Global Aesthetic And Cosmetic Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

3.39 Billion

USD

6.00 Billion

2024

2032

USD

3.39 Billion

USD

6.00 Billion

2024

2032

| 2025 –2032 | |

| USD 3.39 Billion | |

| USD 6.00 Billion | |

|

|

|

|

Aesthetic and Cosmetic Surgery Devices Market Size

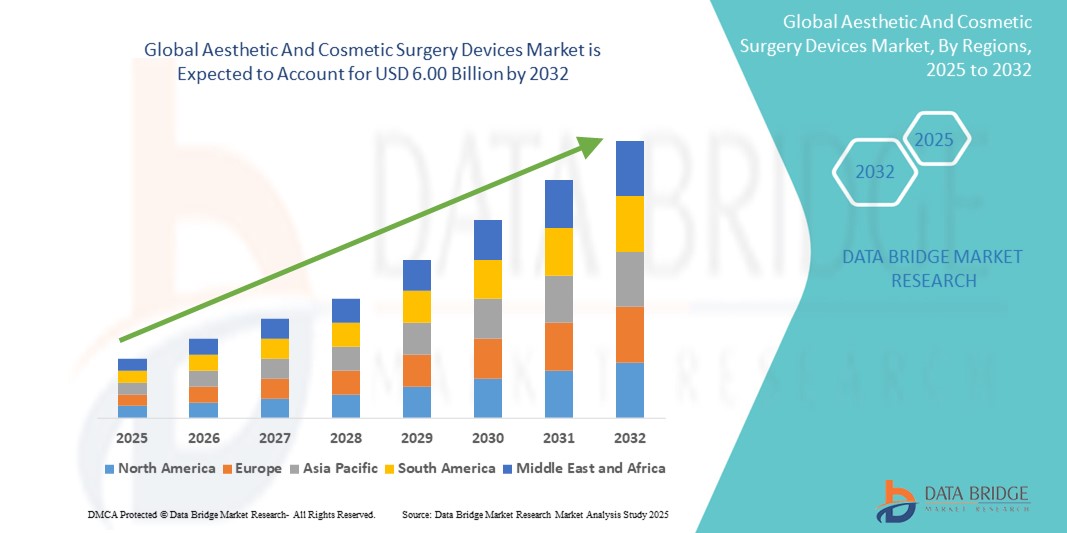

- The global aesthetic and cosmetic surgery devices market size was valued at USD 3.39 billion in 2024 and is expected to reach USD 6.00 billion by 2032, at a CAGR of 7.4% during the forecast period

- The market growth is largely fueled by increasing consumer interest in appearance-enhancing procedures, rising disposable income, and the rapid advancement in non-invasive device technologies, contributing to broader accessibility and acceptance

- Furthermore, growing medical tourism, the expanding influence of social media on beauty standards, and improved safety profiles of aesthetic procedures are driving widespread adoption. These converging factors are propelling demand for cosmetic surgery devices, thereby significantly boosting the industry's growth

Aesthetic and Cosmetic Surgery Devices Market Analysis

- Aesthetic and cosmetic surgery devices, used for procedures that enhance appearance through surgical and non-surgical interventions, are increasingly integral to modern dermatology and plastic surgery practices across residential clinics and hospitals due to their minimally invasive nature, advanced technology, and ability to deliver rapid results with minimal downtime

- The rising demand for these devices is primarily fueled by growing aesthetic consciousness, increased social media influence, technological advancements in energy-based and laser-assisted devices, and a surge in demand for anti-aging and body contouring treatments

- North America dominated the aesthetic and cosmetic surgery devices market with the largest revenue share of 37.2% in 2024, characterized by high aesthetic procedure volumes, strong consumer spending, and the presence of globally leading aesthetic technology companies, particularly in the U.S., where outpatient cosmetic treatments and medical spas are seeing significant growth

- Asia-Pacific is expected to be the fastest growing region in the aesthetic and cosmetic surgery devices market during the forecast period due to rising beauty awareness, growing middle-class population, and increasing medical tourism

