Global Acquired Neuromyotonia Treatment Market

Market Size in USD Billion

CAGR :

%

USD

14.38 Billion

USD

21.25 Billion

2025

2033

USD

14.38 Billion

USD

21.25 Billion

2025

2033

| 2026 –2033 | |

| USD 14.38 Billion | |

| USD 21.25 Billion | |

|

|

|

|

Acquired Neuromyotonia Treatment Market Size

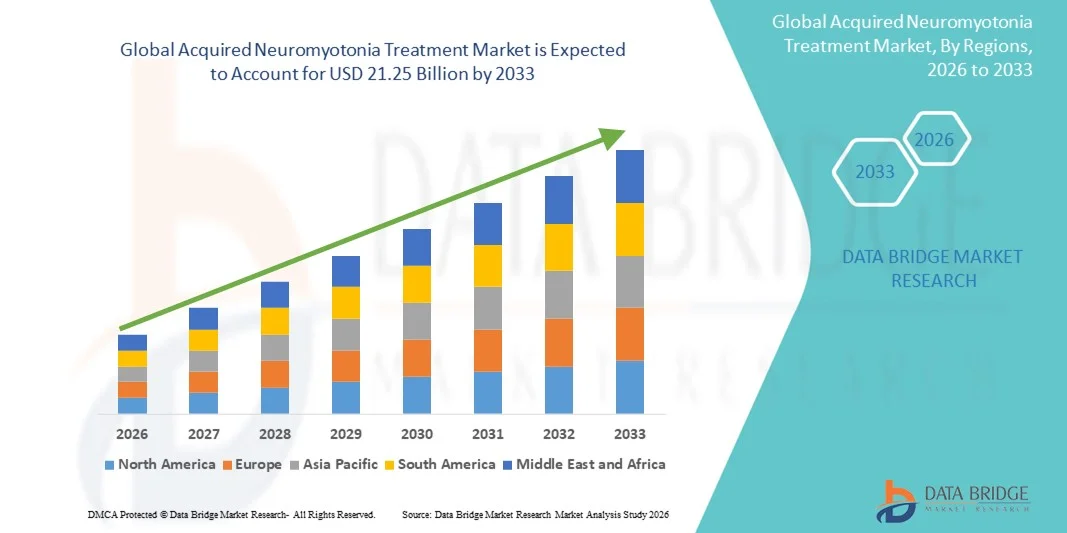

- The global acquired neuromyotonia treatment market size was valued at USD 14.38 billion in 2025 and is expected to reach USD 21.25 billion by 2033, at a CAGR of 5.00% during the forecast period

- The market growth is primarily driven by the increasing prevalence of autoimmune neurological disorders and advancements in diagnostic technologies enabling early and accurate detection of neuromyotonia

- Moreover, the rising adoption of immunotherapies, monoclonal antibodies, and plasma exchange treatments, coupled with growing research initiatives to develop targeted therapeutics, is enhancing patient outcomes and accelerating the expansion of the acquired neuromyotonia treatment industry

Acquired Neuromyotonia Treatment Market Analysis

- Acquired neuromyotonia treatment focuses on managing nerve hyperexcitability symptoms through a range of pharmacological and therapeutic interventions, including anticonvulsant drugs, corticosteroids, and plasma exchange therapy, which are essential for improving neuromuscular function and reducing patient discomfort

- The market’s expansion is primarily driven by increasing diagnostic accuracy through electromyography (EMG) and MRI, rising awareness of autoimmune neurological disorders, and ongoing advancements in targeted drug formulations for long-term disease management

- North America dominated the acquired neuromyotonia treatment market with the largest revenue share of 39.9% in 2025, supported by advanced healthcare infrastructure, strong presence of specialized neurology centers, and growing adoption of immunomodulatory and symptomatic therapies across the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to improved diagnostic accessibility, expanding hospital networks, and rising healthcare expenditure aimed at treating rare neuromuscular disorders

- The anticonvulsant drugs segment dominated the acquired neuromyotonia treatment market with a share of 42.4% in 2025, driven by their effectiveness in stabilizing nerve activity, reducing muscle twitching, and being widely available across both hospital and retail pharmacy distribution channels

