Europe Wet-Milling Market Analysis and Size

Wet corn gluten feed production has increased in recent years, while other by products have decreased, according to the U.S. Census Bureau. From 2007 to 2009, the average monthly production of gluten meal was 165 million pounds. Corn refiners manufacture a variety of feed products, including corn gluten meal, corn germ meal, and wet corn gluten feed.

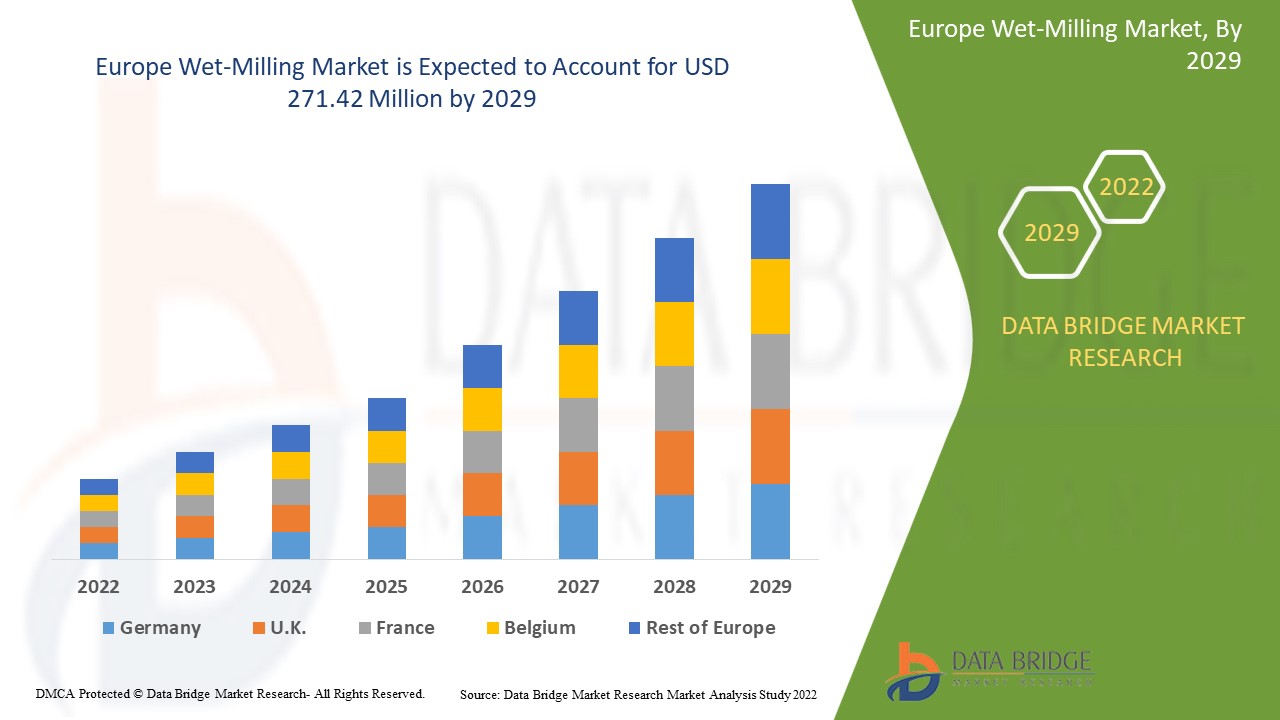

Data Bridge Market Research analyses that the wet-milling market which was growing at a value of 266.39 million in 2021 and is expected to reach the value of USD 271.42 million by 2029, at a CAGR of 0.234% during the forecast period of 2022 to 2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and consumer behaviour.

Market Definition

Wet-milling is a costly but efficient chain of processes in which material such as corn and wheat is soaked in with in order to achieve the goal of softening the kernel to segregate all components of that source so that maximum use of all components can be derived. In the case of corn, for instance, the wet milling process yields corn starch, corn oil, glucose, and a variety of other components. Wet-milling is an important part of many industries, including pharmaceutical, food and beverage, beauty and cosmetics, and others, because it provides ingredients such as starch and protein.

