Global Advanced Lab Reagents Market

Market Size in USD Billion

CAGR :

%

USD

2.17 Billion

USD

5.22 Billion

2025

2033

USD

2.17 Billion

USD

5.22 Billion

2025

2033

| 2026 –2033 | |

| USD 2.17 Billion | |

| USD 5.22 Billion | |

|

|

|

|

Advanced Lab Reagents Market Size

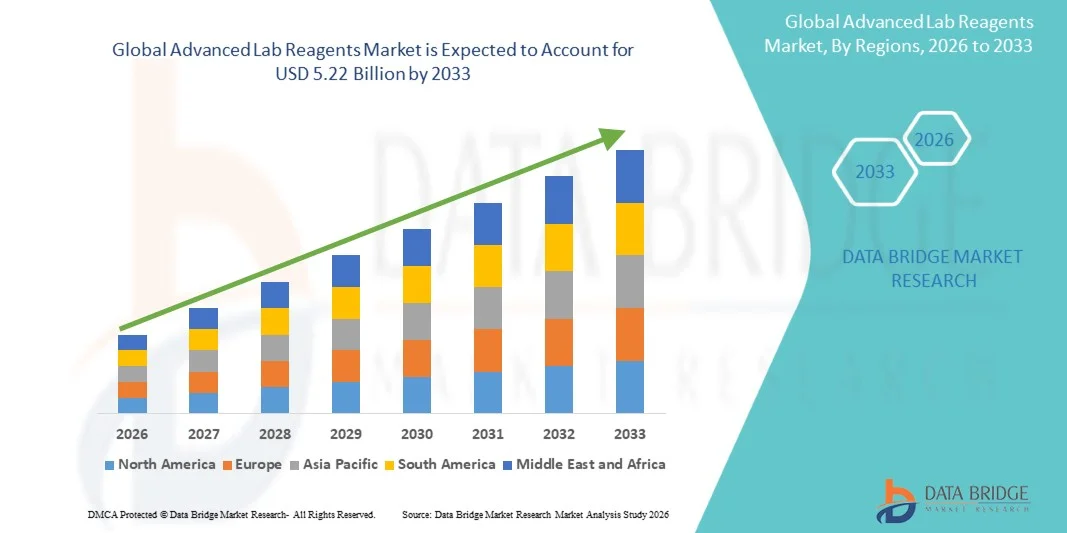

- The global advanced lab reagents market size was valued at USD 2.17 billion in 2025 and is expected to reach USD 5.22 billion by 2033, at a CAGR of 11.60% during the forecast period

- The market growth is largely fueled by increasing demand for high‑precision diagnostic and research tools, coupled with advancements in laboratory automation and analytical technologies, leading to enhanced efficiency and accuracy in both clinical and research settings

- Furthermore, rising focus on early disease detection, personalized medicine, and biopharmaceutical development is driving the adoption of Advanced Lab Reagents solutions, thereby significantly boosting the industry’s growth

Advanced Lab Reagents Market Analysis

- Advanced lab reagents, including chemicals, enzymes, and specialized compounds, are increasingly vital components of modern research and diagnostics laboratories due to their critical role in ensuring accurate experimental results, reproducibility, and compliance with regulatory standards

- The escalating demand for advanced lab reagents is primarily fueled by the growing focus on biotechnology, molecular diagnostics, pharmaceutical research, and increasing government and private sector investments in life sciences R&D

- North America dominated the advanced lab reagents market with the largest revenue share of 45% in 2025, driven by a strong research infrastructure, high adoption of next-generation sequencing, advanced diagnostic techniques, and the presence of key reagent manufacturers. The U.S. particularly experienced substantial growth due to expansion in genomics, proteomics, and biopharmaceutical research activities

- Asia-Pacific is expected to be the fastest growing region in the advanced lab reagents market during the forecast period, registering a CAGR supported by increasing healthcare and research investments, rising biotech startups, and growing adoption of automated laboratory systems in countries such as China, India, and Japan

- The antibodies & immunoassays segment dominated the largest market revenue share of 45.6% in 2025, driven by their widespread use in diagnostic assays, research applications, and therapeutic development

Report Scope and Advanced Lab Reagents Market Segmentation

|

Attributes |

Advanced Lab Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Advanced Lab Reagents Market Trends

“Emerging Trends and Innovations in the Advanced Lab Reagents Market”

