Global Carbonated Beverages Market

Market Size in USD Billion

CAGR :

%

USD

4.17 Billion

USD

5.70 Billion

2024

2032

USD

4.17 Billion

USD

5.70 Billion

2024

2032

| 2025 –2032 | |

| USD 4.17 Billion | |

| USD 5.70 Billion | |

|

|

|

|

Carbonated Beverages Market Size

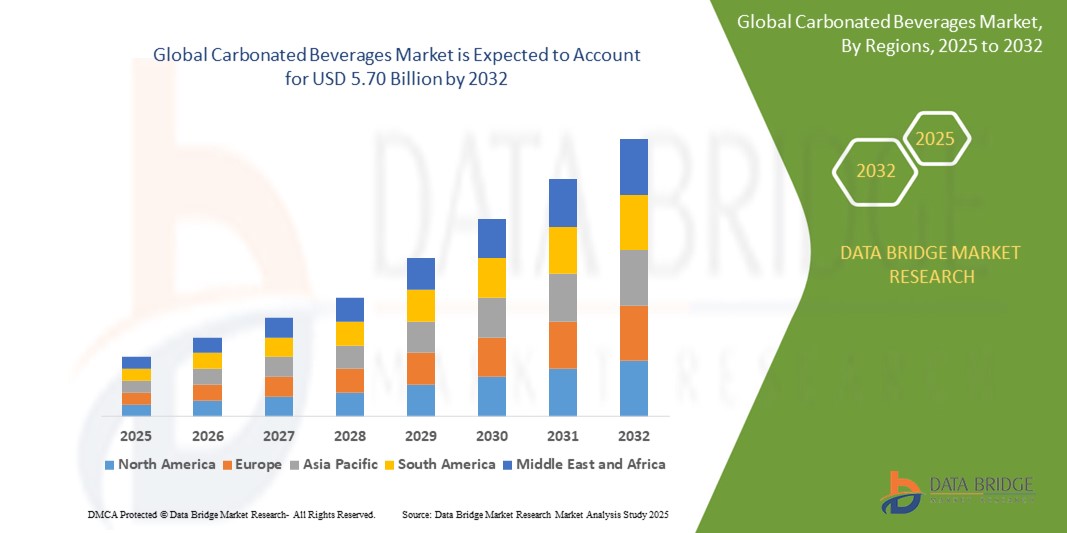

- The global carbonated beverages market size was valued at USD 4.17 billion in 2024 and is expected to reach USD 5.70 billion by 2032, at a CAGR of 4.00% during the forecast period

- The market growth is largely fuelled by the rising demand for convenience beverages, increasing urbanization, and continuous product innovations in flavors and packaging

- The growing popularity of low-sugar and zero-calorie carbonated drinks among health-conscious consumers is also contributing significantly to the market expansion

Carbonated Beverages Market Analysis

- The market is undergoing a transformation with a strong shift towards healthier and functional alternatives that retain the fizzy appeal of traditional soft drinks

- Manufacturers are investing in natural sweeteners and botanical ingredients to appeal to evolving consumer preferences

- North America dominated the carbonated beverages market with the largest revenue share 32.1% in 2024, driven by high consumer demand for ready-to-drink beverages and the increasing popularity of low-calorie carbonated drinks

- Asia-Pacific region is expected to witness the highest growth rate in the global carbonated beverages market, driven by rising urbanization, increasing disposable income, and changing consumer preferences toward Western-style beverages across countries such as China, India, and Indonesia

- The standard segment dominated the market with the largest market revenue share of 46.3% in 2024, driven by its widespread consumer acceptance and deep-rooted presence in global consumption habits. Iconic brands under this segment, such as cola and lemon-lime sodas, continue to perform well due to their availability across all price points and their positioning as an indulgent refreshment option. These beverages also benefit from strong brand loyalty and global marketing investments that sustain their dominance in both developed and emerging economiesa

Report Scope and Carbonated Beverages Market Segmentation

|

Attributes |

Carbonated Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbonated Beverages Market Trends

“Growing Popularity of Functional and Flavored Carbonated Drinks”

- Consumers are shifting toward functional carbonated drinks with added health benefits such as vitamins, probiotics, and antioxidants

- Flavored sparkling waters infused with natural fruit extracts and botanicals are replacing traditional sugary sodas

- Major players are innovating with healthier formulations to meet the demand for clean-label, low-calorie beverages