Europe Wet-Milling Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Equipment (Milling Equipment, Steeping Equipment, Centrifuge System, Washing & Filtration System, and Others), Processing Size (Medium Line Processing, and Large Line Processing), Source (Corn, Wheat, Cassava, Potato and Others), End Product (Starch, Sweetener, Ethanol, Corn Gluten Meal & Gluten Feed, Corn Oil, Corn Steep Liquor, Proteins and Others), Application (Feed, Food, Steep Water, Oil Processing, Fermentation/Bioprocessing, Waste Treatment, Mill, Refinery, Ethanol Production, Starch Modification, Others) |

|

Countries Covered |

Germany, U.K, Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Denmark, Sweden, Poland, Turkey, Rest of Europe |

|

Market Players Covered |

Tate & Lyle PLC (U.K.), ADM (U.S.), Cargill, Incorporated (U.S.), Ingredion Incorporated (U.S.), Agrana Beteiligungs-AG (Austria), The Roquette Freres (France). Bunge Limited (U.S.), China Agri-Industries Holding Limited (China), Global Bio-Chem Technology Group Company Limited (Hong Kong), and Grain Processing Corporation (U.S.) |

|

Opportunities |

|

Wet-Milling Market Dynamics

Drivers

- High demand for high fructose syrups from the food and beverage industry

Increased demand for high fructose corn syrups in the carbonated beverage industry due to its 55 percent fructose content makes it sweeter than sucrose and results in lower manufacturing costs for manufacturers. As high fructose corn syrups are the main product produced in the wet-milling process, an increase in their demand is expected to drive the corn wet-milling market in the near future. Regardless of the Europe economic downturn, the Europe beverage industry is expected to grow significantly. The rise in sales of ready-to-drink beverages, which include carbonated and dairy beverages, tea, fruit drinks, and alcoholic beverages such as beer, ciders, and malted beverages, is the primary driver of the rise in demand for high fructose corn syrups.

- Growing importance of wet milling in animal feed industries

Other factors expected to fuel the Europe corn wet-milling market growth include rising demand for corn ethanol, wet milling products that are high in digestible fibre, amino acids, and energy, protein, cysteine, and methionine. The growing demand for biofuels will benefit the wet-milling industry and increase the demand for wet-milling.

Opportunity

Furthermore, rising demand for meat and meat products in growing regions will provide lucrative growth opportunities for the market in the coming years. Furthermore, the Europe trend toward consumption of animal protein diets will contribute to market growth.

Restraints

However, stringent government regulatory controls over health and safety, as well as rising quality standards, may stymie the growth of the corn wet-milling market. In addition, the cost of maintaining and servicing wet-milling equipment is high. As a result, the wet-milling market is constrained.

This wet-milling market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the wet-milling market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Wet-Milling Market

Several countries imposed strict lockdowns to contain the infection, resulting in the shutdown of F&B processing plants and the disruption of the food and beverages supply chain for a limited time. The shortage of F&B products and essential items, panics buying by consumers around the world, interruption of supply chains due to travel restrictions, and labour shortages have significantly impacted the F&B supply chain. Major robot manufacturing companies worldwide reported a decline in revenue generation during the first and second quarters of 2020 due to lower sales caused by an economic slowdown caused by lockdown and quarantine restrictions imposed by governments worldwide, as well as a temporary drop in demand for automation.

Recent Development

- Tate & Lyle PLC (Tate & Lyle), a leading Europe provider of food and beverage ingredients and solutions, doubled the capacity of its non-GMOMALTOSWEET Maltodextrin production line in Boleraz, Slovakia, in October 2019. MALTOSWEET Maltodextrin is a high-nutritional-value corn-based specialty sweetener. This increases production capacity to meet rising demand.

- In January 2019, ADM introduced a new product line called Tapioca starches, which expanded the company's product portfolio and will allow it to better meet the needs of its customers in the Europe market.

- Tate & Lyle introduced the CLARIAEVERLAST® Line of Clean Label Starches in February 2020, which extends the shelf-life of the product and even preserves food quality in extreme storage conditions. This broadens their product portfolio, which broadens their consumer offerings.

Europe Wet-Milling Market Scope

The wet-milling market is segmented on the basis of equipment, processing size, source, end product and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Equipment

- Milling Equipment

- Steeping Equipment

- Centrifuge System

- Washing & Filtration System

- Others

Application

- Feed

- Food

- Steep Water

- Oil Processing

- Fermentation/Bioprocessing

- Waste Treatment

- Mill

- Refinery

- Ethanol Production

- Starch Modification

- Others

Processing size

- Medium Line Processing

- Large Line Processing

Source

- Corn

- Wheat

- Cassava

- Potato

- Others

End user

- Starch

- Sweetener

- Ethanol

- Corn Gluten Meal & Gluten Feed

- Corn Oil

- Corn Steep Liquor

- Proteins

- Others

Wet-Milling Market Regional Analysis/Insights

The wet-milling market is analysed and market size insights and trends are provided by country, equipment, processing size, source, end product and application as referenced above.