Report Scope and Acquired Neuromyotonia Treatment Market Segmentation

|

Attributes |

Acquired Neuromyotonia Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Acquired Neuromyotonia Treatment Market Trends

Advancements in Immunotherapy and Precision Neurology

- A significant and accelerating trend in the global acquired neuromyotonia treatment market is the growing adoption of immunotherapy and precision neurology approaches, driven by improved understanding of autoimmune mechanisms and antibody-mediated nerve dysfunction. This shift is enhancing treatment personalization and clinical outcomes

- For instance, research on monoclonal antibodies targeting specific ion channel antigens has gained traction, leading to new treatment possibilities aimed at reducing neuronal hyperexcitability and symptom recurrence. Similarly, plasma exchange therapy and intravenous immunoglobulin (IVIg) are being increasingly adopted for refractory cases

- AI integration in neurology is also transforming diagnosis and treatment optimization by analyzing electrophysiological data and predicting therapeutic responses. For instance, AI-assisted electromyography (EMG) interpretation helps clinicians detect subtle nerve irregularities and tailor patient-specific interventions

- The growing use of digital biomarkers and neuroimaging tools in patient monitoring supports real-time disease tracking and enhances the precision of ongoing therapeutic regimens, improving patient outcomes and clinical efficiency

- This trend toward immunologically and technologically advanced treatment paradigms is redefining how neuromyotonia is managed, emphasizing individualized care and early intervention. Consequently, pharmaceutical innovators are focusing on novel biologics and antibody-targeted drugs to enhance efficacy and safety profiles

- The demand for treatments offering greater precision, improved symptom control, and fewer side effects is rapidly growing across global markets, as patients and healthcare providers increasingly prioritize evidence-based, targeted, and data-supported therapy solutions

Acquired Neuromyotonia Treatment Market Dynamics

Driver

Increasing Diagnosis Rates and Advancements in Neuroimmunology

- The rising diagnosis rates of autoimmune neuromuscular disorders, along with rapid advancements in neuroimmunology, are major drivers fueling the demand for acquired neuromyotonia treatments

- For instance, in March 2025, research collaborations between major neurology institutes and biotech firms focused on novel ion-channel antibody identification, facilitating earlier and more accurate diagnosis of neuromyotonia

- As healthcare professionals gain deeper understanding of the autoimmune origins of the condition, targeted therapies such as IVIg and corticosteroids are becoming preferred treatment options, improving patient prognosis and long-term outcomes

- Furthermore, the increasing use of EMG and antibody testing in clinical settings has made early disease detection more efficient, resulting in timely treatment initiation and better symptom management

- The expanding patient pool, growing awareness among neurologists, and improving reimbursement frameworks for rare neuromuscular conditions are further accelerating market growth. The integration of advanced research initiatives and clinical trials is expected to expand therapeutic options in the coming years

- Moreover, government initiatives to support rare disease research and inclusion of neuromuscular disorders under national health coverage plans are creating new growth avenues for treatment access

- Rising collaboration between hospitals and pharmaceutical manufacturers to streamline clinical trials and drug distribution channels is expected to further strengthen treatment availability and adoption worldwide

Restraint/Challenge

High Treatment Costs and Limited Clinical Awareness

- The high cost associated with immunotherapies, IVIg, and plasma exchange therapy poses a significant barrier to widespread adoption, especially in developing healthcare systems with constrained budgets

- For instance, prolonged treatment regimens requiring repeated immunotherapy cycles can become financially burdensome for patients, limiting access to effective care and reducing adherence rates

- Limited clinical awareness and diagnostic expertise in rare autoimmune neuromuscular disorders further hinder early detection and treatment, leading to underreported prevalence and delayed intervention

- In addition, regional disparities in healthcare infrastructure and the shortage of trained neurology specialists exacerbate treatment gaps, especially in low- and middle-income countries

- The lack of standardized treatment guidelines and insufficient inclusion of acquired neuromyotonia in rare disease programs create additional barriers to consistent patient care

- Overcoming these challenges through increased physician education, healthcare funding for rare disorders, and the introduction of cost-effective therapeutic alternatives will be critical for expanding market accessibility and long-term growth

