Global Aerospace Interior Adhesive Market

Market Size in USD Million

CAGR :

%

USD

1.73 Million

USD

3.09 Million

2024

2032

USD

1.73 Million

USD

3.09 Million

2024

2032

| 2025 –2032 | |

| USD 1.73 Million | |

| USD 3.09 Million | |

|

|

|

|

Aerospace interior Adhesive Market Size

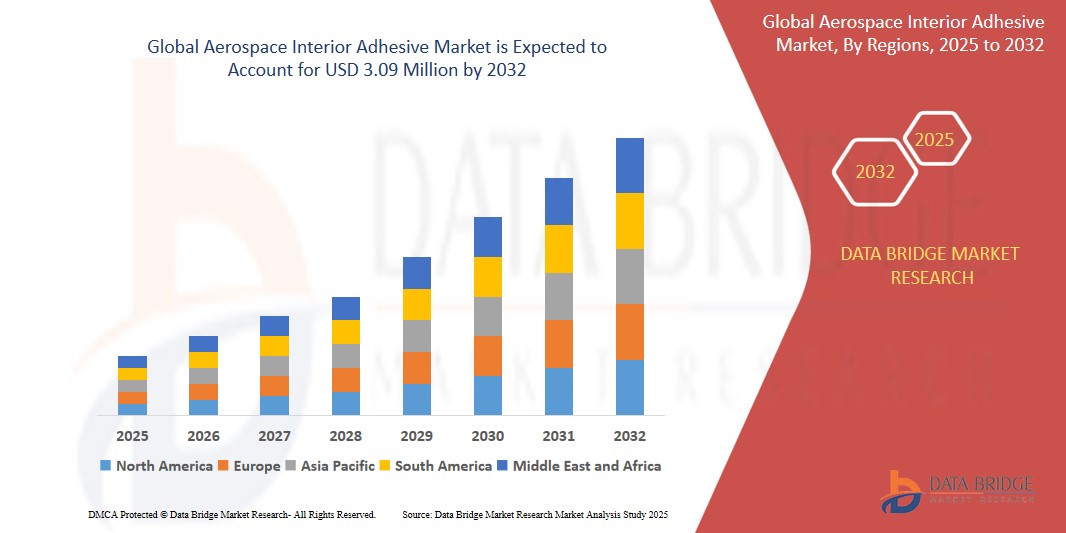

- The global Aerospace interior Adhesive Market was valued at USD 1.73 billion in 2024 and is expected to reach USD 3.09 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.60%, primarily driven by the steady increase in commercial and military aircraft production, fuelled by rising air travel demand and fleet modernization efforts

- This growth is driven by factors such as the growing aircraft production and demand for lightweight materials and growth in aircraft retrofitting & refurbishment.

Aerospace interior Adhesive Market Analysis

- The aerospace interior adhesive market is primarily driven by the increasing demand for lightweight and fuel-efficient aircraft. As airlines strive to reduce emissions and operational costs, interior components that require strong, lightweight adhesives are seeing greater demand across both commercial and military aviation sectors.

- The market is benefiting from growing aircraft production and refurbishment projects, particularly in developing regions. Adhesives play a vital role in bonding interior components such as panels, seats, flooring, overhead bins, and decorative trims—contributing to both functionality and aesthetics.

- Rising focus on passenger safety and comfort is accelerating the adoption of low-VOC (volatile organic compounds), fire-retardant, and FST (flame-smoke-toxicity)-compliant adhesives. Regulatory frameworks like FAR 25.853 in the U.S. and EASA CS-25 in Europe are pushing manufacturers to innovate safer, compliant adhesives for aircraft interiors.

- North America, Europe, and Asia-Pacific are the key markets, driven by strong aerospace manufacturing bases, rising demand for regional jets, and high investments in aircraft modernization. The Asia-Pacific region is expected to see the fastest growth, supported by growing air travel, expanding low-cost carriers, and indigenous aircraft production programs.