The countries covered in the wet-milling market report are Germany, U.K, Italy, France, Spain, Switzerland, Netherlands, Belgium, Russia, Denmark, Sweden, Poland, Turkey, Rest of Europe.

Germany has a thriving wet-milling market due to the growing demand for wet-milling in the food industry. As people become more aware of technological advancements, which have resulted in an increase in wet-milling products and by-products in Germany and the Netherlands, the Netherlands is growing in the European wet-milling market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Wet-Milling Market Share Analysis

The wet-milling market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to wet-milling market.

Some of the major players operating in the wet-milling market are:

- Tate & Lyle PLC (U.K.)

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Ingredion Incorporated (U.S.)

- Agrana Beteiligungs-AG (Austria)

- Roquette Freres (France)

- Bunge Limited (U.S.)

- China Agri-Industries Holding Limited (China)

- Global Bio-Chem Technology Group Company Limited (Hong Kong)

- Grain Processing Corporation (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE WET-MILLING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 EQUIPMENT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MULTI-FUNCTIONALITY OF starch in food and feed applications

5.1.2 risingdemand for fruit sugars in food & beverage industry

5.1.3 Technological advancement in the milling equipment

5.2 RESTRAINTS

5.2.1 HIGH CAPITAL INVESTMENT

5.2.2 lack of skilled labours in developing and underdeveloped countries

5.3 OPPORTUNITIES

5.3.1 INCREASED DEMAND FOR BIOFUEL

5.3.2 Scope of strategic development in the developing regions

5.3.3 Integrated Solutions for wet-milling process

5.4 CHALLENGES

5.4.1 Stringent government regulations

5.4.2 Market disruption by domestic players

6 IMPACT OF COVID-19

6.1 SUPPLY SIDE IMPACT:

6.2 DEMAND SIDE IMPACT:

7 EUROPE WET-MILLING MARKET, BY EQUIPMENT

7.1 OVERVIEW

7.2 MILLING EQUIPMENT

7.3 STEEPING EQUIPMENT

7.4 CENTRIFUGE SYSTEM

7.5 WASHING & FILTRATION SYSTEM

7.6 OTHERS

8 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE

8.1 OVERVIEW

8.2 LARGE LINE PROCESSING

8.3 MEDIUM LINE PROCESSING

9 EUROPE WET-MILLING MARKET, BY SOURCE

9.1 OVERVIEW

9.2 CORN

9.2.1 Dent Corn

9.2.2 Waxy Corn

9.3 WHEAT

9.4 CASSAVA

9.5 POTATO

9.6 OTHERS

10 EUROPE WET-MILLING MARKET, BY END-PRODUCT

10.1 OVERVIEW

10.2 STARCH

10.3 SWEETENER

10.4 ETHANOL

10.5 CORN GLUTEN MEAL& GLUTEN FEED

10.6 CORN OIL

10.7 CORN STEEP LIQUOR

10.8 PROTEINS

10.9 OTHERS

11 EUROPE WET-MILLING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FEED

11.3 FOOD

11.4 STEEP WATER

11.5 OIL PROCESSING

11.6 FERMENTATION/BIOPROCESSING

