Global Aerial Imaging Market

Market Size in USD Billion

CAGR :

%

USD

3.36 Billion

USD

11.11 Billion

2024

2032

USD

3.36 Billion

USD

11.11 Billion

2024

2032

| 2025 –2032 | |

| USD 3.36 Billion | |

| USD 11.11 Billion | |

|

|

|

|

Aerial Imaging Market Size

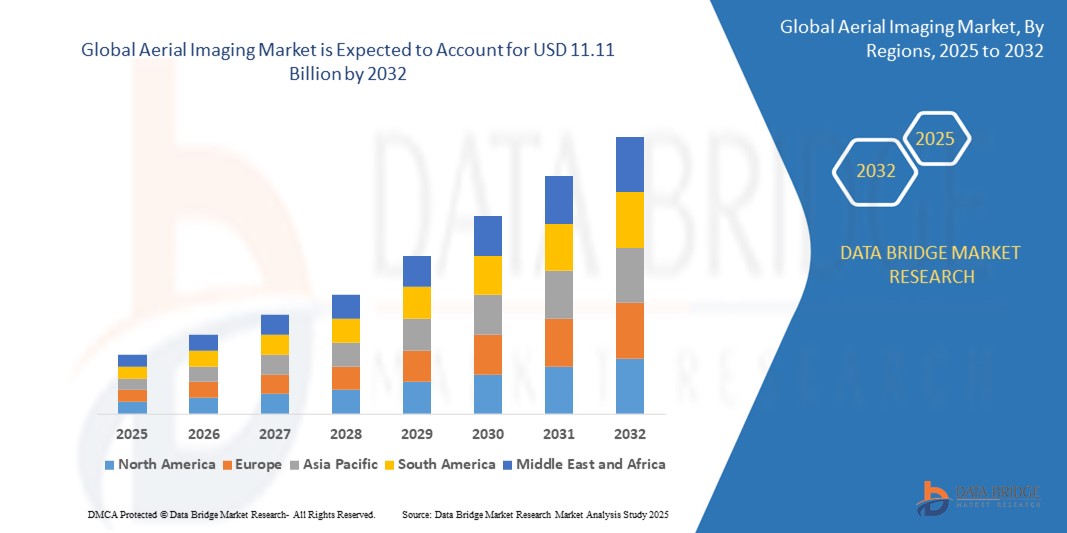

- The global Aerial Imaging market size was valued at USD 3.36 billion in 2024 and is expected to reach USD 11.11 billion by 2032, at a CAGR of 16.12% during the forecast period

- The rapid expansion of this market is driven by increasing adoption of geospatial data across sectors such as agriculture, construction, energy, and defense. Advancements in UAV technology, high-resolution cameras, and image processing software have significantly enhanced the quality, affordability, and accessibility of aerial imaging services.

- Furthermore, the rising demand for real-time aerial surveillance, mapping, and monitoring in smart city development, disaster response, infrastructure planning, and environmental assessment is propelling market growth. These applications are increasingly dependent on data-rich visual analytics provided by aerial imaging platforms.

Aerial Imaging Market Analysis

- Aerial Imaging solutions, which provide high-resolution imagery from platforms such as UAVs/drones, helicopters, and fixed-wing aircraft, are becoming indispensable tools across diverse sectors including agriculture, defense, construction, real estate, and environmental monitoring, due to their ability to deliver detailed visual data, geographic insights, and real-time situational awareness.

- The growing demand for geospatial intelligence, precision agriculture, urban planning, and disaster management is significantly driving the adoption of aerial imaging technologies. Industries increasingly rely on these solutions to optimize operations, reduce costs, and improve decision-making, especially when integrated with AI, GIS, and remote sensing technologies.

- North America dominates the Aerial Imaging market with the largest revenue share of 36.2% in 2024, driven by strong defense expenditure, advanced infrastructure, and early adoption of UAV-based imaging technologies. The United States, in particular, witnesses robust investments in smart agriculture, infrastructure monitoring, and homeland security, which utilize aerial imagery extensively.

- Asia-Pacific is expected to be the fastest-growing region in the Aerial Imaging market during the forecast period, fueled by rapid urbanization, infrastructure development, and government initiatives promoting digital mapping, smart city projects, and agricultural modernization in countries such as China, India, and Japan.

