Global Achard Thiers Treatment Market

Market Size in USD Billion

CAGR :

%

USD

2.80 Billion

USD

4.23 Billion

2025

2033

USD

2.80 Billion

USD

4.23 Billion

2025

2033

| 2026 –2033 | |

| USD 2.80 Billion | |

| USD 4.23 Billion | |

|

|

|

|

Achard Thiers Treatment Market Size

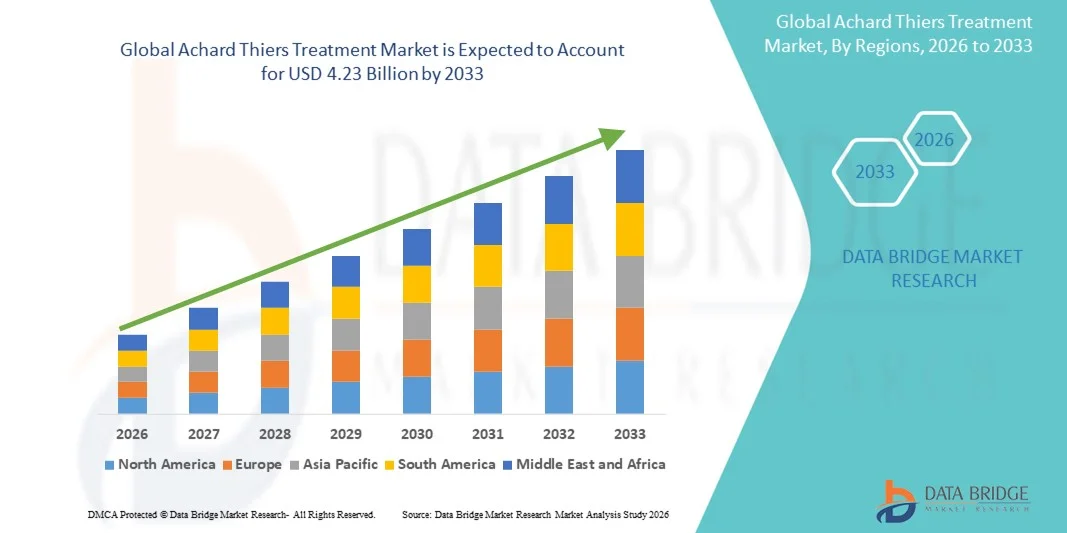

- The global achard thiers treatment market size was valued at USD 2.80 billion in 2025 and is expected to reach USD 4.23 billion by 2033, at a CAGR of 5.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of metabolic and endocrine disorders, rising awareness of rare diseases, and the adoption of effective pharmacological therapies in both developed and emerging regions

- Furthermore, growing investment in healthcare infrastructure, improved diagnostic capabilities, and government initiatives promoting rare disease management are driving higher adoption of achard thiers treatment solutions, thereby significantly boosting industry growth

Achard Thiers Treatment Market Analysis

- Achard Thiers Treatment, encompassing pharmacological and therapeutic interventions, is increasingly vital in managing rare endocrine and metabolic disorders in both adults and pediatric populations due to its proven efficacy, targeted approach, and integration into clinical care protocols

- The escalating demand for achard thiers treatment is primarily fueled by growing awareness of rare diseases, increasing prevalence of metabolic disorders, and rising adoption of advanced diagnostic and treatment practices among healthcare providers

- North America dominated the achard thiers treatment market with the largest revenue share of 39.8% in 2025, supported by advanced healthcare infrastructure, strong pharmaceutical presence, and well-established diagnostic and treatment facilities, with the U.S. witnessing a significant rise in diagnosis rates and the availability of specialized treatment centers for rare endocrine disorders

- Asia-Pacific is expected to be the fastest-growing region in the achard thiers treatment market during the forecast period, projected to expand at a CAGR from 2026 to 2033, driven by high disease burden, improving healthcare access, and growing awareness in countries such as India, China, and Southeast Asia