11.7 WASTE TREATMENT

11.8 MILL

11.9 REFINERY

11.1 ETHANOL PRODUCTION

11.11 STARCH MODIFICATION

11.12 OTHERS

12 EUROPE WET-MILLING MARKET, BY REGION

12.1 EUROPE

12.1.1 gERMANY

12.1.2 U.K.

12.1.3 ITALY

12.1.4 france

12.1.5 SPAIN

12.1.6 SWITZERLAND

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 RUSSIA

12.1.10 DENMARK

12.1.11 SWEDEN

12.1.12 POLAND

12.1.13 TURKEY

12.1.14 REST OF EUROPE

13 EUROPE WET-MILLING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE WET-MILLING STARCH EQUIPMENT MANUFACTURERS

15.1 GEA GROUP AKTIENGESELLSCHAFT

15.1.1 COMPANY snapshot

15.1.2 Company share analysis

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 recent DEVELOPMENT

15.2 ALFA LAVAL

15.2.1 COMPANY snapshot

15.2.2 Company share analysis

15.2.3 REVENUE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 recent DEVELOPMENT

15.3 BÜHLER AG

15.3.1 COMPANY snapshot

15.3.2 Company share analysis

15.3.3 REVENUE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 recent DEVELOPMENT

15.4 ANDRITZ

15.4.1 COMPANY snapshot

15.4.2 Company share analysis

15.4.3 REVENUE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 recent DEVELOPMENTS

15.5 HANNINGFIELD PROCESS SYSTEMS LTD

15.5.1 COMPANY snapshot

15.5.2 PRODUCT PORTFOLIO

15.5.3 recent DEVELOPMENT

15.6 HENAN YONGHAN MACHINERY EQUIPMENT CO., LTD.

15.6.1 COMPANY snapshot

15.6.2 PRODUCT PORTFOLIO

15.6.3 recent DEVELOPMENT

15.7 INGETECSA

15.7.1 COMPANY snapshot

15.7.2 PRODUCT PORTFOLIO

15.7.3 recent DEVELOPMENT

15.8 THAI GERMAN PROCESSING CO., LTD.

15.8.1 COMPANY snapshot

15.8.2 PRODUCT PORTFOLIO

15.8.3 recent DEVELOPMENT

15.9 NETZSCH-FEINMAHLTECHNIK GMBH

15.9.1 COMPANY snapshot

15.9.2 PRODUCT PORTFOLIO

15.9.3 recent DEVELOPMENTs

15.1 UNIVERSAL ENGINEERS

15.10.1 COMPANY snapshot

15.10.2 PRODUCT PORTFOLIO

15.10.3 recent DEVELOPMENT

15.11 WILLY A. BACHOFEN AG

15.11.1 COMPANY snapshot

15.11.2 PRODUCT PORTFOLIO

15.11.3 recent DEVELOPMENT

16 COMPANY PROFILE WET-MILLING STARCH MANUFACTURERS

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 Revenue Analysis

16.1.3 product PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 AGRANA BETEILIGUNGS-AG

16.2.1 COMPANY SNAPSHOT

16.2.2 Revenue Analysis

16.2.3 product PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 CARGILL, INCORPORATED.

16.3.1 COMPANY SNAPSHOT

16.3.2 product PORTFOLIO

16.3.3 RECENT DEVELOPMENTs

16.4 EUROPE BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED.

16.4.1 COMPANY SNAPSHOT

16.4.2 Revenue Analysis

16.4.3 product PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 GRAIN PROCESSING CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 product PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 INGREDION INCORPORATED