- Social media platforms and influencer marketing are accelerating interest in new, trendy carbonated drink variants

- Young consumers, particularly millennials and Gen Z, are showing strong interest in functional drinks that combine taste and wellness

- For instance, PepsiCo launched its Bubly line and Coca-Cola introduced AHA flavored sparkling water, both tailored to health-conscious and flavor-seeking consumers

Carbonated Beverages Market Dynamics

Driver

“Rising Urbanization and Changing Consumer Lifestyles”

- Urban populations are increasingly opting for ready-to-drink carbonated beverages as a part of their fast-paced routines

- Exposure to global food and beverage culture has elevated the demand for diverse soda options

- Quick-service restaurants and vending machines in urban centers are boosting beverage accessibility and consumption

- Younger generations prefer on-the-go beverages with refreshing and indulgent experiences

- Brand strategies now focus on urban youth, with compact and affordable product offerings

- For instance, Coca-Cola India experienced rapid growth in metro cities by introducing small-pack carbonated drinks priced for affordability, aligning with the urban youth’s lifestyle

Restraint/Challenge

“Health Concerns Related to Sugar Content and Artificial Ingredients”

- Consumers are increasingly avoiding high-sugar drinks due to rising health awareness and risk of obesity and diabetes

- Governments are imposing sugar taxes and stricter labeling laws, pressuring companies to reformulate

- Demand for natural ingredients and clean labels is pushing brands to reduce or eliminate artificial additives

- Reformulating with natural sweeteners such as stevia can affect flavor and increase production complexity

- Traditional soda categories are witnessing a decline in mature markets due to growing health consciousness

- For instance, In the U.K., the Soft Drinks Industry Levy led companies such as Britvic and Coca-Cola to reformulate their beverages with lower sugar content to avoid tax penalties

Carbonated Beverages Market Scope

The market is segmented on the basis of type, drinks, and distribution channel.

• By Type

On the basis of type, the carbonated beverages market is segmented into standard, diet, fruit flavoured carbonates, and others. The standard segment dominated the market with the largest market revenue share of 46.3% in 2024, driven by its widespread consumer acceptance and deep-rooted presence in global consumption habits. Iconic brands under this segment, such as cola and lemon-lime sodas, continue to perform well due to their availability across all price points and their positioning as an indulgent refreshment option. These beverages also benefit from strong brand loyalty and global marketing investments that sustain their dominance in both developed and emerging economies.

The fruit flavoured carbonates segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for more natural and exotic flavours. Rising health consciousness among consumers is also contributing to a shift toward lighter, fruit-based sparkling beverages. Brands are actively innovating by infusing drinks with tropical, citrus, and berry flavours to attract health-conscious and younger consumers seeking variety and functional appeal.

• By Drinks

On the basis of drinks, the carbonated beverages market is segmented into soft drinks, sparkling drinks, and functional drinks. The soft drinks segment held the largest market revenue share in 2024 due to its dominant global presence and broad consumer base. These beverages are often affordable and widely available through foodservice, retail, and vending channels, contributing to their continued popularity.

The functional drinks segment is expected to witness the fastest growth rate from 2025 to 2032, driven by consumer interest in added benefits such as hydration, energy, immunity support, and digestive health. Many brands are launching carbonated functional beverages infused with vitamins, natural caffeine, and probiotics to tap into wellness trends. The growth of this segment is supported by rising demand among fitness enthusiasts and health-aware millennials.

• By Distribution Channel

On the basis of distribution channel, the carbonated beverages market is segmented into hypermarkets/supermarkets, specialty stores, convenience stores, online stores, and others. The hypermarkets/supermarkets segment dominated the market in 2024 owing to the large consumer base preferring in-store purchases, better price deals, and product variety. Retail chains often stock an extensive range of carbonated drinks, making it convenient for consumers to explore options and take advantage of promotional bundles.

The online stores segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing e-commerce penetration and changing shopping behaviors. Consumers are increasingly relying on digital platforms for beverage purchases due to home delivery convenience and access to exclusive online-only products and discounts. In addition, brands are investing in digital marketing and D2C strategies to reach tech-savvy and health-conscious consumers.