- The oral segment dominated the largest market revenue share of 52.6% in 2025, owing to the convenience, widespread availability, and established efficacy of oral anti-diabetic and hormone-regulating therapies

Report Scope and Achard Thiers Treatment Market Segmentation

|

Attributes |

Achard Thiers Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Achard Thiers Treatment Market Trends

Focus on Targeted and Multimodal Therapies

- A significant and accelerating trend in the global achard thiers treatment market is the growing focus on targeted and combination therapies, aimed at addressing the complex, multi-systemic nature of the disease

- For instance, clinicians are increasingly employing regimens that combine antihypertensives, corticosteroids, and glucose-regulating agents, which provide improved patient outcomes compared to monotherapy

- Research is emphasizing early intervention and multi-organ monitoring, particularly for cardiac, hepatic, and metabolic complications, which are prominent in Achard Thiers patients

- Clinical studies are exploring enzyme replacement therapies and novel pharmacological approaches, aiming to slow disease progression and improve quality of life

- There is a growing trend toward using real-world patient data to guide therapy decisions and develop disease-specific treatment protocols

- Pharmaceutical companies are also expanding focus on pediatric and geriatric formulations, recognizing the importance of early and tailored treatment

- Patient advocacy groups are increasingly collaborating with healthcare providers to develop awareness campaigns and support programs, contributing to early diagnosis and treatment uptake

- The trend toward integrated care pathways that combine specialist consultation, pharmacological treatment, and lifestyle management is reshaping patient care

- New research emphasizes monitoring metabolic and endocrine complications alongside standard treatment to achieve holistic management of Achard Thiers syndrome

- Treatment innovations are gradually shifting from symptom-based approaches to targeted and patient-specific strategies, reflecting a deeper understanding of disease mechanisms

Achard Thiers Treatment Market Dynamics

Driver

Rising Prevalence and Growing Awareness of Disease

- The increasing prevalence of achard thiers syndrome globally, coupled with growing awareness among healthcare providers, is driving higher demand for advanced treatment options

- For instance, in April 2025, a European clinical consortium announced expanded access programs for combination therapy regimens in multiple hospitals, enhancing patient reach and driving market growth

- Patients and clinicians are seeking therapies that manage both primary endocrine dysfunction and associated metabolic complications, increasing adoption of newer treatment protocols

- Improved diagnostic capabilities and earlier detection of Achard Thiers syndrome contribute to higher treatment uptake

- The availability of updated clinical guidelines and inclusion of Achard Thiers syndrome in rare-disease registries is supporting structured treatment programs

- Rising patient awareness and advocacy campaigns are prompting more proactive management, resulting in greater prescription volumes

- Access to specialty care centers and multidisciplinary clinics further facilitates the adoption of comprehensive therapies

- Real-world evidence from patient registries is being increasingly used to optimize treatment outcomes, fueling industry confidence and growth

Restraint/Challenge

Limited Drug Accessibility and High Treatment Costs

- Limited accessibility of specific Achard Thiers treatment formulations, particularly in low- and middle-income countries, poses a significant challenge to market expansion

- For instance, reports from 2024 highlighted shortages of enzyme-modulating drugs in parts of South Asia, delaying therapy initiation for newly diagnosed patients

- High costs associated with combination therapies and specialized care can restrict adoption, especially among price-sensitive populations

- Limited reimbursement coverage in many regions adds to financial barriers for patients seeking long-term treatment

- Healthcare provider training gaps in rare endocrine disorders may slow early diagnosis and proper therapeutic intervention

- While some generic options are becoming available, the perceived premium of innovative therapies continues to hinder rapid uptake

- Overcoming these challenges through improved drug accessibility, expanded insurance coverage, and regional patient-support programs will be critical for sustained market growth