- The UAVs/Drones segment dominates the Aerial Imaging market with a market share of 43.2% in 2024, owing to their cost-effectiveness, flexibility, and ease of deployment compared to manned aircraft. These platforms are widely used for applications ranging from crop health analysis and mining exploration to real estate visualization and traffic management, making them the preferred aerial imaging method across multiple end-user industries.

Report Scope and Aerial Imaging Market Segmentation

|

Attributes |

Aerial Imaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerial Imaging Market Trends

“Increased Adoption of Drone-Based Mapping and AI-Powered Analytics”

- A key trend in the global Aerial Imaging market is the rapid integration of drones with AI-powered analytics and real-time geospatial processing capabilities, offering users enhanced visualization, automation, and decision-making across multiple sectors.

- For example, in July 2023, Nearmap, a leading aerial imagery and location intelligence company, announced advancements in AI-driven change detection features integrated into its 3D aerial imaging platform, enabling users to analyze historical changes across vast urban areas. This innovation empowers smarter infrastructure planning, urban development, and environmental monitoring.

- Similarly, in September 2023, EagleView Technologies, a major provider of aerial imagery and data analytics, expanded its AI capabilities to deliver more accurate property measurements and condition assessments for insurance and real estate markets, reflecting growing industry demand for automated aerial image interpretation.

- The convergence of drone imaging, cloud computing, and AI is facilitating faster data analysis, enabling industries such as agriculture, construction, and energy to automate inspections, track changes, and forecast risks with higher precision.

- Furthermore, companies such as PrecisionHawk and DJI are continuously investing in AI-integrated aerial imaging solutions that can detect crop health, infrastructure anomalies, or environmental degradation in real-time, demonstrating the market’s pivot toward intelligent, predictive imaging platforms.

- This trend is fundamentally reshaping how industries collect and utilize aerial imagery, shifting from static image capture to dynamic, real-time, AI-enhanced decision ecosystems.

Aerial Imaging Market Dynamics

Driver

“Rising Demand from Agriculture, Infrastructure, and Defense Sectors”

- The global demand for aerial imaging is being significantly driven by its growing applications in precision agriculture, infrastructure inspection, urban planning, and defense intelligence. These sectors increasingly rely on high-resolution, real-time imagery to enhance operational efficiency, reduce risk, and improve strategic planning

- For instance, in May 2023, Trimble Inc. launched a new version of its Trimble Ag Software, featuring integrated aerial imaging and remote sensing tools to help farmers monitor crop health, soil moisture, and field variability, thereby optimizing yields and reducing resource wastage

- Likewise, in February 2023, the U.S. Department of Defense expanded its contract with BlackSky Technology Inc., a geospatial intelligence firm that provides real-time aerial imagery and analytics for mission-critical surveillance and reconnaissance. This development underscores the strategic role of aerial imaging in national defense

- The increasing frequency of natural disasters and climate-related challenges is also driving demand for aerial imaging to support disaster response, environmental monitoring, and recovery planning

- Governments and organizations are investing heavily in drone-based aerial surveys to map urban infrastructure, inspect bridges, monitor deforestation, and assess damage from floods or wildfires. This trend is catalyzing strong, cross-sectoral growth in the market

Restraint/Challenge

“Regulatory Barriers and Data Privacy Concerns”

- One of the key restraints hindering the growth of the aerial imaging market is the complex regulatory environment surrounding UAV/drone operations and the rising concern over data privacy.

- For instance, in 2023, the European Union Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA) introduced stricter drone operation guidelines, including mandatory remote ID requirements, flight restrictions over urban areas, and pilot certification mandates. These compliance costs and legal complexities can delay or deter new market entrants.

- Additionally, aerial imaging often involves the collection of sensitive data over residential or commercial zones, prompting privacy concerns and potential legal repercussions related to unauthorized surveillance.

- In August 2023, a lawsuit was filed against a real estate firm in California for unauthorized drone surveillance that allegedly captured footage of private property without consent, highlighting the legal risks companies face when handling aerial imagery.

- To address these concerns, companies such as DroneDeploy and Pix4D have implemented robust data anonymization tools, encryption protocols, and strict compliance with GDPR and CCPA standards. Nevertheless, the increased scrutiny over data handling practices and airspace usage remains a considerable barrier, especially in populated regions and politically sensitive areas.