- Furthermore, the absence of large-scale epidemiological data limits pharmaceutical investment and regulatory prioritization, slowing the pace of innovation in this therapeutic segment

- Stringent approval processes for biologics and plasma-based therapies can also delay product launches and restrict timely patient access to next-generation neuromyotonia treatments

Acquired Neuromyotonia Treatment Market Scope

The market is segmented on the basis of treatment, dosage, route of administration, diagnosis, symptoms, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the acquired neuromyotonia treatment market is segmented into anticonvulsant drugs, oral corticosteroids, non-steroidal drugs, acetazolamide, and plasma exchange therapy. The anticonvulsant drugs segment dominated the market with the largest revenue share of 42.4% in 2025, primarily due to their effectiveness in stabilizing overactive nerve signals and reducing muscle twitching. These medications, including carbamazepine and phenytoin, are widely prescribed as first-line therapies due to their proven efficacy in managing peripheral nerve hyperexcitability. Their affordability, easy availability, and oral administration make them the preferred choice among neurologists and patients asuch as. Furthermore, continuous advancements in drug formulations have improved patient tolerance and minimized side effects. The increasing inclusion of anticonvulsants in standard treatment protocols further supports their leading position in the market.

The plasma exchange therapy segment is anticipated to witness the fastest growth rate of 22.5% from 2026 to 2033, driven by its clinical success in severe or refractory neuromyotonia cases. This therapy effectively removes autoantibodies from the bloodstream, providing significant improvement in muscle control and reducing symptom recurrence. Growing availability of plasma exchange facilities across major hospitals and neurological centers is expanding treatment access. Moreover, government and private initiatives to support plasma therapy for autoimmune neurological conditions are accelerating adoption. As awareness about the benefits of therapeutic plasma exchange grows, more clinicians are recommending it for difficult-to-treat patients. The rising investment in plasma therapy research is also expected to strengthen segment growth during the forecast period.

- By Dosage

On the basis of dosage, the market is segmented into capsule, injection, tablet, suspension, and others. The tablet segment dominated the market with a share of 39.8% in 2025, as most anticonvulsants and corticosteroids are commonly administered in tablet form for convenience and compliance. Tablets are favored for their consistent dosing accuracy, portability, and longer shelf life compared to liquid formulations. Patients undergoing chronic treatment prefer tablets due to ease of daily use, particularly in outpatient settings. In addition, the availability of generic options and extended-release formulations has improved adherence rates among long-term users. Pharmaceutical companies continue to innovate in tablet design to enhance absorption and minimize gastrointestinal side effects, further reinforcing segment dominance.

The injection segment is expected to record the fastest CAGR of 20.9% from 2026 to 2033, supported by the increasing demand for injectable immunotherapies and corticosteroids in acute neuromyotonia management. Injectables deliver rapid therapeutic response, making them essential in hospital and emergency settings. Physicians prefer injections for patients who are unresponsive to oral medications or require immediate immune modulation. The expanding use of IV immunoglobulin (IVIg) therapy, which is primarily administered via injection, is a major contributor to this growth. Moreover, innovations in prefilled syringes and self-injectable formulations are improving administration efficiency. Rising awareness and availability of biologic injectables are further driving the growth of this segment globally.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, parenteral, intravenous, subcutaneous, and intramuscular. The oral segment held the dominant share of 44.3% in 2025, owing to the widespread use of orally administered anticonvulsants and corticosteroids in managing mild to moderate symptoms. Oral routes are non-invasive, cost-effective, and preferred for chronic disease management. They allow patients to maintain long-term therapy without hospital dependency, making them highly practical in outpatient and home-care settings. Pharmaceutical innovations in sustained-release oral formulations have improved the duration of therapeutic effect and reduced dosing frequency. Increasing patient preference for convenient oral treatments over invasive methods has strengthened this route’s dominance in the market.

The intravenous segment is projected to grow at the fastest CAGR of 23.1% from 2026 to 2033, primarily due to the rising use of intravenous immunoglobulin (IVIg) and plasma exchange therapy. IV administration ensures faster drug action and is critical in acute or severe neuromyotonia episodes. Hospitals and specialty infusion centers are increasingly adopting IV treatments due to their proven efficacy and controlled delivery mechanism. Advancements in infusion pump technologies and improved safety protocols have enhanced patient outcomes and comfort. Furthermore, the growing number of IVIg suppliers and government support for immunotherapy access are expected to drive substantial growth in this segment.