Carbonated Beverages Market Regional Analysis

• North America dominated the carbonated beverages market with the largest revenue share 32.1% in 2024, driven by high consumer demand for ready-to-drink beverages and the increasing popularity of low-calorie carbonated drinks

• The region continues to witness innovations in flavor, packaging, and health-conscious options such as zero-sugar beverages to cater to changing consumer preferences

• The widespread retail presence, strong marketing campaigns by global brands, and a growing inclination towards functional sparkling drinks further fuel market growth across the U.S. and Canada

U.S. Carbonated Beverages Market Insight

The U.S. carbonated beverages market accounted for the largest revenue share in 2024 within North America, fueled by strong brand loyalty, evolving taste preferences, and a shift towards sugar-free options. Companies are increasingly launching functional carbonated drinks enriched with vitamins and minerals to attract health-aware consumers. For instance, Coca-Cola and PepsiCo have introduced innovative beverages such as sparkling waters with added electrolytes, appealing to both younger demographics and fitness-conscious individuals. Furthermore, the rise of flavored sparkling water alternatives has broadened the market’s scope beyond traditional soft drinks.

Europe Carbonated Beverages Market Insight

The Europe carbonated beverages is expected to witness the fastest growth rate from 2025 to 2032, supported by changing lifestyles, rising consumption of ready-to-drink beverages, and increasing demand for premium sparkling drinks. European consumers are showing a strong preference for natural and organic carbonated drinks, especially in countries such as Germany, France, and Italy. Environmental consciousness is also driving demand for eco-friendly packaging, which is influencing new product launches across the region. The growing presence of artisanal and craft carbonated beverages in the region’s foodservice sector further contributes to the market expansion.

U.K. Carbonated Beverages Market Insight

The U.K. carbonated beverages market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising health awareness and government-led initiatives to reduce sugar consumption. Brands are increasingly reformulating products to meet the Sugar Tax guidelines and expanding their portfolio of low-calorie and functional drinks. The growing popularity of non-alcoholic sparkling alternatives among young adults and the rise of online beverage subscriptions are also contributing to sustained market momentum.

Germany Carbonated Beverages Market Insight

Germany’s carbonated beverages market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s strong beverage culture and a well-developed distribution infrastructure. The demand for sugar-free, organic, and flavored sparkling drinks continues to rise among health-conscious consumers. Domestic brands are focusing on launching sustainable and locally sourced products to meet consumer expectations around traceability and environmental impact. In addition, sparkling fruit beverages and low-calorie carbonated water are gaining prominence in both retail and horeca channels.

Asia-Pacific Carbonated Beverages Market Insight

The Asia-Pacific carbonated beverages market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing disposable incomes, and shifting dietary preferences in countries such as China, Japan, and India. The growing youth population and expanding organized retail network are accelerating the demand for flavored and functional carbonated drinks. Governments across the region are also encouraging manufacturers to adopt healthier formulations and sustainable packaging practices, further enhancing market prospects.

Japan Carbonated Beverages Market Insight

The Japan carbonated beverages market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising popularity of wellness-oriented and low-calorie beverages. Consumers in Japan are particularly drawn to unique flavor combinations and value-added options such as probiotic sparkling drinks. Convenience stores and vending machines continue to be strong retail channels for carbonated beverages. For instance, Japanese beverage giant Suntory has been at the forefront of launching innovative carbonated waters and teas with functional health benefits.

China Carbonated Beverages Market Insight

China dominates the Asia-Pacific carbonated beverages market in terms of revenue share, owing to a large consumer base, increasing urbanization, and the expanding influence of Western lifestyle habits. The growth of e-commerce platforms and digital marketing strategies by major brands such as Coca-Cola and PepsiCo have significantly enhanced product reach. Domestic players are also introducing traditional herbal-infused carbonated drinks to meet local taste preferences, contributing to a diverse and competitive marketplace.

Carbonated Beverages Market Share

The Carbonated Beverages industry is primarily led by well-established companies, including:

- The Coca-Cola Company (U.S.)

- PepsiCo Inc. (U.S.)

- Britvic Plc (U.K.)

- SUNTORY BEVERAGE & FOOD LIMITED. (Japan)

- National Beverage Corp. (U.S.)

