Europe Tumor Ablation Market

Market Size in USD Million

CAGR :

%

USD

584.50 Million

USD

1,349.91 Million

2025

2033

USD

584.50 Million

USD

1,349.91 Million

2025

2033

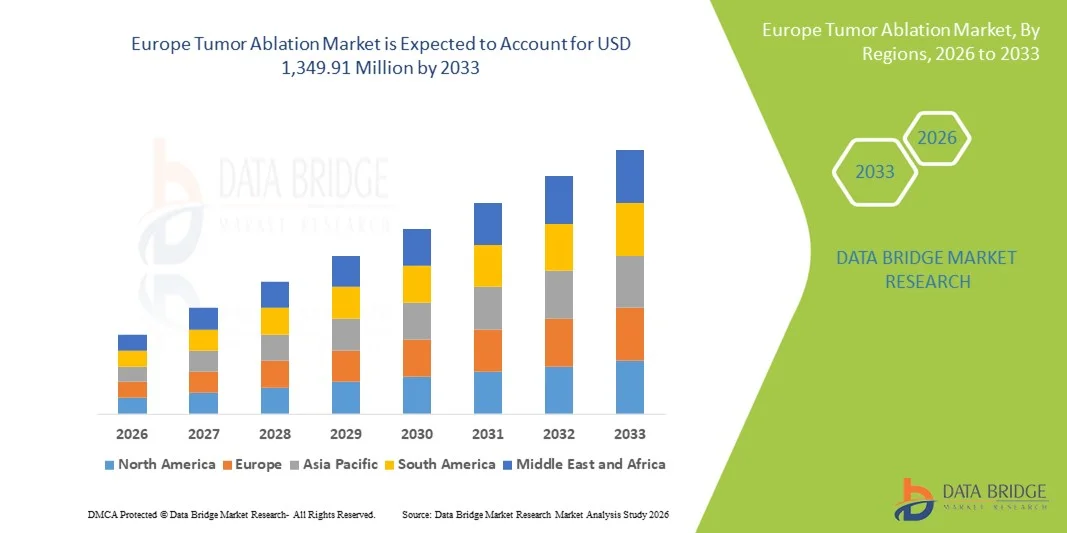

| 2026 –2033 | |

| USD 584.50 Million | |

| USD 1,349.91 Million | |

|

|

|

|

Europe Tumor Ablation Market Size

- The Europe tumor ablation market size was valued at USD 584.50 million in 2025 and is expected to reach USD 1,349.91 million by 2033, at a CAGR of 11.03% during the forecast period

- The market growth is largely fueled by the growing preference for minimally invasive cancer treatment procedures, rising incidence of cancer across key European countries, and increasing adoption of advanced ablation technologies within oncology care pathways. These trends reflect expanding healthcare investments and improved procedural access across both public and private clinical settings in Europe

- Furthermore, technological advancements, stronger integration of image‑guided ablation systems, and rising demand for safer, less invasive therapeutic options for inoperable or early‑stage tumors are establishing tumor ablation as a key modality in multidisciplinary cancer treatment. These converging factors are accelerating the uptake of tumor ablation solutions, thereby significantly boosting the industry’s growth

Europe Tumor Ablation Market Analysis

- Tumor ablation, encompassing minimally invasive procedures such as radiofrequency, microwave, cryoablation, and laser ablation, is increasingly becoming a critical component of cancer treatment in Europe due to its precision, reduced recovery times, and ability to treat inoperable or early-stage tumors

- The escalating demand for tumor ablation is primarily fueled by the rising prevalence of cancer across Europe, increasing preference for minimally invasive therapies, and technological advancements in image-guided and energy-based ablation systems

- Germany dominated the Europe tumor ablation market with the largest revenue share of 22.4% in 2025, supported by advanced healthcare infrastructure, high awareness of minimally invasive cancer treatments, and strong adoption of advanced ablation devices, particularly in major hospitals and oncology centers