Achard Thiers Treatment Market Scope

The market is segmented on the basis of treatment, route of administration, diagnosis, symptoms, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the Achard Thiers Treatment market is segmented into anti-diabetic drugs, hormone replacement therapy, cosmetic measures, and anti-androgens. The anti-diabetic drugs segment dominated the largest market revenue share of 47.5% in 2025, driven by the high prevalence of insulin resistance and metabolic complications among Achard Thiers patients. Anti-diabetic drugs are widely prescribed to manage hyperglycemia and prevent secondary complications, with standardized dosing and long-term treatment regimens supporting consistent market adoption. Government health programs and clinical guidelines emphasize glycemic control, further reinforcing the dominance of anti-diabetic therapies. The efficacy of these drugs in both adult and pediatric patients ensures broad applicability. Increased awareness among endocrinologists and routine screening for diabetes-related symptoms in Achard Thiers syndrome patients also contribute to sustained adoption. Clinical studies show improved patient outcomes and reduced progression of metabolic complications, solidifying their market leadership. The segment benefits from a robust pipeline of novel oral agents and combination therapies, maintaining a strong position in the market. Pharmaceutical companies are continuously launching improved formulations, targeting better patient compliance. Insurance coverage for diabetes treatment enhances accessibility, particularly in developed regions. Overall, anti-diabetic drugs remain the backbone of Achard Thiers syndrome management, accounting for nearly half of the treatment market.

The cosmetic measures segment is expected to witness the fastest CAGR of 19.3% from 2026 to 2033, driven by rising patient awareness of physical manifestations associated with Achard Thiers syndrome. Increasing patient demand for aesthetic improvements, combined with non-invasive procedures, is propelling market growth. Clinics and hospitals are integrating cosmetic care into treatment plans to enhance quality of life. Studies in 2025 highlighted positive patient feedback when cosmetic measures were used alongside pharmacotherapy. Specialist dermatology services and cosmetic-focused outpatient centers are expanding offerings for Achard Thiers patients. Technological innovations in minimally invasive interventions support faster adoption. Awareness campaigns and social media are creating patient demand for cosmetic solutions. Insurance coverage for cosmetic adjunctive care is slowly increasing in some regions. Hospital collaborations for combined endocrine and aesthetic treatment boost accessibility. Growing recognition of patient-centered care drives adoption. Emerging economies are witnessing uptake due to urbanization and increasing disposable income. Overall, cosmetic measures are rapidly gaining traction, representing the fastest-growing treatment segment.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, intravenous, and other routes. The oral segment dominated the largest market revenue share of 52.6% in 2025, owing to the convenience, widespread availability, and established efficacy of oral anti-diabetic and hormone-regulating therapies. Oral drugs enable long-term management and patient self-administration, which is particularly advantageous for chronic disease management. Standardized dosing and integration into daily routines contribute to higher adherence rates. Government programs and clinical protocols endorse oral therapies for both adult and pediatric populations. Availability in retail and hospital pharmacies enhances patient accessibility. Oral administration allows for simultaneous treatment of multiple metabolic and endocrine complications, supporting comprehensive management. Clinical data confirm improved glycemic and hormonal control with oral therapy regimens. Pharmaceutical innovation in combination tablets is further strengthening adoption. Cost-effectiveness compared to hospital-based therapies supports dominance, especially in emerging markets. Overall, oral therapies remain the preferred choice for patients and healthcare providers, accounting for over half of market revenue.

The intravenous segment is expected to witness the fastest CAGR of 18.7% from 2026 to 2033, driven by increased use in acute care and hospital-administered hormone replacement protocols. Hospitals are adopting intravenous therapy for severe or complicated cases requiring rapid therapeutic effects. Integration into inpatient care pathways ensures timely management of metabolic crises. Clinical studies in 2025 demonstrated faster stabilization of endocrine parameters with intravenous administration. Access to infusion services in urban and semi-urban hospitals supports adoption. Specialist endocrinologists recommend intravenous therapy for patients non-responsive to oral treatment. Technological advancements in infusion devices improve safety and efficiency. Hospital collaborations facilitate therapy delivery and patient monitoring. Government-supported programs provide training for safe administration. Intravenous therapy ensures precise dosing for high-risk populations. Patient adherence is enhanced under supervised administration. Expansion of hospital facilities in emerging regions is supporting market growth. Overall, intravenous administration represents the fastest-growing route segment.