- For instance, in June 2021, Henkel, in partnership with Boeing, launched a two-part epoxy adhesive, Loctite 9365FST. This adhesive complies with international EH&S and REACH regulations and meets industrial standards for fire retardancy, smoke density, and toxicity (FST). It is specifically designed for applications in aerospace interiors, enhancing safety and performance.

Report Scope and Aerospace interior Adhesive Market Segmentation

|

Attributes |

Aerospace interior adhesive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerospace interior Adhesive Market Trends

“Rising Adoption of Lightweight, Low-VOC, and High-Performance Adhesives in Aircraft Cabins”

- A key trend in the aerospace interior adhesive market is the shift toward lightweight and low-emission adhesives that enhance fuel efficiency and comply with evolving environmental standards.

- High-performance structural adhesives are increasingly being used to assemble cabin elements such as seats, sidewalls, overhead bins, and floor panels, replacing heavier mechanical fasteners.

- Eco-friendly adhesives with low volatile organic compound (VOC) emissions are gaining traction, driven by regulations and a focus on improved cabin air quality and sustainability.

- For instance, Henkel has developed LOCTITE® EA 9365FST AERO, a two-part epoxy adhesive designed for aerospace interior applications. This adhesive offers high strength bonding, meets FST (fire, smoke, and toxicity) standards, and reduces VOC levels, aligning with green aviation goals.

- These advancements are driving greater design flexibility, reducing aircraft weight, and supporting the growing trend of cabin customization, ultimately transforming the way aircraft interiors are manufactured and maintained.

Aerospace interior Adhesive Market Dynamics

Driver

“Growing Aircraft Production and Demand for Lightweight Materials”

- The aerospace interior adhesive market is primarily driven by the steady increase in commercial and military aircraft production, fueled by rising air travel demand and fleet modernization efforts.

- Lightweight adhesives are replacing traditional mechanical fasteners and rivets in cabin components to improve fuel efficiency and reduce overall aircraft weight.

- Stringent safety and performance regulations in aerospace, such as those concerning flammability, smoke, and toxicity (FST), are encouraging the use of high-performance adhesives compliant with these standards.

- Increasing investments in aircraft cabin refurbishment—particularly in the aftermarket sector—are boosting demand for fast-curing and durable adhesives suitable for use in sidewalls, seats, and floor panels.

- For instance, In 2023, Airbus delivered a total of 735 commercial aircraft, comprising 68 A220s, 571 A320 Family, 32 A330s, and 64 A350s. This marked a significant increase from the 661 aircraft delivered in 2022, reflecting a robust demand for new aircraft and associated interior components.

- These factors are collectively fueling market growth, as adhesives become increasingly vital in meeting aerospace interior performance, safety, and sustainability requirements.

Opportunity

“Expansion in MRO Services and Retrofitting of Aging Fleets”

- A major opportunity in the aerospace interior adhesive market is the surge in demand for MRO (Maintenance, Repair & Overhaul) services, as airlines focus on refurbishing aging fleets to enhance cabin aesthetics and comply with safety regulations

- The retrofitting of aircraft interiors—such as overhead bins, sidewalls, flooring, and lavatories—requires advanced adhesives that meet strict performance criteria including flame resistance, structural integrity, and ease of application

- Governments and regulatory bodies are promoting sustainable aviation practices, creating a market for bio-based or low-emission adhesive solutions used in eco-friendly interior upgrades

- Expanding aviation markets in countries like India and Indonesia are investing heavily in new fleets and regional air connectivity, creating opportunities for interior system suppliers and adhesive manufacturers

- For instance, in January 2024, Akasa Air, India's fastest-growing airline, announced a firm order of 150 fuel-efficient Boeing 737 MAX aircraft at WINGS India 2024. This order expanded Akasa Air's total order book to over 200 aircraft within just 17 months of commencing operations, underscoring the growing demand for aircraft and associated interior components in emerging markets.

- As consumer demand for healthier options rises, these innovations open new avenues for product diversification and market expansion, ultimately contributing to better health outcomes for diabetic individuals.