- A significant and accelerating trend in the global advanced lab reagents market is the growing adoption of high-throughput, automated, and multiplexed reagents for diagnostic and research applications. These advanced reagents improve assay sensitivity, specificity, and reproducibility, enabling faster and more accurate laboratory results

- For instance, high-sensitivity reagents for immunoassays and molecular diagnostics are becoming widely adopted in routine testing and clinical trials, reflecting the market’s move toward faster, more reliable testing solutions

- Manufacturers are increasingly focusing on developing reagents compatible with emerging diagnostic platforms and point-of-care devices, which are expanding across hospitals, research laboratories, and clinical settings

- The integration of standardized reagent kits with automated instruments is helping laboratories minimize errors, reduce manual intervention, and improve operational efficiency

- Multiplexed and next-generation reagents are witnessing strong adoption in genomics, proteomics, and personalized medicine applications, driving demand for highly specialized reagents in both research and clinical diagnostics

- Recent product innovations are emphasizing stability, shelf-life extension, and minimal sample volume requirements, which further enhance laboratory productivity

- In addition, the rise in chronic diseases, increasing prevalence of infectious diseases, and growing emphasis on early diagnosis are promoting the adoption of advanced reagents globally

Advanced Lab Reagents Market Dynamics

Driver

“Rising Demand from Diagnostic and Research Laboratories”

- The increasing number of diagnostic laboratories, research institutions, and biotechnology companies is a key driver for the Advanced Lab Reagents market. Growing investments in R&D and clinical trials further boost demand

- For instance, in March 2024, Thermo Fisher Scientific expanded its line of high-throughput molecular biology reagents targeting both research and diagnostic laboratories, aiming to improve assay accuracy and workflow efficiency

- The growing prevalence of chronic and infectious diseases, along with the global push for preventive healthcare, is increasing the need for reliable reagents to support timely and accurate testing

- Healthcare institutions are investing in standardized, ready-to-use reagents to reduce variability and enhance lab productivity

- Furthermore, the rise of personalized medicine and precision diagnostics is creating a demand for specialized reagents that allow high specificity in biomarker detection and analysis

- Automated workflows and multiplex assay development are supporting faster adoption of advanced reagents, particularly in large clinical and research settings

Restraint/Challenge

“High Cost and Regulatory Compliance”

- The relatively high cost of advanced lab reagents can be a barrier for small laboratories and research institutions, particularly in developing regions. Premium reagents, especially those designed for specialized or automated systems, may be priced significantly higher than standard alternatives

- For instance, limited budget allocations in emerging markets can restrict the purchase of proprietary high-sensitivity reagent kits

- Compliance with stringent regulatory standards, including FDA, ISO, and CE certifications, adds complexity to reagent development and distribution, potentially delaying product launches

- Manufacturers must invest in quality control, validation studies, and documentation to meet global regulatory requirements, which can increase production costs and lead times

- Storage, handling, and stability requirements for advanced reagents also pose logistical challenges, particularly for reagents requiring cold-chain transportation

- Overcoming these challenges requires cost-effective product development, flexible distribution models, and education of end-users about the benefits and proper handling of advanced reagents

Advanced Lab Reagents Market Scope

The market is segmented on the basis of type, technology, and end user.

• By Type

On the basis of type, the Advanced Lab Reagents market is segmented into enzymes & proteins, antibodies & immunoassays, and other reagents. The antibodies & immunoassays segment dominated the largest market revenue share of 45.6% in 2025, driven by their widespread use in diagnostic assays, research applications, and therapeutic development. High specificity and sensitivity of antibody-based reagents make them integral in ELISA, Western blotting, and immunohistochemistry workflows. Strong demand arises from pharmaceutical and biotechnology companies conducting drug discovery, molecular diagnostics, and vaccine research. Growing adoption in clinical laboratories for disease biomarker detection further strengthens their dominance. Key drivers include increasing prevalence of chronic and infectious diseases, the need for precise diagnostics, and continuous innovation in immunoassay reagents. Automated platforms compatible with antibody reagents enhance throughput and reproducibility, fueling consistent market growth. The presence of a broad range of commercially available antibodies and high-quality immunoassays ensures robust market penetration. Repeat testing and long-term research projects contribute to recurring demand. Global expansion of clinical diagnostic facilities and research institutes further boosts adoption.

