Europe Wound Care Biologics Market

Market Size in USD Million

CAGR :

%

USD

491.79 Million

USD

924.53 Million

2024

2032

USD

491.79 Million

USD

924.53 Million

2024

2032

| 2025 –2032 | |

| USD 491.79 Million | |

| USD 924.53 Million | |

|

|

|

|

Europe Wound Care Biologics Market Size

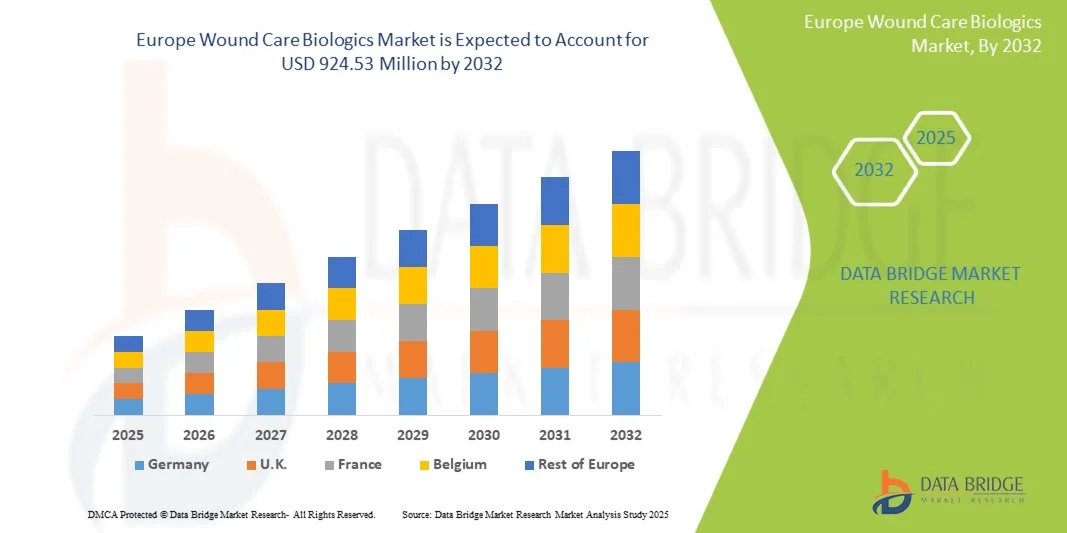

- The Europe wound care biologics market size was valued at USD 491.79 million in 2024 and is expected to reach USD 924.53 million by 2032, at a CAGR of 8.21% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic wounds, such as diabetic foot ulcers and venous leg ulcers, particularly among the aging European population, driving higher demand for advanced biologic therapies

- Furthermore, technological advancements in wound care biologics, including growth factors, collagen-based dressings, and skin substitutes, are improving healing outcomes and reducing complications, positioning these solutions as the preferred choice in hospitals and home care settings, thereby accelerating market growth

Europe Wound Care Biologics Market Analysis

- Wound care biologics, including synthetic skin grafts, growth factors, allografts, and xenografts, are increasingly critical in managing chronic and acute wounds across hospitals, clinics, and home care settings in Europe due to their ability to accelerate healing, reduce complications, and improve patient outcomes

- The rising demand for Europe wound care biologics market is primarily driven by the growing prevalence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, alongside an aging population and increasing healthcare expenditure on advanced wound management solutions

- Germany dominated the Europe wound care biologics market with the largest revenue share of 28% in 2024, attributed to high healthcare awareness, well-established reimbursement policies, and the presence of leading wound care companies, with significant adoption of biologics in hospitals and wound clinics

- Poland is expected to be the fastest growing country in the Europe wound care biologics market during the forecast period due to improving healthcare infrastructure, rising patient awareness, and increasing government initiatives to promote advanced wound care solutions

- Ulcers segment dominated the Europe wound care biologics market by wound type with a market share of 42% in 2024, driven by their high prevalence, chronic nature, and the urgent need for effective biologic treatments, making them the primary focus for healthcare providers and clinicians

Report Scope and Europe Wound Care Biologics Market Segmentation

|

Attributes |

Europe Wound Care Biologics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Wound Care Biologics Market Trends

“Advancements in Biologics and Personalized Wound Care”

- A significant and accelerating trend in the Europe wound care biologics market is the development of advanced biologics, including synthetic skin grafts, growth factors, allografts, and xenografts, which are increasingly tailored to patient-specific wound needs, improving healing outcomes