- By Diagnosis

On the basis of diagnosis, the market is segmented into physical examination, electromyography, blood test, urine test, MRI, and others. The electromyography (EMG) segment dominated the market with a share of 37.5% in 2025, as EMG remains the cornerstone of neuromyotonia diagnosis. This test detects abnormal electrical discharges in muscles, enabling clinicians to differentiate acquired neuromyotonia from other neuromuscular conditions. The advancement of AI-assisted EMG interpretation systems has improved accuracy and reduced diagnostic errors. Growing awareness among neurologists and increased adoption of portable EMG devices in clinical practice have further strengthened its market position. In addition, integration of EMG data with patient monitoring software enhances diagnostic precision and helps in tracking treatment progress effectively.

The blood test segment is expected to witness the fastest CAGR of 21.6% from 2026 to 2033, supported by the growing use of antibody detection for autoimmune neuromyotonia. Blood-based assays identifying voltage-gated potassium channel (VGKC) and CASPR2 antibodies have become key diagnostic tools. These tests are increasingly incorporated into neurology panels for early and accurate detection. As laboratory automation expands, turnaround time and accuracy of immunoassays are improving substantially. The affordability and accessibility of antibody testing in diagnostic centers worldwide further drive this segment. The growing emphasis on biomarker-based diagnostics for targeted therapy selection will continue to boost demand in the coming years.

- By Symptoms

On the basis of symptoms, the market is segmented into myokymia, muscle atrophy, ataxia, diminished reflexes, increased sweating, and other symptoms. The myokymia segment dominated the market with a share of 40.9% in 2025, as it is the most common and recognizable clinical symptom of acquired neuromyotonia. The frequent occurrence of involuntary muscle twitching drives early medical consultation, leading to faster diagnosis and treatment initiation. Anticonvulsant therapies and immunomodulators are often prescribed to relieve myokymic symptoms effectively. Increasing patient awareness and technological progress in EMG-based detection have further reinforced the segment’s significance. In addition, continuous improvement in therapies addressing nerve hyperactivity has enhanced patient quality of life, supporting ongoing dominance.

The muscle atrophy segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by the rising emphasis on early intervention to prevent progressive muscle loss. Muscle atrophy is often observed in long-term untreated neuromyotonia patients, and advancements in physiotherapy and neurorehabilitation have improved treatment outcomes. The growing integration of physical therapy with pharmacological regimens has proven effective in preserving muscle strength. Increasing R&D efforts targeting neuromuscular regeneration pathways are expected to open new treatment opportunities. Hospitals and clinics are also focusing on patient education to reduce disability risks, further propelling segment growth.

- By End-Users

On the basis of end-users, the market is divided into clinic, hospital, and others. The hospital segment dominated the market with the largest revenue share of 52.4% in 2025, attributed to the presence of advanced diagnostic equipment, trained neurologists, and plasma exchange facilities. Hospitals remain the primary point of care for acute and severe neuromyotonia cases requiring IVIg or immunotherapy. The availability of multidisciplinary teams enhances treatment coordination and patient monitoring. Increasing hospital participation in clinical trials for rare neuromuscular diseases further supports market growth. In addition, government funding and improved infrastructure for specialized neurology units are bolstering hospital dominance in this market.

The clinic segment is projected to grow at the fastest CAGR of 21.2% from 2026 to 2033, as outpatient neurology clinics are expanding their role in chronic disease management. Clinics offer cost-effective follow-up care, prescription refills, and patient counseling for long-term therapies. The growing number of specialized neuromuscular centers and neurologists offering private consultations is fueling this growth. Digital patient management tools and telemedicine services are improving accessibility for patients in remote areas. In addition, the shift toward preventive and home-based care models supports the rising importance of clinics in ongoing neuromyotonia management.