The enzymes & proteins segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, driven by increasing applications in molecular biology, proteomics, and pharmaceutical manufacturing. Growing focus on recombinant proteins and enzyme-based assays for drug development accelerates demand. Enzyme reagents are integral to PCR, sequencing, and protease assays, facilitating efficient experimentation. Expanding biotechnology and life sciences research in Asia-Pacific and North America supports rapid uptake. Increasing investments in genomics, personalized medicine, and high-throughput screening further drive growth. Enzyme stabilization technologies and longer shelf-life reagents improve usability and adoption. Research-focused laboratories are increasingly integrating enzyme kits into automated workflows, enhancing efficiency. Rising R&D in therapeutic enzymes and biocatalysis applications also contributes to market expansion.

• By Technology

On the basis of technology, the Advanced Lab Reagents market is segmented into molecular biology techniques, cell biology techniques, and analytical chemistry techniques. The molecular biology techniques segment held the largest market revenue share of 42.8% in 2025, owing to their extensive applications in DNA/RNA analysis, gene editing, and diagnostics. The segment’s dominance is supported by high demand from pharmaceutical companies, academic research institutes, and clinical labs. Increasing adoption of PCR, sequencing, and CRISPR-based assays contributes to consistent usage. Molecular biology reagents are integral for next-generation sequencing, gene therapy development, and pathogen detection. Growth is bolstered by research funding, public health initiatives, and expanding biotech pipelines. Automated molecular platforms and multiplexed assays further reinforce demand. The need for accurate, rapid, and reproducible testing enhances market stability. Availability of high-quality kits and standardized protocols ensures adoption across diverse end users. Expansion of molecular diagnostic testing in emerging regions supports continued growth.

The cell biology techniques segment is expected to witness the fastest CAGR of 20.5% from 2026 to 2033, driven by the growing use of cell-based assays, stem cell research, and immuno-oncology applications. Increasing adoption in drug discovery, toxicity testing, and regenerative medicine fuels demand. Integration with high-content screening and automated cell culture systems further accelerates usage. Rising academic research and contract research organization activities promote rapid market expansion. The focus on functional cell assays for biomarker identification and therapeutic development also supports adoption. Advances in live-cell imaging and cell-based reporter assays enhance accuracy and throughput. Growing interest in organoid technology and precision medicine applications further drives the segment. Expansion of biotechnology and pharmaceutical R&D globally provides sustained demand.

• By End User

On the basis of end user, the market is segmented into pharmaceutical & biotechnology companies, research & academic institutes, and clinical & diagnostic laboratories. The pharmaceutical & biotechnology companies segment dominated the largest market revenue share of 48.1% in 2025, due to high consumption of reagents for drug discovery, preclinical research, and therapeutic development. Companies rely on advanced reagents to ensure assay reproducibility, accuracy, and compliance with regulatory standards. Continuous innovation in biologics, vaccines, and gene therapy increases demand for specialized reagents. Large-scale R&D programs, contract manufacturing, and collaborations between pharma and biotech firms reinforce market leadership. Rising investments in pipeline expansion, high-throughput screening, and personalized medicine further strengthen dominance. Automation adoption and integration of reagents with laboratory instrumentation enhance efficiency and output. Repeat purchases for ongoing research and validation studies ensure sustained demand. Market growth is supported by government funding and private investments in life sciences.

The research & academic institutes segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, fueled by increasing focus on cutting-edge research in genomics, proteomics, and translational medicine. Rising number of research publications, grants, and academic collaborations supports rapid reagent adoption. Growing student and faculty demand for standardized kits for training, experimentation, and innovation drives growth. Expansion of research infrastructure and laboratories in emerging regions accelerates uptake. Integration of reagents with automated teaching and research platforms enhances operational efficiency. Increasing emphasis on high-quality, reproducible experiments promotes consistent use. Rising funding for molecular diagnostics, infectious disease research, and biotech innovation further propels adoption. Emerging research fields such as synthetic biology and CRISPR applications also support segment growth.