- For instance, growth factor-based therapies are now being customized for diabetic foot ulcers, enhancing tissue regeneration and reducing healing time compared to traditional treatments

- Adoption of combination therapies, such as collagen-based dressings with growth factors, is improving recovery rates and minimizing complications for chronic and acute wounds

- Integration of biologics with digital wound monitoring tools allows clinicians to track healing progress, adjust treatment protocols, and improve patient compliance in both hospital and home care settings

- Emerging research in xenografts and allografts is providing alternatives for difficult-to-heal wounds, offering faster tissue integration and reduced infection risk

- Increasing partnerships between biotech companies and hospitals are facilitating clinical trials and accelerating the adoption of next-generation wound care biologics

- This trend towards more effective, personalized, and technologically integrated wound care solutions is reshaping clinical practices, prompting companies such as MTF Biologics and Smith & Nephew to focus on innovative product development

Europe Wound Care Biologics Market Dynamics

Driver

“Increasing Prevalence of Chronic Wounds and Aging Population”

- The rising incidence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, coupled with an aging European population, is a key driver for the Europe wound care biologics market

- For instance, in 2024, Germany reported an increase in diabetic foot ulcer cases, prompting hospitals to adopt growth factor therapies and synthetic skin grafts for faster recovery

- Chronic wound prevalence is placing significant pressure on healthcare systems, creating demand for advanced biologics that improve healing and reduce hospital stays

- Increasing awareness among patients and healthcare providers about the effectiveness of biologics is further driving adoption in hospitals, wound clinics, and specialized care centers

- Improved reimbursement policies and healthcare infrastructure in countries such as Germany, France, and the U.K. are facilitating the uptake of innovative biologic treatments, supporting market growth

- Growing investment in R&D by leading biotech companies is enabling the introduction of more effective wound care biologics with enhanced clinical outcomes

- Expansion of outpatient and home care services across Europe is increasing the adoption of user-friendly biologics that can be applied outside hospital settings

Restraint/Challenge

“High Costs and Regulatory Compliance Hurdles”

- The relatively high cost of advanced wound care biologics compared to conventional dressings and therapies poses a challenge to broader adoption in Europe

- For instance, premium biologics such as xenografts or combination growth factor treatments can be expensive, limiting access in cost-sensitive healthcare settings

- Regulatory requirements for clinical trials, approvals, and safety compliance can delay product launches and restrict market entry for new biologic innovations

- Variations in reimbursement policies across European countries create additional barriers for widespread adoption, particularly in Eastern Europe

- Limited awareness and training among healthcare professionals in emerging European markets may slow the adoption of advanced biologics

- Supply chain complexities for biologics, including storage and transport requirements, can increase costs and affect timely availability

- Overcoming these challenges through cost-effective production, standardized regulatory pathways, and expanded reimbursement coverage will be critical for sustaining market growth

Europe Wound Care Biologics Market Scope

The market is segmented on the basis of product type, wound type, and end user.

- By Product Type

On the basis of product type, the Europe wound care biologics market is segmented into synthetic skin grafts, growth factors, allografts, and xenografts. The Growth Factors segment dominated the market with the largest revenue share of 38% in 2024, driven by their proven efficacy in accelerating wound healing and reducing infection risk. Growth factors are widely used in chronic wounds, such as diabetic foot ulcers and pressure ulcers, where faster tissue regeneration is critical. Hospitals and wound clinics prefer growth factor-based treatments due to clinical evidence supporting improved healing rates and shorter recovery times. Moreover, advancements in recombinant technologies and formulation enhancements are expanding their applicability across diverse wound types. Increasing awareness among clinicians and better reimbursement policies in Western Europe further strengthen the segment’s dominance. The segment also benefits from strong R&D investments that continue to refine biologic efficacy and patient outcomes.

The Synthetic Skin Grafts segment is anticipated to witness the fastest growth rate of 19.8% from 2025 to 2032, fueled by their ability to provide immediate coverage for burns, surgical wounds, and traumatic injuries. Synthetic skin grafts offer standardized quality, reduced immunogenicity, and rapid availability, making them ideal for acute wound care. Hospitals and burn centers increasingly adopt these products for emergency interventions and complex wound management. The segment’s growth is further supported by innovations in biomaterials, enabling improved graft integration and faster wound closure. Rising patient demand for advanced wound care solutions and expanding healthcare infrastructure in Eastern Europe also contribute to its accelerated growth.