- Spain is expected to be the fastest-growing country in the Europe tumor ablation market during the forecast period due to increasing healthcare investments, improved access to minimally invasive treatments, and rising adoption of advanced ablation techniques in public and private hospitals

- Radiofrequency ablation segment dominated the tumor ablation market with a market share of 38.8% in 2025, driven by its established efficacy, safety profile, and widespread adoption across hospitals and specialized oncology centers

Report Scope and Europe Tumor Ablation Market Segmentation

|

Attributes |

Europe Tumor Ablation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Europe Tumor Ablation Market Trends

Advancement Through Image-Guided and AI-Enabled Ablation

- A significant and accelerating trend in the Europe tumor ablation market is the adoption of image-guided systems combined with AI-driven treatment planning, enhancing precision and patient outcomes in minimally invasive oncology procedures

- For instance, Medtronic’s Affinity Ablation platform integrates AI-assisted imaging to optimize probe placement, improving tumor targeting while reducing healthy tissue damage

- AI integration in tumor ablation enables features such as predicting optimal energy delivery and treatment duration, while providing intelligent alerts for procedure adjustments. For instance, some AngioDynamics systems use AI to refine microwave ablation parameters in real time based on tumor size and location

- The seamless integration of tumor ablation devices with hospital imaging platforms facilitates centralized treatment planning, allowing oncologists to combine ablation therapy with CT, MRI, or ultrasound guidance in a single workflow

- This trend towards more precise, intuitive, and integrated ablation solutions is fundamentally reshaping expectations for minimally invasive cancer therapy. Consequently, companies such as Boston Scientific are developing AI-enabled ablation devices capable of automated probe placement and real-time feedback

- The demand for tumor ablation systems that provide enhanced precision and AI-assisted imaging is growing rapidly across both public and private hospitals, as clinicians increasingly prioritize safety, efficacy, and reduced recovery times

- Expansion of multi-modality ablation platforms combining radiofrequency, microwave, and cryoablation in a single system is gaining traction, enabling flexible treatment strategies for complex tumors

Europe Tumor Ablation Market Dynamics

Driver

Increasing Need Due to Rising Cancer Incidence and Minimally Invasive Preference

- The rising prevalence of cancer in Europe, coupled with a growing preference for minimally invasive treatment options, is a significant driver for the heightened adoption of tumor ablation procedures

- For instance, in March 2025, Medtronic announced the expansion of its microwave ablation systems in European hospitals, aiming to improve access to advanced oncology care and drive market growth

- As patients and clinicians seek less invasive alternatives to surgery, tumor ablation offers benefits such as shorter hospital stays, lower complication rates, and faster recovery, providing a compelling option over conventional treatments

- Furthermore, the increasing availability of advanced ablation devices and procedural training programs is making tumor ablation a more viable and trusted therapy in oncology centers across Europe

- The convenience of outpatient procedures, integration with existing imaging platforms, and the ability to combine ablation with other therapies are key factors propelling adoption in both public and private hospitals, while rising awareness campaigns further contribute to market growth

- Rising collaborations between device manufacturers and leading oncology hospitals are driving innovations in device design and procedural workflows, further enhancing market adoption

- Increasing reimbursement support and government initiatives in countries such as Germany and France are incentivizing hospitals to adopt advanced minimally invasive therapies, creating new opportunities for tumor ablation growth

Restraint/Challenge

Technical Complexity and Regulatory Compliance Hurdles

- Concerns surrounding procedural complexity and regulatory approvals pose significant challenges to broader adoption of tumor ablation systems across European healthcare settings

- For instance, high-profile reports of device malfunctions or inconsistent ablation outcomes have made some hospitals cautious about adopting newer ablation technologies without extensive clinical validation

- Addressing these concerns through enhanced training, adherence to CE-mark regulations, and rigorous clinical studies is crucial for building clinician confidence. Companies such as AngioDynamics emphasize operator training programs and robust regulatory compliance in their European marketing strategies

