Europe Uterine Cancer Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

2.88 Billion

USD

6.41 Billion

2024

2032

USD

2.88 Billion

USD

6.41 Billion

2024

2032

| 2025 –2032 | |

| USD 2.88 Billion | |

| USD 6.41 Billion | |

|

|

|

|

Europe Uterine Cancer Diagnostics Market Size

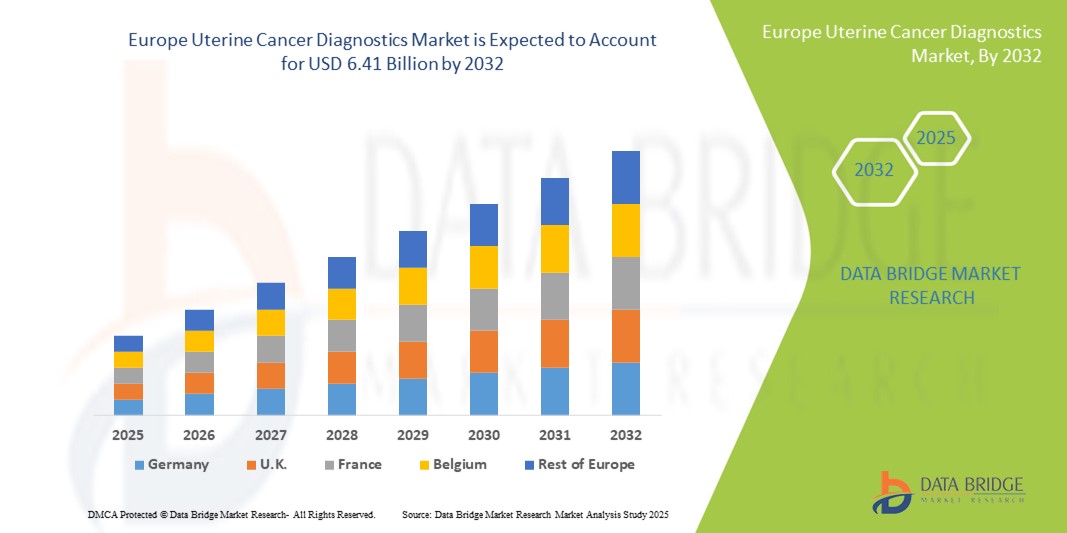

- The Europe uterine cancer diagnostics market size was valued at USD 2.88 billion in 2024 and is expected to reach USD 6.41 billion by 2032, at a CAGR of 10.5% during the forecast period

- The market growth is primarily driven by the increasing prevalence of uterine cancer, advancements in diagnostic technologies, and the rising demand for early and accurate detection methods

- Furthermore, the growing awareness among the population regarding women's health issues and the availability of advanced diagnostic tools are contributing to the market's expansion

Europe Uterine Cancer Diagnostics Market Analysis

- Uterine cancer diagnostics, encompassing molecular testing, imaging, and biopsy-based techniques, are increasingly vital components of early detection and personalized treatment strategies in both clinical and research settings due to their accuracy, minimally invasive procedures, and integration with advanced healthcare IT systems

- The escalating demand for uterine cancer diagnostics is primarily fueled by the rising prevalence of uterine cancer, growing awareness of women’s health, and an increasing emphasis on early detection and precision medicine

- Germany dominated the Europe uterine cancer diagnostics market with the largest revenue share of 33% in 2024, characterized by well-established healthcare infrastructure, high awareness levels, and strong adoption of advanced diagnostic technologies, with substantial growth in testing adoption driven by government initiatives and healthcare investments

- Poland is expected to be the fastest-growing country in the Europe uterine cancer diagnostics market during the forecast period due to increasing healthcare expenditure, rising diagnostic facilities, and growing accessibility to advanced medical technologies

- Instrument-Based Diagnostics segment dominated the Europe uterine cancer diagnostics market by diagnostic type with a market share of 55.5% in 2024 due to the high accuracy, rapid results, and integration with advanced imaging and laboratory systems, making instrument-based methods the preferred choice for early and precise detection of uterine cancer

