Global Activated Roller Belt Sorters Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

2.33 Billion

2024

2032

USD

1.68 Billion

USD

2.33 Billion

2024

2032

| 2025 –2032 | |

| USD 1.68 Billion | |

| USD 2.33 Billion | |

|

|

|

|

Activated Roller Belt Sorters Market Size

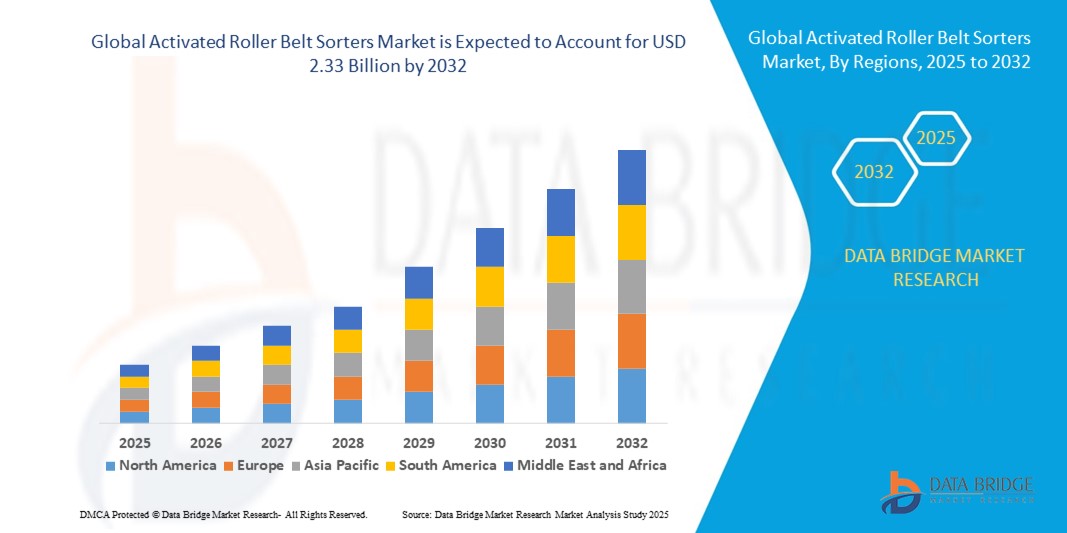

- The global activated roller belt sorters market size was valued at USD 1.68 billion in 2024 and is expected to reach USD 2.33 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is largely fueled by the surge in e-commerce, warehouse automation, and parcel handling operations, which demand efficient and high-speed sorting technologies for enhanced productivity and throughput

- Furthermore, rising demand for reliable, low-maintenance, and energy-efficient material handling systems across industries such as logistics, food & beverage, and retail is driving the adoption of activated roller belt sorters. These converging factors are accelerating the deployment of advanced conveyor sorting solutions, thereby significantly boosting the industry's growth

Activated Roller Belt Sorters Market Analysis

- Activated roller belt sorters, offering precise and high-throughput sorting capabilities, are increasingly essential in modern material handling and logistics systems across industries due to their flexibility, reduced manual labor, and compatibility with high-speed automated operations

- The escalating demand for these systems is primarily fueled by the rapid growth in e-commerce, the need for efficient supply chain operations, and the rising emphasis on cost-effective and space-saving intralogistics solutions

- North America dominated the activated roller belt sorters market with the largest revenue share of 39.5% in 2024, supported by the strong presence of major distribution centers, automation technology providers, and early adoption in retail, courier, and fulfillment sectors

- Asia-Pacific is expected to be the fastest growing region in the activated roller belt sorters market during the forecast period due to accelerated industrialization, expanding warehousing infrastructure, and increasing investments in smart logistics by emerging economies

- Logistics and distribution segment dominated the activated roller belt sorters market with a market share of 46.4% in 2024, driven by its critical need for accurate, high-speed, and scalable sorting solutions to manage growing parcel volumes and streamline last-mile delivery operations

Report Scope and Activated Roller Belt Sorters Market Segmentation

|

Attributes |

Activated Roller Belt Sorters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Activated Roller Belt Sorters Market Trends