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- Tru Blu Beverages (Australia)

- F&N Foods Pte Ltd. (Singapore)

- Bickford's Australia (Australia)

- Parle Agro Pvt. Ltd. (India)

- Laihian Mallas (Finland)

Latest Developments in Global Carbonated Beverages Market

- In December 2023, in response to the growing demand for sugar-free beverages driven by increased health awareness in Japan, Kirin introduced its Tokusei Ginger Ale Sour and a range of sugar-free tea products, including black tea and Hojicha. These new offerings are exclusively available in the Japanese market as of 2023

- In October 2023, Coca-Cola unveiled Coca-Cola Y3000, a new beverage developed with the assistance of artificial intelligence. This latest limited-edition flavor is part of the Coca-Cola Creations platform, showcasing the brand's innovative approach to product development

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CARBONATED BEVERAGES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL CARBONATED BEVERAGES MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CARBONATED BEVERAGES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRIVATE LABEL VS BRAND ANALYSIS

5.2 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.3 SHOPPING BEHAVIOUR AND DYNAMICS

5.3.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.3.2 RESEARCH

5.3.3 IMPULSIVE

5.3.4 ADVERTISEMENT

5.3.4.1. TELEVISION ADVERTISEMENT

5.3.4.2. ONLINE ADVERTISEMENT

5.3.4.3. IN-STORE ADVERTISEMENT

5.3.4.4. OUTDOOR ADVERTISEMENT

5.4 PROMOTIONAL ACTIVITIES

5.5 NEW PRODUCT LAUNCH STRATEGY

5.5.1 NUMBER OF NEW PRODUCT LAUNCH

5.5.1.1. LINE EXTENSTION

5.5.1.2. NEW PACKAGING

5.5.1.3. RE-LAUNCHED

5.5.1.4. NEW FORMULATION

5.5.2 DIFFERNTIAL PRODUCT OFFERING

5.5.3 MEETING CONSUMER REQUIREMENT

5.5.4 PACKAGE DESIGNING

5.5.5 PRICING ANALYSIS

5.5.6 PRODUCT POSITIONING

6 REGULATORY FRAMEWORK AND GOVRENMENT INITIATIVES

7 LABELING AND CLAIMS

8 FACTORS INFLUENCING THE PURCHASE

9 VALUE CHAIN ANALYSIS

10 SUPPLY CHAIN ANALYSIS

11 BRAND COMPETITIVE ANALYSIS

12 PRICING ANALYSIS

13 PRODUCTION CAPACITY OF KEY MANUFACTURERES

14 BRAND OUTLOOK

14.1 COMPARATIVE BRAND ANALYSIS

14.2 PRODUCT VS BRAND OVERVIEW

15 CONSUMER TYPE AND THEIR BUYING PERCEPTION

15.1 MILLENIALS

15.2 GEN X

15.3 BABY BOOMERS

16 GLOBAL CARBONATED BEVERAGES MARKET, BY TYPE, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 NON-ALOCOHOLIC

16.2.1 SOFT DRINKS

16.2.1.1. DIET SOFT DRINKS

16.2.1.1.1. COLA BASED

16.2.1.1.2. NON-COLA

16.2.1.1.2.1 ORANGE

16.2.1.1.2.2 LEMON

16.2.1.1.2.3 APPLE

16.2.1.1.2.4 BERRY

16.2.1.1.2.5 GINGER ALE

16.2.1.1.2.6 CREAMY SODA

16.2.1.1.2.7 PEACH

16.2.1.1.2.8 COFFEE

16.2.1.1.2.9 MANGO

16.2.1.1.2.10 OTHERS

16.2.1.2. NON-DIET SOFT DRINKS

16.2.1.2.1. COLA BASED

16.2.1.2.2. NON-COLA

16.2.2 CARBONATED WATER

16.2.3 CARBONATED ENERGY DRINKS

16.2.3.1. ORIGINAL/UNFLAVOURED

16.2.3.2. LEMON

16.2.3.3. GREEN TEA INFUSED

16.2.3.4. FRUIT PUNCH

16.2.3.5. GREEN APPLE

16.2.3.6. BLUEBERRY

16.2.3.7. MANGO

16.2.3.8. ORANGE

16.2.3.9. GRAPEFRUIT

16.2.3.10. HONEY

16.2.3.11. PINEAPPLE