- By Distribution Channel

On the basis of distribution channel, the market is categorized into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market with a share of 47.9% in 2025, as most immunotherapies, corticosteroids, and plasma exchange drugs are dispensed through hospital-linked pharmacies. These pharmacies ensure proper handling and timely administration of critical medicines under professional supervision. Strong collaboration between hospital pharmacists and neurologists enhances drug safety and inventory management. Furthermore, increasing hospital admissions for acute cases and rising demand for inpatient medication supply have solidified hospital pharmacies’ role in treatment delivery.

The online pharmacy segment is anticipated to record the fastest CAGR of 24.5% from 2026 to 2033, driven by the growing digitalization of healthcare and patient preference for convenient medicine access. The surge in e-commerce platforms offering prescription-based neurological drugs has significantly improved availability for chronic patients. Online pharmacies enable home delivery, virtual consultations, and subscription-based refills, improving adherence to long-term treatment. Governments in several countries are increasingly approving e-pharmacy models to enhance access for rare disease patients. As internet penetration and digital payment adoption rise globally, the online distribution channel is expected to play a crucial role in expanding patient reach.

Acquired Neuromyotonia Treatment Market Regional Analysis

- North America dominated the acquired neuromyotonia treatment market with the largest revenue share of 39.9% in 2025, supported by advanced healthcare infrastructure, strong presence of specialized neurology centers, and growing adoption of immunomodulatory and symptomatic therapies across the U.S. and Canada

- The region’s dominance is further supported by a high rate of diagnosis, increased awareness among healthcare professionals, and widespread access to advanced treatment options such as immunotherapy and plasma exchange therapy

- In addition, the presence of leading pharmaceutical companies and specialized neurology centers enhances therapeutic innovation and accelerates drug approvals. Patients in North America also benefit from favorable reimbursement policies and access to novel treatment protocols, contributing to improved patient outcomes and sustained market growth

U.S. Acquired Neuromyotonia Treatment Market Insight

The U.S. acquired neuromyotonia treatment market captured the largest revenue share of 79% in 2025 within North America, fueled by the strong presence of advanced neurology centers, high diagnostic accuracy, and widespread adoption of immunotherapy and anticonvulsant-based treatments. The growing prevalence of autoimmune neurological disorders, along with government support for rare disease research, drives market growth. Furthermore, extensive clinical trials and FDA approvals of new therapeutic drugs strengthen the U.S. market position. The availability of advanced electromyography (EMG) and MRI diagnostics supports early detection, improving treatment outcomes.

Europe Acquired Neuromyotonia Treatment Market Insight

The Europe acquired neuromyotonia treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increased awareness of rare neuromuscular disorders and access to high-quality healthcare systems. Strong investment in clinical research and collaborations between hospitals and pharmaceutical companies are accelerating therapeutic advancements. European countries are adopting modern immunomodulatory and plasma exchange therapies, improving patient care standards. The presence of supportive reimbursement frameworks further encourages treatment adoption across hospitals and specialty clinics.

U.K. Acquired Neuromyotonia Treatment Market Insight

The U.K. acquired neuromyotonia treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by advancements in neurology research and expanding access to specialized care facilities. The National Health Service (NHS) plays a pivotal role in facilitating early diagnosis through improved referral pathways and diagnostic technologies. Rising patient awareness of autoimmune nerve conditions and growing emphasis on patient-centric care further contribute to market growth. Increasing participation in clinical trials for next-generation neurological drugs also strengthens the U.K. market landscape.

Germany Acquired Neuromyotonia Treatment Market Insight

The Germany acquired neuromyotonia treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s strong medical infrastructure, advanced research institutions, and adoption of high-precision neurodiagnostic tools. German healthcare providers emphasize early detection and comprehensive treatment plans involving anticonvulsants and plasma exchange therapies. Supportive reimbursement systems and collaboration between public and private healthcare institutions enhance accessibility. In addition, the nation’s focus on medical technology innovation further promotes the integration of advanced therapeutic solutions.

Asia-Pacific Acquired Neuromyotonia Treatment Market Insight

The Asia-Pacific acquired neuromyotonia treatment market is poised to grow at the fastest CAGR of 22% during 2026–2033, driven by expanding healthcare access, rising patient awareness, and improved diagnostic capabilities in countries such as China, Japan, and India. Rapid growth in healthcare infrastructure and government investments in rare disease programs are facilitating early intervention and treatment availability. Pharmaceutical companies in the region are increasingly investing in research and partnerships for developing affordable therapies, expanding accessibility across both rural and urban populations.