- Energy-Based Aesthetic Device segment dominated the aesthetic and cosmetic surgery devices market with a market share of 61.9% in 2024, driven by its effectiveness in non-invasive procedures and continuous advancements in laser, radiofrequency, and ultrasound technologies

Report Scope and Aesthetic and Cosmetic Surgery Devices Market Segmentation

|

Attributes |

Aesthetic and Cosmetic Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aesthetic and Cosmetic Surgery Devices Market Trends

“Rising Demand for Non-Invasive and AI-Integrated Aesthetic Solutions”

- A significant and accelerating trend in the global aesthetic and cosmetic surgery devices market is the shift toward non-invasive procedures supported by AI and smart device integration, offering safer, faster, and more personalized treatments. Consumers increasingly seek aesthetic enhancements that deliver visible results without the risks and downtime of traditional surgery

- For instance, AI-powered laser and radiofrequency devices now offer skin analysis features that adapt treatment protocols to individual skin types and conditions, optimizing outcomes. Devices such as Cutera’s AviClear and Lumenis' NuEra Tight use AI-driven energy modulation to maximize safety and efficiency

- AI integration in aesthetic devices enables capabilities such as automated energy adjustment, treatment customization, and predictive analytics for patient outcomes. These innovations help practitioners deliver highly targeted and consistent results, enhancing patient satisfaction and clinic efficiency

- Moreover, connected devices with smart sensors and digital interfaces allow practitioners to track treatment history and monitor device performance in real-time, ensuring safety and regulatory compliance. The convenience and precision offered by these innovations are attracting a broader patient base and contributing to the market's rapid expansion

- This trend toward technologically advanced, minimally invasive, and intelligent aesthetic solutions is reshaping consumer expectations. As a result, manufacturers are investing in AI-enabled systems that support mobile app connectivity, real-time feedback, and advanced skin diagnostics, further driving adoption across dermatology and cosmetic clinics

- The demand for smart, AI-integrated aesthetic systems is growing rapidly across both developed and emerging markets, as patients prioritize convenience, safety, and tailored outcomes in their aesthetic treatments

Aesthetic and Cosmetic Surgery Devices Market Dynamics

Driver

“Growing Popularity of Aesthetic Procedures and Advancements in Device Technology”

- The rising acceptance of aesthetic procedures across various age groups, coupled with increasing awareness around beauty standards, is a major driver of the aesthetic and cosmetic surgery devices market

- For instance, in February 2024, Cynosure launched the Potenza RF microneedling system with enhanced AI-supported skin monitoring, aimed at delivering precision-based results across a wider demographic. Such product innovations are enhancing the appeal of aesthetic devices across both clinical and home-use markets

- Increased consumer interest in body contouring, wrinkle reduction, and anti-aging treatments has led to a surge in demand for minimally invasive devices offering fast recovery and visible results. The growing influence of social media, along with celebrity endorsements of aesthetic procedures, is further fueling consumer interest

- In addition, advancements in laser, RF, ultrasound, and cryolipolysis technologies are offering practitioners safer, more efficient treatment options with fewer complications, promoting adoption in both urban and semi-urban settings

- The expansion of medical tourism and increasing availability of skilled aesthetic professionals are also contributing to market growth, particularly in countries such as South Korea, India, and Brazil

Restraint/Challenge

“High Procedure Costs and Regulatory Compliance Barriers”

- The high cost associated with aesthetic procedures and advanced surgical devices remains a key restraint, particularly in price-sensitive markets. While demand is rising, many treatments are not covered under health insurance, making affordability a major hurdle

- For instance, full-body contouring or laser-based treatments using high-end devices such as those from Alma Lasers or InMode can cost several thousand dollars, deterring many potential users

- Regulatory compliance is another major challenge. Aesthetic devices must adhere to stringent safety standards, particularly in regions such as the U.S. (FDA) and Europe (CE Marking). The time and cost involved in achieving compliance can delay product launches and limit innovation

- In addition, the shortage of trained professionals for device operation and the risk of adverse side effects in unregulated clinics can deter patient trust. As procedures become more advanced, proper training and certification for providers become essential to ensure patient safety

- Overcoming these challenges through increased accessibility, cost-effective treatment solutions, education for providers, and robust regulatory frameworks will be crucial for sustaining market momentum

Aesthetic and Cosmetic Surgery Devices Market Scope

The market is segmented on the basis of type, raw material, application, body parts, end user, and distribution channel.