16.2.3.12. STRAWBERRY

16.2.3.13. RASPBERRY

16.2.3.14. BERRY INFUSION

16.2.3.15. MIXED FRUIT INFUSION

16.2.3.16. MOCHA

16.2.3.17. OTHERS

16.2.4 CARBONATED SPORTS DRINKS

16.2.4.1. ORIGINAL/UNFLAVOURED

16.2.4.2. LEMON

16.2.4.3. GREEN TEA INFUSED

16.2.4.4. FRUIT PUNCH

16.2.4.5. GREEN APPLE

16.2.4.6. BLUEBERRY

16.2.4.7. MANGO

16.2.4.8. ORANGE

16.2.4.9. GRAPEFRUIT

16.2.4.10. HONEY

16.2.4.11. PINEAPPLE

16.2.4.12. STRAWBERRY

16.2.4.13. RASPBERRY

16.2.4.14. BERRY INFUSION

16.2.4.15. MIXED FRUIT INFUSION

16.2.4.16. MOCHA

16.2.4.17. OTHERS

16.2.5 OTHERS

16.3 ALOCOHOLIC

16.3.1 BEER

16.3.2 SPARKLING WINE

16.3.2.1. RED WINE

16.3.2.2. WHITE WINE

16.3.3 OTHERS

17 GLOBAL CARBONATED BEVERAGES MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 ORGANIC

17.3 INORGANIC

18 GLOBAL CARBONATED BEVERAGES MARKET, BY PACKAGING, 2022-2031 (USD MILLION)

18.1 OVERVIEW

18.2 BOTTLE

18.2.1 GLASS

18.2.2 PLASTIC

18.3 CAN

18.4 TETRAPACK

18.5 OTHERS

19 GLOBAL CARBONATED BEVERAGES MARKET,BY TYPE OF USER, 2022-2031 (USD MILLION)

19.1 OVERVIEW

19.2 WITH MEALS

19.3 SPECIAL OCCASIONS

20 GLOBAL CARBONATED BEVERAGES MARKET, BY AGE GROUP USER, 2022-2031 (USD MILLION)

20.1 OVERVIEW

20.2 TEEN

20.3 ADULTS

20.3.1 18-34 YEARS

20.3.2 35-54 YEARS

20.3.3 >55 YEARS

21 GLOBAL CARBONATED BEVERAGES MARKET,BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

21.1 OVERVIEW

21.2 FOOD SERVICE OUTLETS

21.3 STORE BASED RETAILERS

21.3.1 SUPERMARKETS/HYPERMARKETS

21.3.2 CONVENIENCE STORES

21.3.3 GROCERY RETAILERS

21.3.4 OTHERS

21.4 NON-STORE RETAILERS

21.4.1 ONLINE

21.4.2 VENDING MACHINE

22 GLOBAL CARBONATED BEVERAGES MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 U.K.

22.2.3 ITALY

22.2.4 FRANCE

22.2.5 SPAIN

22.2.6 SWITZERLAND

22.2.7 NETHERLANDS

22.2.8 BELGIUM

22.2.9 RUSSIA

22.2.10 TURKEY

22.2.11 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 SOUTH KOREA

22.3.4 INDIA

22.3.5 AUSTRALIA

22.3.6 SINGAPORE

22.3.7 THAILAND

22.3.8 INDONESIA

22.3.9 MALAYSIA

22.3.10 PHILIPPINES

22.3.11 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 UAE

22.5.3 SAUDI ARABIA

22.5.4 KUWAIT

22.5.5 REST OF MIDDLE EAST AND AFRICA

23 GLOBAL CARBONATED BEVERAGES MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

23.3 COMPANY SHARE ANALYSIS: EUROPE

23.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

23.5 MERGERS & ACQUISITIONS

23.6 NEW PRODUCT DEVELOPMENT & APPROVALS

23.7 EXPANSIONS & PARTNERSHIP

23.8 REGULATORY CHANGES

24 GLOBAL CARBONATED BEVERAGES MARKET, SWOT AND DBMR ANALYSIS

25 GLOBAL CARBONATED BEVERAGES MARKET, COMPANY PROFILE

25.1 THE COCA-COLA COMPANY

25.1.1 COMPANY OVERVIEW

25.1.2 PRODUCT PORTFOLIO

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 RECENT DEVELOPMENTS

25.2 PEPSICO, INC.

25.2.1 COMPANY OVERVIEW

25.2.2 PRODUCT PORTFOLIO

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 RECENT DEVELOPMENTS

25.3 BRITVIC PLC

25.3.1 COMPANY OVERVIEW

25.3.2 PRODUCT PORTFOLIO

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 RECENT DEVELOPMENTS

25.4 SUNTORY HOLDINGS

25.4.1 COMPANY OVERVIEW

25.4.2 PRODUCT PORTFOLIO