Japan Acquired Neuromyotonia Treatment Market Insight

The Japan acquired neuromyotonia treatment market is gaining momentum due to its advanced healthcare infrastructure, aging population, and growing demand for specialized neurological care. Japan’s robust focus on technological innovation has led to the development of improved diagnostic devices and effective treatment regimens. For instance, hospital collaborations with biotech firms are enabling faster availability of immune-targeted drugs. The government’s strong healthcare support policies and high patient awareness contribute to increasing treatment uptake across hospitals and clinics.

India Acquired Neuromyotonia Treatment Market Insight

The India acquired neuromyotonia treatment market accounted for the largest revenue share within Asia-Pacific in 2025, driven by expanding diagnostic reach, growing medical awareness, and a rapidly improving healthcare infrastructure. The market is supported by government initiatives promoting rare disease management and the entry of global pharmaceutical players offering affordable therapies. Increased adoption of oral and parenteral treatment options, along with enhanced clinical support across urban hospitals, is strengthening market penetration. India’s focus on domestic drug manufacturing also positions it as an emerging hub for cost-effective neuromyotonia treatment solutions.

Acquired Neuromyotonia Treatment Market Share

The Acquired Neuromyotonia Treatment industry is primarily led by well-established companies, including:

- Grifols, S.A. (Spain)

- Octapharma AG (Switzerland)

- Takeda Pharmaceutical Company Limited (Japan)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Baxter (U.S.)

- CSL (Australia)

- UCB (Belgium)

- Jazz Pharmaceuticals, Inc. (Ireland)

- Biogen (U.S.)

- Kedrion (Italy)

- Mallinckrodt plc (Ireland)

- Teva Pharmaceutical Industries Ltd (Israel)

- Fresenius Kabi AG (Germany)

- Natus Medical Incorporated (U.S.)

- NIHON KOHDEN CORPORATION. (Japan)

- Cadwell (U.S.)

- GC Corp. (South Korea)

- Merck & Co., Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

What are the Recent Developments in Global Acquired Neuromyotonia Treatment Market?

- In January 2025, a case study published in PubMed reported a 16-year-old female diagnosed with acquired neuromyotonia who exhibited remarkable clinical recovery following intravenous immunoglobulin (IVIG) therapy after failing to respond to conventional anticonvulsants. This finding reinforces IVIG as a cornerstone treatment option for immune-mediated neuromyotonia, offering rapid symptom relief and sustained neurological improvement in refractory cases

- In February 2024, a clinical report in the International Journal of Research in Medical Sciences detailed the case of a 51-year-old woman suffering from persistent muscle twitching, stiffness, and excessive sweating diagnosed as acquired neuromyotonia. The patient demonstrated significant recovery following repeated plasma exchange therapy, highlighting the importance of plasmapheresis in managing autoimmune forms of the disease and its growing role in clinical practice for symptom control

- In September 2023, a mechanistic review published in MDPI Biomolecules analyzed CASPR2-antibody-associated peripheral nerve hyperexcitability and its molecular link to acquired neuromyotonia. The study identified new therapeutic targets aimed at restoring disrupted ion channel clustering and synaptic stability, paving the way for future development of biologic and precision therapies for autoimmune neuromyotonia

- In December 2022, researchers on ResearchGate published a documented case of a young male developing acquired neuromyotonia following COVID-19 vaccination, with strong positivity for anti-CASPR2 and VGKC-complex antibodies. The report emphasized that vaccine-triggered autoimmune responses may precipitate nerve hyperexcitability syndromes, underscoring the necessity for early antibody testing and immunotherapy in similar post-vaccination neurological presentations

- In October 2022, a case report published in Cureus Journal of Medical Science presented a patient with severe Isaacs’ syndrome who achieved complete symptom remission following Rituximab infusion. The study highlighted Rituximab’s therapeutic potential in refractory cases resistant to corticosteroids and anticonvulsants, offering new hope for patients with antibody-mediated peripheral nerve hyperexcitability disorders

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.