- By Type

On the basis of type, the aesthetic and cosmetic surgery devices market is segmented into energy-based aesthetic devices and non-energy based aesthetic devices. The energy-based aesthetic devices segment dominated the market with the largest revenue share of 61.9% in 2024, driven by their broad application in non-invasive procedures such as laser hair removal, skin resurfacing, and body contouring. These devices are favored for their high efficacy, minimal downtime, and growing adoption across dermatology and cosmetology clinics.

The non-energy based aesthetic devices segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by their use in traditional surgical procedures such as implants and dermal fillers. Their widespread use in procedures such as lip and breast augmentation, particularly in markets with high demand for surgical enhancement, contributes to their relevance.

- By Raw Material

On the basis of raw material, the aesthetic and cosmetic surgery devices market is segmented into polymers, metals, and biomaterials. The polymers segment held the largest market share of 42.6% in 2024, attributed to their flexibility, lightweight nature, biocompatibility, and use in implants and filler applications. Polymers are increasingly favored in procedures requiring minimally invasive approaches and aesthetic flexibility.

The biomaterials segment is expected to witness the fastest CAGR from 2025 to 2032, driven by their compatibility with human tissue, making them ideal for next-generation aesthetic treatments such as bio-integrated implants and regenerative procedures.

- By Application

On the basis of application, the aesthetic and cosmetic surgery devices market is segmented into skin resurfacing and tightening, anti-aging, wrinkle reduction, face lift, lip augmentation, hair removal, body contouring and cellulite reduction, tattoo removal, breast augmentation, and others. The body contouring and cellulite reduction segment dominated the market with a revenue share of 26.9% in 2024, fueled by rising demand for non-surgical fat reduction technologies and increasing interest in body sculpting across both genders.

The anti-aging and wrinkle reduction segments is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand for youthful appearance and advances in radiofrequency and ultrasound-based treatments.

- By Body Parts

On the basis of body parts, the aesthetic and cosmetic surgery devices market is segmented into face, eyes, nose, lip, ears, body and extremities, neck, and scalp. The face segment dominated with a market share of 34.2% in 2024, reflecting high demand for facial rejuvenation treatments including wrinkle reduction, botox, and dermal fillers.

The body and extremities segment is anticipated to grow at a fast pace during forecast period, due to rising adoption of procedures such as body contouring, cellulite reduction, and tattoo removal in aesthetic-focused populations.

- By End User

On the basis of end user, the aesthetic and cosmetic surgery devices market is segmented into clinics, ambulatory surgical clinics, hospitals, dermatology and cosmetology clinics, dental clinics, and others. The dermatology and cosmetology clinics segment led the market with a revenue share of 38.5% in 2024, driven by the increasing preference for specialized aesthetic treatments in outpatient settings. These clinics offer a wide range of services using advanced devices with minimal downtime, making them a preferred choice for patients seeking convenience and cosmetic expertise.

The ambulatory surgical clinics segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for cost-effective, same-day aesthetic procedures performed in specialized outpatient settings. These clinics combine the advantages of lower procedure costs, reduced hospital stays, and increased accessibility for patients seeking minimally invasive or day-care cosmetic treatments such as body sculpting, laser resurfacing, and non-surgical facelifts.

- By Distribution Channel

On the basis of distribution channel, the aesthetic and cosmetic surgery devices market is segmented into direct tender and retail pharmacies. The direct tender segment dominated with a market share of 58.1% in 2024, as most hospitals and clinics procure aesthetic devices and consumables directly from manufacturers or authorized distributors through contractual agreements.