- By Diagnosis

On the basis of diagnosis, the market is segmented into complete blood count, thyroid function test, liver function test, ultrasound scan of abdomen, CT scan, and others. The thyroid function test segment dominated the largest market revenue share of 45.1% in 2025, owing to its critical role in identifying endocrine imbalances central to Achard Thiers syndrome. Early diagnosis through thyroid function assessment allows timely intervention and therapy initiation. Routine testing is widely adopted in clinical practice and supported by healthcare guidelines. Standardized laboratory protocols ensure reliable results, increasing clinician confidence in treatment planning. The test is applicable across adult and pediatric populations, supporting broad adoption. Screening programs and hospital protocols incorporate thyroid function testing as a key diagnostic tool. Results inform dosage adjustments for hormone replacement and metabolic therapies. Educational campaigns have raised clinician and patient awareness about the importance of thyroid testing. The segment’s strong presence in both outpatient and inpatient settings further reinforces dominance. Technological advancements in automated analyzers improve efficiency and accuracy. Overall, thyroid function tests remain essential for monitoring disease progression and guiding therapy.

The ultrasound scan of the abdomen segment is expected to witness the fastest CAGR of 20.4% from 2026 to 2033, driven by increasing utilization for evaluating liver and organ complications associated with Achard Thiers syndrome. Early detection of hepatomegaly and organ-specific changes supports timely intervention. Non-invasive imaging ensures patient safety and enhances diagnostic confidence. Hospital adoption of high-resolution devices facilitates accurate monitoring. Integration into routine endocrine assessments boosts frequency of use. 2025 studies highlighted improved clinical decision-making and patient outcomes. Increasing awareness among clinicians drives utilization. Government-funded hospitals are expanding ultrasonography services. Specialist training improves interpretation accuracy. Growing patient preference for non-invasive diagnostic tools supports adoption. Accessibility in urban and semi-urban centers accelerates uptake. Overall, ultrasound scans represent the fastest-growing diagnostic segment.

- By Symptoms

On the basis of symptoms, the market is segmented into onset of diabetes, frequent urination, excessive thirst and hunger, weight loss, and others. The onset of diabetes segment dominated the largest market revenue share of 47.3% in 2025, due to its high prevalence among Achard Thiers syndrome patients and its critical role in early diagnosis and management. The symptom is a key clinical indicator prompting endocrinology evaluation and metabolic intervention. Routine monitoring of blood glucose levels allows timely initiation of therapy and reduces complications. Standardized protocols across hospitals and clinics ensure reliable detection and support broad adoption. Diabetes onset is relevant across both adult and pediatric patients, strengthening market penetration. Screening programs, hospital protocols, and community health initiatives incorporate monitoring for early hyperglycemia. Educational campaigns and patient awareness programs have further increased detection rates. Technology-assisted glucose monitoring devices improve compliance and accuracy. Clinical guidelines emphasize diabetes onset as a primary marker for multidisciplinary treatment. Hospital and clinic data confirm consistent patient presentation patterns. Overall, onset of diabetes remains the most widely reported and clinically significant symptom driving the market.

The frequent urination segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by increased recognition of polyuria as a secondary symptom associated with insulin resistance and early endocrine dysfunction. Early identification allows clinicians to adjust treatment plans proactively and prevent further complications. Hospitals and outpatient clinics are increasingly integrating frequent urination monitoring into patient assessments. Patient self-reporting tools enhance data collection accuracy and compliance. Clinical studies in 2025 highlighted its correlation with metabolic derangements and improved outcomes when addressed promptly. Growing awareness among endocrinologists and primary care physicians boosts utilization of symptom tracking. Non-invasive diagnostic aids and mobile applications facilitate patient engagement. Community health programs emphasize monitoring in high-risk populations. Frequent urination serves as an early indicator of glycemic control and renal involvement. Technological advancements in wearable glucose and urine monitoring devices further support adoption. Patient-centered care models encourage proactive symptom management. Accessibility in urban and semi-urban centers accelerates reporting and evaluation. Overall, frequent urination represents the fastest-growing symptom segment due to its predictive value and integration into early intervention strategies.