Advanced Lab Reagents Market Regional Analysis

- North America dominated the advanced lab reagents market with the largest revenue share of 45% in 2025

- Driven by a strong research infrastructure, high adoption of next-generation sequencing, advanced diagnostic techniques, and the presence of key reagent manufacturers

- The market particularly experienced substantial growth due to expansion in genomics, proteomics, and biopharmaceutical research activities

U.S. Advanced Lab Reagents Market Insight

The U.S. advanced lab reagents market captured the largest revenue share in 2025 within North America, fueled by increasing research activities in genomics and proteomics, adoption of high-throughput screening, and growing demand for precision medicine. Investments in automated laboratory equipment, coupled with the integration of AI in diagnostic workflows, are significantly contributing to the market’s expansion.

Europe Advanced Lab Reagents Market Insight

The Europe advanced lab reagents market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing biotechnology research, rising government funding for laboratory modernization, and growing adoption of automated diagnostic systems. The region is experiencing significant growth across hospitals, research institutes, and commercial laboratories, particularly in countries such as Germany, the U.K., and France.

U.K. Advanced Lab Reagents Market Insight

The U.K. advanced lab reagents market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding biotechnology research, increased adoption of next-generation sequencing, and rising demand for high-quality reagents in diagnostic and research applications. Strong government support and robust laboratory infrastructure further boost the market.

Germany Advanced Lab Reagents Market Insight

The Germany advanced lab reagents market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing biotechnology research, high adoption of automated laboratory systems, and focus on precision diagnostics. Germany’s advanced infrastructure and emphasis on innovation are key factors promoting market growth in both research and clinical laboratories.

Asia-Pacific Advanced Lab Reagents Market Insight

The Asia-Pacific advanced lab reagents market is poised to grow at the fastest CAGR of 26% during the forecast period of 2026 to 2033, driven by rising healthcare and research investments, expansion of biotechnology startups, and increasing adoption of automated laboratory systems in countries such as China, India, and Japan. The region’s growing focus on genomics, proteomics, and precision medicine is further propelling the demand for advanced lab reagents.

Japan Advanced Lab Reagents Market Insight

The Japan advanced lab reagents market is gaining momentum due to rapid technological adoption, expanding laboratory infrastructure, and increased focus on precision medicine. Research institutes and hospitals are increasingly investing in automated laboratory solutions and next-generation sequencing, driving the demand for advanced reagents across clinical and research applications.

China Advanced Lab Reagents Market Insight

The China advanced lab reagents market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid biotechnology development, growing research investments, and adoption of automated laboratory systems. The expanding middle-class research workforce, government initiatives to enhance laboratory capabilities, and increasing use of high-throughput screening technologies are key factors propelling the market in China.

Advanced Lab Reagents Market Share

The Advanced Lab Reagents industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific (U.S.)

- Sigma-Aldrich (Germany)

- Agilent Technologies (U.S.)

- PerkinElmer (U.S.)

- GE Healthcare Life Sciences (U.S.)

- Qiagen (Netherlands)

- Cytiva (U.S.)

- Bio-Rad Laboratories (U.S.)

- Promega Corporation (U.S.)

- Abcam (U.K.)

- BD Biosciences (U.S.)

- Takara Bio (Japan)

- New England Biolabs (U.S.)

- Hyglos (Germany)

- Sartorius AG (Germany)

Latest Developments in Global Advanced Lab Reagents Market

- In November 2021, Bio‑Rad Laboratories launched the StarBright UltraViolet 400 Dye, the company’s first fluorescent nanoparticle reagent designed for use with 355 nm UV lasers in multicolour flow‑cytometry. The new dye delivers exceptionally high brightness, narrow excitation/emission profiles with low spillover, and improved stability for complex immunology panels

- In April 2022, Bio‑Rad introduced three additional dyes in its StarBright series — UltraViolet 510, UltraViolet 665, and UltraViolet 795 — aimed at enhancing multiplex panel design by offering compatibility with 355 nm UV lasers and enabling improved resolution of low‑density antigens in spectral flow cytometry

- In June 2023, Merck KGaA announced a major investment to build a new high‑performance reagent manufacturing plant in Nantong, China. The 40,000 m² facility is expected to cater to reagents for quality control, diagnostics and industrial testing, and be operational by 2026

- In February 2023, Bio‑Rad launched its StarBright Blue and StarBright Yellow dyes specifically designed for blue (488 nm) and yellow (561 nm) lasers, expanding its reagent portfolio to 28 dyes and offering researchers enhanced flexibility in multiplex flow cytometry panel construction with minimized compensation and greater reproducibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.