- By Wound Type

On the basis of wound type, the market is segmented into ulcers, surgical and traumatic wounds, and burns. The Ulcers segment dominated the market with a share of 42% in 2024, owing to the high prevalence of diabetic foot ulcers, venous leg ulcers, and pressure ulcers in Europe. Chronic ulcers require long-term care, making biologics a preferred choice to enhance healing and reduce complications. Hospitals and wound clinics heavily rely on biologic therapies to improve patient outcomes and minimize readmission rates. Increasing awareness among clinicians and patients, coupled with better reimbursement policies, drives segment dominance. Technological advancements in topical biologic formulations and integration with digital wound monitoring also improve treatment efficacy. The segment remains a key revenue contributor due to sustained chronic wound prevalence and aging population trends.

The Surgical and Traumatic Wounds segment is expected to witness the fastest growth during the forecast period due to rising surgical procedures and trauma cases across Europe. Advanced biologics, such as synthetic grafts and growth factor formulations, are increasingly adopted to enhance post-surgical wound healing and minimize scarring. Hospitals and specialized trauma centers are implementing biologic treatments to shorten recovery time and reduce infection risk. Innovations in graft materials and biologic delivery systems further accelerate adoption. The segment’s growth is supported by increasing investments in reconstructive surgery and post-trauma rehabilitation programs. Rising patient awareness of faster recovery solutions contributes to robust growth.

- By End User

On the basis of end user, the market is segmented into HOSPITALS, ASCS, BURN CENTERS, AND WOUND CLINICS. The Hospitals segment dominated the Europe Wound Care Biologics Market with the largest revenue share of 45% in 2024, driven by high patient volumes, availability of advanced wound care facilities, and access to specialized clinicians. Hospitals treat a wide range of chronic and acute wounds, making biologics essential for improving healing outcomes. Availability of reimbursement support, clinical guidelines, and R&D-backed products strengthens hospital adoption. Increasing collaborations with biotech companies and continuous medical education programs further consolidate market dominance. Hospitals also prefer biologics for post-surgical and trauma care due to evidence-based efficacy and reduced hospitalization periods.

The Wound Clinics segment is anticipated to witness the fastest growth at a CAGR of 18.5% from 2025 to 2032, fueled by their specialization in chronic wound management and patient-centric care. Wound clinics adopt advanced biologics, including growth factors and synthetic grafts, to deliver targeted therapies and close monitoring for better clinical outcomes. Expansion of outpatient services and home care integration is increasing demand for clinic-based biologics. Rising awareness among patients for specialized wound care centers and government initiatives supporting outpatient wound management further accelerate segment growth. Wound clinics also benefit from technological integration such as digital wound assessment tools, enhancing treatment efficacy and patient satisfaction.

Europe Wound Care Biologics Market Regional Analysis

- Germany dominated the Europe wound care biologics market with the largest revenue share of 28% in 2024, attributed to high healthcare awareness, well-established reimbursement policies, and the presence of leading wound care companies, with significant adoption of biologics in hospitals and wound clinics

- Hospitals, wound clinics, and specialized care centers in Germany widely adopt advanced biologics for chronic wounds, surgical wounds, and burns, supported by clinical evidence demonstrating faster healing and reduced complications

- This dominance is further supported by strong R&D activities, advanced healthcare infrastructure, and government initiatives promoting innovative wound care solutions, establishing biologics as the preferred treatment option for both acute and chronic wounds across the country

The Germany Wound Care Biologics Market Insight

The Germany wound care biologics market captured the largest revenue share of 28% in 2024, driven by advanced healthcare infrastructure, well-established reimbursement policies, and the strong presence of key wound care companies. Chronic wounds, including diabetic foot ulcers, pressure ulcers, and surgical wounds, are increasingly treated with growth factors, synthetic skin grafts, allografts, and xenografts in hospitals and wound clinics. Rising awareness among clinicians and patients about the clinical benefits of biologics, combined with government support for innovative wound care solutions, is boosting adoption. Hospitals and specialized wound care centers are integrating biologics into standard care to improve healing outcomes and reduce hospitalization durations. Continuous R&D and clinical trials in Germany are enhancing treatment efficacy, safety, and accessibility. Furthermore, outpatient and home care programs are driving demand for biologics that can be effectively applied outside hospitals.