Report Scope and Europe Uterine Cancer Diagnostics Market Segmentation

|

Attributes |

Europe Uterine Cancer Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Uterine Cancer Diagnostics Market Trends

Enhanced Accuracy Through AI and Minimally Invasive Techniques

- A significant and accelerating trend in the Europe uterine cancer diagnostics market is the growing adoption of AI-powered diagnostic tools and minimally invasive testing methods, which are improving detection accuracy and reducing patient discomfort

- For instance, AI-assisted imaging systems can identify early-stage endometrial abnormalities more precisely, allowing clinicians to recommend targeted interventions faster. Similarly, liquid biopsy techniques are enabling non-invasive detection of uterine cancer markers

- AI integration in diagnostics enables predictive analytics, pattern recognition, and personalized risk assessment, providing clinicians with more informed decision-making capabilities. For instance, some AI-enabled imaging platforms learn from historical patient data to suggest optimal diagnostic pathways

- The integration of minimally invasive procedures with AI-based platforms facilitates streamlined workflows in clinics and diagnostic centers, reducing procedure times and enhancing patient throughput

- This trend towards smarter, less invasive, and more accurate diagnostics is fundamentally reshaping expectations for uterine cancer care. Consequently, companies such as MedTech Diagnostics are developing AI-enabled imaging solutions capable of automated anomaly detection and workflow optimization

- The demand for diagnostics that offer seamless AI integration and minimally invasive approaches is growing rapidly across both hospitals and specialized diagnostic centers, as patients and healthcare providers increasingly prioritize efficiency, precision, and patient comfort

Europe Uterine Cancer Diagnostics Market Dynamics

Driver

Rising Incidence of Uterine Cancer and Awareness Programs

- The increasing prevalence of uterine cancer in Europe, combined with growing awareness of women’s health and early detection benefits, is a significant driver for the heightened demand for advanced diagnostic solutions

- For instance, in April 2024, a leading diagnostic center in Germany launched AI-assisted endometrial screening programs to enhance early detection and risk stratification in high-risk populations. Such initiatives by key institutions are expected to drive market growth in the forecast period

- As healthcare providers and patients become more aware of early-stage detection advantages, uterine cancer diagnostics offer precise testing, predictive insights, and improved monitoring capabilities, providing a compelling case over conventional diagnostic methods

- Furthermore, the growing investment in women’s health programs and integration of advanced diagnostic technologies into routine screening are making diagnostics an essential component of preventive healthcare strategies

- The convenience of minimally invasive tests, faster reporting, and integration with electronic medical records are key factors propelling the adoption of uterine cancer diagnostics across Europe. Awareness campaigns and outreach programs by government and private organizations further contribute to market growth

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- Concerns regarding the high cost of advanced diagnostic systems, including AI-enabled imaging and molecular testing platforms, pose a significant challenge to broader market penetration. High capital investment may limit adoption in smaller clinics or budget-sensitive regions

- For instance, some advanced AI-assisted imaging systems require specialized equipment and trained personnel, making them less accessible for low-resource diagnostic centers

- Ensuring regulatory compliance across different European countries, including CE marking and GDPR adherence for patient data, is critical but can slow product launches and market expansion. Companies such as Siemens Healthineers and Roche Diagnostics emphasize regulatory certifications and training to mitigate these challenges

- While costs are gradually decreasing, the perceived premium for AI-enabled or high-throughput diagnostics can hinder widespread adoption among smaller healthcare providers

- Overcoming these challenges through cost optimization, reimbursement support, regulatory alignment, and clinician training will be vital for sustained growth in the Europe uterine cancer diagnostics market

Europe Uterine Cancer Diagnostics Market Scope

The market is segmented on the basis of diagnostic type, cancer type, age group, end user, and distribution channel.