- Resolving these challenges through transparent policies, advanced data protection, and regulatory harmonization will be essential for broader adoption and market scalability.

Aerial Imaging Market Scope

The market is segmented on the basis of platform, imaging type, application, and end-use.

By Platform

On the basis of platform, the Aerial Imaging market is segmented into Fixed-Wing Aircraft, Helicopters, UAVs/Drones, and Others. The UAVs/Drones segment dominates the market with the largest revenue share of 43.2% in 2024, attributed to the increased deployment of drones for high-resolution, cost-effective aerial data collection across agriculture, infrastructure, and environmental monitoring applications. Their ease of use, accessibility, and ability to capture real-time imagery make them a preferred platform. Additionally, companies such as Parrot and Skydio continue to expand offerings in autonomous drone imaging solutions tailored for construction, inspection, and mapping needs.

The Fixed-Wing Aircraft segment is expected to witness the fastest growth from 2025 to 2032, as they are increasingly used for large-scale geographic surveys and infrastructure planning, thanks to their extended flight duration and wider coverage area.

• By Imaging Type

On the basis of imaging type, the Aerial Imaging market is segmented into Vertical Imaging and Oblique Imaging. The Vertical Imaging segment held the largest revenue share in 2024 due to its wide usage in mapping, urban planning, and land surveying applications, offering orthorectified, top-down images ideal for GIS systems and cadastral data collection.

The Oblique Imaging segment is projected to register the highest CAGR from 2025 to 2032, driven by its enhanced visual perspective and detail, making it ideal for 3D city modeling, architectural visualization, and real estate applications.

• By Application

On the basis of application, the Aerial Imaging market is segmented into Geospatial Mapping, Disaster Management, Energy & Resource Management, Surveillance & Monitoring, Urban Planning, Conservation & Research, and Others.The Geospatial Mapping segment dominated the market in 2024, driven by the growing adoption of aerial imaging in geographic information systems (GIS), cadastral surveys, and infrastructure development.

The Disaster Management segment is expected to experience the fastest CAGR during the forecast period, as governments and NGOs increasingly adopt drone and aerial imaging technologies to assess damage, guide relief efforts, and monitor recovery progress after natural disasters.

• By End-Use

On the basis of end-use, the Aerial Imaging market is segmented into Government, Military & Defense, Agriculture & Forestry, Real Estate & Architecture, Energy, Commercial & Media, and Others.

The Government segment held the largest market share in 2024, supported by national investments in smart city initiatives, cadastral data management, and environmental monitoring.

Aerial Imaging Market Regional Analysis

- North America dominates the global Aerial Imaging market with the largest revenue share of 36.2% in 2024, primarily driven by extensive use in geospatial mapping, infrastructure development, agriculture, and government surveillance initiatives. The region benefits from well-established aerial imaging providers and strong integration of aerial data with GIS and analytics platforms.

- The adoption of UAVs/drones for commercial imaging and asset monitoring is accelerating due to favorable regulatory support and growing investments in smart infrastructure and defense applications.

- Leading players such as EagleView, Nearmap, and Maxar Technologies continue to expand services through advanced imaging platforms and cloud-based solutions.

U.S. Aerial Imaging Market Insight

The U.S. accounted for approximately 82% of the North America Aerial Imaging market in 2024, propelled by high demand from sectors like agriculture, real estate, utilities, and defense. The country is leveraging aerial imagery for smart city planning, environmental monitoring, and disaster response, supported by programs like the National Agriculture Imagery Program (NAIP) and infrastructure modernization efforts. Significant investments in UAV capabilities and public-private partnerships further bolster the U.S. market, with innovations in 3D mapping and AI-driven geospatial analytics.

Europe Aerial Imaging Market Insight

The European Aerial Imaging market is projected to expand at a strong CAGR over the forecast period, supported by increasing application in urban development, environmental monitoring, and energy infrastructure projects. Regulatory support for carbon footprint monitoring and sustainable land use planning has driven demand for high-resolution imaging across EU countries. The integration of aerial imagery in national GIS initiatives and climate change modeling is further enhancing its adoption in public administration and private sectors.