France Wound Care Biologics Market Insight

The France wound care biologics market is expected to expand at a considerable CAGR during the forecast period, fueled by rising chronic wound prevalence and growing hospital adoption of advanced biologics. Growth factors and synthetic skin grafts are widely used for diabetic ulcers, surgical wounds, and burns, supported by healthcare facilities with advanced wound management protocols. Increasing patient awareness and government initiatives for chronic disease management are promoting biologic utilization. Hospitals, burn centers, and outpatient wound clinics are integrating biologics to reduce healing time and complications. Innovations in formulation and delivery methods are enhancing clinical outcomes, safety, and ease of application. Additionally, reimbursement policies in France encourage adoption across both private and public healthcare facilities.

U.K. Wound Care Biologics Market Insight

The U.K. wound care biologics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing chronic wound cases and rising healthcare expenditure. Biologics such as growth factors, allografts, and xenografts are increasingly adopted in hospitals, wound clinics, and specialized care centers to accelerate healing and prevent infections. Patient awareness, coupled with clinician confidence in evidence-based biologics, supports robust adoption. The U.K.’s strong healthcare infrastructure, coupled with outpatient wound management services, facilitates the use of biologics beyond hospital settings. Clinical research and product innovations further enhance treatment efficacy and safety. Government programs promoting chronic disease and wound care management are expected to boost market growth.

Italy Wound Care Biologics Market Insight

The Italy wound care biologics market is projected to grow at a substantial CAGR during the forecast period, driven by increasing incidences of diabetic foot ulcers, surgical wounds, and trauma cases. Hospitals, burn centers, and specialized wound clinics are progressively adopting biologics such as growth factors, synthetic grafts, and allografts to improve healing outcomes. Rising patient awareness and physician recommendations are accelerating biologic usage in both inpatient and outpatient settings. Government support, clinical trials, and R&D initiatives are further enhancing the safety, efficacy, and availability of biologics. The expansion of home care and outpatient wound management programs is also driving demand for user-friendly biologic treatments.

Europe Wound Care Biologics Market Share

The Europe Wound Care Biologics industry is primarily led by well-established companies, including:

- ActiMaris (Switzerland)

- Advanced Medical Solutions Group plc (U.K.)

- Coloplast A/S (Denmark)

- Levabo (Denmark)

- neoplas med GmbH (Germany)

- NTC S.r.l. (Italy)

- Plastod S.p.A. (Italy)

- Flen Health (Luxembourg)

- MediWound. (Israel)

- Advancis Medical Ltd. (U.K.)

- B-WISE (Netherlands)

- BAP Medical GmbH (Germany)

- Bravida Medical Inc. (U.S.)

- COLDPLASMATECH GmbH (Germany)

- JeNaCell GmbH (Germany)

- Histocell S.L. (Spain)

- UPM Biomedicals (Finland)

- KERECIS (Iceland)

- Nanordica Medical. (Denmark)

- Genadyne Biotechnologies Inc. (U.S.)

What are the Recent Developments in Europe Wound Care Biologics Market?

- In March 2025, Convatec presented its most advanced wound care innovation pipeline at the European Wound Management Association (EWMA) conference in Barcelona. The company highlighted new developments aimed at improving healing outcomes, reducing treatment burdens, and enhancing patient quality of life. These innovations underscore Convatec's commitment to advancing wound care solutions in Europe

- In March 2025, MiMedx introduced AmnioVisc™, a viscous amniotic tissue allograft designed for surgical wounds, to the European market. This launch expands MiMedx's biologics offerings in advanced wound healing, providing clinicians with a new option to address complex surgical wounds

- In March 2025, Molnlycke participated in the EWMA 2025 conference in Barcelona, showcasing its commitment to advancing wound care. The company engaged in discussions on the latest innovations and real-world practices in wound management, emphasizing holistic solutions that empower both patients and clinicians

- In August 2024, Convatec's CEO, Karim Bitar, cautioned that the company's UK investments might be at risk if a new wound care product, developed following a £45 million acquisition of an Oxfordshire tech platform, is not approved by regulators. The new product, designed for diabetic foot ulcers, is part of Convatec's expansion of its wound care portfolio

- In June 2023, Sonoma Pharmaceuticals launched a new intraoperative pulse lavage irrigation treatment in the European Union. This non-toxic solution is designed to replace traditional IV bags in various surgical procedures, aiming to prevent infection and expedite healing. The product was developed in collaboration with the medical community and distribution partners in Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.