- By Diagnostic Type

On the basis of diagnostic type, the Europe uterine cancer diagnostics market is segmented into instrument based and procedure based diagnostics. The Instrument-Based segment dominated the market with the largest revenue share of 55.5% in 2024, driven by its high accuracy, rapid processing, and ability to integrate with advanced imaging and molecular testing platforms. Instrument-based diagnostics, including AI-assisted imaging, ultrasound, and laboratory analyzers, are widely adopted in hospitals and diagnostic centers for precise detection of endometrial abnormalities. The preference for instrument-based diagnostics is supported by clinicians’ need for reproducible results and early-stage detection. In addition, continuous technological innovations and upgrades in instruments enhance their reliability and workflow efficiency, making them a preferred choice for uterine cancer screening. Hospitals and specialized diagnostic centers often prioritize instrument-based methods to reduce procedural time and improve patient throughput.

The procedure-based segment is anticipated to witness the fastest growth rate of 12.8% from 2025 to 2032, fueled by increasing adoption of minimally invasive techniques such as hysteroscopy and endometrial biopsy procedures. Procedure-based diagnostics provide direct tissue evaluation, which allows for early detection and accurate classification of endometrial and uterine sarcoma cases. These methods are particularly preferred in outpatient settings due to shorter recovery times and reduced complications. Rising awareness among patients about minimally invasive diagnostics and growing support from healthcare programs for early screening contribute to the segment’s expansion. Moreover, procedure-based diagnostics are gaining traction in private clinics and ambulatory surgical centers due to their cost-effectiveness and integration with advanced imaging technologies.

- By Type

On the basis of type, the Europe uterine cancer diagnostics market is segmented into endometrial cancer and uterine sarcoma. The Endometrial Cancer segment dominated the market with the largest revenue share of 72% in 2024, driven by the higher prevalence of endometrial cancer compared to uterine sarcoma across Europe. Endometrial cancer diagnostics benefit from well-established screening protocols, availability of advanced imaging, and molecular biomarker testing. Clinicians often rely on early detection through routine screenings, especially in women over 50, which boosts demand for diagnostic services. The large patient pool, combined with growing awareness campaigns about women’s health, has resulted in widespread adoption in hospitals, diagnostic centers, and specialized clinics. Technological advancements, such as AI-assisted imaging and molecular panels, have improved diagnostic sensitivity and specificity, further reinforcing the dominance of this segment.

The uterine sarcoma segment is expected to witness the fastest growth rate of 10.5% from 2025 to 2032, owing to increasing awareness of rare uterine cancers and the development of specialized diagnostic procedures. Although uterine sarcoma has a lower incidence, its aggressive nature necessitates advanced diagnostic tools for early detection. Emerging technologies, such as high-resolution MRI and molecular profiling, are enabling more accurate differentiation from benign uterine tumors. Research initiatives and government-supported rare cancer programs are encouraging adoption of these diagnostics in leading hospitals and oncology centers. The growth is also fueled by an increase in specialized clinics focusing on gynecologic oncology and the rising number of clinical studies targeting uterine sarcoma.

- By Age Group

On the basis of age group, the Europe uterine cancer diagnostics market is segmented into <30, 31-40, 41-50, 51-60, and >60. The 51-60 age group dominated the market with the largest share of 38% in 2024, as the risk of uterine cancer increases significantly with age. Diagnostic adoption is highest in this cohort due to routine screening recommendations and increased healthcare interactions. Women in this age range frequently undergo endometrial sampling, imaging, and molecular tests to detect early-stage cancer, particularly in Germany, France, and the U.K., which have advanced preventive care programs. Hospitals, diagnostic centers, and private clinics actively target this demographic for screening campaigns. Awareness programs and patient education about menopausal and post-menopausal uterine health further drive demand.

The 41-50 age group is expected to witness the fastest growth rate of 11.6% from 2025 to 2032, driven by rising awareness of early detection and preventive healthcare initiatives. Women in this age bracket are increasingly participating in regular gynecologic checkups and advanced diagnostic testing. Adoption is supported by government and private healthcare programs offering subsidized screening for at-risk populations. Technological advancements allowing minimally invasive diagnostics also encourage uptake among this cohort. Early detection efforts in working-age women are growing, as this group balances preventive healthcare with professional and family commitments.