16.6.1 COMPANY SNAPSHOT

16.6.2 Revenue analysis

16.6.3 product PORTFOLIO

16.6.4 RECENT DEVELOPMENTs

16.7 ROQUETTE FRÈRES

16.7.1 COMPANY SNAPSHOT

16.7.2 Product portfolio

16.7.3 RECENT DEVELOPMENT

16.8 TATE & LYLE

16.8.1 COMPANY SNAPSHOT

16.8.2 Revenue Analysis

16.8.3 Product portfolio

16.8.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

LIST OF TABLES

TABLE 1 EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 2 EUROPE MILLING EQUIPMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 EUROPE STEEPING EQUIPMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 EUROPE CENTRIFUGE SYSTEM IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 EUROPE WASHING & FILTRATION SYSTEM IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 8 EUROPE LARGE LINE PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 EUROPE MEDIUM LINE PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 EUROPE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 11 EUROPE CORN IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 EUROPE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 13 EUROPE WHEAT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 EUROPE CASSAVA IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 EUROPE POTATO IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 EUROPE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 18 EUROPE STARCH IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 19 EUROPE SWEETENER IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 EUROPE ETHANOL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 EUROPE CORN GLUTEN MEAL & CORN GLUTEN FEED IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 EUROPE CORN OIL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 EUROPE CORN STEEP LIQUOR IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 EUROPE PROTEINS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 EUROPE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 27 EUROPE FEED IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 EUROPE FOOD IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 EUROPE STEEP WATER IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 EUROPE OIL PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 EUROPE FERMENTATION/BIOPROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 EUROPE WASTE TREATMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 EUROPE MILL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 EUROPE REFINERY IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 EUROPE ETHANOL PRODUCTION IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 EUROPE STARCH MODIFICATION IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 37 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 38 EUROPE WET-MILLING MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 39 EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 40 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 41 EUROPE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 42 EUROPE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 43 EUROPE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 44 EUROPE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 45 GERMANY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 46 GERMANY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 47 GERMANY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 48 GERMANY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 49 GERMANY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 50 GERMANY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 U.K. WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 52 U.K. WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 53 U.K. WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 54 U.K. CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 55 U.K. WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 56 U.K. WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 ITALY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 58 ITALY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 59 ITALY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 60 ITALY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 61 ITALY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 62 ITALY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 63 FRANCE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 64 FRANCE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 65 FRANCE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 66 FRANCE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 67 FRANCE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 68 FRANCE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 69 SPAIN WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 70 SPAIN WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 71 SPAIN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 72 SPAIN CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 73 SPAIN WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 74 SPAIN WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 75 SWITZERLAND WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 76 SWITZERLAND WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 77 SWITZERLAND WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 78 SWITZERLAND CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 79 SWITZERLAND WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 80 SWITZERLAND WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 81 NETHERLANDS WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 82 NETHERLANDS WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 83 NETHERLANDS WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 84 NETHERLANDS CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 85 NETHERLANDS WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 86 NETHERLANDS WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 87 BELGIUM WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 88 BELGIUM WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 89 BELGIUM WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 90 BELGIUM CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 91 BELGIUM WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 92 BELGIUM WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 93 RUSSIA WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 94 RUSSIA WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 95 RUSSIA WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 96 RUSSIA CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 97 RUSSIA WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 98 RUSSIA WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 99 DENMARK WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 100 DENMARK WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 101 DENMARK WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 102 DENMARK CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 103 DENMARK WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 104 DENMARK WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 105 SWEDEN WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 106 SWEDEN WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 107 SWEDEN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 108 SWEDEN CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 109 SWEDEN WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 110 SWEDEN WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 111 POLAND WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 112 POLAND WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 113 POLAND WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 114 POLAND CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 115 POLAND WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 116 POLAND WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 117 TURKEY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 118 TURKEY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 119 TURKEY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 120 TURKEY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 121 TURKEY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 122 TURKEY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 123 REST OF EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

List of Figure

LIST OF FIGURES

FIGURE 1 EUROPE WET-MILLING MARKET: SEGMENTATION

FIGURE 2 EUROPE WET-MILLING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE WET-MILLING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE WET-MILLING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE WET-MILLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE WET-MILLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE WET-MILLING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE WET-MILLING MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE WET-MILLING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE WET-MILLING MARKET: SEGMENTATION

FIGURE 11 THE GROWING MULTI-FUNCTIONALITY OF STARCH IN FOOD AND FEED APPLICATIONS AND THE RISING DEMAND FOR FRUIT SUGARS IN FOOD & BEVERAGE INDUSTRY ARE EXPECTED TO DRIVE THE EUROPE WET-MILLING MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 MILLING EQUIPMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE WET-MILLING MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE WET-MILLING MARKET

FIGURE 14 EUROPE WET-MILLING MARKET: BY EQUIPMENT, 2019

FIGURE 15 EUROPE WET-MILLING MARKET: BY PROCESSING SIZE, 2019

FIGURE 16 EUROPE WET-MILLING MARKET: BY SOURCE, 2019

FIGURE 17 EUROPE WET-MILLING MARKET: BY END-PRODUCT, 2019

FIGURE 18 EUROPE WET-MILLING MARKET: BY APPLICATION, 2019

FIGURE 19 EUROPE WET-MILLING MARKET: SNAPSHOT (2019)

FIGURE 20 EUROPE WET-MILLING MARKET: BY COUNTRY (2019)

FIGURE 21 EUROPE WET-MILLING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 22 EUROPE WET-MILLING MARKET: BY COUNTRY (2019 & 2027)

FIGURE 23 EUROPE WET-MILLING MARKET: BY EQUIPMENT (2020-2027)

FIGURE 24 EUROPE WET-MILLING MARKET: COMPANY SHARE 2019 (%)

Europe Wet Milling Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Wet Milling Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Wet Milling Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.