Retail pharmacies are expected to witness growth during forecast period, particularly for over-the-counter aesthetic products and home-use devices gaining popularity in urban markets.

Aesthetic and Cosmetic Surgery Devices Market Regional Analysis

- North America dominated the aesthetic and cosmetic surgery devices market with the largest revenue share of 37.2% in 2024, characterized by high aesthetic procedure volumes, strong consumer spending, and the presence of globally leading aesthetic technology companies

- Consumers in the region increasingly seek procedures that offer visible results with minimal recovery time, favoring technologies such as laser therapy, RF treatments, and body contouring devices that are widely available in medical spas and dermatology clinics

- This widespread adoption is further supported by a strong presence of key market players, growing medical aesthetics awareness, and rising acceptance of aesthetic procedures among both younger and older demographics, establishing North America as the leading hub for aesthetic innovations and treatment demand

U.S. Aesthetic and Cosmetic Surgery Devices Market Insight

The U.S. aesthetic and cosmetic surgery devices market captured the largest revenue share of 79.4% in North America in 2024, driven by strong demand for minimally invasive procedures and early adoption of advanced technologies. Consumers are increasingly opting for treatments such as body contouring, laser resurfacing, and injectable aesthetics due to shorter recovery times and growing aesthetic consciousness. High disposable incomes, a robust presence of dermatology and medspa chains, and the influence of social media trends further contribute to market growth. In addition, technological innovations by leading U.S.-based aesthetic device manufacturers continue to fuel the market’s expansion.

Europe Aesthetic and Cosmetic Surgery Devices Market Insight

The Europe aesthetic and cosmetic surgery devices market is projected to expand at a substantial CAGR during the forecast period, driven by rising aesthetic awareness, an aging population, and growing demand for non-surgical treatments. Consumers in Europe are increasingly inclined toward procedures such as wrinkle reduction, hair removal, and skin tightening using energy-based devices. Regulatory support for safe aesthetic practices and increasing investments in aesthetic clinics are also contributing to market growth. Both new and refurbished clinics in urban areas are integrating advanced devices, enhancing accessibility and adoption across the region.

U.K. Aesthetic and Cosmetic Surgery Devices Market Insight

The U.K. aesthetic and cosmetic surgery devices market is expected to grow at a noteworthy CAGR throughout the forecast period, driven by increased demand for safe, effective aesthetic treatments and the rapid expansion of cosmetic dermatology clinics. Heightened concerns over aging, coupled with a cultural shift toward preventive skincare, are encouraging consumers to explore laser, ultrasound, and radiofrequency-based treatments. The country’s strong regulatory framework and expanding base of qualified professionals are also fostering the adoption of aesthetic devices in both public and private sectors.

Germany Aesthetic and Cosmetic Surgery Devices Market Insight

The Germany aesthetic and cosmetic surgery devices market is anticipated to expand at a considerable CAGR, fueled by increasing consumer focus on anti-aging solutions and the preference for precision-driven, non-invasive treatments. Germany’s strong healthcare infrastructure and growing med-aesthetic tourism industry are key growth enablers. Moreover, the country’s focus on safety, sustainability, and clinical excellence aligns well with the adoption of advanced devices for body sculpting, tattoo removal, and skin rejuvenation procedures in both dermatology and plastic surgery clinics.

Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market Insight

The Asia-Pacific aesthetic and cosmetic surgery devices market is poised to grow at the fastest CAGR of 23.5% from 2025 to 2032, driven by rising beauty consciousness, increasing disposable income, and booming medical tourism. Countries such as China, Japan, South Korea, and India are witnessing rapid adoption of non-invasive treatments due to cultural emphasis on appearance and growing accessibility to high-quality care. Government support for private healthcare investment and the presence of local device manufacturers are further propelling the market forward.