Restraint/Challenge

“Stringent Regulatory Compliance and Volatile Raw Material Prices”

- One of the primary challenges facing the aerospace interior adhesive market is the need to meet rigorous regulatory standards related to fire retardancy, toxicity, smoke emission, and environmental impact

- Certification processes for aerospace adhesives, such as FAR 25.853 compliance, can be time-consuming and costly, especially for new entrants or companies introducing innovative materials

- Volatile raw material prices, particularly for specialty chemicals and resins used in adhesive formulations, can impact profit margins and disrupt supply chain stability

- Additionally, geopolitical factors, supply chain bottlenecks, and trade restrictions on chemicals pose risks to adhesive manufacturers’ sourcing strategies

- For instance, In July 2023, C&EN reported that the global chemical industry faced exceptional challenges in 2022, including increased energy prices and disrupted supplies of natural gas to Europe due to geopolitical tensions. These factors contributed to higher costs for chemical producers, impacting the availability and pricing of raw materials essential for aerospace adhesives.

Aerospace interior Adhesive Market Scope

The market is segmented on the basis product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Resin Type |

|

|

By Aircraft Type |

|

|

By Product Type |

|

|

By Application Type |

|

Aerospace interior Adhesive Market Regional Analysis

“North America is the Dominant Region in the Aerospace Interior Adhesive Market”

- North America leads the aerospace interior adhesive market, driven by the presence of major aircraft manufacturers such as Boeing and key aerospace OEMs and Tier-1 suppliers

- The region benefits from strong investment in R&D, a mature aviation industry, and a well-established regulatory framework supporting the development and certification of high-performance interior adhesives

- The U.S. accounts for a significant share owing to continuous demand for aircraft modernization, refurbishment of commercial fleets, and innovation in lightweight and fire-retardant materials.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the fastest growth in the aerospace interior adhesive market due to rising aircraft production, increasing air travel demand, and expansion of low-cost carriers

- Countries like China and India are key growth markets, with China rapidly scaling its domestic aircraft manufacturing capabilities and India becoming a hub for MRO (Maintenance, Repair, and Overhaul) services

- Growth is also supported by rising investments in aviation infrastructure and the entry of new players in aircraft manufacturing and component supply

- Collaborations between regional airlines and global aircraft manufacturers, along with the localization of supply chains, are boosting the adoption of aerospace-grade adhesives across the region

Aerospace Interior Adhesive Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Solvay (Belgium)

- Arkema (France)

- Henkel AG & Co. KGaA (Germany)

- Huntsman International LLC (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Hexcel Corporation (U.S.)

- DELO Industrie Klebstoffe GmbH & Co. KGaA (Germany)

Latest Developments in Global Aerospace interior Adhesive Market

- In December 2020, Hexcel Corporation strengthened its strategic cooperation with Aerospace contractor Safran to cover a wider range of commercial aerospace applications. Hexcel has long been Safran's reliable source for high-tech, high-performance composites like carbon fiber, dry textiles and adhesives.

- In June 2019, the Adhesive Technologies business segment of Henkel opened a new production facility in Montornés, Spain, for aerospace applications. The new facility would boost Henkel's production capacity and enable the company to fulfill the growing demand for high-performance solutions from the Aerospace sector.

- In May 2024, Solvay introduced AeroPaste 1003, an epoxy-based structural paste adhesive designed for bonding metallic and composite parts. This product aims to increase part assembly efficiency and offers processing flexibility, suitable for rapid assembly and repair applications, including out-of-autoclave processes.

- In May 2024, H.B. Fuller Company acquired ND Industries Inc., a U.S.-based manufacturer of aerospace adhesives for interiors. This acquisition aims to bolster H.B. Fuller's strategic position in high-margin market segments within the functional coatings, adhesives, sealants, and elastomers (CASE) industry.

- In May 2024, Arkema announced its agreement to acquire Dow’s flexible packaging laminating adhesives business, a leading producer in the market. This acquisition is expected to significantly expand Arkema’s portfolio of solutions for flexible packaging, enabling the company to become a key player in this attractive market segment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerospace Interior Adhesive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerospace Interior Adhesive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerospace Interior Adhesive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.