Automation Surge through AI-Driven Logistics and Smart Sorting

- A prominent and accelerating trend in the global activated roller belt sorters market is the integration of artificial intelligence (AI) and smart sensor technologies to optimize real-time parcel identification, routing, and sorting operations. This shift is significantly improving operational speed, accuracy, and adaptability in dynamic logistics environments

- For instance, companies such as Vanderlande and BEUMER Group have developed AI-powered sortation systems that utilize vision technology and machine learning to handle varying parcel shapes and weights with minimal human intervention. These innovations reduce error rates and improve throughput

- AI integration enables predictive maintenance, real-time data analytics, and intelligent decision-making based on load variations and demand patterns. This allows operators to preemptively resolve issues, streamline traffic on the belt, and adjust sorter behavior dynamically

- In addition, smart sensors embedded in roller belts provide advanced diagnostics and performance tracking, enabling operators to manage sortation systems remotely and make data-driven improvements

- The trend toward fully automated, AI-enabled, and connected sorting solutions is redefining expectations for intralogistics performance. As a result, companies such as Intralox are launching next-generation sorter models equipped with intelligent controls and self-correcting mechanisms for seamless distribution center integration

- The demand for adaptive, intelligent sorting systems is surging across logistics, e-commerce, and manufacturing sectors, driven by the need for high efficiency, rapid order fulfillment, and flexibility in parcel management

Activated Roller Belt Sorters Market Dynamics

Driver

Rising Throughput Demands and E-commerce-Driven Warehouse Automation

- The exponential growth of e-commerce and the increasing demand for fast, accurate, and high-volume order processing are major drivers propelling the adoption of activated roller belt sorters across logistics and fulfillment centers

- For instance, in March 2024, Daifuku Co., Ltd. announced the launch of an advanced sorting system featuring modular roller belt design to meet the scaling needs of large e-commerce players and third-party logistics (3PL) providers

- Activated roller belt sorters offer high-speed, low-friction handling and are capable of sorting a wide variety of package sizes and shapes, making them well-suited for the growing complexity of modern supply chains

- The efficiency gains from reducing manual sorting, along with improved space utilization and energy savings, make these systems attractive investments for operators seeking to boost productivity and lower operational costs

- Furthermore, the increasing trend toward warehouse automation and the integration of smart technologies for end-to-end logistics management are making these sorters indispensable components in modern distribution infrastructure

Restraint/Challenge

High Initial Investment and System Integration Complexities

- Despite their efficiency benefits, the high initial capital required for the deployment of activated roller belt sorters poses a significant barrier for small- and medium-sized enterprises, especially in cost-sensitive markets

- For instance, many companies face challenges in aligning real-time sortation data with broader logistics systems, which may lead to inefficiencies or data silos if not properly addressed

- The complexity of integrating these systems with existing warehouse management software (WMS), conveyor networks, and robotics platforms can result in extended implementation timelines and additional customization costs

- In addition, downtime during installation or maintenance and the need for specialized technical expertise can deter some organizations from fully embracing this technology

- To overcome these limitations, manufacturers are focusing on modular, scalable sorter designs and offering cloud-based integration platforms to streamline implementation. Providing comprehensive training and after-sales support is also becoming a key focus for vendors to ensure smoother adoption and system longevity

Activated Roller Belt Sorters Market Scope

The market is segmented on the basis of product type and end-user.

- By Product Type

On the basis of product type, the activated roller belt sorters market is segmented into automated roller belt sorters and manual roller belt sorters. The automated roller belt sorters segment dominated the market with the largest market revenue share in 2024, driven by the rising demand for high-speed, efficient, and low-labor sorting solutions in e-commerce, courier, and warehouse operations. These systems are widely adopted in modern distribution centers due to their ability to manage diverse parcel sizes and weights while reducing human intervention.

The manual roller belt sorters segment, is expected to witness fastest growth during forecast period, due to its lower cost and minimal technical complexity, making it an attractive option for facilities in developing regions or businesses with limited automation budgets.