- In addition, the relatively high initial cost of advanced ablation systems compared to conventional surgical equipment can be a barrier for budget-constrained hospitals or smaller oncology centers. While basic ablation devices are becoming more affordable, premium systems with integrated imaging and AI guidance often carry higher price tags

- Overcoming these challenges through clinician education, strong regulatory compliance, and the development of cost-effective ablation solutions will be vital for sustained growth of the Europe tumor ablation market

- Limited availability of trained specialists for complex procedures in some countries continues to restrict market penetration in smaller hospitals or emerging healthcare centers

- Variability in healthcare policies and insurance coverage across European countries creates inconsistencies in adoption rates, challenging uniform market expansion

Europe Tumor Ablation Market Scope

The market is segmented on the basis of type, cancer type, technology, mode of treatment, and end user.

- By Type

On the basis of type, the Europe tumor ablation market is segmented into tumor ablation systems, image guidance products, and accessories. The tumor ablation systems segment dominated the market in 2025 with the largest revenue share of 38.8%, driven by their critical role in performing minimally invasive ablation procedures. Hospitals and oncology centers prioritize these systems due to their effectiveness, reliability, and compatibility with multiple tumor types. The high adoption of radiofrequency and microwave ablation systems within these platforms further strengthens their market dominance. In addition, these systems are increasingly integrated with imaging platforms to enhance precision, reduce procedure times, and improve patient outcomes. Continuous innovations and the introduction of AI-assisted features have also contributed to strong demand.

The image guidance products segment is expected to witness the fastest growth rate during 2026–2033, fueled by the rising adoption of image-guided ablation procedures across Europe. These products, including CT, MRI, and ultrasound guidance systems, enable accurate probe placement and real-time monitoring, which improves procedural safety and treatment success. Growing awareness among clinicians of the benefits of guided ablation and increasing hospital investments in imaging infrastructure are accelerating this trend. Furthermore, integration with AI-based planning tools enhances procedural efficiency and reduces complications. The adoption is particularly strong in countries such as Germany, France, and the U.K., where advanced oncology facilities prioritize precision-based therapies.

- By Cancer Type

On the basis of cancer type, the market is segmented into liver, brain, lung, bone, kidney, pancreatic, breast, and other cancers. The liver cancer segment dominated the market in 2025, accounting for 30% of total revenue, driven by the high prevalence of hepatocellular carcinoma in Europe and the effectiveness of ablation in treating unresectable liver tumors. Ablation procedures for liver cancer are widely preferred due to their minimally invasive nature, shorter hospital stays, and improved patient outcomes. Hospitals increasingly invest in liver-specific ablation systems equipped with advanced imaging guidance. Clinical studies supporting the efficacy of radiofrequency and microwave ablation for liver tumors further boost adoption. In addition, patient preference for minimally invasive options and faster recovery has strengthened market penetration.

The pancreatic cancer segment is expected to witness the fastest growth during the forecast period, fueled by rising incidence rates of pancreatic tumors and limited surgical options. Ablation is increasingly recognized as an effective palliative and therapeutic option for inoperable tumors. Advancements in high-precision ablation technologies, coupled with AI-assisted targeting, allow clinicians to perform safer procedures in this anatomically challenging region. The demand is particularly strong in specialized oncology centers across Western Europe. Growing research and clinical trials highlighting improved outcomes with ablation also drive market expansion.

- By Technology

On the basis of technology, the market is segmented into radiofrequency ablation (RFA), microwave ablation (MWA), cryoablation, and other technologies. The radiofrequency ablation segment dominated the market with a revenue share of 38% in 2025, owing to its established efficacy, safety, and wide adoption in liver, kidney, and lung cancers. RFA systems are widely available in major European hospitals and are supported by strong clinical evidence for multiple tumor types. Their reliability, ease of integration with imaging platforms, and proven treatment outcomes make them a preferred choice among oncologists. In addition, operator familiarity and ongoing technological refinements in probe design continue to drive adoption.