- By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. The hospital segment dominated the largest market revenue share of 53.7% in 2025, driven by the availability of comprehensive facilities for managing multi-organ complications of Achard Thiers syndrome. Hospitals offer integrated diagnostic and therapeutic services, including endocrine management, metabolic care, and advanced supportive therapies. They provide access to specialized endocrinologists and multidisciplinary care teams, ensuring effective treatment planning. Government hospitals and major private institutions participate in standardized treatment protocols and awareness programs, increasing adoption. Hospitals are central to long-term follow-up and monitoring, enhancing patient compliance. Clinical studies indicate improved outcomes with hospital-based management for severe cases. Hospitals also provide infrastructure for intravenous and complex drug administration. Routine monitoring, laboratory support, and imaging facilities make hospitals the preferred choice for end-users. Education and training of staff ensure accurate diagnosis and therapy implementation. Access to insurance coverage and reimbursement programs further supports hospital dominance. Overall, hospitals remain the largest end-user segment, providing holistic care.

The clinic segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by the expansion of outpatient services and early intervention programs. Community clinics enhance accessibility, particularly in semi-urban and rural regions, enabling timely management of Achard Thiers syndrome. Clinics are increasingly integrating diagnostics, pharmacotherapy, and lifestyle counseling to improve patient outcomes. Telemedicine services allow follow-up care and remote monitoring, boosting adoption. Local clinics are becoming centers for preventive screening, particularly for diabetes and metabolic complications. Awareness campaigns in 2025 highlighted the benefit of early clinic-based intervention for better long-term outcomes. Clinics offer personalized care and enhanced patient adherence, particularly for pediatric and adult populations. Collaboration with hospitals ensures smooth referral pathways for complicated cases. Emerging clinic networks in Asia-Pacific and Latin America are driving growth. Community engagement and patient education programs support trust and uptake. Clinics provide convenient access for routine monitoring, reducing travel and cost burdens. Overall, clinics are emerging as the fastest-growing end-user segment due to accessibility and personalized care.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the largest market revenue share of 50.5% in 2025, owing to its central role in controlled distribution of anti-diabetic, hormone, and adjunctive therapies for Achard Thiers patients. Hospital pharmacies ensure treatment adherence by supplying prescribed medications alongside clinical supervision. Government and private hospitals are primary sources for high-cost drugs, hormone replacement therapies, and specialty formulations. Hospitals also provide patient counseling and medication monitoring, reinforcing pharmacy adoption. Standardized dispensing procedures support compliance and safety. Hospital pharmacies are integrated with patient record systems, allowing accurate tracking of treatment history. Bulk procurement and programmatic drug supply enhance availability in endemic regions. Institutional support for therapeutic campaigns ensures consistent distribution. Clinical trials and research partnerships often collaborate with hospital pharmacies. Education for patients and healthcare staff ensures proper usage. Overall, hospital pharmacies remain the dominant distribution channel, facilitating effective treatment delivery.

The online pharmacy segment is expected to witness the fastest CAGR of 21.5% from 2026 to 2033, driven by rising e-commerce penetration and increasing patient preference for home delivery of medications. Online platforms improve access for patients in remote or underserved areas, supporting adherence to long-term therapies. In 2025, Southeast Asian online pharmacies introduced bundled packages of oral and topical treatments, enhancing convenience and reducing travel burdens. Digital ordering platforms integrate prescription verification and reminders, improving compliance. Rising awareness and trust in online healthcare services support adoption. Teleconsultation partnerships allow seamless integration of prescriptions and home delivery. Promotions and patient education campaigns boost online engagement. Growth is supported by expanding logistics networks and cold-chain solutions for sensitive formulations. Online pharmacies also cater to patient demand for privacy and discretion. Technological innovation in mobile apps facilitates order tracking and adherence monitoring. Social media campaigns increase patient outreach and engagement. Overall, online pharmacies are the fastest-growing distribution channel due to convenience, accessibility, and digital adoption.