- By End-User

On the basis of end-user, the activated roller belt sorters market is segmented into logistics and distribution, food and beverage, pharmaceutical and healthcare, and others. The logistics and distribution segment dominated the market in 2024 with the highest revenue share of 46.4%, fueled by the exponential growth of e-commerce, omnichannel retailing, and same-day delivery models. High-volume fulfillment centers and postal hubs are increasingly adopting activated roller belt sorters to enhance parcel processing speed and accuracy while optimizing floor space and labor utilization.

The pharmaceutical and healthcare segment is projected to witness the fastest growth rate from 2025 to 2032. This growth is driven by the increasing demand for error-free and hygienic sorting systems in pharmaceutical packaging and distribution. Activated roller belt sorters offer precise product handling, contamination-free movement, and traceability features, making them suitable for sensitive medical and healthcare logistics

Activated Roller Belt Sorters Market Regional Analysis

- North America dominated the activated roller belt sorters market with the largest revenue share of 39.5% in 2024, supported by the strong presence of major distribution centers, automation technology providers, and early adoption in retail, courier, and fulfillment sectors

- Businesses in the region prioritize efficient, high-speed sortation systems that can handle growing order volumes and diverse package types, making activated roller belt sorters a preferred solution across logistics, retail, and third-party logistics sectors

- This widespread adoption is further supported by substantial investments in industrial automation, a strong presence of key technology providers, and the region's emphasis on operational efficiency and data-driven logistics management, firmly establishing these systems as integral components in modern supply chains

U.S. Activated Roller Belt Sorters Market Insight

The U.S. activated roller belt sorters market captured the largest revenue share of 79.4% in 2024 within North America, fueled by the rapid expansion of e-commerce, last-mile delivery, and warehouse automation. The country's high concentration of fulfillment centers and major logistics providers is driving the demand for efficient, high-throughput sorting systems. The preference for scalable, AI-integrated sortation technologies, coupled with investments in smart warehousing infrastructure, continues to propel market growth. In addition, the presence of key manufacturers and system integrators enhances the deployment of advanced roller belt sorter solutions across logistics and distribution operations.

Europe Activated Roller Belt Sorters Market Insight

The Europe activated roller belt sorters market is projected to grow at a substantial CAGR throughout the forecast period, driven by the region’s strong logistics infrastructure and increased automation in postal and parcel services. The growth is supported by regulatory emphasis on operational efficiency, safety, and sustainability in supply chain operations. Industries such as food and beverage and pharmaceutical are adopting advanced sorting systems to comply with stringent quality standards. Ongoing modernization of older facilities and expansion of e-commerce warehouses across Germany, France, and the Netherlands further fuel adoption.

U.K. Activated Roller Belt Sorters Market Insight

The U.K. activated roller belt sorters market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased demand for efficient parcel handling in the booming e-commerce sector. Rising labor costs and the need for fast order fulfillment are prompting distribution centers and retailers to adopt automated sorting technologies. In addition, government support for digital transformation in logistics and the growth of same-day delivery services are accelerating the deployment of roller belt sorters in key logistics hubs across the country.

Germany Activated Roller Belt Sorters Market Insight

The Germany activated roller belt sorters market is expected to expand at a considerable CAGR during the forecast period, driven by its advanced industrial base and the widespread adoption of Industry 4.0 practices. German companies prioritize high-efficiency, precise, and low-maintenance solutions for parcel and product sorting. Strong demand from automotive, pharmaceutical, and food industries is further bolstering the adoption of automated sorters. In addition, Germany’s focus on sustainability and lean logistics supports the integration of energy-efficient sortation systems in distribution facilities.

Asia-Pacific Activated Roller Belt Sorters Market Insight

The Asia-Pacific activated roller belt sorters market is poised to grow at the fastest CAGR of 26.3% during the forecast period of 2025 to 2032, fueled by rapid urbanization, surging e-commerce activity, and increasing investments in warehouse automation across China, India, and Southeast Asia. The region’s emergence as a global logistics hub and manufacturing center is generating strong demand for scalable and cost-effective sorting solutions. Government-led initiatives for smart infrastructure and digital transformation are further accelerating the adoption of activated roller belt sorters in regional logistics and industrial sectors.

