany’s focus on innovation and precision in biomedical research promotes the adoption of advanced transfection methods, particularly in mammalian cell research and protein production. The integration of CRISPR-based techniques and automated transfection platforms is becoming increasingly prevalent, with researchers favoring efficient and reproducible gene editing solutions aligned with regulatory standards.

France Transfection Market Insight

The France transfection market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the expanding biotechnology sector and rising investments in gene therapy and pharmaceutical R&D. French researchers and companies increasingly adopt non-viral and viral transfection methods for preclinical studies, therapeutic development, and high-throughput screening. Government-backed research initiatives, collaborations between academic institutions and biotech firms, and stringent safety standards are supporting the growth of the market. France is seeing substantial adoption of transfection technologies in both research laboratories and biopharmaceutical manufacturing facilities.

United Kingdom Transfection Market Insight

The U.K. transfection market is expected to grow at a strong CAGR during the forecast period, driven by the country’s focus on precision medicine, gene therapy research, and functional genomics studies. Increasing demand for reliable, efficient, and reproducible transfection solutions, coupled with robust academic and industrial research infrastructure, is supporting market growth. The UK’s advanced biotech ecosystem, government grants, and collaborations with contract research organizations are encouraging the adoption of both non-viral and viral transfection methods. The integration of CRISPR-based genome editing into research pipelines further accelerates demand for optimized transfection reagents and kits.

Italy Transfection Market Insight

The Italy transfection market is poised to grow at a considerable CAGR, fueled by rising investments in biotechnology and pharmaceutical research. Italian academic institutions and biopharma companies are adopting advanced transfection solutions for mammalian cell studies, protein expression, and gene therapy research. Increasing collaborations between universities and biotech firms, alongside government-supported R&D initiatives, are driving market adoption. The demand for both transient and stable transfection methods, as well as viral and non-viral CRISPR applications, is expanding across research and industrial labs.

Europe Transfection Market Share

The Europe Transfection industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Promega Corporation (U.S.)

- F. Hoffmann La Roche Ltd (Switzerland)

- Bio Rad Laboratories, Inc. (U.S.)

- QIAGEN (Netherlands)

- Merck KGaA (Germany)

- Lonza (Switzerland)

- MaxCyte, Inc. (U.S.)

- Polyplus Transfection SA (France)

- Eurogentec (Belgium)

- PromoCell GmbH (Germany)

- Altogen Biosystems (U.S.)

- SBS Genetech (U.S.)

- FUJIFILM Irvine Scientific (Japan)

- Avanti Polar Lipids (U.K.)

- PerkinElmer (Germany)

- Cytiva (U.S.)

- OriGene Technologies, Inc. (U.S.)

- Applied Biological Materials Inc. (Canada)

- Beckman Coulter, Inc. (U.S.)

What are the Recent Developments in Europe Transfection Market?

- In September 2025, a strategic industry consortium was formed among leading European biotech companies to accelerate gene therapy research and development, aiming to streamline R&D, vector design, and clinical pathways for next‑generation therapies, reflecting stronger collaboration to overcome development and regulatory hurdles

- In February 2025, SCTbio expanded its cGMP cell manufacturing services in Prague to include viral vector production capabilities, enhancing its transfection and gene delivery manufacturing infrastructure for advanced therapy medicinal products (ATMPs), supporting both viral and non‑viral workflows

- In November 2024, PlasmidFactory GmbH participated at BioEurope 2024 in Stockholm, a major biotech partnering conference focused on tools for genetic engineering and transfection workflows, indicating increasing visibility and networking for European plasmid/transfection solution providers in the wider biopharma ecosystem

- In April 2024, HuidaGene Therapeutics announced it would open the first CRISPR MEDiCiNE European Conference in Copenhagen, highlighting advances and challenges in next‑generation CRISPR gene‑editing technology, including delivery methods relevant to transfection and therapeutic gene editing discussions across Europe

- In February 2024, the European Commission granted conditional marketing authorization to CASGEVY™ (exagamglogene autotemcel), the first CRISPR/Cas9‑based gene‑edited therapy for sickle cell disease (SCD) and transfusion‑dependent beta thalassemia (TDT), marking a regulatory milestone for CRISPR‑enabled treatments in Europe and highlighting clinical adoption of advanced gene editing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.