Japan Aesthetic and Cosmetic Surgery Devices Market Insight

The Japan aesthetic and cosmetic surgery devices market is gaining traction due to the country's advanced technological landscape and deep-rooted focus on skincare and beauty. Japan’s demand for anti-aging solutions and minimally invasive devices is driven by its aging population and preference for subtle, natural-looking enhancements. The widespread use of advanced energy-based technologies in dermatology clinics and the integration of AI-enabled diagnostic tools contribute significantly to market growth.

India Aesthetic and Cosmetic Surgery Devices Market Insight

The India aesthetic and cosmetic surgery devices market accounted for the largest revenue share in Asia-Pacific in 2024, supported by a growing urban population, rising aesthetic awareness, and an expanding middle class. The surge in dermatology and cosmetic clinics across tier 1 and tier 2 cities, along with affordable treatment options, is boosting market growth. India’s positioning as a leading hub for aesthetic medical tourism, coupled with a strong domestic manufacturing base for aesthetic devices, makes it a critical market in the region.

Aesthetic and Cosmetic Surgery Devices Market Share

The aesthetic and cosmetic surgery devices industry is primarily led by well-established companies, including:

- Johnson & Johnson Services, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- AirXpanders, Inc. (U.S.)

- BonashMedical (Iran)

- Coloplast Corp (Denmark)

- Establishment Labs. (Costa Rica)

- GC Aesthetics (Ireland)

- HansBioMed. (South Korea)

- IDEAL IMPLANT INCORPORATED (U.S.)

- Implantech (U.S.)

- KOKEN CO., LTD. (Japan)

- PMT Corporation (U.S.)

- POLYTECH Health & Aesthetics GmbH (Germany)

- Rigicon, Inc. (U.S.)

- Sebbin (France)

- lipoelasticshop.com (Czech Republic)

What are the Recent Developments in Global Aesthetic and Cosmetic Surgery Devices Market?

- In April 2023, Cutera, Inc., a leading provider of aesthetic and dermatology solutions, announced the launch of AviClear in key international markets. AviClear is the first FDA-cleared energy-based device for the treatment of mild to severe acne. The expansion reflects Cutera’s strategic push to broaden its global footprint and meet growing demand for non-invasive, energy-based dermatological treatments. This move underscores the company's dedication to offering innovative solutions in high-growth segments of aesthetic dermatology

- In March 2023, Cynosure LLC introduced the Potenza RF Microneedling system in Europe and Asia-Pacific, designed for customizable skin rejuvenation. The system leverages monopolar and bipolar RF energy with ultrafine needles for deep and surface-level treatments. This development reflects Cynosure's commitment to expanding its product portfolio with versatile, minimally invasive devices, catering to both physicians and patients seeking personalized aesthetic outcomes with minimal downtime

- In March 2023, Lumenis Be Ltd. partnered with a network of leading aesthetic clinics in South Korea to introduce its Stellar M22 multi-application platform. This advanced device combines IPL, Nd:YAG, and ResurFX technologies to offer treatments for over 30 skin conditions. The partnership underscores Lumenis’ intent to tap into the growing Asia-Pacific aesthetic market by offering clinicians a flexible, multi-functional solution that meets diverse skin needs

- In February 2023, InMode Ltd. launched its EmpowerRF platform in Canada, targeting the women’s wellness and aesthetic market. EmpowerRF combines multiple technologies—RF microneedling, fractional RF, and muscle stimulation—to treat a wide range of conditions including skin laxity, tone, and pelvic floor disorders. The launch highlights InMode’s focus on holistic, technology-driven platforms that address both functional and aesthetic concerns, expanding its footprint in North America

- In January 2023, Alma Lasers GmbH, a global provider of aesthetic and surgical lasers, unveiled the Alma Hybrid system at IMCAS World Congress 2023 in Paris. This device integrates ablative, non-ablative, and thermal technologies into one platform, allowing physicians to customize treatments for scars, wrinkles, and texture irregularities. Alma’s introduction of this hybrid solution reflects the industry's broader move toward adaptable and combination-based therapies, providing patients with more precise and comprehensive treatment options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.