Japan Activated Roller Belt Sorters Market Insight

The Japan activated roller belt sorters market is gaining momentum due to its technologically advanced logistics networks and increasing need for labor-saving automation solutions. Japan’s focus on high-speed, compact sorting systems aligns with its dense urban distribution environment. Growing demand from electronics, pharmaceuticals, and e-commerce sectors, coupled with the integration of AI and robotics in warehousing, is driving adoption. Moreover, Japan’s aging workforce is prompting businesses to deploy intelligent, low-maintenance sorters to improve operational efficiency and reduce dependency on manual labor.

India Activated Roller Belt Sorters Market Insight

The India activated roller belt sorters market accounted for the largest market revenue share in Asia Pacific in 2024, supported by the rapid rise in e-commerce, retail logistics, and domestic manufacturing. The country’s increasing number of fulfillment centers and the ongoing development of smart warehouses under the Digital India and Make in India initiatives are key drivers. Indian businesses are adopting automated sorting systems to enhance throughput and reduce labor reliance. The availability of affordable automation solutions and growing presence of domestic and global sorter manufacturers further contribute to India’s leadership in the regional market.

Activated Roller Belt Sorters Market Share

The activated roller belt sorters industry is primarily led by well-established companies, including:

- Intralox, L.L.C. (U.S.)

- BEUMER Group GmbH & Co. KG (Germany)

- Daifuku Co., Ltd. (Japan)

- Fives Group (France)

- Interroll Holding AG (Switzerland)

- Siemens Logistics GmbH (Germany)

- Bastian Solutions, LLC (U.S.)

- Vanderlande Industries B.V. (Netherlands)

- Honeywell Intelligrated (U.S.)

- TGW Logistics Group GmbH (Austria)

- Murata Machinery, Ltd. (Japan)

- KNAPP AG (Austria)

- MHS Global (U.S.)

- Körber Supply Chain Logistics GmbH (Germany)

- System Logistics S.p.A. (Italy)

- Okura Yusoki Co., Ltd. (Japan)

- KUKA AG (Germany)

- SSI SCHAEFER Group (Germany)

- Falcon Autotech Pvt. Ltd. (India)

- Jungheinrich AG (Germany)

What are the Recent Developments in Global Activated Roller Belt Sorters Market?

- In May 2023, Intralox, a global leader in conveyor belting and sorting technologies, introduced its next-generation Activated Roller Belt (ARB) Sorter 7000 series, designed to deliver higher throughput and reliability for e-commerce and parcel distribution centers. This product launch emphasizes Intralox’s focus on modular innovation, enabling seamless integration into high-speed systems with minimal maintenance. The new series supports increased SKU variety and rapid deployment in large-scale facilities

- In April 2023, BEUMER Group expanded its smart logistics portfolio with the deployment of ARB-based automated sortation solutions for a leading global courier in Europe. The system leverages AI and sensor technology to optimize parcel routing, reduce energy consumption, and enhance package handling efficiency. This project highlights BEUMER’s strategic focus on sustainable, high-performance automation systems tailored for the fast-growing e-commerce and express logistics sectors

- In March 2023, Daifuku Co., Ltd., a prominent material handling systems provider, announced the launch of a modular ARB sorter configuration as part of its new automation offerings aimed at midsize distribution centers. This development enables flexible system scalability and faster installation timelines. The solution caters to growing demands for customizable and space-efficient sorting in retail and omnichannel logistics networks across Asia and North America

- In February 2023, Fives Group completed a strategic installation of an advanced ARB sorting solution for a major retail client in North America. The system significantly enhanced order accuracy and fulfillment speed, incorporating AI-driven diagnostics and predictive maintenance tools. Fives’ implementation reflects the rising importance of intelligent sortation systems in high-volume retail distribution environments

- In January 2023, Interroll Group announced the integration of its ARB sorters with cloud-based data analytics and IoT platforms to offer real-time system monitoring and performance optimization. The upgrade was showcased at the LogiMAT trade fair in Germany, attracting interest from global logistics operators. This development underscores Interroll’s commitment to digital transformation in intralogistics through connected, adaptive sortation technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Activated Roller Belt Sorters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Activated Roller Belt Sorters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Activated Roller Belt Sorters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.