- By End User

On the basis of end user, the Europe uterine cancer diagnostics market is segmented into hospitals, diagnostic centers, cancer research centers, ambulatory surgical centers, specialized clinics, and others. The Diagnostic Centers segment dominated the Europe uterine cancer diagnostics market with a revenue share of 40% in 2024, due to specialized focus on testing, faster turnaround times, and accessibility for outpatient procedures. Diagnostic centers are equipped with advanced instrument-based and procedure-based diagnostic technologies, allowing accurate and timely results. Their efficiency in handling large patient volumes and integration with electronic medical records makes them the preferred choice for clinicians. Partnerships with hospitals and government screening programs further enhance adoption. Private diagnostic chains across Germany, France, and Spain have contributed to the dominance of this segment.

The Specialized Clinics segment is anticipated to witness the fastest growth rate of 13.2% from 2025 to 2032, driven by increasing establishment of gynecologic oncology clinics and centers of excellence. Specialized clinics focus on minimally invasive diagnostics, AI-assisted imaging, and molecular profiling for uterine cancer. Rising patient preference for targeted and personalized care, coupled with government support for specialized cancer programs, accelerates growth. These clinics are also adopting advanced instrumentation and procedure-based diagnostics to enhance detection accuracy. Collaboration with research institutions and clinical trials further strengthens market penetration for this segment.

- By Distribution Channel

On the basis of distribution channel, the Europe uterine cancer diagnostics market is segmented into direct tender, third-party distributors, and others. The Direct Tender segment dominated the market with a revenue share of 45% in 2024, driven by procurement by large hospitals, government health programs, and public diagnostic centers. Direct tender contracts ensure timely supply of advanced diagnostic instruments and kits, along with after-sales support, calibration, and training services. Major players supply directly to healthcare institutions across Germany, France, and the U.K., facilitating smooth integration and compliance with local regulations. This method ensures consistency in quality and reduces reliance on intermediaries.

The third-party distributors segment is expected to witness the fastest growth rate of 12.5% from 2025 to 2032, owing to expanding access to private clinics, specialized diagnostic centers, and smaller hospitals across emerging European regions. Distributors provide flexible supply options, support for installation, and access to multiple brands, making them ideal for institutions lacking direct procurement capacity. Growth is further supported by increasing penetration in Eastern Europe and expanding partnerships with key diagnostic players.

Europe Uterine Cancer Diagnostics Market Regional Analysis

- Germany dominated the Europe uterine cancer diagnostics market with the largest revenue share of 33% in 2024, characterized by well-established healthcare infrastructure, high awareness levels, and strong adoption of advanced diagnostic technologies, with substantial growth in testing adoption driven by government initiatives and healthcare investments

- Patients and healthcare providers in the region highly value early detection, accuracy, and minimally invasive diagnostic solutions, which are increasingly available in hospitals, diagnostic centers, and specialized clinics across the country

- This widespread adoption is further supported by government-backed screening programs, growing investment in women’s health initiatives, and a strong presence of key diagnostic companies, establishing Germany as the leading market for uterine cancer diagnostics in Europe

The Germany Europe Uterine Cancer Diagnostics Market Insight

The Germany uterine cancer diagnostics market dominated the Europe market with the largest revenue share of 33% in 2024, driven by advanced healthcare infrastructure, high awareness of women’s health, and strong adoption of instrument-based and procedure-based diagnostics. The country emphasizes early detection and precision medicine, promoting routine screenings in hospitals, diagnostic centers, and specialized clinics. Integration of AI-assisted imaging, molecular diagnostics, and hospital workflows enhances accuracy, efficiency, and patient outcomes. Government-supported screening programs and well-established preventive healthcare policies further reinforce market dominance. The presence of key diagnostic companies and continuous R&D in Germany accelerates technological adoption and market growth.