Achard Thiers Treatment Market Regional Analysis

- North America dominated the achard thiers treatment market with the largest revenue share of 39.8% in 2025, supported by advanced healthcare infrastructure, strong pharmaceutical presence, and well-established diagnostic and treatment facilities

- Consumers in the region highly value specialized treatment centers, advanced diagnostic capabilities, and increased awareness of rare endocrine disorders

- This widespread adoption is further supported by the U.S. witnessing a significant rise in diagnosis rates and the availability of specialized treatment centers for Achard Thiers syndrome

U.S. Achard Thiers Treatment Market Insight

The U.S. achard thiers treatment market captured the largest revenue share in 2025 within North America, fueled by increasing diagnosis rates and the availability of specialized treatment centers. Patients are increasingly seeking timely and effective interventions, supported by advanced healthcare infrastructure and a strong presence of pharmaceutical companies focusing on rare endocrine disorders.

Europe Achard Thiers Treatment Market Insight

The Europe achard thiers treatment market is projected to expand at a substantial CAGR throughout the forecast period, driven by growing awareness of rare endocrine disorders and advanced healthcare systems. Increased urbanization, coupled with rising access to specialized treatment centers, is fostering adoption across both public and private healthcare facilities.

U.K. Achard Thiers Treatment Market Insight

The U.K. achard thiers treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of rare endocrine disorders and the presence of specialized treatment infrastructure. Healthcare policies supporting rare disease management and strong patient advocacy are further stimulating market growth.

Germany Achard Thiers Treatment Market Insight

The Germany achard thiers treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of rare endocrine disorders and the demand for advanced treatment options. Germany’s well-developed healthcare system and focus on innovation in diagnostics and therapeutics promote the adoption of specialized treatment services.

Asia-Pacific Achard Thiers Treatment Market Insight

The Asia-Pacific achard thiers treatment market is expected to be the fastest-growing region during the forecast period, projected to expand at a significant CAGR from 2026 to 2033. Growth is driven by high disease burden, improving healthcare access, and growing awareness in countries such as India, China, and Southeast Asia.

Japan Achard Thiers Treatment Market Insight

The Japan achard thiers treatment market is gaining momentum due to increasing awareness of rare endocrine disorders, rapid urbanization, and the demand for specialized treatment centers. Patients are adopting advanced diagnostic and therapeutic solutions, supported by Japan’s technologically advanced healthcare system.

China Achard Thiers Treatment Market Insight

The China achard thiers treatment market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s growing healthcare infrastructure, expanding patient awareness, and increasing access to specialized treatment facilities. Government initiatives for rare disease management and improving healthcare access are key factors driving market growth.

Achard Thiers Treatment Market Share

The Achard Thiers Treatment industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (U.K.)

- Sanofi S.A. (France)

- Eli Lilly and Company (U.S.)

- Bayer AG (Germany)

- Merck & Co., Inc. (U.S.)

- AstraZeneca plc (U.K.)

- Boehringer Ingelheim GmbH (Germany)

- AbbVie Inc. (U.S.)

- Johnson & Johnson (U.S.)

- Roche Holding AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Limited (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Novome Biotech (U.S.)

- Amgen Inc. (U.S.)

- Servier Laboratories (France)

Latest Developments in Global Achard Thiers Treatment Market

- In September 2022, the Alström Syndrome International (which focuses on a different rare syndrome but is relevant for rare‑disease advocacy) held an Externally‑Led Patient Focused Drug Development (EL‑PFDD) meeting to capture patient and caregiver perspectives on needs for therapy development

- In August 2022, a genetic and phenotypic cohort study for Alström syndrome (again a different rare disease) in China identified 24 novel variants in the ALMS1 gene and uncovered a new phenotype (olfactory impairment)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.