The microwave ablation segment is expected to witness the fastest growth from 2026 to 2033, driven by its ability to treat larger tumors more efficiently and provide shorter ablation times compared to RFA. MWA is increasingly preferred in complex liver, lung, and pancreatic tumors due to better heat distribution and reduced procedure duration. Hospitals are adopting MWA systems alongside image guidance solutions to improve precision and patient outcomes. Growing investments in microwave ablation technologies and favorable reimbursement trends across Europe are accelerating market growth.

- By Mode of Treatment

On the basis of mode of treatment, the market is segmented into percutaneous ablation, laparoscopic ablation, and surgical ablation. The percutaneous ablation segment dominated the market in 2025, driven by its minimally invasive nature, shorter recovery times, and cost-effectiveness. This approach is widely adopted in liver, kidney, and lung cancers, where needle-based probe insertion under imaging guidance allows precise treatment with minimal tissue damage. The segment’s dominance is further supported by strong clinician preference, patient demand for outpatient procedures, and growing hospital infrastructure supporting percutaneous interventions.

The laparoscopic ablation segment is expected to witness the fastest growth during the forecast period, fueled by its suitability for complex tumors in anatomically challenging locations, such as the pancreas and liver. Laparoscopic techniques allow direct visualization of tumors while minimizing invasiveness compared to open surgery. Adoption is rising in leading oncology centers that focus on precision therapy and patient safety. Integration with advanced imaging and AI-guided navigation systems further enhances procedural success rates.

- By End User

On the basis of end user, the market is segmented into hospitals, oncology clinics, and others. The hospitals segment dominated the market with the largest revenue share in 2025, driven by the availability of advanced ablation systems, dedicated imaging infrastructure, and specialized oncology departments. Hospitals are the primary adopters of RFA, MWA, and cryoablation systems due to their capability to handle complex procedures, provide multidisciplinary care, and invest in staff training. Strong clinician trust, higher procedure volumes, and comprehensive patient care services further strengthen the dominance of hospitals.

The oncology clinics segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising number of specialized cancer treatment centers offering minimally invasive ablation therapies. These clinics focus on targeted interventions, outpatient procedures, and personalized treatment plans, attracting patient demand for convenient and effective therapy options. Expanding investments in clinic infrastructure and partnerships with device manufacturers are supporting faster adoption of tumor ablation systems. The growing awareness of ablation benefits among patients and referring physicians also contributes to this growth trend.

Europe Tumor Ablation Market Regional Analysis

- Germany dominated the Europe tumor ablation market with the largest revenue share of 22.4% in 2025, supported by advanced healthcare infrastructure, high awareness of minimally invasive cancer treatments, and strong adoption of advanced ablation devices, particularly in major hospitals and oncology centers

- Hospitals and oncology centers in the country prioritize precision-based ablation procedures due to their effectiveness in treating liver, kidney, and lung tumors, along with shorter recovery times and reduced complication rates

- This widespread adoption is further supported by strong government healthcare initiatives, high clinician awareness, and the presence of major medical device companies, establishing tumor ablation as a preferred treatment modality across both public and private healthcare settings

Germany Tumor Ablation Market Insight

The Germany tumor ablation market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, high clinical expertise, and the increasing focus on minimally invasive treatment modalities. Hospitals in Germany are rapidly adopting radiofrequency, microwave, and cryoablation systems, particularly for liver, kidney, and lung cancers. Integration of AI-assisted image-guided systems allows improved procedural accuracy and patient safety. The country’s emphasis on innovation, clinical research, and high-quality patient care promotes adoption in both public and private oncology centers. Ongoing government healthcare initiatives and favorable reimbursement policies further enhance market penetration. Germany’s strong presence of global device manufacturers also supports continuous technology upgrades and awareness campaigns

France Tumor Ablation Market Insight

The France tumor ablation market is witnessing steady growth due to increasing cancer incidence, growing patient preference for outpatient procedures, and adoption of minimally invasive treatment options. Hospitals and oncology centers prioritize precision-based ablation therapies supported by advanced imaging systems. Favorable healthcare reimbursement schemes and government initiatives promoting cancer care infrastructure are significant growth enablers. The market is further boosted by rising awareness among clinicians about the advantages of ablation over conventional surgery. Integration of AI-assisted navigation and real-time monitoring in ablation procedures is increasingly common, enhancing adoption. Both new installations and technology upgrades in existing facilities are contributing to the market’s expansion.