U.K. Aerial Imaging Market Insight

The U.K. market is expected to grow steadily, driven by applications in construction site monitoring, coastal erosion assessment, and transport infrastructure planning. Local authorities and urban planners are integrating aerial data with smart planning tools to support green infrastructure and traffic management systems. Expansion of drone delivery trials and urban aerial surveys is expected to further boost demand in the coming years.

Germany Aerial Imaging Market Insight

Germany is experiencing significant growth in aerial imaging, backed by initiatives in renewable energy planning, forestry management, and smart mobility. The country’s emphasis on sustainability and innovation is driving adoption in agriculture and land surveying, particularly with drone-assisted imaging services. Major geospatial companies and R&D institutions are advancing aerial analytics through partnerships for climate risk evaluation and precision farming.

Asia-Pacific Aerial Imaging Market Insight

The Asia-Pacific Aerial Imaging market is poised to grow at the fastest CAGR of 24.8% during 2025 to 2032, driven by increasing urbanization, smart city developments, and rising use of aerial data in agriculture and infrastructure. Governments in countries like India, China, and Indonesia are deploying aerial imaging for flood risk mapping, resource management, and infrastructure audits. The region is also emerging as a manufacturing hub for imaging sensors and drone platforms, enhancing accessibility and affordability for commercial and governmental use.

Japan Aerial Imaging Market Insight

Japan’s Aerial Imaging market is gaining traction due to its focus on disaster preparedness, transportation planning, and 3D city modeling. The country’s advanced infrastructure and integration of AI in urban development support the widespread use of aerial imagery for predictive maintenance and smart zoning. The adoption is also driven by demographic shifts, with increased focus on automated monitoring systems for public safety and elder care facilities.

China Aerial Imaging Market Insight

China captured the largest revenue share in Asia-Pacific in 2024, supported by a rapidly expanding construction sector, smart city initiatives, and widespread use of UAVs for aerial surveys. Local governments and enterprises are investing in aerial imagery for environmental impact assessments, transport network expansion, and digital agriculture. Companies like DJI and Alibaba Cloud are integrating aerial data with AI-powered analytics platforms, offering scalable solutions for both urban and rural applications.

Aerial Imaging Market Share

The Aerial Imaging industry is primarily led by well-established companies, including:

- EagleView Technologies, Inc. (U.S.)

- Fugro N.V. (Netherlands)

- Nearmap Ltd. (Australia)

- Kucera International Inc. (U.S.)

- Digital Aerial Solutions, LLC (U.S.)

- Cooper Aerial Surveys Co. (U.S.)

- GeoVantage, Inc. (Aeroptic, LLC) (U.S.)

- Global UAV Technologies Ltd. (High Eye Aerial Imaging Inc.) (Canada)

- Aerobotics (Pty) Ltd. (South Africa)

- SZ DJI Technology Co., Ltd. (China)

Latest Developments in Global Aerial Imaging Market

- In February 2024, Nearmap, a leading provider of aerial imagery and location intelligence, announced the expansion of its AI-powered aerial imagery services to cover additional metropolitan areas across the United States and Australia. This move aims to provide high-resolution data for sectors including insurance, roofing, and urban planning, reinforcing Nearmap’s position as a major player in the global aerial imaging space.

- In January 2024, EagleView Technologies, a key aerial imagery provider, introduced its next-generation EagleView Cloud platform, combining ultra-high-resolution aerial imagery with real-time geospatial analytics. The solution enables advanced decision-making in sectors such as construction, public safety, and disaster management.

- In October 2023, Bluesky International, a U.K.-based aerial survey company, secured a contract to supply aerial LiDAR data to support the UK Environment Agency’s flood risk modeling and planning. This project reflects the growing role of aerial imaging in climate resilience and environmental monitoring applications.

- In September 2023, Maxar Technologies announced a multi-year agreement with Esri, a leader in GIS software, to integrate Maxar’s Vivid and Metro satellite imagery into Esri’s ArcGIS Living Atlas. This development enhances user access to high-resolution base maps, strengthening geospatial analysis capabilities across industries.

- In July 2023, Woolpert, a global architecture, engineering, and geospatial firm, acquired AAM Group, a key aerial surveying and geospatial firm based in Australia. The acquisition boosts Woolpert’s global aerial imaging capabilities, particularly in the Asia-Pacific region, for infrastructure, environmental, and urban planning projects.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.