Poland Europe Uterine Cancer Diagnostics Market Insight

The Poland uterine cancer diagnostics market is expected to be one of the fastest-growing countries in the Europe market during the forecast period, driven by rising healthcare expenditure, expanding diagnostic facilities, and increasing accessibility to advanced medical technologies. Awareness campaigns focusing on women’s health and early detection of uterine cancer are encouraging adoption in hospitals, diagnostic centers, and specialized clinics. The integration of minimally invasive procedures and AI-assisted diagnostics is gaining traction, improving diagnostic efficiency and patient compliance. Growth is further supported by government initiatives and private healthcare investments, facilitating penetration in both urban and semi-urban regions.

France Europe Uterine Cancer Diagnostics Market Insight

The France uterine cancer diagnostics market is also expected to witness rapid growth in the Europe market due to increasing investment in women’s health programs, rising prevalence of uterine cancer, and expansion of advanced diagnostic centers. Hospitals and diagnostic facilities are upgrading to include AI-assisted imaging, molecular diagnostics, and minimally invasive procedures, improving early detection rates. Government-led screening campaigns and reimbursement policies encourage routine diagnostic adoption. Awareness among patients and clinicians about early-stage detection benefits contributes to faster market penetration.

Italy Europe Uterine Cancer Diagnostics Market Insight

The Italy uterine cancer diagnostics market is projected to be another fastest-growing country in the Europe market, driven by rising patient awareness, adoption of advanced diagnostic technologies, and supportive healthcare policies. Diagnostic centers and specialized clinics are increasingly providing instrument-based and procedure-based diagnostics, enhancing accuracy and patient outcomes. Minimally invasive techniques and AI-assisted tools are being integrated into routine screenings. Growth is further supported by government initiatives, private healthcare investments, and increasing urbanization, allowing broader accessibility to diagnostic services.

Europe Uterine Cancer Diagnostics Market Share

The Europe uterine cancer diagnostics industry is primarily led by well-established companies, including:

- MiMARK (Spain)

- Hologic, Inc. (U.S.)

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- F. Hoffmann-La Roche AG (Switzerland)

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Illumina, Inc. (U.S.)

- PerkinElmer (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- BD (U.S.)

- Agilent Technologies, Inc. (U.S.)

- QIAGEN (Germany)

- BIOMÉRIEUX (France)

- Sysmex Corporation (Japan)

- Ortho Clinical Diagnostics (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Mindray Bio-Medical Electronics Co., Ltd. (China)

What are the Recent Developments in Europe Uterine Cancer Diagnostics Market?

- In July 2025, Gnosis introduced EdenDx, the first commercially available, non-invasive, liquid-based cytology test for early-stage endometrial cancer detection in the U.S. The test identifies hypermethylation of two genes, CDO1 and CELF4, associated with endometrial cancer

- In May 2025, the European Commission announced the launch of the first National Cancer Mission Hub in Poland. This initiative aims to enhance cancer care through research and innovation, aligning with the EU's broader cancer mission objectives

- In April 2025, MiMark Diagnostics announced the clinical validation of a non-invasive endometrial cancer test utilizing gynecologic fluids from the uterus. This ELISA-based test aims to detect biomarkers indicative of endometrial cancer, offering a less invasive alternative to traditional diagnostic methods

- In August 2024, AstraZeneca announced the European approval of the combination of Imfinzi (durvalumab) plus Lynparza (olaparib) for certain patients with advanced or recurrent endometrial cancer. This approval, based on the DUO-E trial, marked a major step forward, particularly for patients with mismatch repair proficient (pMMR) disease who have had limited treatment options

- In November 2021, Eisai and Merck & Co., Inc. (MSD) announced that the European Commission approved the combination of LENVIMA (lenvatinib) plus KEYTRUDA® (pembrolizumab) for the treatment of certain types of advanced or recurrent endometrial carcinoma

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.