Italy Tumor Ablation Market Insight

The Italy tumor ablation market is expected to grow at a significant CAGR over the forecast period, driven by increasing awareness of minimally invasive oncology treatments and rising adoption in hospitals and specialized clinics. Growth is particularly notable in liver, kidney, and pancreatic cancer treatments, where ablation offers safer alternatives to open surgery. Advanced image-guided ablation platforms are being increasingly utilized to enhance procedural accuracy. Government support for cancer treatment infrastructure and favorable reimbursement policies encourage hospital adoption. The market is witnessing higher demand for outpatient and laparoscopic ablation procedures due to patient preference for shorter recovery times. Expanding clinical research and training programs are further facilitating the adoption of tumor ablation systems in Italy.

Spain Tumor Ablation Market Insight

The Spain tumor ablation market is poised for robust growth, driven by rising cancer prevalence, expanding hospital infrastructure, and increasing awareness of minimally invasive therapies. Oncology centers are adopting radiofrequency, microwave, and cryoablation technologies to treat liver, kidney, and lung tumors with improved safety and precision. Integration with imaging and AI-assisted guidance systems enhances procedural success and reduces complications. Favorable government policies and reimbursement schemes encourage wider adoption in both public and private healthcare settings. Spain’s growing investment in oncology research and outpatient treatment facilities supports market expansion. Patient awareness and preference for minimally invasive procedures are steadily increasing adoption across the country.

Europe Tumor Ablation Market Share

The Europe Tumor Ablation industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- AngioDynamics, Inc. (U.S.)

- EDAP TMS S.A. (France)

- Mermaid Medical A/S (Denmark)

- HealthTronics, Inc. (U.S.)

- Galil Medical Inc. (U.S.)

- SonaCare Medical, LLC (U.S.)

- Neuwave Medical, Inc. (U.S.)

- Misonix, Inc. (U.S.)

- Cortex Technology (Netherlands)

- BVM Medical Limited (U.K.)

- Olympus Corporation (Japan)

- BIOTRONIK SE & Co. KG (Germany)

- Varian Medical Systems, Inc. (U.S.)

- Cook (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Terumo Corporation (Japan)

- AtriCure, Inc. (U.S.)

- CONMED Corporation (U.S.)

What are the Recent Developments in Europe Tumor Ablation Market?

- In October 2025, an NHS patient at Addenbrooke’s Hospital in Cambridge became the first person in Europe to receive a histotripsy treatment for liver cancer outside of a clinical trial, marking a major step forward in non‑invasive oncology care

- In October 2025, Addenbrooke’s Hospital in Cambridge became the first centre in Europe to offer histotripsy cancer treatment outside of a clinical trial, where a pioneering liver cancer procedure using focused ultrasound an incisionless, non‑invasive ablation technology was successfully performed, marking a major milestone in minimally invasive oncology care

- In July 2025, Varian (Siemens Healthineers) introduced its next‑generation IntelliBlate microwave ablation system in Europe after receiving CE Mark approval, offering clinicians a precision‑driven, minimally invasive option integrated with image‑guided therapy tools for treating soft tissue tumors

- In June 2025, the UK’s National Health Service (NHS) began offering incision‑less ultrasound histotripsy therapy for liver cancer patients, a groundbreaking non‑invasive treatment that destroys tumors using focused sound waves without surgery, radiation, or chemotherapy

- In December 2023, Clinical Laserthermia Systems (CLS) participated in the IRMPROFT research study with its TRANBERG image‑guided focal laser ablation technology, advancing minimally invasive focal tumor ablation research and clinical application

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.