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 RECENT DEVELOPMENTS

25.5 ASAHI GROUP HOLDINGS

25.5.1 COMPANY OVERVIEW

25.5.2 PRODUCT PORTFOLIO

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 RECENT DEVELOPMENTS

25.6 PARLE AGRO PVT. LTD.

25.6.1 COMPANY OVERVIEW

25.6.2 PRODUCT PORTFOLIO

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 RECENT DEVELOPMENTS

25.7 TRU BLU BEVERAGES

25.7.1 COMPANY OVERVIEW

25.7.2 PRODUCT PORTFOLIO

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 RECENT DEVELOPMENTS

25.8 F&N FOODS PTE LTD.

25.8.1 COMPANY OVERVIEW

25.8.2 PRODUCT PORTFOLIO

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 RECENT DEVELOPMENTS

25.9 DR PEPPER SNAPPLE

25.9.1 COMPANY OVERVIEW

25.9.2 PRODUCT PORTFOLIO

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 RECENT DEVELOPMENTS

25.1 COTT. SINAR SOSRO

25.10.1 COMPANY OVERVIEW

25.10.2 PRODUCT PORTFOLIO

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 RECENT DEVELOPMENTS

25.11 NATIONAL BEVERAGE CORP.

25.11.1 COMPANY OVERVIEW

25.11.2 PRODUCT PORTFOLIO

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 RECENT DEVELOPMENTS

25.12 BERTS SOFT DRINKS

25.12.1 COMPANY OVERVIEW

25.12.2 PRODUCT PORTFOLIO

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 RECENT DEVELOPMENTS

25.13 DELUXE RICH SDN BHD

25.13.1 COMPANY OVERVIEW

25.13.2 PRODUCT PORTFOLIO

25.13.3 GEOGRAPHIC PRESENCE

25.13.4 RECENT DEVELOPMENTS

25.14 WESTS NZ LTD.

25.14.1 COMPANY OVERVIEW

25.14.2 PRODUCT PORTFOLIO

25.14.3 GEOGRAPHIC PRESENCE

25.14.4 RECENT DEVELOPMENTS

25.15 TOMBOW BEVERAGE CO. LTD.

25.15.1 COMPANY OVERVIEW

25.15.2 PRODUCT PORTFOLIO

25.15.3 GEOGRAPHIC PRESENCE

25.15.4 RECENT DEVELOPMENTS

25.16 RED BULL GMBH

25.16.1 COMPANY OVERVIEW

25.16.2 PRODUCT PORTFOLIO

25.16.3 GEOGRAPHIC PRESENCE

25.16.4 RECENT DEVELOPMENTS

25.17 MONSTER ENERGY COMPANY

25.17.1 COMPANY OVERVIEW

25.17.2 PRODUCT PORTFOLIO

25.17.3 GEOGRAPHIC PRESENCE

25.17.4 RECENT DEVELOPMENTS

25.18 KIMINO

25.18.1 COMPANY OVERVIEW

25.18.2 PRODUCT PORTFOLIO

25.18.3 GEOGRAPHIC PRESENCE

25.18.4 RECENT DEVELOPMENTS

25.19 ANHEUSER-BUSCH INBEV SA/NV

25.19.1 COMPANY OVERVIEW

25.19.2 PRODUCT PORTFOLIO

25.19.3 GEOGRAPHIC PRESENCE

25.19.4 RECENT DEVELOPMENTS

25.2 KEURIG DR PEPPER INC.

25.20.1 COMPANY OVERVIEW

25.20.2 PRODUCT PORTFOLIO

25.20.3 GEOGRAPHIC PRESENCE

25.20.4 RECENT DEVELOPMENTS

25.21 LOTTE CHILSUNG BEVERAGE

25.21.1 COMPANY OVERVIEW

25.21.2 PRODUCT PORTFOLIO

25.21.3 GEOGRAPHIC PRESENCE

25.21.4 RECENT DEVELOPMENTS

25.22 ANADOLU GRUBU A.ÅŽ

25.22.1 COMPANY OVERVIEW

25.22.2 PRODUCT PORTFOLIO

25.22.3 GEOGRAPHIC PRESENCE

25.22.4 RECENT DEVELOPMENTS

25.23 DANONE

25.23.1 COMPANY OVERVIEW

25.23.2 PRODUCT PORTFOLIO

25.23.3 GEOGRAPHIC PRESENCE

25.23.4 RECENT DEVELOPMENTS

26 CONCLUSION

27 REFERENCE

28 QUESTIONNAIRE

29 RELATED REPORTS

30 ABOUT DATA BRIDGE MARKET RESEARCH

Global Carbonated Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Carbonated Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Carbonated Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.